Standalone Accounts-2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MCB Bank Annual Report 2010

Annual Report 2010 I 3 Contents 06 Vision and Mission Statement Stakeholder’s Information 08 Strategic Objectives 43 Key Performance Indicators 20 Core Values 44 Six Years’ Financial Summary 22 Awards 46 Six Years’ Growth Summary 24 Products and Services 46 Key Financial Highlights Per Branch 26 Corporate Information 48 Graphical Presentation of Financial Statements 28 Profiles of the Board of Directors 49 Key Interest Bearing Assets and Liabilities 33 Board Committees 50 Segment Information 35 Organisational Structure 51 Maturity Analysis of Assets and Liabilities 36 Management Committees 52 Groupwise Performance 39 Corporate Profile of the Bank 53 Statement of Value Added 40 Chairman’s Message 54 Vertical Analysis 41 President’s Review 55 Horizontal Analysis 56 Quarterly Performance for 2010 and 2009 56 Summary of Cash Flows 57 Market Statistics of MCB’s Share 58 MCB Calendar 4 I MCB Bank Limited 59 Entity Ratings Consolidated Financial Statements 60 Directors’ Report to the Members 166 Directors’ Report on Consolidated Financial 73 Corporate Social Responsibility Statements 74 Statement of Ethics & Business Practices 167 Auditors’ Report to the Members 77 Statement of Compliance with the Code of 168 Consolidated Statement of Financial Position Corporate Governance 169 Consolidated Profit and Loss Account 78 Auditors’ Review Report to the Members 170 Consolidated Statement of Comprehensive Income on Code of Corporate Governance 171 Consolidated Cash Flow Statement 172 Consolidated Statement of Changes in Equity Standalone Financial Statements -

Media Monitoring Report Wednesday, January 30, 2019

Balochistan Drought Media Monitoring Report Wednesday, January 30, 2019 Please find below news article published in English dailies of Pakistan highlighting drought situation in Balochistan: Date Newspaper Description 30 Jan Sky Meter Rain, snow over Sindh, Karachi, Balochistan with hailstorm in offing Weather At present, a fresh Western Disturbance is over Jammu and Kashmir and its induced Cyclonic Circulation is over Central Pakistan and adjoining Rajasthan. A trough is also extending across Central Pakistan to South Sindh. https://www.skymetweather.com/content/global-news/rain-snow-over-sindh- karachi-balochistan-with-hailstorm-in-offing/#sthash.VVxNhApj.dpuf 30 Jan Times of Construction of small dams solution to Balochistan’s water crisis: Governor Islamabad QUETTA: Governor Balochistan Justice (R) Amanullah Khan Yasinzai said that in view of the increasing human necessities and emerging problem of water shortage in the province there is need to develop a comprehensive strategy for construction of small dams. https://timesofislamabad.com/30-Jan-2019/construction-of-small-dams- solution-to-balochistan-s-water-crisis-governor 30 Jan Daily Times Revisiting Water Policy Drought conditions in the two southern provinces are getting worse. The International Federation of Red Cross and Red Crescent Societies has already started work to set up a Disaster Emergency Relief Fund. In Sindh, the provincial government has declared Tharparkar, Umerkot, Dadu, Thatta, Sanghar, KambarShadadkot, Jamshoro and Badin as worst affected districts. Estimates suggest around 184,244 people have been affected by the latest drought spell. https://dailytimes.com.pk/349198/revisiting-water-policy/ 30 Jan UNPO News Sindh & Balochistan: Drought Conditions is Developing Into a Humanitarian Disaster A case has been sent to the regional office of the International Federation of Red Cross Society in Kuala Lumpur to set up an initial fund of Rs30 million. -

03. Hallmark 2015-16.Pdf

Say you, ‘If the sea be the ink for the words of my Lord, then necessarily, the sea would be exhausted and the words of my Lord would not come to an end, though We may bring the like of it for help. Say you, ‘Apparently in facial outlook of a man, I am like you, I receive revelation that your God is one God, then who-so-ever hopes to meet his Lord, he should do noble deeds and associate not any one in the worship of his Lord. Army Burn Hall College for Boys Q U M O A N ND The Hallmark 2013-14 ON ASCE CONTENTS Message of the Chairman Board of Governors .....................................................................................................................5 Message of the Deputy Chairman Board of Governors .......................................................................................................7 Message of the Principal ...........................................................................................................................................................9 From the Editor’s Pen ............................................................................................................................................................. 11 The College Faculty ................................................................................................................................................................ 13 The Junior Wing Faculty ....................................................................................................................................................... 17 -

