Publication 551 (Rev

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised Or Amended in 2005)

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised or Amended in 2005) drafted by the NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS and by it APPROVED AND RECOMMENDED FOR ENACTMENT IN ALL THE STATES at its ANNUAL CONFERENCE MEETING IN ITS ONE-HUNDRED-AND-THIRTEENTH YEAR PORTLAND, OREGON JULY 30-AUGUST 6, 2004 WITH PREFATORY NOTE AND COMMENTS Copyright ©2004 By NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS April 2005 ABOUT NCCUSL The National Conference of Commissioners on Uniform State Laws (NCCUSL), now in its 114th year, provides states with non-partisan, well-conceived and well-drafted legislation that brings clarity and stability to critical areas of state statutory law. Conference members must be lawyers, qualified to practice law. They are practicing lawyers, judges, legislators and legislative staff and law professors, who have been appointed by state governments as well as the District of Columbia, Puerto Rico and the U.S. Virgin Islands to research, draft and promote enactment of uniform state laws in areas of state law where uniformity is desirable and practical. • NCCUSL strengthens the federal system by providing rules and procedures that are consistent from state to state but that also reflect the diverse experience of the states. • NCCUSL statutes are representative of state experience, because the organization is made up of representatives from each state, appointed by state government. • NCCUSL keeps state law up-to-date by addressing important and timely legal issues. • NCCUSL’s efforts reduce the need for individuals and businesses to deal with different laws as they move and do business in different states. -

Deed Recording

DEED RECORDING Deeds are important legal documents. The Onondaga County Clerk’s Office strongly recommends consulting an attorney regarding the preparation and filing/recording of any legal document. OUR OFFICE IS PROHIBITED BY LAW FROM PROVIDING ANY LEGAL ADVCE. THE ACCEPTANCE OF AN INSTRUMENT FOR RECORDING IN NO WAY IMPLIES AN ENDORSEMENT OR LEGAL SUFFICIENCY OR A GUARANTEE OF TITLE. IF YOU CHOOSE TO ACT AS YOUR OWN ATTORNEY YOU ARE SOLELY RESPONSIBLE FOR LEGAL COMPLIANCE AND ANY IMPLICATIONS THEREOF. To find a local attorney who specializes in real estate, contact the Onondaga County Bar Association Lawyer Referral Serve at 315.471.2690. Their website is located at https://www.onbar.org/ Our office does not supply forms. To purchase a New York State specific deed form, you may visit the Blumberg Legal Forms website at: https://www.blumberg.com/forms/ All deed filings must be accompanied by both an RP-5217 and TP 584 All recording in Onondaga County require a legal description for the subject property. ADDITIONAL RECORDING FEE EFFECTIVE MARCH 11, 2020 Effective March 11, 2020 there will be a $10 fee added to all residential deed recordings. On January 11, 2020 Governor Cuomo signed into law an amendment to Real Property Law Section 291 that requires County Clerks to notify the owner(s) of record of residential real property when a document is recorded affecting said residential property. The law also allows a reasonable fee to be assessed for said notices. The NYS Association of County Clerks, in order to provide uniformity throughout NYS, has determined that $10 is a reasonable fee per document. -

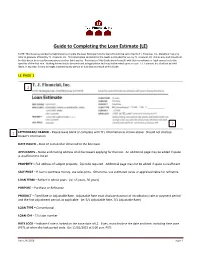

Guide to Completing the Loan Estimate (LE)

Guide to Completing the Loan Estimate (LE) NOTE: This Guide is provided to help brokers complete the Loan Estimate form for loans that will be submitted to T.J. Financial, Inc., therefore may only refer to products offered by T.J. Financial, Inc. The information contained in this Guide is intended for use by T.J. Financial, Inc. clients only and should not be distributed to or used by consumers or other third-parties. Recipients of this Guide should consult with their compliance or legal counsel as to the specifics of the final rule. Nothing herein should be construed as legal advice and may not be relied upon as such. T.J. Financial, Inc. shall not be held liable, in any way, for any damages incurred by any person or business as a result of this Guide. LE PAGE 1 1 2 1 LETTERHEAD/ HEADER – Please leave blank or complete with TJ’s information as shown above. Should not disclose broker’s information. DATE ISSUED – Date LE is mailed or delivered to the borrower. APPLICANTS – Name and mailing address of all borrowers applying for the loan. An additional page may be added if space is insufficient to list all. PROPERTY – Full address of subject property. Zip code required. Additional page may not be added if space is insufficient. SALE PRICE – If loan is purchase money, use sales price. Otherwise, use estimated value or appraised value for refinance. LOAN TERM – Reflect in whole years. (ie: 15 years, 30 years) PURPOSE – Purchase or Refinance PRODUCT – Fixed Rate or Adjustable Rate. Adjustable Rate must disclose duration of introductory rate or payment period and the first adjustment period, as applicable. -

