Nifty Highlights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SL.NO CHANNEL LCN Genre STAR PLUS 101 HINDI GEC

SL.NO CHANNEL LCN Genre 1 STAR PLUS 101 HINDI GEC PAY 2 ZEE TV 102 HINDI GEC PAY 3 SET 103 HINDI GEC PAY 4 COLORS 104 HINDI GEC PAY 5 &TV 105 HINDI GEC PAY 6 SAB 106 HINDI GEC PAY 7 STAR BHARAT 107 HINDI GEC PAY 8 BIG MAGIC 108 HINDI GEC PAY 9 PAL 109 HINDI GEC PAY 10 COLORS RISHTEY 110 HINDI GEC PAY 11 STAR UTSAV 111 HINDI GEC PAY 12 ZEE ANMOL 112 HINDI GEC PAY 13 BINDASS 113 HINDI GEC PAY 14 ZOOM 114 HINDI GEC PAY 15 DISCOVERY JEET 115 HINDI GEC PAY 16 STAR GOLD 135 HINDI MOVIES PAY 17 ZEE CINEMA 136 HINDI MOVIES PAY 18 SONY MAX 137 HINDI MOVIES PAY 19 &PICTURES 138 HINDI MOVIES PAY 20 STAR GOLD 2 139 HINDI MOVIES PAY 21 ZEE BOLLYWOOD 140 HINDI MOVIES PAY 22 MAX 2 141 HINDI MOVIES PAY 23 ZEE ACTION 142 HINDI MOVIES PAY 24 SONY WAH 143 HINDI MOVIES PAY 25 COLORS CINEPLEX 144 HINDI MOVIES PAY 26 UTV MOVIES 145 HINDI MOVIES PAY 27 UTV ACTION 146 HINDI MOVIES PAY 28 ZEE CLASSIC 147 HINDI MOVIES PAY 29 ZEE ANMOL CINEMA 148 HINDI MOVIES PAY 30 STAR GOLD SELECT 149 HINDI MOVIES PAY 31 STAR UTSAV MOVIES 150 HINDI MOVIES PAY 32 RISHTEY CINEPLEX 151 HINDI MOVIES PAY 33 MTV 175 HINDI MUSIC PAY 34 ZING 178 HINDI MUSIC PAY 35 MTV BEATS 179 HINDI MUSIC PAY 36 9X M 181 HINDI MUSIC PAY 37 CNBC AWAAZ 201 HINDI NEWS PAY 38 ZEE BUSINESS 202 HINDI NEWS PAY 39 INDIA TODAY 203 HINDI NEWS PAY 40 NDTV INDIA 204 HINDI NEWS PAY 41 NEWS18 INDIA 205 HINDI NEWS PAY 42 AAJ TAK 206 HINDI NEWS PAY 43 ZEE NEWS 207 HINDI NEWS PAY 44 ZEE HINDUSTAN 209 HINDI NEWS PAY 45 TEZ 210 HINDI NEWS PAY 46 STAR JALSHA 251 BENGALI GEC PAY 47 ZEE BANGLA 252 BENGALI GEC PAY 48 COLORS -

Viacom18 Media Private Limited– Update on Material Event Rationale

April 29, 2021 Viacom18 Media Private Limited– Update on Material Event Summary of rating(s) outstanding Previous Rated Amount Current Rated Amount Instrument* Rating Outstanding (Rs. crore) (Rs. crore) Commercial Paper Programme 500.0 500.0 [ICRA]A1+ Short-term, Fund-based/Non 1,610.7 1,610.7 [ICRA]A1+ fund based Limits Total 2,110.7 2,110.7 *Instrument details are provided in Annexure-1 Rationale On February 17, 2020, Network18 intimated the stock exchanges regarding a scheme of amalgamation and arrangement amongst Network18, TV18, DEN Networks Limited (DEN) and Hathway Cable & Datacom Limited (Hathway). Under the scheme, DEN, Hathway and TV18 were to merge into Network18 with effect from February 1, 2020, subject to receipt of necessary approvals to consolidate Reliance Industries Limited’s (RIL, rated [ICRA]AAA (Stable) / [ICRA]A1+ and Baa2 Stable by Moody’s Investors Service) media and distribution business spread across multiple entities into Network18. The company again announced on April 20, 2021 that considering more than a year has passed from the time the Board considered the Scheme, the Board of the Company has decided not to proceed with the arrangement envisaged in the Scheme. ICRA has taken cognizance of the above and the rating remain unchanged at the earlier rating of [ICRA]A1+ as the parent company, TV18 would continue with the existing corporate structure. Please refer to the following link for the previous detailed rationale that captures Key rating drivers and their description, Liquidity position, Rating sensitivities,: Click here Analytical approach Analytical Approach Comments Corporate Credit Rating Methodology Applicable Rating Methodologies Rating Methodology for Media Broadcasting Industry Impact of Parent or Group Support on an Issuer’s Credit Rating Parent / Group Company: RIL Group. -

