Great Ocean Road World Class Tourism Investment Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Victoria Rural Addressing State Highways Adopted Segmentation & Addressing Directions

23 0 00 00 00 00 00 00 00 00 00 MILDURA Direction of Rural Numbering 0 Victoria 00 00 Highway 00 00 00 Sturt 00 00 00 110 00 Hwy_name From To Distance Bass Highway South Gippsland Hwy @ Lang Lang South Gippsland Hwy @ Leongatha 93 Rural Addressing Bellarine Highway Latrobe Tce (Princes Hwy) @ Geelong Queenscliffe 29 Bonang Road Princes Hwy @ Orbost McKillops Rd @ Bonang 90 Bonang Road McKillops Rd @ Bonang New South Wales State Border 21 Borung Highway Calder Hwy @ Charlton Sunraysia Hwy @ Donald 42 99 State Highways Borung Highway Sunraysia Hwy @ Litchfield Borung Hwy @ Warracknabeal 42 ROBINVALE Calder Borung Highway Henty Hwy @ Warracknabeal Western Highway @ Dimboola 41 Calder Alternative Highway Calder Hwy @ Ravenswood Calder Hwy @ Marong 21 48 BOUNDARY BEND Adopted Segmentation & Addressing Directions Calder Highway Kyneton-Trentham Rd @ Kyneton McIvor Hwy @ Bendigo 65 0 Calder Highway McIvor Hwy @ Bendigo Boort-Wedderburn Rd @ Wedderburn 73 000000 000000 000000 Calder Highway Boort-Wedderburn Rd @ Wedderburn Boort-Wycheproof Rd @ Wycheproof 62 Murray MILDURA Calder Highway Boort-Wycheproof Rd @ Wycheproof Sea Lake-Swan Hill Rd @ Sea Lake 77 Calder Highway Sea Lake-Swan Hill Rd @ Sea Lake Mallee Hwy @ Ouyen 88 Calder Highway Mallee Hwy @ Ouyen Deakin Ave-Fifteenth St (Sturt Hwy) @ Mildura 99 Calder Highway Deakin Ave-Fifteenth St (Sturt Hwy) @ Mildura Murray River @ Yelta 23 Glenelg Highway Midland Hwy @ Ballarat Yalla-Y-Poora Rd @ Streatham 76 OUYEN Highway 0 0 97 000000 PIANGIL Glenelg Highway Yalla-Y-Poora Rd @ Streatham Lonsdale -

CW Adventure Word Template

Our Self-Guided Walking Adventures are ideal for travelers with an independent spirit who enjoy exploring at their own pace. We provide authentic accommodations, luggage transfers, and some meals, along with comprehensive Route Notes, detailed maps, and 24-hour emergency assistance. This gives you the freedom to focus on the things that matter to you—no group, no guide, and no set schedule to stand in the way of enjoying your adventure, your way. The wild coast of Australia’s state of Victoria has long been hidden from view, an unspoiled green ribbon of rolling hills sandwiched between the scenic Great Ocean Road and the tempestuous surf of the Southern Ocean. Today, walkers can finally experience the primitive and pristine beauty of this staggeringly beautiful corner of Great Otway National Park, thanks to the recently completed Great Ocean Walk. Lace up your boots to explore almost 60 miles of untouched wilderness, choosing high trails over towering sea cliffs or beach hikes alongside crashing surf. From the charming village of Apollo Bay to the famed Twelve Apostles sea stacks, this is some of the most remote and remarkable terrain you are ever likely to traverse. Using rustic, homestead-style lodgings in sparsely populated seaside towns as your base, you hike through primeval manna gum forests where koalas linger high in the canopy and past wide grassland grazed by kangaroos. Trace heathland ablaze with vibrant wildflowers and lush wetlands where rivers and waterfalls meet the sea. Marvel at colossal shipwrecked anchors cemented in beach sand and stroll through working farmlands. But perhaps the real beauty of hiking the undulating Great Ocean Walk is this: few people have walked it before you, and it is pure privilege to count yourself among the first to witness its magnificence. -

