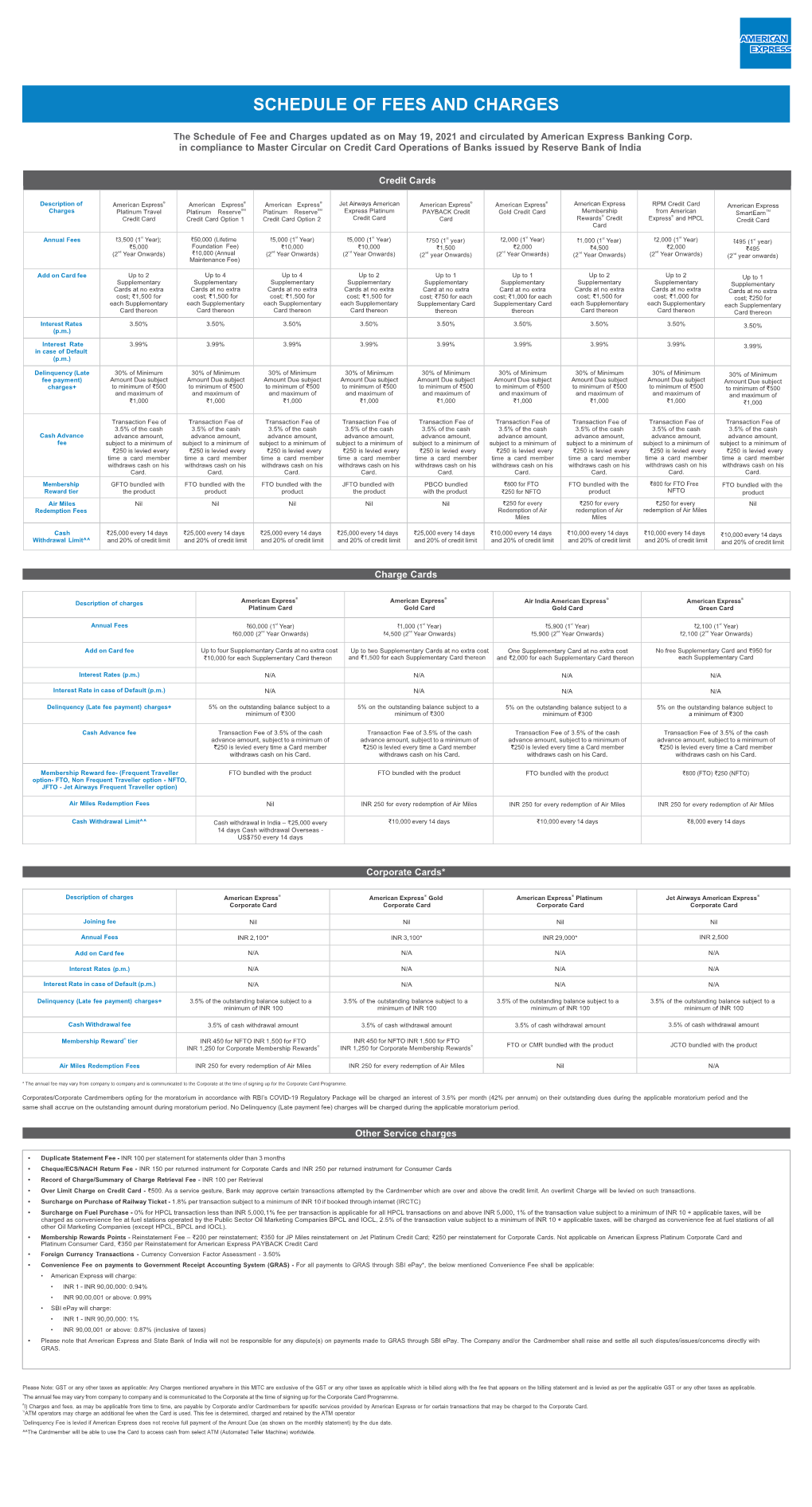

Schedule-Of-Fee-And-Charges.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VX690 User Manual

