Joint Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IT Risk Management and Control Frameworks

IT Risk Management and Control Frameworks Guðjón Viðar Valdimarsson CIA, CFSA, CISA Product Manager and Internal Auditor Summary • Introduction or the “art” of Risk Management • The objectives, risks and controls • Risk Management Methodology • The control frameworks • IT Risk Management Introduction or the “art” of Risk Management “Risk management is the identification, assessment, and prioritization of risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability and/or impact of unfortunate events or to maximize the realization of opportunities.” Or how to stop bad things from happening by figuring out what can happen and do something about it ! What do you need ? To do a risk assessment you need : Objectives/assets • What does management and the board want to aim for in terms of risk appetite and risk tolerance. • What are the critical assets and processess you want to protect Risks • What are the relevant risks for the subject/assets at hand Controls • What generally accepted control framework is appropriate for the subject matter. Risk Management Methodology There are a number areas of risk management areas depending on the industry or subject at hand. Risk Risk Risk Financial risk management Enterprise management management management activities as risk regarding of (VaR and applied to management natural information CVaR) project disasters technology management IT Risk Management The Certified Information Systems Auditor Review Manual provides the following definition of -

Software Security Total Risk Management

Software Security Total Risk Management SECURITY INNOVATION’S BLUEPRINT FOR EFFECTIVE PROGRAM DEVELOPMENT 187 Ballardvale Street, Wilmington, MA 01887 +1.978.694.1008 www.securityinnovation.com Software Security Total Risk Management 2 Table of Contents Introduction ......................................................................................................................................3 Why Software Security Risk Management Matters .............................................................................3 Why Software Security Risk Management Gets Overlooked ................................................................4 Foundations of IT Risk Management ...................................................................................................5 Operational Integration, Availability and Security Risk Management ...................................................6 From ITSRM to Software Security Total Risk Management ..................................................................7 The Steps of the SSTRM......................................................................................................................8 Summary ......................................................................................................................................... 10 www.securityinnovation.com Software Security Total Risk Management INTRODUCTION 3 Introduction Current challenges of the financial services sector aside, risk management has a long and venerable tradition of practical success in the world of insurance -

The Case for Enterprise Risk Management in Insurance Manage Risk, Change Your Business, Create Value, Achieve Your Objectives

Research partner Independent research by The Case for Enterprise Risk Management in Insurance Manage risk, change your business, create value, achieve your objectives March 2017 About Chartis Chartis Research is the leading provider of research and analysis on the global market for risk technology. It is part of Incisive Media, which owns market-leading brands such as Risk and Waters Technology. Chartis’s goal is to support enterprises as they drive business performance through improved risk management, corporate governance and compliance and to help clients make informed technology and business decisions by providing in-depth analysis and actionable advice on virtually all aspects of risk technology. Areas of expertise include: • Credit risk • Operational risk and governance, risk and compliance (GRC) • Market risk • Asset and liability management (ALM) and liquidity risk • Energy and commodity trading risk • Financial crime including trader surveillance, anti-fraud and anti-money laundering • Cyber risk management • Insurance risk • Regulatory requirements including Basel 2 and 3, Dodd-Frank, MiFID II and Solvency II Chartis is solely focussed on risk and compliance technology, which gives it a significant advantage over generic market analysts. The firm has brought together a leading team of analysts and advisors from the risk management and financial services industries. This team has hands-on experience of implementing and developing risk management systems and programs for Fortune 500 companies and leading consulting houses. Visit www.chartis-research.com for more information. Join our global online community at www.risktech-forum.com. © Copyright Chartis Research Ltd 2017. All Rights Reserved. Chartis Research is a wholly owned subsidiary of Incisive Media Ltd. -

