Financial Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CAPITALAND MALL TRUST (Constituted in the Republic of Singapore Pursuant to a Trust Deed Dated 29 October 2001 (As Amended))

CAPITALAND MALL TRUST (Constituted in the Republic of Singapore pursuant to a trust deed dated 29 October 2001 (as amended)) ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the SGX-ST Listing Manual, CapitaLand Mall Trust Management Limited (the "Company"), as manager of CapitaLand Mall Trust ("CMT", and manager of CMT, the "Manager"), wishes to announce that the Manager has obtained independent valuations as at 31 December 2018 for all properties owned by CMT. The valuations for Funan, Lot One Shoppers’ Mall, Bukit Panjang Plaza, Clarke Quay and Raffles City Singapore were conducted by CBRE Pte. Ltd.. The valuations for Tampines Mall, Junction 8 Shopping Centre, IMM Building, Bugis Junction, JCube, Bugis+ and Bedok Mall were conducted by Knight Frank Pte Ltd. The valuations for Plaza Singapura, The Atrium@Orchard and Westgate were conducted by Colliers International Consultancy & Valuation (Singapore) Pte Ltd. The valuations are shown with their preceding valuations as follows: S$ million Valuation Valuation Description of Property as at as at Variance 31 December 2018 30 June 2018 Tampines Mall 1,059.0 1,051.0 8.0 4 Tampines Central 5 Junction 8 Shopping Centre 743.0 740.0 3.0 9 Bishan Place Funan1 360.0 360.0 - 109 North Bridge Road IMM Building 649.0 644.0 5.0 2 Jurong East Street 21 Plaza Singapura 1,296.0 1,293.0 3.0 68 Orchard Road Bugis Junction 1,089.0 1,086.0 3.0 200 Victoria Street JCube 288.0 288.0 - 2 Jurong East Central 1 Lot One Shoppers’ Mall 536.0 535.0 1.0 21 Choa Chu Kang Avenue 4 Bukit Panjang Plaza (90 out of -

18 August 2015 NEW DELHI, INDIA

PVAI - SISV JOINT VALUATION CONFERENCE 16 August – 18 August 2015 NEW DELHI, INDIA GROWTH OF REITS IN SINGAPORE A PAPER WRITTEN BY Teo Li Kim Singapore Director, Project SINGAPORE INSTITUTE OF SURVEYORS AND VALUERS 1 Abstract Basically REIT is a company that owns and operates income-producing real estate or assets and these are likely to include varied commercial real estate such as office, industrial, retail, warehouse, serviced apartments, hotel rooms and other types of properties in the market. Under the Monetary Authority of Singapore (MAS), Singapore’s REITs or S-REITs market was established to provide investors with an opportunity to gain exposure to real estate. This paper outlines the listing of the first REIT in Singapore and the growth of the S-REIT market in Singapore and discusses the type of real estate in Singapore which have gone into the REIT market including the type of acquisitions the various S-REITs have made since 2002. Introduction The Growth of REITS in Singapore Basically REIT is a company that owns and operates income-producing real estate or assets and these are likely to include varied commercial real estate such as office, industrial, retail, warehouse, serviced apartments, hotel rooms and other types of properties in the market. The Monetary Authority of Singapore (MAS) has said that the Singapore’s REITs or S-REITs market was established to provide investors with an opportunity to gain exposure to real estate. Through these REITs vehicles, investors are able to receive stable income distributions via their passive ownership of these real estate properties. However as listed vehicles, it is a requirement that REITs comply with the first and on-going listing set by the Singapore Exchange. -

