St Barbara Mining (SBM.AX) – Good Company but Fully Priced

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TORIAN RESOURCES LIMITED (ASX:TNR) Key Participant in the Zuleika Corridor Gold Camp Is There a Better Goldfield Anywhere in the World Today? SUMMARY

TORIAN RESOURCES LIMITED (ASX:TNR) Key participant in the Zuleika Corridor Gold Camp Is there a better goldfield anywhere in the world today? SUMMARY Torian Resources Limited (TNR) is a gold explorer with a difference. Its access to more 5 October 2016 – Initiation than 220km2 of key tenements in the Coolgardie Domain along the highly productive and high grade Zuleika Shear Corridor near Kundana, just 40km west of Kalgoorlie, gives it an 18 Month Price Target: A $0.80 excellent position in Australia’s fifth largest producing and most exciting goldfield. The Zuleika Corridor is the most exciting goldfield in Australia today. It is CAPITAL STRUCTURE revitalising Kalgoorlie as a global gold production centre. TNR’s Mt Stirling Project is also in line to soon produce a modest JORC resource. Share Price $0.175 KEY POINTS Net Asset Value A$16m 12 Month Range $0.095 - $0.38 TNR is earning 49% of ~223km2 along the Zuleika Corridor by spending $5m Market Cap (diluted) $17.0m Enterprise Value $13.2m Zuleika Corridor Coolgardie Domain already has >7moz in resources Issued Shares 96.94m 7 major recent gold discoveries in contiguous ground by NST & EVN 55,000m of RAB and RC drilling planned by TNR for FY17 Existing local mill facilities allow rapid discovery to production potential Cash $3.8m Mt Stirling offers high-grade, >98% recovery near-term production potential DIRECTORS A$3.5m raised in recent capital issue to fully fund its FY17 programme TNR’s exciting Zuleika tenements include a cumulative 25km (2nd largest) of strike of the Andrew Sparke Non-Executive Chairman black Centenary Shale within the K2/Strzelecki Structures that host the most important Matt Sullivan Managing Director high grade deposits in the Zuleika Corridor Gold Camp. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

17 Newcrest Sustainability Report

2017 SUSTAINABILITY REPORT ‘SAFETY IS SOMETHING WE CAN NEVER BE COMPLACENT ABOUT AND OUR FOCUS WILL NOT WANE OVER THE COMING YEAR.’ SANDEEP BISWAS MANAGING DIRECTOR AND CHIEF EXECUTIVE OFFICER MESSAGE FROM THE CHIEF CONTENTS 2 EXECUTIVE OFFICER WHO 4 WE ARE ABOUT THIS 28 REPORT 32 OUR Our People 32 PEOPLE ECONOMIC 50 PERFORMANCE SOCIAL 58 PERFORMANCE 50 ENVIRONMENTAL Economic 74 STEWARDSHIP Performance DATA 86 TABLES ASSURANCE 102 STATEMENT CORPORATE 105 DIRECTORY 58 Social Performance 74 Environmental Stewardship ON THE COVER Local indigenous Newcrest-MacMahon’s alliance employees, Jackson Ware and Florence Alfred, at Telfer operation in Western Australia. MESSAGE FROM THE CHIEF EXECUTIVE OFFICER ur commitment to achieving our vision is evident in the genuine Newcrest’s vision is to be the progress our people have achieved over the last three years; through improving safety and addressing major hazards, Miner of Choice. in implementing Edge, improving operational performance, Oand populating our growth pipeline. We have made significant headway on aligning our workforce with our priorities and in engaging We aim to achieve our vision with our stakeholders. by applying sustainable During the year, Newcrest applied for and successfully attained membership with the International Council on Mining and Metals practices across all aspects (ICMM). The ICMM brings together the world’s leading mining and metals companies and associations to address core sustainable development of our business. opportunities and challenges faced by the industry. Our admission is testament to the strong sustainability foundation we have built. Our progress in our safety performance is testament to our people and their firm commitment to safety for themselves, their families and their colleagues. -