Decoding the Future IT Risk Management. Disrupted

Decoding the future IT Risk Management. Disrupted. Exploring the future of IT risk management By Chris Recchia, Tom Bigham and Rob Dighton Decoding the future | IT Risk Management. Disrupted. IT Risk Management. Disrupted. With fragmented IT architecture and legacy infrastructure still widespread across the financial services industry, many organisations are already struggling to get IT risk management right. A wave of change is coming that will make this challenge even more complex. Current approaches to managing IT risk, developed in an era focused on establishing controls for financial reporting, are no longer fit-for-purpose and need to be redesigned. Now is the time for senior financial services risk professionals to begin preparing for the array of changes that are altering the world in which we all operate and compete. The need for effective risk management is rapidly increasing in response to the rise in threats and the unprecedented wave of innovation spreading across the financial services industry. Robotics, Fintech, artificial intelligence, cognitive computing and blockchain are some of the emerging trends that are expected to reshape the financial services industry and have a substantial impact on firms of all sizes and geographical spread. Financial services firms employ many more risk managers than they traditionally did, yet risk management teams remain on a reactive footing with a predominant focus on traditional IT general controls and risk assessment techniques, and are limited by the processes, systems and wider business insight with which they have been equipped. As technology transforms banking and insurance and shifts the risk landscape, organisations will need to develop an entirely new approach to IT risk management. -

Information Technology Sector Baseline Risk Assessment

Information Technology Sector Baseline Risk Assessment Table of Contents EXECUTIVE SUMMARY .........................................................................................................................................4 1 INTRODUCTION TO INFORMATION TECHNOLOGY SECTOR CRITICAL INFRASTRUCTURE PROTECTION ............................................................................................................................................................9 1.1. PARTNERING FOR SECURITY...........................................................................................................................9 1.2. IT SECTOR PROFILE......................................................................................................................................11 2 RISK MANAGEMENT APPROACH, METHODOLOGY, AND PROCESS ............................................13 2.1. ASSESSING RISK AT A SECTOR-LEVEL ..........................................................................................................13 2.2. IDENTIFYING CRITICAL FUNCTIONS..............................................................................................................14 2.3. DEVELOPING ATTACK TREES .......................................................................................................................16 2.4. IDENTIFYING AND MEASURING RISK ............................................................................................................17 2.4.1 Analyzing Threats ................................................................................................................................17 -

Risk Management Guide for Information Technology Systems

Special Publication 800-30 Risk Management Guide for Information Technology Systems Recommendations of the National Institute of Standards and Technology Gary Stoneburner, Alice Goguen, and Alexis Feringa NIST Special Publication 800-30 Risk Management Guide for Information Technology Systems Recommendations of the National Institute of Standards and Technology Gary Stoneburner, Alice Goguen1, and 1 Alexis Feringa C O M P U T E R S E C U R I T Y Computer Security Division Information Technology Laboratory National Institute of Standards and Technology Gaithersburg, MD 20899-8930 1Booz Allen Hamilton Inc. 3190 Fairview Park Drive Falls Church, VA 22042 July 2002 U.S. DEPARTMENT OF COMMERCE Donald L. Evans, Secretary TECHNOLOGY ADMINISTRATION Phillip J. Bond, Under Secretary for Technology NATIONAL INSTITUTE OF STANDARDS AND TECHNOLOGY Arden L. Bement, Jr., Director SP 800-30 Page ii Reports on Computer Systems Technology The Information Technology Laboratory (ITL) at the National Institute of Standards and Technology promotes the U.S. economy and public welfare by providing technical leadership for the nation’s measurement and standards infrastructure. ITL develops tests, test methods, reference data, proof-of- concept implementations, and technical analyses to advance the development and productive use of information technology. ITL’s responsibilities include the development of technical, physical, administrative, and management standards and guidelines for the cost-effective security and privacy of sensitive unclassified information in federal computer systems. The Special Publication 800-series reports on ITL’s research, guidance, and outreach efforts in computer security, and its collaborative activities with industry, government, and academic organizations. National Institute of Standards and Technology Special Publication 800-30 Natl. -

