Desert Renewable Energy Conservation Plan Proposed Land

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

California Renewable Energy Projects in Development with Existing And

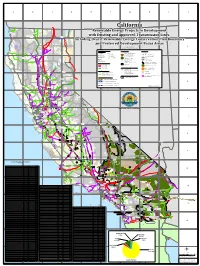

A B C D E F G H I J California ¨¦§5 2 ¤£101 !( Crescent Renewable Energy Projects in Development City Yreka D e l N o r t e !( C o u n t y S i s k i y o u M o d o c with Existing and Approved Transmission Lines C o u n t y C o u n t y Alturas !( Including Desert Renewable Energy Conservation Plan Boundary ¤£395 and Preferred Development Focus Areas Updated 12/17/2015 3 Prepared by the California Energy Commission S h a s t a H u m b o l d t C o u n t y Renewable Energy Projects Eureka C o u n t y Land Ownerships Other Features !( L a s s e n In Development C o u n t y Biomass/ Solar PV Bureau of Land Management (! City Weaverville (! !( [[ !( Landfill Gas 1 - 20 MW )" [ [ Existing Substation* [ Department of Defense 5 (! Geothermal (! )" ¨¦§ 21 - 200 MW Bureau of Indian Affairs Approved Substation* 101 Redding !( ¤£ T r i n i t y !( (! Small Hydro C o u n t y (! 201 - 2,400 MW California State Park Road (! Wind State Owned Land County Boundary Susanville !( (! Solar Thermal Williamson Act NOTE: Williamson Act for Alpine, Del Norte, Inyo, Mono, Orange, San Benito, San Francisco and Yuba Counties not available Desert Renewable Energy Existing Transmission Line Conservation Plan Boundary Private Land 4 Red 345 - 500kV Bluff DRECP Conservation Lands !( 200 - 287kV Te h a m a Prohibited, Restricted & Limited Lands C o u n t y 110 - 161kV Mohave Ground Squirrel ¤£395 Category I Lands Key Population Center Energy Development Prohibited or Restricted by Policy Quincy !( Federal Energy Corridors P l u m a s Category II Lands Dry Lake C o u n t -

Appendix O, Existing Renewable Energy Projects Within DRECP

Appendix O Existing Renewable Energy Projects Within DRECP Plan Area Draft DRECP and EIR/EIS APPENDIX O. EXISTING RENEWABLE ENERGY PROJECTS WITHIN PLAN AREA O EXISTING RENEWABLE ENERGY PROJECTS WITHIN PLAN AREA Background. The list of projects included in this file was developed to help define the number and capacity of existing renewable energy projects in the Plan Area. These projects are considered part of the affected environment in the EIR/EIS Volume III. A map indicating the locations of these projects is presented as Figure III.1-2. Existing projects include those that are either operational or under construction as of October 2013. Two tables are attached: Table O-1: Summary of Existing RE Projects (data summarized from Table O-2) Table O-2: Existing RE Projects (all projects) Table O-1 below presents the acreage of existing renewable energy projects in the DRECP Plan Area. For informational purposes, 57% (50,337 acres) of the land affected by existing renewable energy projects are located in the Preferred Alternative DFAs, as defined in Volume II. This represents less than 2.5% of the DFA acreage for the Preferred Alternative. Table O-1 Summary of Existing Renewable Energy (RE) Projects in the DRECP Plan Area Generation Capacity Acreage Percent of Percent Total Acres Total Total of Percent of RE Projects Acres of RE Project Total Total of Total in the RE Projects Acreage MW MW Acres Plan Area in DFAs* in DFAs* BLM-Administered 1,805 29% 28% 24,593 8,686 35% Public Lands – Total Wind 615 34% 61% 15,028 2,592 11% Solar 1,190 66% 39% 9,565 6,094 25% Private Lands and 4,445 71% 72% 64,463 41,634 65% Other Public Lands – Total Wind 2,015 45% 69% 44,643 23,222 36% Solar 2,330 53% 31% 19,265 18,419 29% Geothermal 100 2% 0.1% 545 545 0.1% Total RE Projects 6,250 100% 100% 89,046 50,337 57% *The DFA locations for the Preferred Alternative are used to define in this exercise. -