Sivu 1(36) 28.9.2016 VX690 User Manual English Author: Verifone Finland Oy Date: 28.9.2016 Pages: 20 Sivu 2(36) 28.9.2016 INDEX: 1. BEFORE USE ............................................................................................................................... 5 1.1 Important ......................................................................................................................................... 5 1.2 Terminal Structure ......................................................................................................................... 6 1.3 Terminal start-up and shutdown .................................................................................................. 6 1.4 Technical data ................................................................................................................................ 7 1.5 Connecting cables ......................................................................................................................... 7 1.6 SIM-card.......................................................................................................................................... 8 1.7 Touchscreen ................................................................................................................................... 8 1.8 Using the menus ............................................................................................................................ 9 1.9 Letters and special characters.................................................................................................... -

ENG Full-07.Ai

Welcome Aboard Rewards & Privileges Dining Entertainment Tra ve l Pleasures Services Forms Terms & Conditions Welcome to the Platinum Credit Card membership Every day is a new adventure with the American Express® Platinum Credit Card. So start using your Card and embark on an exciting journey of dining, entertainment and movie privileges, relaxing getaways, amazing rewards and much more. The Card is welcomed all over town - from booking your annual vacation to picking up your daily groceries. You can even apply for two complimentary Supplementary Cards and share the Platinum privileges with your loved ones. While you are online, why not take advantage of our online services which give you fast‚ ultra-safe access to your Card account anywhere, anytime. You can check your Membership Rewards points balance, offset your purchase with points, redeem for your rewards, and view your atestl transactions. After registration, you might also enroll into paperless for your statements. Switching to online statements is an easy way to cut down on paper usage and help save the environment. Enroll for paper-free online statements. Don’t miss the latest updates on our official Facebook page. Follow us. Ready to start playing? Page 2 of 13 Welcome Aboard Rewards & Privileges Dining Entertainment Tra ve l Pleasures Services Forms Terms & Conditions Rewards & Privileges American Express Platinum Credit Card Redeem Air Miles, Room Nights Membership Rewards® Program You may use your points to redeem for free flights, airline upgrade As an American Express Platinum Credit Cardmember, you are and companion tickets with airlines. Or treat yourself to luxurious automatically enrolled in this Program for free. -

Consumer Credit Card Agreement and Disclosure

CONSUMER CREDIT CARD AGREEMENT AND DISCLOSURE MASTERCARD This Consumer Credit Card Agreement and Disclosure together with the Account Opening Disclosure and any other Account opening documents or any subsequent documents provided to You related to this Account (hereinafter collectively referred to as “Agreement”) govern the terms and conditions of this Account. “We,” “Us,” “Our” and “Ours” and “Credit Union” refers to Pen Air Federal Credit Union with which this Agreement is made. “You,” “Your,” and “Yours” refers to each applicant and co-applicant for the Account; any person responsible for paying the Account; and anyone You authorize to use, access or service the Account. "Card" means the Mastercard® credit card and any other access devices, duplicates, renewals, or substitutions, the Credit Union issues to You. "Account" means the line of credit established by this Agreement and includes Your Card. SECURITY INTEREST You grant the Credit Union a security interest under the Uniform Commercial Code and under any common law rights the Credit Union may have in any goods You purchase. If You give the Credit Union a specific pledge of shares by signing a separate pledge of shares, Your pledged shares will secure Your Account. You may not withdraw amounts that have been specifically pledged to secure Your Account until the Credit Union agrees to release all or part of the pledged amount. You grant Us a security interest in all individual and joint share and/or deposit accounts You have with Us now and in the future to secure Your credit card Account. Shares and deposits in an IRA or any other account that would lose special tax treatment under state or federal law if given as security are not subject to the security interest You have given in Your shares and deposits. -

Credit Card Disclosure (PDF)

