News Release Cincinnati, OH 45202

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Second Time Moms & the Truth About Parenting

Second Time Moms & The Truth About Parenting Summary Why does our case deserve an award? In the US, and globally, every diaper brand obsesses about the emotion and joy experienced by new parents. Luvs took the brave decision to focus exclusively on an audience that nobody was talking to: second time moms. Planning made Luvs the official diaper brand of experienced moms. The depth of insights Planning uncovered about this target led to creative work that did a very rare thing for the diaper category: it was funny, entertaining and sparked a record amount of debate. For the first time these moms felt that someone was finally standing up for them and Luvs was applauded for not being afraid to show motherhood in a more realistic way. And in doing so, we achieved the highest volume and value sales in the brand’s history. 2 Luvs: A Challenger Facing A Challenge Luvs is a value priced diaper brand that ranks a distant fourth in terms of value share within the US diaper category at 8.9%. Pampers and Huggies are both premium priced diapers that make up most of the category, with value share at 31, and 41 respectively. Private Label is the third biggest player with 19% value share. We needed to generate awareness to drive trial for Luvs in order to grow the brand, but a few things stood in our way. Low Share Of Voice Huggies spends $54 million on advertising and Pampers spends $48 million. In comparison, Luvs spends only $9 million in media support. So the two dominant diaper brands outspend us 9 to 1, making our goal of increased awareness very challenging. -

Innovation Is P&G's Life Blood

Innovation is P&G Innovations P&G’s Life Blood It is the company’s core growth strategy and growth engine. It is also one of the company’s five core strengths, outlined for focus and investment. Innovation translates consumer desires into new products. P&G’s aim is to set the pace for innovation and the benchmark for innovation success in the industry. In 2008, P&G had five of the top 10 new product launches in the US, and 10 of the top 25, according to IRI Pacesetters, a report released by Information Resources, Inc., capturing the most successful new CPG products, as measured by sales, over the past year. Over the past 14 years, P&G has had 114 top 25 Pacesetters—more than our six largest competitors combined. PRODUCT INNOVATION FIRSTS 1879 IVORY First white soap equal in quality to imported castiles 1901 GILLETTE RAZOR First disposable razor, with a double-edge blade, offers alternative to the straight edge; Gillette joins P&G in 2005 1911 CRISCO First all-vegetable shortening 1933 DREFT First synthetic household detergent 1934 DRENE First detergent shampoo 1946 TIDE First heavy-duty The “washday miracle” is introduced laundry detergent with a new, superior cleaning formula. Tide makes laundry easier and less time-consuming. Its popularity with consumers makes Tide the country’s leading laundry product by 1949. 1955 CREST First toothpaste proven A breakthrough-product, using effective in the prevention fluoride to protect against tooth of tooth decay; and the first decay, the second most prevalent to be recognized effective disease at the time. -

Procter & Gamble Ecosystem

The Procter & Gamble Company 1 Procter & Gamble Plaza Procter & Gamble Ecosystem Cincinnati, Ohio 45202 Phone: (513)-983-1100 www.us.pg.com Outside Relationships Outside Relationships The Procter & Gamble Company (Ohio Corporation) Securities Regulators Capital Suppliers Customers Regulation Customers Suppliers Capital Regulators and NYSE Bond Lenders Debt Structure Equity Structure Listing Rules Securities Financing Debt ($34.6 Billion as of 6/31/20) Credit Ratings (Senior Unsecured): AA- (S&P); Aa3 (Moody’s) Equity Convertible Class A preferred stock, stated value $1 per share (600 shares Regulators Bondholders Equity Working Capital authorized) Significant Short-Term Debt: $5B 2020 Maturity: $1.27zB @ 2022 Maturity: 3.37B @ 2024 Maturity: 1.46B @ Capital US Financing 2023 Revolving Credit 2020-2021 Maturity Remaining years (2026- Shareholders Commercial Paper Debt avg 3.08% avg 2.14% avg 0.58% Non-Voting Class B preferred stock, Class C Capital Stock Securities Commercial Foreign Currency, Facility ($4.0B; $0 (ESOP Notes): $119M 50): $10.98B @ avg Financing (Non- 2021 Maturity: 2.32B @ 2023 Maturity: 2.4B @ 2025 Maturity: 750M @ stated value $1 per share (200 shares (350M Shares Authorized; 340,979,832 Professional and Banks Cash Flow, and Drawn as of 12/31/19) @ avg 9.36% 3.14% Vanguard Interest Rate Outstanding as of 12/31/19) avg 1.85% avg 1.95% avg 2.55% authorized) Shares Outstanding) Services Firms Group (8.48%) Exchange Derivatives Commission SSgA Funds Hedging Ernst & Young Communications Finance and Operatons Professional Management New York Counterparties Governance Human Resources Corporate Matters (Auditing Services) Services (4.68%) Stock (e.g., Banks) Board of Directors Digital and Social Media Finance and Accounting Committees: Audit Talent Recruitment/Diversity Legal Exchange Jones Lang BlackRock Francis S. -