Solar Spotlight: California

Solar Spotlight: California At a glance There are currently more than 2,387 solar companies1 at work throughout the value chain in California, employing 75,598 people2. These companies provide a wide variety of solar products and services ranging from solar system installations to the manufacturing of components used in photovoltaic (PV) panels. These companies can be broken down across the following categories: 392 manufacturers, 85 manufacturing facilities, 1043 contractor/installers, 148 project developers, 149 distributors and 655 California Annual Solar Installations engaged in other solar activities 6000 including financing, engineering and legal support. 5000 In 2015, California installed 3,266 MW 4000 of solar electric capacity, ranking it first 3000 nationally. 3 2000 In 2015, $7.268 billion was invested on solar installations in California. 1000 (MWdc) Capacity Installed The 15,049 MW of solar energy 0 currently installed in California ranks the state first in the country in installed solar capacity. Of this capacity, 3,268 MW are residential, 2,326 MW are commercial, 8,199 MW are utility-scale and 1,256 MW are from concentrating solar power. There is enough solar energy installed in the state to power 3,772,000 homes. Over the next 5 years, California is expected to install 20,487 MW of solar electric capacity, ranking the state first over that time span. This amount is more than 2 times the amount of solar installed over the last 5 years. Installed solar PV system prices in the U.S. have dropped steadily- by 12% from last year and 66% from 2010. Notable Projects Solar Star was completed in 2015 by developer SunPower. -

Nevada Green Bank Study Deliverable 1 – Nevada Clean Energy Market & Policy Review

Nevada Green Bank Study Deliverable 1 – Nevada Clean Energy Market & Policy Review Jeffrey Schub, Executive Director, CGC April 2016 Project Deliverables (1) Market & (2) Green Bank Review (3) Market Sizing Policy Review Review (4) Financing Synthesis Gaps & Needs Assessment (5) Green Bank & Recommendations Financing (6) Next Steps Solutions 2 Transportation is largest use of energy; electricity mostly from natural gas & coal Energy Use in NV by Sector Transportation 18% Transportation is single largest user Industrial 31% Buildings and Industry is 69% Residential Commercial 25% 26% Electricity Generation in NV by Source 0% 11% Natural Gas Electricity generation dominated by 7% Coal fossil fuels, primarily natural gas. Hydro Other Renewable 18% Oil (.04%) Coal second largest and falling 64% 3 Source: EIA 2013 data and 2014 data. Most renewable energy is large hydro, followed by Geothermal Renewable Electricity generation in • Largest single renewable NV, excluding large hydro, 2014 energy source in Nevada Solar, 24.0% is Hoover Dam, which Distributed Generation, has recently suffered 1.9% declines Wind, 7.1% Biomass, 1.3% • Geothermal followed by Small Hydro, solar are large 0.9% contributors Waste Heat, 0.4% Geothermal, 64.5% 4 Source: EIA 2014 data. Nevada highly dependent on energy imports Energy Resources Produced in • About 90% of all Nevada, 2013 (trillion BTU) energy (natural gas, 80 coal, gasoline) used in 70 Nevada comes from 60 outside the state. 50 • Nearly 100% of all 40 “home grown” energy 30 in Nevada is from 20 renewable sources 10 0 Coal Natural Crude Oil Nuclear Biofuels Renewable Gas - Electric Energy Marketed Power 5 Source: EIA 2013 data. -

Solar Is Driving a Global Shift in Electricity Markets

SOLAR IS DRIVING A GLOBAL SHIFT IN ELECTRICITY MARKETS Rapid Cost Deflation and Broad Gains in Scale May 2018 Tim Buckley, Director of Energy Finance Studies, Australasia ([email protected]) and Kashish Shah, Research Associate ([email protected]) Table of Contents Executive Summary ......................................................................................................... 2 1. World’s Largest Operational Utility-Scale Solar Projects ........................................... 4 1.1 World’s Largest Utility-Scale Solar Projects Under Construction ............................ 8 1.2 India’s Largest Utility-Scale Solar Projects Under Development .......................... 13 2. World’s Largest Concentrated Solar Power Projects ............................................... 18 3. Floating Solar Projects ................................................................................................ 23 4. Rooftop Solar Projects ................................................................................................ 27 5. Solar PV With Storage ................................................................................................. 31 6. Corporate PPAs .......................................................................................................... 39 7. Top Renewable Energy Utilities ................................................................................. 44 8. Top Solar Module Manufacturers .............................................................................. 49 Conclusion ..................................................................................................................... -

Bryan Whitcomb General Manager, Solar Star Project October 18, 2016 Topics Covered