OPEN-END CONSUMER CREDIT AGREEMENTS AND TRUTH IN LENDING DISCLOSURES Effective July 1, 2016 FEDERALLY INSURED BY NCUA PATELCO CREDIT UNION in agreements governing specific services you have and your general OPEN-END CONSUMER CREDIT AGREEMENTS AND membership agreements with Patelco, and you must have a satisfactory TRUTH IN LENDING DISCLOSURES loan, account and membership history with Patelco. MASTERCARD® CREDIT CARDS 2. On joint accounts, each borrower can borrow up to the full amount of SECURED MASTERCARD CREDIT CARD the credit limit without the other’s consent. PERSONAL LINE OF CREDIT 3. Advances Effective: JULY 1, 2016 a. Credit Card Advances: Credit Cards will be issued as instructed on This booklet contains agreements and Truth in Lending Disclosures your application. To make a purchase or get a cash advance, you that govern your use of the following Patelco Credit Union open-end can present the Card to a participating MasterCard plan merchant, consumer credit programs: to the Credit Union, or to another financial institution, and sign Pure MasterCard Payback Rewards World MasterCard the sales or cash advance draft imprinted with your Card number. Keep sales and cash advance drafts to reconcile your monthly Pure Secured MasterCard Passage Rewards World Elite MasterCard statements. You can also make purchases by giving your Card Points Rewards World MasterCard Personal Line of Credit number to a merchant by telephone, over the internet, or by other means, in which case your only record of the transaction may In addition to this booklet, -

Agreement Between Corporate Card Member and American Express

Agreement Between FDR# 1122575 Corporate Card Member and American Express Travel Related Services Company, Inc. Welcome to American Express® Corporate Card Membership conversion spread. Charges converted by seller(s) of goods and Read this Agreement thoroughly before you sign or use the enclosed services (such as airlines) will be billed at the rates such sellers use. American Express® Corporate Card. By signing, using or accepting the Corporate Card, you will be agreeing with us to everything 6) Liability written here. Your use of the Corporate Card will be governed by Your Corporate Card account is issued to you by us for the benefit this Agreement. If you do not wish to be bound by this Agreement, of the Company. If we opened your Corporate Card account on the cut the Corporate Card in half and return the pieces to us. If you do basis of “Full Corporate Liability”, then the Company is fully liable sign the Corporate Card, you should not use it before the valid date to us for all Charges incurred on your Corporate Card account. If or after the expiration date printed on the face of the Corporate we opened your Corporate Card account on the basis of “Combined Card. Liability”, then you, as the Corporate Card Member, and the Company are jointly and severally liable to us for all Charges billed 1) Definitions to your Corporate Card account, except that the Company shall not As you read this Agreement, remember that the words “you”, be liable for Charges you incur that are personal in nature or not for “your” or “Corporate Card Member” mean the person named on business purposes. -

American Express 4Th Member February 2009

EMVCO WELCOMES AMERICAN EXPRESS AS ITS FOURTH OWNER-MEMBER 03 February 2009 – EMVCo, the EMV standards body jointly owned by JCB International, MasterCard Worldwide and Visa Inc., today announced American Express as its fourth owner-member. The addition of this latest international payment organisation aligns with EMVCo’s intent to attract further industry participation in the development of the EMV Specifications. As an established supporter and end-user of EMV technology, American Express has acquired a one-fourth share of EMVCo from the respective holdings of JCB International, MasterCard Worldwide and Visa Inc., and will therefore have an equal interest in the organisation. EMVCo’s management structure has been changed to give American Express representation on the organisation’s Executive Committee and Board of Managers, in addition to equal participation in its working groups. “EMVCo welcomes American Express as its fourth global payment system member,” said Tad Fordyce, Chairman of the EMVCo Executive Committee and Head of Global Cross Product Platforms at Visa Inc. “American Express will be able to lend expertise at both the technical and management level which will directly support the EMVCo goal to enhance global chip standards, and offer secure and interoperable payments at the point of sale around the world.” Susan Hillel, Senior Vice President of Global Network Operations at American Express, says: “American Express is delighted to join and become a member of EMVCo. We are committed to driving interoperability in payments and know that our participation in EMVCo will facilitate this for our merchant, issuer and card member customers. Involvement by the four major payment organisations will drive secure and interoperable payments globally for transactions made with chip cards by aligning and progressing EMV Specifications. -