Closing Costs and Other Fees

CHAPTER 5 LOAN CLOSING AND INSURANCE 5-1 LOAN CLOSING. The conditions of the DE lender’s approval (FHA's commitment if applicable) should be discussed with the borrower and, if applicable, the seller or builder. A. Title Insurance. Title insurance is not required at closing. However, the lender is responsible for conveying good, marketable title to FHA when a claim is filed. The one exception to this involves property that previously had been sold by HUD (REO sale) and FHA has insured the mortgage financing the sale by HUD. If such a property had a title defect prior to the original conveyance to FHA, the lender will not be held responsible for any title defects arising prior to the sale by FHA. See 24 CFR 203.390 for additional information. B. Title Objections. Any additional exceptions discovered during the title search should be reported to the DE underwriter before the loan is closed, unless the exceptions are covered by the General Waiver. Lenders should ensure that any conditions of title to the property will be acceptable to FHA. FHA regulations at 24 CFR 203.389 state that FHA will not object to title because of common customary easements, restrictions, and encroachments and provides a general waiver for these title conditions. These include easements for public utilities, party walls, driveways, wooden or wire fences and for other similar purposes. Lenders should review 24 CFR 203.389 for a full description of the general waiver provisions. Other title matters not covered by this general waiver must be reviewed by the lender. -

Title Matters Affecting Parties in Possession: By

TITLE MATTERS AFFECTING PARTIES IN POSSESSION: ADVERSE POSSESSION, AFTER-ACQUIRED TITLE, & THE RULE AGAINST PERPETUITIES BY DONALD G. SINEX SCOTT C. PETRY SUSAN A. STANTON TABLE OF CONTENTS INTRODUCTION…………………………………………………………………………….. 1 I. ADVERSE POSSESSION…….……………………………………………………………. 1 1. Adverse Possession………...………………...……………………………………….......... 2 2. Identifying Issues in Record Title…………………………………………………………. 3 a. Historical Changes in Metes and Bounds…………………………………………… 4 b. Adverse Possession of Minerals……………………………………………………… 4 c. Adverse Possession in Cotenancy, Landlord-Tenant, & Grantor-Grantee Situations………………………………………………………………………….…...... 5 d. Distinguishing Coholders from Cotenants………………………………………….. 6 3. Adverse Possession Requirement………………………………………………………… 7 4. Other Issues………………………………………...……………………………………….. 9 II. AFTER ACQUIRED TITLE………………………….…………………………………………. 10 1. The Doctrine………………..……... ……………………………………………………….. 10 2. Bases Used by Courts in Applying the Doctrine…………………………………........... 11 3. Conveyance Instruments that an Examiner is Likely to Encounter…………………… 12 a. Deeds of Trust and Liens……………………………………………………………... 12 b. Oil & Gas Leases and Limitations……………………………………………………. 14 c. Public Lands……………………………………………………………………………. 15 d. Title Acquired in Trust………………………………………………………………… 16 e. Quitclaims and Limitations…………………………………………………………… 16 4. Effect on Notice and Purchasers………………………………………………………….. 18 a. Subsequent Purchaser…………………………………………………………………. 19 b. Protections……………………………………...………………………………………. 19 c. Duty to Search…………………………………………………………………………. -

