Pimlico & Westminster Q3 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Venue: City of Westminster College: Paddington Green Campus, Paddington Green, London W2 1NB

Venue: City of Westminster College: Paddington Green Campus, Paddington Green, London W2 1NB Google Maps Link: https://maps.google.co.uk/maps?ie=utf- 8&gl=uk&daddr=Paddington+Green+Campus,+Paddington+Green,+London+W2+1NB&panel=1&f=d &fb=1&dirflg=d&geocode=0,51.521366,- 0.174933&cid=0,0,10359591107328907017&hq=city+of+westminster+college&hnear=city+of+west minster+college PDF London Underground Map: http://www.tfl.gov.uk/assets/downloads/standard-tube-map.pdf Nearest Tube Station to City of Westiminster College: Edgware Road served by the Bakerloo, Hammersmith & City, District and Circle Lines. Hotels The venue is extremely close to PADDINGTON which is chocca with hotels and a bit of a tourist hotspot. You will find hotels across all price points here. Paddington is also a major mainline station and walking distance to the college. Directions From Nearest Mainline Stations From Euston Station: Allow 40 mins from the Euston to the College including walking time By Black Cab: A cab will get you there in less than 15 mins – will cost under £10. By Tube: You will have to physically leave Euston Mainline Station and walk the 5 mins to Euston Square where you can get on the Hammersmith & City or Circle Line to Edgware Road. By Bus: The Number 18 from Euston runs to the Edgware Road. It leaves from the main road outside Euston Station but you need to cross the main road and check you are going in the direction of Harlesden. The buses will not accept money, so you either need to Purchase an Oyster Card and put money on it or you some but stops have ticket machines by them but not all. -

City of Westminster

St. Joseph’s Catholic Primary School Headteacher: Mrs. K Husain Deputy Headteacher: Dr. N Fernandes Viana Jesus said: ‘I have come that they may have life and have it to the full’. Dear Parents, 2nd November 2018 Thank you to all the parents who attended the Funding Update meetings in school on Tuesday. The school has been one of the lowest funded primary schools in Westminster for several years. However, the recent funding changes because of the new National Funding Formula, the fall in primary age children in Westminster in recent years and the increased costs faced by all schools have fundamentally changed the financial position of the school. To maintain the current enriched curriculum and to provide the best education for the children that we can, we rely on your financial help and ask for. Your financial support currently takes two forms. Firstly, the fundraising of the School Association, this is still very strong: in 2017/18 they raised approximately £130,000. For this we are grateful, and long may it continue. Secondly, contributions to the Governors’ Fund. This has dropped by over 40% in recent years. Considering the recent funding changes and costs pressures we are asking all parents to consider donating monthly to the Governors’ fund or increase the amount they currently donate. Monthly contributions will provide Governors’ with a certainty to plan. We are looking to target annual contributions of £200,000 to the fund which is a £160,000 increase from the current level. I must stress that any contributions are voluntary, and all funds received are used for the benefit of all the children at the school. -

Pimlico Sw1 16697

PIMLICO SW1 16,697 - 52,442 Sq Ft Refurbished Offices to Let A LANDMARK PIMLICO OFFICE BUILDING One Drummond Gate is a contemporary office building with a recently refurbished high quality reception. The building totals 108,527 sq ft (10,083 Sq M) arranged over Lower Ground to Fourth floors, we currently have 52,442 sq ft of available office accommodation. SPECIFICATION VAV air-conditioning / fan coil on ground floor Male, female & DDA WCs Part raised floor Metal tiled suspended acoustic ceiling 3 x16 passenger lifts Goods lift 24 hour access Cycle storage Car parking (by separate arrangement) Excellent natural light & impressive views over London (3rd & 4th floors) Refurbished reception area Fourth Floor THE AVAILABLE ACCOMMODATION IS OVER THE GROUND, THIRD AND FOURTH FLOORS The accommodation is arranged in an efficient rectangular shape, wrapped around the central atrium and lift lobby. The upper floors draw light from the central atrium and floor to ceiling windows on all sides of the floor plate. Each upper floor possesses two points of access and are partially fitted out with a number of meeting rooms, shower facilities and the remaining as open plan space. The large windows and views across London make the upper floors a very attractive prospect to any incoming occupier looking for highly productive and inspiring space for all their staff. TYPICAL UPPER FLOOR 17,941 SQ FT / 1,667 SQ M Atrium ACCOMMODATION Atrium Floor Sq Ft Sq M Fourth 16,697 1,551 Third 17,941 1,667 Ground 17,804 1,654 Total 52,442 4,872 For indicative purposes only, not to scale. -

