Download Full Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Social Monitoring Report IND:Uttarakhand Emergency Assistance Project

Social Monitoring Report Project Number: 47229-001 October 2016 Period: January 2016 – June 2016 IND: Uttarakhand Emergency Assistance Project Submitted by Project implementation Unit –UEAP (Roads and Bridges), Dehradun This report has been submitted to ADB by the Project implementation Unit –UEAP (Roads and Bridges), Dehradun and is made publicly available in accordance with ADB’s Public Communications Policy (2011). It does not necessarily reflect the views of ADB. This social Monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area SEMI ANNUAL SOCIAL MONITORING REPORT JANUARY - JUNE 2016 UTTARAKHAND EMERGENCY ASSISTANCE PROJECT Project Implementation Unit (Roads and Bridges) State Disaster Management Authority Government of Uttarakhand Dehradun Semi Annual Social Monitoring Report JAN– JUN 2016 INDEX 1. Project Fact Sheet…………………………………………………………………….....3 2. Introduction …………………………………………..………………………………...5 3. Institutional Arrangement……………………………..………………………………...6 4. Verification / Validation………………………………………………………………...7 5. Impact Assessment progress and RP Implementation……………………………..….8 6. Measures to Minimize -

Uttarakhand Board of School Education

UTTARAKHAND BOARD OF SCHOOL EDUCATION, RAMNAGAR, NAINITAL NATIONAL SERVICE SCHEME 'C' CERTIFICATE EXAMINATION 2015 LIST OF QUALIFIED CANDIDATES GARHWAL REGION District : 101 - HARIDWAR Exam Centre : 003 - S S N M I C MAKHDOOMPUR HARIDWAR 200003 200004 200005 200007 200008 200009 200011 200012 200013 200015 200016 District : 101 - HARIDWAR Exam Centre : 006 - NATIONAL KANYA I C KHANPUR HARIDWAR 200040 200048 District : 101 - HARIDWAR Exam Centre : 007 - ARYA KANYA I C BAHADRABAD HARIDWAR 200054 200057 200066 District : 102 - DEHRADUN Exam Centre : 010 - GOVT I C LANGHA DEHRADUN 200075 District : 102 - DEHRADUN Exam Centre : 013 - SHRI LAXMAN VIDYALAYA I C DEHRADUN 200089 District : 102 - DEHRADUN Exam Centre : 019 - GOVT I C QUANSI DEHRADUN 200099 200100 200108 District : 102 - DEHRADUN Exam Centre : 020 - S V M I C BABUGARH VIKASNAGAR DEHRADUN 200115 200116 200119 200120 200121 200122 200123 200125 200127 200128 200130 200132 200134 District : 102 - DEHRADUN Exam Centre : 021 - S V M I C DAKPATHAR VIKASNAGAR DEHRADUN 200136 200140 200142 200144 200148 200150 200152 District : 103 - UTTARKASHI Exam Centre : 027 - GOVT I C CHINYALISAUR UTTARKASHI 200176 200177 200185 200186 District : 104 - TEHRI GARHWAL Exam Centre : 036 - GOVT I C KIRTINAGAR TEHRI GARHWAL 200213 District : 104 - TEHRI GARHWAL Exam Centre : 037 - GOVT GIRLS I C CHAMBA TEHRI GARHWAL 200222 Page 1 UTTARAKHAND BOARD OF SCHOOL EDUCATION, RAMNAGAR, NAINITAL NATIONAL SERVICE SCHEME 'C' CERTIFICATE EXAMINATION 2015 LIST OF QUALIFIED CANDIDATES GARHWAL REGION District : 104 - -

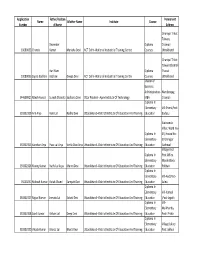

Application Father/Husban Permanent Name Mother Name Institute Course Number D Name Address

