Engage | Inform

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

10 December 2018 Hollywood Bowl Group Plc Final Results for the Year

10 December 2018 Hollywood Bowl Group plc Final Results for the year ended 30 September 2018 CONTINUED STRONG REVENUE AND PROFIT GROWTH ENABLING ENHANCED CASH RETURNS, ALL DELIVERED THROUGH THE SUCCESSFUL EXECUTION OF OUR STRATEGY Hollywood Bowl Group plc, (“Hollywood Bowl” or the “Group”), the UK’s market leading ten-pin bowling operator, is pleased to announce its audited results for the year ended 30 September 2018 (“FY2018”). Financial Highlights 12 months ended 12 months ended % 30 September 2018 30 September 2017 Movement (“FY2017”) Total revenues £120.5m £114.0m +5.8% Like for like (LFL1) revenues +1.8% +3.5% Group adjusted2 EBITDA £36.2m £33.4m +8.3% Group adjusted2 EBITDA 30.0% 29.3% +70bps margin Operating profit £24.9m £22.2m +12.1% Profit before tax £23.9m £21.1m +13.4% Basic earnings per share 12.52p 12.17p +2.9% Net debt £2.5m £8.1m -69.1% Interim ordinary dividend 2.03p 1.80p paid per share Final ordinary dividend per 4.23p 3.95p +7.1% share Special dividend per share 4.33p 3.33p +30.0% Total dividend per share 10.59p 9.08p +16.6% Operational Highlights Strong returns on investment across the existing estate – on track to outperform 33% ROI target o Four Bowlplex rebrands completed in the period and delivering improved returns since completion: all 11 former Bowlplex sites now rebranded as Hollywood Bowl centres and fully integrated into the estate o Two further rebrands of the AMF estate completed o Three other refurbishments completed New centre pipeline committed to the end of FY2022, on track to open two new centres -

New Accounts

Property Ref Account Holder Account Holder Address Address Address Address Postcode Rv VO Property DescriptionVO CodeProperty Description Liable From Mandatory Discretionary SBRR Empty Property Correspondence Address Correspondence Address Correspondence Address Correspondence Postcode 6100240002302 UNIT 1 23 ANGEL PLACE WORCESTER WR1 3QN 9900 CS3 shop and premises 01/07/2016 N N Y N DUDLEY DY1 2SS 6100241001100 11 ANGEL STREET WORCESTER WR1 3QT 15000 CR Restaurant and Premises 06/07/2016 N N N N 6100362000210 WESTON SPENCER GROUP LTD 2 THE AVENUE THE CROSS WORCESTER WR1 3QA 7300 CO Offices and Premises 01/08/2016 N N N N WESTGATE WAKEFIELD WF1 1EP 6100453003103 31A BARBOURNE ROAD WORCESTER WR1 1SA 4350 CS SHOP AND PREMISES 01/07/2016 N N Y N WORCESTER WR3 7DQ 6100453004600 NICOL & CO ESTATE AGENTS LIMITED GND FLOOR RIGHT 46 BARBOURNE ROAD WORCESTER WR1 1HU 11250 CS7 SHOWROOM AND PREMISES 05/08/2016 N N N Y DROITWICH SPA WORCS WR9 8QY 6100685000130 LANSDOWNE RODWAY ESTATES LTD UNITS G1-G3 BLACKPOLE EAST WORCESTER WR3 8SG 33250 CW Warehouse and Premises 21/07/2016 N N N Y BLACKPOLE EAST WORCESTER WR3 8SG 6100685000130 LANSDOWNE RODWAY ESTATES LTD UNITS G4-G5 BLACKPOLE EAST WORCESTER WR3 8SG 24500 CW Warehouse and Premises 21/07/2016 N N N Y BLACKPOLE EAST WORCESTER WR3 8SG 6100685000131 LANSDOWNE RODWAY ESTATES LTD UNITS G1-G3 BLACKPOLE EAST WORCESTER WR3 8SG 33250 CW Warehouse and Premises 21/07/2016 N N N Y BLACKPOLE EAST WORCESTER WR3 8SG 6100685000131 LANSDOWNE RODWAY ESTATES LTD UNITS G4-G5 BLACKPOLE EAST WORCESTER WR3 8SG 24500 CW -

