RANDGOLD RESOURCES LIMITED Incorporated in Jersey, Channel Islands Reg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ga Mashie Issues Addressed

Addressing Urban Poverty in sub-Saharan Africa: An Overview of the Millennium Cities Initiative Accra, Ghana July 2011 The Millennium Cities Initiative (MCI) A project of The Earth Institute at Columbia University, Millennium Cities Initiative was founded in 2006 by world-renowned development economist Jeffrey D. Sachs as the urban complement to the Millennium Villages Project, which aims to eradicate extreme poverty in rural sub- Saharan Africa. MCI Works Together with Underserved Cities across sub-Saharan Africa Country Millennium Cities • Ethiopia • Mekelle • Ghana • Accra • Ghana • Kumasi • Kenya • Kisumu • Malawi • Blantyre • Mali Bamako Mali • • • Segou • Nigeria Akure Nigeria • • • Kaduna • Senegal Tanzania • Louga • Tabora • Mali • • Rwanda • Timbuktu* • Uganda • Kigali* • Mbarara* *Future Cities 3 MCI Works in Two Arenas Social Sector Investment/Business Development 4 Investment Sector: Research and Analysis • Research and analysis of investment opportunities and constraints, with emphasis on farm-to- market • Targeting of potential investors • Focus on investment promotion and capacity- building 5 Social Sector: Research and Analysis MCI conducts needs assessments and costing analyses in public health, gender, education and water/sanitation and other follow-on research, to help the cities determine how far they still need to go to attain the MDGs 6 MCI Builds Comprehensive Development Strategies for the Cities • Consultative stakeholder meetings to determine and rank top development priorities • Working closely with municipal -

Special Caring Awards Issue

® November 2012 Vol. XXXI, No. 11 $5.00 Special Caring Awards Issue International Caring Award Winner His Holiness the Dalai Lama Nutrition Oral nutrition supplements: Facts Shake well. Serve cold. Improve patient outcomes. Serv. Size: 1 bottle (8 fl. oz.) Reduction in rehospitalizations 50%1 Calories: 350 Reduction in overall complications 56%2 Protein and Revigor® Reduction in pressure ulcers 25%3 Recommend: 2 bottles per day Tools needed to enhance nutrition care plans 100% Use under medical supervision. Missing your daily recommended allowance of improved outcomes? Learn how our Feed the 485 Initiative can give you the tools for successful nutrition intervention. Visit us at www.Feedthe485.com. ©2012 Abbott Laboratories Inc. 85184.001/October 2012 1. Norman K et al. Clin Nutr. 2008; 27:48-56 2. Stratton RJ, Green CJ, et al. Wallingford. www.abbottnutrition.com CABI Publishing 2003 3. Stratton RJ et al. Ageing Res Rev. 2005; 4(3): 422-450 Oral nutrition supplements: Nutrition ByThe Val J. Halamandaris Caring Imperative Facts Shake well. Serve cold. Improve patient outcomes. his issue of CARING magazine celebrates the hu- hunger among the citizens of this nation for such stories. Serv. Size: Tman spirit. Through the stories of the people pro- We seek to promote the solidarity of the American fam- 1 bottle (8 fl. oz.) filed, it strives to promote positive values and underscore ily, which we perceive to be the bedrock of our society. It is Reduction in rehospitalizations 50%1 the importance of service to others in an institution we believe to be presently Calories: 350 the belief that the solution to most threatened by dangerous influences. -