PRESS RELEASE Directorate of Public Relations (Navy) Tel: 021

PRESS RELEASE Directorate of Public Relations (Navy) Tel: 021- 48506127-8, 21- 9201467, 051-20062097 PAKISTAN NAVY CELEBRATES HANGOR DAY……. REMINISCENT OF SINKING OF INDIAN NAVY SHIP BY PAKISTAN NAVY SUBMARINE HANGOR IN 1971 WAR Islamabad, 09 December 2018:Pakistan Navy celebrates 9th December as HANGOR Day which is reminiscent of unmatched courage and unwavering commitment of Pakistan Navy’s Submarine HANGOR during 1971 war. In order to commemorate 47th HANGOR DAY i.e sinking of Indian Navy Ship KHUKRI by Pakistan Navy Submarine HANGOR in 1971 war, a simple yet elegant ceremony was organised by 5thSubmarine Squadron. The spectacular naval action took place 30 miles South East off 'Diu Head' on west coast of India. The event is distinguished in naval history being the first successful kill by a submarine after WW-II. In recognition of their courage, the valiant crew of HANGOR was decorated with 04 x Sitara-e-Jurrats, 06 x Tamgha-e-Jurrats and 14 x lmtiaziAsnad. This is the highest number of operational gallantry awards given to a single unit of Pakistan Navy. The ceremony was held in the folds of PNS/M HANGOR at Pakistan Maritime Museum. Vice Admiral (Retd) AbaidUllah Khan graced the occasion as Chief Guest. Commander Pakistan Fleet Rear Admiral Muhammad Amjad Khan Niazi received the Chief Guest upon arrival. the While addressing the gathering, Chief Guest emphasized that Submarine HANGOR remained a pride for Pakistan Navy in 1971 war and her gallant action was not only a spectacular tactical battle resulting in sinking of Indian Navy's Frigate but it was a strategic overture of Pakistan Navy which effectively thwarted and marginalized Indian aggression imposed on Pakistan during 1971 war. -

Executive MBA Brochure 2016

CONTENTS 03 Message from the Associate Dean 04 Why an EMBA from LUMS ? 05 What Sets the Programme Apart ? 06 Executive MBA Project 07 Class Environment 08 The SDSB EMBA Advantage 09 Here’s What You Need to Enroll 10 Sponsoring Employees 11 EMBA Participating Organisations 2 Welcome to the Executive MBA Programme at the Suleman Dawood School of Business (SDSB). The school, to date has been successful in attracting an impressive applicant pool, and admitting a remarkable group of people who have gone on to further their careers and their host organisation’s productivity. These leaders are now well equipped with the skills and tools needed to take on exigent roles as global business leaders. The SDSB’s Executive MBA Programme has an outstanding faculty that comprises experts in their respective fields. The faculty has proven academic track records of teaching and research. Foreign adjunct faculty and visiting professors from highly reputed universities add to the diversity and richness of the learning experience. The programme’s competitive edge is the Case Method pedagogy. It not only imparts functional expertise but also cross-functional learning and application that is requisite for the realistic outlook required by top management. From this year onwards participants will also have the opportunity of selecting their specialisations from General Management, Entrepreneurship and Public Enterprise Management. These specialisations will further allow candidates to impact their organisations with enhanced efficiency and relevance. Furthermore, a week-long international study module is also being offered to increase the global outlook and learning of our Executive MBA candidates. Our participants come from assorted backgrounds, both professionally and personally. -

Later Mughals;