PDF Download

HOLLYWOOD BOWL GROUP PLC NOTICE OF THE 2021 ANNUAL GENERAL MEETING OF HOLLYWOOD BOWL GROUP PLC TO BE HELD ON FRIDAY 29 JANUARY 2021 AT 9.30AM (LONDON TIME) THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to the action you should take, please take advice immediately from an independent financial adviser authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares, please send this document, together with the accompanying documents, at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Please note that Hollywood Bowl Group plc’s 2021 AGM will be a ‘closed’ meeting due to COVID-19 restrictions. Shareholders will not be permitted to attend the meeting in person. 1 NOTICE OF THE ANNUAL GENERAL MEETING LETTER FROM THE CHAIRMAN 23 December 2020 DEAR SHAREHOLDER, On behalf of the Directors of Hollywood Bowl Group plc (together the ‘Directors’), I am pleased to inform you that the 2021 Annual General Meeting (AGM) of Hollywood Bowl Group plc (the ‘Company’) will be held on Friday 29 January at 9.30am (London time). The formal Notice of AGM is set out on the following pages of this document, detailing the resolutions that the shareholders are being asked to vote on along with explanatory notes of the business to be conducted at the AGM. COVID-19 AND ATTENDING THE AGM In light of the UK Government’s current guidance on public gatherings, the Board has decided that in accordance with the Corporate Insolvency and Governance Act 2020, the AGM will be held as a ‘closed’ meeting with the minimum number of Directors and officers who hold shares present to form the necessary legal quorum. -

Word 2003 Template

Hollywood Bowl Group plc Final Results for the year ended 30 September 2020 FULL YEAR PERFORMANCE UNDERPINNED BY EXCELLENT FIRST HALF WELL POSITIONED FOR THE FUTURE Hollywood Bowl Group plc, ("Hollywood Bowl" or the "Group"), the UK's market leading ten-pin bowling operator, announces its audited results for the year ended 30 September 2020 ("FY2020"). This year included five months of normal trading conditions in the first half and the subsequent five month closure of the estate from March, followed by the reopening in mid-August (subject to localised lockdowns) with trading restricted by capacity limitations, 10pm curfew and smaller group sizes. Operational Highlights • Well managed financial and operational response to COVID-19 pandemic o Strengthened balance sheet with equity placing, landlord negotiations and increased revolving credit facility o Reopening plan executed well as 98% of estate reopened in mid-August with comprehensive new COVID- secure measures • Consistent customer-focused strategy and ongoing rollout of new initiatives underpinned excellent H1 and successful reopening o Renewed focus on “Sales, Service and Safety Superiority” with introduction of a new “Have Fun, Play Safe” campaign with safety initiatives including lane seating dividers, unique bowling balls and a food and drink ordering app o Further roll out of digital enhancements, new scoring system now in 44 centres and Pins on Strings now in 18 centres • Strong customer demand and better than expected performance in August and September upon reopening despite -

Presentation

Loungers plc MAY 2019 “Serving everyone, for every occasion, everywhere” plc board members Extensive consumer experience amongst executive and non-executive board members Executives Alex Reilley Nick Collins Gregor Grant Co-founder & Chairman CEO CFO Joined in 2018 Co-founded Loungers in 2002 Joined in 2012 as Finance Director CEO until 2015 when he became Chairman Appointed CEO in 2015 Previously worked at Novus Leisure, Fuddruckers, Eldridge Pope and Morrells of Oxford Previously worked at AIM listed Capital Pub Company plc and Fuzzy’s Grub Qualified ACA with Deloitte in 1992 Non-Executives Nick Backhouse Jill Little Adam Bellamy James Cocker Senior independent NED Independent NED Independent NED Non-Executive Nomination Committee Chair Remuneration Committee Chair Audit Committee Chair Director Independent Director at Independent Director of Independent Director of Ten Partner at Lion Capital and Hollywood Bowl Group, Joules, Shaftesbury, Nobia Entertainment Group and led Lion’s investment in Eaton Gate Gaming and Green Jade PureGym Loungers in 2016 Previously at Marston’s, Consultant at El Corte Ingles Previously worked at Previously at McKinsey & Guardian Media Group and Previously worked at John PureGym as CFO, and as Company All3Media Lewis FD at Atmosphere Bars & Previously Deputy CEO at Clubs and D&D London David Lloyd Group 1 Loungers is a winner in an evolving hospitality sector Only growing all-day operator of scale in the UK Consistently outperforming the wider UK hospitality sector delivering strong returns across -