Solar Power and the Future Bryan Whitcomb General Manager, Solar Star Project October 18, 2016 Topics Covered • Berkshire Hathaway Energy (BHE) introduction • Solar Technologies – Photovoltaic (PV) and Concentrated PV – Concentrated – Emerging technologies • Solar Star – Large utility-scale solar PV project • Energy Trends • Solar energy trends 2 Berkshire Hathaway Energy • 11.5 million customers worldwide • 21,000 employees worldwide • $85.0 billion in assets • $18.1 billion in revenue • 32,600 miles of transmission lines • 16,400 miles of natural gas pipeline • More than 33,000 MW owned/contracted generation capacity • 34% renewable or noncarbon • Largest regulated owner of wind (5500 MW) in US BHE Renewables Unregulated Independent Power Producer (IPP) Geothermal Wind Solar Hydro Imperial Valley Projects: 338 MW Bishop Hill II: 81 MW Agua Caliente: 290 MW Wailuku: 10 MW Pinyon Pines: 300 MW Topaz Solar Farms: 550 MW Philippines: 128 MW Jumbo Road: 300 MW Solar Star: 586 MW Grande Prairie: 400 MW Marshall: 72 MW 338 MW geothermal 1,153 MW wind 1,278 MW solar 138 MW hydro 4 Solar Technology – Photovoltaic 5 Solar Technology – Concentrated Photovoltaic 6 Solar PV Plant Overview Power Conversion Station (PCS) – each PCS has 2 inverters and 1 transformer Common electrical hardware for all electrical energy technologies 7 Concentrated Solar Power 8 Concentrated Solar Power 9 Concentrated Solar – Ivanpah (Primm, NV) 10 Emerging Solar Technologies • Concentrator PV • Floatovoltaics • Energy Storage – Electrochemical (batteries) – Mechanical -

SOLAR POWER, a CRITICAL Component in the WORLD’S Sustainable Energy Supply

A NEW ENERGY FUTURE WITH SOLAR ENERGY AN AmBITIOuS, LOng-TERM cOmmITmEnT SOLAR ENERGY – ABundAnT, cLEAn And rEnEwABLE – IS BECOMIng MORE EFFICIEnT EVERy DAy. HERE AT TOTAL, WE ARE ACTIVELy PREPARIng THE FuTuRE By STEPPIng uP OuR OngOIng InVESTMEnT In SOLAR POWER, A CRITICAL COMPOnEnT In THE WORLD’S SuSTAInABLE EnERgy SuPPLy. For 30 years, specialists at Total and in our subsidiaries have helped drive progress across the photovoltaic solar energy chain, fostering the emergence of a reliable, efficient and cost-effective technology. In 2011, by becoming the majority shareholder of SunPower, one of the world’s leading solar energy operators, Total has given new impetus to its development. A major change in scale, with a key ambition: to become a new world leader in solar energy. ur strengthened commitment is underpinned human, financial and technological resources to by a belief, a real credibility and a strategic improve efficiency, lower costs and diversify applica- O vision. The belief that photovoltaic energy will tions, bringing it to commercial maturity. Total is one soon fulfill its promise and become a key driver of the of the companies capable of harnessing these energy transition that society has to successfully resources and becoming an international solar energy implement in the coming decades. The credibility operator. Organic asset growth, new industrial part- conferred by our recognized solar expertise and our nerships, research and innovation are the solid position as an energy company. And a strategic vision foundations on which we are building a long-term, that the solar energy industry requires significant profitable solar energy business. -

Mit Solar Electric Vehicle Team

MIT SOLAR ELECTRIC VEHICLE TEAM The MIT Solar Electric Vehicle Team (SEVT) TEAM GOALS: is a student organization dedicated to • Facilitate continuous demonstrating the viability of alternative innovation and deve- energy-based transportation. The team was lopment in all fields founded in 1985 and since 1993 has worked related to solar under the auspices of MIT’s Edgerton electric vehicles Center. through international participation and We build each vehicle from the ground competition up, allowing us to apply our theoretical knowledge while gaining hands-on • Give our sponsors manufacturing experience and project publicity through management skills. Team members work positive exposure and with professors and industry to overcome press coverage. the design and fabrication challenges • Provide members of inherent to this complex project. Since the MIT community its creation, the SEVT has built nearly 15 with incomparable vehicles and competed successfully in experience in engin- national and international races, most eering, management, recently the 2015 World Solar Challenge in marketing, and Austrailia. We are currently constructing business. our newest race vehicle for competition in the 2017 World Solar Challenge. • Be active in the com- munity, promoting We share our enthusiasm for applied alternative energy and engineering and renewable technologies by transportation. actively reaching out to local schools and • Inspire children the Greater Boston community. Through to pursue careers our interactions, we hope to educate in science and the public about alternative energy and engineering. transportation, as well as inspire the next generations of innovators. WHAT IS SOLAR RACING? In a solar car race, highly specialized Each solar car is accompanied by provement in efficiency and perfor- vehicles that run entirely on solar lead and chase vehicles to provide mance of their vehicles. -