Steel Intouch WA #8:Layout 1 1/6/07 10:53 AM Page 2 Steelintouch

Steel InTouch WA #8:Layout 1 1/6/07 10:53 AM Page 2 steelintouch News for Western Australian Customers ISSUE NUMBER 8 WINTER 2007 with BlueScope Steel 24 hours a day, seven days a week. WELCOME See page 2 for details. We include a ‘Tech Talk’ section addressing technical queries relating to XLERPLATE® steel. Welcome to the Winter edition of XLERPLATE® As always, we welcome your feedback and on behalf Steel In Touch. of the BlueScope XLERPLATE® steel team, thank you for In this issue we bring you the latest news on your continued support. Happy reading! developments in the industry, XLERPLATE® steel product updates, and announce some of our monthly prize winners in the ‘Backing the Aussie Spirit’ campaign. We also introduce you to the advantages of using our online business portal, Bluescopesteelconnect.com™ which provides instant access to 12 months’ data history, Elly Pilkadaris allowing you to cost-effectively and efficiently transact State Sales Manager - Western Australia GOLDEN OPPORTUNITY FOR WA MINING EQUIPMENT FABRICATOR Riding the wave of the rolled structural steel sections to hold the mining and resources componentry in place and provide workers boom, Western Australia’s with access to it,” JV Engineering’s JV Engineering has landed Director Peter Robbins says. a major contract for the JV Engineering began fabrication work at $1.8 billion Boddington its Welshpool workshop in July 2006, and Gold Mine (BGM) is expected to finish the job in early 2008. Expansion Project. BGM is expected to start production later The BGM project involves that year. building a new processing “The greatest challenge we face with large plant to retrieve gold and contracts like this is meeting the delivery copper ore from deadline,” Mr Robbins says. -

ANNUAL REPORT 2019 OUR PURPOSE WHO WE ARE Our Purpose Is to Make a South32 Is a Globally Diversified Mining and Metals Company

6 September 2019 South32 Limited (Incorporated in Australia under the Corporations Act 2001 (Cth)) (ACN 093 732 597) ASX / LSE / JSE Share Code: S32 ADR: SOUHY ISIN: AU000000S320 south32.net 2019 ANNUAL REPORT South32 Limited (ASX, LSE, JSE: S32; ADR: SOUHY) (South32) today releases its 2019 Annual Report, Corporate Governance Statement and Appendix 4G. These documents are also available online at https://www.south32.net/investors-media/annual-report-suite. The Notice of Annual General Meeting will be dispatched by no later than 25 September 2019. A hard copy of the Annual Report will also be dispatched on the same day to those shareholders who have requested one. Yours sincerely Nicole Duncan Company Secretary About South32 South32 is a globally diversified mining and metals company. We produce bauxite, alumina, aluminium, energy and metallurgical coal, manganese, nickel, silver, lead and zinc at our operations in Australia, Southern Africa and South America. We are also the owner of a high grade zinc, lead and silver development option in North America and have several partnerships with junior explorers with a focus on base metals. Our purpose is to make a difference by developing natural resources, improving people’s lives now and for generations to come, and to be trusted by our owners and partners to realise the potential of their resources. Further Information Investor Relations Alex Volante Tom Gallop T +61 8 9324 9029 T +61 8 9324 9030 M +61 403 328 408 M +61 439 353 948 E [email protected] E [email protected] Media Relations James Clothier Jenny White T +61 8 9324 9697 T +44 20 7798 1773 M +61 413 391 031 M +44 7900 046 758 E [email protected] E [email protected] Further information on South32 can be found at www.south32.net. -

Columbium (Niubium) and Tantalum

COLUMBIUM (NIOBIUM) AND TANTALUM By Larry D. Cunningham Domestic survey data and tables were prepared by Robin C. Kaiser, statistical assistant, and the world production table was prepared by Regina R. Coleman, international data coordinator. Columbium [Niobium (Nb)] is vital as an alloying element in economic penalty in most applications. Neither columbium nor steels and in superalloys for aircraft turbine engines and is in tantalum was mined domestically because U.S. resources are of greatest demand in industrialized countries. It is critical to the low grade. Some resources are mineralogically complex, and United States because of its defense-related uses in the most are not currently (2000) recoverable. The last significant aerospace, energy, and transportation industries. Substitutes are mining of columbium and tantalum in the United States was available for some columbium applications, but, in most cases, during the Korean Conflict, when increased military demand they are less desirable. resulted in columbium and tantalum ore shortages. Tantalum (Ta) is a refractory metal that is ductile, easily Pyrochlore was the principal columbium mineral mined fabricated, highly resistant to corrosion by acids, a good worldwide. Brazil and Canada, which were the dominant conductor of heat and electricity, and has a high melting point. pyrochlore producers, accounted for most of total estimated It is critical to the United States because of its defense-related columbium mine production in 2000. The two countries, applications in aircraft, missiles, and radio communications. however, no longer export pyrochlore—only columbium in Substitution for tantalum is made at either a performance or upgraded valued-added forms produced from pyrochlore. -