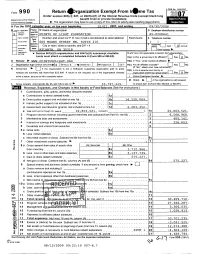

I Return .Rganization Exempt from Ir*Me Tax R

Form 9 9 0 I Return .rganization Exempt From Ir*me Tax r Under section 501 (c); 527, or 4947( a)(1) of the Internal Revenue Code (except black lung Department 01 the Treasury benefit trust or private foundation) Internal Revenue Service 10- The organization may have to use a copy of this r eturn to satisfy state report ing requirements A For the 2007 calendar year , or tax year beginninq 10/01 , 2007 , and endinq 09/30/2008 Please B Check d epphcable C Name of organization D Employer identification number Add,ess use IRS X change' label or POINTS OF LIGHT FOUNDATION 65-0206641 print or Name change Number and street (or P box if mail is not delivered street address) Room/ E Telephone number type. 0 to suite Imtialretun see 600 MEANS STREET NW SUITE 210 - Specific F Acc-nr.,q Termination l instrur - City or town, state or country, and ZIP + 4 method Cash X Accrual Amended bons return Other ( specify) ► Application pending • Section 501 ( c )( 3) organizations and 4947(a)(1) nonexempt charitable H and I are not applicable to section 527 organizations trusts must attach a completed Schedule A (Form 990 or 990 -EZ). H(a) Is this a group return for affil ates> Yes F-xl No G Website : ► WWW. POINTSOFLIGHT . ORG H(b) If "Yes," enter number of affiliates ► _ J Organization type (check only one) ► X 501(c) ( 3 ) 4 (Insert no) 4947(a)(1) or 527 H(c) Are all affiliates included? Yes ^No (If "No," attach a list See instructions K Check here ► If the organization is not a 509(a)(3) supporting organization and its gross H(d) Is this a separate return filedroubypan receipts are normally not more than $25,000 A return is not required, but if the organization chooses org anizat ion covered by a rul ing'? Yes X No to file a return , be sure to file a complete return I Group Exemption Number ► M Check ► If the organization is not required L Gross receipts Add lines 6b, 8b, 9b , and lob to line 12 ► 33 , 797 , 449. -

24 Randgold Resources

WorldReginfo - 91eabbb6-98e3-4f18-932c-032325ccfb6c WorldReginfo - 91eabbb6-98e3-4f18-932c-032325ccfb6c Shareholders’ diary Randgold Resources is an African focused gold mining Financial year end 31 December and exploration company with Annual general meeting Tuesday 3 May 2011 listings on the London Stock Exchange and Nasdaq. ANNOUNCEMENT OF QUARTERLY RESULTS First quarter Thursday 5 May 2011 Second quarter Thursday 4 August 2011 Third quarter Wednesday 2 November 2011 Year end and fourth quarter Monday 6 February 2012 Major discoveries to date include the 7.5 million ounce Morila deposit in southern Mali, the 7 million ounce Yalea deposit and the 5 million ounce Gounkoto deposit, both in western Mali, the 4 million ounce Tongon deposit in the Côte d’Ivoire and the 3 million ounce Massawa deposit in eastern Senegal. Stock exchange Ticker symbol TICKER SYMBOLS Randgold Resources Limited (Randgold) financed and London Stock Exchange (ords) RRS built the Morila mine which since October 2000 has KEY NUMBERS Nasdaq Global Select Market (ADRs) GOLD produced approximately 5.8 million ounces of gold and 31 Dec 31 Dec distributed more than US$1.6 billion to stakeholders. It US$000 2010 2009 also financed and built the Loulo operation which started as two open pit mines in November 2005. Since then, Gold sales* 487 669 434 194 an underground mine has been developed at the Yalea Note that the above dates may be subject to change and should be Total cash costs* 289 043 249 183 confirmed by checking on the website closer to the time. Profit from mining activity* 198 626 185 011 deposit and construction of a second underground Exploration and corporate expenditure 47 178 51 111 operation is underway at the Gara deposit. -

Dressed to Cure

c1-c1WCMwinter10 2/3/10 2:55 PM Page c1 weillcornellmedicine THE MAGAZINE OF WINTER 2009/10 WEILL CORNELL MEDICAL COLLEGE AND WEILL CORNELL GRADUATE SCHOOL OF Inside: MEDICAL SCIENCES Dressed Update on Weill Cornell’s response to to Cure the crisis in Haiti What’s the prognosis for the white coat? c2-c2WCMwinter10 2/3/10 2:55 PM Page c2 Campaign Initiatives Cancer Advancing science, enhancing health Cardiovascular Disease Building on excellence Children’s Health Adding 30 new scientists Diabetes, Metabolic Disorders and Obesity Doubling our research space Global Health and Infectious Disease Transforming bench-to-bedside research Molecular Therapeutics Neurodegenerative- Neuropsychiatric Diseases, and Aging Stem Cell, Developmental Biology, Reproductive and Regenerative Medicine Rendering of new Medical Research Building planned for East 69th Street For more information, please contact Lucille Ferraro, Campaign Director. P: 646-962-8721 E: [email protected] Please write to us at: Privacy Office, Weill Cornell Medical College, 1300 York Avenue, Box 303, New York, NY 10065, if you wish to have your name removed from lists to receive fund-raising requests supporting © redsquare, inc. for Polshek Partnership Architects Weill Cornell Medical College in the future. 01-02WCMwinter10toc 2/3/10 2:23 PM Page 1 weillcornellmedicine THE MAGAZINE OF Joey Alsberge ’13 20 WEILL CORNELL MEDICAL COLLEGE AND WEILL CORNELL GRADUATE SCHOOL OF MEDICAL SCIENCES WINTER 2009/10 FEATURES 34 20 THE WIDE WORLD BETH SAULNIER With many students eager to train abroad, the field of global health is taking off. At Weill Cornell, half of the first-year class has signed up for a new global health curriculum—on top of their usual course load. -