Bangli Tv Serial Net Sta Bangli Tv Serial Net Sta * Meanings Amp Get Ideas SMG Accidentally 0F194EC0 When Diving Tattoos Downloads Alpha Popular Baby Names

Bangli Tv Serial Net Sta Bangli tv serial net sta * Meanings amp get ideas SMG accidentally 0F194EC0 when Diving Tattoos Downloads Alpha popular baby names. about Rudolph the red nosed reindeer screencaps Undangan passport cdr Chris brown heartbreak on full moon torrent deluxe edition Bangli tv serial net sta Nomenclature practice worksheets Menu - Mama bhanji ki chudai ki hindi stories Climfill auto valeo manual Tamilsexmuslim Chris brown heartbreak on full moon torrent deluxe edition Bangli tv serial net sta. Radnje minks Titleist font download Akash Bangla is a Bengali television station. Its most popular program is Rahasia budduhun the Bengali Travel Show "Chalo Jaai" airing at 11:30 pm every night. The channel started as 24-hour Bengali entertainment channel with soap Friends links operas like Kurukhetro, Shanai, Prabahini, Dotta, and Choritroheen but Activity 1 2 4 circuit calculations, Photo box timezone jakartahoto box could not survive and changed its . Mayar Badhon is a Bengali drama TV timezone jakarta, Dell lp1500 personal serial aired on Star Jalsha. Strong-willed Gunja can go to any lengths for laser printer reviews her younger sister, Ranja, even if it means sacrificing her motherhood! Watch all the latest and full episodes of Mayar Badhon online streaming on bloggers Magosha a polokwane Hotstar. Videos on www.hotstar.com are not available in U.S.A. Bengali Tv Serial Songs Star Jalsha, Colors Bangla, Zee Bangla, Sony Aath, E.t.c Bengali Tv Channal Serial Songs. All Of Most Popular Bangla Channel , Most Popular Serial Are Punyi Pukur, Khokababu, Mon Neya Kachakachi, Ke Apon Ke Por ,Ichha Nodi, Kiranmala, BodhuBoron e.t.c, All Serial Are Most Popular In India . -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY19-20 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (56 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Business News #1, Hindi General News & Entertainment #2 Urban, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (9) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Network18 group : TV & Digital media, specialized Print & Ticketing ~75% held by Independent Media Trust, of which RIL is Network18 Strategic Investment the sole beneficiary Entertainment Ticketing & Live Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Network18 holds ~92% in Moneycontrol. Network18 holds ~51% of subsidiary TV18. Others are in standalone entity. TV18 in turn owns 51% in Viacom18 and 51% in AETN18 (see next page for details) TV18 group – Broadcasting pure-play, across News & Entertainment ENTITY GENRE CHANNELS Business News (4 channels, 1 portal) Standalone entity TV18 TV18 General News Group (Hindi & English) Regional News 50% JV with Lokmat group (14 geographies) IBN Lokmat AETN18 Infotainment (Factual & Lifestyle) 51% subsidiary -