LATER MUGHALS WILLIAM IRVINE, i.c.s. {ret), Author of Storia do Mogor, Army of the Indian Moghuls, &c» Edited by JADUNATH SARKAR, i.e.s., Author of History of Aurangzib, Shivaji and His Times, Studies in Mughal India, &c. 3. 9 3. & <l Vol. I 1707—1720 Calcutta : M. C. SARKAR & SONS, London : LUZAC & CO. Printer : S. C. Mazumdar SRI GOURANGA PRESS 7///, Mirzapur Street, Calcutta. Copyright reserved by Mrs. Margaret L. Seymour, 195 Goldhurst Terrace, LONDON. Published by S. C. Sarkar M. C. Sarkar & Sons. 90/2A, Harrison Road, Calcutta. CONTENTS William Irvine ... ... ... ••• xiii—xxxii His life, xiii—works, xv—Manucci's Travels, xix—as a man, xxii—as a historian, xxiv—humour, xxvi—composition of Later Mughals, xxvi—editor's work, xxviii—list of Irvine's writings, xxx—author's foreword, xxxii. Chapter I. Bahadur Shah ... ... ... ... 1—157 Aurangzib's children, 1 —his will, 5—Azam's measures on Aurangzib's death, 7—Azam marches to Hindustan, 11 —Azim-ush-shan reaches Agra, 15 —Bidar Bakht advances to the Chambal, 17—Bahadur Shah marches to Agra, 18—his letter to Azam and reply, 21 —march to Jajau, 22—battle, 27 —slaughter in Azam's army, 30—Azam killed, 33—his character, 34—Bahadur Shah I.'s chief appointments, 36—Asad Khan's powers, 37—Rajput States, 41 — 42— 43— life — Mewar, Amber, Jodhpur ; early of Ajit Singh, 44 Bahadur Shah marches to Rajputana, 46—enters Amber, 46—Ajit is defeated, sub- mits, 48—Emperor returns, 49—Kam Bakhsh's doings in the Dakhin, 50— factions in his Court, 52—mad acts of Kam Bakhsh, 55—Bahadur Shah reaches the -

Consolidated Accounts

MCB Bank Limited & Subsidiary Companies Consolidated Financial Statements For the year ended December 31, 2010 MCB Bank Limited & Subsidiary Companies Consolidated Statement of Financial Position As at December 31, 2010 Note 2010 2009 (Rupees in '000) Assets Cash and balances with treasury banks 6 45,407,264 38,774,871 Balances with other banks 7 1,551,518 6,077,354 Lendings to financial institutions 8 4,401,781 3,000,000 Investments - net 9 215,747,844 169,484,647 Advances - net 10 254,565,471 253,248,265 Operating fixed assets 11 21,061,787 18,099,010 Deferred tax assets - net - - Other assets - net 12 27,746,198 23,057,731 570,481,863 511,741,878 Liabilities Bills payable 14 10,265,537 8,201,090 Borrowings 15 25,684,593 44,662,088 Deposits and other accounts 16 431,295,499 367,581,075 Sub-ordinated loan - - Liabilities against assets subject to finance lease - - Deferred tax liabilities - net 17 5,146,733 3,201,756 Other liabilities 18 16,090,374 15,782,589 488,482,736 439,428,598 Net assets 81,999,127 72,313,280 Represented by: Share capital 19 7,602,150 6,911,045 Reserves 20 40,164,526 38,387,656 Unappropriated profit 23,458,429 17,821,670 71,225,105 63,120,371 Minority interest 2,698 71 71,227,803 63,120,442 Surplus on revaluation of assets - net of tax 21 10,771,324 9,192,838 81,999,127 72,313,280 Contingencies and commitments 22 The annexed notes 1 to 46 and Annexures I to V form an integral part of these financial statements. -

Benefits of the Programme the LUMS Executive MBA Provides a Number of Benefits Both to the Participants and the Sponsoring Organisations

CONTENTS WELCOME FROM THE ASSOCIATE DEAN THE SDSB ADVANTAGE A CONTINUED CUSTOM OF EXCELLENCE PROGRAMME 01 FEATURES CLASS 02 ENVIRONMENT BENEFITS OF THE 05 PROGRAMME ADMISSION 06 CRITERIA SOME OF OUR 08 ALUMNI PARTICIpaTING 10 ORGANISATIONS 11 12 13 Welcome from the Associate Dean Welcome to the Executive MBA Programme at the Suleman Dawood School of Business. The school has been successful in attracting an impressive applicant pool, and admitting remarkable group of people who have gone on to further their careers and their host organi- sation’s productivity. These leaders are now well equipped with skills and tools needed to take on exigent roles as global business leaders. The SDSB’s Executive MBA Programme has a lot to offer. The SDSB has an outstanding faculty that comprises experts in their respective fields. The faculty has proven academic track records of teaching and research. Foreign adjunct faculty and visiting professors from highly reputed universities add to the diversity and richness of the learning experience. The programme’s competitive edge is the Case Method Learning. Combining originality with an applied approach to learning, gives participants the structural tools to further their careers. This is in keeping with attempts to provide participants with a rigorous practical approach. It not only imparts functional expertise but also cross-functional learning and application that is requisite for the realistic outlook required by top management. From this year onwards participants will also have the opportunity of selecting their specialisations from General Management, Entrepreneurship, and Public Enterprise Management. These specialisations will further allow candidates to impact their organisations with enhanced efficiency and relevance. -

