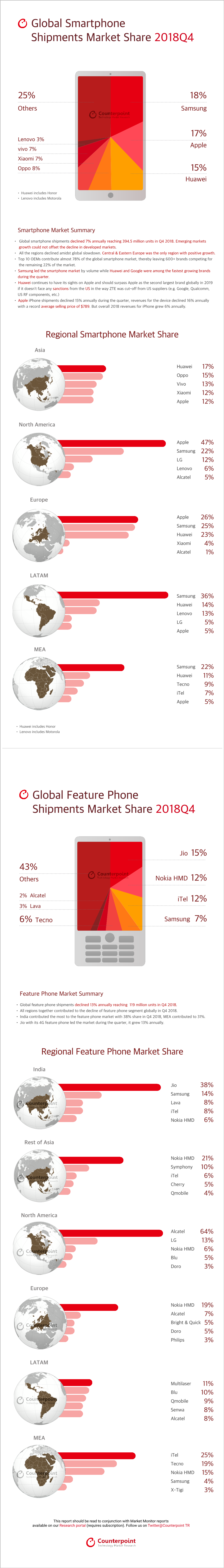

Global Feature Phone Shipments Market Share 2018Q4 Global

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Completing the TAC Request Application Form

Training Module Four: Completing the TAC Request Application Form TAC Application Module July 2018 v1.0 All product names, model numbers or other manufacturer identifiers not attributed to GSMA are the property of their respective owners. ©GSMA Ltd 2018 Before applying for TAC, your company must be registered and have sufficient TAC credit Brand owner 1 registration TAC 2 payment TAC 3 application TAC 4 certificate Select Request a TAC to begin the TAC Application Request Form process Take great care completing the form with the details of the device that will use the TAC The form has seven sections: 1 2 3 4 5 6 7 Device Manufacturing Operating Networks LPWAN Device Review details details System Certification Bodies Your details will already be there! 1 2 3 4 5 6 7 Device details Applicant name Applicant email This information is address automatically populated from log-in, It is not editable here C Brand Name Select the equipment type you require TAC for, from the dropdown 1 2 3 4 5 6 7 Device details Feature phone Smartphone Tablet IoT device Wearable Dongle Modem WLAN router There should be only one model name, but you may input up to three marketing names 1 2 3 4 5 6 7 Device details Device model name is a specific name given to the Model name handset. This can vary from the marketing name. The marketing name is typically used as the name the TM Marketing name device is sold/marketed to general public. You can include up to 3 marketing names, separated by a comma. -

Nokia Phones: from a Total Success to a Total Fiasco

Portland State University PDXScholar Engineering and Technology Management Faculty Publications and Presentations Engineering and Technology Management 10-8-2018 Nokia Phones: From a Total Success to a Total Fiasco Ahmed Alibage Portland State University Charles Weber Portland State University, [email protected] Follow this and additional works at: https://pdxscholar.library.pdx.edu/etm_fac Part of the Engineering Commons Let us know how access to this document benefits ou.y Citation Details A. Alibage and C. Weber, "Nokia Phones: From a Total Success to a Total Fiasco: A Study on Why Nokia Eventually Failed to Connect People, and an Analysis of What the New Home of Nokia Phones Must Do to Succeed," 2018 Portland International Conference on Management of Engineering and Technology (PICMET), Honolulu, HI, 2018, pp. 1-15. This Article is brought to you for free and open access. It has been accepted for inclusion in Engineering and Technology Management Faculty Publications and Presentations by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. 2018 Proceedings of PICMET '18: Technology Management for Interconnected World Nokia Phones: From a Total Success to a Total Fiasco A Study on Why Nokia Eventually Failed to Connect People, and an Analysis of What the New Home of Nokia Phones Must Do to Succeed Ahmed Alibage, Charles Weber Dept. of Engineering and Technology Management, Portland State University, Portland, Oregon, USA Abstract—This research intensively reviews and analyzes the management made various strategic changes to take the strategic management of technology at Nokia Corporation. Using company back into its leading position, or at least into a traditional narrative literature review and secondary sources, we position that compensates or reduces the losses incurred since reviewed and analyzed the historical transformation of Nokia’s then. -

Estimating Consumer Inertia in Repeated Choices of Smartphones

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Grzybowski, Lukasz; Nicolle, Ambre Working Paper Estimating Consumer Inertia in Repeated Choices of Smartphones CESifo Working Paper, No. 7434 Provided in Cooperation with: Ifo Institute – Leibniz Institute for Economic Research at the University of Munich Suggested Citation: Grzybowski, Lukasz; Nicolle, Ambre (2018) : Estimating Consumer Inertia in Repeated Choices of Smartphones, CESifo Working Paper, No. 7434, Center for Economic Studies and ifo Institute (CESifo), Munich This Version is available at: http://hdl.handle.net/10419/198794 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen -

Apple and Nokia: the Transformation from Products to Services

9 Apple and Nokia: The Transformation from Products to Services In the mid- to late 2000s, Nokia flourished as the world’s dominant mobile phone – and mobile phone operating software – producer. Founded in 1871 originally as a rubber boots manufacturer, by 2007 Nokia produced more than half of all mobile phones sold on the planet, and its Symbian mobile operating system commanded a 65.6 percent global market share. 1 But within half a decade, Nokia would falter and be surpassed in the smartphone market not only by Apple’s revolu- tionary iPhone but also by competitors including Google and Samsung. And in September 2013, Nokia would sell its mobile phone business to Microsoft for $7 billion. 2 Apple literally came out of nowhere – it sold exactly zero mobile phones before the year 2007 (the year Nokia held more than half of the global market share) – but by the first quarter of 2013, Apple had captured almost 40 percent of the US smartphone market and over 50 percent of the operating profit in the global handset industry.3 In fiscal year 2013, Apple would sell five times more smart- phones than Nokia: 150 million iPhones compared to Nokia’s sales of 30 million Lumia Windows phones. 4 In contrast to Nokia, Apple real- ized it wasn’t just about the mobile device itself, it was about leveraging software to create a platform for developing compelling mobile experi- ences – including not just telephony but also music, movies, applica- tions, and computing – and then building a business model that allows partners to make money alongside the company (e.g., Apple’s iTunes and AppStore) and, in so doing, perpetuate a virtuous cycle of making the iPhone attractive to customers over multiple life cycles through ever-ex- panding feature sets. -

Background Document 3 Proposal for A

ITU EXPERT GROUP ON HOUSEHOLD INDICATORS (EGH) BACKGROUND DOCUMENT 3 PROPOSAL FOR A DEFINITION OF SMARTPHONE1 SUMMARY The added features and functionalities of smartphones provide additional opportunities for individuals to participate in the digital economy. However, data on smartphone access, use and ownership is not currently included in the list of ICT Household Indicators collected by ITU. The list of ICT Household Indicators includes one indicator on mobile phone access (HH3) and two indicators on mobile phone usage (HH10) and ownership (HH18); however, none of these indicators have a specific sub-category to track the access, use and ownership of smartphones. The issue of smartphones has come up several times at previous EGH meetings (mainly related to the definition of computers); however, the definition of smartphones has not been discussed at length. Smartphones are often described in different ways; however, most definitions tend to focus on its internet connectivity and advanced features. In order to start collecting data on smartphone access, use and ownership, it is first necessary to agree on a clear and common definition of smartphones to ensure internationally comparable data. Comments received from the online forum: Brazil (Cetic.br), Cyprus, Kenya, Saudi Arabia, United Kingdom (GSMA), Uruguay (Agesic) Preliminary conclusion: Tracking smartphone adoption is highly relevant for policy makers and investors. There is need to add a sub-category to specifically track smartphone adoption in HH3: Proportion of households with telephone, HH10: Proportion of individuals using a mobile cellular telephone and in HH18 Proportion of individuals who own a mobile phone. Many different definitions of smartphones exist; however, the boundaries between feature phones vs. -

Identifying the Effect of Mobile Operating Systems on the Mobile Services Market

Kyoto University, Graduate School of Economics Discussion Paper Series Identifying the Effect of Mobile Operating Systems on the Mobile Services Market Toshifumi Kuroda Teppei Koguchi Takanori Ida Discussion Paper No. E-17-004 Graduate School of Economics Kyoto University Yoshida-Hommachi, Sakyo-ku Kyoto City, 606-8501, Japan July, 2017 1 Identifying the Effect of Mobile Operating Systems on the Mobile Services Market* Toshifumi Kuroda, Tokyo Keizai University† Teppei Koguchi, Shizuoka University Takanori Ida, Kyoto University Keywords: Mobile phone, Handset, Internet service, Platform competition JEL classification: L12, L43, L96 Abstract Modern economic theory predicts that tying can serve as a tool for leveraging market power. In line with this economic theory, competition authorities regulate the tying of Microsoft Windows with its Media Player or Internet browser in the EU and Japan. The authorities also take note of the market power of mobile handset operating systems (OSs) over competition in the app and services markets. However, no empirical evidence has thus far been presented on the success of government intervention in the Microsoft case. To assess the effectiveness of government intervention on mobile handset OSs, we identify the extent to which complementarity and consumer preferences affect the correlation between mobile handset OSs and mobile service app markets (mail, search, and map). We find significant positive complementarity between the mail, search, and map services, and mobile handset OSs. However, the elasticities of the mobile handset OS–mobile service correlations are rather small. We conclude that taking action to restrict mobile handset OSs is less effective than acting on mobile services market directly. -

