FUTURES EXCHANGE LIMITED (A Wholly-Owned Subsidiary of Hong Kong Exchanges and Clearing Limited)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chinese Corporate Acquisitions in Sweden: a Survey Jerker Hellström, Oscar Almén, Johan Englund

Chinese corporate acquisitions in Sweden: A survey Jerker Hellström, Oscar Almén, Johan Englund Main conclusions • This survey has resulted in the first comprehensive and openly accessible compilation of Chinese corporate acquisitions in Sweden. • The audit has identified 51 companies in Sweden in which Chinese (including Hong Kong) companies have acquired a majority ownership. In addition, the survey has identified another 14 minority acquisitions. • Zhejiang Geely’s acquisition of a minority stake in Swedish truck-maker AB Volvo was among the largest Chinese acquisitions completed in Europe and North America in 2018. • Through these acquisitions, Chinese investors have taken control of at least some one hundred subsidiaries. • Most of the identified acquisitions were made since 2014. The highest annual amount of acquisitions was recorded in 2017. • The majority of the acquired companies belong to the following five sectors: industrial products and machinery, health and biotechnology, information and communications technology (ICT), electronics, and the automotive industry. • For nearly half of the acquired companies, there is a correlation between their operations and the technology sectors highlighted in the “Made in China 2025” plan for China's national industrial development. The sectors included in the plan are of particular importance to the Chinese state. • This survey includes several companies that have not been identified as Chinese acquisitions in previous compilations of Chinese investments. • More than 1,000 companies have reported to Sweden’s Companies Registration Office that their beneficial owner is a citizen of either China or Hong Kong. For the majority of these companies, however, the Chinese ownership is not a result of an acquisition. -

China Evergrande Group 中國恒大集團

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your securities in China Evergrande Group (中國恒大集團), you should at once hand this circular and the accompanying form of proxy to the purchaser or transferee or to the bank, licensed securities dealer, or other agent through whom the sale or transfer was effected for onward transmission to the purchaser or the transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. CHINA EVERGRANDE GROUP 中 國 恒 大 集 團 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 3333) MAJOR TRANSACTION ACQUISITION OF SHARES IN CHINA VANKE CO. LTD. A letter from the Board is set out on pages 3 to 7 of this circular. 13 January 2017 CONTENTS Page Definitions .......................................................................... 1 Letter from the Board ............................................................... 3 Appendix I — Financial information of the Group ................................ I-1 Appendix II — Financial -

Evergrande to Enter NEV Market Fast

CHINA DAILY | HONG KONG EDITION Monday, November 18, 2019 MOTORING | 19 profit could fall as much as 43 per cent this year. BJEV, the largest maker of elec Evergrande to tric cars in the world, also forecast a 2019 loss in a grim earnings update. Startups are facing an even more serious situation, jostling enter NEV for attention in an almost over crowded sector and trying to pro duce convincing arguments about future profitability. They raised just $783 million market fast from January to midJune 2019, compared with $6 billion for the Chinese property development company will same period last year, according invest 45 billion yuan in auto sector by 2021 to Reuters, citing data from Pitch Book. For 2018, the total funds raised stood at $7.7 billion. By LI FUSHENG Nio, once hailed as Tesla of Chi [email protected] na, failed last month in its attempt For core technology to get local government funding. Chinese property developer In the first 10 months this year, Evergrande has rolled out grand — and companies the startup that has burned if not grandiose — plans for elec available to be through more than $5 billion in tric vehicles at a time when estab four years delivered less than lished carmakers in the country purchased, we’ll buy 15,000 vehicles. are seeing sales slumps and start them all. For those we By the end of the third quarter, ups are jostling for attention of Nio had cut its workforce to 7,800 investors. couldn’t buy, we’d from 9,900 employees in January, The company will invest a total like to join hands with and its shares have dropped more of 45 billion yuan ($6.4 billion) by than 70 percent this year, accord 2021 in electric vehicles, said its them through ing to Bloomberg. -

