Steward Large Cap Enhanced Index Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MM .1.20 Clking

CL King Market Maker List AAXN Axon Enterprise, Inc. CROX Crocs, Inc. HELE Helen of Troy Limited MPAA Motorcar Parts of America, Inc. SBAC SBA Communications Corporation ADBE Adobe Inc. CSCO Cisco Systems, Inc. HIBB Hibbett Sports, Inc. MRVL Marvell Technology Group Ltd. SBUX Starbucks Corporation ADSK Autodesk, Inc. CSOD Cornerstone OnDemand, Inc. HLIT Harmonic Inc. MSFT Microsoft Corporation SCVL Shoe Carnival, Inc. ADTN ADTRAN, Inc. CTAS Cintas Corporation HSIC Henry Schein, Inc. MU Micron Technology, Inc. SGMS Scientific Games Corp AGNC AGNC Investment Corp. CTSH Cognizant Technology Solutions Corporation HSII Heidrick & Struggles International, Inc. NDLS Noodles & Company SHOO Steven Madden, Ltd. AIMC Altra Industrial Motion Corp. CVLT Commvault Systems, Inc. HSKA Heska Corporation NEOG Neogen Corporation SMPL The Simply Good Foods Company ALGT Allegiant Travel Company DAKT Daktronics, Inc. HSON Hudson Global, Inc. NLOK NortonLifeLock Inc. SMRT Stein Mart, Inc. AMZN Amazon.com, Inc. DECK Deckers Outdoor Corporation IART Integra LifeSciences Holdings Corporation NTUS Natus Medical Incorporated SMSI Smith Micro Software, Inc. ANDE The Andersons, Inc. DENN Denny's Corporation ICON Iconix Brand Group, Inc. ON ON Semiconductor Corporation SNBR Sleep Number Corporation ANGO AngioDynamics, Inc. DIOD Diodes Incorporated IDXX IDEXX Laboratories, Inc. OSUR OraSure Technologies, Inc. SQBG Sequential Brands Group, Inc. ANSS ANSYS, Inc. DISCA Discovery, Inc. ILMN Illumina, Inc. Holdings PACB Pacific Biosciences of California, Inc. SRDX Surmodics, Inc. AOBC American Outdoor Brands Corporation DISH DISH Network Corporation IMBI iMedia Brands, Inc. PATK Patrick Industries, Inc. STAF Staffing 360 Solutions, Inc. AOSL Alpha and Omega Semiconductor Limited DLTR Dollar Tree, Inc. IOSP Innospec Inc. PDCO Patterson Companies, Inc. -

Cornerstone 8.3 Getting Started Guide 3 Introduction

IDEXX Cornerstone* Getting Started Guide 8.3 Proprietary Rights Notice Information in this document is subject to change without notice. Companies, names and data used in examples are fictitious unless otherwise noted. No part of this document may be reproduced or transmitted in any form or by any means, electronic, mechanical or otherwise, for any purpose, without the express written permission of IDEXX Laboratories. IDEXX Laboratories may have patents or pending patent applications, trademarks, copyrights or other intellectual or industrial property rights covering this document or subject matter in this document. The furnishing of this document does not give a license to these property rights except as expressly provided in any written license agreement from IDEXX Laboratories. © 2014 IDEXX Laboratories, Inc. All rights reserved. • 06-28486-05 *Cornerstone, IDEXX SmartOrder, IDEXX SmartService, IDEXX Monitor, IDEXX VetLab, IDEXX VetVault, Image Coach, I-Vision Mobile, LaserCyte, Patient Clipboard, Pet Health Network, SmartLink, VetConnect and VetTest are trademarks or registered trademarks of IDEXX Laboratories, Inc. or its affiliates in the United States and/or other countries. DICOM is the registered trademark of the National Electrical Manufacturers Association for its standards publications relating to digital communication of medical information. Microsoft, Hotmail, Internet Explorer, Outlook, Windows, Windows Server and Windows Vista are trademarks or registered trademarks of Microsoft Corporation in the United States and/or other countries. Accelerated Payment Technologies and XCharge are trademarks or registered trademarks of Accelerated Payment Technologies, Inc. Topaz, ClipGem, SigLite and SignatureGem are trademarks of Topaz Systems, Inc. in the U.S. and/or other countries. AMD Athlon, Opteron and Sempron are trademarks of Advanced Micro Devices, Inc. -

