Embracer Group Acquires Force Field

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redeye-Gaming-Guide-2020.Pdf

REDEYE GAMING GUIDE 2020 GAMING GUIDE 2020 Senior REDEYE Redeye is the next generation equity research and investment banking company, specialized in life science and technology. We are the leading providers of corporate broking and corporate finance in these sectors. Our clients are innovative growth companies in the nordics and we use a unique rating model built on a value based investment philosophy. Redeye was founded 1999 in Stockholm and is regulated by the swedish financial authority (finansinspektionen). THE GAMING TEAM Johan Ekström Tomas Otterbeck Kristoffer Lindström Jonas Amnesten Head of Digital Senior Analyst Senior Analyst Analyst Entertainment Johan has a MSc in finance Tomas Otterbeck gained a Kristoffer Lindström has both Jonas Amnesten is an equity from Stockholm School of Master’s degree in Business a BSc and an MSc in Finance. analyst within Redeye’s tech- Economic and has studied and Economics at Stockholm He has previously worked as a nology team, with focus on e-commerce and marketing University. He also studied financial advisor, stockbroker the online gambling industry. at MBA Haas School of Busi- Computing and Systems and equity analyst at Swed- He holds a Master’s degree ness, University of California, Science at the KTH Royal bank. Kristoffer started to in Finance from Stockholm Berkeley. Johan has worked Institute of Technology. work for Redeye in early 2014, University, School of Business. as analyst and portfolio Tomas was previously respon- and today works as an equity He has more than 6 years’ manager at Swedbank Robur, sible for Redeye’s website for analyst covering companies experience from the online equity PM at Alfa Bank and six years, during which time in the tech sector with a focus gambling industry, working Gazprombank in Moscow he developed its blog and on the Gaming and Gambling in both Sweden and Malta as and as hedge fund PM at community and was editor industry. -

25 Jahre Koch Media – Ein Jubiläum (PDF Download)

25 JAHRE KOCH MEDIA - EIN JUBILÄUM Während Unternehmen in manch anderen Branchen mit 25 Und so ist die Entwicklung von Koch Media in den vergange- Jahren noch zu den Newcomern zählen würden, ist diese nen 25 Jahren auch ein Mutmacher: Sie zeigt, dass man mit Zeitspanne in der Entertainment-Branche kaum zu überbli- der Entwicklung und dem Vertrieb von Games auch in und cken. Zu schnell kommen und gehen Trends und mit ihnen aus Deutschland heraus enorm erfolgreich sein kann. häufig auch ganze Unternehmen. Das gilt ganz besonders für die Games-Branche, die zwar seit vielen Jahren stark Koch Media hat sich in den vergangenen 25 Jahren zu einem wächst, deren dynamische Entwicklung aber selbst Bran- integralen Bestandteil der deutschen Games-Branche ent- chen-Urgesteine von Zeit zu Zeit überfordert. Das 25-jähri- wickelt. Als Gründungsmitglied des BIU – Bundesverband ge Jubiläum von Koch Media ist daher ein Meilenstein, der Interaktive Unterhaltungssoftware und mit Dr. Klemens Kun- gar nicht hoch genug geschätzt werden kann. dratitz als aktivem Vorstand des Verbandes hat sich Koch Media immer für die Themen der Branche und die Weiter- Die Erfolgsgeschichte von Koch Media ist auch mit dem entwicklung der gamescom engagiert. Seit vielen Jahren ist Blick auf ihren Entstehungsort einmalig. Die Geschichte der Koch Media Partner von Spiele-Entwicklern in Deutschland deutschen Games-Branche ist sehr wechselhaft, nur wenige wie aktuell von King Art oder hat eigene Studios wie Deep Unternehmen schaffen es über viele Jahre, hier Games zu Silver Fishlabs. Doch darf man das Unternehmen nicht nur entwickeln und zu verlegen. Das Image von Games hat sich auf seine Rolle in Deutschland beschränken: Mit Niederlas- erst in den vergangenen Jahren verbessert und war zuvor sungen in allen europäischen Kernmärkten, in Nordamerika allzu lange von Klischees bestimmt. -