Bonds to Help Shantytown Bid Top 3 Richest Men in China

RAPID STRIDES Dongfeng Motor reaps fruitful reform rewards p18 LINKS GET NEW ENERGY CGN’s concentrated solar plant enters operation p20 BIG FILLIP B&R Initiative crucial to boost ties with Central, Eastern Europe BUSINESS p19 CHINA DAILY HONG KONG EDITION Thursday, October 11, 2018 Bonds to help shantytown bid Top 3 richest men in China (for the shantytown renovation June. By the end of the third ket as measures to mitigate to the program, in order to Analysts see their program) will not be reduced, quarter of this year, more than domestic and external eco rein in fast rising property pri issuance as key and these will be accompanied 165 billion yuan ($23.8 billion) nomic growth headwinds. ces, especially in third and by an increase in shantytown had been raised using this The authorities announced fourthtier cities. means of fueling renovationrelated special financial instrument, accord an almost 750 billion yuan A statement issued after the Jack Ma, Xu Jiayin, Pony Ma, local government bond issu ing to China Central Deposito cash injection into the bank latest State Council executive chairman of chairman of chairman of investment and ance,” said an expert close to ry & Clearing Co Ltd. ing system on Sunday by low meeting stressed that any Alibaba Group Evergrande Group Tencent Holdings boosting growth the Ministry of Finance. Goldman Sachs economist ering the reserve requirement irregular borrowing by local $39 billion $36 billion $35 billion Local governments’ shanty Song Yu also expected local ratio by 1 percentage point, governments, under the name Source: 2018 Hurun China Rich List LIU LUNAN / CHINA DAILY town renovation targets for governments to increase the and Minister of Finance Liu of shantytown renovation, By CHEN JIA 2019 should remain within a amount of special bonds tar Kun also pledged to further should be prohibited. -

Automotive Industry Weekly Digest

Automotive Industry Weekly Digest 12 Apr – 16 Apr 2021 IHS Markit Automotive Industry Weekly Digest - Apr 2021 WeChat Auto VIP Contents [OEM Highlights] GMC reveals Hummer electric SUV, ahead of early 2023 availability 3 [OEM Highlights] Xiaomi to invest up to USD10 bil. in EV production 6 [Sales Highlights] GM to unveil Envision Plus SUV on 18 April, reports sales growth of 69% y/y in China during Q1 8 [Sales Highlights] BYD posts sales growth of 33% y/y during March 9 [Shanghai Motor Show 2021] MG to unveil Cyberster sports car 11 [Shanghai Motor Show 2021] Xpeng to unveil P5 electric sedan 11 [GSP] Greater China Sales and Production Commentary -2021.03 13 [Supplier Trends and Highlights] HKT uses 5G standalone network with network slicing for trials of C-V2X applications 15 [Supplier Trends and Highlights] Commsignia combines cloud and V2X messaging in 4G, 5G V2N solution 15 Confidential. ©2021 IHS Markit. All rights reserved. 2 IHS Markit Automotive Industry Weekly Digest - Apr 2021 WeChat Auto VIP [OEM Highlights] GMC reveals Hummer electric SUV, ahead of early 2023 availability IHS Markit perspective Implications GMC has revealed the GMC Hummer electric SUV, debuted during a college basketball championship tournament on 3 April. The new EV is due in early 2023 as a 2024 model year product. Outlook Between the October 2020 reveal of the GMC Hummer electric pick-up and the Hummer electric SUV, GM has continued to push forward with announcements relative to investment and plans for an all-electric light-vehicle range by 2035. The GMC Hummer electric SUV and pick-up both are to set expectations on delivery of high levels of capability and performance. -