How to Find the Best Credit Card for You

How to find the best credit card for you Why should you shop around? Comparing offers before applying for a credit card helps you find the right card for your needs, and helps make sure you’re not paying higher fees or interest rates than you have to. Consider two credit cards: One carries an 18 percent interest rate, the other 15 percent. If you owed $3,000 on each and could only afford to pay $100 per month, it would cost more and take longer 1. Decide how you plan to pay off the higher-rate card. to use the card The table below shows examples of what it might You may plan to pay off your take to pay off a $3,000 credit card balance, paying balance every month to avoid $100 per month, at two different interest rates. interest charges. But the reality is, many credit card holders don’t. If you already have a credit card, let APR Interest Months history be your guide. If you have carried balances in the past, or think 18% = $1,015 41 you are likely to do so, consider 15% = $783 38 credit cards that have the lowest interest rates. These cards typically do not offer rewards and do not The higher-rate card would cost you an extra charge an annual fee. $232. If you pay only the minimum payment every month, it would cost you even more. If you have consistently paid off your balance every month, then you So, not shopping around could be more expensive may want to focus more on fees and than you think. -

Credit Cards American Express Company 24-Hour Number: (800) 528-2121 (U.S

Credit Cards American Express Company 24-Hour Number: (800) 528-2121 (U.S. and Canada) American Express Cards include: Personal Green (pictured), Gold, Platinum, Corporate Green (pic - tured), Corporate Gold, Corporate Platinum, Corpo - rate Optima, Optima, Optima Gold, Purchasing Card, American Express Blue (pictured), Green and Gold Rewards, and more. American Express also issues co-branded cards, including Hilton, Delta SkyMiles (pictured), ITT Sheraton Club Miles, and more. American Express issues multiple styles of prepaid cards. Gift Cards (4 are pictured) can be variable load or pre-denominated ranging from $25 to $3,000. Gift Cards are not reloadable and can be personalized or issued anonymously. Reloadable prepaid cards are also available in various styles and offer different functionality. Serve and Bluebird prepaid cards are multifunction cards with many new features such as bill pay, check writing, and funds transfer. All prepaid cards have the word “PREPAID” printed on either the front or back of the card. Account numbers are 15 digits, begin with 37 or 34, and are sequenced 4-6-5. UV light reveals large “AMEX” and phosphorescence on the face of each card, excluding the Gift Card. The Centurion or the American Express Blue Box appears on most Amer - ican Express cards. To establish the validity of a card, or determine its status, please call (866) 375-3684. 98 Credit Cards Diners Club International ® 2500 Lake Cook Rd. Riverwoods, IL 60015 Security Contacts: Law Enforcement Phone Line: 1-800-347-3083 for law enforcement officers Merchant Code 10 Authorization: 1-800-347-1111 for suspicious transactions Diners Club ® account numbers start with 36 or 55. -

Unionpay: Visa and Mastercard's Tough Chinese Rival

1.35% AXP American Express Co $66.0 USD 0.87 1.32% Market data is delayed at least 15 minutes. Company Lookup Ticker Symbol or Company Go Among the myriad designer brands at the Harrods flagship store in London, Chinese housewife Li Yafang spotted a corporate logo she knows from back home: the red, blue, and green of UnionPay cards. “It’s very convenient,” said Li, 39, as a salesperson rang up a £1,190 ($1,920) Prada Saffiano Lux handbag. With 2.9 billion cards in circulation—equal to 45 percent of the world’s total last year—UnionPay has grown into a payments processing colossus just 10 years after the company was founded. Now accepted in 135 countries, its share of global credit- and debit-card transaction volume for the first half of 2012 rose to 23.8 percent, propelling it to No. 2 behind Visa International (V), according to the Nilson Report, an industry newsletter. “UnionPay has absolute dominance in China, and it’s now expanding beyond that to become a top global player,” says James Friedman, an analyst at Susquehanna International Group. “Their numbers show they are already in the league of Visa and MasterCard (MA).” Yin Lian, UnionPay’s name in Mandarin, means “banks united,” which reflects its ownership structure. Its founding shareholders were 85 Chinese banks, led by the five biggest state-owned lenders. UnionPay’s top managers are former senior officials at the People’s Bank of China, the nation’s central bank. (The company would not make executives available for interviews.) At home, the Shanghai-based firm enjoys a big competitive edge: The government requires that all automated teller machines and Chinese merchants use UnionPay’s electronic payments network to process payments in the local currency. -