List of Participating Employment Agencies Under Eldercarer FDW Scheme

List of participating employment agencies under Eldercarer FDW Scheme EA on the EA able to Advanced Provide Live- Contact Contact S/N Employment Agency (EA) Placement Branch Addresses Email Address In Nurse Person (s) Number(s) Scheme Caregivers (APS)? 1 1.Care Employment APS Yes 213 Jalan Besar #03- Ms Janice Tan/ 8448 0820 [email protected] Agency 00 Singapore 208897 Ms Mary Yeo / 8778 7002 2 21st Century Caregivers Non-APS Yes 304 Orchard Road Farah 6737 1277 [email protected] Pte Ltd #04-04 Lucky Plaza Singapore 238863 3 21st Century Employment Non-APS Yes 304 Orchard Road Amy Chia 6737 1022 [email protected] Pte Ltd #02-15 Lucky Plaza Singapore 238863 4 1 Assist Agency Non-APS No 170 Upper Bukit Dylan 6463 0419 [email protected] Timah Road #03-63K Bukit Timah Shopping Centre Singapore 588179 5 A4 Employment Agency APS No 170 Upper Bukit Ms Maureen / 6465 0014 [email protected] Timah Road, Mr George / Bukit Timah Shopping 6465 0054 Centre, #04-09, Singapore 588179. 6 AA Celest Employment Non-APS No 158 East Coast Road, Ms Tay Mei Mei 8798 3478 [email protected] Singapore 428866 7 Achieve Employment LLP APS No 545 Orchard Road Ms Lynn Ng 6733 6678/ [email protected] #06-02 Far East 8588 0371 Shopping Centre Singapore 238852 8 Active Global Specialised APS Yes 51 Goldhill Plaza #12- Mr Teo Koon 6536 0086 [email protected] Caregivers Pte Ltd 11 S308900 Cho 9 Anisya LLP Non-APS No 304 Orchard Road Kevin Teo NIL [email protected] #06-22 Singapore 238863 Updated as -

By Shop Name)

Optical Services Survey There are many common eye conditions which could lead to permanent blindness. Most of these conditions do not show any symptoms. Hence, early detection and diagnosis are crucial to maintaining your vision. The Optometrists and Opticians Board has conducted a survey with local optical outlets to collate information on the various optical services provided at their outlets. In addition to the more common optical services available, the information includes the provision of four other useful screening tools used at the optical outlets. You may refer to the respective outlets for the required optical services. *Disclaimer: The information is provided by the respective optical practices and the optical practices shall be fully responsible for the accuracy of the information provided. Information on general uses of optical equipment 1. Subjective Refraction: it is a type of visual test carried out to determine the degree of one’s short- sightedness or long-sightedness. Any patient who is undergoing subjective refraction will normally be presented with test lenses of different optical powers or focal lengths before being prescribed the most suitable lenses. 2. Fundus photography: it is an advanced digital retina photography capturing an image of the back of the eye. It is often used to inspect anomalies and to monitor progression of eye diseases such as macular degeneration, retina neoplasms, choroid disturbances and diabetic retinopathy. 3. Non-contact Tonometer (NCT): it is a diagnostic tool to measure the intraocular pressure (IOP) inside a patient’s eyes to determine patient’s risk for developing glaucoma, a disease that causes blindness by damaging the nerve in the back of the eye. -

Capitaland Corporate Presentation Template 2019 W Dividers

CAPITALAND MALL TRUST Third Quarter 2019 Financial Results 21 October 2019 Disclaimer This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. You are cautioned not to place undue reliance on these forward-looking statements, which are based on the current view of management on future events. The information contained in this presentation has not been independently verified. No representation or warranty expressed or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Neither CapitaLand Mall Trust Management Limited (the ‘Manager’) or any of its affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising, whether directly or indirectly, from any use, reliance or distribution of this presentation or its contents or otherwise arising in connection with this presentation. The past performance of CapitaLand Mall Trust (‘CMT’) is not indicative of the future performance of CMT. -

