Trading Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Legoland® California Resort Announces Reopening April 1!

Media Contacts: Jake Gonzales /760-429-3288 [email protected] AWESOME IS BACK! LEGOLAND® CALIFORNIA RESORT ANNOUNCES REOPENING APRIL 1! Park Preview Days April 1-12 Includes access to select rides and attractions Resort officially reopens April 15 to include SEA LIFE® aquarium and LEGO® CHIMA™ Water Park Priority access to hotel guests, pass holders and existing ticket holders to be first Park guests in April With limited capacities, guests are required to book online in advance Resort is implementing safety guidelines LINK TO IMAGES: https://spaces.hightail.com/space/nMvjw0kEAr LINK TO BROLL: https://spaces.hightail.com/space/cNda6CmOIX CARLSBAD, Calif. (March 19, 2021) – LEGOLAND® California Resort is excited to offer Park Preview Days with access to select rides and attractions beginning April 1, 2021, under California’s reopening health and safety guidelines with official reopening on April 15, 2021. After closing its gates one year ago, the theme park built for kids is offering priority access to Hotel guests, pass holders and existing ticket holders impacted by COVID- 19 Park closure, for the month of April. Park Preview Days offers access to select rides including Driving School, LEGO® TECHNIC™ Coaster, Fairy Tale Brook and Coastersaurus. Kids and families can also enjoy socially distant character meet and greets, live entertainment, a wide variety of food options and Miniland U.S.A. The Resort officially reopens April 15, offering access to SEA LIFE® aquarium and LEGO® CHIMA™ Water Park. Guests will once again be immersed into the creative world of LEGO® and some of the Park’s more than 60 rides, shows and attractions. -

2019 Tier 1 Corporate Document December 2019 - Issued 28/11/2019

2019 Tier 1 Corporate Document December 2019 - Issued 28/11/2019 2019 Tier 1 Corporate Document December 2019 - Issued 28/11/2019 Please remember that the Merlin Attractions discounted rates should only be listed within staff / members area of your website or intranet and the discounted tickets are for staff / members personal use only. The discounts or logos should not be listed in any form on social media or public facing websites and are not for re-sale. 2019 Tier 1 Corporate Document December 2019 - Issued 28/11/2019 The Merlin Entertainments Group have populated the To access your exclusive tickets, click the relevant link, if required, stores already with the relevant products for your offer, log into the site with the username and password provided. please find below a step by step process for purchasing and printing tickets; Please note that individual tickets are non-refundable and non- exchangeable. 1. Log into store using credentials supplied. This offer is for personal use only to enable you to book tickets for your family and friends when visiting the attraction together. 2. Your discounted tickets will be displayed- add the tickets you require to your basket selecting your chosen date and The sharing of the offer details, may result in this offer being time. terminated and action being taken. 3. Choose if you would like to collect your tickets at the Proof of company employment/membership may be requested on attraction or a print@home/mobile ticket. arrival. 4. Proceed to check out to confirm your booking and make payment using a credit/debit card or Paypal account. -

LIFE-Nature 2005 Application Forms, Sections

Draft CCB Annual Activities Report 2017 For bibliographic purposes this document should be cited as: Coalition Clean Baltic, 2018. Annual Activities Report 2017. Uppsala, Sweden. Information included in this publication or extracts thereof are free for citation on the condition that the complete reference of the publication is given as stated above. © Copyright 2018 by the Coalition Clean Baltic Published in May 2018 by the Coalition Clean Baltic with a support of EU Life Programme and the Nordic Council of Ministers Address: Östra Ågatan 53, SE-753 22 Uppsala, Sweden +46 (0)18 71 11 70 Email: [email protected] URL: www.ccb.se Layout & Production: Coalition Clean Baltic 2 Draft CCB Annual Activities Report 2017 CONTENTS I. SUMMARY OF THE IMPLEMENTATION OF THE WORK PROGRAMME ................................................. 4 II. HIGHLIGHTS ........................................................................................................................................ 7 III. WORK PROGRAMME ACTIVITIES IN EACH POLICY AREA ..................................................................... 8 AREA A. WORKING UPSTREAM / WORKING ON LAND ......................................................................................... 9 A1. Water protection in Agriculture ....................................................................................................................... 9 A1.1 Nutrient resource management and nutrient runoff ................................................................... 10 A1.2 Industrial Animal Farming -

