Global Tire Intelligence Report RESEARCH Dateline: 30 Sept 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 0024-13 Date: January 4, 2013 To: All Participants Category: Dividends From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief – Country: Korea Depository – BNY Mellon | CUSIPs – Various Subject: South Korea ADR Market Announcement | EDS Cutoff & Documentation Deadline Extension DTCC has received the following notice from GlobeTax. Please go the next page for more information. GlobeTax 212-747-9100 Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. To ensure compliance with Internal Revenue Service Circular 230, you are hereby notified that: (a) any discussion of federal tax issues contained or referred to herein is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties that may be imposed under the Internal Revenue Code; and (b) as a matter of policy, DTC does not provide tax, legal or accounting advice and accordingly, you should consult your own tax, legal and accounting advisor before engaging in any transaction. -

Korea Companies in US with Products

Multinational Corporations to Be Given Rights Beyond the Rights of U.S. Companies Under the Korea Free Trade Agreement Source: Uniworld & Public Citizen Rep. Last District Company Address Rep. First Name Name Party State Product Description 4600 Postmark Dr., # NB 216, Anchorage, AK AK-00 KOREAN AIR 99502-1038 Donald Young R AK International passenger and cargo air transport. HYUNDAI MOTOR MANUFACTURING AL-02 ALABAMA, LLC 700 Hyundai Blvd., Montgomery, AL 36105-9622 Bobby Bright D AL Mfr., sales and service of automobiles. Mfr. automobile parts specializing in internationally competitive state-of-the-art chassis AL-03 MANDO AMERICA CORPORATION 4201 North Park Dr., Opelika, AL 36801-9667 Michael Rogers R AL components and systems. 2312 Center Hill Dr., Ste. A, Opelika, AL 36801- Mfr. quartz countertop surfaces and interior AL-03 HANWHA L&C ALABAMA, LLC 7279 Michael Rogers R AL building materials. Mfr. tires, steel products, electronics, AL-05 HYOSUNG USA, INC. 500 19th Ave. SE, Decatur, AL 35601-3424 Parker Griffith R AL fabrics/yarns, and musical instruments. 201 James Record Rd., Huntsville, AL 35824- Technology services; consumer electronics, home AL-05 LG ELECTRONICS ALABAMA INC. (LGEAI) 1513 Parker Griffith R AL appliances and mobile communications. AL-05 EKO PEROXIDE LLC 1455 Redhat Rd., Decatur, AL 35601-7588 Parker Griffith R AL Mfr. chemicals and petrochemicals. AZ-02 LG SOLID SURFACE LLC 8009 W. Olive Ave., Peoria, AZ 85345-7109 Trent Franks R AZ Mfr. chemicals. 1702 E. Highland Ave., Ste. 400, Phoenix, AZ Manufacturing and sales of electronically AZ-04 SNTECH INC. USA 85016-4630 Edward Pastor D AZ commutated motors (ECM). -

History Contents

HISTORY HANKOOK TIRE CONTENTS 2009 • Winter tire receives highest evaluation in Germany’s ADAC test Corporate Profile 012 The Stature of Hankook Tire ANNUAL REPORT VENTUS V12 evo ranked 1st in US auto magazine (Car&Driver) 016 Business Portfolio Started supplying OE tires to Audi 022 Global Network 2008 • Geumsan Plant’s 2nd phase expansion completed 024 Organizational Structure Globally announced “Kontrol Technology” 026 Top Management •enfren and Optimo 4S awarded with the 032 Message from the CEO iF Product Design Award 2009 2007 • Hungary Plant begins production 2009 Management Report 036 • 100 millionth tire produced in China in March 2009 Key Figures 040 2009 Global Business Review 2006 • Only tire manufacturer to receive FAW-Volkswagen 10 Best 049 Major Activities in 2009 Suppliers award • Entered into Technical Agreement with premium car maker Audi • Started construction of the Hungary Plant in July Global Outlook 062 Industrial Dynamics 2005 • Roll-out of T’Station one-stop auto service concept 067 2010 Outlook • Selected as strategic partner of Ford • Completion of Geumsan Test Track (G,Trac) Mission&Vision, Strategy 074 Mission&Vision 2004 • Unveiled new Corporate Identity 077 Strategy 2003 • Established strategic alliance with Michelin 2001 • Opened Europe Distribution Center (EDC) in the Netherlands Corporate Social 086 Integrated CSR Management System 2000 •Introduced ERP System Responsibility 087 Environmental Management 1999 • Completed Jiangsu and Jiaxing Plant (China) 090 Social Contributions 093 Risk Management 1998 -