Notice of 2019 Annual Meeting of Shareholders & Proxy Statement

Notice of 2019 Annual Meeting of Shareholders & Proxy Statement Wednesday, May 8, 2019, 10:00 a.m., Eastern Time Our PURPOSE To be a great company that creates exceptional long- term value for our customers, employees and shareholders by enhancing the health and well-being of pets, people and livestock. Out Guiding Principles achieve and sustain market leadership exceed the expectations of our customers empower and reward our employees innovate with intelligence cultivate entrepreneurial spirit contribute to our communities Our Achieve and sustain market GUIDING leadership PRINCIPLES Exceed the expectations of our customers Contribute Empower and to our reward our communities employees Cultivate Innovate entrepreneurial with spirit intelligence Jonathan W. Ayers President, Chief Executive Officer and Chairman of the Board of Directors March 25, 2019 Dear Fellow Shareholders, In 2018, IDEXX delivered another year of strong growth and financial performance, sustaining our track record of creating exceptional long-term value for our customers, employees and shareholders. We are inspired by the continued pursuit of our Purpose to enhance the health and well-being of pets, people and livestock. Our Purpose We achieved outstanding financial results in 2018, with 12% revenue growth over the prior year, driven by 12% organic revenue growth, operating margin expansion of To be a great company that creates 120 basis points and growth of diluted earnings per share (“EPS”) of 45% (or exceptional long-term value for our comparable constant currency EPS growth of 36%).1 We further extended our track customers, employees and record of long-term shareholder value-creation, as reflected in the 20% compound shareholders by enhancing the annual growth rate of our stock price over the past fifteen years, and our 19% annual health and well-being of pets, total shareholder return in 2018, which again outperformed the benchmark S&P people and livestock. -

MDT Tax Aware All Cap Core SMA Model Portfolio Holdings --March

MDT Tax Aware All Cap Core SMA Model Portfolio Holdings -- March 31, 2021 Sector Holding Name Communication Services Activision Blizzard, Inc. Alphabet Inc. * Charter Communications Inc Facebook, Inc. MSG Networks Inc. Netflix, Inc. Verizon Communications Inc. Consumer Discretionary Amazon.com, Inc. AutoZone, Inc. Carnival Corporation Dollar General Corporation Domino's Pizza, Inc. eBay Inc. Genuine Parts Company Las Vegas Sands Corp. Lowe's Companies, Inc. O'Reilly Automotive, Inc. Royal Caribbean Cruises Ltd. Tesla, Inc. The Home Depot, Inc. V.F. Corporation Wingstop, Inc. Consumer Staples Colgate-Palmolive Company * Costco Wholesale Corporation Kimberly-Clark Corporation Philip Morris International Inc. * The Clorox Company Energy Continental Resources, Inc. Halliburton Company Marathon Petroleum Corporation Schlumberger Limited Financials BlackRock, Inc. Chubb Ltd. Cincinnati Financial Corporation Discover Financial Services First Republic Bank IntercontinentalExchange Inc. MarketAxess Holdings Inc. MetLife, Inc. MSCI Inc. Prudential Financial, Inc. * State Street Corporation * The Allstate Corporation * The PNC Financial Services Group, Inc. The Travelers Companies, Inc. Health Care Abbott Laboratories Abbvie, Inc. Align Technology, Inc. Amgen Inc. Anthem, Inc. Eli Lilly and Company Humana Inc. IDEXX Laboratories, Inc. Johnson & Johnson Masimo Corporation McKesson Corporation Merck & Co., Inc. Regeneron Pharmaceuticals, Inc. Veeva Systems Inc. Vertex Pharmaceuticals Incorporated Zoetis Inc. Industrials Booz Allen Hamilton Holding Corporation Generac Holdings Inc. Howmet Aerospace, Inc. Lennox International Inc. Otis Worldwide Corporation * Southwest Airlines Co. The Boeing Company Verisk Analytics, Inc. Information Technology Adobe Systems Incorporated Analog Devices, Inc. Apple Inc. * Arista Networks, Inc. Atlassian Corporation Plc Broadcom Limited Cadence Design Systems, Inc. Citrix Systems, Inc. Cloudfare, Inc. DocuSign, Inc. DXC Technology Company Fortinet, Inc. Keysight Technologies, Inc. -

