Tritax Big Box REIT Plc – Pure Big Box UK Distribution Assets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

XINT F UK Real Estate NTR GBP Index

Created on 30 th 08 2019 XINT F UK Real Estate NTR GBP Index GBp The XINT F UK Real Estate NTR GBP Index is designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. This index measures the Net Total Return, reflecting the tax adjustment of Property Income Dividends (PIDs). INDEX PERFORMANCE - PRICE RETURN GBp 110 108 106 104 102 100 98 96 94 92 90 Jun 2019 Jul 2019 Aug 2019 Index Return % annualised Standard Deviation % annualised Maximum Drawdown 3M - 3M - From 4 Jul 2019 6M - 6M - To 15 Aug 2019 1Y - 1Y - Return -8.53% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com TOP 10 Largest Constituents FFMV million Weight Industry Sector Segro PLC 16.29% 854,105 16.29% Real Estate Land Securities Group PLC 10.49% 550,208 10.49% Real Estate British Land Company PLC 9.17% 480,919 9.17% Real Estate Derwent London PLC 6.03% 316,409 6.03% Real Estate Unite Group PLC 5.76% 302,120 5.76% Real Estate Tritax Big Box REIT Plc 4.54% 238,191 4.54% Real Estate Shaftesbury PLC 3.62% 189,641 3.62% Real Estate Great Portland Estates PLC 3.59% 188,127 3.59% Real Estate Hammerson PLC 3.31% 173,427 3.31% Real Estate Assura PLC 3.15% 165,041 3.15% Real Estate Total 3,458,187 65.95% This information has been prepared by Index Intelligence GmbH (“IIG”). -

XINT F UK Real Estate P GBP Index

As of December 30, 2020 XINT F UK Real Estate P GBP Index DE000A13PXZ5 GBP The XINT F UK Real Estate P GBP Index is a free-float adjusted index, designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 120 115 110 105 100 95 90 85 80 75 70 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 69.43% 3M 23.80% From 14.02.2020 6M 21.90% 6M 21.90% To 19.03.2020 1Y -17.08% 1Y -17.08% Return -38.63% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (GBPm) Weight % Industry Sector Segro PLC 11,298 19.84 Real Estate Land Securities Group PLC 4,910 8.62 Real Estate British Land Company PLC 4,630 8.13 Real Estate Unite Group PLC 3,341 5.87 Real Estate Derwent London PLC 3,136 5.51 Real Estate Tritax Big Box REIT Plc 2,866 5.03 Real Estate LondonMetric Property PLC 2,059 3.61 Real Estate Assura PLC 2,021 3.55 Real Estate Primary Health Properties PLC 1,989 3.49 Real Estate Grainger PLC 1,900 3.34 Real Estate Total 38,151 66.99 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Primary Market Fact Sheet

February 2016 Main Market Factsheet http://www.londonstockexchange.com UK Markets Analysis Fact sheets are located within the Statistics section Main Market Factsheet Table 1: Main - UK Listed Companies: New Issues (IPOs) February 2016 Equity and Fixed Interest New companies Issue Market Cap at New Money Company/ Issue type/ price admission (£m) raised Date Security Business sector (pence) (closing price) (£m)* 12/02/2016 ASCENTIAL PLC Placing 200.00 872.00 199.90 ORD GBP0.10 5555 - Media Agencies #REF! 10/02/2016 CMC MARKETS Placing 240.00 642.07 14.85 ORD GBP0.25 8777 - Investment Services #REF! 17/02/2016 COUNTRYSIDE PROPERTIES PLC Placing 225.00 1,080.00 130.00 ORD GBP1 3728 - Home Construction 08/02/2016 CYBG PLC Placing 0.00 1,785.01 0.00 ORD GBP0.10 5752 - Gambling 02/02/2016 GVC HLDGS PLC Placing transfer from AIM 422.00 1,490.40 150.00 ORD EUR0.01 5752 - Gambling 03/02/2016 HIGHLANDS NATURAL RESOURCES PLC Placing Re-admission 12.00 4.11 0.77 ORD GBP0.05 8995 - Nonequity Investment Instruments 15/02/2016 MEDICLINIC INTERNATIONAL PLC Placing Re-admission 832.00 7,144.05 600.00 ORD GBP0.10 4533 - Health Care Providers * Money raised figure in brackets is an of which fixed interest money raised Summary Money Money No. of Market raised No. of Market raised companies value (£m) (£m) companies value (£m) (£m) February 2016 Year to date New companies 4 4,379.08 344.75 7 4,388.62 351.75 of which Fixed Interest 0.00 0.00 Transfer 1 1,490.40 150.00 2 2,369.95 150.00 of which Fixed Interest 0.00 0.00 Relisting 2 7,148.16 600.76 2 7,148.16 -