Gc Data 4 .Pdf

[발표자료집] [ SessionⅠ] Aligning climate actions of economic actors with Paris Agreement (1.5℃) Presentation ll The Evaluation of the Efforts of Korean Corporations to Address Climate and Energy Issues : Focusing on the Electric Equipment and Transportation Sector Sun-Jin Yun (Professor, Seoul National University) The Evaluation of the Efforts of Korean Corporations to Address Climate and Energy Issues: Focusing on the Electric Equipment and Transportation Sectors YUN, Sun-Jin Professor of Environmental and Energy Policy Graduate School of Environmental Studies Seoul National University Contents 1. Introduction 2. Research Method 3. Assessment1 - Targets & Performance 4. Assessment2 - Information disclosure 5. Assessment3 - Comprehensive comparison 6. Conclusion & Implication 2 Introduction 3 Introduction Business & Global Climate Change • Global climate change with extreme weather disasters like intense storms, floods and droughts is becoming realized, imposing real costs on companies and the communities they help support. • Climate change threatens facilities and operations, supply and distribution chains, and access to electricity and water. It can also prevent employees from coming to work and customers from buying products or services. • Leading companies recognize climate change as both a risk and an opportunity. • A growing number of companies are taking steps to strengthen their resilience to climate impacts, reduce their greenhouse gas emissions, produce innovative low.carbon technologies, and support policies enabling a smooth transition to a low.carbon economy. 4 Center for climate and energy solutions Introduction Leading companies for Global Climate Action • Google, a global technology leader, carbon neutral since 2007 and sourcing 100% renewable electricity in 2017 • Tata Motors, the India’s largest automobile manufacturer, setting the goal of using 100% renewable energy across all its own operations by the year 2030. -

Accelerate Hyundai Proposals Unlocking Value at One of the World’S Leading Automotive Brands

Accelerate Hyundai Proposals Unlocking Value at One of the World’s Leading Automotive Brands 1 Important Information This Presentation (i) is from and is published by Elliott Associates, L.P. (“EALP”) and Potter Capital LLC (“Potter”), both of which are Elliott affiliates; and (ii) accompanies a letter from EALP and Potter to the directors of Hyundai Mobis Co., Ltd., Hyundai Motor Company, and Kia Motors Corporation (the “Letter”). Capitalized terms used in this Presentation shall unless otherwise defined bear the meanings ascribed to them in the Letter. Many of the statements in this Presentation as well as in the Letter are the opinions and/or beliefs of EALP and/or Potter, which are based on their own analysis of publicly available information. Any statement or opinion expressed or implied in this Presentation and the Letter is provided in good faith but only on the basis that no investment decision(s) will be made based on, or other reliance will be placed on, any of the contents herein by others. EALP, Potter, Elliott and/or any of their respective affiliates (i) may at any time in the future, without notice to any person (other than as reQuired under, or in compliance with, applicable laws and regulations), increase or reduce their holdings of any Hyundai group entity’s shares or other eQuity or debt securities (including such securities and derivative products directly and/or indirectly related to such securities including, for example, KOSPI 200 Index) and/or may at any time have long, short, neutral or no economic or other exposure -

APRIL 2015 L DHS 20 /- I USD 5.99

TP www.tiresandparts.net DHS 20 /- I USD 5.99/- l APRIL 2015 l The Middle East’s First Automotive, Tires & Parts News Source ISSUE 102 102 ISSUE VAUXHALL INSTALLATION PROVES TO BE A CROWDPULLER Apple Watch PAGE 64 www.alexiatires.com Bespoke tires Specifically designed and produced for you. ART 1100 ART 1200 ART 1300 ART 1400 ART 1500 ART 1600 ART 1700 ART 1900 Guided by the main principles of value, trust, honesty and quality Alexia tires has been proudly manufacturing commercial and OTR tires from Asia with the intention to fill a gap in the replacement tire market. Alexia Tires believes in delivering the greatest value, quality and service without com- promising on innovation and style. With over 35 years of experience in the industry, Alexia Tires is passionate about its work. We bring to the market unique tire products and designs that specialize in the manufacturing of custom products that fit the market requirements of the day. Alexia’s strength lies in its flexibility and its ability to listen to the demands of the market and make subsequent swift changes as needed. Alexia Tires is a global company comprised of passionate designers and engineers who continue to use the latest technology to deliver the most innovative and original tires in the market. With worldwide distribution, Alexia Tires looks forward to further reaching out to the masses with truly one of a kind products and continuing to be trailblazers in the industry. For exclusive territory enquiries pls contact [email protected]. PUBLISHER’S NOTE The UAE is a thriving hub of the automotive trade. -

