Go West! Bristol’S Film and Television Industries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Secret Crimes of the Cuckoo

springwatch the con is on The CON isON Cavan Scott investigates the crimes of the star of this year’s Springwatch David Kjaer /naturepl.com Photo: may 2009 COUNTRYFILE 49 springwatch the con is on such extraordinary lengths, and worldwide only around 1 percent “Within hours of hatching of all birds share its methods. the blind and naked cuckoo After 23 years studying the cuckoo’s sinister plans in Wicken chick pushes any remaining Fen, Britain’s foremost expert on cuckoo behaviour, Dr Nicholas eggs from the nest” Davies of the University of Cambridge, is able to shed some light on the matter. 1 “Foisting your parental duties on somebody else may seem to be a wonderful thing to do,” he explains. “But over evolutionary time, the hosts fight back so that the poor cuckoo has to work 2 3 incredibly hard to be lazy, simply because it has to overcome all of these defences. What we witness is a fantastic arms race between parasite and host.” 4 5 This titanic battle commences with that famous bird call. In May, A host of hosts the blue-grey male cuckoo arrives In Britain, five main hosts account for on our shores from Africa and 90 percent of the parasitised nests. booms out his distinctive ‘cuc-coo’, In heathland the cuckoo will choose thereby establishing himself as the dunnock (1), in marshland it picks God’s gift to the slightly browner the reed warbler (2), while in open female. Nature takes its course and country it’s the pied wagtail (3). The meadow pipit (4) falls foul of the the female’s work begins. -

Aardman in Archive Exploring Digital Archival Research Through a History of Aardman Animations

Aardman in Archive Exploring Digital Archival Research through a History of Aardman Animations Rebecca Adrian Aardman in Archive | Exploring Digital Archival Research through a History of Aardman Animations Rebecca Adrian Aardman in Archive: Exploring Digital Archival Research through a History of Aardman Animations Copyright © 2018 by Rebecca Adrian All rights reserved. Cover image: BTS19_rgb - TM &2005 DreamWorks Animation SKG and TM Aardman Animations Ltd. A thesis submitted in partial fulfilment of the requirements for the degree of Master of Arts in Media and Performance Studies at Utrecht University. Author Rebecca A. E. E. Adrian Student number 4117379 Thesis supervisor Judith Keilbach Second reader Frank Kessler Date 17 August 2018 Contents Acknowledgements vi Abstract vii Introduction 1 1 // Stop-Motion Animation and Aardman 4 1.1 | Lack of Histories of Stop-Motion Animation and Aardman 4 1.2 | Marketing, Glocalisation and the Success of Aardman 7 1.3 | The Influence of the British Television Landscape 10 2 // Digital Archival Research 12 2.1 | Digital Surrogates in Archival Research 12 2.2 | Authenticity versus Accessibility 13 2.3 | Expanded Excavation and Search Limitations 14 2.4 | Prestige of Substance or Form 14 2.5 | Critical Engagement 15 3 // A History of Aardman in the British Television Landscape 18 3.1 | Aardman’s Origins and Children’s TV in the 1970s 18 3.1.1 | A Changing Attitude towards Television 19 3.2 | Animated Shorts and Channel 4 in the 1980s 20 3.2.1 | Broadcasting Act 1980 20 3.2.2 | Aardman and Channel -

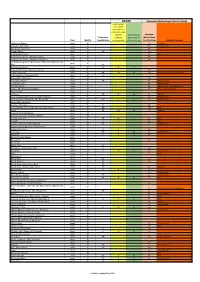

Kijkwijzer (Netherlands Classification) Some Content May Not Be Appropriate for Children This Age