Character Overview Westminster Has 56 Designated Conservation Areas

Westminster’s Conservation Areas - Character Overview Westminster has 56 designated conservation areas which cover over 76% of the City. These cover a diverse range of townscapes from all periods of the City’s development and their distinctive character reflects Westminster’s differing roles at the heart of national life and government, as a business and commercial centre, and as home to diverse residential communities. A significant number are more residential areas often dominated by Georgian and Victorian terraced housing but there are also conservation areas which are focused on enclaves of later housing development, including innovative post-war housing estates. Some of the conservation areas in south Westminster are dominated by government and institutional uses and in mixed central areas such as Soho and Marylebone, it is the historic layout and the dense urban character combined with the mix of uses which creates distinctive local character. Despite its dense urban character, however, more than a third of the City is open space and our Royal Parks are also designated conservation areas. Many of Westminster’s conservation areas have a high proportion of listed buildings and some contain townscape of more than local significance. Below provides a brief summary overview of the character of each of these areas and their designation dates. The conservation area audits and other documentation listed should be referred to for more detail on individual areas. 1. Adelphi The Adelphi takes its name from the 18th Century development of residential terraces by the Adam brothers and is located immediately to the south of the Strand. The southern boundary of the conservation area is the former shoreline of the Thames. -

MJC Media Guide

2021 MEDIA GUIDE 2021 PIMLICO/LAUREL MEDIA GUIDE Table of Contents Staff Directory & Bios . 2-4 Maryland Jockey Club History . 5-22 2020 In Review . 23-27 Trainers . 28-54 Jockeys . 55-74 Graded Stakes Races . 75-92 Maryland Million . 91-92 Credits Racing Dates Editor LAUREL PARK . January 1 - March 21 David Joseph LAUREL PARK . April 8 - May 2 Phil Janack PIMLICO . May 6 - May 31 LAUREL PARK . .. June 4 - August 22 Contributors Clayton Beck LAUREL PARK . .. September 10 - December 31 Photographs Jim McCue Special Events Jim Duley BLACK-EYED SUSAN DAY . Friday, May 14, 2021 Matt Ryb PREAKNESS DAY . Saturday, May 15, 2021 (Cover photo) MARYLAND MILLION DAY . Saturday, October 23, 2021 Racing dates are subject to change . Media Relations Contacts 301-725-0400 Statistics and charts provided by Equibase and The Daily David Joseph, x5461 Racing Form . Copyright © 2017 Vice President of Communications/Media reproduced with permission of copyright owners . Dave Rodman, Track Announcer x5530 Keith Feustle, Handicapper x5541 Jim McCue, Track Photographer x5529 Mission Statement The Maryland Jockey Club is dedicated to presenting the great sport of Thoroughbred racing as the centerpiece of a high-quality entertainment experience providing fun and excitement in an inviting and friendly atmosphere for people of all ages . 1 THE MARYLAND JOCKEY CLUB Laurel Racing Assoc. Inc. • P.O. Box 130 •Laurel, Maryland 20725 301-725-0400 • www.laurelpark.com EXECUTIVE OFFICIALS STATE OF MARYLAND Sal Sinatra President and General Manager Lawrence J. Hogan, Jr., Governor Douglas J. Illig Senior Vice President and Chief Financial Officer Tim Luzius Senior Vice President and Assistant General Manager Boyd K. -