Usaa Fund Holdings Usaa Nasdaq-100 Index Fund

USAA FUND HOLDINGS As of June 30, 2021 USAA NASDAQ-100 INDEX FUND CUSIP TICKER SECURITY NAME SHARES/PAR/CONTRACTS MARKET VALUE 00507V109 ATVI ACTIVISION BLIZZARD INC 229,531.00 21,906,438.64 00724F101 ADBE ADOBE INC 141,201.00 82,692,953.64 007903107 AMD ADVANCED MICRO DEVICES 358,915.00 33,712,885.95 015351109 ALXN ALEXION PHARMACEUTICALS 65,289.00 11,994,242.19 016255101 ALGN ALIGN TECHNOLOGY INC 23,377.00 14,283,347.00 02079K107 GOOG ALPHABET INC - CLASS C 62,814.00 157,431,984.48 02079K305 GOOGL ALPHABET INC - CLASS A 58,382.00 142,556,583.78 023135106 AMZN AMAZON.COM, INC. 97,900.00 336,791,664.00 025537101 AEP AEP CO., INC. 147,626.00 12,487,683.34 031162100 AMGN AMGEN, INC. 169,722.00 41,369,737.50 032654105 ADI ANALOG DEVICES, INC. 108,951.00 18,757,004.16 03662Q105 ANSS ANSYS INC 25,745.00 8,935,059.70 037833100 AAPL APPLE, INC. 3,239,420.00 443,670,963.20 038222105 AMAT APPLIED MATERIALS, INC. 269,988.00 38,446,291.20 052769106 ADSK AUTODESK, INC. 65,007.00 18,975,543.30 053015103 ADP AUTOMATIC DATA PROCESSING 125,698.00 24,966,136.76 056752108 BIDU BAIDU INC 76,539.00 15,606,302.10 09062X103 BIIB BIOGEN INC 44,474.00 15,400,011.98 09857L108 BKNG BOOKING HOLDINGS INC 12,127.00 26,534,967.43 11135F101 AVGO BROADCOM INC 120,612.00 57,512,626.08 12514G108 CDW CDW CORP OF DELAWARE 41,416.00 7,233,304.40 126408103 CSX CSX CORP. -

Alliant Techsystems, Inc

Appendix A General Industry Compensation Benchmark Group A&P Cincinnati Bell GTECH McDermott A.O. Smith Cintas H.B. Fuller McGraw-Hill Abercrombie & Fitch Clear Channel Communications H.J. Heinz MeadWestvaco AbitibiBowater Cliffs Natural Resources Hanesbrands Mecklenburg County ACH Food Clorox Harland Clarke Medtronic Activision Blizzard Coach Harley-Davidson Memorial Sloan-Kettering Cancer Center Acuity Brands Coinstar Hasbro Meredith Advanced Micro Devices Cole Haan HD Supply Metro-Goldwyn-Mayer Aeropostale Colgate-Palmolive Health Net Micron Technology Agilent Technologies Columbia Sportswear HealthSouth Millennium Inorganic Chemicals Agrium ConAgra Foods Hearst Millennium Pharmaceuticals Air Liquide Conde Nast Publications Henkel of America Millipore Air Products and Chemicals ConvaTec Henry Ford Health Systems Mizuno USA Alcoa Convergys Herman Miller Molson Coors Brewing Alcon Laboratories Cooper Industries Hershey Momentive Specialty Chemicals Alexander & Baldwin Corning Hertz Monsanto Allergan Covance Hexcel Mosaic Alpha Natural Resources Covidien HNI MTV Networks American Crystal Sugar Cox Enterprises Home Shopping Network Murphy Oil AMERIGROUP Cracker Barrel Old Country Stores Hormel Foods MWH Global AMETEK Crown Castle Hospira Nash-Finch Amgen Crown Holdings Host Hotels & Resorts National Starch Polymers Group Anadarko Petroleum CSC Houghton Mifflin Harcourt Publishing Navistar International Ann Taylor Stores CSM HR Access NCR AOL CSX Hunt Consolidated Neoris USA APL Curtiss-Wright Huntsman New York Times Applied Materials Cytec -