ACCM Kijkwijzer (Netherlands Classification) Some content may not be appropriate for children this age. Parental Content is age Kijkwijzer Australian guidance appropriate for (Netherlands Year Netflix Classification recommended children this age Classification) Kijkwijzer reasons 1 Chance 2 Dance 2014 N 12+ Violence 3 Ninjas: Kick Back 1994 N 6+ Violence; Fear 48 Christmas Wishes 2017 N All A 2nd Chance 2011 N PG All A Christmas Prince 2017 N 6+ Fear A Christmas Prince: The Royal Baby 2019 N All A Christmas Prince: The Royal Wedding 2018 N All A Christmas Special: Miraculous: Tales of Ladybug & Cat 2016 N Noir PG A Cinderella Story 2004 N PG 8 13 A Cinderella Story: Christmas Wish 2019 N All A Dog's Purpose 2017 N PG 10 13 12+ Fear; Drugs and/or alcohol abuse A Dogwalker's Christmas Tale 2015 N G A StoryBots Christmas 2017 N All A Truthful Mother 2019 N PG 6+ Violence; Fear A Witches' Ball 2017 N All Violence; Fear Airplane Mode 2020 N 16+ Violence; Sex; Coarse language Albion: The Enchanted Stallion 2016 N 9+ Fear; Coarse language Alex and Me 2018 N All Saints 2017 N PG 8 10 6+ Violence Alvin and the Chipmunks Meet the Wolfman 2000 N 6+ Violence; Fear Alvin and the Chipmunks: The Road Chip 2015 N PG 7 8 6+ Violence; Fear Amar Akbar Anthony 1977 N Angela's Christmas 2018 N G All Annabelle Hooper and the Ghosts of Nantucket 2016 N PG 12+ Fear Annie 2014 N PG 10 13 6+ Violence Antariksha Ke Rakhwale 2018 N April and the Extraordinary World 2015 N Are We Done Yet? 2007 N PG 8 11 6+ Fear Arrietty 2010 N G 6 9+ Fear Arthur 3 the War of Two -

Animação Em Stop-Motion

THIAGO FRANCO RIBEIRO Animação em stop-motion : Tecnologia de produção através da história Belo Horizonte Escola de Belas Artes 2009 THIAGO FRANCO RIBEIRO Animação em stop-motion : Tecnologia de produção através da história Dissertação apresentada ao Curso de Mestrado da Escola de Belas Artes da Universidade Federal de Minas Gerais como requisito parcial de obtenção do título de Mestre em Artes. Área de concentração: Arte e tecnologia da imagem. Orientador: Prof. Dr. Heitor Capuzzo Filho. Belo Horizonte Escola de Belas Artes 2009 i Dedico este trabalho a Antônio Franco, que por muitas vezes me deu asas através de suas histórias e eu não soube quão valorosas e saudosas estas seriam. ii AGRADECIMENTOS A Deus, sempre presente nos momentos mais questionáveis. Aos meus pais Luiz Carlos (In Memoriam) e Marisa, pelo incontestável apoio ao passar dos anos. Aos amados, Thaís, Luizinho e Lara. À Juliana Carolina, minha querida amada. Ao meu orientador Heitor Capuzzo, pela cumplicidade, competência, amizade e admiração a mim transmitida. À Ana Lúcia Andrade, pelos fundamentais apontamentos e apoio a este trabalho. Ao meu revisor Ruzembergue Carvalho Jr., pela atenção e carinho com as minhas frases desconexas. Aos amigos, eternos, cujo trabalho tem nos afastado. À Marcela Simões Nascimento, por tudo que você representa. Aos colegas e amigos de trabalho no Centro Pedagógico – UFMG, pelo ensinamento e paciência adquirida e compartilhada. À Geuva, Wagner e D. Zina, pelo apoio nas horas mais difíceis. Aos colegas animadores, pelo estímulo e troca de experiências, especialmente a Willian Salvador ( In Memoriam ), cujos sonhos ainda nos matem tão próximos. À FUMP, por tanto apoio ao longo destes seis anos, que acredito ser impossível eu estar onde estou sem vocês. -