Liste D'hôtels Pour Le Pick-Up

Liste d’hôtels pour le pick-up CODE NOM ADRESSE HEURE MÉTRO POSTAL Abbey & Westpoint 168-176 Sussex Gardens W2 1TP 07:10 Paddington ABC Hyde Park 121 Sussex Gardens W2 2RU 07:00 Paddington Apollo Hotel 64 Queensborough Terrace W2 3SH 07:20 Queensway Athena Hotel 110-114 Sussex Gardens W2 1UA 07:00 Paddington Belmont Hotel 100-104 Sussex Gardens W2 1UH 07:00 Paddington Best Western Phoenix 1-8 Kensington Gardens W2 4BH 07:20 Queensway 36-38 Queensborough Byron Hotel Terrace W2 3SH 07:20 Queensway Camelot House 18 Sussex Gardens W2 1UL 07:00 Paddington Carlton Hotel 90 Belgrave Road SW1V 2BJ 07:45 Pimlico Central Park 49 QueensboroughTerrace W2 3SS 07:20 Queensway Citadines South Kensington 35 Gloucester Road SW7 4PL 07:25 Gloucester Road Classic Hotel 92 Sussex Gardens W2 1UH 07:00 Paddington Copthorne Tara Scarsdale Place W8 5SR 07:40 High St.Kensington Corus Hyde Park 1-7 Lancaster Gate W2 3LG 07:30 Lancaster Gate Crowne Plaza Kensington 100 Cromwell Road SW7 4ER 07:45 Gloucester Road Cumberland Hotel (main entrance) Great Cumberland Place W1C 1LZ 07:35 Marble Arch Danubius 18 Lodge Rd NW8 7JT 07:20 St John's Wood Darlington Hotel 111-117 Sussex Gardens W2 2RU 07:00 Paddington Days Inn Hyde Park 148-152 Sussex Gardens W2 1UD 07:10 Paddington Doubletree by Hilton Hyde Park 150 Bayswater Road W2 4RT 07:05 Queensway Doubletree by Hilton Tower of London 7 Pepy's Street EC3N 4AF 07:15 Tower Hill Express Holiday Inn Victoria 106-110 Belgrave Road SW1V 2BJ 07:45 Pimlico Four Stars Hotel 26-28 Sussex Gardens W2 1UL 07:00 Paddington Fraser Suites -

Irina Porter, Uncovering Kilburn's History: Part 7

Uncovering Kilburn’s History – Part 7 Thank you for joining me again for the final part of this Kilburn local history series. 1. New flats in Cambridge Road, opposite Granville Road Baths, c.1970. (Brent Archives online image 10127) In Part 6 we saw the major rebuilding that took place, particularly in South Kilburn, between the late 1940s and the 1970s. Many of the workers on the building sites were Irish. The new wave of Irish immigration to Northwest London, which reached its peak in the 1950s, was quickly transforming the area. As well as abundant work, Kilburn offered plenty of cheap accommodation, and a bustling High Road with cultural and eating establishments, many of them catering for the Irish population, who soon represented a majority in the area. ‘County Kilburn’ was dubbed Ireland’s 33rd county. 2. Kilburn's Irish culture – an Irish Festival poster and Kilburn Gaels hurling team. (From the internet) The Irish community, close-knit and mutually supportive, hit the headlines in the negative way in the 1970s, when Kilburn became a focal point for “the Troubles” in London. On 8 June 1974, an estimated 3,000 came out onto the streets of Kilburn for the funeral procession of Provisional IRA member Michael Gaughan. An Irishman, who had lived in Kilburn, Gaughan was imprisoned for an armed bank robbery in 1971 and in 1974 died as the result a hunger strike. Gaughan’s coffin, accompanied by an IRA guard of honour, was taken from the Crown at Cricklewood through Kilburn to the Catholic Church of the Sacred Heart in Quex Road, before being flown to Dublin for another ceremony and funeral. -