Download Press Release

For Immediate Release Media Contacts: Jake Gonzales/760-918-5379 LEGOLAND® CALIFORNIA RESORT ANNOUNCES BIGGEST PARK ADDITION: THE LEGO® MOVIE™ WORLD! Family Theme Park and Warner Bros. Consumer Products Unveil New Rides, Attractions and Iconic LEGO Characters for 2020! LINK TO ART: https://spaces.hightail.com/space/UsoTZWbIm4 LINK TO IMAGES: https://spaces.hightail.com/space/uCKBaVi2g8 LINK TO BROLL: https://spaces.hightail.com/space/2w5rcshZ6S CARLSBAD, Calif. (August 15, 2019) –The audience erupted in cheer and confetti filled the theater as LEGOLAND® California Resort unveiled its biggest gift for its 20th birthday by announcing the largest addition in the Park’s history: The LEGO® MOVIE™ WORLD. General Manager Peter Ronchetti is excited to take guests from theater to theme park in 2020. “The LEGO MOVIE WORLD is LEGOLAND California Resort’s largest Park addition ever and we are thrilled to create an interactive experience that fully immerses guests into a world that was so brilliantly created by LEGO and celebrated by the hugely popular LEGO film franchise from our friends at Warner Bros.,” said Ronchetti. “We can’t wait to see the faces on all the children as they interact within the creative world of Bricksburg and experience the incredible Masters of Flight ride which is taking the traditional soaring-type of ride to new heights.” On the flagship ride Masters of Flight, guests hop aboard Emmet’s triple decker flying couch for a thrill- seeking adventure. The flying theater attraction whisks guests away on a suspended ride with a full- dome virtual screen, giving the sensational feeling of flying above memorable lands such as Middle Zealand, Cloud Cuckoo Land, Pirates Cove and Outer Space. -

Deep-Sea Life Issue 14, January 2020 Cruise News E/V Nautilus Telepresence Exploration of the U.S

Deep-Sea Life Issue 14, January 2020 Welcome to the 14th edition of Deep-Sea Life (a little later than anticipated… such is life). As always there is bound to be something in here for everyone. Illustrated by stunning photography throughout, learn about the deep-water canyons of Lebanon, remote Pacific Island seamounts, deep coral habitats of the Caribbean Sea, Gulf of Mexico, Southeast USA and the North Atlantic (with good, bad and ugly news), first trials of BioCam 3D imaging technology (very clever stuff), new deep pelagic and benthic discoveries from the Bahamas, high-risk explorations under ice in the Arctic (with a spot of astrobiology thrown in), deep-sea fauna sensitivity assessments happening in the UK and a new photo ID guide for mesopelagic fish. Read about new projects to study unexplored areas of the Mid-Atlantic Ridge and Azores Plateau, plans to develop a water-column exploration programme, and assessment of effects of ice shelf collapse on faunal assemblages in the Antarctic. You may also be interested in ongoing projects to address and respond to governance issues and marine conservation. It’s all here folks! There are also reports from past meetings and workshops related to deep seabed mining, deep-water corals, deep-water sharks and rays and information about upcoming events in 2020. Glance over the many interesting new papers for 2019 you may have missed, the scientist profiles, job and publishing opportunities and the wanted section – please help your colleagues if you can. There are brief updates from the Deep- Ocean Stewardship Initiative and for the deep-sea ecologists amongst you, do browse the Deep-Sea Biology Society president’s letter. -

