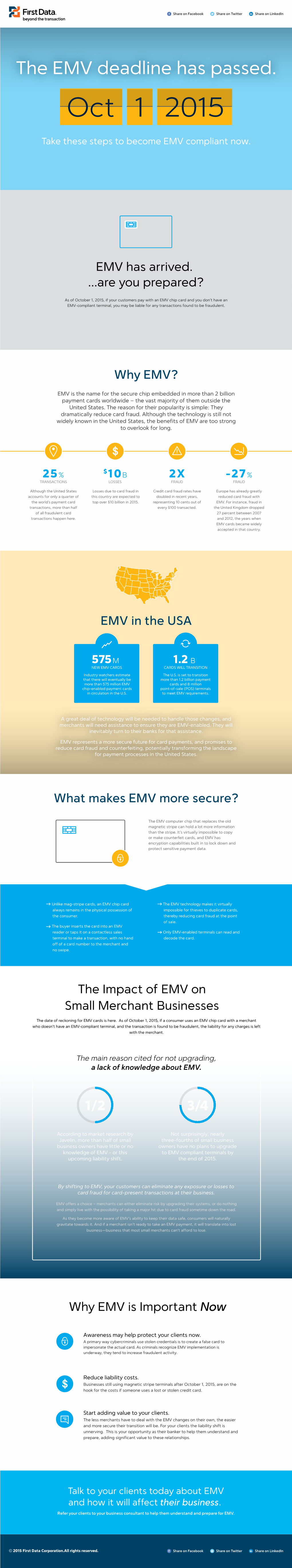

EMV in the USA Why EMV Is Important Now What Makes EMV More

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How Can Private Sector Systems Achieve Public Policy Goals?

Faster Payments in the United States: How Can Private Sector Systems Achieve Public Policy Goals? Fumiko Hayashi June 2015 RWP 15-03 Faster Payments in the United States: How Can Private Sector Systems Achieve Public Policy Goals?∗ Fumiko Hayashi† June 2015 Abstract Consumers and businesses are increasingly expecting faster payments. While many countries have already developed or are in process of developing faster payments, the availability of these payments is fragmented in the United States. The recently released paper by the Federal Reserve encourages private sector participants to provide faster payment services. However, private- sector faster payments systems will face significant challenges in achieving public policy goals of ubiquity, safety, and efficiency unless system governance represents broad public interests. One way to better align private-sector interests with those of the public is for the Federal Reserve to influence governance of the private-sector systems through its leadership role. JEL Classification: L5; L88; M14 Keywords: Faster payments, System governance, Public interest ∗ The author thanks Kelly Edmiston and Richard J. Sullivan for valuable comments, and Elizabeth Cook for editorial suggestions. The views expressed herein are those of the author and do not necessarily reflect the views of the Federal Reserve Bank of Kansas City or the Federal Reserve System. † Fumiko Hayashi is a senior economist at the Federal Reserve Bank of Kansas City. E-mail: [email protected]. 1 1. Introduction In the wake of technological innovations such as high-speed data networks and sophisticated mobile computing devices, consumers and businesses have raised their expectations for faster payments. Payment users increasingly expect electronic payment products to be accessible through mobile and online channels at any time. -