Application Father/husban Permanent Name Mother Name Institute Course Number d Name Address Ghaniyal Trikot Talwari, Devender Diploma Chamoli 10080033 Chanda Kumar Manisha Devi NCT Delhi--National Insdustrial Training Centre Courses Uttrakhand Ghaniyal Trikot Talwari Chamoli Hari Ram Diploma Tharali 10080035 Sapna Badhani Badhani Deepa Devi NCT Delhi--National Insdustrial Training Centre Courses Uttrakhand Master of Business Administration- Nandprayag 344600921 Ritesh Kumar Suresh Chandra Sadhana Devi Uttar Pradesh--Apex Institute Of Technology MBA Chamoli Diploma In Elementary Vill-Shersi,Post- 350302329 Anil Arya Ram Lal Radha Devi Uttarakhand--District Institute Of Education And Training Education Badasu Alaknanda Vihar, Ward No- Diploma In 03, House No- Elementary 39 Srinagar 350302325 Kanchan Arya Pusu Lal Arya Vimla Devi Arya Uttarakhand--District Institute Of Education And Training Education Garhwal Village And Diploma In Post Office Elementary Masoli Block 350302326 Manoj Kumar Nathi Lal Arya Munni Devi Uttarakhand--District Institute Of Education And Training Education Pokhari Diploma In Elementary Vill-And,Post- 35030231 Mukesh Kumar Gulab Chand Sampati Devi Uttarakhand--District Institute Of Education And Training Education Salna Diploma In Elementary Vill-Kamsal 350302327 Rajpal Kumar Jematu Lal Sobati Devi Uttarakhand--District Institute Of Education And Training Education ,Post-Jagoth Diploma In Vill- Elementary Maikhanda, 350302328 Sunil Kumar Kishan Lal Deep Devi Uttarakhand--District Institute Of Education And Training -

PINCODE List Updated 31-3-2018

Name of the Circle:- Uttarakhand Dehradun NSH SL NO NAME OF PO STATUS PINCODE District 1 DEHRADUN Gazetted GPO GPO 248001 Dehradun 2 Mothrowala BO 248001 Dehradun 3 Kanwali BO 248001 Dehradun 4 Balawala BO 248001 Dehradun 5 Harrawala BO 248001 Dehradun 6 Bhaniawala BO 248001 Dehradun 7 K.P Shetra BO 248001 Dehradun 8 AJABPUR TSO 248121 Dehradun 9 Banjarawala BO 248121 Dehradun 10 ARAGHAR NDTSO 248001 Dehradun 11 ARHAT BAZAR NDTSO 248001 Dehradun 12 BHOGPUR SO 248143 Dehradun 13 Badogal BO 248143 Dehradun 14 Haldwari BO 248143 Dehradun 15 Dharkot BO 248143 Dehradun 16 Itharna BO 248143 Dehradun 17 Sangaon BO 248143 Dehradun 18 Thano BO 248143 Dehradun 19 C.D.A.(AF) NDTSO 248001 Dehradun 20 N.I.V.H NDBO 248001 Dehradun 21 CANNAUGHTPLACE NDTSO 248001 Dehradun 22 CLEMENT TOWN TSO 248002 Dehradun 23 Mohebbewala BO 248002 Dehradun 24 DEFENCE COLONY TSO 248012 Dehradun 25 Doon University NDBO 248012 Dehradun 26 DALANWALA NDTSO 248001 Dehradun 27 DEHRADUN CITY NDTSO 248001 Dehradun 28 DEHRADUN KUTCHERY NDTSO 248001 Dehradun 29 DILARAM BAZAR NDTSO 248001 Dehradun 30 DOIWALA SO 248140 Dehradun 31 Bullawala BO 248140 Dehradun 32 Badonwala BO 248140 Dehradun 33 Doodhli BO 248140 Dehradun 34 FatehpurTanda BO 248140 Dehradun 35 Khairi BO 248140 Dehradun 36 Lachhiwala BO 248140 Dehradun 37 Markhamgrant BO 248140 Dehradun 38 Nagal Bulandawala BO 248140 Dehradun 39 Nagal Jawalapur BO 248140 Dehradun 40 Resham Majri BO 248140 Dehradun 41 GOVINDGARH NDTSO 248001 Dehradun 42 HATHI BARKALA NDTSO 248001 Dehradun 43 I I P - SO 248005 Dehradun 44 Badripur- BO -