Issues Paper on Cyber Risk to the Insurance Sector

ISSUES PAPER ON CYBER RISK TO THE INSURANCE SECTOR AUGUST 2016 About the IAIS The International Association of Insurance Supervisors (IAIS) is a voluntary membership organisation of insurance supervisors and regulators from more than 200 jurisdictions in nearly 140 countries. The mission of the IAIS is to promote effective and globally consistent supervision of the insurance industry in order to develop and maintain fair, safe and stable insurance markets for the benefit and protection of policyholders and to contribute to global financial stability. Established in 1994, the IAIS is the international standard setting body responsible for developing principles, standards and other supporting material for the supervision of the insurance sector and assisting in their implementation. The IAIS also provides a forum for Members to share their experiences and understanding of insurance supervision and insurance markets. The IAIS coordinates its work with other international financial policymakers and associations of supervisors or regulators, and assists in shaping financial systems globally. In particular, the IAIS is a member of the Financial Stability Board (FSB), member of the Standards Advisory Council of the International Accounting Standards Board (IASB) and partner in the Access to Insurance Initiative (A2ii). In recognition of its collective expertise, the IAIS also is routinely called upon by the G20 leaders and other international standard setting bodies for input on insurance issues as well as on issues related to the regulation and supervision of the global financial sector. Issues Papers provide background on particular topics, describe current practices, actual examples or case studies pertaining to a particular topic and/or identify related regulatory and supervisory issues and challenges. -

IT Risk Assessment – a Practical Holistic Approach

BAKER TILLY AND ACUA WEBINAR IT risk assessment – a practical holistic approach The information provided here is of a general nature and is not intended to address the specific circumstances of any individual or entity. In specific circumstances, the services of a professional should be sought. Tax information, if any, contained in this communication was not intended or written to be used by any person for the purpose of avoiding penalties, nor should such information be construed as an opinion upon which any person may rely. The intended recipients of this communication and any attachments are not subject to any limitation on the disclosure of the tax treatment or tax structure of any transaction or matter that is the subject of this communication and any attachments. Baker Tilly Virchow Krause, LLP trading as Baker Tilly is a member of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. © 2019 Baker Tilly Virchow Krause, LLP 1 INTRODUCTIONS Today’s webinar moderator Amy Hughes ACUA Distance Learning Director Director of Internal Audit Michigan Technological University 2 INTRODUCTIONS GoToWebinar guide — Everyone is muted to avoid background noise. — Asking questions: Ask questions by clicking on the Questions panel on the right side of your screen, type your question and submit to all organizers. — If disconnected: If audio is disconnected, click on the Audio panel on the right side of your screen, or refer back to your e-mail for the dial-in number. — Support #: If you have any technical problems, call GoToWebinar support at 1 888 646 0014. -

THE ART of THREAT MODELING for IT RISK MANAGEMENT Solving the Application Risk Riddle

THE ART OF THREAT MODELING FOR IT RISK MANAGEMENT Solving the application risk riddle Ed Adams CEO, Security Innovation THE ART OF THREAT MODELING FOR IT RISK MANAGEMENT Table of Contents Introduction ......................................................................................................................................2 A Note on Scope........................................................................................................................................ 2 Risk Management Practices ................................................................................................................3 The Need for Threat Modeling............................................................................................................3 Common Pitfalls and Problems that Threat Models Helps You Avoid ...................................................... 4 Penetration Testing vs. Automated Tools ............................................................................................. 4 Common Problems of Risk Management ............................................................................................. 4 Threat Modeling for Better Risk Management ......................................................................................... 5 Threat Modeling for Existing Applications ................................................................................................ 6 Threat Modeling in the SDLC ................................................................................................................... -

IT Risk Management for E-Government Implementation Success ปีที่ 35 ฉบับที่ 135 กรกฎาคม-กันยายน 2555

IT Risk Management for E-Government Implementation Success ปีที่ 35 ฉบับที่ 135 กรกฎาคม-กันยายน 2555 Krongras Tiatasin Graduate Student of Master of Science Program in Management Information Systems, Thammasat Business School. Dr.Siriluck Rotchanakitumnuai Professor of Department of Management Information Systems, Thammasat Business School. IT Risk Management for E-Government Implementation Success การบริหารความเสี่ยงทางด้านเทคโนโลยีสารสนเทศ เพื่อก่อให้เกิดความสำเร็จในระบบรัฐบาลอิเล็กทรอนิกส์ ABSTRACT -Government is a multidimensional concept which requires an understanding and management in order to implement successfully. Information technology (IT) risk management is one of the important issues of e-Government implementation success. This research presents the factors of IT risk management for e-Government implementation success. A survey was conducted with Thai government officers who are involved in e-Government implementation. There are five IT risk management factors which are IT infrastructure risk, economic risk, legal and regulation risk, change management risk and performance risk. The Thai government can apply the research framework to prevent implementation failure. Keywords: E-Government, IT risk management คณะพาณิชยศาสตร์และการบัญชี มหาวิทยาลัยธรรมศาสตร์ 61 IT Risk Management for E-Government Implementation Success บทคัดย่อ ฐบาลอิเล็กทรอนิกส์เป็นแนวคิดที่มีหลายมิติ ซึ่งต้องใช้ความเข้าใจและการบริหารจัดการเพื่อก่อให้เกิดความสำเร็จใน ดำเนินการ การบริหารความเสี่ยงทางด้านเทคโนโลยีสารสนเทศเป็นหนึ่งในปัญหาสำคัญของการดำเนินการ รัฐบาลอิเล็กทรอนิกส์ให้ประสบความสำเร็จ -