201005 Newcrest Annual Report

2020 Annual Report We are well positioned to deliver on our near-term growth options of Havieron, Red Chris and Wafi-Golpu. Sandeep Biswas, Managing Director and Chief Executive Officer OUR VISION To be the Miner of ChoiceTM for our people, shareholders, host communities, partners and suppliers. LIHIR, PAPUA NEW GUINEA NEWCREST 2020 ANNUAL REPORT 1 OUR COMPANY OUR MISSION Asset Overview 04 Key Achievements for FY20 06 To safely deliver Chairman’s Report 08 superior returns to our Managing Director’s Review 10 stakeholders from finding, Safety & Sustainability 12 developing and operating People 14 gold/copper mines. Organic Growth Opportunities 16 Newcrest’s Value Proposition 18 The Board 20 Mineral Resources and Ore Reserves 24 Directors’ Report 34 Corporate Directory 184 2 FORGING A STRONGER NEWCREST Forging a Stronger Newcrest Our clear focus remains on eliminating The health and safety of fatalities and life-changing injuries from our business, while striving to make continual progress on reducing all injuries our people is of primary and health impacts. importance at Newcrest. We believe that a strong and enduring commitment to the health and safety of our workforce best reflects our values and underpins and sustains optimal business performance. To achieve Newcrest’s full potential for our stakeholders, our company strategy focuses on five key pillars, each with associated aspirations which were set in February 2016. Safety & People Operating Technology Profitable sustainability performance & innovation growth Our aspirations Zero -

Progress on the Leonora Province Plan

ASX Release / 21 June 2021 Progress on the Leonora Province Plan Highlights • An additional circa 1.4 million ounces added to Mineral Resources in the Leonora Province, an uplift of around 30% • Resource Development and Extensional drilling commenced • Additional Resource inventory supports a Mill Expansion Study • Gwalia Intermediates incorporated in the Life of Mine plan • Third party ore sources secured to fill the mill for FY22 Previously Reported Updated 1, 2 Mineral Resources0F 1F LPP Mineral Resources Resource Area Tonnes (Mt) Ounces (Moz) Tonnes (Mt) Ounces (Moz) Gwalia Deeps 22.6 4.4 22.6 4.4 Gwalia Open Pit - - 8.4 0.8 Tower Hill 5.1 0.6 5.1 0.6 Harbour Lights - - 12.9 0.6 Totals 27.7 5.0 49.0 6.4 Increase with updated Mineral Resources 44% 28% 1 Refer to ASX release 24 August ’30 June 2020 Ore Reserves and Mineral Resource Statements’ 2 Current Mineral Resources are stated as at 30 June 2020 and not adjusted for FY21 year to date depletion Investor Relations Mr David Cotterell Manager Investor Relations +61 3 8660 1959 ASX: SBM Media Relations Mr Ben Wilson GRACosway +61 407 966 083 ADR: STBMY Authorised by Mr Craig Jetson Managing Director & CEO 21 June 2021 St Barbara Limited Level 10, 432 St Kilda Road, Melbourne VIC 3004 T +61 3 8660 1900 F +61 3 8660 1999 ACN 009 165 066 Locked Bag 9, Collins Street East, Melbourne VIC 8003 W www.stbarbara.com.au Leonora Province Plan Progress In the December 2020 Investor briefing, St Barbara Limited (St Barbara) outlined its strategy to grow production sustainably, lower the Company’s cost profile, and deliver superior returns to shareholders through three stages of uplift for the business. -

Gwalia Investor and Analyst Site Visit 12 February 2016 Disclaimer

Kous Kirsten, General Manager Leonora Operations Rowan Cole, Company Secretary Gwalia investor and analyst site visit 12 February 2016 Disclaimer This presentation has been prepared by St Barbara Limited (“Company”). The material contained in this presentation is for information purposes only. This presentation is not an offer or invitation for subscription or purchase of, or a recommendation in relation to, securities in the Company and neither this presentation nor anything contained in it shall form the basis of any contract or commitment. This presentation may contain forward-looking statements that are subject to risk factors associated with exploring for, developing, mining, processing and sale of gold. Forward-looking statements include those containing such words as anticipate, estimates, forecasts, should, will, expects, plans or similar expressions. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the control of the Company, and which could cause actual results or trends to differ materially from those expressed in this presentation. Actual results may vary from the information in this presentation. The Company does not make, and this presentation should not be relied upon as, any representation or warranty as to the accuracy, or reasonableness, of such statements or assumptions. Investors are cautioned not to place undue reliance on such statements. This presentation has been prepared by the Company based on information available to it, including information from third parties, and has not been independently verified. No representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of the information or opinions contained in this presentation. -