PDF Download

hollywood bowl Annual Report group plc Accounts and 2017 Rolling out fun nationwide Annual Report and Accounts 2017 Rolling out fun nationwide OUR BUSINESS WHERE WE OPERATE Our centres are typically The UK’s largest ten-pin co-located with cinema and bowling operator casual dining sites in the midst of large, high footfall, edge-of-town leisure and £114m revenue retail developments. 1 58 high-quality centres Amusement areas AMF Bowling American-themed Diners Bowlplex hollywood bowl Licensed bars Hemel Hempstead support office The complete family entertainment experience 1 Includes Dagenham which was acquired on 18 September 2017 but did not open until 4 October 2017. 43 OUR SECONDARY BRAND IS 11 CENTRES TO BE HOLLYWOOD REFURBISHED & RE-BRANDED AS BOWL cONTENTS Strategic Report Chairman’s statement 16 Chief Executive Officer’s review 18 Market overview 22 Our business model 26 Our strategy at a glance 28 Strategy in action 30 Key performance indicators 34 Principal risks 36 Financial review 39 Sustainability 43 Governance Chairman’s introduction 47 Board of Directors 48 Corporate Governance report 50 Report of the Nomination Committee 54 Report of the Audit Committee 56 Chair of the Remuneration Committee’s annual statement 60 Directors’ remuneration policy 62 Annual report on remuneration 64 Directors’ report 70 Statement of Directors’ responsibilities 73 Hollywood Bowl Group is the UK’s largest Independent auditor’s report 74 ten-pin bowling operator. We inspire customers to become loyal fans of our brands by providing a fun-filled, safe Financial Statements and great value entertainment experience that surprises and delights them on every visit. -

Half-Year Results

Half-year Results Released : 23.05.2018 RNS Number : 7801O Hollywood Bowl Group plc 23 May 2018 23 May 2018 Hollywood Bowl Group plc Interim Results for the Six Months Ended 31 March 2018 STRONG REVENUE AND PROFIT GROWTH DELIVERED THROUGH SUCCESSFUL EXECUTION OF STRATEGY Hollywood Bowl Group plc ("Hollywood Bowl" or the "Group"), the UK's market leading ten‐pin bowling operator, is pleased to announce its interim results for the six month period ended 31 March 2018 ("H1 FY2018"). Financial highlights 6 months ended 6 months ended % Movement 31 March 2018 31 March 2017 Total revenues £63.6m £58.2m(1) +9.3% Like‐for‐like ("LFL") revenue 4.0% 1.2% +2.8%pts growth (2) Group Adj. EBITDA (3) £20.7m £18.2m +13.4% Group Adj. EBITDA margin 32.5% 31.3% +1.2%pts Operating Profit £15.0m £13.0m +16.1% Profit before tax £14.6m £12.4m +17.4% Earnings per share 7.85p 6.64p +18.1% Net debt £7.2m £13.5m ‐46.7% Interim ordinary dividend per 2.03p 1.80p +12.8% share Operational Highlights · Further progress with new centre pipeline o Two new centres opened in H1 FY2018, which are performing in line with management's expectations, increasing the total estate to 59 o Strong pipeline bolstered with the signing of developments in exciting new leisure schemes in Swindon and Southend · Centre rebrand and refurbishment programme on track, and delivering significant returns o One Hollywood Bowl refurbishment and two Bowlplex rebrands and refurbishments completed in H1 FY2018 o Three more rebrands planned for the second half of the year o At least one further refurbishment planned before the financial year end · Successful execution of organic growth strategy continues to result in strong operating performance o Game volumes increased 3.6 per cent. -