Registrant List

Registrant List Event Name: 2021 Financial Reporting Series Event Date: 06/09/2021 - 06/10/2021, 9:00 am - 4:00 pm Registration Date Range: All Dates Registrant Full Name Organization Name City, State, Zip Sofia Ali Fortive Corporation Everett, WA 98203 Jeff Allen Starbucks Coffee Company Seattle, WA 98134 Christopher P. Anderson Facebook, Inc. Danville, CA 94506 Samruddhi Bhure Cadence Design Systems, Inc. San Jose, CA 95148 Kristin S. Booth Mimecast North Reading, MA 01864-3215 Jill Brady Best Buy Co., Inc. Richfield, MN 55423 Amy Chan Facebook, Inc. Belmont, CA 94002-1944 Eva Chan Bio-Rad Laboratories, Inc. Hecules, CA 94547 Ms. Weng-Ling Chen Facebook, Inc. Palo Alto, CA 94306-2551 Jean Chui Airbnb, Inc. San Francisco, CA 94103-4928 Baret Claborn BancFirst Moore, OK 73160-4819 Elizabeth A. Clevenger La-Z-Boy Incorporated Monroe, MI 48162 Renee Comernisky Hyster-Yale Group, Inc. Cleveland, OH 44124-4069 Fortune Brands Home & Elizabeth Cunningham Deerfield, IL 60015-5634 Security, Inc. Mary DeSanctis QlikTech Inc. Warrington, PA 18976-2717 Esia Do IDEXX Laboratories, Inc. Westbrook, ME 04092-2040 John R. Duyck Dart Container Corporation Battle Creek, MI 49015-7946 Patrick Evans Tax Executives Institute, Inc. Washington, DC 20005 Laurie Ewald Dart Container Corporation Mason, MI 48854 John C. Farris, Jr RealPage, Inc. Richardson, TX 75082-4305 Briana Faulknor Sonic Automotive, Inc. Charlotte, NC 28211 Jessica Gluck Alexander & Baldwin, Inc. Honolulu, HI 96813-3924 Kelsey Godfrey Synopsys, Inc. San Jose, CA 95118 Janelle Groce TTEC Englewood, CO 80112-5833 Mr. Charles R. Harris Acadia Pharmaceuticals Inc. San Diego, CA 92106 Scott Heaton Cadence Design Systems, Inc. -

Definitive Proxy Statement Filed March 29, 2018

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) ☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant CHECK THE APPROPRIATE BOX: ☐ Preliminary Proxy Statement ☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☑ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Under Rule 14a-12 IDEXX Laboratories, Inc. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): ☑ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ Fee paid previously with preliminary materials: ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. 1) Amount previously paid: 2) Form, Schedule or Registration Statement No.: 3) Filing Party: 4) Date Filed: Table of Contents Notice of 2018 Annual Meeting of Shareholders & Proxy Statement Wednesday, May 9, 2018, 12:00 Noon, Eastern Time Table of Contents Our PURPOSE To be a great company that creates exceptional long-term value for our customers, employees, and shareholders by enhancing the health and well- being of pets, people, and livestock. -

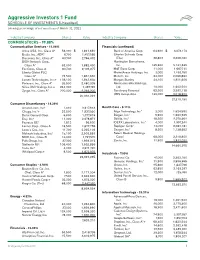

Aggressive Investors 1 Fund SCHEDULE of INVESTMENTS (Unaudited) Showing Percentage of Net Assets As of March 31, 2021

Aggressive Investors 1 Fund SCHEDULE OF INVESTMENTS (Unaudited) Showing percentage of net assets as of March 31, 2021 Industry Company Shares Value Industry Company Shares Value COMMON STOCKS - 99.88% Communication Services - 11.08% Financials (continued) Altice USA, Inc., Class A* 56,000 $ 1,821,680 Bank of America Corp. 84,600 $ 3,273,174 Baidu, Inc., ADR* 6,700 1,457,585 Charles Schwab Corp. Discovery, Inc., Class A* 63,700 2,768,402 (The) 38,803 2,529,180 DISH Network Corp., Huntington Bancshares, Class A* 52,000 1,882,400 Inc. 135,600 2,131,632 Fox Corp., Class A 60,700 2,191,877 M&T Bank Corp. 11,000 1,667,710 Liberty Global PLC, MarketAxess Holdings, Inc. 3,000 1,493,760 Class C* 72,500 1,851,650 MetLife, Inc. 34,000 2,066,860 Lumen Technologies, Inc.+ 138,100 1,843,635 Morgan Stanley 24,100 1,871,606 Pinterest, Inc., Class A* 33,500 2,480,005 RenaissanceRe Holdings, Sirius XM Holdings, Inc.+ 244,300 1,487,787 Ltd. 10,000 1,602,500 Zynga, Inc., Class A* 220,000 2,246,200 Synchrony Financial 62,300 2,533,118 UBS Group AG+ 130,000 2,018,900 20,031,221 27,210,150 Consumer Discretionary - 14.39% Amazon.com, Inc.* 1,040 3,217,843 Health Care - 8.11% Chegg, Inc.*+ 22,500 1,927,350 Align Technology, Inc.* 3,000 1,624,590 Dollar General Corp. 6,800 1,377,816 Biogen, Inc.* 5,900 1,650,525 Etsy, Inc.* 11,300 2,278,871 DaVita, Inc.* 19,300 2,079,961 Faurecia SE* 1,812 96,530 IDEXX Laboratories, Inc.* 4,000 1,957,240 Lennar Corp., Class A 18,500 1,872,755 Repligen Corp.* 10,700 2,080,187 Lowe's Cos., Inc. -