Fifth Report on Card Fraud, September 2018 – Contents 1

Fifth report on card fraud September 2018 Contents Executive summary 2 Introduction 5 1 Total level of card fraud 7 2 Card fraud according to different card functions 9 3 Card-not-present fraud 10 Box 1 Some market perspectives on online card fraud 10 4 Categories of fraud committed at ATMs and POS terminals 13 Box 2 Some market perspectives on card-present fraud 14 5 Domestic and cross-border card fraud 16 6 A country-by-country perspective on card fraud 19 7 Conclusions 27 Fifth report on card fraud, September 2018 – Contents 1 Executive summary This fifth oversight report on card fraud analyses developments in fraud related to card payment schemes (CPSs) in the Single Euro Payments Area (SEPA) and covers almost the entire card market.1 It provides an overview of developments in card payment fraud between 2012 and 2016. The total value of fraudulent transactions conducted using cards issued within SEPA and acquired worldwide amounted to €1.8 billion in 2016 – a decrease of 0.4% compared with 2015. In relative terms, i.e. as a share of the total value of transactions, fraud dropped by 0.001 percentage point to 0.041% in 2016, down from 0.042% in 2015. Compared, again in relative terms, with the levels of fraud observed in 2012, fraud increased by 0.003 percentage points in 2016. Although there was an upward trend in card fraud between 2012 and 2015, it seems the trend is changing, given that fraud went down in 2016. With respect to the composition of card fraud in 2016, 73% of the value of card fraud resulted from card-not-present (CNP) payments, i.e. -

Contactless Operating Mode Requirements Clarification Whitepaper

Contactless Operating Mode Requirements Clarification Whitepaper Version 1.0 Publication Date: February 2020 U.S. Payments Forum ©2020 Page 1 About the U.S. Payments Forum The U.S. Payments Forum, formerly the EMV Migration Forum, is a cross-industry body focused on supporting the introduction and implementation of EMV chip and other new and emerging technologies that protect the security of, and enhance opportunities for payment transactions within the United States. The Forum is the only non-profit organization whose membership includes the entire payments ecosystem, ensuring that all stakeholders have the opportunity to coordinate, cooperate on, and have a voice in the future of the U.S. payments industry. Additional information can be found at http://www.uspaymentsforum.org. EMV ® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC. Copyright ©2020 U.S. Payments Forum and Smart Card Alliance. All rights reserved. The U.S. Payments Forum has used best efforts to ensure, but cannot guarantee, that the information described in this document is accurate as of the publication date. The U.S. Payments Forum disclaims all warranties as to the accuracy, completeness or adequacy of information in this document. Comments or recommendations for edits or additions to this document should be submitted to: [email protected]. U.S. Payments Forum ©2020 Page 2 Table of Contents 1. Introduction .......................................................................................................................................... 4 2. Contactless Operating Modes ............................................................................................................... 5 2.1 Impact of Contactless Operating Mode on Debit Routing Options .............................................. 6 3. Contactless Issuance Requirements ..................................................................................................... 7 4. -

Chip Cards and EMV: Coming Soon

What are the benefits? Chip cards and Chip cards offer a more secure way to process card transactions. The secure microchip contains security EMV: coming soon data and software – because it is more difficult to fraudulently copy the details of the card, security is increased. Accepting chip cards therefore helps you reduce the risk of processing a counterfeit, lost or stolen card. And better card security means fewer disputed transactions. ADB3492 110908 We’re here to help You can find more information about EMV at www.commbank.com.au/emv If you have any further queries about EMV, you can email [email protected] or call our Merchant Help Desk on 1800 022 966, 24 hours, Important information about 7 days a week. your EFTPOS terminal inside What is EMV? What do you need to do? EMV (Europay MasterCard Visa) is the global All you need to do is leave your terminal switched ON electronic transaction standard named after the three overnight from 08 October, and we’ll do the rest. organisations that established it. The EMV standard enables EFTPOS terminals worldwide to process chip-based debit and credit cards. How do you know when To meet EMV standards, the Commonwealth Bank the upgrade is complete? is planning upgrades to its EFTPOS terminals so they can process chip cards. Once you swipe a card that has a chip, your EFTPOS Please note that after the upgrade, you will still be able terminal will prompt you to ‘insert card’ rather than to process cards using the magnetic strip, including ‘swipe card’. -