The State of Mobile Apps Created for the Appnation Conference with Insights from the Nielsen Company’S Mobile Apps Playbook by the Nielsen Company

The State Of Mobile Apps Created for the AppNation Conference with Insights from The Nielsen Company’s Mobile Apps Playbook by The Nielsen Company Introduction Most Americans can’t imagine leaving home without their mobile phones. Nearly all adults in the U.S. now have cellphones, with one in four having smartphones, pocket-sized devices more powerful than the computers initially used to send men to the moon. By the end of 2011, Nielsen predicts that the majority of mobile subscribers in the U.S. will have smartphones. With their rich features and capabilities, these devices have been fertile ground for the growth of mobile apps. As of June 2010, 59% of smartphone owners and nearly 9% of feature phone owners report having downloaded a mobile app in the last 30 days. To better understand the growing popularity of mobile apps—and help all players in the mobile ecosystem figure out how to profit from their growth—The Nielsen Company launched the Mobile Apps Playbook in December 2009. The most recent version of the study was released in September 2010 and was based on an August 2010 survey of more than 4,000 mobile subscribers who had reported downloading a mobile app in the previous 30 days. This white paper summarizes some of the findings of the Nielsen App Playbook study and was created for the first-ever AppNation Conference, held in San Francisco in September 2010. Most Popular Apps Games continue to be the most popular category of apps for used apps are popular among users of all operating systems, both feature phone and smartphone users alike. -

Android Software Platform Development at Fujitsu

Android Software Platform Development at Fujitsu Makoto Honda Makoto Kobayashi Masahiko Nagumo Yasuhiro Kawakatsu Smartphones using the Android platform first appeared on the market in October 2008. They have since overtaken Apple’s iPhone—the first entry in the smartphone market—in number of units shipped and have helped to bring about major changes in the way that mobile phones are used. Android was developed and is distributed as open source software that a device maker integrates into its own hardware after adding original software technologies. The Android platform evolves in short cycles on the basis of software and hardware developments as the network infrastructure continues to expand in the form of WiMAX and LTE and as usage scenarios and services become increasingly diverse. Fujitsu has been developing Android smartphones with compelling functions and enhanced convenience since December 2010, when it released the REGZA Phone T-01C featuring a water-resistant enclosure, one-seg support, and FeliCa contactless IC card and infrared-communication functions. This paper describes Fujitsu’s approach to smartphone development, focusing on memory management and current-con- sumption management as important elements in the system design of the Android software platform, diverse manner modes for enhancing user convenience, high-picture-quality technol- ogy achieved by using the Mobile REGZA Engine, and audio-visual device-linking technology based on DLNA standards. 1. Introduction and Internet services, the smartphone market share of November 2007 marked the establishment of the Android devices continued to grow, and in fiscal 2011, Open Handset Alliance (OHA) centered about Google it came to exceed 50%. -

Programming of Mobile Services in Java ME EP2900, HI1017

Mobila appliaktioner och trådlösa nät, HI1033, HT 2012 Today: - Challengers with mobile services - Platforms - Android What is a Mobile Service? What is a Mobile Service? Mobile devices Pico Pocket Palm Pad Lap Desk Mobile PDA E-reader Laptop PC Smartphone Net-book Tablet Smartphone vs Feature phone • Smartphone - “A handheld computer integrated within a mobile telephone” • Smartphones run complete operating system software providing a platform for application developers • Common features (italics: usually not on a feature phone) - Play media - Connect to internet - Touch screen - Hard/Soft keyboard - Run third party software (e.g. J2ME or “apps”) - Run third party software written in a native language - Additional devices like WiFi, GPS, accelerometer, … - Access to hardware Market Market Computer Sweden, februari 2012 Some platforms • iPhone, iPad (derived from Mac OS X, Unix-like). API: Objective C. • Symbian OS (derived from EPOC). API: C++. Open source, today maintained by Nokia. • Android. Linux kernel + Dalvik Virtual Machine running applications. API in Java dialect. Open source, maintained by Open Handset Alliance • Windows Phone. Operating system with 3rd party and Microsoft services. • Java Micro Edition: Cross platform; runs on a virtual machine on top of other OS. Designed for embedded systems. Down-scaled Java API. Some Smartphone platforms Q2 2012. Källa: Millennial Media Market; App Stores • Revolution in distribution of mobile applications. • Applications available for download “over the air” (June 2011) - App Store: 400 000 (from approximately 30 000 developers) - Google Play (tidigare Android Market): 400 000 - Windows Phone Marketplace: > 20 000 - BlackBerry AppWorld: > 30 000 • App Store 2009: Every app store user spends an average of €4.37 every month. -