The Mergers and Acquisitions Market in China 2020 by Daxue Consulting

The M&A market in China February 2021 HONG KONG | BEIJING | SHANGHAI www.daxueconsulting.com [email protected] +86 (21) 5386 0380 TO ACCESS MORE INFORMATION ON THE MOBILITY MARJET IN CHINA, PLEASE CONTACT [email protected] CONTENT OUTLINE 1. M&A market dynamics 03 2. Retail & consumer sector 24 3. High-tech sector 37 4. Material sector 47 5. Automotive sector 58 6. Fashion sector 73 © 2021 DAXUE CONSULTING 2 ALL RIGHTS RESERVED 1 M&A market dynamics © 2021 DAXUE CONSULTING 3 ALL RIGHTS RESERVED China-related M&A transactions rose significantly in 2020 In 2020, the value and number of China M&A increased by 31.3% and 11.3% respectively compared to 2019, the average value of M&A deals increased about 16%. It means there were more large deals in 2020 than 2019. M&A deal of financial buyers is the major growing segment as strong government investment support. Total number and value of M&A deals in China (2016-2020) 2016 2017 2018 2019 2020 Number Value Number Value Number Value Number Value Number Value Strategic buyers (USDbn) (USDbn) (USDbn) (USDbn) (USDbn) Domestic 4,870 316.9 5,111 361.9 4,778 361.9 4,498 272.4 4,530 349.4 Foreign 271 6.7 255 13.8 178 13.8 278 20.9 181 14.6 Total strategic buyers 5,141 323.6 5,366 357.7 4,956 338.6 4,746 293.3 4,711 364.0 Financial buyers Private equity 1,767 212.0 1,324 361.9 1,920 212.9 1,585 206.3 2,077 332.4 VC 3,492 5.6 2,338 13.8 3,410 7.0 2,546 2.6 3,361 2.8 Total financial buyers 5,259 217.7 3,662 177.1 5,330 219.9 4,134 208.9 5,438 335.2 China mainland Outbound SOE 116 63.2 101 27.0 -

Opportunities from China's Environmental Renaissance Overview of the Kraneshares MSCI China Environment ETF (Ticker: KGRN)

KGRN 9/30/2020 Opportunities from China's Environmental Renaissance Overview of the KraneShares MSCI China Environment ETF (Ticker: KGRN) [email protected] 1 Introduction to KraneShares About KraneShares Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. Our suite of China focused ETFs provides investors with solutions to capture China’s importance as an essential element of a well-designed investment portfolio. We strive to provide innovative, first to market strategies that have been developed based on our strong partnerships and our deep knowledge of investing. We help investors stay current on global market trends and aim to provide meaningful diversification. Krane Funds Advisors, LLC is majority owned by China International Capital Corporation (CICC). 2 2 Investment Strategy: The KraneShares MSCI China Environment ETF (KGRN) seeks to track the performance of the MSCI China IMI Environment 10/40 (USD Net) Index. The Index is comprised of securities that derive at least 50% of their revenues from environmentally beneficial products and services. The Index is based on five key Clean Technology environmental themes: Alternative Energy, Sustainable Water, Green Building, Pollution Prevention and Energy Efficiency. The Index aims to serve as a benchmark for investors seeking exposure to Chinese KGRN companies that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation. Constituent selection is based on data from MSCI Environment, KraneShares MSCI Social, and Governance (ESG). China Environnent ETF China’s Environmental Protection Highlights: • China is the world leader in total renewable energy capacity, at approximately 31% of total global capacity1. -

Three Key Trends in Automotive Industry

2016/12 Three key trends in automotive industry 普华永道思略特管理咨询(上海)有限公司 PwC Strategy& Three key trends in automotive will fundamentally transform automotive industry Digitalization Electrification Changing mobility Source: Strategy& analysis Strategy& | PwC 1 “互联网+”顶层设计 “Internet +” high level design Digitalization will disrupt the whole value chain from R&D and production to sales Value chain of traditional auto industry Value chain changes Marketing R&D Sourcing Mfg. Dealership & service • Linear value chain • Focus on products/hardware • Vehicle as a means of transportation • Multi-level distribution structure Value chain of digital auto industry • Mainly finished products R&D • Multi-dimensional connectivity in value chain Mkt & Mfg. • Focus on service/software service Real time • Vehicle as a consumption scenario connecti • Client relationship without vity intermediary • Customized products/services in Supply Product small scale chain Source: literature research; Strategy& analysis Strategy& | PwC Daimler, as a pioneer, optimized its value chain via digital innovation Smart R&D: • Various Apps, infotainment, automation and battery techs have been developed by 150 digital engineers as well as prototype designers in the R&D center in Silicon Valley Smart marketing service: Smart manufacturing: • Restructured the marketing • Global unified component department, with the steering R&D standard and system framework, committee at HQ consisting of as well as auto control module sales, technicians for in-car info • The standard module is applied -