Stoxx® Asia 1200 Ex Japan Index

BROAD INDICES 1 STOXX® ASIA 1200 EX JAPAN INDEX Stated objective Key facts STOXX calculates several ex region, ex country and ex sector indices. This means that from the main index a specific region, country or sector is excluded. The sector classification is based on ICB Classification (www.icbenchmark.com.)Some examples: a) Blue-chip ex sector: the EURO STOXX 50 ex Financial Indexexcludes all companies assigned to the ICB code 8000 b) Benchmark ex region: the STOXX Global 1800 ex Europe Index excludes all companies from Europe c) Benchmark ex country: the STOXX Europe 600 ex UK Index excludes companies from the United Kingdom d) Size ex sector: the STOXX Europe Large 200 ex Banks Index excludes all companies assigned to the ICB code 8300 Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Asia 1200 ex Japan Index 6,737.8 3,815.8 5.6 2.7 165.7 0.6 4.3 0.0 8.6 STOXX Asia 1200 Index 10,713.7 7,202.3 6.0 2.7 169.8 0.6 2.4 0.0 5.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Asia 1200 ex Japan Index 0.9 12.1 22.7 29.6 57.3 11.3 18.3 22.2 8.8 9.2 STOXX Asia 1200 Index -0.5 6.0 16.7 27.1 42.1 -5.7 9.0 16.4 8.1 7.1 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Asia 1200 ex Japan Index 9.0 9.5 10.1 15.8 16.6 0.3 1.8 2.1 0.5 0.5 STOXX Asia 1200 Index 8.8 11.2 11.0 14.5 15.1 -1.2 0.8 1.4 0.5 0.4 Index to benchmark Correlation Tracking error (%) STOXX Asia 1200 ex Japan Index 0.8 0.8 0.8 0.8 0.8 5.6 7.4 7.3 8.7 9.2 Index to benchmark Beta Annualized information ratio STOXX Asia 1200 ex Japan Index 0.8 0.6 0.7 0.9 0.9 2.4 1.1 0.7 0.1 0.2 1 For information on data calculation, please refer to STOXX calculation reference guide. -

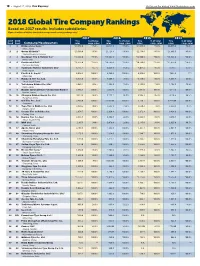

2018 Global Tire Company Rankings Based on 2017 Results

18 • August 27, 2018, TIRE BUSINESS Visit us on the web at www.tirebusiness.com 2018 Global Tire Company Rankings Based on 2017 results. Includes subsidiaries. (Figures in millions of dollars, translated at average annual currency exchange rates) 2017 2016 2015 2014 2017 2016 Tire % of total Tire % of total Tire % of total Tire % of total Rank Rank Company/Headquarters sales corp. sales sales corp. sales sales corp. sales sales corp. sales 1 1 Bridgestone Corp.# 1 *24,350.0 *75.0% 22,121.0 *75.0% *24,045.0 *75.0% *26,045.0 *75.0% Tokyo, Japan 2 2 Group Michelin#2 *23,560.0 *95.0% 21,129.4 *95.0% *22,130.0 *95.0% *24,668.5 *95.0% Clermont-Ferrand, France 3 3 Goodyear Tire & Rubber Co.# *14,300.0 *93.0% *13,645.0 *90.0% *14,800.0 *90.0% *16,355.0 *90.0% Akron, Ohio 4 4 Continental A.G.# *11,325.0 *28.5% *10,785.0 *25.0% *10,780.0 *25.0% *11,875.0 *24.8% Hanover, Germany 5 6 Sumitomo Rubber Industries Ltd.# 6,755.1 85.7% 6,029.9 85.6% 6,051.2 86.3% 6,917.7 87.3% Kobe, Japan 6 5 Pirelli & C. S.p.A.# 3 6,034.2 100.0% 6,380.0 100.0% 6,933.6 100.0% 7,992.2 ??? Milan, Italy 7 7 Hankook Tire Co. Ltd. *5,535.0 *92.0% 5,008.7 91.6% *5,320.0 *90.0% 5,595.4 88.0% Seoul, South Korea 8 8 Yokohama Rubber Co. -