Acquisition of 100% Stake in Food Junction Group of Companies

Investor Presentation Acquisition of 100% Stake in Food Junction Group of Companies 2 September 2019 Acquisition of 100% Stake in Food Junction (“FJ”) Group . Transaction Summary . Food Junction Business Overview . Appendix – List of Food Republic Food Courts in Singapore and Malaysia 1 Acquisition of 100% Stake in FJ Group TRANSACTION SUMMARY Acquisition BreadTalk Auric Pacific Structure Group Limited (“BTG”) Group Limited Singapore Singapore 100% 98.10% Topwin Investment Food Junction Holding Pte Ltd Holdings Ltd Singapore Singapore 100% Acquisition of 100% Stake Food Junction Management (“FJM”) Pte Ltd Singapore 100% 100% Food Junction T&W Food Singapore (“FJS”) Junction (“T&W”) Pte Ltd Sdn Bhd Singapore Malaysia Acquisition . Enterprise Value S$ 80 million. Terms . Funded by approximately 60% borrowings and 40% cash. 2 Acquisition of 100% Stake in FJ Group FJ BUSINESS OVERVIEW Singapore FJ operates 12 food courts and its direct operated stores across Singapore, including the newly opened Five Spice Food Court at Jewel Changi Airport. Lot One Shoppers’ Mall Junction 8 Nex Serangoon Jewel Changi Airport Food Junction Food Court LocationsList of Food Junction Food Courts 1. Bugis Junction 2. Century Square 3. Great World City 4. Harbourfront Centre 5. Junction 8 6. Lot One Shoppers’ Mall 7. Nex Serangoon 8. One Raffles Place 9. Raffles City 10. Rivervale Mall 11. United Square 12. Jewel Changi Airport Source: Google Maps, Food Junction Website 3 Acquisition of 100% Stake in FJ Group FJ BUSINESS OVERVIEW Malaysia FJ operates a total of 3 food courts and its direct operated stores in Kuala Lumpur, Malaysia. The 4th food court is scheduled to open in 2020 at The Mall, Mid Valley Southkey in Johor Bahru, Malaysia. -

S$10 Billion Market Capitalisation

Exceeding S$10 Billion Market Capitalisation CAPITALAND LIMITED ANNUAL REPORT TO SHAREHOLDERS 2005 LIMITED ANNUAL REPORT CAPITALAND REPORT TO SHAREHOLDERS 2005 S$751 Million – Highest Profi t Since Inception S$8.5 Billion Assets Under Management More than S$8 Billion of Value Created for AsianAsian Shareholders of Listed Entities in CapitaLand Group Since 2000 GrowthGrowth 5-year Compounded Annual Growth Rate of 12% CompanyCompany Presence in More Than 70 Cities in 18 Countries CapitaLand Limited 168 Robinson Road #30-01 Capital Tower Singapore 068912 Tel: (65) 6823 3200 Fax: (65) 6820 2202 Company Reg. No. 198900036N www.capitaland.com Vision 2010 & Our Mission Main Contacts CapitaLand Limited CapitaLand Retail Limited CapitaLand Financial Limited 168 Robinson Road 39 Robinson Road 39 Robinson Road #30-01 Capital Tower #18-01 Robinson Point #18-01 Robinson Point A world-class Singapore 068912 Singapore 068911 Singapore 068911 Tel +65 6823 3200 Tel +65 6536 1188 Tel +65 6536 1188 Fax +65 6820 2202 Fax +65 6536 3788 Fax +65 6536 3788 www.capitaland.com www.capitalandretail.com www.capitalandfinancial.com entrepreneurial, [email protected] [email protected] [email protected] (Reg. No. 198900036N) (Reg. No. 200413169H) (Reg. No. 200308451M) CapitaLand Residential Limited CapitaMall Trust 8 Shenton Way Raffles Holdings Limited Management Limited prosperous #21-01 Temasek Tower 250 North Bridge Road 39 Robinson Road Singapore 068811 #15-03/04 Raffles City Tower #18-01 Robinson Point Tel +65 6820 2188 Singapore 179101 Singapore 068911 Marketing Hotline +65 6826 6800 Tel +65 6398 5777 Tel +65 6536 1188 and lasting Fax +65 6820 2208 Fax +65 6398 5767 Fax +65 6536 3884 www.capitalandresidential.com www.rafflesholdings.com www.capitamall.com Vision 2010 [email protected] [email protected] [email protected] (Reg. -