Embracer Group Acquires Easy Trigger

Press release Karlstad, Sweden, 5 August 2021 Embracer Group acquires Easy Trigger Embracer Group AB (“Embracer”) through its wholly owned subsidiary Coffee Stain Studios AB ("Coffee Stain"), have entered into an agreement to acquire 100 percent of the shares in Easy Trigger AB ("Easy Trigger"), the studio behind the critically acclaimed title Huntdown. “We have worked with Easy Trigger for a couple of years already on the Huntdown game and are impressed with talent within the studio. We will continue to work closely with the team and are excited welcome them into the Embracer family”, says Anton Westbergh, Co-founder and CEO Coffee Stain. Background and rationale Easy Trigger is a development studio founded in 2016, with headquarters located in Trollhättan, Sweden. The studio consists of 5 employees that have collaborated with Coffee Stain on the development and release of the critically acclaimed indie title Huntdown. Easy Trigger is led by co-founder and CEO Tommy Gustafsson, and co- founder and lead programmer Andreas Renberg. The company was wholly owned by the two co-founders who will remain in their current roles post-transaction. Through the acquisition, Coffee Stain onboards a talented team that will boost the development of 1st party IP within the group. Going forward, Easy Trigger will collaborate with Coffee Stain to continue working on the Huntdown IP as well as creating new original indie titles. “We look forward to continuing our partnership with Coffee Stain and further leverage the knowledge and experience within the entire Embracer Group, to accelerate growth within Easy Trigger and continue to make great games” says Tommy Gustafsson, Co-founder and CEO Easy Trigger. -

OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 EXTENDED FINANCIAL YEAR REPORT • 1 JAN 2018 – 31 MAR 2019 OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION JANUARY–MARCH 2019 JANUARY 2018–MARCH 2019, 15 MONTHS (Compared to January–March 2018) (Compared to full year 2017) > Net sales increased 158% to SEK 1,630.5 m > Net sales increased to SEK 5,754.1 m (507.5). (632.9). > EBITDA increased to SEK 1,592.6 m (272.6), > EBITDA increased 174% to SEK 618.6 m (225.9), corresponding to an EBITDA margin of 28%. corresponding to an EBITDA margin of 38%. > Operational EBIT increased to SEK 897.1 m > Operational EBIT increased 217% to SEK 395.9 m (202.3) corresponding to an Operational EBIT (124.9) corresponding to an Operational EBIT margin of 16%. margin of 24%. > Cash flow from operating activities amounted > Cash flow from operating activities amounted to SEK 1,356.4 m (179.1). to SEK 777.2 m (699.8). > Earnings per share was SEK 4.68 (1.88). > Earnings per share was SEK 1.10 (1.02). > As of 31 March 2019, cash and cash equivalents were SEK 2,929.1 m. Available cash including credit facilities was SEK 4,521.1 m. KEY PERFORMANCE INDICATORS, Jan-Mar Jan-Mar Jan 2018- Jan-Dec GROUP 2019 2018 Mar 2019 2017 Net sales, SEK m 1,630.5 632.9 5,754.1 507.5 EBITDA, SEK m 618.6 225.9 1,592.6 272.6 Operational EBIT, SEK m 395.9 124.9 897.1 202.3 EBIT, SEK m 172.0 107.3 574.6 188.2 Profit after tax , SEK m 103.0 81.1 396.8 139.2 Cash flow from operating activities, SEK m 777.2 699.8 1,356.4 179.1 Sales growth, % 158 673 1,034 68 EBITDA margin, % 38 36 28 54 Operational EBIT margin, % 24 20 16 40 Throughout this report, the extended financial year 1 January 2018 – 31 March 2019 is compared with the financial year 1 January – 31 December 2017. -

Nicole Vickery Thesis (PDF 10MB)

ENGAGING IN ACTIVITIES: THE FLOW EXPERIENCE OF GAMEPLAY Nicole E. M. Vickery Bachelor of Games and Interactive Entertainment, Bachelor of Information Technology (First Class Honours) Submitted in fulfilment of the requirements for the degree of Doctor of Philosophy School of Electrical Engineering and Computer Science Science and Engineering Faculty Queensland University of Technology 2019 Keywords Videogames; Challenge; Activities; Gameplay; Play; Activity Theory; Dynamics; Flow; Immersion; Game design; Conflict; Narrative. i Abstract Creating better player experience (PX) is dependent upon understanding the act of gameplay. The aim of this thesis is to develop an understanding of enjoyment in dynamics actions in-game. There are few descriptive works that capture the actions of players while engaging in playing videogames. Emerging from this gap is our concept of activities, which aims to help describe how players engage in both game-directed (ludic), and playful (paidic) actions in videogames. Enjoyment is central to the player experience of videogames. This thesis utilises flow as a model of enjoyment in games. Flow has been used previously to explore enjoyment in videogames. However, flow has rarely been used to explore enjoyment of nuanced gameplay behaviours that emerge from in-game activities. Most research that investigates flow in videogames is quantitative; there is little qualitative research that describes ‘how’ or ‘why’ players experience flow. This thesis aims to fill this gap by firstly understanding how players engage in activities in games, and then investigating how flow is experience based on these activities. In order to address these broad objectives, this thesis includes three qualitative studies that were designed to create an understanding of the relationship between activities and flow in games. -

