Form 10-K Winmark Corporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Blacklined Copy

FRANCHISE DISCLOSURE DOCUMENT BLACKLINED COPY 605 Highway 169 N, Suite 400 Minneapolis, Minnesota 55441 Telephone: (763) 520-8500 pias-franchise-developmentfgiplavitagainsports.coin www.plavitagainsports.com The franchisee will own and operate a Play It Again Sports® retail store from which the franchisee will sell quality used and new sporting goods equipment and accessories. : The total investment necessary to begin operation pfsa.Play It:Again Sports® store.Ts from'iS24<>.SQ0240,45D to $407,000.222^00. This includes $39,30041j00 to $4^WA^ which must be paid to us. This disclosure document summarizes certain provisions of your franchise agreement and other information in plain English. Read this disclosure document and all accompanying agreements carefiilly. You must receive this disclosure document at least 14 calendar days before you sign a binding agreement with, or make any payment to, the franchisor or an affiliate in connection with the proposed franchise sale. Note, however, that no government agency has verified the information contained in this document. You may wish to receive your disclosure document in another format that is more convenient for you. To discuss the availability of disclosures in different formats, contact the Franchise Development Department at 605 Highway 169 N, Suite 400, Minneapolis, Minnesota 55441, (763) 520-8500. The terms of your contract will govern your franchise relationship. Don't rely on the disclosure document alone to understand your contract. Read all of your contract carefiilly. Show your contract and this disclosure document to an advisor, like a lawyer or an accountant. Buying a franchise is complex investment. The information in this disclosure document can help you make up your mind. -

Where Is the Resale Industry the Next Five Years?

WHERE IS THE RESALE INDUSTRY Headed in THE NEXT FIVE YEARS? Table of Contents I. Foreword: The Resale Industry is Outfitted for Growth II. The Rise of Resale: Factors Driving Market Gains III. What’s in Store for the Future of Resale IV. Afterword: Resale Franchises are Ripe for Investment Foreword: The Resale Industry is Outfitted for Growth A nearly 50 percent year-over-year growth rate may be par for the course for new, emerging industries. But, few long-established verticals have seen the kind of explosive growth experienced by the resale segment in $24 the last several years. BILLION Since 2016, the resale sector grew 21 times faster than its traditional Current retail counterpart – and the impressive growth of resale doesn’t appear Resale Market to be slowing any time soon. Now a $24 billion market, resale is projected to more than double in the next five years, reaching $51 billion in revenue by 2024. Not only is the industry seeing unprecedented growth, but it’s also more disruptive, powerful and sizeable than ever. $51 When people think of resale, they commonly associate the industry with gently used clothing. The industry is actually much larger and BILLION more diverse, with respect to business concepts and inventory. Apparel Projected concepts make up 50 percent of resale’s market share, but the segment also includes businesses reselling quality used products such as musical 2024 Revenue instruments, sports gear, furniture and home goods. Beyond the breadth and depth of the industry, resale’s strong appeal and staying power put it in prime position to maintain its impressive growth rate in the future. -

SUMMER MARKET 2019 STORE LIST June 18-20, 2019 | Colorado Convention Center | Denver, CO

SUMMER MARKET 2019 STORE LIST June 18-20, 2019 | Colorado Convention Center | Denver, CO This retail store location list details only one unique storefront per city/state and/or city/country that attended Outdoor Retailer Summer Market 2019. ALABAMA THE WILDLAND TREKKING COMPANY ............................FLAGSTAFF DEPARTMENT OF DEFENSE .................................................SEASIDE HIBBETT SPORTING GOODS ........................................BIRMINGHAM DOTT.......................................................................HERMOSA BEACH MCCOY OUTDOOR COMPANY ............................................... MOBILE ARKANSAS DSPTCH ....................................................... SOUTH SAN FRANCISCO MOUNTAIN HIGH OUTFITTERS .....................................BIRMINGHAM ASPIRE OUTDOORS ...............................................MOUNTAIN HOME EAST 68TH STREET ..............................................WOODLAND HILLS NICHOLS OUTFITTERS.......................................................... PELHAM B-UNLIMITED ............................................................... FAYETTEVILLE ELEVATION .........................................................................LONE PINE THOMPSONS ..................................................................... HAMILTON DILLARDS ......................................................................LITTLE ROCK EV RIDEABLES ..................................................HUNTINGTON BEACH WERNERS TRADING ........................................................... CULLMAN -