Capitaland Corporate Presentation Template 2019 W Dividers

CAPITALAND MALL TRUST Morgan Stanley Virtual ASEAN Best Conference 29 June 2020 Disclaimer This presentation may contain forward-looking statements. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, availability of real estate properties, competition from other developments or companies, shifts in customer demands, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training, property operating expenses), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. You are cautioned not to place undue reliance on these forward-looking statements, which are based on the current view of management regarding future events. No representation or warranty expressed or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Neither CapitaLand Mall Trust Management Limited (“Manager”) nor any of its affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising, whether directly or indirectly, from any use, reliance or distribution of this presentation or its contents or otherwise arising in connection with this presentation. The past performance of CapitaLand Mall Trust (“CMT”) is not indicative of future performance. The listing of [the units in the CMT (“Units”) on the Singapore Exchange Securities Trading Limited (the “SGX-ST”) does not guarantee a liquid market for the Units. -

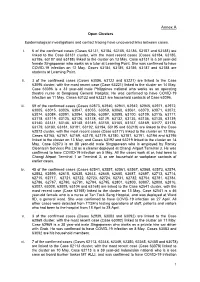

Annex a Open Clusters

Annex A Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 6 of the confirmed cases (Cases 63131, 63184, 63185, 63186, 63187 and 63188) are linked to the Case 63131 cluster, with the most recent cases (Cases 63184, 63185, 63186, 63187 and 63188) linked to the cluster on 13 May. Case 63131 is a 50 year-old female Singaporean who works as a tutor at Learning Point. She was confirmed to have COVID-19 infection on 12 May. Cases 63184, 63185, 63186, 63187 and 63188 are students at Learning Point. ii. 3 of the confirmed cases (Cases 63096, 63122 and 63221) are linked to the Case 63096 cluster, with the most recent case (Case 63221) linked to the cluster on 14 May. Case 63096 is a 33 year-old male Philippines national who works as an operating theatre nurse at Sengkang General Hospital. He was confirmed to have COVID-19 infection on 11 May. Cases 63122 and 63221 are household contacts of Case 63096. iii. 59 of the confirmed cases (Cases 62873, 62940, 62941, 62942, 62945, 62971, 62972, 63005, 63015, 63026, 63047, 63055, 63059, 63060, 63061, 63070, 63071, 63072, 63074, 63084, 63091, 63094, 63095, 63097, 63098, 63100, 63109, 63115, 63117, 63118, 63119, 63125, 63126, 63128, 63129, 63132, 63135, 63136, 63138, 63139, 63140, 63141, 63146, 63148, 63149, 63150, 63165, 63167, 63169, 63177, 63178, 63179, 63180, 63181, 63191, 63192, 63194, 63195 and 63219) are linked to the Case 62873 cluster, with the most recent cases (Case 63177) linked to the cluster on 12 May, Cases 63165, 63167, 63169, 63178, 63179, 63180, 63181, 63191, 63194 and 63195 linked to the cluster on 13 May, and Cases 63192 and 63219 linked to the cluster on 14 May. -