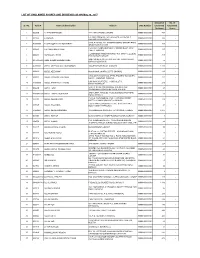

LIST of UNCLAIMED SHARES and DIVIDENDS AS on May 30, 2017

LIST OF UNCLAIMED SHARES AND DIVIDENDS AS ON May 30, 2017 Amount of No. of Sr. No. Folio # Name of Shareholder Address CNIC Number Unclaimed Unclaimed Dividend Shares 1 002060 A. AHAD MAHMOOD 88-C, MAYO ROAD, LAHORE 00000-0000000-0 494 - LT. CDR. PN(RETD)., 50-A LALAZAR, FLATE NO. 3 2 001368 A. RASHID 00000-0000000-0 334 - QUEENS ROAD KARACHI 538/5, FLAT NO. 202, GARDEN HOMES, GARDEN EAST, 3 A-000005 A. SHAKOOR H. ALI MOHAMMAD 00000-0000000-0 203 - GRUMANDIR,KARACHI C/O KAWY CORPORATION 3/14 FRERE ROAD, NEW 4 004661 A.G. MOHAMMAD VALLI 00000-0000000-0 135 - CHALLI, KARACHI COMMANDER PAKISTAN NAVEY P.N. STAFF COLLEGE 5 004206 ABAIDULLAH KHAN 00000-0000000-0 378 - PNS KARSAZ.KARACHI UMER BROTHERS, KATCHI GALI NO. 1.JODIA BAZAR 6 001508/4405 ABBA OOMER HASHEM GHELI 00000-0000000-0 14 - KARACHI-2.KARACHI 7 A-000068 ABDUL AZIZ HAJI WALI MOHAMMAD 135--BHURGARI ROAD, KARACHI 00000-0000000-0 1,129 - 8 000693 ABDUL AZIZ KHAN MOCHI MOH. OKARA DISTT. SAHIWAL 00000-0000000-0 120 - GHULAM HUSSAIN HAJI JETHA BHAINEW NAHAM RD, 9 000833 ABDUL HUSSAIN HAJI ABOO 00000-0000000-0 414 - MANZIL, KARADAR, KARACHI LAKHANY BROTHERS, I -SIND CLOTH 10 A-000039 ABDUL KARIM HAJI TAYOOB 00000-0000000-0 270 - MARKET,KARACHI 52-B, (P-III), BEHIND MOSQUE, SHEIKHA ABU 11 004280 ABDUL LATIF 00000-0000000-0 27 - SALIM,MODEL TOWN LINK ROAD, LAHORE 2ND FLOOR, AMEEJEE VALEEJEE BUILDING,FRERE 12 000855/2935 ABDUL LATIF A. MOTIWALA 00000-0000000-0 83 - ROAD, KARACHI C/O A.A. -