Pr-Dvd-Holdings-As-Of-September-18

CALL # LOCATION TITLE AUTHOR BINGE BOX COMEDIES prmnd Comedies binge box (includes Airplane! --Ferris Bueller's Day Off --The First Wives Club --Happy Gilmore)[videorecording] / Princeton Public Library. BINGE BOX CONCERTS AND MUSICIANSprmnd Concerts and musicians binge box (Includes Brad Paisley: Life Amplified Live Tour, Live from WV --Close to You: Remembering the Carpenters --John Sebastian Presents Folk Rewind: My Music --Roy Orbison and Friends: Black and White Night)[videorecording] / Princeton Public Library. BINGE BOX MUSICALS prmnd Musicals binge box (includes Mamma Mia! --Moulin Rouge --Rodgers and Hammerstein's Cinderella [DVD] --West Side Story) [videorecording] / Princeton Public Library. BINGE BOX ROMANTIC COMEDIESprmnd Romantic comedies binge box (includes Hitch --P.S. I Love You --The Wedding Date --While You Were Sleeping)[videorecording] / Princeton Public Library. DVD 001.942 ALI DISC 1-3 prmdv Aliens, abductions & extraordinary sightings [videorecording]. DVD 001.942 BES prmdv Best of ancient aliens [videorecording] / A&E Television Networks History executive producer, Kevin Burns. DVD 004.09 CRE prmdv The creation of the computer [videorecording] / executive producer, Bob Jaffe written and produced by Donald Sellers created by Bruce Nash History channel executive producers, Charlie Maday, Gerald W. Abrams Jaffe Productions Hearst Entertainment Television in association with the History Channel. DVD 133.3 UNE DISC 1-2 prmdv The unexplained [videorecording] / produced by Towers Productions, Inc. for A&E Network executive producer, Michael Cascio. DVD 158.2 WEL prmdv We'll meet again [videorecording] / producers, Simon Harries [and three others] director, Ashok Prasad [and five others]. DVD 158.2 WEL prmdv We'll meet again. Season 2 [videorecording] / director, Luc Tremoulet producer, Page Shepherd. -

Review of Regional TV Production and Programming Guidance Consultation

Review of Regional TV Production and Programming Guidance Consultation CONSULTATION: Publication Date: 19 December 2018 Closing Date for Responses: 27 February 2019 Contents Section 1. Overview 1 2. Background 7 3. The changing TV production landscape 14 4. Appraisal of the current regime and the Guidance 29 5. Review proposals 46 Annex A1. Responding to this consultation 65 A2. Ofcom’s consultation principles 68 A3. Consultation coversheet 69 A4. Consultation questions 70 Review of Regional TV Production and Programming Guidance 1. Overview Ofcom is reviewing the Regional Production and Programming Guidance (‘the Guidance’) 1 and associated reporting and compliance regime to ensure that the regulatory framework is effective in a rapidly evolving production landscape. Nations and regions’ production is a crucial part of the UK television production sector, accounting for almost half of public service broadcaster (‘PSB’) qualifying programme hours2 in 2017. TV production outside of London helps to disperse and stimulate investment and job opportunities in the sector, throughout the UK. This has resulted in the employment of a broad range of talent with a diversity of editorial perspectives, to create a wide variety of programmes for the enjoyment of UK viewers. This can also assist in strengthening regional production centres for the long term and supporting broader creative and cultural economies across the UK. To help promote nations and regions’ TV production, Ofcom has imposed quotas on the PSBs3 to ensure that a suitable proportion of their network programmes are made in the UK outside of the M25 (‘regional productions’). The BBC and Channel 3 services also have quotas to broadcast localised programmes, including regional news, across different areas of the UK (‘regional programming’), and a suitable proportion of these should be made in the local area. -

African Cats Study Notes

African Cats Directed by: Keith Scholey and Alastair Fothergill Certificate: U (contains documentary footage of animals hunting and fighting) Running time: 89 mins Release Date: 27th April 2012 Suitable for: The activities in these study notes address aspects of the curriculum for literacy, science and geography for pupils between ages 5–11. www.filmeducation.org 1 ©Film Education 2012. Film Education is not responsible for the content of external sites Synopsis An epic true story set against the backdrop of one of the wildest places on Earth, African Cats captures the real-life love, humour and determination of the majestic kings of the Savannah. The story features Mara, an endearing lion cub who strives to grow up with her mother’s strength, spirit and wisdom; Sita, a fearless cheetah and single mother of five mischievous newborns; and Fang, a proud leader of the pride who must defend his family from a rival lion and his sons. Genre African Cats is a nature documentary, referred to by its producers as a ‘true life adventure’. It was filmed in the Maasai Mara National Reserve, a major game region in southwestern Kenya. The film uses real-life footage to tell the true story of two families of wild animals, both fighting to survive in the Savannah. African Cats features a voiceover narration by the actor Samuel L. Jackson and a portion of the money made from ticket sales went to the African Wildlife Foundation. Before SeeinG the film Review pupils’ understanding of the documentary genre. How are they different to other films they watch? Make two lists, one of nature documentaries children have seen (e.g. -