BC-TES-TMP-2443.Pdf (5.514Mb)

UNIVERSIDAD NACIONAL “PEDRO RUIZ GALLO” Facultad de Ingeniería Mecánica y Eléctrica TESIS Para Optar el Título Profesional de INGENIERO MECÁNICO ELECTRICISTA “UTILIZACIÓN DE LA ENERGÍA EÓLICA Y SOLAR COMO FUENTE PARA EL SUMINISTRO DE ENERGÍA ELÉCTRICA AL CASERÍO ALTO PONGOYA EN CHIMBAN PROVINCIA DE CHOTA DEPARTAMENTO DE CAJAMARCA” Presentado Por: Bach. KEVIN ARNOLD TARRILLO VÁSQUEZ Asesor: Msc. Ing. JONY VILLALOBOS CABRERA LAMBAYEQUE – PERÚ Enero del 2019 UNIVERSIDAD NACIONAL “PEDRO RUIZ GALLO” Facultad de Ingeniería Mecánica y Eléctrica TESIS Para Optar el Título Profesional de INGENIERO MECÁNICO ELECTRICISTA “UTILIZACIÓN DE LA ENERGÍA EÓLICA Y SOLAR COMO FUENTE PARA EL SUMINISTRO DE ENERGÍA ELÉCTRICA ALELECTRICISTA CASERÍO ALTO PONGOYA EN CHIMBAN PROVINCIA DE CHOTA DEPARTAMENTO DE CAJAMARCA” Presentado Por: Bach. KEVIN ARNOLD TARRILLO VÁSQUEZ Aprobado por el Jurado Examinador PRESIDENTE: Dr. DANIEL CARRANZA MONTENEGRO. SECRETARIO: ING. CARLOS JAVIER COTRINA SAAVEDRA. MIEMBRO: ING. TEOBALDO EDGAR JULCA OROZCO. ASESOR: M.Sc. JONY VILLALOBOS CABRERA. LAMBAYEQUE – PERÚ Enero del 2019 UNIVERSIDAD NACIONAL “PEDRO RUIZ GALLO” Facultad de Ingeniería Mecánica y Eléctrica TESIS TITULO “UTILIZACIÓN DE LA ENERGÍA EÓLICA Y SOLAR COMO FUENTE PARA EL SUMINISTRO DE ENERGÍA ELÉCTRICA AL CASERÍO ALTO PONGOYA EN CHIMBAN PROVINCIA DE CHOTA DEPARTAMENTO DE CAJAMARCA” CONTENIDOS CAPITULO I: PROBLEMA DE LA INVESTIGACIÓN. CAPITULO II: MARCO TEÓRICO. CAPITULO III: MARCO METODOLÓGICO. CAPITULO IV: PROPUESTA DE LA INVESTIGACIÓN. CAPITULO V: ANÁLISIS E INTERPRETACIÓN DE LOS RESULTADOS. CAPITULO VI: CONCLUSIONES Y RECOMENDACIONES. AUTOR: Bach. KEVIN ARNOLD TARRILLO VÁSQUEZ --------------------------------- --------------------------------------- PRESIDENTE SECRETARIO ---------------------------------- ------------------------------------- MIEMBRO ASESOR LAMBAYEQUE – PERÚ Enero del 2019 DEDICATORIA Dedico éste Proyecto de Tesis a: Dios ya que gracias a Él he llegado a concluir una de mis metas la cual es concluir con mi carrera. -