P R O S P E C T U S 2013

F BA Y O LO IT C S H R I E S T V I A N N U ������������������������� ������ ��������������������� P R O S P E C T U S 2013 The University of Balochistan is the largest and highest seat of learning having more than 650 faculty members, over 6000 on-campus students, 85 affiliated colleges and 01 Constituent Law College. The University of Balochistan offers admissions in Postgraduate, under- graduate and various other Programs in almostmore than40Departments, Centers and Institutes in morning and evening programs with the aim to prepare qualified, skilled human resource to meet manpower demands at Provincial and National level. We believe that every student is bestowed with the requisite potential and our aim is to see that this potential is realized and fulfilled. To this end, I am pleased to offer you admission in postgraduate programs of your choice in one of more than 40 disciplines for the new academic year 2013 with the hope that you would join this Institution as a regular student of this University. I assure you that we remain absolutely unwavering in our commitment to provide you the quality education you deserve and desire. Looking forwardtohave you on Campus as partof communityof regular students Wish you all the best! Prof. Dr. Rasool Bakhsh Raisani Vice Chancellor PRO VICE CHANCELLOR'S MESSAGE It gives me an immense pleasure to welcome you to the University of Balochistan campus. University of Balochistan, Quetta, is the oldest and the only general university in the province offering a wide range of high quality programs in the fields of Sciences, Arts, Humanities, Languages etc, at various levels including Honors, Masters, M.Phil and Ph.D. -

Prospectus 2016

VICE CHANCELLOR’S MESSAGE The University of Balochistan is the oldest and premier University of Balochistan. Since its establishment in 1970, it has achieved heights of success in all fields, especially Science, Arts and Humanities. Having been started from only 5 teaching departments, it now, with the grace of Allah Almighty, is running 48 departments under the umbrella of 8 Faculties, 4 specialized Centers, 2 Institutes and 1 Constituent Law College. Beside these, University of Balochistan has 86 affiliated colleges across the province. University of Balochistan has maintained its excellence in education, training and research in various fields of arts, Social Sciences, Business and Languages. The University aims at high standards of quality education compatible with national needs and comparable to International Universities of high repute abroad. It has always attracted talented students coming from all walks of life and regions within its territorial limits and all provinces of Pakistan under exchange program and reserve seats. The University of Balochistan recognizes an integrated and inter-disciplinary approach to synchronize and cooperative teaching among the various disciplines belonging to different faculties of constituent parts of the University under one umbrella. The hundred thousand of Alumni of University of Balochistan are serving at higher professional positions, research organizations, government and development sectors and universities at home and abroad serving the country. University of Balochistan is devoted to providing best possible facilities in terms of faculty staff, laboratories, libraries and environment of research & development activities leading to higher degrees. I hope that the talented students will be joining the Master degree courses with the strong commitment to keep up the tradition of this Institution and help maintaining the flag of the University high in the sky I am quite hopeful and wishes for the sparkling future ahead. -

July 2019 NEWS COVERAGE PERIOD from JULY 1ST to JULY 7TH 019 HOTTER THAN DEATH VALLEY: SEVEN DIE AS EUROPE BURNS, SWEATS in RECORD HEAT

The Globalization Bulletin Climate Change January 2019 NEWS COVERAGE PERIOD FROM JANUARY 21ST TO JANUARY 27TH 2019 PRCS TO CREATE AWARENESS ABOUT CLIMATE CHANGE RECORDER REPORT January 26, 2019 LAHORE: Pakistan Red Crescent Society (PRCS) in collaboration with the German Red Cross is initiating country-wide awareness drive for raising awareness about threats associated with the climate change. Chairman Pakistan Red Crescent Society Dr Saeed Elahi said this while speaking at a workshop organized by the Pakistan Red Crescent Punjab at a two-day capacity enhancement session under its climate change adaptation programme in Lahore. The speakers and experts who convened the technical sessions covered the basic climate science, the environmental problems faced by Punjab, local adaptation measures, Pakistan’s climate governance, advocacy and campaigning, youth for volunteerism and green entrepreneurship in their modules. Dr Saeed Elahi highlighted that the brunt of global climatic change is being faced by Pakistan being the 7th most vulnerable country of the world and immediate adaptation initiatives should be initiated to address the issue with all stakeholders across all tiers and levels. Provincial Chairman Pakistan Red Crescent Punjab Lt Gen Khalid Maqbool (R) in his address said the youth needed to play a key role in creating awareness about impact of climate change. The representative from German Red Cross encouraged the participants of the workshop, to replicate the trainings with their immediate social circle and assured full assistance in supporting their local climate advocacy campaigns. https://epaper.brecorder.com/2019/01/26/5-page/760313-news.html SOUTHERN AUSTRALIA HEATWAVE SMASHES RECORD TEMPERATURES AFP Updated January 25, 2019 ADELAIDE: Temperatures in southern Australia topped 49 degrees on Thursday, shattering previous records as heat-stressed bats fell from trees.