Urban Logistics REIT

Urban Logistics REIT Real estate | Initiation note | 10 August 2021 Shed load of growth to come Sector Property – UK Logistics Urban Logistics REIT (SHED) is pressing ahead with its ambitious Ticker SHED LN growth strategy, having raised £108.3m in a placing of shares in July Base currency GBP 2021. This is the third successful capital raise it has made during the Price 176.0p pandemic (totalling £336.7m), highlighting the strength and resilience of NAV 150.0p its investment proposition. SHED is the only listed company focused Premium/(discount) 17.3% solely on the urban logistics sub-sector, which is benefitting from a Yield 4.3% surge in demand for space from e-commerce operators, as online retailing rates accelerate and are faced with a chronic lack of supply of property. SHED’s manager, led by Richard Moffitt, has an active asset management approach whereby it can impact the portfolio’s value through lease re-gears (beneficial renegotiations of leases for existing Ambitious growth plans in tenants) and new lettings, meaning it is less reliant on market structurally favoured urban conditions. The majority of SHED’s assets are acquired off-market logistics sub-sector (sourced through contacts rather than through formal bidding processes), which is testament to the manager’s reputation and skillset – especially with the logistics investment market being so hot right now. The company has reached a size that justifies a move from the AIM market to a premium listing on the main market of the London Stock Exchange, which should happen in the near future and increase liquidity Manager’s focus on asset in its shares. -

Big Box Bulletin Half Yearly Update of Distribution Activity H1 2019

Scotland RESEARCH Big box bulletin Half yearly update of distribution activity H1 2019 View > Occupier Market Key stats Investment market Investment data Business Rates / Outlook Map Contact East Midlands West Midlands London, South East & East North West South West & Wales Yorkshire & North East Scotland E-commerce dominates demand There has been a stronger level of take-up for big sheds during the UK GRADE A BIG SHED TAKE-UP (OVER 100,000 SQ FT) second quarter of 2019 as requirements have increased following a Million sq ft slow start to the year. Activity has been particularly dominated by the 35.0 e-commerce sector, with take-up concentrated along the length of 30.0 the M1 corridor, with Yorkshire, the East Midlands and the South East accounting for more than 90% of activity. 25.0 5 year average Take-up of grade A warehouses over 100,000 sq ft totalled 9.5 million sq ft during 20.0 H1, which is 16% down on the five year six monthly average of 11.2 million sq ft. 15.0 The retail (non-food) sector was by far the most acquisitive during the first half of the year, accounting for 62% of take-up (with internet only retail companies 10.0 ANDREW JACKSON accounting for almost half of take-up). The largest deals of the year so far have 5.0 Principal & Managing Director been to a retailer who took a 1.75 million sq ft pre-let at Summit Park, Mansfield, Industrial along with two other significant lettings of 500,000 sq ft plus at Doncaster and - 2014 2015 2016 2017 2018 H1 2019 Milton Keynes. -

191220 Industrial Property Sector Overview QD

QuotedData Sector overview | Real estate 20 December 2019 Industrial property market The gift that keeps on giving Companies covered in this report: The industrial and logistics sector has been on a Aberdeen Standard ASLI LN European Logistics tremendous run over the past five years or so. It is hard Income to think now, given the current dynamics in the property LondonMetric LMP LN industry, that retail and offices were the sectors of Property SEGRO SGRO LN choice for investors for many years with industrial cast Stenprop STP LN aside by most. St Modwen SMP LN Properties All that changed, primarily off the back of a fundamental shift in Tritax Big Box REIT BBOX LN consumer buying habits. Amazon has become a behemoth and Tritax Eurobox EBOX LN online-only retailers have popped up and taken significant market Urban Logistics REIT SHED LN share from their high street rivals – operating from a network of Warehouse REIT WHR LN warehouses across the country. The trend towards ecommerce, and its effect on both the industrial and retail sectors, is well-known. Consumer spending online has been growing dramatically to the point Industrial property performance1 now where just under 20% of all retail transactions in the UK are made Time period 30/11/2014 to 30/11/2019 on the internet. 130 This has meant that traditional retailers, as well as their online-only 120 peers, have been scrambling to get their distribution networks 110 functioning efficiently. Long gone are the days of one huge warehouse in the middle of the country that served a retailer’s shops. -

