Hedge Fund Activism, Corporate Governance, and Firm Performance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Largest Gathering of Hedge Fund of Funds & Their Investors in The

Leading Investors Sheila Healy Berube, 3M Company Karin E. Brodbeck, Nestlé Business Services Craig R. Dandurand, CalPERS Joel Katzman New opportunities for managers & Kevin E. Lynch, Verizon Investment Management Corp allocators to meet, one-on-one, via the Maurice E. Maertens, New York University “Manager & Allocators’Access Platform” Donald Pierce, San Bernardino County Employees see p 13 for details Retirement Association Mario Therrien, Caisse De Dépôt Et Placement Du Québec David W Wiederecht, GE Asset Management Incorporated Salim A. Shariff, Weyerhaeuser Company Retirement Plan Leading Consultants Janine Baldridge, Russell Investment Group Alan H. Dorsey, CRA RogersCasey Tim Jackson, Rocaton Investment Advisors J. Alan Lenahan, Fund Evaluation Group Kevin P. Quirk, Casey, Quirk & Associates Leading Hedge Fund of Funds Mustafa Jama, Morgan Stanley September 18-20, 2006 • Pier Sixty • New York, NY Carrie A. McCabe, FRM Research LLC George H. Walker, Goldman Sachs & Co Thomas Strauss, Ramius HVB Partners, LLC The largest gathering of Hedge Fund of Funds Judson P. Reis, Sire Management Corporation Charles M. Johnson, III, Private Advisors, LLC R. Kelsey Biggers, K2 Advisors & their investors in the USA in 2006 Kent A. Clark, Goldman Sachs Hedge Fund Strategies (HFS) Madhav Misra, AllianceHFP Michael F. Klein, Aetos Capital At GAIM USA Fund of Funds 2006: Jerry Baesel, Morgan Stanley Alternative Investment Partners I The largest, most senior gathering of hedge fund of I Over 20 hand picked, out-performing niche hedge fund Stuart Leaf, Cadogan Management, LLC fund leaders in the US, including: of funds discussing how they are generating alpha and Jean Karoubi, The Longchamp Group differentiating themselves in a crowded space Robert A. -

Hedge Fund Investor Activism and Takeovers

08-004 Hedge fund investor activism and takeovers Robin Greenwood Michael Schor Copyright © 2007 by Robin Greenwood and Michael Schor. Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Hedge fund investor activism and takeovers* Robin Greenwood Harvard Business School [email protected] Michael Schor Harvard University [email protected] July 2007 Abstract We examine long-horizon stock returns around hedge fund activism in a comprehensive sample of 13D filings by portfolio investors between 1993 and 2006. Abnormal returns surrounding investor activism are high for the subset of targets that are acquired ex-post, but not detectably different from zero for targets that remain independent a year after the initial activist request. Announcement returns show a similar pattern. Firms that are targeted by activists are more likely to get acquired than those in a control sample. We argue that the combination of hedge funds’ short investment horizons and their large positions in target firms makes M&A the only attractive exit option. The results also suggest that hedge funds may be better suited to identifying undervalued targets and prompting a takeover, than at engaging in long-term corporate governance or operating issues. * We appreciate funding from the Harvard Business School Division of Research. We thank Julian Franks, André Perold, Richard Ruback, Andrei Shleifer, Erik Stafford and various seminar participants for useful discussions. I. Introduction It is well known that managers of public companies lack proper incentives to maximize shareholder value, preferring to consume private benefits instead. -