EMF Implementing EMV at The

Implementing EMV®at the ATM: Requirements and Recommendations for the U.S. ATM Community Version 2.0 Date: June 2015 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community About the EMV Migration Forum The EMV Migration Forum is a cross-industry body focused on supporting the EMV implementation steps required for global and regional payment networks, issuers, processors, merchants, and consumers to help ensure a successful introduction of more secure EMV chip technology in the United States. The focus of the Forum is to address topics that require some level of industry cooperation and/or coordination to migrate successfully to EMV technology in the United States. For more information on the EMV Migration Forum, please visit http://www.emv- connection.com/emv-migration-forum/. EMV is a trademark owned by EMVCo LLC. Copyright ©2015 EMV Migration Forum and Smart Card Alliance. All rights reserved. The EMV Migration Forum has used best efforts to ensure, but cannot guarantee, that the information described in this document is accurate as of the publication date. The EMV Migration Forum disclaims all warranties as to the accuracy, completeness or adequacy of information in this document. Comments or recommendations for edits or additions to this document should be submitted to: ATM- [email protected]. __________________________________________________________________________________ Page 2 Implementing EMV at the ATM: Requirements and Recommendations for the U.S. ATM Community TABLE OF CONTENTS -

Phishing and Email Spoofing

NCUA LETTER TO CREDIT UNIONS NATIONAL CREDIT UNION ADMINISTRATION 1775 Duke Street, Alexandria, VA 22314 DATE: December 2005 LETTER NO.: 05-CU-20 TO: Federally Insured Credit Unions SUBJ: Phishing Guidance for Credit Unions And Their Members REF: Letter to Credit Unions #04-CU-12 Phishing Guidance for Credit Union Members DEAR BOARD OF DIRECTORS: In our Letter to Credit Unions #04-CU-12 Phishing Guidance for Credit Union Members, we highlighted the need to educate your membership about phishing activities. As the number and sophistication of phishing scams continues to increase, we would like to emphasize the importance of educating your employees and members on how to avoid phishing scams as well as action you and/or your members may take should they become a victim. Appendix A of this document contains information you may share with your members to help them from becoming a victim of phishing scams. Appendix B contains information you may share with your members who may have become a victim of phishing scams. Background Phishing is a form of social engineering, characterized by attempts to fraudulently acquire sensitive information, such as passwords, account, credit card details, etc. by masquerading as a trustworthy person or business in an apparently official electronic communication, such as an e-mail or an instant message. Often the message includes a warning regarding a problem related to the recipient’s account and requests the recipient to respond by following a link to a fraudulent website and providing specific confidential information. The format of the e-mail typically includes proprietary logos and branding, such as a “From” line disguised to appear as if the message came from a legitimate sender, and a link to a website or a link to an e-mail address. -

Credit Card and Cheque Fraud

Credit Card and Cheque fraud Credit Card and Cheque Fraud Adopting thorough checking procedures can help protect your business from fraudulent credit cards and cheques. Please remember you are under no using stolen credit cards will often obligation to accept credit cards or cheques damage the magnetic strip to avoid the as a form of payment and have the right to card being identified by EFTPOS systems ask for photo identification. as stolen. Be alert for customers who: • Check card signatures. • Buy an item with a cheque or credit card • Check that the card numbers on the then return later to purchase more items. front and back of the card match. In some cases the initial purchase may be • Make sure holograms are clearly visible, a chance to test out your policies. appear three dimensional and move • Travel from interstate to purchase items when the card is tilted. that are commonly available in their local • Check the card is current by checking city or town. They may be forced to shop the “valid to” date. outside their local community as they are known for using bad cheques or may be • Check for ghosting or shading used part of an organised syndicate travelling to cover-up changed numbers. interstate to use fraudulent credit cards. • Ensure the transaction successfully processes before providing the goods to the customer. How to reduce • Ask for further explanation if unsure. credit card fraud • It is preferable to sight the credit card To help reduce credit card fraud against being used but if accepting credit card you and your customers, you can do payments over the telephone or internet the following: request the customer quote the 3 or 4 digit security number printed on the • Do not enter the card details into the back of the card and seek approval via EFTPOS terminal manually without prior the telephone from the card issuer. -

Chargeback Procedures and Fraud Prevention - Secure Credit Card Processing | E-Onlinedata