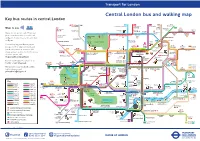

Central London Bus and Walking Map Key Bus Routes in Central London

General A3 Leaflet v2 23/07/2015 10:49 Page 1 Transport for London Central London bus and walking map Key bus routes in central London Stoke West 139 24 C2 390 43 Hampstead to Hampstead Heath to Parliament to Archway to Newington Ways to pay 23 Hill Fields Friern 73 Westbourne Barnet Newington Kentish Green Dalston Clapton Park Abbey Road Camden Lock Pond Market Town York Way Junction The Zoo Agar Grove Caledonian Buses do not accept cash. Please use Road Mildmay Hackney 38 Camden Park Central your contactless debit or credit card Ladbroke Grove ZSL Camden Town Road SainsburyÕs LordÕs Cricket London Ground Zoo Essex Road or Oyster. Contactless is the same fare Lisson Grove Albany Street for The Zoo Mornington 274 Islington Angel as Oyster. Ladbroke Grove Sherlock London Holmes RegentÕs Park Crescent Canal Museum Museum You can top up your Oyster pay as Westbourne Grove Madame St John KingÕs TussaudÕs Street Bethnal 8 to Bow you go credit or buy Travelcards and Euston Cross SadlerÕs Wells Old Street Church 205 Telecom Theatre Green bus & tram passes at around 4,000 Marylebone Tower 14 Charles Dickens Old Ford Paddington Museum shops across London. For the locations Great Warren Street 10 Barbican Shoreditch 453 74 Baker Street and and Euston Square St Pancras Portland International 59 Centre High Street of these, please visit Gloucester Place Street Edgware Road Moorgate 11 PollockÕs 188 TheobaldÕs 23 tfl.gov.uk/ticketstopfinder Toy Museum 159 Russell Road Marble Museum Goodge Street Square For live travel updates, follow us on Arch British -

Charming Pimlico 2 Bedroom Split Level Apartment With

C HARMING PIMLICO 2 BEDROOM SPLIT LEVEL APARTMENT WITH BALCONY CAMBRIDGE STREET, PIMLICO, LONDON, SW1V 4QG Furnished, £555 pw (£2,405 pcm) + £285 inc VAT tenancy paperwork fee and other charges apply.* Available Now CHAR MING PIMLICO 2 BEDROOM SPLIT LEVEL APART MENT WITH BALCONY. CAMBR IDGE STREET, PIMLICO, £555 pw (£2,405 pcm) Furnished • 2 Bedrooms • 2 Bathrooms • 1 Receptions • Beautiful period maisonette • 2 bedrooms • 2 bathrooms • Roof terrace and balcony • Reception (with dining area) • Kitchen • 691 sq ft (approx) • Victoria Line (approx) 0.3 miles (Pimlico) • Fully furnished • EPC Rating = D • Council Tax = F Description A beautiful 2 bedroom split level apartment situated on the first and second floor of an attractive Pimlico white stucco fronted building, it neatly combines its charming period features with contemporary fixtures and fittings. This property was previously owner occupied, this is evident in the high quality refurbishment and furniture, making it an unusually attractive home on the lettings market. The apartment, of approx 691 sq ft comprises: 2 bedrooms, 2 bathrooms, kitchen, reception (with dining area), balcony (front) and terrace (rear). Energy Performance A copy of the full Energy Performance Certificate is available on request. Viewing Strictly by appointment with Savills. Location Cambridge Street is set in the heart of the Pimlico 'grid', running to the south of Victoria and east of Belgravia. The property is within reach of the many amenities, restaurants, cafes and shops of Victoria, Westminster and Pimlico. Transport Links include: Victoria Line (Pimlico): approx 0.5 miles. Circle & District Lines and mainline rail services (Victoria): approx 0.5 miles FLOORPLANS Gross inte rnal area: 691 sq ft, 64.2 m² *Tenancy paperwork fees including drawing up the tenancy agreement, reference charge for one tenant - £285 (inc VAT). -