Smart Destinations All Locations 22 March 2019

NEW ONLINE PRICING EFFECTIVE 1 APRIL 2019 Smart Destinations All Locations 22 March 2019 Smart Destinations provides the only multi-attraction passes to maximize the fun, savings and convenience of sightseeing with flexible purchase options for every type of traveler. Smart Destinations products (Go City Cards, Explorer Pass and Passes) provide admission to more than 400 attractions across North American and overseas, including Oahu, San Diego, Los Angeles, San Francisco, Las Vegas, San Antonio, Chicago, Boston, Philadelphia, New York, Washington, D.C., Orlando, Miami, South Florida, New Orleans, London, Paris, Dubai, Cancun, Berlin, Barcelona and Dublin. All passes come with valuable extras, including the ability to skip the line at select attractions and comprehensive city guides that offer insider tips and bonus discounts on shopping and dining. Smart Destinations passes leverage the company’s patented technology and the industry’s largest network of attraction partners to save consumers up to 55% compared to purchasing individual tickets. Be sure to check the website for all available saving opportunities and current attraction list (www.smartdestinations.com) as changes can occur throughout the year without notice. NOTE: All pricing is guaranteed until 3/31/2020. After 3/31/2020, rates are subject to change with 30 days written notice from Smart Destinations. Smart Destinations - Oahu, HI 1 April 2019 The Go Oahu Card is the best choice for maximum savings and flexibility. Save up to 55% off retail prices on admission to over 35 activities, attractions, and tours for one low price, including Pearl Harbor attractions, hiking, snorkeling, paddle boarding, kayaking, and more. -

Written Evidence Submitted by Merlin Entertainments

TAC0126 Written evidence submitted by Merlin Entertainments About Merlin Entertainments Merlin Entertainments is a global leader in location-based, family entertainment. As Europe's Number 1 and the world's second-largest visitor attraction operator, Merlin now operates 130 attractions, 20 hotels and 6 holiday villages in 25 countries and across 4 continents. Merlin’s purpose is to deliver memorable experiences to its 67 million guests around the world, through its iconic global and local brands, and the commitment and passion of its c.28,000 employees (peak season). Merlin Entertainments is a privately-owned company and is headquartered in Poole, Dorset, UK. It has 29 number of attractions located within the UK, including Alton Towers, THORPE PARK, Chessington World of Adventures, Warwick Castle, LEGOLAND Windsor, The London Eye, Madame Tussauds and various SEA LIFE centres. 2020 has been Merlin’s most challenging year to date, as the vast majority of our 130 attractions around the world were closed for part of the pandemic, including all of our UK attractions which had to shut their doors between March and June / July, missing out on their busiest and most crucial trading period. When these attractions did safely re-open, they benefited from the pandemic staycation boost, but with significantly reduced capacity to enable social distancing. With a lower footfall, our UK attractions have not been able to provide so many seasonal jobs; nor generate substantial additional spend from our guests for the wider community surrounding our attractions and local visitor economies. Nevertheless, a range of Government measures – including the moratorium on rent enforcement, the temporary reduction in VAT to 5% and the business rates holiday – have helped our UK attractions to resume trading, offering safe, memorable experiences to thousands of visitors between mid-summer and the November lockdown – whilst ensuring that our ticket prices remain competitive and attractive. -

Big Ticket - Melbourne Legoland Discovery Centre Entry Ticket Plus SEA LIFE Melbourne Aquarium Entry Ticket