Chargeback Procedures and Fraud Prevention - Secure Credit Card Processing | e-onlinedata 0 Home Merchant Services Reseller Programs Current Resellers Customer Service Our Company Home > Customer Service > Chargeback and Fraud Prevention Customer Service FAQs Chargeback Procedures & Fraud Prevention PCI Data Security Our Commitment to Secure Credit Card Processing PCI Frequently Asked Questions Criminals and hackers are all too aware of the latest security measures that Visa and MasterCard are creating to control fraud and identity theft. Merchants must Chargeback and Fraud Prevention be alert and take extra precautions wherever possible, because they are financially responsible for fraudulent transactions, including those approved by Best Practices the cardholder’s issuing bank. e-onlinedata is committed to helping merchants Glossary of Terms control and prevent credit card fraud. Support Request Forms Page index: General Inquiry Chargeback Process Merchant Inquiry Preventing Chargebacks 12 potential signs of Card Not Present Fraud Privacy Policy Visa-MasterCard Card Not Present Fraud Prevention Tools Visa and MasterCard will allow any cardholder to chargeback a purchase if the customer can demonstrate to ANY degree that they have not received the products or services promised by your company in the quantity, quality and time frame promised. In other words, if your company promises product or services delivery on Tuesday, but the product or service is not delivered until Wednesday (a day late), that cardholder can probably charge that sale back with little you can do about it. Likewise, if the quantity or quality of products or services delivered are not exactly as described on your site or in other marketing materials, the cardholder will be allowed to chargeback the purchase. -

Mastercard International Security and Risk Management: Credit Card Fraud

Cornish, Delpha, Erslon / MasterCard International Security and Risk Management MASTERCARD INTERNATIONAL SECURITY AND RISK MANAGEMENT: CREDIT CARD FRAUD Michael Cornish Kathleen Delpha Mary Erslon Executive Summary Credit card fraud is a growing concern of global proportions. Resourceful criminals are finding creative ways to capture private credit card holder account and identification information, and are using this information for fraudulent acquisitions of everything from personal care items to cars to home loans. Because of the universal reach of the Internet, criminals are easily able to perpetrate their crimes from anywhere in the world. The costs of credit card fraud reach nearly U.S. $2.5 billion annually. Internet fraud alone accounts for nearly 3% of Internet sales, or 30 times higher than credit card fraud rates in the “physical world.” While consumers are generally held harmless for credit card fraud, the payment industry and merchants absorb the losses from fraudulent purchases, and its participants continually search for ways to detect and prevent them. MasterCard International, the licensor and franchisor of the MasterCard branded family of payment products, is appropriately concerned about credit card fraud, since MasterCard research shows that the majority of their cardholders are alarmed about credit card fraud and the risk to their personal and financial information. MasterCard and other credit card systems are susceptible to two general categories of threats for fraudulent activities: Internal threats and external threats. Internal threats are those that evolve from collusion within the credit card system itself. However, internal threats are often mitigated by following good employment practices such as conducting employee background checks, and implementing strong controls that prevent unauthorized access to sensitive information and tracking authorized access. -

The Smarts Behind EMV Smart Cards Part 2 – Offline Transaction Processing Yash Kapadia CEO, Omnipayments, Inc