Elephant Park

Retail & Leisure 2 Embrace the spirit Retail at Elephant Park Embrace the spirit Retail at Elephant Park 3 Over 100,000 sq ft of floorspace Elephant Park: including affordable retail Opportunity-packed 50+ Zone 1 retail & shops, bars leisure space in & restaurants Elephant & Castle Four curated retail areas 4 Embrace the spirit Retail at Elephant Park Embrace the spirit Retail at Elephant Park 5 Be part of 2,700 a £2.3 billion new homes regeneration scheme at 97,000 sq m largest new park in Elephant Park Central London for 70 years Introducing Elephant Park, set to become the new heart of Elephant & Castle. This ambitious new development will transform and reconnect the area with its network of walkable streets and tree-lined squares, offering residents £30m transport investment and workers a place to meet, socialise and relax. Goodge Street Exmouth Market 6 Embrace the spirit Retail at Elephant Park Embrace the spirit Retail at Elephant Park 7 Barbican Liverpool Street Marylebone Moorgate Fitzrovia Oxford Circus Shopping Holborn Oxford Circus Farringdon Bond Street Tottenham Marble Arch Court Road Covent Garden THE STRAND Cheapside Soho Shopping Whitechapel City St Paul’s City of The Gherkin Thameslink Catherdral THE STRANDTemple Covent Garden London Leadenhall Market Tower Hill Leicester Shopping WATERLOO BRIDGE Monument Mayfair Square BLACKFRIARS BRIDGE SouthwarkPiccadilly One of London’s fastest-developing areas Circus Embankment LONDON BRIDGE Tower of St James’s Charing Tate Modern London Cross Southbank Centre London Green Park Borough Bridge Food Markets Market Flat Iron A3200 TOWER BRIDGE Elephant Park will offer an eclectic range of retail, leisure and F&B, all crafted to meet the demands Southwark Markets The Shard of the diverse customer profile. -

London's Last Great Plague

London's last great plague [Wellcome Library, London] Vanessa Harding, Birkbeck London Weekly Bill of Mortality, 21-28 February 1664/5 [Wellcome Library, London] Deaths by parish, grouped into: ‘the 97 parishes within the walls’ __________ ‘the 16 parishes without the walls, and the pesthouse’ __________ ‘the 12 out parishes in Middlesex and Surry’ ________ ‘the 5 parishes in the city and liberties of Westminster’ London and the Bills of Mortality A: the 97 parishes within the walls B: the 16 parishes outside the walls but partly or wholly within the City's jurisdiction C: the 10 (later 12) outparishes in Middlesex and Surrey D: the Westminster parishes Verso of London Weekly Bill of Mortality, 21-28 February 1664/5 [Wellcome Library, London] ‘The Diseases and Casualties this Week’, together with the total Christenings and Burials by gender, the decrease in burials over the preceding week, the number of parishes infected with or clear of the plague, and the statutory weight of a penny and halfpenny loaf of bread. [I] observed that most of them who constantly took in the weekly Bills of Mortality, made little other use of them, then to look at the foot, how the Burials increase, or decrease; And, among the Casualties, what had happened rare, and extraordinary in the week currant; so as they might take the same as a text to talk upon, in the next Company; and withall, in the Plague-time, how the Sickness increased, or decreased, that so the Rich might judge of the necessity of their removall, and Trades-men might conjecture what doings they were like to have in their respective dealings: John Graunt, Natural and Political Observations on the Bills of Mortality (1662) 27 July. -

St John's Wood

St John’s Wood Area Guide St John’s Wood lies within the City of Westminster in the North West London. Once part of the Great Middlesex Forest, the area was one of the first London suburbs to be developed from the early 19th century onwards, mainly with low density “villa” type housing. St. John’s Wood was once part of the Great Forest of Middlesex, its name derived from its mediaeval owners, the Knights of the Order of St John of Jerusalem. After the Reformation and the Dissolution of monastic orders, St John’s Wood became Crown land, and Henry VIII established Royal Hunting Grounds in what became known as Marylebone Park, to the north of which lay St John’s Wood. The area remained in agricultural use until the end of the eighteenth century, when plans for residential development first appeared. Building began in 1809 in Alpha Road, on the southern boundary of St John’s Wood. One of the first London suburbs to be developed, it was a unique pattern of development and mainly planned with a large amount of low density, semi-detached villas, abandoning the familiar terraced house. Although many of the original houses and gardens disappeared during the twentieth century, through bomb damage and the building of new roads, railways and schools, much of the original character of the area remains. In the 1960s, most of St John’s Wood was designated a Conservation Area and its houses listed by English Heritage. It remains a highly desirable residential location, and one of the most expensive areas of London.