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

CHFA Form 381: CHFA Homeaccess Second Mortgage Loan Estimate

Save this Loan Estimate to compare with your Closing Disclosure. Loan Estimate LOAN TERM 30 years PURPOSE Purchase DATE ISSUED PRODUCT 5 Year Interest Only, 5/3 Adjustable Rate APPLICANTS LOAN TYPE Conventional FHA VA _____________ LOAN ID # 1330172608 RATE LOCK NO YES, until PROPERTY Before closing, your interest rate, points, and lender credits can change unless you lock the interest rate. All other estimated closing costs expire on Sales Price Loan Terms Can this amount increase after closing? Loan Amount Interest Rate Monthly Principal & Interest See Projected Payments below for your Estimated Total Monthly Payment Does the loan have these features? Prepayment Penalty Balloon Payment Projected Payments Payment Calculation Principal & Interest Mortgage Insurance Estimated Escrow Amount can increase over time Estimated Total Monthly Payment This estimate includes In escrow? Property Taxes Estimated Taxes, Insurance & Assessments Homeowner’s Insurance Amount can increase over time Other: See Section G on page 2 for escrowed property costs. You must pay for other property costs separately. Costs at Closing Estimated Closing Costs Includes in Loan Costs + in Other Costs – in Lender Credits. See page 2 for details. Estimated Cash to Close Includes Closing Costs. See Calculating Cash to Close on page 2 for details. Visit for general information and tools. LOAN ESTIMATE PAGE 1 OF 3 • LOAN ID # 1330172608 Closing Cost Details Loan Costs Other Costs A. Origination Charges E. Taxes and Other Government Fees % of Loan Amount (Points) Recording Fees and Other Taxes Desk Review Fee $150 es Loan Origination Fee $1,000 F. Prepaids Processing Fee $300 Rate Lock Fee $525 Homeowner’s Insurance Premium ( months) Underwriting Fee $675 Mortgage Insurance Premium ( months) Verification Fee $200 Prepaid Interest ( per day for days @ ) Property Taxes ( months) G. -

Mortgage-Backed Securities & Collateralized Mortgage Obligations

Mortgage-backed Securities & Collateralized Mortgage Obligations: Prudent CRA INVESTMENT Opportunities by Andrew Kelman,Director, National Business Development M Securities Sales and Trading Group, Freddie Mac Mortgage-backed securities (MBS) have Here is how MBSs work. Lenders because of their stronger guarantees, become a popular vehicle for finan- originate mortgages and provide better liquidity and more favorable cial institutions looking for investment groups of similar mortgage loans to capital treatment. Accordingly, this opportunities in their communities. organizations like Freddie Mac and article will focus on agency MBSs. CRA officers and bank investment of- Fannie Mae, which then securitize The agency MBS issuer or servicer ficers appreciate the return and safety them. Originators use the cash they collects monthly payments from that MBSs provide and they are widely receive to provide additional mort- homeowners and “passes through” the available compared to other qualified gages in their communities. The re- principal and interest to investors. investments. sulting MBSs carry a guarantee of Thus, these pools are known as mort- Mortgage securities play a crucial timely payment of principal and inter- gage pass-throughs or participation role in housing finance in the U.S., est to the investor and are further certificates (PCs). Most MBSs are making financing available to home backed by the mortgaged properties backed by 30-year fixed-rate mort- buyers at lower costs and ensuring that themselves. Ginnie Mae securities are gages, but they can also be backed by funds are available throughout the backed by the full faith and credit of shorter-term fixed-rate mortgages or country. The MBS market is enormous the U.S. -

Buying a Home: What You Need to Know

Buying a Home: What you need to know n Getting Started n Ready to Buy n Refinancing n Condos n Moving to a Larger Home n Vacation Homes Apply anytime, anywhere Fast and easy Total security for your personal information Personal Service from our Mortgage Planners Go to Blackhawkbank.com Mortgages Home Loans/Apply Online Revised 4.2018 Owning a home has long been “the American In Wisconsin: WHEDA Fannie Mae Advantage: When you use the WHEDA Fannie Mae Advantage, you need less cash dream.” It’s a long-term commitment, but as your to close your loan and you will have lower monthly house equity increases with time (and payments) your payments than with most mortgages. What’s more, you’ll have peace of mind that your rate will never change with home will be a source of financial stability for you. their fixed rate and term. WHEDA FHA Advantage: With the WHEDA FHA Advantage, Wisconsin residents have the flexibility to leverage down payment assistance and other There are many things to think about whether you’re advantages to buy a home with an affordable mortgage. buying your first home, moving up, refinancing, or considering a vacation property. Let’s get the In Illinois: IHDA works with financial partners across Illinois conversation started! to offer programs that help qualified Illinois first-time homebuyers to receive down payment and closing cost assistance. Buying a home can be both exciting and intimidating, so IHDA strives to make the goal of homeownership as streamlined as possible. Be sure to ask your Blackhawk Mortgage Planner for a current list what IDHA offers. -