Great Ocean Road and Scenic Environs National Heritage List

Australian Heritage Database Places for Decision Class : Historic Item: 1 Identification List: National Heritage List Name of Place: Great Ocean Road and Rural Environs Other Names: Place ID: 105875 File No: 2/01/140/0020 Primary Nominator: 2211 Geelong Environment Council Inc. Nomination Date: 11/09/2005 Principal Group: Monuments and Memorials Status Legal Status: 14/09/2005 - Nominated place Admin Status: 22/08/2007 - Included in FPAL - under assessment by AHC Assessment Recommendation: Place meets one or more NHL criteria Assessor's Comments: Other Assessments: : Location Nearest Town: Apollo Bay Distance from town (km): Direction from town: Area (ha): 42000 Address: Great Ocean Rd, Apollo Bay, VIC, 3221 LGA: Surf Coast Shire VIC Colac - Otway Shire VIC Corangamite Shire VIC Location/Boundaries: About 10,040ha, between Torquay and Allansford, comprising the following: 1. The Great Ocean Road extending from its intersection with the Princes Highway in the west to its intersection with Spring Creek at Torquay. The area comprises all that part of Great Ocean Road classified as Road Zone Category 1. 2. Bells Boulevarde from its intersection with Great Ocean Road in the north to its intersection with Bones Road in the south, then easterly via Bones Road to its intersection with Bells Beach Road. The area comprises the whole of the road reserves. 3. Bells Beach Surfing Recreation Reserve, comprising the whole of the area entered in the Victorian Heritage Register (VHR) No H2032. 4. Jarosite Road from its intersection with Great Ocean Road in the west to its intersection with Bells Beach Road in the east. -

Corangamite Heritage Study Stage 2 Volume 3 Reviewed

CORANGAMITE HERITAGE STUDY STAGE 2 VOLUME 3 REVIEWED AND REVISED THEMATIC ENVIRONMENTAL HISTORY Prepared for Corangamite Shire Council Samantha Westbrooke Ray Tonkin 13 Richards Street 179 Spensley St Coburg 3058 Clifton Hill 3068 ph 03 9354 3451 ph 03 9029 3687 mob 0417 537 413 mob 0408 313 721 [email protected] [email protected] INTRODUCTION This report comprises Volume 3 of the Corangamite Heritage Study (Stage 2) 2013 (the Study). The purpose of the Study is to complete the identification, assessment and documentation of places of post-contact cultural significance within Corangamite Shire, excluding the town of Camperdown (the study area) and to make recommendations for their future conservation. This volume contains the Reviewed and Revised Thematic Environmental History. It should be read in conjunction with Volumes 1 & 2 of the Study, which contain the following: • Volume 1. Overview, Methodology & Recommendations • Volume 2. Citations for Precincts, Individual Places and Cultural Landscapes This document was reviewed and revised by Ray Tonkin and Samantha Westbrooke in July 2013 as part of the completion of the Corangamite Heritage Study, Stage 2. This was a task required by the brief for the Stage 2 study and was designed to ensure that the findings of the Stage 2 study were incorporated into the final version of the Thematic Environmental History. The revision largely amounts to the addition of material to supplement certain themes and the addition of further examples of places that illustrate those themes. There has also been a significant re-formatting of the document. Most of the original version was presented in a landscape format. -