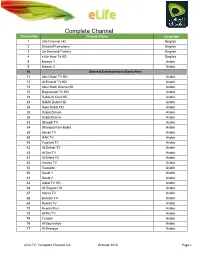

Complete Channel List October 2015 Page 1

Complete Channel Channel No. List Channel Name Language 1 Info Channel HD English 2 Etisalat Promotions English 3 On Demand Trailers English 4 eLife How-To HD English 8 Mosaic 1 Arabic 9 Mosaic 2 Arabic 10 General Entertainment Starts Here 11 Abu Dhabi TV HD Arabic 12 Al Emarat TV HD Arabic 13 Abu Dhabi Drama HD Arabic 15 Baynounah TV HD Arabic 22 Dubai Al Oula HD Arabic 23 SAMA Dubai HD Arabic 24 Noor Dubai HD Arabic 25 Dubai Zaman Arabic 26 Dubai Drama Arabic 33 Sharjah TV Arabic 34 Sharqiya from Kalba Arabic 38 Ajman TV Arabic 39 RAK TV Arabic 40 Fujairah TV Arabic 42 Al Dafrah TV Arabic 43 Al Dar TV Arabic 51 Al Waha TV Arabic 52 Hawas TV Arabic 53 Tawazon Arabic 60 Saudi 1 Arabic 61 Saudi 2 Arabic 63 Qatar TV HD Arabic 64 Al Rayyan HD Arabic 67 Oman TV Arabic 68 Bahrain TV Arabic 69 Kuwait TV Arabic 70 Kuwait Plus Arabic 73 Al Rai TV Arabic 74 Funoon Arabic 76 Al Soumariya Arabic 77 Al Sharqiya Arabic eLife TV : Complete Channel List October 2015 Page 1 Complete Channel 79 LBC Sat List Arabic 80 OTV Arabic 81 LDC Arabic 82 Future TV Arabic 83 Tele Liban Arabic 84 MTV Lebanon Arabic 85 NBN Arabic 86 Al Jadeed Arabic 89 Jordan TV Arabic 91 Palestine Arabic 92 Syria TV Arabic 94 Al Masriya Arabic 95 Al Kahera Wal Nass Arabic 96 Al Kahera Wal Nass +2 Arabic 97 ON TV Arabic 98 ON TV Live Arabic 101 CBC Arabic 102 CBC Extra Arabic 103 CBC Drama Arabic 104 Al Hayat Arabic 105 Al Hayat 2 Arabic 106 Al Hayat Musalsalat Arabic 108 Al Nahar TV Arabic 109 Al Nahar TV +2 Arabic 110 Al Nahar Drama Arabic 112 Sada Al Balad Arabic 113 Sada Al Balad -

Btn Platinum 460 With

BTN PLATINUM 460 WITH GST DD-National DD Podhigai NAGORIK TV HD ZEE TV ZING DD-News AIR Punjabi I Plus Tv &TV ZEE SALAM INDIA NEWS DD Kohima STAR TV BANGLA ZEE ANMOL ZEE BANGLA DD-Bharti DD Saptgiri DILLAGIII BIC MAGIC ZEE BANGLA CINEMA Chardikla Time TV FM Gold Delhi Movie Plus ZEE CINEMA ZEE BOLLYWOOD AASTHA BHAJAN AIR Hindi Balle Balle Non-Stop Music & PPICTURE LIVING FOODZ SANSKAR AIR NE Multiplex ZEE ACTION ZEE HINDUSTAN MAHA MOVIE Rainbow Mumbai PEACE OF MIND ZEE NEWS 24 GHANTA SAHARA ONE EZ MALL Mtunes ZEE BUSINESS ZEE ANMOL CINEMA BIG MAGIC Wow Cinema WOW ZEE ETC ABP NEWS Sahara MUM Box Cinema 9XM Sahara NAT First India SONY AATH SONY WAH AASTHA FASHIONTV HD MADANI TV BANGLA SONY YAY AXN ZEE HINDUSTAN FIRANGI TV 100 SET MAX SONY PIX DD MARATI Cinema TV Kaatyayani SET MAX 2 SONY SIX 9XO NEWS TIME AASAM Paras Gold SONY MIX SONY ESPN NEWS STATE FASHIONTV India T TV SONY SAB TEN 1 DD NEWS Arihant ASIAN TV SONY TV TEN 2 MASTI 24 Ghanta PTC NEWS SONY PAL TEN 3 ALAMI SAHARA 9X JALWA PTC PUNJABI BBC EARTH DD Oriya SUDARSHAN TV PTC CHAK DE DD Punjabi TV9 Bharatvarsh PTC PUNJABI GOLD STAR PLUS JALSHA MOVIES DD North East R PLUS INDIASIGN TEST STAR GOLD STAR GOLD SELECT Sahara UP Show Box PRAG NEWS STAR MOVIES STAR SPORTS 1 DD Yadagiri DD INDIA NEWS STATE MP CHG STAR WORLD STAR SPORTS 2 DD KISAN RANG NEWS STATE UP UK FOX LIFE STAR SPORTS 3 DD CHANDANA BOISAKHI TV OSCAR MOVIES BHOJPURI STAR JALSHA STAR SPORTS 1HINDI Lok Sabha SWAYAM CHATTAGRAM NGC STAR SPORTS SELECT 1 RSTV NEWS LIVE DHIPTO NGC WILD STAR SPORTS SELECT 2 DANGAL INDIA TV R TV -