THQ Nordic AB (Publ) Acquires Koch Media

THQ Nordic AB (publ) acquires Koch Media Investor Presentation February 14, 2018 Acquisition rationale AAA intellectual property rights Saints Row and Dead Island Long-term exclusive licence within Games for “Metro” based on books by Dmitry Glukhovsky 4 AAA titles in production including announced Metro Exodus and Dead Island 2 2 AAA studios Deep Silver Volition (Champaign, IL) and Deep Silver Dambuster Studios (Nottingham, UK) #1 Publishing partner in Europe for 50+ companies Complementary business models and entrepreneurial cultural fit Potential revenue synergy and strong platform for further acquisitions EPS accretive acquisition to THQ Nordic shareholders 2 Creating a European player of great scale Internal development studios1 7 3 10 External development studios1 18 8 26 Number of IPs1 91 15 106 Announced 12 5 17 Development projects1 Unannounced 24 9 33 Headcount (internal and external)1 462 1,181 1,643 Net sales 2017 9m, Apr-Dec SEK 426m SEK 2,548m SEK 2,933m2 Adj. EBIT 2017 9m, Apr-Dec SEK 156m SEK 296m3 SEK 505m2,3 1) December 31, 2017. 2) Pro forma. 3) Adjusted for write-downs of SEK 552m. Source: Koch Media, THQ Nordic 3 High level transaction structure THQ Nordic AB (publ) Koch Media Holding GmbH, seller (Sweden) (Germany) Purchase price EUR 91.5m 100% 100% SALEM einhundertste Koch Media GmbH, Operations Holding GmbH operative company (Austria) 100% (Austria) Pre-transaction Transaction Transaction information . Purchase price of EUR 91.5m – EUR 66m in cash paid at closing – EUR 16m in cash paid no later than August 14, 2018 – EUR 9.5m in shares paid no later than June 15, 2018 . -

Pegi Annual Report

PEGI ANNUAL REPORT ANNUAL REPORT INTRODUCTION 2 CHAPTER 1 The PEGI system and how it functions 4 AGE CATEGORIES 5 CONTENT DESCRIPTORS 6 THE PEGI OK LABEL 7 PARENTAL CONTROL SYSTEMS IN GAMING CONSOLES 7 STEPS OF THE RATING PROCESS 9 ARCHIVE LIBRARY 9 CHAPTER 2 The PEGI Organisation 12 THE PEGI STRUCTURE 12 PEGI S.A. 12 BOARDS AND COMMITTEES 12 THE PEGI CONGRESS 12 PEGI MANAGEMENT BOARD 12 PEGI COUNCIL 12 PEGI EXPERTS GROUP 13 COMPLAINTS BOARD 13 COMPLAINTS PROCEDURE 14 THE FOUNDER: ISFE 17 THE PEGI ADMINISTRATOR: NICAM 18 THE PEGI ADMINISTRATOR: VSC 20 PEGI IN THE UK - A CASE STUDY? 21 PEGI CODERS 22 CHAPTER 3 The PEGI Online system 24 CHAPTER 4 PEGI Communication tools and activities 28 Introduction 28 Website 28 Promotional materials 29 Activities per country 29 ANNEX 1 PEGI Code of Conduct 34 ANNEX 2 PEGI Online Safety Code (POSC) 38 ANNEX 3 The PEGI Signatories 44 ANNEX 4 PEGI Assessment Form 50 ANNEX 5 PEGI Complaints 58 1 INTRODUCTION Dear reader, We all know how quickly technology moves on. Yesterday’s marvel is tomorrow’s museum piece. The same applies to games, although it is not just the core game technology that continues to develop at breakneck speed. The human machine interfaces we use to interact with games are becoming more sophisticated and at the same time, easier to use. The Wii Balance Board™ and the MotionPlus™, Microsoft’s Project Natal and Sony’s PlayStation® Eye are all reinventing how we interact with games, and in turn this is playing part in a greater shift. -