Hedge Funds: Due Diligence, Red Flags and Legal Liabilities

Hedge Funds: Due Diligence, Red Flags and Legal Liabilities This Website is Sponsored by: Law Offices of LES GREENBERG 10732 Farragut Drive Culver City, California 90230-4105 Tele. & Fax. (310) 838-8105 [email protected] (http://www.LGEsquire.com) BUSINESS/INVESTMENT LITIGATION/ARBITRATION ==== The following excerpts of articles, arranged mostly in chronological order and derived from the Wall Street Journal, New York Times, Reuters, Los Angles Times, Barron's, MarketWatch, Bloomberg, InvestmentNews and other sources, deal with due diligence in hedge fund investing. They describe "red flags." They discuss the hazards of trying to recover funds from failed investments. The sponsor of this website provides additional commentary. "[T]he penalties for financial ignorance have never been so stiff." --- The Ascent of Money (2008) by Niall Ferguson "Boom times are always accompanied by fraud. As the Victorian journalist Walter Bagehot put it: 'All people are most credulous when they are most happy; and when money has been made . there is a happy opportunity for ingenious mendacity.' ... Bagehot observed, loose business practices will always prevail during boom times. During such periods, the gatekeepers of the financial system -- whether bankers, professional investors, accountants, rating agencies or regulators -- should be extra vigilant. They are often just the opposite." (WSJ, 4/17/09, "A Fortune Up in Smoke") Our lengthy website contains an Index of Articles. However, similar topics, e.g., "Bayou," "Madoff," "accountant," may be scattered throughout several articles. To locate all such references, use your Adobe Reader/Acrobat "Search" tool (binocular symbol). Index of Articles: 1. "Hedge Funds Can Be Headache for Broker, As CIBC Case Shows" 2. -

THE PEP BOYS – MANNY, MOE & JACK 3111 West Allegheny Avenue

THE PEP BOYS – MANNY, MOE & JACK 3111 West Allegheny Avenue Philadelphia, PA 19132 ______________ Letter To Our Shareholders ______________ To Our Shareholders: The year 2006 was a time of change for Pep Boys. As you know, Pep Boys ended the year with strong results and great momentum but began the year with disappointing comparable sales, particularly on the retail side of the business. Despite an improvement in operating profit in the first quarter and gradually improving service center revenues, the company’s overall lack of significant financial performance since 2004 led to a leadership change and Board reconstitution last summer. Non-executive Chairman of the Board Bill Leonard took the helm as interim CEO in July, and he and his management team have done an outstanding job getting Pep Boys back on track and restoring the company’s profitability by year end. As I recap the highlights of the company’s 2006 performance, I want to take this opportunity to thank Bill for his interim leadership that was the catalyst for this traction and I look forward to partnering with Bill, the Board of Directors, and all of our associates to build on this momentum in the months ahead. It is important for you to know that I am extremely proud and excited to lead Pep Boys. As you may know, I have more than 25 years of experience in the automotive industry, including the operation of multi-unit service centers. I spent the last ten years at Sonic Automotive, Inc., a Fortune 300 company and the third largest auto retailer in the United States. -

Xinergy Ltd. Announces Results of 2012 Annual Shareholders Meeting and Appointment of New Board Member

Xinergy Ltd. Announces Results of 2012 Annual Shareholders Meeting and Appointment of New Board Member Toronto Stock Exchange: XRG KNOXVILLE, TN, May 24, 2012 /PRNewswire/ - Xinergy Ltd., (TSX:XRG) ("Xinergy" or the "Company"), a Central Appalachian coal producer, today announced the re-election of 5 members to its Board of Directors at the Company's annual meeting of shareholders held Tuesday, May 22, 2012 in Toronto, Ontario. Re-elected Directors include Todd Q. Swanson, Chairman, Matthew Goldfarb, Interim CEO; Bernie Mason, President of the Company; Robert Metcalfe and David Smith. The Company also announced the election of Stephen Loukas as well as the appointment of Jay Thornton to its Board of Directors, pursuant to the representation agreement, increasing the total number of board members to 7. Biographies for the re-elected Directors are available in the Proxy Statement or on SEDAR at www.sedar.com. "Both Stephen and Jay have extensive experience in the energy markets and we welcome their insight to our Board", said Todd Q. Swanson, Chairman of the Board. "Jay and I believe that an extraordinary opportunity exists over the next few years to create significant shareholder value at Xinergy. We look forward to working with the Board and management on executing the Company's growth initiatives", said Stephen Loukas. Mr. Loukas has been a Managing Member and Portfolio Manager of FrontFour Capital Group LLC ("FrontFour"), an investment management firm investing in both Canadian and US securities since February 2009. Prior to joining FrontFour, from May 2006 to February 2009, Mr. Loukas was a Director at Credit Suisse Securities where he was a Portfolio Manager and Head of Investment Research of the Multi-Product Event Proprietary Trading Group across the group's three trading strategies: merger arbitrage, value, event-driven equities and distressed debt. -

Value Creation of Hedge Fund Activism and the Impact on Long Term Returns and Volatility of the Target Company