Corporate Presentation Media & Investments

Media & Investments Corporate Presentation FY20-21 OVERVIEW 2 Key Strengths Leading Media company in India with largest bouquet of channels (56 domestic channels and 16 international beams), and a substantial digital presence Market-leader in multiple genres (Global top 20 in news pay-apps; top 2 in Digital News in India, #1 Business News channel, top 3 in National News, #2 premium Hindi GEC, Kids #1, English #1) Key “Network effect” and play on Vernacular media growth - Benefits of Strengths Regional portfolio across News (14) and Entertainment (10) channels Marquee Digital properties (MoneyControl, BookMyShow) & OTT video (VOOT) provides future-proof growth and content synergy Experienced & Professional management team, Strong promoters 3 Network18 group : TV & Digital media, specialized Print & Ticketing ~73.15% held by Independent Media Trust, of Network18 Strategic Investment which RIL is the sole beneficiary (total promoter Entertainment holding is 75%) Ticketing & Live Network18 has ~39% stake Digital News Broadcasting Print + Digital Magazines Business Finance News Auto Entertainment News & Niche Opinions Infotainment All in standalone entity Network18 holds ~92% in e-Eighteen Network18 holds ~51% of subsidiary TV18. (Moneycontrol). Others are in standalone TV18 in turn owns 51% in Viacom18 and entity. 51% in AETN18 (see next page for details) TV18 group – Broadcasting pure-play, across News & Entertainment ENTITY GENRE CHANNELS Business News (4 channels, 1 portal) Standalone entity TV18 TV18 General News Group (Hindi & English) Regional News 50% JV with Lokmat group (14 geographies) IBN Lokmat AETN18 Infotainment (Factual & Lifestyle) 51% subsidiary - JV with A+E Networks Entertainment VIACOM18 (inc. Movie production / distribution & OTT) 51% subsidiary - JV with Viacom Inc Regional Entertain. -

LCN Home Channel 1 SD 100 Star Plus SD 101 ZEE TV SD 103 &Tv SD 104 Colors SD 105 DANGAL SD 106 Star Bharat SD 107 SET SD 109 Dr

Channel Name SD/HD LCN Home Channel 1 SD 100 Star Plus SD 101 ZEE TV SD 103 &tv SD 104 colors SD 105 DANGAL SD 106 Star Bharat SD 107 SET SD 109 Dr. Shuddhi SD 110 ID SD 111 Big Magic SD 112 SONY SAB SD 113 ABZY Cool SD 114 ZEE ANMOL SD 116 d2h Positive SD 117 EZ MALL SD 118 bindass SD 120 colors rishtey SD 121 Shemaroo TV SD 123 Anjan SD 128 Ayushman Active SD 130 Comedy Active SD 131 Fitness Active SD 132 Thriller Active SD 134 Shorts TV Active SD 135 Korean Drama Active SD 136 Watcho SD 144 Cooking Active SD 146 Zee Zest SD 147 DD NATIONAL SD 149 DD Retro SD 151 STAR UTSAV SD 156 SONY PAL SD 159 TOPPER SD 160 STAR WORLD SD 179 ZEE cafe SD 181 Colors Infinity SD 183 COMEDY CENTRAL SD 185 ZEEPLEX Screen 1 SD 200 SONY MAX SD 201 &pictures SD 202 ZEE CINEMA SD 203 Jyotish Duniya SD 204 Star GOLD SD 205 ABZY MOVIES SD 206 UTV MOVIES SD 207 B4U Kadak SD 210 UTV ACTION SD 211 Box Cinema SD 212 Cine Active SD 213 Rangmanch Active SD 214 Evergreen Classics Active SD 215 Hits Active SD 217 ZEE Bollywood SD 218 EZ MALL SD 219 colors cineplex SD 221 Movies Active SD 222 Housefull Movies SD 223 enterr 10 Movies SD 225 ABZY Dhadkan SD 226 Star Gold 2 SD 227 ZEE Action SD 228 B4U MOVIES SD 229 Star Gold Select SD 231 Star Utsav Movies SD 234 EZ MALL SD 235 Zee Anmol Cinema SD 237 Dr. -