Pursuing Super Economic Cooperation

Comparative Connections A Quarterly E-Journal on East Asian Bilateral Relations China-Korea Relations: Pursuing Super Economic Cooperation Scott Snyder Pacific Forum CSIS/The Asia Foundation The torrid growth in Sino-Korean bilateral trade relations has slowed by half to the 20 percent range in the first part of 2005 after expanding by almost 40 percent to $79.3 billion in 2004. Nonetheless, South Korean firms are working with their government to lobby for expanded access to China’s domestic market in key sectors. This quarter, the focus included the Chinese energy, insurance, and automobile sectors, cooperation in nanotechnology research, and facilitation of Korean expanded cultural exports to China. A bevy of South Korean ministers, CEOs, and opinion leaders flocked to Beijing – including separate visits by the prime minister and the Grand National Party (GNP) opposition leader – to meet Chinese counterparts and to lobby for expanded Sino-South Korean economic cooperation. Presidents Hu Jintao and Roh Moo-hyun met briefly on the sidelines of a ceremony commemorating the end of World War II in Moscow, and Foreign Ministers Ban Ki-moon and Li Zhaoxing also met on the side of an Asia-Europe Meeting (ASEM) in Kyoto for consultations on the North Korean nuclear issue, including a “balanced” rebuke to both the U.S. and DPRK for exchanging vituperative rhetoric instead of face-to-face negotiations. The Sino-Korean contact that did not take place this quarter was an anticipated call by PRC President Hu Jintao on the Dear Leader in Pyongyang. Despite extensive China- DPRK diplomatic activity in early April, including a visit to Beijing by Kim Jong-il’s trusted advisor Vice Minister Kang Sok-ju, the Chinese made no apparent progress in securing the DPRK’s participation in the Six-Party Talks. -

Passenger Car Bus & Truck

ADDRESS: SUYEONG-GU, MILLAK-DONG 126-11 CENTUM VISTA DONGWON 2-CHA, 204-304 PHONE: (82) 10 7695 1278, Website: http://foxtradekorea.com, EMAIL: [email protected] [SPARE PARTS] PASSENGER CAR RENAULT SAMSUNG BUS & TRUCK TATA DAEWOO TRUCK DAEWOO BUS HYUNDAI BUS & TRUCK GRANDBIRD & KIA BONGO III ADDRESS: SUYEONG-GU, MILLAK-DONG 126-11 CENTUM VISTA DONGWON 2-CHA, 204-304 PHONE: (82) 10 7695 1278, Website: http://foxtradekorea.com, EMAIL: [email protected] BRAND LOGO BRAND NAME MAIN PRODUCTS Radiator & Condenser & Rad Fan Motor Assy & A/C Fan HVCC HALLA VISTEON Motor Assy & Fan Clutch & A/C Filter & Compressor Assy & Motor Fan Heater & Heater Core Shock Absorber & Starter Motor & Alternator & Steering Gear Parts & Brake Pad & Shoe & Brake Caliper & Break MANDO+ Master System & Water Pump & Air Filter & Cabin Filter & Brake Disc, Drum Timing Belt & V-Belt & Auto Tensioner Bearing & Idle GATES Bearing Clutch Cover & Clutch Disc & Clutch Release Bearing & Clutch Kit & Cilynder-Clutch Master & Release & Brake VALEO Disc & Drum-Brake & Water Pump & Starter Motor & Alternator & Shock Absorber & Spark Plug Cable & Tesioner & Idler Bearing & Wheel Bearing & Wiper Blad Clutch Cover & Clutch Disc & Clutch Release Bearing & SECO Clutch Kit & Brake-Disc & Drum-Brake & CamShaft SANGSIN Brake Pad & Brake Shoe Tensioner Bearing & Idler Bearing & Water Pump & GMB Universal Joint Bearing & Fan Clutch Wheel Hub Bearing Hub Assy & Suspension Parts All (Tie ILJIN Rod End & Ball Joint Assy) KBC Ball Bearing Radiator & Condenser & Rad Fan Motor Assy & -