Julie Vernon Mosaics 20 Edwald Road Edwalton Nottingham NG12 4AQ Mob: 07789 456885 Email: [email protected]

Julie Vernon Mosaics 20 Edwald Road Edwalton Nottingham NG12 4AQ Mob: 07789 456885 Email: [email protected] www.julievernonmosaics.com Artist Statement I am a Nottingham based artist producing contemporary mosaics. I established my practice in 2010 and work with a mixture of materials from vitreous glass and ceramic through to natural marble and slate, often incorporating individual pieces of vintage porcelain or found materials. I am largely inspired by the natural environment and like to work in a freehand and organic way guided by the materials from which I am working. Materials are skilfully cut and shaped by hand, which in turn makes each design unique and a one off. I work on a variety of public and private commissions, schools and community arts projects and run a programme of workshops from my Edwalton studio. Clients include schools, councils, community groups, businesses and a variety of private customers. Professional member of the British Association for Modern Mosaic. My previous career was in marketing and product development so I have strong inter-personal skills and experience in managing projects, working to timescales and budgets. Awards 2015 Silver Award winner – specialist media Craft and Design selected awards 2011 Finalist Craft and Design Selected Awards – mixed media 2011 Selected as a member of Design Factory 2011 Selected to showcase work at Blenheim Palace emerging designers 2010 Selected for Nottinghamshire Creative 2010 - a creative business initiative organised by Nottinghamshire County Council Larger Commissions Jan- April 2019 Public art for Groby Leicestershire commissioned by Anstey Parish Council Sept 2018 ‘Vandoeuvre les Nancy’ Twinning mosaic stone commissioned by Gedling Borough Council May/June 2018 Hoodwinked2018 Public art sculpture created for Nottingham ‘Royal Robin Redbreast’ Feb – April 2018 Feature floor mosaic for newly constructed fire station Newark, Nottinghamshire Jan – April 2018 Public art for Anstey, Leicestershire. -

Future of Public Service Media: Open University Response Summary

Ofcom – Future of Public Service Media: Open University Response Summary 1. Education is a crucial part of the Public Service Broadcasting (PSB) requirements. Several of the statutory requirements set out in Section 264 of the Communications Act 2003 relate to educational objectives. There are opportunities to strengthen these requirements as part of the new Public Service Media (PSM) offer. 2. The Open University (OU) plays a key role in supporting the delivery of PSB requirements around education through its partnership with the BBC. The partnership co-produces high-quality factual content across several channels and platforms, which is developed in collaboration with academic experts and closely linked to related educational materials hosted by the OU. A key objective of the partnership is to encourage people to embark on learning journeys from the informal, factual content produced with the BBC, through online and printed educational resources which enhance and enrich their broadcast/digital experience, to taking up formal learning opportunites inspired by watching, listening to and engaging with the content produced as part of the partnership. 3. In 2019/20: • A total of 257 hours of content produced via the OU/BBC partnership was broadcast by the BBC. • This resulted in a combined total of 308 million viewing/listening “events” and digital engagement interactions. • The three most popular television programmes broadcast – A Perfect Planet, Springwatch and Hospital (Series 5) all saw viewing figures in excess of 22 million. • There were 765,000 unique visitors to the online educational content related to the OU/BBC partnership hosted on the OU’s free online learning platform, OpenLearn. -