Big Ticket - Melbourne Legoland Discovery Centre Entry Ticket plus SEA LIFE Melbourne Aquarium Entry Ticket • • 1. One visit at Legoland Discovery Centre 1. Transport from/to hotels 2. One visit at SEA LIFE Melbourne Aquarium 2. Food & beverages not listed as Inclusions *PLEASE NOTE: The first attraction you visit must be 3. Souvenirs Legoland Discovery Centre. 4. Travel Insurance Depature point 【Covid Operating Hours】 ● Legoland Discovery Centre - Please note: the attraction will close on every Tuesday and Wednesday until further notice. - During VIC school holidays the attraction will be open 7 days a week from 09:30 to 17:30 (last entry at 15:30). - Pre-purchased open-dated tickets must pre-book timeslot before visiting each attraction. ● SEA LIFE Melbourne Aquarium - Please note: the attraction will close on every Tuesday and Wednesday until further notice. - During VIC school holidays the attraction will be open 7 days a week from 10:00 to 17:30 (last entry at 16:30). - Pre-purchased open-dated tickets must pre-book timeslot before visiting each attraction. How to get there ● SEA LIFE Melbourne Aquarium Address: King St, Melbourne VIC 3000, Australia ● LEGOLAND® Discovery Centre Melbourne Address: Level 2, Chadstone – The Fashion Capital 1341 Dandenong Road, Chadstone VIC 3148 Operating hours *Covid Operating Hours - SEA LIFE Melbourne (Thursdays to 10:00 - Last Entry: Mondays) 17:00 16:00 *Covid Operating Hours - SEA LIFE Melbourne (Tuesdays, Closed Wednesdays) *Covid Operating Hours - Legoland Discovery Centre (Thursdays to 09:30 -

Creating a Theme Park

CREATING A THEME PARK HOME SCHOOLING RESOURCES PACK Designed and created by J. Gray (Key Stage 2 Teacher) for Merlin Annual Pass and Merlin Magic Making. © Merlin Entertainments 2021 WELCOME PARENT/CARER NOTES Dear Parents/Carers, Welcome to our ‘Creating a Theme Park’ Home Schooling Resources Pack. These resources have been especially created with Key Stage 2 children in mind but can be enjoyed by adults and children alike during these difficult times. This pack will place you at the heart of Merlin Magic Making (MMM), our in-house creative and project delivery team, as children set out to create their own imaginary theme park within the United Kingdom through 4 key approaches; Finding, Creating, Producing and Delivering the Magic. The worksheets contained within this pack will guide you through each stage, providing you and your family with hours of fun! We would love to see some of your work, so don’t forget to tag us on social media using the hashtag #MagicMakingPack. Keep safe! Merlin Annual Pass Designed and created by J. Gray (Key Stage 2 Teacher) for Merlin Annual Pass and Merlin Magic Making. © Merlin Entertainments 2021 INDEX 1. FINDING THE MAGIC A. PLOTTING THE LOCATIONS OF UK CITIES ON A MAP B. PLOTTING MERLIN ATTRACTIONS ON A MAP C. RESEARCHING UK CITIES D. COMPARING SIMILARITIES AND DIFFERENCES 2. CREATING THE MAGIC A. RESEARCHING IMAGINARY WORLDS B. CREATING AN IMAGINARY WORLD C. WRITING ABOUT YOUR IMAGINARY WORLD D. DESIGNING YOUR THEME PARK’S LOGO E. DESIGNING YOUR THEME PARK’S UNIFORM 3. PRODUCING THE MAGIC A. BUILDING YOUR PARK 4. -

Deep-Sea Life Issue 16, January 2021 Cruise News Sedimentation Effects Survey Series (ROBES III) Completed

Deep-Sea Life Issue 16, January 2021 Despite the calamity caused by the global pandemic, we are pleased to report that our deep ocean continues to be investigated at an impressive rate. Deep-Sea Life 16 is another bumper issue, brimming with newly published research, project news, cruise news, scientist profiles and so on. Even though DOSI produce a weekly Deep-Sea Round Up newsletter and DOSI and DSBS are active on social media, there’s still plenty of breaking news for Deep- Sea Life! Firstly a quick update on the status of INDEEP. As most of you are aware, INDEEP was a legacy programme of the Census of Marine Life (2000-2010) and was established to address knowledge gaps in deep-sea ecology. Among other things, the INDEEP project played central role in the creation of the Deep-Ocean Stewardship Initiative and funded initial DOSI activities. In 2018, the DOSI Decade of Ocean Science working group was established with a view to identifying key priorities for deep-ocean science to support sustainable development and to ensure deep- ocean ecological studies were included in the UN Decade plans via truly global collaborative science. This has resulted in an exciting new initiative called “Challenger 150”. You are all invited to learn more about this during a webinar on 9th Feb (see p. 22 ). INDEEP has passed on the baton and has now officially closed its doors.Eva and I want to sincerely thank all those that led INDEEP with us and engaged in any of the many INDEEP actions. It was a productive programme that has left a strong legacy. -