Great Ocean Walk Guided Tour

GREAT OCEAN WALK GUIDED TOUR AllTrails Tours - The Great Ocean Road Slow Travel Tour Specialists This is a 7-day walk along the entire length of the Great Ocean Walk, with no missing sections, at an enjoyable pace. Each day you will enjoy this world class walking track and rejuvenate nightly with hot showers and the conveniences of modern accommodation - perhaps even a massage and a few drinks before a quality dinner. AllTrails has been taking groups for multi-day tours around Australia for over 20 years and have extensive experience in the Great Ocean Road region. We now apply our winning AllTrails formula to the famous Great Ocean Walk journey: top accommodation (no lodge accommodation or shared facilities), quality restaurant meals (even some of the lunches), luggage transfers (no carrying a pack), massage therapist (staff), full guide support and that famous AllTrails camaraderie. AllTrails creates bespoke tours for the discerning traveller - unique, individual experiences where we are as excited to be on tour as you are. The Tour at a Glance Duration: 7 days / 6 nights Distance: 104 km Average Daily: 14km (shorter options available) Group Size: 10-15 approx Accommodation: Quality ensuite accom all the way Trail snacks: Included Meals: All meals included Deposit: $400pp Surface: Well compacted walking tracks, some steps/stairs Terrain: Undulating coastal tracks with some hilly sections Staff: Walking guide, vehicle support, massage therapist Difficulty Rating: Generally easy to moderate (occasional harder sections) Current dates available 10-16 Sep 2020* and 6-12 Apr 2021 * New date of departure, amended from 10 Sep due to COVID-19 Always wanted to walk the full length of the Great Ocean Walk? This is the Great Ocean Walk without the logistical headaches – we organise everything that you will need including quality accommodation, food, vehicle support, safety briefings, first-aid qualified guides, massage therapist, luggage transfer, great camaraderie and much more. -

The Great Ocean Road: from Where to Where?

The Great Ocean Road: from where to where? © Rachel Faggetter In the genre of ‘scenic routes’ the Great Ocean Road on Victoria’s southwest coast is one of the best in the world. It has compelling beauty and drama, a high-energy coastline and it winds through a region of rich natural and cultural significance. Serious consideration should be given to proposing the Great Ocean Road for inscription on the World Heritage List as a cultural landscape of international importance. Among the 690 sites on the List, 14 are Australian, none of them in Victoria. Yet this paper suggests a paradox. In the context of contemporary values about conservation and sustainability, the Great Ocean Road would probably not be built. Mention of the Great Ocean Road stirs the imagination of many Australians. Spectacular landscapes and wild seas: shipwrecks, drama and tragedy; bushfires and landslides; summer holidays and winter bushwalking; sand, surf and swimming. Drivers think of the concentrated negotiation of narrow roads and passengers remember looking down at the waves and rocks waiting at the bottom of steep cliffs. Scenic lookouts abound. Scenic is an appropriate word, for this is a constructed landscape, a deliberate arrangement designed to enhance the drama and impact of the coastline as seen through the windscreen of a motor vehicle. The traditional custodians of this country are the Wauthurong, the people who harboured escapee William Buckley for 32 years from 1803. They camped in the creek valleys to harvest the rich seafood but made their tracks and trading routes along ridges and up into the hills. -

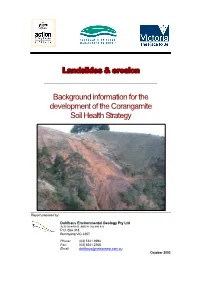

Professional Report

Landslides & erosion Background information for the development of the Corangamite Soil Health Strategy Report prepared by: Dahlhaus Environmental Geology Pty Ltd ACN 085846813 ABN 81 085 846 813 P.O. Box 318 Buninyong VIC 3357 Phone: (03) 5341 3994 Fax: (03) 5341 2768 Email: [email protected] October 2003 CCMA Soil Health Strategy background report – Landslides & erosion Table of Contents 1 INTRODUCTION ......................................................................................................................1 2 LANDSLIDES.............................................................................................................................2 2.1 CURRENT CONDITION AND TRENDS .....................................................................................2 2.2 LANDSLIDE PROCESSES.........................................................................................................2 2.3 MANAGEMENT OPTIONS.......................................................................................................5 2.3.1 National guidelines for landslide risk management.................................................................... 5 2.3.2 Landslide management options for the CCMA........................................................................... 6 2.4 SCENARIOS.............................................................................................................................8 2.4.1 No change scenario ..................................................................................................................... -