2013 Global Gold Price Report Annually, Pwc Surveys Gold Mining Companies from Around the World

www.pwc.com/ca/mining 2013 Global Gold Price Report Annually, PwC surveys gold mining companies from around the world. This year, we contacted executives from a cross-section of senior, mid-tier and junior gold mining companies representing 35 million ounces of gold mined in 2012 and 35 million ounces expected to be mined in 2013. Inside 1 Survey participants 14 Interview with Randy Smallwood, President and CEO, Silver Wheaton Corporation 2 PwC’s point of view 17 Global silver price survey responses 4 Gold price performance 18 Deals activity in 2012 6 Interview with Jamie Sokalsky, President and CEO, Barrick Gold Corporation 20 Gold deal activity 8 Gold miners’ cash allocation and capital 22 Mining in South Africa — 2013 outlook investment strategies Back Contact information 10 Mine planning data ii Global gold price Global silver price survey participants survey participants We would like to thank the senior executives from the companies We would like to thank the senior executives listed below for participating in our Global Gold Price Survey. from the companies listed below for participating in our Global Silver Price Survey. Agnico-Eagle Mines Ltd McEwen Mining Inc Coeur d’Alene Mines Corp Amara Mining plc Midway Gold Corp Endeavour Silver Corp B2Gold Corp New Gold Inc First Majestic Silver Corp Barrick Gold Corp Newmont Mining Corp Fortuna Silver Mines Inc Caledonia Mining Corp Northern Star Mining Corp Great Panther Silver Ltd Cerro Grande Mining Corp OceanaGold Corp Impact Silver Corp Centerra Gold Inc Orvana Minerals Corp Pan American -

The Mineral Industry of Australia in 2008

2008 Minerals Yearbook AUSTRALIA U.S. Department of the Interior August 2010 U.S. Geological Survey THE MINERAL INDUS T RY OF AUS T RALIA By Pui-Kwan Tse Australia was one of the world’s leading mineral producing and the Brockman iron project in the Pilbara region of Western countries and ranked among the top 10 countries in the world Australia (Australian Bureau of Agricultural and Resource in the production of bauxite, coal, cobalt, copper, gem and Economics, 2009a). near-gem diamond, gold, iron ore, lithium, manganese ore, tantalum, and uranium. Since mid-2008, the global financial Minerals in the National Economy crisis had sharply weakened world economic activities, and the slowdown had been particularly pronounced in the developed Australia’s mining sector contributed more than $105 billion countries in the West. Emerging Asian economies were also to the country’s gross domestic product (GDP), or 7.7% of the adversely affected by the sharply weaker demand for exports GDP during fiscal year 2007-08. In 2008, the mining sector and tighter credit conditions. After a period of strong expansion, employed 173,900 people who worked directly in mining and an Australia’s economic growth decreased by 0.5% in the final additional 200,000 who were involved in supporting the mining quarter of 2008. Overall, Australia’s economy grew at a rate activities. Expectations of sustained levels of global demand for of 2.4% during 2008. During the past several years, owing to minerals led to increased production of minerals and metals in anticipated higher prices of mineral commodities in the world Australia, and the mineral industry was expected to continue markets, Australia’s mineral commodity output capacities to be a major contributor to the Australian economy in the next expanded rapidly. -

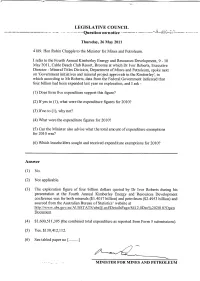

2011-08-09 Qon Exploration Expenditure

LEGISLATIVE COUNCIL C 'lff"\ 1"'.( "''1 ---------~~-~Question- on"notice ----------- ..'-?ibt;-:s::'.;"--- --_.- Thursday, 26 May 2011 4189. Hon Robin Chapple to the Minister for Mines and Petroleum. I refer to the Fourth Annual Kimberley Energy and Resources Development, 9 - 10 May 2011, Cable Beach Club Resort, Broome at which Dr Ivor Roberts, Executive Director - Mineral Titles Division, Department of Mines and Petroleum, spoke next on 'Government initiatives and mineral project approvals in the Kimberley', in which according to Mr Roberts, data from the Federal Government indicated that four billion had been expended last year on exploration, and 1 ask - (1) Does form five expenditure support this figure? (2) If yes to (1), what were the expenditure figures for 201O? (3) Ifno to (1), why not? (4) What were the expenditure figures for 2010? (5) Can the Minister also advise what the total amount of expenditure exemptions for 2010 was? (6) Which leaseholders sought and received expenditure exemptions for 2010? Answer (1) No. (2) Not applicable. (3) The exploration figure of four billion dollars quoted by Dr Ivor Roberts during his presentation at the Fourth Annual Kimberley Energy and Resources Development conference was for both minerals ($1.4017 billion) and petroleum ($2.4953 billion) and sourced from the Australian Bureau of Statistics' website at http://www.abs.gov.au/AUSST ATS/[email protected]/DetailsPage/8412.0Dec%20201 O?Open Document (4) $1,600,511,395 (the combined total expenditure as reported from Form 5 submissions). (5) Yes, $130,412,112.