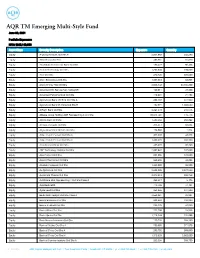

AQR TM Emerging Multi-Style Fund June 30, 2021

AQR TM Emerging Multi-Style Fund June 30, 2021 Portfolio Exposures NAV: $685,149,993 Asset Class Security Description Exposure Quantity Equity A-Living Services Ord Shs H 2,001,965 402,250 Equity Absa Group Ord Shs 492,551 51,820 Equity Abu Dhabi Commercial Bank Ord Shs 180,427 96,468 Equity Accton Technology Ord Shs 1,292,939 109,000 Equity Acer Ord Shs 320,736 305,000 Equity Adani Enterprises Ord Shs 1,397,318 68,895 Equity Adaro Energy Tbk Ord Shs 2,003,142 24,104,200 Equity Advanced Info Service Non-Voting DR 199,011 37,300 Equity Advanced Petrochemical Ord Shs 419,931 21,783 Equity Agricultural Bank of China Ord Shs A 288,187 614,500 Equity Agricultural Bank Of China Ord Shs H 482,574 1,388,000 Equity Al Rajhi Bank Ord Shs 6,291,578 212,576 Equity Alibaba Group Holding ADR Representing 8 Ord Shs 33,044,794 145,713 Equity Alinma Bank Ord Shs 1,480,452 263,892 Equity Ambuja Cements Ord Shs 305,517 66,664 Equity Anglo American Platinum Ord Shs 174,890 1,514 Equity Anhui Conch Cement Ord Shs A 307,028 48,323 Equity Anhui Conch Cement Ord Shs H 1,382,025 260,500 Equity Arab National Bank Ord Shs 485,970 80,290 Equity ASE Technology Holding Ord Shs 2,982,647 742,000 Equity Asia Cement Ord Shs 231,096 127,000 Equity Aspen Pharmacare Ord Shs 565,696 49,833 Equity Asustek Computer Ord Shs 1,320,000 99,000 Equity Au Optronics Ord Shs 2,623,295 3,227,000 Equity Aurobindo Pharma Ord Shs 3,970,513 305,769 Equity Autohome ADS Representing 4 Ord Shs Class A 395,017 6,176 Equity Axis Bank GDR 710,789 14,131 Equity Ayala Land Ord Shs 254,266 344,300 -

Schedule of Investments (Unaudited) Blackrock Advantage Emerging Markets Fund January 31, 2021 (Percentages Shown Are Based on Net Assets)