Solar Power Card U.S

NORTH SCORE AMERICAN SOLAR POWER CARD U.S. SOLAR POWER Canada Solar Power Total grid-connected PV generating capacity for the U.S., as of the Total PV grid-connected capacity, end of 2019: 3,196 MW end of Q1, 2020: 81,400 megawatts (MW) Installed in 2019: 102 MW Growth in PV generated capacity during 2019: 13,300 MW of new solar PV ✷ Solar power accounted for nearly 40 percent of all new electricity generating capacity added in the U.S. in 2019, the largest annual share in the industry’s history. Canadian Solar Power Initiatives ✷ The U.S. solar market installed 3.6 gigawatts (GW) of new solar photovoltaic (PV) capacity in Q1 2020, representing its largest first quarter ever in the U.S. ✷ The Government of Canada launched the long-awaited Greening Government initiative, a power purchase agreement (PPA) program, with a request for information regarding The COVID-19 pandemic is having a significant impact on the U.S. solar industry, but overall, the ✷ the procurement of up to 280,000 MWh per year in newly-built solar PV and wind generation Solar Energy Industries Association (SEIA) and consulting firm Wood Mackenzie forecast 33 percent capacity. It is designed to offset federal government operations within the province of growth in 2020, owing entirely to the strong performance of the utility-scale segment, which is Alberta, as well as an additional 240,000 – 360,000 MWh per year in Renewable Energy expected to account for more than 14 GW of new installations this year. Certificates (REC) to offset Federal electricity emissions in other provinces. -

July 12, 2018 Department Report

Department of Land Conservation and Development Oregon 635 Capitol Street NE, Suite 150 Salem, Oregon 97301-2540 Kate Brown, Governor Phone: (503) 373-0050 Fax: (503) 378-5518 www.oregon.gov/LCD July12, 2018 TO: Land Conservation and Development Commission FROM: Jim Rue, Director Ellen Miller, Urban Policy Analyst and Legislative Coordinator SUBJECT: Agenda Item 6 July 26-27, 2018, LCDC Meeting TEMPORARY RULEMAKING RELATING TO SIZE OF SOLAR AND POWER GENERATION FACILITIES ON FARMLAND I. AGENDA ITEM SUMMARY This agenda item is for the Land Conservation and Development Commission (LCDC or commission) to consider adoption of a temporary rule amending OAR 660-033-0130, “Minimum Standards Applicable to the Schedule of Permitted and Conditional Uses.” This rule implements Statewide Planning Goal 3, “Agricultural Land.” The purpose of the proposed amendment is to restate the original intent of the rule in regard to size of solar and other power generation facilities sited on farmland without a goal exception. The proposed amendment applies to commercial projects only. Adoption of a temporary rule amendment will not impact the schedule or the scope of the solar siting rulemaking as defined in the 2017-19 Policy Agenda. For further information about this report, please contact Ellen Miller, Legislative Coordinator and Urban Policy Analyst at 503-934-0020, or at [email protected]. II. SUMMARY OF RECOMMENDED ACTION The department recommends that the commission adopt temporary rule amendments to limit the siting of power generation facilities, including solar arrays, to facilities that occupy no more than 12 acres on high value farmland, 20 acres on arable farmland, and 320 acres on nonarable farmland, unless an exception is taken. -

Project Bond Focus Issue 4 Bis | Project Bonds: New Energies – Solar

Project Bond Focus Issue 4 bis | Project Bonds: New Energies – Solar Project Bonds: New Energies – Solar Crédit Agricole CIB, a leader in the global Project Bond market, is authoring a series of articles covering key topics for issuers to consider. Update Renewable Project Bonds first gained traction in North America, followed by projects in Europe and Latin America, demonstrating the increasing comfort and global Since the release of our “ Projects Bonds: New Energies – appetite among investors for renewable assets. Solar” article in December 2016, some rating agencies have updated their criteria and methodologies for solar While renewables offerings have gained wider acceptance projects. In particular, Fitch released updated criteria on over time, there are challenges that need to be considered March 1, 2017 reflecting lower DSCR guidance for prior to approaching the Capital Markets. Lessons learned investment-grade solar transactions. This positive from past renewable financings can help ensure future development demonstrates the increased comfort of rating successful executions. agencies for the asset class. This article provides a review of historical Project Bond issuances for utility-scale solar assets globally. This article replaces our previous publication and updates the rating agency criteria and market trends previously detailed. Solar Project Bonds New Energies Solar Project Bonds (Global volume in $MM equivalent) 5,000 The volume of Project Bonds issued for renewable energy 4,500 projects has steadily increased in recent years. 4,000 3,500 3,000 The Capital Markets opened its doors to renewable energy 2,524 2,500 1,896 projects with a wind Project Bond in 2003, followed by 2,000 1,780 1,446 1,500 1,284 solar Project Bonds a few years later in 2010.