Hollywood Bowl Group Plc 14 August 2020

RNS Number : 2455W Hollywood Bowl Group plc 14 August 2020 Hollywood Bowl Group plc ("Hollywood Bowl" or the "Group") Reopening of bowling centres in England and opening of new Puttstars centres Hollywood Bowl Group plc ("Hollywood Bowl" or the "Group"), the UK's market leading ten-pin bowling operator, is delighted to announce that following the Government's announcement on 13 August 2020, it will reopen 49 of its 55 English bowling centres on 15 August 2020. The Group is confident that it has implemented the necessary measures to provide a safe and enjoyable leisure experience for its team and customers, including comprehensive COVID-secure operating bowling protocols, social distancing guidelines and enhanced safety and cleaning measures. Hollywood Bowl will reopen 49 of its English bowling centres on 15 August 2020, in addition to its two previously opened centres in Wales on 3 August 2020 and its previously opened Puttstars mini golf centre in Leeds. The Group's bowling centres in Bradford, Manchester, Wigan, Bolton and Bury and four centres in Scotland are ready to reopen once the local restrictions in these areas are lifted. The Group will now un-furlough team members, all of whom have received training in the new COVID- secure operating procedures. More information on these can be seen on Hollywood Bowl's website www.hollywoodbowl.co.uk/have-fun-play-safe. Puttstars The Group is pleased to announce that it has opened its second Puttstars mini golf centre in Rochdale today. It expects to also open its new Hollywood Bowl centre and new Puttstars centre in York on Monday 17 August, taking the total Group portfolio to 64 centres. -

AEW UK Real Estate Fund

AEW UK Real Estate Fund Annual Report and Financial Statements for the year ended 31 December 2019 AEW UK Core Property Fund AEW UK Real Return Fund 2019 AEW UK – Winner, UK Property Manager of the Year Pension Investment Provider Awards Contents Statement of Authorised Status of the Scheme 1 Basis of Reporting 1 Statement concerning the debts of the Company 1 Managing Director’s report 2-7 Role of the Authorised Corporate Director (ACD) 8-9 Report from the Chair of the Governance Committees 10-13 Assessment for Value report 14-17 Statement of the ACD’s Responsibilities 18 ACD’s Statement 18 Statement of Depositary’s Responsibilities 19 Report of the Depositary 19 Report of the Auditor 20-22 AEW UK Core Property Fund Fund Manager’s Report 24-35 Fund Objective 36 Investment Benchmark 36 Investment Policy 36 Investment Strategy 36 Investment Guidelines 37 Report of the Valuer 38-41 Portfolio Statement 42-44 Summary of Material Portfolio Changes 45 Fund Information 46-52 Statement of Total Return 53 Statement of Changes in Net Assets Attributable to Shareholders 53 Balance Sheet 54 Statement of Cash Flows 55 Notes to the Financial Statements 56-77 Distribution Tables 78-79 AEW UK Real Return Fund Fund Manager’s Report 81-90 Fund Objective 91 Reference Benchmark 91 Investment Policy 91 Investment Strategy 92 Investment Guidelines 92-94 Report of the Valuer 95-97 Portfolio Statement 98-100 Summary of Material Portfolio Changes 101 Fund Information 102-107 Statement of Total Return 108 Statement of Changes in Net Assets Attributable to Shareholders 108 Balance Sheet 109 Statement of Cash Flows 110 Notes to the Financial Statements 111-129 Distribution Tables 130-131 Depositary, ACD & Advisers 132 AEW UK Real Estate Fund • Annual Report and Financial Statements • 31 December 2019 AEW UK Real Estate Fund Statement of Authorised Status of the Scheme The AEW UK Real Estate Fund (the ‘Company’) is an open-ended investment company which is a Property Authorised Investment Fund (‘PAIF’) registered in England and Wales under registered number IC000974. -