Revised Drawing & Disbursing Officers List

Revised Drawing & Disbursing Officers List DDO Sl No District DDO Name Location Treasury Department Code 1 Almora 2132 Chief Agriculture Officer Almora Almora Agriculture 2 Almora 2133 Agriculture & Soil Conservation Officer Almora Almora Agriculture 3 Almora 2133 Agriculture & Soil Conservation Officer Bhikiyasain Bhikiyasain Agriculture 4 Almora 2133 Agriculture & Soil Conservation Officer Ranikhet Ranikhet Agriculture 5 Almora 2135 Agriculture & Soil Conservation Officer Barechhina Almora Agriculture Principal Govt Soil Conservation Training 6 Almora 2191 Majkhali Ranikhet Agriculture Institute 7 Bageswar 2132 Chief Agriculture Officer Bageswar Bageswar Agriculture 8 Bageswar 2133 Agriculture & Soil Conservation Officer Bageswar Bageswar Agriculture 9 Chamoli 2132 Chief Agriculture Officer Chamoli Gopeswar Agriculture 10 Chamoli 2133 Agriculture & Soil Conservation Officer Chamoli Gopeswar Agriculture 11 Chamoli 2133 Agriculture & Soil Conservation Officer Karnprayag Karnprayag Agriculture 12 Chamoli 2133 Agriculture & Soil Conservation Officer Tharali Tharali Agriculture 13 Champawat 2132 Chief Agriculture Officer Champawat Champawat Agriculture 14 Champawat 2133 Agriculture & Soil Conservation Officer Lohaghat Lohaghat Agriculture 15 Dehradun 2132 Chief Agriculture Officer Dehradun Dehradun Agriculture 16 Dehradun 2133 Agriculture & Soil Conservation Officer Chakarata Chakarata Agriculture 17 Dehradun 2133 Agriculture & Soil Conservation Officer Raipur Dehradun Agriculture 18 Dehradun 2133 Agriculture & Soil Conservation Officer -

A Case Study of Chamoli District, Uttarakhand

aphy & N r at og u e ra G l Khanduri, J Geogr Nat Disast 2018, 8:2 f D o i s l Journal of Geography and Natural a DOI: 10.4172/2167-0587.1000226 a s n t r e u r s o J Disasters ISSN: 2167-0587 Research Article Open Access Landslide Distribution and Damages during 2013 Deluge: A Case Study of Chamoli District, Uttarakhand Khanduri S* Department of Disaster Management, Disaster Mitigation and Management Centre, Rajpur Road, Uttarakhand Secretariat, Dehradun, Uttarakhand 248001, India *Corresponding author: Khanduri S, Geologist, Department of Disaster Management, Disaster Mitigation and Management Centre, Rajpur Road, Uttarakhand Secretariat, Dehradun, Uttarakhand 248001, India, Tel: +919927721776; E-mail: [email protected] Received date: Feb 09, 2018; Accepted date: July 31, 2018; Published date: August 08, 2018 Copyright: © 2018 Khanduri S. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. Abstract In June 2013 multiple disaster involving flash flood and landslides struck many parts of Uttarakhand state. This caused massive devastation in the state on 16 and 17 June, 2013. In the present paper, attempt was made to analysis the landslide incidences and damages in Chamoli district. A total of 220 landslides were observed in the area. About 92% of slide occurred on northerly (48 percent) and southerly (43 percent) facing slopes. These may be subject to freeze-thaw and drier cycles. Heavy rainfall and low shear strength of the rocks have played a major role in facilitating these slides. -