Credit Sales

Section 8.0 Credit Sales General Information ARC participating carrier. Introduction For the purpose of this section, the term "credit card company" collectively refers to bankcards, T&E Cards, UATP Cards, and As an alternative to accepting cash, most ARC participating “airline” cards. carriers will accept credit cards as payment for air transportation and related services. The terms and conditions of credit card Credit Card Designator acceptance are governed by individual agreements between credit card companies and carriers. Form of Payment Entries As stated in Section 5.2, "If payment is by credit card, enter or To conduct a credit card transaction on behalf of an ARC imprint (in the “Form of Payment” box on the ticket) the two- participating carrier, travel agents are required to do the letter alpha credit card designator and the complete credit card following: number (to preclude cash refunding of the ticket)." • Comply with the general instructions contained in this Generally Accepted Credit Cards section (Section 8.0). To assist agents in complying with the above, the following is a • Determine whether or not the carrier accepts the credit listing of generally accepted credit cards and their respective card presented by the client; and, if it does, under what two letter alpha credit card designator: conditions (Section 8.4). AX American Express • Obtain an authorization, a.k.a. approval code, from the CA MasterCard/Diners Club International credit card company (Section 8.2). CB Carte Blanche DC Diners Club • Follow the credit card acceptance procedures shown in the DS Discover Network ARC Credit Card Chargeback Policy (Section 8.4). -

Effectively Managing Employees to Get Results in a Diverse Workplace Such As American Express

Journal of Business Studies Quarterly 2015, Volume 7, Number 1 ISSN 2152-1034 Effectively Managing Employees to Get Results in a Diverse Workplace such as American Express Valerie Alexander, Colleen Havercome, and Bahaudin G. Mujtaba Nova Southeastern University Abstract Diversity in the modern workplace is not just a reality, but it is also necessary for competitive advantage. The purpose of this paper is to explore the concept of diversity in an organization and to outline the overall benefits of effectively managing employees to get results in a diverse workplace at American Express Corporation. This paper will elaborate on managing diverse strategies, managerial theories, structures and strategies, the consequences of ignoring diversity, diversity training, and recommendations. Keywords: Workplace Diversity, Managing Diversity, Management Theories, Management Practices, Employees. Introduction In today’s global environment, the workplace is a diverse melting pot of different cultures where one must learn to accept, understand and celebrate the differences of other people values, age, religious beliefs, gender, ethnicity, sexual orientation, educational background, and physical abilities. The subject of diversity requires one to examine one’s own beliefs and values and to learn the skills of dealing with those whose beliefs and values which are different from our own. The subject of diversity can be overwhelming, emotional and powerful for most who deals with it directly or indirectly (Mujtaba, 2010). Diversity issues in the workplace are now considered crucial and are likely to increase due to cultural differences. Therefore, organizations need to focus on diversity and to look for ways in which to become more flexible and work together in an inclusive environment. -

Mastercard Frequently Asked Questions Platinum Class Credit Cards

Mastercard® Frequently Asked Questions Platinum Class Credit Cards How do I activate my Mastercard credit card? You can activate your card and select your Personal Identification Number (PIN) by calling 1-866-839-3492. For enhanced security, RBFCU credit cards are PIN-preferred and your PIN may be required to complete transactions at select merchants. After you activate your card, you can manage your account through your Online Banking account and/or the RBFCU Mobile app. You can: • View transactions • Enroll in paperless statements • Set up automatic payments • Request Balance Transfers and Cash Advances • Report a lost or stolen card • Dispute transactions Click here to learn more about managing your card online. How do I change my PIN? Over the phone by calling 1-866-297-3413. There may be situations when you are unable to set your PIN through the automated system. In this instance, please visit an RBFCU ATM to manually set your PIN. Can I use my card in my mobile wallet? Yes, our Mastercard credit cards are compatible with PayPal, Apple Pay®, Samsung Pay, FitbitPay™ and Garmin FitPay™. Click here for more information on mobile payments. You can also enroll in Mastercard Click to Pay which offers online, password-free checkout. You can learn more by clicking here. How do I add an authorized user? Please call our Member Service Center at 1-800-580-3300 to provide the necessary information in order to qualify an authorized user. All non-business Mastercard account authorized users must be members of the credit union. Click here to learn more about authorized users.