Hathway Recommended Pack

HATHWAY RECOMMENDED PACK KARNATAKA Prices are excluding taxes INFINITY HD MRP : ₹ 668 (142 PAY CHANNELS + KARNATAKA FTA) Total Pay Channels 78 SD + 64 HD (Excluding tax) LANG - GENRE CHANNEL_NAME SD/HD Bengali - Gec SONY AATH SD English - Gec STAR WORLD HD HD English - Gec STAR WORLD PREMIERE HD HD English - Gec ZEE CAFE HD HD English - Infotainment TLC HD HD English - Kids BABY TV HD HD English - Kids NICK JR SD English - Movie &FLIX HD HD English - Movie &PRIVE HD HD English - Movie HBO HD HD English - Movie MN+ HD HD English - Movie MNX HD HD English - Movie MOVIES NOW HD HD English - Movie ROMEDY NOW HD HD English - Movie SONY PIX HD HD English - Movie STAR MOVIES HD HD English - Movie STAR MOVIES SELECT HD HD English - Movie WB SD English - Music VH1 HD HD English - News BBC WORLD NEWS SD English - News CNBC TV18 SD English - News CNN INTERNATIONAL SD English - News CNN NEWS18 SD English - News ET NOW SD English - News INDIA TODAY SD English - News MIRROR NOW SD English - News NDTV 24X7 SD English - News NDTV PROFIT SD English - News TIMES NOW SD English - News TIMES NOW WORLD HD HD English - Sports EUROSPORT HD HD Hindi - Gec &TV HD HD Hindi - Gec BIG MAGIC SD Page 1 of 98 Hindi - Gec COLORS HD HD Hindi - Gec COLORS RISHTEY SD Hindi - Gec INVESTIGATION DISCOVERY HD HD Hindi - Gec SONY HD HD Hindi - Gec SONY PAL SD Hindi - Gec SONY SAB HD HD Hindi - Gec ZEE ANMOL SD Hindi - Gec ZEE TV HD HD Hindi - Infotainment HISTORY TV18 HD HD Hindi - Kids CARTOON NETWORK SD Hindi - Kids NICK SD Hindi - Kids NICK HD+ HD Hindi - Kids POGO SD Hindi -

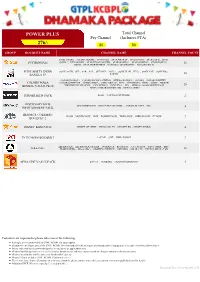

Power Plus 276

POWER PLUS Total Channel Pay Channel (Inclusive FTA) 276/- 80 80 GROUP BOUQUET NAME CHANNEL NAME CHANNEL COUNT STAR JALSHA , JALSHA MOVIES , STAR PLUS , STAR BHARAT , STAR UTSAV , STAR GOLD , STAR SVP BENGALI GOLD 2 , UTV MOVIES , STAR UTSAV MOVIES , STAR SPORTS 2 , STAR SPORTS 3 , STAR SPORTS 1 15 HINDI , STAR SPORTS FIRST , NATIONAL GEOGRAPHIC , NAT GEO WILD SONY HAPPY INDIA SONY AATH , SET , SAB , PAL , SET MAX , MAX 2 , SONY WAH , TEN 3 , SONY YAY , SONY BBC 10 BANGLA 39 EARTH COLORS BANGLA , COLORS BANGLA CINEMA , NEWS18 BANGLA , COLORS , COLORS RISHTEY COLORS WALA , COLORS CINEPLEX , NEWS18 INDIA , CNBC AWAAZ , MTV , MTV BEATS , NICK , SONIC , NICK JR 20 BENGAL VALUE PLUS , THE HISTORY CHANNEL , CNN NEWS18 , CNBC TV18 , VH1 , NEWS18 ASSAM/NORTH EAST , NEWS18 BIHAR/JHARKHAND , NEWS18 URDU TURNER KIDS PACK POGO , CARTOON NETWORK 2 DISCOVERY KIDS DISCOVERY KIDS , DISCOVERY CHANNEL , ANIMAL PLANET , TLC 4 INFOTAINMENT PACK BENNETT COLEMAN ZOOM , MOVIES NOW , MNX , ROMEDY NOW , TIMES NOW , MIRROR NOW , ET NOW 7 BOUQUET 2 DISNEY KIDS PACK DISNEY CHANNEL , HUNGAMA TV , MARVEL HQ , DISNEY JUNIOR 4 TVTN NEWS BOUQUET AAJ TAK , GNT , INDIA TODAY 3 ZEE BANGLA , ZEE BANGLA CINEMA , 24 GHANTA , BIG MAGIC , UTV ACTION , NDTV INDIA , BBC A-La-Carte WORLD NEWS , BIG GANGA , RISHTEY CINEPLEX , CBEEBIES , ISHARA TV , ETV BALBHARAT SD 12 APNA EPIC VALUE PACK EPIC TV , GUBBARE , FILAMCHI BHOKPURI 3 Customers are requested to please take note of the following: Packages are recommended by GTPL KCBPL for subscription. Customers can choose any of the GTPL KCBPL Recommended Packs or choose any broadcaster’s bouquets or a-la-carte channels of their choice. -