Social Monitoring Report IND:Uttarakhand Emergency

Social Monitoring Report Project Number: 47229-001 September 2017 Period: January 2017 – June 2017 IND: Uttarakhand Emergency Assistance Project Submitted by Project implementation Unit –UEAP (Roads and Bridges), Dehradun This report has been submitted to ADB by the Project implementation Unit –UEAP (Roads and Bridges), Dehradun and is made publicly available in accordance with ADB’s Public Communications Policy (2011). It does not necessarily reflect the views of ADB. This social monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area SEMI ANNUAL SOCIAL MONITORING REPORT JANUARY - JUNE 2017 UTTARAKHAND EMERGENCY ASSISTANCE PROJECT Project Implementation Unit (Roads and Bridges) State Disaster Management Authority Government of Uttarakhand Dehradun Semi Annual Social Monitoring Report Jan- Jun 2017 INDEX 1. Project Fact Sheet…………………………………………………………………….....3-3 2. Introduction …………………………………………..……………………………….....5-5 3. Minimizing Resettlement Impact……………………………………………………….5-5 4. Institutional Arrangement……………………………..………………………………...6-7 5. Resettlement Plan Implementation…………………………………………………....7-9 6. Grievance Redress Mechanism……………………..………………………………..9-10 7. Public Consultation …………………………………………………………………..10-11 8. Conclusion…………………………………………………………………………….11-11 List of Tables - Table – 1 Details of social expert of DSCs………………………………………………7-7 Table – 2 Summary of resettlement impact subproject wise (after mitigation) ……. 8-8 Table – 3 Status of due diligence report at a glance…………………………………….8-9 Annexed - 1. -

UK GDS Recruitment

NOTIFICATION FOR THE POSTS OF GRAMIN DAK SEVAKS CYCLE – II/2019-2020 UTTARAKHAND CIRCLE RECTT./GDS ONLINE/CYCLE-II/2020 Applications are invited by the respective engaging authorities as shown in the annexure ‘I’against each post, from eligible candidates for the selection and engagement to the following posts of Gramin Dak Sevaks. I. Job Profile:- (i) BRANCH POSTMASTER (BPM) The Job Profile of Branch Post Master will include managing affairs of Branch Post Office, India Posts Payments Bank ( IPPB) and ensuring uninterrupted counter operation during the prescribed working hours using the handheld device/Smartphone/laptop supplied by the Department. The overall management of postal facilities, maintenance of records, upkeep of handheld device/laptop/equipment ensuring online transactions, and marketing of Postal, India Post Payments Bank services and procurement of business in the villages or Gram Panchayats within the jurisdiction of the Branch Post Office should rest on the shoulders of Branch Postmasters. However, the work performed for IPPB will not be included in calculation of TRCA, since the same is being done on incentive basis.Branch Postmaster will be the team leader of the Branch Post Office and overall responsibility of smooth and timely functioning of Post Office including mail conveyance and mail delivery. He/she might be assisted by Assistant Branch Post Master of the same Branch Post Office. BPM will be required to do combined duties of ABPMs as and when ordered. He will also be required to do marketing, organizing melas, business procurement and any other work assigned by IPO/ASPO/SPOs/SSPOs/SRM/SSRM and other Supervising authorities. -