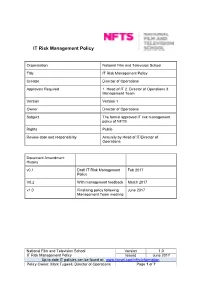

IT Risk Management Policy

IT Risk Management Policy Organisation National Film and Television School Title IT Risk Management Policy Creator Director of Operations Approvals Required 1. Head of IT 2. Director of Operations 3. Management Team Version Version 1 Owner Director of Operations Subject The formal approved IT risk management policy of NFTS Rights Public Review date and responsibility Annually by Head of IT/Director of Operations Document Amendment History v0.1 Draft IT Risk Management Feb 2017 Policy V0.2 With management feedback March 2017 v1.0 Finalising policy following June 2017 Management Team meeting National Film and Television School Version 1.0 IT Risk Management Policy Issued June 2017 Up to date IT policies can be found at: www.tinyurl.com/nfts-information Policy Owner: Mark Tugwell, Director of Operations Page 1 of 7 1. Introduction In addition to the NFTS risk management policy, which forms part of the School’s internal control and corporate governance arrangements, the National Film and Television School (NFTS) shall conduct ongoing assessments of threats and risks related to information assets, to determine the necessity of safeguards, countermeasures and controls. In the NFTS risk management policy the NFTS shall be considered to be averse to IT risk. The NFTS shall continuously monitor for any change in the threat environment and make any adjustment necessary to maintain an acceptable level of risk. The NFTS risk management process Includes: Identifying key information assets and subjecting them to IT specific risk assessments Identifying level of compliance to Industry best practice for risk management and Information Security Assessing exposure to a list of common threats and vulnerabilities Maintaining risk registers, which include information security and operational risks Implementing technical, policy, Business Continuity and Management initiatives to reduce or eliminate identified risks. -

A Risk Management Framework for IT Systems Which Adopt Cloud Computing

future internet Article ERMOCTAVE: A Risk Management Framework for IT Systems Which Adopt Cloud Computing Masky Mackita 1, Soo-Young Shin 2 and Tae-Young Choe 3,* 1 ING Bank, B-1040 Brussels, Belgium; [email protected] 2 Department of IT Convergence Engineering, Kumoh National Institute of Technology, Gumi 39177, Korea; [email protected] 3 Department of Computer Engineering, Kumoh National Institute of Technology, Gumi 39177, Korea * Correspondence: [email protected]; Tel.: +82-54-478-7526 Received: 22 June 2019; Accepted: 3 September 2019; Published: 10 September 2019 Abstract: Many companies are adapting cloud computing technology because moving to the cloud has an array of benefits. During decision-making, having processed for adopting cloud computing, the importance of risk management is progressively recognized. However, traditional risk management methods cannot be applied directly to cloud computing when data are transmitted and processed by external providers. When they are directly applied, risk management processes can fail by ignoring the distributed nature of cloud computing and leaving numerous risks unidentified. In order to fix this backdrop, this paper introduces a new risk management method, Enterprise Risk Management for Operationally Critical Threat, Asset, and Vulnerability Evaluation (ERMOCTAVE), which combines Enterprise Risk Management and Operationally Critical Threat, Asset, and Vulnerability Evaluation for mitigating risks that can arise with cloud computing. ERMOCTAVE is composed of two risk management methods by combining each component with another processes for comprehensive perception of risks. In order to explain ERMOCTAVE in detail, a case study scenario is presented where an Internet seller migrates some modules to Microsoft Azure cloud.