Vanguard FTSE UK All Share Index Unit Trust

Interim Report and Financial Statements | For the six months ended 30 April 2021 Vanguard FTSE U.K. All Share Index Unit Trust (An authorised unit trust established under the laws of England and Wales) Contents Statement of the Manager’s Commentary and Responsibilities 1 Tracking Error* 3 Performance Summary* 4 Summary of Significant Changes* 6 Portfolio Statement* 7 Balance Sheet 13 Statement of Total Return 13 Statement of Change in Net Assets Attributable to Unitholders 13 Further Information* 14 Directory* Inside Back Cover * The items with an asterisk, plus the Trust's Investment Objective, Investment Strategy and Performance Comparative Table, collectively constitute the Manager's Report. Vanguard FTSE U.K. All Share Index Unit Trust Manager’s Commentary and Statement of Responsibilities Period ended 30 April 2021 The Authorised Fund Manager (the ‘’Manager’’) of Vanguard FTSE U.K. All Share Index Unit Trust (the ‘’Trust’’) is Vanguard Investments UK, Limited. The Trustee is State Street Trustees Limited and the Independent Auditors are PricewaterhouseCoopers LLP. The Trust is a unit trust established under the Trust Deed between the Manager and the Trustee and authorised by the Financial Conduct Authority under Section 243 of the Financial Services and Markets Act 2000 and has been established as a UK Undertaking for Collective Investments in Transferable Securities (“UK UCITS”) scheme. The unitholders are not liable for the debts of the Trust. The investment objective of the Trust, the Manager’s policy for pursuing that objective and a review of the Trust’s investment activities for the relevant period are included within the Performance Summary. -

Cohen & Steers SICAV European Real Estate Securities Fund

Cohen & Steers SICAV European Real Estate Securities Fund As of 31/07/2021 Current % of Total Security Name Sector Market Value Market Value Vonovia SE Residential €11,035,605.94 8.67 % Klepierre Retail €7,181,283.35 5.65 % British Land Co. PLC Diversified €6,909,826.29 5.43 % Icade Diversified €6,169,222.60 4.85 % Assura Group Ltd Health Care €5,249,895.51 4.13 % Segro PLC Industrial €5,168,891.94 4.06 % Leg Immobilien AG Residential €5,159,844.90 4.06 % Castellum AB Industrial Office €5,031,967.25 3.96 % Safestore Holdings Ltd. Self Storage €4,577,914.04 3.60 % Tritax Big Box REIT Industrial €4,516,401.94 3.55 % VIB Vermoegen AG Industrial €4,392,828.00 3.45 % Sirius Real Estate Diversified €4,045,943.58 3.18 % Fastighets AB Balder-B Shrs Diversified €3,511,701.88 2.76 % Aedifica Health Care €3,347,609.60 2.63 % Londonmetric Property PLC Diversified €3,214,787.08 2.53 % Eurocommercial Properties NV Retail €3,152,143.12 2.48 % Unibail Group Stapled Retail €3,081,305.04 2.42 % Instone Real Estate Group Bv Residential €2,882,196.90 2.27 % Wihlborgs Fastigheter AB Diversified €2,840,186.46 2.23 % Deutsche Wohnen AG Residential €2,571,569.28 2.02 % Fabege AB Office €2,478,319.17 1.95 % Great Portland Estates PLC Diversified €2,469,790.13 1.94 % Ctp NV Industrial €2,444,022.00 1.92 % Workspace Group PLC Office €2,430,234.91 1.91 % Catena AB Industrial €2,387,190.04 1.88 % Big Yellow Group PLC Self Storage €2,158,784.52 1.70 % Alstria Office AG Office €2,091,870.36 1.64 % Merlin Properties Socimi SA Diversified €2,059,319.02 1.62 % Neinor Homes Sa Residential €1,692,112.94 1.33 % Befimmo S.C.A. -

Tritax Big Box REIT Plc Annual Report 2017

Tritax Big Box REIT plc Annual Report Tritax Big Box REIT plc Annual Report Fulfilling structural change Tritax Big Box REIT plc Annual Report CONTENTS STRATEGIC REPORT Tritax Big Box Tritax Big Box at a Glance Highlights Chairman’s Statement The Year in Brief Our Portfolio Our Market Our Business Model Our Strategy and Objectives Manager’s Report The Manager Key Performance Indicators EPRA Performance Measures Our Principal Risks and Uncertainties Responsible Business Going Concern and Viability Board Approval of the Strategic Report GOVERNANCE Chairman’s Governance Overview Leadership How we govern the Company The Board of Directors Effectiveness Nomination Committee Report Accountability Audit Committee Report Management Engagement Committee Report Relations with Shareholders and stakeholders Directors’ Remuneration Report Directors’ Report Directors’ Responsibilities Statement Independent Auditor’s Report FINANCIAL STATEMENTS Group Statement of Comprehensive Income Group Statement of Financial Position Group Cash Flow Statement Group Statement of Changes in Equity Notes to the Consolidated Accounts Company Balance Sheet Company Statement of Changes in Equity Notes to the Company Accounts ADDITIONAL INFORMATION Notes to the EPRA Performance Measures Application of the Principles of the AIC Code Financial Calendar Company Information STRATEGIC REPORT STRATEGIC Tritax Big Box is the UK’s leading investment company focused on larger scale GOVERNANCE logistics real estate. These properties are critically important to our Customers helping them to deliver their long-term business strategies by improving operational efficiency, providing cost savings and fulfilling fast growing e-commerce sales. Strong demand and limited supply, both occupationally and for investment stock, make Big Box logistics one of the most exciting asset classes in UK real estate. -