Korea Corporate Governance Service(KCGS) Annouced 2014 ESG Ratings for Public Companies in Korea on Aug 13

2014 Environmental Ratings of public companies in Korea Korea Corporate Governance Service(KCGS) annouced 2014 ESG ratings for public companies in Korea on Aug 13. With the ESG ratings, investors may figure out the level of ESG risks that companies face and use them in making investment decision. KCGS provides four ratings for each company which consist of Environmental, Social, Governance and Integrated rating. ESG ratings by KCGS are graded into seven levels: S, A+, A, B+, B, C, D. 'S' rating means that a company has all the system and practices that the code of best practices requires and there hardly exists a possibility of damaging shareholder value due to ESG risks. 'D' rating means that there is a high possibility of damaging shareholder value due to ESG risks. Company Environmental Company Name Code Rating 010950 S-Oil Corporation A+ 011170 LOTTE CHEMICAL CORPORATION A+ 034730 SK C&C Company Limited A+ 066570 LG Electronics Inc. A+ 009150 Samsung Electro-Mechanics Co., Ltd. A+ 139480 E-MART Inc. A+ 000150 DOOSAN CORPORATION A 000210 Daelim Industrial Co., Ltd. A 000810 Samsung Fire & Marine Insurance Co., Ltd. A 000830 Samsung C&T Corporation A 001300 Cheil Industries Inc. A 006360 GS Engineering & Construction Corp. A 006400 SAMSUNG SDI Co., Ltd. A 010140 Samsung Heavy Industries Co., Ltd. A 010620 Hyundai Mipo Dockyard Co., Ltd. A 011070 LG Innotek Co., Ltd. A 011790 SKC Co., Ltd. A 012330 HYUNDAI MOBIS A 012450 Samsung Techwin Co., Ltd. A 021240 Coway Co., Ltd. A 023530 Lotte Shopping Co., Ltd. A 028050 Samsung Engineering Co., Ltd. -

JOONYOUNG KIM 113 Village Cir, Apt F, Ithaca, NY 14850 Email: [email protected] / +1-607-592-8085

JOONYOUNG KIM 113 Village Cir, Apt F, Ithaca, NY 14850 Email: [email protected] / +1-607-592-8085 EDUCATION Ph.D., Cornell University 2024 (anticipated) Human Resource Studies ILR School Ithaca, New York M.S., Cornell University 2021 (anticipated) Human Resource Studies ILR School Ithaca, New York M.I.L.R., Cornell University (GPA: 4.00 / 4.00) 2018 Human Resources & Organizations ILR School Ithaca, New York B.B.A., Korea University (GPA: 3.91 / 4.50) 2009 Business Administration Business School Seoul, Korea WORKING PAPERS & CURRENT PROJECTS Kim, J. Y., Chang, H. K., & Bell, B. The Relationship between Corporate Training Programs and Organizational Performance (Preparing for submission) Zitek, E., Stroup, C., Kim, J. Y., & Weingarten, A. Should Numbers Be Gone For Good? How the Format of Performance Feedback Affects Fairness Judgments and Improvement Intentions (Preparing for submission) Kim, J. Y. Human Resources and Entrepreneurship: A Review and Suggestions for Future Research (Writing) Kim, J. Y. & Chang, H. K. Talent Review Session as the Core of Strategic Human Resource Management (Data collection) Kim, J. Y. Research-Practice Gap in Human Resource Management (Data collection) CONFERENCE PRESENTATIONS Kim, J. Y., Chang, H. K., & Bell, B. The Relationship between Corporate Training Programs and Organizational Performance. The 79th Annual Meeting of the Academy of Management, Boston, MA, August 2019. Updated September, 2019 RESEARCH EXPERIENCE Student Researcher September 2018 – August 2019 Institute of Compensation Studies (Supervisor : Dr. Hassan Enayati) ▪ Conducted literature reviews on gender pay gap and employee outcomes after M&As ▪ Conducted research and organization of datasets to be used for gender pay gap and M&A research Research Assistant May 2018 – August 2018 Institute of Compensation Studies (Supervisor : Dr.