24 Randgold Resources

Shareholders’ diary Randgold Resources is an African focused gold mining Financial year end 31 December and exploration company with Annual general meeting Tuesday 3 May 2011 listings on the London Stock Exchange and Nasdaq. ANNOUNCEMENT OF QUARTERLY RESULTS First quarter Thursday 5 May 2011 Second quarter Thursday 4 August 2011 Third quarter Wednesday 2 November 2011 Year end and fourth quarter Monday 6 February 2012 Major discoveries to date include the 7.5 million ounce Morila deposit in southern Mali, the 7 million ounce Yalea deposit and the 5 million ounce Gounkoto deposit, both in western Mali, the 4 million ounce Tongon deposit in the Côte d’Ivoire and the 3 million ounce Massawa deposit in eastern Senegal. Stock exchange Ticker symbol TICKER SYMBOLS Randgold Resources Limited (Randgold) financed and London Stock Exchange (ords) RRS built the Morila mine which since October 2000 has KEY NUMBERS Nasdaq Global Select Market (ADRs) GOLD produced approximately 5.8 million ounces of gold and 31 Dec 31 Dec distributed more than US$1.6 billion to stakeholders. It US$000 2010 2009 also financed and built the Loulo operation which started as two open pit mines in November 2005. Since then, Gold sales* 487 669 434 194 an underground mine has been developed at the Yalea Note that the above dates may be subject to change and should be Total cash costs* 289 043 249 183 confirmed by checking on the website closer to the time. Profit from mining activity* 198 626 185 011 deposit and construction of a second underground Exploration and corporate expenditure 47 178 51 111 operation is underway at the Gara deposit. -

Clinton Global Initiative 2005-2009

ACTION L O U D E R T H A N W O R D S SPEAKSCLINTON GLOBAL INITIATIVE 2005-2009 CLINTON GLOBAL INITIATIVE What does it mean to be a global citizen in the 21st century? For Clinton Global Initiative members, it means committing to educate a child. Committing Clinton Global Initiative Intel to build a sustainable business. Committing to work across organizations, across sectors, across borders. It means moving from opinion to conviction, from inclination to action, from “I wish” to “I will.” The members of CGI have accomplished a great deal. Those who have worked the hardest, however, will be Vision Spring Clinton Global Initiative Clinton Global Initiative Asia the first to declare that their work to address pressing global challenges is far from over. We must never lose sight of what is important, for together we will chart a course to a better tomorrow. Clinton Global Initiative Global Fund for Children, Guatemala CMEA, CGI Commitment Clinton Global Initiative Clinton Global Initiative How do you go about taking the best of intentions “and turning them into positive changes that benefit other people? That is the question that you must ask and the question you must answer.” PRESIDENT BILL CLINTON Clinton Global Initiative Dear Friends, In 2005, we sought to create a global movement based on the simple notion that problems have solutions. These numbers represent only a sampling of the positive changes that our members have helped make We convened the world’s most innovative and influential citizens – Nobel Prize winners, global CEOs, heads around the globe. -

Annual Report 2010: 40 Snapshots of Results for More About Our Work Visit Letter from the CEO

F our d E c A d E s of improving lives worldwide 2010 ANNUAL REPORT HEALTH PARTNERsHIPs equity and opportunity for all women, through which we multiply our strengths, men, children, and families knowledge, and commitment SCIENcE HOLIsTIc APPROAcHEs to discover solutions that generate lasting impact for and improve impact communities and nations fHi Annual report 2010: 40 snapshots of results For more about our work visit www.fhi.org Letter from the cEO Looking Forward by Looking Back A window to fHi's next 40 Years CEO Albert J. Siemens The year 2010 saw a momentous breakthrough for As one of the first organizations to focus on family HIV/AIDS prevention and women’s empowerment: planning in the early 1970s, alongside other pioneers, Researchers at the Centre for the AIDS Programme we helped revolutionize family planning policies while of Research in South Africa (CAPRISA)—with FHI as a increasing the availability of contraceptive counseling, collaborating partner—showed for the first time that products, and methods around the world. In so doing, a vaginal gel containing an antiretroviral agent could we offered women and their families the choice and significantly reduce acquisition of HIV and herpes control needed to improve their lives and their futures. infection in women. Science named the study one of the top ten scientific breakthroughs of the year, while As students of public health in the developing world, Lancet ranked it the second most likely to influence we saw early the potentially devastating human toll practice and research. of an uncharacterized infectious disease—ultimately known to the world as HIV/AIDS—and we responded by CAPRISA 004 exemplifies the FHI story as we celebrate risking FHI’s capital in demonstration projects aimed at our 40th anniversary: a story of leveraging world-class preventing its spread. -