Disneynature Penguins Activity Packet

ACTIVITY PACKET Created in Partnership with Disney’s Animals, Science and Environment IN THEATERS EARTH DAY 2019 arrated by Ed Helms (The Office, The Hangover trilogy, The Daily Show with NJon Stewart), Disneynature’s all-new feature filmPenguins is a coming-of-age story about an Adélie penguin named Steve who joins millions of fellow males in the icy Antarctic spring on a quest to build a suitable nest, find a life partner and start a family. None of it comes easily for him, especially considering he’s targeted by everything from killer whales to leopard seals, who unapologetically threaten his happily ever after. From the filmmaking team behindBears and Chimpanzee, Disneynature’s Penguins opens in theaters and in IMAX® April 17, 2019. Acknowledgments Disney’s Animals, Science and Environment would like to take this opportunity to thank the amazing teams that came together to develop the Disneynature Penguins Activity Packet. It was created with great care, collaboration and the talent and hard work of many incredible individuals. A special thank you to Dr. Mark Penning for his ongoing support in developing engaging educational materials that connect families with nature. These materials would not have happened without the diligence and dedication of Kyle Huetter and Lacee Amos who worked side by side with the filmmakers and educators to help create these compelling activities and authored the unique writing found throughout each page. A big thank you to Hannah O’Malley and Michelle Mayhall whose creative thinking and artistry developed games and crafts into a world of outdoor exploration. Special thanks to director Jeff Wilson, director/producer Alastair Fothergill and producers Mark Linfield, Keith Scholey and Roy Conli for creating such an amazing story that inspired the activities found within this packet. -

BBC Cymru Wales Apprenticeship Role: Sound Apprentice Location: Roath Lock Studios, Cardiff

Sound Apprentice - Drama Company: BBC Cymru Wales Apprenticeship Role: Sound Apprentice Location: Roath Lock Studios, Cardiff About the Organisation BBC Cymru Wales is the nation's broadcaster, providing a wide range of English and Welsh language content for audiences across Wales on television, radio and on our websites Roath Lock, is the BBC's state of the art centre of excellence for Drama, a place brimming with new energy and talent. When the first productions moved into Roath Lock in September 2011, they fulfilled a BBC commitment to create a centre of excellence for Drama in Cardiff. Located in Porth Teigr, Cardiff Bay, the 170,000 square foot facility, including nine studios and equivalent in length to three football pitches, is now the permanent, purpose-built home of four flagship BBC dramas - Casualty, Pobol y Cwm, Doctor Who - as well as new productions in the future. Job Description Sound Assistants are a member of the Production Sound Crew and provide general back up and support to the Production Sound Mixer and the Boom Operator. They are responsible for checking all stock, microphones and batteries and making sure that the sound department runs as smoothly as possible. Although the work is physically demanding, the hours are long and are sometimes performed on location in extreme terrain and/or severe weather the work can be very rewarding. Sound Assistants usually begin work early arriving on set half at least an hour before call time, with the rest of the Sound Crew. They help to unload the sound van, and working with the Boom Operator, check that all equipment is prepared and fully operational. -

Talking Book Topics November-December 2017

Talking Book Topics November–December 2017 Volume 83, Number 6 Need help? Your local cooperating library is always the place to start. For general information and to order books, call 1-888-NLS-READ (1-888-657-7323) to be connected to your local cooperating library. To find your library, visit www.loc.gov/nls and select “Find Your Library.” To change your Talking Book Topics subscription, contact your local cooperating library. Get books fast from BARD Most books and magazines listed in Talking Book Topics are available to eligible readers for download on the NLS Braille and Audio Reading Download (BARD) site. To use BARD, contact your local cooperating library or visit nlsbard.loc.gov for more information. The free BARD Mobile app is available from the App Store, Google Play, and Amazon’s Appstore. About Talking Book Topics Talking Book Topics, published in audio, large print, and online, is distributed free to people unable to read regular print and is available in an abridged form in braille. Talking Book Topics lists titles recently added to the NLS collection. The entire collection, with hundreds of thousands of titles, is available at www.loc.gov/nls. Select “Catalog Search” to view the collection. Talking Book Topics is also online at www.loc.gov/nls/tbt and in downloadable audio files from BARD. Overseas Service American citizens living abroad may enroll and request delivery to foreign addresses by contacting the NLS Overseas Librarian by phone at (202) 707-9261 or by email at [email protected]. Page 1 of 128 Music scores and instructional materials NLS music patrons can receive braille and large-print music scores and instructional recordings through the NLS Music Section.