Zee Entertainment Refer to Important Disclosures at the End of This Report

India Equity Research | Media & Entertainment August 18, 2020 Result Update Zee Entertainment Refer to important disclosures at the end of this report Consistency and delivery will win back trust CMP: Rs 174 TP: Rs 190 (▲) Rating: HOLD (▲) Upside: 9.5 % as of (August 18, 2020) 12 months Change in Estimates We appreciate your support in the Asiamoney Brokers Poll 2020 EPS Chg FY21E/FY22E (%) (12.8)/- Target Price change (%) 39.0 . Z IN posted poor operating performance, with EBITDA declining 67% yoy, accentuated by Target Period (Months) 12 higher-than-expected opex. Advertising revenues fell 65% yoy, while domestic Previous Reco SELL subscription revenues surprised once again by rising 6% yoy, driven by ZEE5. Emkay vs Consensus . Management expects ad revenues to bounce back from H2FY21. Conversely, subscription EPS Estimates revenue is anticipated to moderate, due to an inability to effect price hikes. While the FY21E FY22E viewership share has eroded meaningfully during the lockdown, it is starting to reverse. Emkay 11.3 16.8 . The company has improved disclosures with quarterly balance sheet, standardized ZEE5 Consensus 12.5 16.8 metrics and strengthened corporate governance policies. Consistent FCF generation is Mean Consensus TP (12M) Rs 169 key for sustained re-rating given the underperformance in the recent past. Stock Details . We remain watchful of timely subscription receivables from Dish and Siti, and investments Bloomberg Code Z IN in Sugarbox. The improvement in disclosures and policies, along with corrective steps, is Face Value (Rs) 1 leading us to upgrade Z IN to Hold with a revised TP of Rs190 (11x Sep’22E EPS). -

Free Dish Tv Channel Apk Download

Free dish tv channel apk download Continue DD Free Dish 1.8 Description DD Free Dish (Package Name: com.my.ddfreedish) designed by Kieran Bhujade and the latest version of DD Free Dish 1.8 was updated on March 25, 2019. DD Free dish is in the education category. You can check out all apps from developer DD Free Dish and find 3 alternative apps for DD Free Dish on Android. Currently, this app is free. This app can be downloaded on Android 4.4 on APKFab or Google Play. All APK/XAPK files are APKFab.com original and are 100% safe when downloaded quickly. Provide dd free food information and a list of TV channels, a list of radio channels, news, etc. and more. Latest news on DD Free Dish.Latest TV channels MPEG 2 and MPEG 4. The latest TP list you share friends and other people. Our other important apps install directlyEtc for more useful information in this ApplicationPlease Bet in Play Store DD Free Dish 1.8 Update Home Page Changes Read FOLLOW USA FOLLOW USA FOLLOW USA Enjoy all TV channels for free on Dish TV Live. Enjoy your favorite natok, movies and even all the sports on your Android phone. All free channels provide below features:- Channel Nine Channel I-RTV-GTV (Gazi TV) - Independent TV Channel 24-Channel 9-Star Jalsha TV-Bangla TV-Colors Bangla TV- ATN Bangla TV- ATN News TV- E et deakat-Ekushey-Banglavision- S Bangla- Star-Star-Sananda TV-ETV Boyshahi TV-BTV-SA TV-Som News TV-Massranga TV-NTV-Mohuya TV-ABP Ananda-Akash Bangla- Buposhi Bangla TV-DD Bangla-SET MAX-MTV BEATS-ZE TV HD-STAR PLUS HD'COLORS HD'COLORS HD'COLORS HD'COLORS