Division H—Department of State, For- Eign Operations, and Related Pro- Grams Appropriations Act, 2009

[House Appropriations Committee Print] Omnibus Appropriations Act, 2009 (H.R. 1105; Public Law 111–8) DIVISION H—DEPARTMENT OF STATE, FOR- EIGN OPERATIONS, AND RELATED PRO- GRAMS APPROPRIATIONS ACT, 2009 (1779) VerDate Nov 24 2008 04:55 Mar 27, 2009 Jkt 047494 PO 00000 Frm 00515 Fmt 6601 Sfmt 6601 E:\HR\OC\A494P2.XXX A494P2 rfrederick on PROD1PC65 with HEARING VerDate Nov 24 2008 04:55 Mar 27, 2009 Jkt 047494 PO 00000 Frm 00516 Fmt 6601 Sfmt 6601 E:\HR\OC\A494P2.XXX A494P2 rfrederick on PROD1PC65 with HEARING CONTENTS, DIVISION H Page Legislative Text: Title I—Department of State and Related Agency ........................................ 1785 Title II—United States Agency for International Development ................... 1794 Title III—Bilateral Economic Assistance ....................................................... 1796 Title IV—International Security Assistance .................................................. 1809 Title V—Multilateral Assistance ..................................................................... 1811 Title VI—Export and Investment Assistance ................................................. 1812 Title VII—General Provisions ......................................................................... 1815 Explanatory Statement: Title I—Department of State and Related Agency ........................................ 1873 Title II—United States Agency for International Development ................... 1891 Title III—Bilateral Economic Assistance ....................................................... 1893 Title IV—International -

FINANCING Global Capital Investment OOD Is

FINANCING Global Capital Investment OOD is – Bulgaria financing company it is a member of Sahara Group UK S.A world wide. It is working to build the financing formulas for each project and the best way to finance and build successful result. PROJECT EVALUATION, MARKER RESEARCH AND Feasibility studies for (road, railways, ports, airports, hotels, offices, shopping centres, commercial and residential real estate development* Markets and marketing for (market appraisal, selection of markets and projects, exports, marketing policies, consumer research, distribution, purchasing). and CONSULTANCY SERVICES. Economic and social development plus planning , Financial and fiscal studies Finance or facilities and tailor a scheme to suit your particular requirements. The approach is simply for us to study your requirements or problem, and providing the proposal is acceptable and can be done within the confines of Particular emphasis on international business for multi- national currency for short, medium and long term loans; finance provided through discounting of bills and other negotiable documents; Foreign currency Time Deposits, including Certificates of Deposit; documentary and Standby Letters of Credit; export finance services, leasing financial guarantees and the syndication and provision of funds for international projects; The following are a general indication of the terms upon which approved proposals can be favourably entertained, but which are subject to prevailing monetary market conditions and Policy trends at the time of funding being -

G8 International Parliamentarians' Conference on Population And

G8 International Parliamentarians’ Conference on Population & Sustainable Development Global Health, Climate Change & Food Security 2-3 July 2008 Tokyo, Japan Organized by Asian Population and Development Association (APDA) Hosted by Japan Parliamentarians Federation for Population (JPFP) Supported by United Nations Population Fund (UNFPA) Ministry of Foreign Affairs of Japan (MOFA) Asian Forum of Parliamentarians on Population & Development (AFPPD) Cooperating Agencies European Parliamentary Forum on Population & Development (EPF) Inter-American Parliamentary Group on Population & Development (IAPG) Forum of African & Arab Parliamentarians on Population & Development (FAAPPD) International Planned Parenthood Federation (IPPF) German Foundation for World Population (DSW) Parliamentarians for Global Action (PGA) World Bank/Parliamentary Network on the World Bank (PNoWB) Table of Contents Programme ............................................................................................................................................ 5 Corporate Supporters ........................................................................................................................... 8 OPENING CEREMONY ....................................................................................................................... 9 Hon. Yasuo Fukuda.......................................................................................................................... 11 Mr. Koji Tsuruoka...........................................................................................................................