2020 Real Estate Review

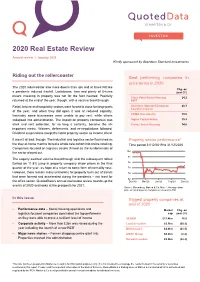

2020 Real Estate Review Annual review | January 2021 Kindly sponsored by Aberdeen Standard Investments Riding out the rollercoaster Best performing companies in price terms in 2020 The 2020 rollercoaster saw more downs than ups and at times felt like Chg. on a pandemic induced freefall. Lockdowns, tiers and plenty of U-turns year (%) meant investing in property was not for the faint hearted. Positivity Triple Point Social Housing 24.2 returned at the end of the year, though, with a vaccine breakthrough. REIT Retail, leisure and hospitality sectors were forced to close for large parts Aberdeen Standard European 20.3 Logistics Income of the year, and when they did open it was at reduced capacity. Inevitably some businesses were unable to pay rent, while others CEIBA Investments 19.0 collapsed into administration. The impact on property companies was Sigma Capital Group 15.9 stark and rent collection, for so long a certainty, became the all- Civitas Social Housing 14.8 important metric. Waivers, deferments, and re-negotiations followed. Dividend suspensions swept the listed property sector as income dived. It wasn’t all bad, though. The industrial and logistics sector flourished as Property sector performance* the stay-at-home mantra forced a whole new cohort into online retailing. Time period 31/12/2019 to 31/12/2020 Companies focused on logistics assets thrived as the fundamentals of the sector played out. 102 94 The eagerly awaited vaccine breakthrough and the subsequent rollout fuelled an 11.8% jump in property company share prices in the final 86 quarter of the year, as hope of a return to some form of normality rose. -

Wilmington Funds Holdings Template DRAFT 04.30.2021.Xlsx

Wilmington Real Asset Fund as of 4/30/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS DFA COMMODITY STRATEGY PORTFOLIO 15.83% SCHWAB US TIPS ETF 10.16% INVESCO OPTIMUM YIELD DIVERSIFIED COMMODITY STRATEGY NO K-1 ETF 8.73% CREDIT SUISSE COMMODITY RETURN STRATEGY FUND 8.00% VANGUARD COMMODITY STRATEGY FUND 5.44% SCHWAB U.S. REIT ETF 4.53% SPDR S&P GLOBAL NATURAL RESOURCES ETF 4.39% VANGUARD GLOBAL EX-U.S. REAL ESTATE ETF 4.26% PARAMETRIC COMMODITY STRATEGY FUND 3.91% DREYFUS GOVT CASH MGMT-I 3.76% ISHARES GOLD TRUST 3.22% ABERDEEN STANDARD BLOOMBERG ALL COMMODITY STRATEGY K-1 FREE ETF 2.26% TORTOISE MLP & PIPELINE FUND 2.20% PROLOGIS INC 0.96% ISHARES SILVER TRUST 0.75% EQUINIX INC 0.71% DIGITAL REALTY TRUST INC 0.49% PUBLIC STORAGE 0.48% SIMON PROPERTY GROUP INC 0.44% VONOVIA SE 0.41% WELLTOWER INC 0.35% AVALONBAY COMMUNITIES INC 0.30% REALTY INCOME CORP 0.29% EQUITY RESIDENTIAL 0.28% GOODMAN GROUP 0.27% ALEXANDRIA REAL ESTATE EQUITIES INC 0.26% SUN HUNG KAI PROPERTIES LTD 0.25% MITSUBISHI ESTATE CO LTD 0.25% VENTAS INC 0.23% MITSUI FUDOSAN CO LTD 0.23% LINK REIT 0.22% INVITATION HOMES INC 0.22% DEUTSCHE WOHNEN SE 0.22% DAIWA HOUSE INDUSTRY CO LTD 0.22% EXTRA SPACE STORAGE INC 0.22% SUN COMMUNITIES INC 0.21% ESSEX PROPERTY TRUST INC 0.21% MID-AMERICA APARTMENT COMMUNITIES INC 0.20% HEALTHPEAK PROPERTIES INC 0.20% DUKE REALTY CORP 0.19% VICI PROPERTIES INC 0.19% SEGRO PLC 0.18% SUMITOMO REALTY & DEVELOPMENT CO LTD 0.18% CK ASSET HOLDINGS LTD 0.17% BOSTON PROPERTIES INC 0.17% UDR INC 0.14% MEDICAL PROPERTIES TRUST