List of All Live Business Rates Addresses with Associated Current Account As at 31St August 2017 Where Disclosure Permitted

List of all live Business Rates addresses with associated current account as at 31st August 2017 where disclosure permitted. Full Property Address Primary Liable party name Account Start date 154, Horn Lane, London, W3 6PG Right Flooring Ltd 04/11/2011 Units 16 17 18 Acton Park Ind Est, The Vale, London, W3 7QE Jack Morton Worldwide Ltd 01/04/1990 Unit 19a Acton Park Industrial Estate, The Vale, London, W3 7QE Clearspring Ltd 23/12/1991 Unit 19 Acton Park Industrial Estate, The Vale, London, W3 7QE Waterrower (Uk) Ltd 31/05/2013 Unit 33 & 34, Acton Park Industrial Estate, The Vale, London, W3 7QE Allan Reeder Ltd 08/06/2011 Unit 35 Acton Park Industrial Estate, The Vale, London, W3 7QE Howden Joinery Ltd 13/02/2015 Unit 36 Acton Park Industrial Estate, The Vale, London, W3 7QE Unique Ltd 11/07/2014 26-28, Agnes Road, London, W3 7RE Cleaning By Appointment Ltd 15/06/1992 14, Alliance Court, Alliance Road, London, W3 0RB Alternative Business Machines Ltd 31/07/2015 15, Alliance Court, Alliance Road, London, W3 0RB National Grid Uk Pension Scheme Trustee Ltd 24/03/2017 16, Alliance Court, Alliance Road, London, W3 0RB Swiss Post Solutions Ltd 01/04/2011 19, Alliance Court, Alliance Road, London, W3 0RB National Grid Uk Pension Scheme Trustee Ltd 24/03/2017 20-21, Alliance Court, Alliance Road, London, W3 0RB Beach Course Ltd 02/12/2002 22, Alliance Court, Alliance Road, London, W3 0RB National Grid Uk Pension Scheme Trustee Ltd 08/07/2016 23, Alliance Court, Alliance Road, London, W3 0RB Enlighten Smiles Ltd 17/09/2015 3, Warple Way, London, -

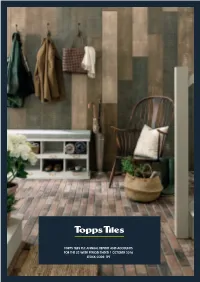

Topps Tiles Plc Annual Report and Accounts for the 52 Week Period Ended 1 October 2016

TOPPS TILES PLC ANNUAL REPORT AND ACCOUNTS FOR THE 52 WEEK PERIOD ENDED 1 OCTOBER 2016 TOPPS TILES PLC ANNUAL REPORT TOPPS TILES PLC ANNUAL REPORT AND ACCOUNTS FOR THE 52 WEEK PERIOD ENDED 1 OCTOBER 2016 STOCK CODE: TPT Topps Tiles Annual Report 2016 Front.indd 3 25153.04 9 December 2016 3:56 PM Proof 5 09/12/2016 16:01:29 Our strategy of “Out-Specialising At a Glance the Specialists” remains very much at the heart of what we do Topps is the UK’s leading specialist retailer of tiles. and the management team will Our business is focused on the tile market for refurbishment continue to evolve the key strands of domestic housing and provides an industry leading range of tiles and associated accessories to this of this strategy to maximise the market. Our customer base includes both homeowners opportunities to drive performance. (predominantly retail customers) and tile fitters (trade customers) and our business is based on a broadly The business has continued to even split between the two customer types. demonstrate it can lead the market Our colleagues are a key ingredient of our business model through a combination of inspiring – our customers rely on our expert product knowledge and world class customer service. its customers, offering a leading range and maximising convenience. 352 STORES 18 3 51 CORPORATE WEBSITE We maintain an 49 16 investors website containing a wide 79 136 range of information of interest to investors. Topps has over 350 stores across the UK with a broad geographic reach which means that most customers require less than a 20 minute drive time to reach their local store.