The Great Ocean Walk

The Great Ocean Walk This tour hikes the stunning Great Ocean Walk trail, from the quaint town of Apollo Bay finishing at the iconic Twelve Apostles. It is the ultimate guided tour with a relaxed pace, luxury accommodation and fabulous food and wine. The hiking is wonderfully varied and includes an amazing variety of coastal environments with a diverse array of flora and fauna - towering gum trees, deserted beaches and fertile farmland. The fabulous hiking is enhanced by the compelling history of Victoria’s Shipwreck Coast. Cost: $3150 per person based on a twin-share Single supplement $300* * Depending on the make-up of the group single travellers may be required to share a bathroom, but not a bedroom. What's Included? • Mick and Jackie Parsons as your experienced and knowledgeable guides who will look after your every need and bring this stunning area to life • 2 nights in luxury bed and breakfast accommodation in Apollo Bay (Captains on the Bay) • 3 nights in luxury cottage-style accommodation mid-trail (Southern Anchorage Retreat). Cottages have one or two bedrooms. All bedrooms have ensuite facilities. Each cottage has a Jacuzzi. Ample breakfast provisions provided in the cottages. • 1 night in boutique accommodation in Port Campbell • All meals including quality local wines • Gourmet picnic lunches each day, snacks en route, drinks at end of hike • Delicious dinners: In Apollo Bay we eat in two excellent local restaurants including the award-winning Chris’s restaurant. At Southern Anchorage the in-house dinners are prepared by Mick, a qualified chef, and matched to wonderful local wines. -

The Great Ocean Road Where Nature’S Drama Unfolds at Every Turn

The Great Ocean Road Where nature’s drama unfolds at every turn. The raw energy of the Great Southern Ocean meets a spectacular landscape to create awe inspiring scenery and a vast array of ever changing landscapes, communities, habitats and wildlife that will captivate and invigorate. GeoloGy in real time from special viewing platforms just after the sun goes down. Offshore islands provide a home for the critically Limestone layers have eroded at different rates to create endangered orange-bellied parrot. tunnels and caves as well as spectacular natural structures like the Twelve Apostles and the Loch Ard Gorge. Erosion occurs at a rapid rate as the awesome power of the sea a livinG oCean pounds the earth — collapsing one of the Twelve Apostles in 2005 and tumbling the London Bridge rock formation Beneath the ocean surface lies an explosion of life — 85 per into the sea in 1990. cent of species found in the waters here are found nowhere else on earth. Deep sea and reef fish, sharks, dolphins, octopus, sea Coastal landsCapes dragons and the Australian fur seal all inhabit the area. The breathtaking cliff faces of the Great Ocean Road fall Offshore reefs 30 to 60 metres underwater are home to away to a spectacular marine environment. The intertidal brilliant sponge gardens and kelp forests where fish and zone supports a vast array of crabs, molluscs, fish, seaweed other aquatic species such as sea dragons, sea slugs and and algae as well as fantastic bird life. sea stars make their homes. The diversity and abundance of marine wildlife has significantly increased since the Over 170 bird species can be seen throughout the introduction of a marine reserve system in 2002. -