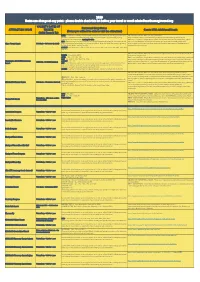

2020 Dates Can Change at Any Point - Please Double Check This List Before Your Travel Or Email [email protected]

2020 Dates can change at any point - please double check this list before your travel or email [email protected] VALIDITY DATES OF Restricted Entry Dates ATTRACTION NAME TICKETS Guests With Additional Needs (Dates you will not be able to visit the attraction) (Valid From & To) APRIL – Easter Bank Holiday – not restricted but we strongly advise not attending at this time as • GUESTS WITH ADDITIONAL NEEDS – please visit the Park is expected to be extremely busy which can have an effect on travel time, parking, https://www.altontowers.com/media/buhjammz/online-resort-access-guide-2019.pdf queuing for ride access passes, queuing for rides • RIDE ACCESS PASSES - Magic Wand’s tickets do not cover ride access or priority entry, please MAY – Bank Holidays – not restricted but we strongly advise not attending on these dates as the visit. For full information including a form to help you save time on the day please visit - Alton Towers Resort 21st March – 1st October (included) park is expected to be extremely busy which can have an effect on travel time, parking, queuing https://support.altontowers.com/hc/en-us/articles/360000458092-What-is-the-Ride-Access- for ride access passes, queuing for rides System-and-how-do-I-apply- AUGUST – not valid on 1st, 2nd, 7th, 8th, 9th, 14th, 15th, 16th, 21st, 22nd, 23rd, 28th, 29th, 30th and 31st. • GUESTS WITH ADDITIONAL NEEDS –please visit https://www.chessington.com/plan/disabled- MARCH – Closed 24th & 25th guide-for-chessington.aspx APRIL – 10th, 11th, 12th, 13th • RIDE ACCESS PASSES - Magic Wand’s -

Mixed-Species Exhibits with Seals and Walrus

MIXED-SPECIES EXHIBITS WITH CARNIVORANS VI. Mixed-species exhibits with Eared Seals (Otariidae), Walrus (Odobenidae) and Earless Seals (Phocidae) Written by KRISZTIÁN SVÁBIK Assistant Curator, Budapest Zoo and Botanical Garden, Hungary Email: [email protected] 13th November 2018 Refreshed: 6th June 2020 Cover photo © Krisztián Svábik Mixed-species exhibits with Eared Seals (Otariidae), Walrus (Odobenidae) and Earless Seals (Phocidae) 1 CONTENTS INTRODUCTION ........................................................................................................... 4 „Temporary” combinations ..................................................................................... 5 LIST OF SPECIES COMBINATIONS – OTARIIDAE .................................................... 8 California Sea Lion, Zalophus californianus .......................................................... 9 South American Sea Lion, Otaria byronia ............................................................10 Australian Sea Lion, Neophoca cinerea ................................................................ 11 Steller Sea Lion, Eumetopias jubatus .................................................................... 12 Northern Fur Seal, Callorhinus ursinus ................................................................ 13 South American Fur Seal, Arctocephalus australis .............................................. 14 Afro-Australian Fur Seal, Arctocephalus pusillus ................................................. 15 New Zealand Fur Seal, Arctocephalus forsteri