The Smarts Behind EMV Smart Cards Part 2 – Offline Transaction Processing Yash Kapadia CEO, OmniPayments, Inc. For the November/December 2014 Issue of The Connection It seems that every month comes with an announcement of another hack in which the data of millions of payment cards has been stolen. This data is used to clone credit cards and debit cards, which are then sold in the underground Internet. Is there any protection available to us to thwart such attacks? The answer is yes – smart cards. A smart card, also called a chip card or an integrated-circuit card (ICC), includes an embedded computer chip that employs cryptographic and risk-management features. In conjunction with a smart-card POS or ATM terminal, these features are designed to thwart skimming, card-cloning, card-counterfeiting, and other fraudulent attacks. A decade or more ago, a consortium of card issuers comprising Europay, MasterCard, and Visa (EMV) began the specification of smart cards or as they are formally known today, EMV cards. EMV card technology has been adopted by most of the countries on all continents in the world except for the United States. The United States is the laggard. Representing almost half of all payment cards and terminals in the world, the U.S. still runs its payment- card services on outdated magnetic-stripe technology. However, this is about to change. The U.S. payment-card industry has mandated that all merchants be EMV-compatible by October, 2015 (except for gas stations, which have until 2017) or face a “liability shift.” If a merchant does not process at least 75% of its transactions through an EMV-enabled terminal (whether via chip-cards or magnetic-stripe cards) and accepts a disputed or fraudulent card payment, the merchant will be liable for the transaction rather than the issuer. -

NATIONWIDE CREDIT CARD FRAUD PREVENTION Hendi Yogi Prabowo Recent Global Payment Fraud Statistics Indicate the Seriousness of Th

NATIONWIDE CREDIT CARD FRAUD PREVENTION Hendi Yogi Prabowo* Recent global payment fraud statistics indicate the seriousness of the credit card fraud problem. In the United Kingdom, in 2009 alone, losses from plastic (debit and credit) card fraud according to the report by the Financial Fraud Action UK (FFA) were $US696 million (Financial Fraud Action UK, 2010). In the same year, the Australian Payments Clearing Association (APCA) recorded losses of $US144 million from credit and charge card fraud perpetrated on Australian issued cards (Australian Payments Clearing Association, 2010). Both countries have been experiencing an upward trend in the losses from the offences over the past few years. Payment fraud statistics from the two countries suggest that card-not- present fraud (e.g. online credit card fraud) is the most common type of credit card fraud followed by skimming/counterfeit card fraud. This is different from a decade ago when skimming/counterfeit card fraud was statistically the most prevalent modus operandi. The emergence and growth of e-commerce has been a driving factor behind such a change. The implementation of the Chip and PIN technology in many countries, for example, has caused geographical displacement (e.g. from one country to another) and tactical displacement (e.g. from skimming/counterfeit card fraud to online credit card fraud) of credit card fraud. Many credit card fraud offenders are now better organized than before, resulting in higher losses from their offences. They even have their own supply and demand in the underground economy for stolen credit card information (Wilson, 2008, p. 5). Some of the proceeds from this economy are used to finance other crimes including terrorism1. -

Guidelines for Contactless ATM Transactions – a Guide for ATM Owners and Operators

Guidelines for Contactless ATM Transactions – A Guide for ATM Owners and Operators Version 2.0 Publication Date: July 2019 U.S. Payments Forum ©2019 Page 1 About the U.S. Payments Forum The U.S. Payments Forum, formerly the EMV Migration Forum, is a cross-industry body focused on supporting the introduction and implementation of EMV chip and other new and emerging technologies that protect the security of, and enhance opportunities for payment transactions within the United States. The Forum is the only non-profit organization whose membership includes the entire payments ecosystem, ensuring that all stakeholders have the opportunity to coordinate, cooperate on, and have a voice in the future of the U.S. payments industry. Additional information can be found at http://www.uspaymentsforum.org. About the ATM Working Committee The U.S. Payments Forum ATM Working Committee explores the challenges of EMV migration for the U.S. ATM industry, works to identify possible solutions to challenges, and facilitates the sharing of best practices with the various industry constituents, with the goal result being more positive EMV migration experience for consumers. EMV is a trademark owned by EMVCo LLC. Copyright ©2019 U.S. Payments Forum and Secure Technology Alliance. All rights reserved. The U.S. Payments Forum has used best efforts to ensure, but cannot guarantee, that the information described in this document is accurate as of the publication date. The U.S. Payments Forum disclaims all warranties as to the accuracy, completeness or adequacy of information in this document. Comments or recommendations for edits or additions to this document should be submitted to: [email protected].