KARANPRAYAG Laitumkhrah,Shillong-793011

ELECTORAL ROLL - 2017 STATE - (S28) UTTARAKHAND No., Name and Reservation Status of Assembly Constituency: 6-Karnprayag(GEN) Last Part No., Name and Reservation Status of Parliamentary Service Constituency in which the Assembly Constituency is located: 2-Garhwal(GEN) Electors 1. DETAILS OF REVISION Year of Revision : 2017 Type of Revision : De-novo preparation Qualifying Date : 01.01.2017 Date of Draft Publication: 04.10.2017 2. SUMMARY OF SERVICE ELECTORS A) NUMBER OF ELECTORS 1. Classified by Type of Service Name of Service No. of Electors Members Wives Total A) Defence Services 3695 4 3699 B) Armed Police Force 0 0 0 C) Foreign Service 1 0 1 Total in Part (A+B+C) 3696 4 3700 2. Classified by Type of Roll Roll Type Roll Identification No. of Electors Members Wives Total I Original Preliminary Preliminary De-novo 3696 4 3700 Roll, 2017 preparation of last part of Electoral Roll Net Electors in the Roll 3696 4 3700 Elector Type: M = Member, W = Wife Page 1 Draft Electoral Roll, 2017 of Assembly Constituency 6-Karnprayag (GEN), (S28)UTTARAKHAND A . Defence Services Sl.No Name of Elector Elector Rank Husband's Regimental Address for House Address Type Sl.No. despatch of Ballot Paper (1) (2) (3) (4) (5) (6) (7) Assam Rifles 1 OM PRAKASH GAIROLA M Warrant Headquarters Directorate General BANGRI SIMLI 000000 Officer Assam Rifles, Record Branch, KARANPRAYAG Laitumkhrah,Shillong-793011 2 BALWANT RAM M Subedar Headquarters Directorate General DHANGA Assam Rifles, Record Branch, KARANPRAYAG Laitumkhrah,Shillong-793011 KARANPRAYAG GAIRSAIN 000000 -

Selection List of Gramin Dak Sevak for Uttarakhand Circle Cycle II Vide Notification No.RECTT./GDS ONLINE/CYCLE-II/2020

Selection list of Gramin Dak Sevak for Uttarakhand circle Cycle II vide Notification No.RECTT./GDS ONLINE/CYCLE-II/2020 S.No Division HO Name SO Name BO Name Post Name Cate No Registration Selected Candidate gory of Number with Percentage Post s 1 Almora Almora H.O Almora H.O Almora H.O GDS ABPM/ UR 1 CR66A5AFC14148 PARISHA VERMA- Dak Sevak (95)-UR 2 Almora Almora H.O Almora H.O Chaumu GDS ABPM/ UR 1 CR2E4BA4169145 VIVEK TEWARI- Uchyur B.O Dak Sevak (95)-UR 3 Almora Almora H.O Almora H.O Dal B.O GDS BPM UR 1 CR4393474CE458 BHARAT- (97)-UR 4 Almora Almora H.O Almora H.O Kharaun B.O GDS BPM EWS 1 CR6B34B8C8E18D AYUSH MISHRA- (95)-UR-EWS 5 Almora Almora H.O Bageshwar Are B.O GDS ABPM/ UR 1 CR5F7B71ABB6D NAMITA BORA- S.O Dak Sevak B (95)-UR 6 Almora Almora H.O Bageshwar Ason B.O GDS ABPM/ SC 1 CR7DD94E362D94 SARATH K- (94.05)- S.O Dak Sevak SC 7 Almora Almora H.O Bageshwar Bahuli B.O GDS BPM UR 1 CR8657A348B3AD KAMLESH KUMAR S.O SINGH- (95)-UR 8 Almora Almora H.O Bageshwar Chirang B.O GDS ABPM/ UR 1 CR8ED9AD7529A1 VANDANA SINGH- S.O Dak Sevak (93.1)-UR 9 Almora Almora H.O Bageshwar Doba Katyur GDS ABPM/ SC 1 CR423BEFE44413 ROHIT PRASAD- S.O B.O Dak Sevak (91.2)-SC 10 Almora Almora H.O Bageshwar Gadera B.O GDS BPM ST 1 CR5247FD579695 PRAHLAD KUMAR- S.O (95)-ST 11 Almora Almora H.O Bageshwar Ghiroli B.O GDS BPM ST 1 CR04E27BFAC41D MOUNIKA S.O BANOTH- (91.8333)- ST 12 Almora Almora H.O Bageshwar Jaulkande GDS ABPM/ SC 1 CR1E4987CE36C4 VINOD ARYA- S.O B.O Dak Sevak (88.3333)-SC 13 Almora Almora H.O Bageshwar Kanyalikote GDS ABPM/ UR 1 CR3238486C4241 -