Participating Merchants

PARTICIPATING MERCHANTS PARTICIPATING POSTAL ADDRESS MERCHANTS CODE 460 ALEXANDRA ROAD, #01-17 AND #01-20 119963 53 ANG MO KIO AVENUE 3, #01-40 AMK HUB 569933 241/243 VICTORIA STREET, BUGIS VILLAGE 188030 BUKIT PANJANG PLAZA, #01-28 1 JELEBU ROAD 677743 175 BENCOOLEN STREET, #01-01 BURLINGTON SQUARE 189649 THE CENTRAL 6 EU TONG SEN STREET, #01-23 TO 26 059817 2 CHANGI BUSINESS PARK AVENUE 1, #01-05 486015 1 SENG KANG SQUARE, #B1-14/14A COMPASS ONE 545078 FAIRPRICE HUB 1 JOO KOON CIRCLE, #01-51 629117 FUCHUN COMMUNITY CLUB, #01-01 NO 1 WOODLANDS STREET 31 738581 11 BEDOK NORTH STREET 1, #01-33 469662 4 HILLVIEW RISE, #01-06 #01-07 HILLV2 667979 INCOME AT RAFFLES 16 COLLYER QUAY, #01-01/02 049318 2 JURONG EAST STREET 21, #01-51 609601 50 JURONG GATEWAY ROAD JEM, #B1-02 608549 78 AIRPORT BOULEVARD, #B2-235-236 JEWEL CHANGI AIRPORT 819666 63 JURONG WEST CENTRAL 3, #B1-54/55 JURONG POINT SHOPPING CENTRE 648331 KALLANG LEISURE PARK 5 STADIUM WALK, #01-43 397693 216 ANG MO KIO AVE 4, #01-01 569897 1 LOWER KENT RIDGE ROAD, #03-11 ONE KENT RIDGE 119082 BLK 809 FRENCH ROAD, #01-31 KITCHENER COMPLEX 200809 Burger King BLK 258 PASIR RIS STREET 21, #01-23 510258 8A MARINA BOULEVARD, #B2-03 MARINA BAY LINK MALL 018984 BLK 4 WOODLANDS STREET 12, #02-01 738623 23 SERANGOON CENTRAL NEX, #B1-30/31 556083 80 MARINE PARADE ROAD, #01-11 PARKWAY PARADE 449269 120 PASIR RIS CENTRAL, #01-11 PASIR RIS SPORTS CENTRE 519640 60 PAYA LEBAR ROAD, #01-40/41/42/43 409051 PLAZA SINGAPURA 68 ORCHARD ROAD, #B1-11 238839 33 SENGKANG WEST AVENUE, #01-09/10/11/12/13/14 THE -

Capitals Material Issues What We Do 2019 Value Created Manufactured

Capitals Material Issues What we do 2019 Value Created Manufactured • Occupational • CMT believes all employees can make a • An almost equal • Environmentally health & significant contribution based on their talent, proportion of sustainable, healthy, safety expertise and experience, regardless of males and females, safe and accessible • Supply chain ethnicity, age or gender. We adopt consistent, at a ratio of 44:55 quality buildings management equitable, and fair labour policies and practices • 64.0% of CMT’s • Innovative and • Employment in rewarding, as well as developing employees workforce was sustainable • Diversity • CapitaLand is a signatory to the UN Global aged between 30 construction • Human rights Compact. As part of CapitaLand, CMT has and 50 methods and implemented key efforts and programmes • About 65.3% of technologies in relation to the key UN Sustainable employees who Development Goals are manager Human • Provide a work environment that is safe and and above were • Health and safety contributes to the general well-being of its women • Job creation and employees • About 59.1% security • CMT values the occupational health and safety of senior • Learning and of our stakeholders who access our properties. management were development The stakeholders include employees, tenants, women • Benefits and contractors, suppliers and the communities • Over 22 training remuneration hours per employee. • Zero employee fatality or permanent disability • 100% of main contractors appointed for new development projects were both ISO 14001 -

Singapore Liew Mun Leong Group President & CEO

CapitaLand Group Financial Year 2006 Results 14 February 2007 Disclaimer This presentation may contain forward-looking statements that involve risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, availability of real estate properties, competition from other companies and venues for the sale/distribution of goods and services, shifts in customer demands, customers and partners, changes in operating expenses, including employee wages, benefits and training, governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. You are cautioned not to place undue reliance on these forward looking statements, which are based on current view of management on future events. 1 FY 2006 Results * 14 February 2007 * Singapore Liew Mun Leong Group President & CEO Results Overview 2 FY2006 Over S$1 Billion Record Profit 3 FY 2006 Results * 14 February 2007 * Singapore FY 2006 – Over S$1 Billion Record Profit FY 2005 FY 2006 Change PATMI (S$ million) 750.5 1,018.0 35.6% EPS (S cents) 28.3 36.8 30.0% EBIT (S$ million) 860.3 1,822.0 111.8% ● Created total shareholder returns of S$8.9 billion, gain of 87% for year ● Propose total dividend of 12