Great Ocean Road Action Plan

B100 GREAT OCEAN ROAD ACTION PLAN Protecting our iconic coast and parks Dormant Tower Hill Volcano 30 responsible organisations 8.6m visitors a year 2/3 within ten years journeys are day trips Nearly 170,000 hectares of Crown land Up to 12,000 visitors Over a day to the 12 Apostles 200 shipwrecks 5.8m visitors spent $1.3b 2cm/yr generating the rate at which the cliffs are being eroded From 1846, the 12 Apostles were once known as limestone “The Sow and Piglets” 7 stacks (out of the original 9), known as the 12 Apostles Great Ocean Road Action Plan Eastern Maar and B100 The Great Wadawurrung Ocean Road People have known is the world’s and cared for this largest war CountryInfographic for at least In 2011 memorial 35,000 Added to the years National Heritage List Rip Curl Pro at Bells Beach is the world’s longest running 2 surfing competition National Parks 24,000 Number of people in Lorne during the Pier to Pub (up from normal population of 1,100) 11,200 jobs 2 in the region in 1983 Ash Wednesday bushfires destroyed Marine National the year ending June 2017 Parks 42,000 and 729 hectares houses 3 2015 Wye River bushfire destroyed Marine National Sanctuaries and Rare polar dinosaur 2,260 115 fossil sites hectares houses Protecting our iconic coast and parks Purpose Acknowledgement This Action Plan is the Victorian Government’s response to the Great Ocean Road Taskforce Co-Chairs The Victorian Government proudly acknowledges the Report recommended reforms to Eastern Maar and Wadawurrung People as the traditional management arrangements of the custodians of the Great Ocean Road region. -

Comment on Objections 54

Comment on objections 54 Sarah Voogels 3 pages Victorian secretariat Phone (03) 9285 7197 Fax (02) 6293 7664 Email [email protected] From: To: FedRedistribution - VIC Subject: [VIC REDISTRIBUTION COMMENT ON OBJECTIONS] Sarah Voogels *WWW* [SEC=UNCLASSIFIED] Date: Friday, 18 May 2018 1:36:24 PM Attachments: vic-Sarah Voogels-.pdf Victorian Redistribution comments on objections uploaded from the AEC website. Name: Sarah Voogels Organisation: Individual Address: Phone number: Additional information: In relation to OB126, as proposed by Mr Andy McClusky, if the indigenous name of Corangamite is to be replaced, I agree and believe that a more appropriate name should be Gadubanud, to honor and acknowledge one of our first Australian tribes of the Surf Coast Shire - Colac Otway Shire - Great Ocean Road region of Victoria. Historical facts attached. Kind Regards, Sarah Voogels Indigenous History of the Otways “We acknowledge the Traditional Custodians of Gadubanud country, The Gunditjmara people, Elders past and present.” Aboriginal people have lived in Victoria for at least 30,000. The Gadubanud (Ktabanut) or King Parrot people have occupied the rainforest, estuaries, grass and wetlands, and coastline of The Otways for many thousands of years. Local estuaries such as the Barwon and Gellibrand rivers provided natural boundaries with other tribes. Wada Wurrung to the north east of the Barwon River, Guidjan to the north (Lake Colac area) and Girai Wurrung to the west of the Gellibrand River. The Gadubanud maintained complex ties -

The Executive Officer Rural and Regional Committee Parliament House Melbourne 3002

Submission no.20 The Executive Officer Rural and Regional Committee Parliament House Melbourne 3002 Dear Sir/Madam, Re: Inquiry into Rural and Regional Tourism Thank you for the opportunity to provide feedback through the Inquiry into Rural and Regional Tourism. The LBIBC and Lake Bolac community is traditionally a farming community but many businesses such as LBIBC, food outlets and accommodation are also extremely reliant on the tourist trade. We are deemed to be part of the Grampians region. As a small community, 193 township residents (ABS 2001) and local population (15km radius) approximately 500, we are extremely fortunate to have a naturally occurring tourist attraction in the freshwater Lake Bolac and a large flow of traffic through our town as we are located on the busy crossroads of Glenelg Highway and Ararat-Mortlake Road. VicRoad traffic counters indicate daily traffic in the vicinity of 1600 vehicles per day travelling through Lake Bolac. No surveys have been carried out to date on the number of occupants per vehicle. The local residents and groups all agree that there is more that can be done, in terms of tourist attractions and tourism promotions, to meet the needs of those staying in or travelling through the area. This has been highlighted with the drying out of our lake in recent months, drastically reducing recreational use. The attached comments generally relate to the township of Lake Bolac and the enormous untapped potential. This document has also been emailed to [email protected] If you have any queries please do not hesitate to contact the undersigned.