NH Length for NIC.Xlsx

STATEWISE LENGTH OF NATIONAL HIGHWAYS IN INDIA Sl. NH No. Route Length (Km.) No. Andhra Pradesh 1 4 Karnataka Border - Palmaner - Chittoor - Naraharipeta - Tamil Nadu Border 83.62 Odisha Border - Ichchapuram - Narasannapeta - Srikakulam - Bhimunipatnam - Vishakhapatnam - 2 5 Prattipadu - Rajahmundry - Eluru - Vijaywada - Guntur - Ongole - Nellor - Gudur - Nayadupeta - 1024.00 Tamil Nadu Border Maharashtra Border - Adilabad - Nirmal - Ramayampet - Hyderabad - Kurnool - Gooty - Anantpur - 3 7 773.64 Penukonda - Karnataka Border 4 9 Karnataka Border - Zahirabad - Hyderabad - Suriapet - Vijaywada - Machillipatnam 455.74 5 16 Nizamabad - Armur - Jagtial - Lakshettipet - Chinnur - Maharashtra Border 235.15 6 18 Kurnool - Nandyal - Cuddapah - Rayachoti - Chittoor 362 7 18A Putalapattu - Tirupati 58.85 8 42 New Ananthapur (NH-44) - Urvakonda - Junction of NH-67 71.52 9 43 Odisha border - Ramabhadrapuram - Vizianagaram - Natavalasa (NH-5) 90.33 50 New NH No. 161 - Karnataka Border on NH-48 at Lakshmisagara. 0.00 10 63 Karnataka Border - Guntakal - Gooty 55.43 67 Ext. 11 Maidukuru (NH-40) - Badvel - Atmakur - Nellore - Krishnapatnam 204.00 (New) 12 150 New Karnataka border - Krishna on N.H-167 12.25 Karnataka border - Alur - Adoni - Mantralayam - Karnataka border 13 167 (New) 212.05 Karnataka border - Mehboobnagar - Jadcherla (NH-44) 14 202 Hyderabad - Jangaon - Warangal - Venkatpuram - Chhattisgarh Border 306.00 15 205 Ananthapur - Kadiri - Madanapalle - Pileru - Renigunta - Puttur - Tamil Nadu Border 341.60 16 214 Kathipudi - Kakinada - Razole -

Road Alignment and Its Impact Assessment on Environs in Parts of Himalayan Region Using Geospatial Tools

Road Alignment and its Impact Assessment on environs in Himalayan Region using Geospatial Tools Thesis submitted to the Andhra University, Visakhapatnam in partial fulfilment of the requirement for the award of Master of Technology in Remote Sensing and GIS Submitted By: Harjeet Singh Urban and regional Studies Department Project Supervisor: Project Co-supervisor: Dr. Sadhana Jain Mr. Kamal Pandey Scientist SE Scientist SD Urban and Regional Studies Department Remote sensing and Geo-informatics Group IIRS, Dehradun IIRS, dehradun Indian Institute of Remote Sensing, ISRO, Dept. of Space, Govt. of India Dehradun – 248001 Uttarakhand, India June 2015 Road Alignment and its Impact Assessment on Environs in parts of Himalayan Region Using Geospatial Tools Dedicated to all my well wishers ii Road Alignment and its Impact Assessment on Environs in parts of Himalayan Region Using Geospatial Tools Acknowledgement This thesis arose as a part of M.Tech project work carried out at Indian Institute of Remote Sensing. The thesis would not have materialized without the guidance and support of many people. Their contribution in the making of this thesis deserves a special mention. This is a humble acknowledgement to convey my gratitude to them all. First, I would like to express my deepest thanks to my mother (Smt. Veena Rani) and my uncle and best friend (Sardar Jasvir Singh Brar). I am really grateful for all the love and support they have always showered on me. I would like to acknowledge the efforts of my supervisor Dr. Sadhana Jain Scientist SE, Urban and Regional Studies Department, IIRS and Co-supervisor Mr. Kamal Pandey Scientist SD, Remote sensing and Geo-informatics Group, IIRS.