Interim Report • 1 January – 30 September 2018

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 INTERIM REPORT • 1 JANUARY – 30 SEPTEMBER 2018 EBIT INCREASED 278% TO SEK 90.8 MILLION We had another stable quarter with continued momentum. The strategy of diversification is paying off. Net sales increased by 1,403% to a record SEK 1,272.7 million in the quarter. EBITDA increased by 521% to SEK 214.8 million and EBIT increased by 278% to SEK 90.8 million compared to the same period last year. The gross margin percentage decreased due to a large share of net sales with lower margin within Partner Publishing. Cash flow from operating activities in the quarter was SEK –740.1 million, mainly due to the decision to replace forfaiting of receivables with bank debt within Koch Media. Both THQ Nordic and Koch Media contributed to the group’s EBIT during the quarter. Net sales in the THQ Nordic business area were up 47% to SEK 124.2 million. This was driven by the release of Titan Quest, Red Faction Guerilla Re-Mars-tered and This is the Police 2, in addition to continued performance of Wreckfest. Net sales of Deep Silver were SEK 251.8 million, driven by the release of Dakar 18 and a good performance of Pathfinder Kingmaker at the end of the quarter. The digital net sales of the back-catalogue in both business areas continued to have solid performances. Our Partner Publishing business area had a strong quarter driven by significant releases from our business partners Codemasters, SquareEnix and Sega. During the quarter, we acquired several strong IPs such as Alone in the Dark, Kingdoms of Amalur and Time- splitters. -

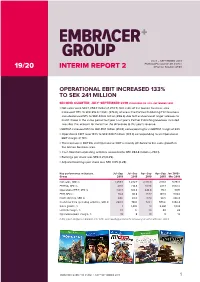

19/20 Interim Report 2 Reg No

JULY – SEPTEMBER 2019 EMBRACER GROUP AB (PUBL) 19/20 INTERIM REPORT 2 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 133% TO SEK 241 MILLION SECOND QUARTER, JULY–SEPTEMBER 2019 (COMPARED TO JULY–SEPTEMBER 2018) > Net sales were SEK 1,259.7 million (1,272.7). Net sales of the Games business area increased 117% to SEK 816.0 million (376.0), whereas the Partner Publishing/Film business area decreased 51% to SEK 443.6 million (896.6) due to the absence of larger releases to match those in the same period last year. Last year’s Partner Publishing revenues included two titles that account for more than the difference to this year’s revenue. > EBITDA increased 95% to SEK 418.1 million (214.8), corresponding to an EBITDA margin of 33%. > Operational EBIT rose 133% to SEK 240.7 million (103.4) corresponding to an Operational EBIT margin of 19%. > The increase in EBITDA and Operational EBIT is mainly attributed to the sales growth in the Games business area. > Cash flow from operating activities amounted to SEK 284.8 million (–740.1). > Earnings per share was SEK 0.21 (0.25). > Adjusted earnings per share was SEK 0.65 (0.28). Key performance indicators, Jul–Sep Jul–Sep Apr–Sep Apr–Sep Jan 2018– Group 2019 2018 2019 2018 Mar 2019 Net sales, SEK m 1,259.7 1,272.7 2,401.8 2,110.1 5,754.1 EBITDA, SEK m 418.1 214.8 807.6 421.7 1,592.6 Operational EBIT, SEK m 240.7 103.4 444.8 173.1 897.1 EBIT, SEK m 76.4 90.8 157.7 143.3 574.6 Profit after tax, SEK m 64.6 65.0 117.4 98.5 396.8 Cash flow from operating activities, SEK m 284.8 –740.1 723.1 –575.6 1,356.4 Sales growth, % –1 1,403 14 2,281 1,034 EBITDA margin, % 33 17 34 20 28 Operational EBIT margin, % 19 8 19 8 16 In this report, all figures in brackets refer to the corresponding period of the previous year, unless otherwise stated. -