Federated Hermes Kaufmann Large Cap Fund

Federated Hermes Kaufmann Large Cap Fund Seeking growth through IPOs and innovation (KLCAX, KLCIX) Federated Hermes Kaufmann: Ticker Portfolio Date of Price Current An intensive, bottom-up focus on Holdings symbol weight (%) IPO of IPO price growth Communication Services Investors are drawn to growth funds for Activision Blizzard, Inc. ATVI 0.22 $92.38 many reasons. One primary reason is Alphabet Inc. GOOGL 3.10 $2,510.37 the pursuit of capital appreciation, the ability to grow assets over a long Facebook, Inc. FB 2.70 5/17/12 $38.00 $350.42 period. The true power of growth T-Mobile US, Inc. TMUS 3.28 $146.01 investing rests with the ability to The Walt Disney Company DIS 0.46 $177.04 compound earnings at an above-average rate. The challenge is Consumer Discretionary identifying those stocks capable of Airbnb, Inc. ABNB 0.48 12/10/20 $68.00 $149.64 doing so over at least a three to five-year time horizon. Alibaba Group Holding Limited - ADR BABA 0.72 9/18/14 $68.00 $205.94 This underscores the value of Amazon.com, Inc. AMZN 3.87 $3,719.34 Federated Hermes Kaufmann’s Chipotle Mexican Grill, Inc. CMG 0.57 $1,592.25 emphasis on pursuing exceptional, long-term growth opportunities at the Coupang LLC CPNG 0.36 3/11/21 $35.00 $42.13 best possible price—whether by Etsy, Inc. ETSY 1.01 $195.09 uncovering up-and-coming companies Floor & Decor Holdings, Inc. FND 0.55 $107.92 through intensive research, increasing positions in great companies when the Home Depot, Inc. -

Torrayresolute Concentrated Large Growth

QUARTERLY COMMENTARY March 31, 2020 Before reviewing the results of the first quarter, we would like to say that our thoughts are with all those directly and indirectly impacted by COVID-19. We are particularly grateful to the healthcare workers and first responders who are putting their lives at risk for our well-being. During this strange period of self-quarantine, it has been particularly helpful to speak with our clients and partners as we all learn to navigate an unfamiliar environment. We would like you to know that our team has been able to maintain operations without interruption and as always, we welcome your questions and observations. We look forward to hearing from you and wish that you remain safe and well. TorrayResolute Concentrated Large Growth Market Overview It would not be hyperbole to say the beginning of 2020 is proving to be among the most challenging periods for investors ever. The rapid spread of the coronavirus pandemic continues to produce historic market volatility, leaving investors with few scientific facts or economic precedents on which to base their decisions. It is something of a cliché to say that markets hate uncertainty, but true, nonetheless. It took just 17 trading days between February 19th and March 13th to bring the longest running bull market (11 years) to a conclusive end. In contrast to the financial crisis of ’08 and ’09, the monetary and fiscal The magnitude and duration of response has been swift and decisive. While the efficacy of these measures the economic downturn are not will be borne out in the coming weeks and months, the market’s direction will only dependent on how quickly be largely dictated by the trajectory of the disease. -

Husson Stock Index Week Ended August 9, 2019 Introduction for The

Husson Stock Index Week Ended August 9, 2019 Introduction For the week ending August 9, 2019, the Husson Stock Index (HSI) finished up (0.053%), closing at $162.05. Year-to-date, the HSI has posted a +19.50% increase. In comparison, the S&P 500 finished the week down (-0.46%), and has a YTD increase of +17.83%1. Summary The top performer within the HSI came from IDEXX Laboratories, Inc. (NYSE: IDXX), which finished the week up +3.78%. The stock started the week out at $268.71 and ended at $278.86, an increase of $10.15. Last week IDEXX Labs released their second quarter earnings report. The report showed a 7% growth in earnings. The report increased 2019 revenue guidance to $2.38 - $2.41 billion and EPS outlook to $4.82 - $4.92. The second-best performance of the week was Rite Aid Corporation. (NYSE: RAD), which finished the week up another +2.86%. RAD took a jump from starting the week out with a stock price of $6.99 to ending the week at $7.19. Josh Enomoto of InvestorPlace wrote that a deal with Amazon, whereby Amazon customers can pick up their orders at Rite-Aid, might benefit Rite-Aid as a result of introducing a different demographic (younger buyers) to Rite-Aid. The worst performer of the week was Bar Harbor Bankshares. (NYSE: BHB), which finished down (-6.53%). The company’s stock price started the week out at $24.52 and dropped down to $22.92 by the end of the week, a decrease of $1.60 per share.