The Determinants of Attitudes Towards Strategic Default on Mortgages∗

June 2011 The Determinants of Attitudes towards Strategic Default on Mortgages∗ Luigi Guiso European University Institute, EIEF, & CEPR Paola Sapienza Northwestern University, NBER, & CEPR Luigi Zingales University of Chicago, NBER, & CEPR Abstract We use survey data to measure households’ propensity to default on mortgages even if they can afford to pay them (strategic default) when the value of the mortgage exceeds the value of the house. The willingness to default increases both in the absolute and in the relative size of the home- equity shortfall. Our evidence suggests that this willingness is affected both by pecuniary and non- pecuniary factors, such as views about fairness and morality. We also find that exposure to other people who strategically defaulted increases the propensity to default strategically because it conveys information about the probability of being sued. ∗ An earlier version of this paper circulated with the title “Moral and Social Constraints to Strategic Default on Mortgages.” We would like to thank the University of Chicago Booth School of Business and Kellogg School of Management for financial support in establishing and maintaining the Chicago Booth Kellogg School Financial Trust Index. Luigi Guiso is grateful to PEGGED for financial support. We thank Campbell Harvey (editor), Amir Sufi, two anonymous referee and seminar participants at the University of Chicago and New York University for very useful suggestions, Gabriella Santangelo and Filippo Mezzanotti for excellent research assistantship, and Peggy Eppink for editorial help. We also thank Amit Seru for providing us with a time series of actual strategic default within his sample. 1 In 2009, for the first time since the Great Depression, millions of American households found themselves with a mortgage that exceeded the value of their home. -

Total Cost and Profit

4/22/2016 Total Cost and Profit Gina Rablau Gina Rablau - Total Cost and Profit A Mini Project for Module 1 Project Description This project demonstrates the following concepts in integral calculus: Indefinite integrals. Project Description Use integration to find total cost functions from information involving marginal cost (that is, the rate of change of cost) for a commodity. Use integration to derive profit functions from the marginal revenue functions. Optimize profit, given information regarding marginal cost and marginal revenue functions. The marginal cost for a commodity is MC = C′(x), where C(x) is the total cost function. Thus if we have the marginal cost function, we can integrate to find the total cost. That is, C(x) = Ȅ ͇̽ ͬ͘ . The marginal revenue for a commodity is MR = R′(x), where R(x) is the total revenue function. If, for example, the marginal cost is MC = 1.01(x + 190) 0.01 and MR = ( /1 2x +1)+ 2 , where x is the number of thousands of units and both revenue and cost are in thousands of dollars. Suppose further that fixed costs are $100,236 and that production is limited to at most 180 thousand units. C(x) = ∫ MC dx = ∫1.01(x + 190) 0.01 dx = (x + 190 ) 01.1 + K 1 Gina Rablau Now, we know that the total revenue is 0 if no items are produced, but the total cost may not be 0 if nothing is produced. The fixed costs accrue whether goods are produced or not. Thus the value for the constant of integration depends on the fixed costs FC of production. -

REPORTING and ANALYZING INVENTORY LO 1: Discuss How to Classify and Determine Inventory

ACC101 Chapter 6 11th Ed REPORTING AND ANALYZING INVENTORY LO 1: Discuss how to classify and determine inventory. • Inventory: “Assets a company intends to sell in the normal course of business, has in production for future sale, or uses currently in the production of goods to be sold.” 1. Inventory--ON BALANCE SHEET: “represents the cost of inventory STILL ON HAND.” 2. Cost of Goods Sold---ON INCOME STATEMENT: “represents the cost of inventory SOLD DURING THE PERIOD.” • Merchandising companies have ONE type of inventory: Merchandise Inventory • Manufacturing companies have THREE types of inventory: 1. Raw Materials 2. Work in Process 3. Finished Goods DETERMINING INVENTORY QUANTITIES • Physical inventory is taken for 2 reasons: o Perpetual System 1. Check accuracy of inventory records. 2. Determine amount of inventory lost due to wasted raw materials, shoplifting, or employee theft. o Periodic System 1. Determine the inventory on hand. 2. Determine the cost of goods sold for the period. • One challenge in determining inventory quantities is making sure a company owns the inventory. o Goods in transit: purchased goods not yet received and sold goods not yet delivered. • FOB (Free on Board) Shipping Point: Ownership of the goods passes to the buyer when the public carrier accepts the goods from the seller. • If goods are in transit they are the BUYERS. • FOB (Free on Board) Destination: Ownership of the goods remains with the seller until the goods reach the buyer. • If goods are in transit they are the SELLERS. 1 ACC101 Chapter 6 11th Ed o Consigned Goods: Goods held for other parties to see if they can sell the goods for the other party.