Paul Rintamäki 365143 Value creation of hedge fund activism and the impact on long term returns and volatility of the target company ABSTRACT This study provides new evidence on value creation ability of hedge fund activism and its effects on target firm’s riskiness and long-term returns. With the data-set from SEC Edgar 13D filings 215 events were identified and tested about the common beliefs that hedge fund activism increases the medium- and long term volatility of the target and adversely affects target company’s long term returns. The findings suggest that neither belief is supported by the data. In fact, targets are able to maintain the abnormal returns in the long term as well, which indicate about the value creation ability of hedge fund activists. The results are mainly consistent with existing literature but also offer some new evidence about negative correlation between target firms’ returns and the value premium after the activist intervention. Finance Bachelor’s thesis Autumn 2016 Table of Contents 1 Introduction ........................................................................................................................ 3 2 Literature review ................................................................................................................. 4 2.1 Value creation or stock picking? ........................................................................................................ 4 2.2 Long term effects and changes in firm’s riskiness ............................................................................ -

Extreme Money: Masters of the Universe and the Cult of Risk

Praise for Extreme Money “A true insider’s devastating analysis of the financial alchemy of the last 30 years and its destructive consequences. With his intimate first-hand knowledge, Das takes a knife to global finance and financiers to reveal the inner workings without fear or favor.” —Nouriel Roubini, Professor of Economics at NYU Stern School of Business and Chairman of Roubini Global Economics “Das describes the causes of the financial crisis with the insight and understanding of a financial wizard, the candor and objectivity of an impartial observer, and a wry sense of humor that reveals the folly in it all.” —Brooksley Born, Former Chairperson of the U.S. Commodity Futures Trading Commission (CFTC) “This is the best book yet to come out of the financial crisis. Das is a graceful, witty writer, with an unusually broad range of reference. He is also a long-time master of the arcana of the netherworlds of finance and nicely balances historical sweep with illuminating detail. Extreme Money is lively, scathing, and wise. ” —Charles Morris, Author of The Two Trillion Dollar Meltdown: Easy Money, High Rollers, and the Great Credit Crash “Like Hunter S. Thompson’s Fear and Loathing in Las Vegas, Extreme Money launches you into a fascinating and disturbing alternative view of reality. But now greed predominates, the distorted world of finance is completely global, and the people making crazy decisions can ruin us all. This is an informative, entertaining, and deeply scary account of Hades’s new realm. Read it while you can. ” —Simon Johnson, Ronald A. Kurtz Professor of Entrepreneurship at MIT Sloan School of Management and Author of 13 Bankers: The Wall Street Takeover and the Next Financial Meltdown “You know when Lewis Caroll, Max Weber, Alan Greenspan, and Sigmund Freud all appear on the same early page that you are about to read an intellectual tour de force. -

Hedge Fund Activism, Corporate Governance, and Firm Performance

THE JOURNAL OF FINANCE • VOL. LXIII, NO. 4 • AUGUST 2008 Hedge Fund Activism, Corporate Governance, and Firm Performance ALON BRAV, WEI JIANG, FRANK PARTNOY, and RANDALL THOMAS∗ ABSTRACT Using a large hand-collected data set from 2001 to 2006, we find that activist hedge funds in the United States propose strategic, operational, and financial remedies and attain success or partial success in two-thirds of the cases. Hedge funds seldom seek control and in most cases are nonconfrontational. The abnormal return around the announcement of activism is approximately 7%, with no reversal during the subse- quent year. Target firms experience increases in payout, operating performance, and higher CEO turnover after activism. Our analysis provides important new evidence on the mechanisms and effects of informed shareholder monitoring. ALTHOUGH HEDGE FUND ACTIVISM IS WIDELY discussed and fundamentally important, it remains poorly understood. Much of the commentary on hedge fund activism is based on supposition or anecdotal evidence. Critics and regulators question whether hedge fund activism benefits shareholders, while numerous commen- tators claim that hedge fund activists destroy value by distracting managers from long-term projects. However, there is a dearth of large-sample evidence about hedge fund activism, and existing samples are plagued by various biases. ∗ We thank the Acting Editor who handled our submission. Brav is with Duke University, Jiang is with Columbia University, Partnoy is with University of San Diego, and Thomas is with Van- -