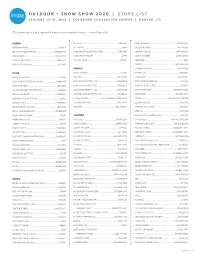

Snow Show 2020 Store List

OUTDOOR + SNOW SHOW 2020 | STORE LIST JANUARY 29-31, 2020 | COLORADO CONVENTION CENTER | DENVER, CO The below list includes registered buyers that attended Outdoor + Snow Show 2020. ALABAMA SKI HAUS ..........................................................................FLAGSTAFF CLEAN AESTHETIC .....................................................PLAYA DEL REY MOBTOWN MERCH................................................................ MOBILE SKI PRO INC ...............................................................................MESA COLLEGE OUTSIDE ....................................................... CARPINTERIA MOUNTAIN HIGH OUTFITTERS .....................................BIRMINGHAM SNOW MOUNTAIN RIVER INC (SMR) ...............................FLAGSTAFF COMFORT KICKS LA ..................................................SANTA MONICA PANTS STORE ............................................................... LEEDSLEEDS SUNRISE PARK RESORT .........................................................GREER COOZIE OUTDOORS ...................................................SANTA MONICA TRUCK GEAR BY LINE-X .................................................HUNTSVILLE THE HIKE HOUSE .................................................................. SEDONA COSMOTOG .................................................................................BREA WERNERS TRADING CO ..................................................... CULLMAN CURATED ..................................................................SAN FRANCISCO ARKANSAS CUSTOM SKI ESCAPE -

Vividata - Leisure Activities Report

Vividata - Leisure Activities Report Benchmark West Vancouver North Vancouver Attribute (CSD,BC) (CSD,BC) Value Percent Value Percent Index Number of Households 26,459 17,553 Population of Age 18 and Up 48,447 35,998 Leisure Activities Personally Participated Past Year Baking From Scratch 27,541 56.85% 18,810 52.25% 92 Billiards 4,868 10.05% 2,676 7.43% 74 Bird Watching 5,072 10.47% 3,892 10.81% 103 Camping 13,023 26.88% 9,642 26.78% 100 Collecting: Coins/Stamps 4,288 8.85% 3,270 9.08% 103 Crafts 12,072 24.92% 8,323 23.12% 93 Dancing 7,840 16.18% 6,090 16.92% 105 Sewing/Knitting 10,976 22.66% 8,909 24.75% 109 Entertaining At Home 21,748 44.89% 16,427 45.63% 102 Gardening 20,539 42.39% 17,528 48.69% 115 Genealogy/Family Tree 3,903 8.06% 2,630 7.31% 91 Gourmet Cooking 11,854 24.47% 9,093 25.26% 103 Photography 12,422 25.64% 10,483 29.12% 114 Woodworking: Building/Stripping/Refinishing/Staining 4,669 9.64% 2,803 7.79% 81 Leisure Activities Participated Past Year - Frequency - 1-2 Times Baking From Scratch 7,990 16.49% 5,153 14.32% 87 Billiards 4,063 8.39% 2,424 6.73% 80 Bird Watching 2,742 5.66% 1,888 5.25% 93 Camping 6,421 13.25% 5,143 14.29% 108 Collecting: Coins/Stamps 3,136 6.47% 2,318 6.44% 100 Crafts 4,697 9.70% 3,050 8.47% 87 Dancing 4,407 9.10% 3,611 10.03% 110 Sewing/Knitting 3,097 6.39% 2,912 8.09% 127 Entertaining At Home 6,666 13.76% 4,081 11.34% 82 Gardening 6,153 12.70% 5,421 15.06% 119 Genealogy/Family Tree 1,888 3.90% 984 2.73% 70 Gourmet Cooking 2,238 4.62% 1,466 4.07% 88 Photography 4,482 9.25% 2,756 7.66% 83 Woodworking: -

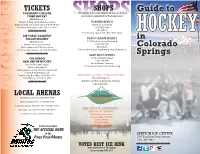

Guide to in Colorado Springs

TICKETS SHOPS COLORADO COLLEGE The following are some Pikes Peak area shops that Guide to TIGER HOCKEY specialize in equipment for hockey players. NCAA Division 1 SHOPS Western Collegiate Hockey Association PLAYERS BENCH Games played at Colorado Springs World Arena 6255 Corporate Drive For ticket information, call (719) 576-2626 (719) 442-0045 cctigerhockey.com Open Daily New hockey equipment, skate sharpening HOCKEY AIR FORCE ACADEMY FALCON HOCKEY PLAY IT AGAIN SPORTS in NCAA Division 1 5170 North Academy Boulevard Atlantic Hockey Association (719) 528-5840 Games played at AFA Clune Arena Open Daily Colorado For ticket information, call (719) 472-1895 New and used sports equipment, skate sharpening goairforcefalcons.com SLAP SHOT SPORTS Springs COLORADO 121 East Boulder Street AVALANCHE HOCKEY (719) 520-9547 Open Monday-Saturday National Hockey League Full ice hockey shop, skate sharpening Western Conference Games played at Pepsi Center; Denver, CO For ticket information, call: Pepsi Center Box Office: (303) 405-1110 Information is current as of September 2015 Ticket Master: (719) 520-9090 The printing of a avalanche.nhl.com Guide to Hockey in Colorado Springs is provided by: TICKETS LOCAL ARENAS AFA Clune Ice Arena: (719) 333-4008 COLORADO CC Honnen Ice Rink: (719) 389-6157 SPRINGS Colorado Springs World Arena: (719) 477-2150 parks ∙ recreation ∙ cultural services Colorado Sports Center: (719) 487-8572 SERTICH ICE CENTER Sertich Ice Center: (719) 385-5983 1705 East Pikes Peak Avenue Colorado Springs, CO 80909 P: (719) 385-5983 F: (719)