Ecodesign Preparatory Study on Mobile Phones, Smartphones and Tablets

Ecodesign preparatory study on mobile phones, smartphones and tablets Draft Task 4 Report Technologies Written by Fraunhofer IZM, Fraunhofer ISI, VITO October – 2020 Authors: Karsten Schischke (Fraunhofer IZM) Christian Clemm (Fraunhofer IZM) Anton Berwald (Fraunhofer IZM) Marina Proske (Fraunhofer IZM) Gergana Dimitrova (Fraunhofer IZM) Julia Reinhold (Fraunhofer IZM) Carolin Prewitz (Fraunhofer IZM) Christoph Neef (Fraunhofer ISI) Contributors: Antoine Durand (Quality control, Fraunhofer ISI) Clemens Rohde (Quality control, Fraunhofer ISI) Simon Hirzel (Quality control, Fraunhofer ISI) Mihaela Thuring (Quality control, contract management, VITO) Study website: https://www.ecosmartphones.info EUROPEAN COMMISSION Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs Directorate C — Sustainable Industry and Mobility DDG1.C.1 — Circular Economy and Construction Contact: Davide Polverini E-mail: [email protected] European Commission B-1049 Brussels 2 Ecodesign preparatory study on mobile phones, smartphones and tablets Draft Task 4 Report Technologies 4 EUROPEAN COMMISSION Europe Direct is a service to help you find answers to your questions about the European Union. Freephone number (*): 00 800 6 7 8 9 10 11 (*) The information given is free, as are most calls (though some operators, phone boxes or hotels may charge you). LEGAL NOTICE This document has been prepared for the European Commission however it reflects the views only of the authors, and the Commission cannot be held responsible for any use which may be made of the information contained therein. More information on the European Union is available on the Internet (http://www.europa.eu). Luxembourg: Publications Office of the European Union, 2020 ISBN number doi:number © European Union, 2020 Reproduction is authorised provided the source is acknowledged. -

How to Download Free Mobile Phone Games

How to download free mobile phone games You can find many free java mobile games downloads here. The game catalog is daily updated with top mobile phone games. Download free jar jad games for Real Football · Bubble Blaster · Dark Assassin · Counter Strike: Sniper Mission. Download free mobile phone games & apps to your cell phone. MobileRated is your free and legal provider of mobile games, puzzles, trivia, productivity apps. How to get laods of free mobile games for your mobile phone. Entering no mobile number or sending SMS. Play a fun casual arcade matching game on your Windows Phone with AE Roundy POP. Download. Available for: | Publisher: AE Mobile | Language: English. It is highly recommended to select your Mobile Phone first from the dropdown above so you would not download the game which is not supported by your Mobile. Connect your way. Download the Skype mobile app for free, and talk, text, instant message, or video chat whenever, wherever. Get started. Download free Windows Phone apps from Softonic. Safe and % virus-free. Discover apps for Windows Phone, Windows, Mac and mobile, tips, tutorials and. Top free games. Top free; Games . Sniper Ops 3D Shooter - Top Sniper Shooting Game SBK16 Official Mobile Game. Rating: 4/5. Free. Check out Knowledge Adventure's collection of cool, fun mobile games! Just download our games from the app store and get started immediately! Mobile Games - Play top-notch multiplayer mobile games for free on iOS and Modern technology has progressed to allow for mobile phone games to be deep. And we've got all the free mobile games you need right here! So whether you're looking for tablet games or phone games come play until your battery is spent. -

Android—The Big Picture

1 Android in Action, Third Edition By W. Frank Ableson, Robi Sen, and Chris King Android has become a market-moving technology platform—not just because of the functionality available in the platform but because of how the platform has come to market. In this article based on chapter 5 of Android in Action, Third Edition, the authors introduce the platform and provide context to help you understand Android and where it fits in the global cell phone scene. To save 35% on your next purchase use Promotional Code ableson3gp35 when you check out at http://www.manning.com/. You may also be interested in… Android—the Big Picture Android has become a market-moving technology platform—not just because of the functionality available in the platform but because of how the platform has come to market. You’ve heard about Android. You’ve read about Android. Now it’s time to begin unlocking Android. Android is a software platform that’s revolutionizing the global cell phone market. It’s the first open-source mobile application platform that’s moved the needle in major mobile markets around the globe. When you’re examining Android, there are a number of technical and market-related dimensions to consider. In this green paper, we introduce the platform and provide context to help you understand Android and where it fits in the global cell phone scene. Android has eclipsed the cell phone market, and with the release of Android 3.X, and now with the recent release of Android 4 (also known as Ice Cream Sandwich), it has begun making inroads into the tablet market as well.