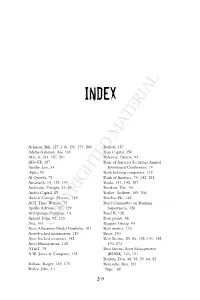

Copyrighted Material

Index Ackman, Bill, 127, 146, 150, 174, 200 Bailout, 187 Adidas-Salomon AG, 101 Bain Capital, 150 AIG, 6, 181, 187, 201 Balyasny, Dmitry, 93 AIG-FP, 187 Banc of America Securities Annual Ainslie, Lee, 33 Investment Conference, 74 Alpha, 90 Bank holding companies, 142 Al Quaeda, 78 Bank of America, 74, 142, 181 Amaranth, 14, 132–133 Banks, 141, 142, 187 Anderson, Dwight, 33, 85 Barakett, Tim, 93 Andor Capital, 85 Barber, Andrew, 169, 204 Andrew Carnegie (Nasaw), 149 Barclays Plc, 142 AOL Time Warner, 75 Basel Committee on Banking Apollo Advisors, 127, 129 Supervision, 128 Archipelago Holdings, 14 Basel II, 128 Arnold, John, 92, 133 Basis points, 88 Asia, 161 Baupost Group, 93 Asset AllocationCOPYRIGHTED Model Portfolio, 194 Bear market, MATERIAL 173 Asset-backed instruments, 119 Bears, 190 Asset-backed securities, 142 Bear Stearns, 85, 86, 128, 141, 142, Asset Management, 142 170, 173 AT&T, 75 Bear Stearns Asset Management A.W. Jones & Company, 132 (BSAM), 143, 151 Benton, Dan, 48, 58, 59, 64, 85 Babson, Roger, 149, 175 Bernanke, Ben, 181 Bailey, John, 14 “Bips,” 88 209 bbindex.inddindex.indd 220909 111/17/091/17/09 99:36:04:36:04 AAMM index Black, Leon, 127 Chess King, 32 BlackRock, 145 China, 86, 95, 109 Blackstone Group, 13, 127, 144, 145, 151 Chuck E. Cheese, 204 Black Week, 182, 188 Citadel Investment Group, 11, 92, Blake, Rich, 5 102, 119 Blogging, 159–164, 180, 181, 189–190 Clarium Capital Management, 92, 190 Blue Ridge Capital, 33 Clark, Tanya, 148 Blue Wave, 1, 144, 155, 177 Client letters, 202 Blum, Michael, 26, 76, 106, 111, -

Case 2:08-Cv-03178-LDWARL Document 18 Filed 05/05/2009 Page 1 of 3

Case 2:08-cv-03178-LDWARL Document 18 Filed 05/05/2009 Page 1 of 3 UNI lED STA lES DISTRICT COURT EAS lERN DISTRICT OF NEW YORK MASSACHUSETTS BRICKLAYERS AND : Civil Action No. 08-CIV-03178 MASONS TRUST FUNDS, Individually and On Behalf of All Others Similarly Situated, • CLASS ACTION Plaintiff, . THE MASSACHUSETTS BRICKLAYERS AND MASONS TRUST FUNDS AND THE vs. PIPEFIT lERS' RETIREMENT FUND • LOCAL 597'S MOTION FOR DEUTSCHE ALT-A SECURITIES, INC., et APPOINTMENT AS LEAD PLAINTIFF al., . AND APPROVAL OF LEAD PLAINTIFF'S • SELECTION OF LEAD COUNSEL Defendants. ' Case 2:08-cv-03178-LDWARL Document 18 Filed 05/05/2009 Page 2 of 3 TO ALL PARTIES AND THEIR COUNSEL OF RECORD PLEASE TAKE NOTICE that proposed lead plaintiff the Massachusetts Bricklayers and Masons Trust Funds and the Pipefitters' Retirement Fund Local 597 (the "Trust and Retirement Funds") will and hereby do move this Court, on a date and at such time as may be designated by the Court, at 944 Federal Plaza, Central Islip, NY 11722 for an order: (1) appointing the Trust and Retirement Funds as lead plaintiff pursuant to the Private Securities Litigation Reform Act of 1995, 15 U.S.C. §77z-1; and (2) approving the Trust and Retirement Funds' selection of Coughlin Stoia Geller Rudman & Robbins LLP and Labaton Sucharow LLP as lead counsel. In support of this motion, the Trust and Retirement Funds submit the accompanying Memorandum of Law, the Declaration of David A. Rosenfeld and a [Proposed] Order. DA 1ED: March 27, 2009 COUGHLIN STOIA GELLER RUDMAN & ROBBINS LLP SAMUEL H. -