Schedule of Investments (unaudited) BlackRock Advantage Emerging Markets Fund January 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Security Shares Value Common Stocks China (continued) China Life Insurance Co. Ltd., Class H .................. 221,000 $ 469,352 Argentina — 0.0% China Longyuan Power Group Corp. Ltd., Class H ....... 52,000 76,119 (a) 313 $ 60,096 Globant SA .......................................... China Mengniu Dairy Co. Ltd.(a) ......................... 15,000 89,204 Brazil — 4.9% China Merchants Bank Co. Ltd., Class H ................ 36,000 275,683 Ambev SA ............................................. 236,473 653,052 China Overseas Land & Investment Ltd.................. 66,500 151,059 Ambev SA, ADR ....................................... 94,305 263,111 China Pacific Insurance Group Co. Ltd., Class H......... 22,000 90,613 B2W Cia Digital(a) ...................................... 20,949 315,188 China Railway Group Ltd., Class A ...................... 168,800 138,225 B3 SA - Brasil Bolsa Balcao............................. 33,643 367,703 China Resources Gas Group Ltd. ....................... 30,000 149,433 Banco do Brasil SA..................................... 15,200 94,066 China Resources Land Ltd. ............................. 34,000 134,543 BRF SA(a).............................................. 22,103 85,723 China Resources Pharmaceutical Group Ltd.(b) .......... 119,500 62,753 BRF SA, ADR(a) ........................................ 54,210 213,045 China Vanke Co. Ltd., Class A .......................... 67,300 289,157 Cia de Saneamento de Minas Gerais-COPASA .......... 52,947 150,091 China Vanke Co. Ltd., Class H .......................... 47,600 170,306 Duratex SA ............................................ 19,771 71,801 CITIC Ltd............................................... 239,000 186,055 Embraer SA(a).......................................... 56,573 90,887 Contemporary Amperex Technology Co. Ltd., Class A .... 1,700 92,204 Gerdau SA, ADR ...................................... -

Xpeng Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 001-39466 XPeng Inc. (Exact name of Registrant as specified in its charter) Cayman Islands (Jurisdiction of incorporation or organization) No. 8 Songgang Road, Changxing Street Cencun, Tianhe District, Guangzhou Guangdong 510640 People’s Republic of China (Address of principal executive offices) Hongdi Brian Gu, Vice Chairman and President Telephone: +86-20-6680-6680 Email: [email protected] At the address of the Company set forth above (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered American Depositary Shares, each representing XPEV New York Stock Exchange two Class A ordinary shares Class A ordinary shares, par value US$0.00001 New York Stock Exchange per share* * Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares. -

Evergrande Group

China Evergrande Group China Evergrande Group 中國恒大集團 (incorporated in the Cayman Islands with limited liability) Stock Code: 3333 ANNUAL REPORT 2017 ANNUAL REPORT 2017 ANNUAL REPORT 207 NATIONAL LAYOUT MAP H BEIJING Changsha 1 Evergrande Palace Beijing 61 Evergrande City Changsha Heilongjiang 2 Evergrande Metropolis Beijing 62 Evergrande Oasis Changsha 3 Evergrande Emerald Court Beijing 63 Evergrande Atrium Changsha 4 Evergrande Left Riverbank Beijing 64 Evergrande Bay Changsha 5 Evergrande Elite Shadow Creek Beijing 65 Evergrande Royal Scenic Peninsula Changsha 6 Evergrande International Hotspring Tourist City Baoding 66 Evergrande Emerald Court Changsha REAL ESTATE HEALTH* TOURISM 7 Evergrande Royal Scenic Peninsula Beijing 67 Evergrande Royal Scenic Bay Changsha Jilin 8 Evergrande Culture Tourist City Beijing 68 Evergrande Royal View Splendor Changsha 9 Evergrande the Great Wall Village Chengde 69 Evergrande Financial Plaza Changsha 70 Changsha Huangxing Road North Project SHANGHAI 71 Evergrande Forest creek County Changsha 10 Evergrande Palace Shanghai 72 Evergrande Fairy Tale World Changsha 11 Evergrande Royal Scenic Bay Shanghai 73 Evergrande Palace Liuyang Xinjiang Liaoning 12 Evergrande Royal Palace Sheshan Shanghai 74 Evergrande Jade Palace Changsha 13 Evergrande Royal View Garden Shanghai 75 Evergrande Shanglin Garden Changsha Hebei 14 Evergrande Metropolis Shanghai 76 Evergrande Palace of Glory Changsha 15 Evergrande Royal Seaview Garden Qingpu 77 Evergrande Royal View Splendor Ningxiang Beijing 16 Evergrande Bay Palace Shanghai