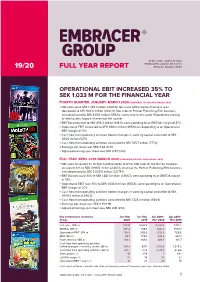

19/20 Full Year Report Reg No

APRIL 2019 – MARCH 2020 EMBRACER GROUP AB (PUBL) 19/20 FULL YEAR REPORT REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 35% TO SEK 1,033 M FOR THE FINANCIAL YEAR FOURTH QUARTER, JANUARY–MARCH 2020 (COMPARED TO JANUARY–MARCH 2019) > Net sales were SEK 1,339.1 million (1,630.5). Net sales of the Games business area decreased to SEK 903.5 million (1,034.9). Net sales of Partner Publishing/Film business area decreased to SEK 435.6 million (595.6), mainly due to the covid-19 pandemic closing of retail outlets towards the end of the quarter. > EBITDA amounted to SEK 495.2 million (618.6), corresponding to an EBITDA margin of 37%. > Operational EBIT amounted to SEK 286.0 million (395.9) corresponding to an Operational EBIT margin of 21%. > Cash flow from operating activities before changes in working capital amounted to SEK 384.6 million (527.1). > Cash flow from operating activities amounted to SEK 765.7 million (777.2). > Earnings per share was SEK 0.42 (0.37). > Adjusted earnings per share was SEK 0.97 (1.00). FULL YEAR, APRIL 2019–MARCH 2020 (COMPARED TO APRIL 2018–MARCH 2019) > Net sales increased 3% to SEK 5,249.4 million (5,121.2). Net sales of the Games business area grew 31% to SEK 3,196.5 million (2,447.1), whereas the Partner Publishing/Film business area decreased to SEK 2,052.9 million (2,674,1). > EBITDA increased 33% to SEK 1,821.3 million (1,366.7), corresponding to an EBITDA margin of 35%. -

THQ Nordic Completes the Acquisition Warhorse Studios

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, WITHIN OR TO THE UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL OR WOULD REQUIRE REGISTRATION OR ANY OTHER MEASURES. Press release Karlstad (Sweden), 13 February 2019 THQ Nordic completes the acquisition Warhorse Studios THQ Nordic AB's indirectly wholly owned subsidiary Koch Media GmbH has today entered into an agreement to acquire Warhorse Studios s.r.o., which was announced earlier today through a press release, for a purchase price amounting to MEUR 33.2 on a cash and debt free basis. All conditions for the transaction have now been fulfilled and the transaction is thereby completed. The Purchase of MEUR 42.8, corresPonding to MEUR 33.2 on a cash and debt free basis has today been Paid through a cast Payment of MEUR 40.4 to the sellers and 142,870 B shares, corresPonding to a value of MEUR 2.4, have been issued, subscribed for and allotted to the sellers. Warhorse Studios will be consolidated into THQ Nordic’s financial as of 13 February 2019. For further information on the transaction, reference is made to the Press release announced earlier today. Advisers Ernst & Young AB is providing transaction suPPort and Baker McKenzie is acting as legal counsel to THQ Nordic in connection with the transaction. For additional information, please contact: Lars Wingefors, GrouP CEO Tel: +46 708 47 19 78 E-mail: [email protected] About THQ Nordic THQ Nordic acquires, develoPs and Publishes PC and console games for the global games market. -

Embracer Group Acquires Digixart

Press release Karlstad, Sweden, 5 August 2021 Embracer Group acquires Digixart Embracer Group AB (”Embracer”), through its wholly owned subsidiary Koch Media GmbH (”Koch Media”), has entered into an agreement to acquire 100 percent of the shares in the France-based DigixArt from its current owners. DigixArt is a development studio and the creator of “Lost in Harmony”, “11-11 Memories Retold” and upcoming title “Road 96”. “DigixArt is a very talented studio with an experienced team and proven capabilities to create great IPs. As part of Koch Media and the Embracer Group, DigixArt has the potential to grow and become a leading studio within narrative games. We look forward welcoming them to our team” says Klemens Kundratitz, Co-founder and CEO of Koch Media. Background and rationale After 14 years within the game industry, Yoan Fanise and Anne-Laure Fanise founded DigixArt in 2015 in Montpellier, France. Digixart is today an award-winning and profitable games development studio with 20+ employees. The team consists of veterans from the AAA industry as well as young talented developers and with experience in mobile, PC and console games development. The studio has proven capabilities of creating and developing original IP and through the acquisition, Embracer strengthens its position in the growing sector of narrative games. Going forward, the team will continue to focus on development of new IPs and with support from Koch Media and Embracer, will look to grow the team. The company was owned to 95 percent by the sellers Yoan and Anne-Laure who will both remain in their current roles.