Hedge Fund Activism, Corporate Governance, and Firm Performance

Sanjiv R. Das FDIC Center for Financial Research Darrell Duffie Working Paper Nikunj Kapadia No. 2008-06 Empirical Comparisons and Implied Recovery Rates Hedge Fund Activism, Corporate Governance, and Firm Performance Risk-Based Capital Standards, Deposit Insurance and Procyclicality kkk May 2008 Risk-Based Capital Standards, Deposit Insurance and Procyclicality An Empirical September 2005 An Empirical Analysis Federal Dposit Insurance Corporation •Center for Financial Researchh State- May, 2005 Efraim Benmel Efraim Benmelech June 20 May , 2005 Asset S2005-14 Hedge Fund Activism, Corporate Governance, and Firm Performance Alon Brav, Wei Jiang, Frank Partnoy, and Randall Thomas* ABSTRACT Using a large hand-collected dataset from 2001 to 2006, we find that activist hedge funds in the U.S. propose strategic, operational, and financial remedies and attain success or partial success in two thirds of the cases. Hedge funds seldom seek control and in most cases are non- confrontational. The abnormal return around the announcement of activism is approximately 7%, with no reversal during the subsequent year. Target firms experience increases in payout, operating performance, and higher CEO turnover after activism. Our analysis provides important new evidence on the mechanisms and effects of informed shareholder monitoring. JEL Classification: G14, G23, G3. Keywords: Hedge Fund, Activism, Corporate Governance. * Brav: Duke University, Durham, NC 27708, Tel: (919) 660-2908, email: [email protected]. Jiang: Columbia University, New York, NY 10027, Tel: (212) 854-9002, email: [email protected]. Partnoy: University of San Diego, San Diego CA 92110, Tel: (619) 260-2352, email: [email protected]. Thomas: Vanderbilt University, Nashville TN 37203, Tel: (615) 343-3814, email: [email protected]. -

HATTERAS Alternative Mutual Funds Fund of Funds in a Mutual Fund

HATTERAS Alternative Mutual Funds Fund of funds in a mutual fund | Table of Contents Hatteras Alternative Mutual Funds . 2 Investment Process . .10 Performance . 18 Managers . 19 Table of Contents | 1 Hatteras Alternative Mutual Funds Ź Alternative investment manager Ź Established in 2002 Ź Offers fund of funds in a mutual fund Ź Assets* Firm: $1.98 billion Mutual Funds: $357 million * As of March 31, 2011 Hatteras Alternative Mutual Funds | 2 Liquid Hedge Fund Strategies LONG/SHORT MARKET NEUTRAL RELATIVE VALUE – EVENT EQUITY EQUITY LONG/SHORT DEBT DRIVEN Ź Generalist Ź Generalist Ź Multi-Strategy Ź Merger Arbitrage Ź Sector Focus Ź Sector Focus Ź Long/Short Fixed Ź Activist Income Ź International Ź International Ź Distressed / Ź Credit Arbitrage Restructuring Ź Variable Bias Ź Quantitative Ź Hedged High Yield Ź Event Equity/Debt Hatteras Alternative Mutual Funds | 3 Fund Structure Open-End Mutual Fund f Daily liquidity f No investor qualifications Hatteras Alpha f Complete position level transparency Hedged Strategies Fund f Investment team can implement allocations daily Underlying Funds Long/ Market Relative f Strategy-specific Event Short Neutral Value – Driven f Scalability for more managers/strategies Equity Equity Long/Short Debt f Proprietary mutual funds Sub-Advisors f Managers are given trading authority of 6 4 4 5 managed trading accounts Hedge Fund Hedge Fund Hedge Fund Hedge Fund Managers Managers Managers Managers f Primebroker: JP Morgan & Jeffries f Custodians: JP Morgan/CTC & US Bank f Administrator: US Bancorp Fund