2006 Annual Report Financial Highlights

2006 Annual Report Financial Highlights FINANCIAL SUMMARY (UNAUDITED) Amounts in millions, except per share amounts; Years ended June 30 2006 2005 2004 2003 2002 Net Sales $68,222 $56,741 $51,407 $43,377 $40,238 Operating Income 13,249 10,469 9,382 7,312 6,073 Net Earnings 8,684 6,923 6,156 4,788 3,910 Net Earnings Margin 12.7% 12.2% 12.0% 11.0% 9.7% Basic Net Earnings Per Common Share $2.79 $ 2.70 $ 2.34 $ 1.80 $ 1.46 Diluted Net Earnings Per Common Share 2.64 2.53 2.20 1.70 1.39 Dividends Per Common Share 1.15 1.03 0.93 0.82 0.76 NET SALES OPERATING CASH FLOW DILUTED NET EARNINGS (in billions of dollars) (in billions of dollars) (per common share) 68.2 11.4 2.64 4 0 4 0 4 4 40 0 0 04 0 06 0 0 04 0 06 0 0 04 0 06 Contents Letter to Shareholders 2 Capability & Opportunity 7 P&G’s Billion-Dollar Brands 16 Financial Contents 21 Corporate Officers 64 Board of Directors 65 Shareholder Information 66 11-Year Financial Summary 67 P&GataGlance 68 P&G has built a strong foundation for consistent sustainable growth, with clear strategies and room to grow in each strategic focus area, core strengths in the competencies that matter most in our industry, and a unique organizational structure that leverages P&G strengths. We are focused on delivering a full decade of industry-leading top- and bottom-line growth. -

409 Carpet Cleaner 7Th Gen Wipes Refill 7Th Generation Dish Powder

409 Carpet Cleaner 7th Gen Wipes Refill 7th Generation Dish Powder 7th Generation Fabric Soft 7th Generation Laundry A Ben A Qui Scrubbing Cream A&H Carpet Fresh Powder A&H Clean Shower Ammonia Lemon Better Life Cleansing Scrubber Better Life Dish Soap Better Life Floor Cleaner Better Life Sage Citrus Lotion Better Life Tub/Tile Cleaner Better Life Wipes Peppermint Better Life Wood Polish BioKleen Bleach Alternative (powder) BioKleen Laundry (liquid) Bounce Sheets Cascade Action Pacs Cascade Gel Cascade Powder Citrus Magic Solid Citrus Magic Tropical Citrus Clorox Bleach 30oz Clorox Bleach 64oz Comet Bathroom Cleaner Comet Powder Dawn Dish Orig Liquid Dove White Bath Soap 2 Pack Downy Mountain Spring Easy Off Oven Cleaner Febreze X Strength 16.9oz Glass Plus Handmade VT Soap Irish Spring 3pack Ivory Snow Liquid 2X Joy Dish Soap Liquid Plumber Drain Cleaner Lysol Toilet Bowl Cleaner Method All Purpose Grapefruit Method All Purpose Lavender Method Dish Liquid Lemon Method Dish Soap Method Hand Wash PG MR Clean Magic Eraser Murphy Oil Soap Natures Miracle Stain/Odor Remover O-Cel-O Med 2 Sponges Pine Sol 24oz RESOLVE CARPET CLNR TRIGR Sanitizing Wipes Bathroom Shout Stain Remover Trigger SIMPLE GREEN CLEANER Soft Scrub w/ bleach Soft Soap With Aloe SOS Scrubber Heavy Duty SOS Soap Pads SPIC & SPAN CLEANER Static Guard 5.5oz Sun & Earth Stain Pen Sun & Earth Travel Kit Swiffer Cloth Refill Swiffer Duster Refill Tide HE 50 oz. TIDE LIQ ULTRA REG Tide Pods Original Tide to Go Toilet Duck Cleaner Windex Original . -

An Example of Open Innovation: P&G

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Elsevier - Publisher Connector Available online at www.sciencedirect.com ScienceDirect Procedia - Social and Behavioral Sciences 195 ( 2015 ) 1496 – 1502 World Conference on Technology, Innovation and Entrepreneurship An Example of Open Innovation: P&G Nesli Nazik Ozkan* Istanbul University, Faculty of Economy, Istanbul Abstract Open innovation, also known as crowdsourcing or co-creation, is a way for companies to utilize the ideas and strength of the people outside their organization to make improvements in the internal processes or products. Many companies seek input from those people outside their organization for solving some of their trickiest problems. Open innovation help them to drive employee productivity, customer loyalty and better innovation. Open innovation process consists of three main steps. These are concept phase, development phase and implementation phase. In the concept phase, research activities are carried out. In the development phase, skills are defined and projects are developed. In the implementation phase projects are implemented and exchange of information is accelerated. P&G leads the companies who applied concept of open innovation successfully in the world. Procter & Gamble Co. as the world’s 40th biggest and 84th innovative company created the web site for this propose which is known Connect + Develop to encourage open innovation to help them to drive employee productivity. P&G's open innovation strategy has enabled to establish more than 2,000 successful agreements with innovation partners around the world. C+D already has delivered strategic value all across the company, and a series of game-changing consumer innovations. -

GWK01123 Greenworks Liquid Dish Soap Original • 98% Naturally

GWK01064 GWK01123 GWK01155 Greenworks All Purpose Greenworks Liquid Dish Soap Greenworks Naturally Derived Compostable Cleaner Original Cleaning Wipes • Powers through grease, • 98% naturally derived • Cleans grease, grime and dirt with the grime and dirt • Cuts through grease and convenience of a wipe • Safe to use on multiple baked‐on foods • Compostable cleaning wipes made with naturally surfaces throughout kitchens • Leaves a streak‐free shine derived ingredients • 99% naturally derived and bathrooms, including • Non abrasive • Works on grease, grime and dirt throughout stainless steel, sealed granite • Dermatologist tested bathrooms, kitchens, breakrooms, office surfaces and chrome • 98% naturally 650 mL 12/Case and counters 62 wipes/can derived 6/Case 946mL 12/Case CLO01169 CLO01537 Clorox Fresh Scent Disinfecting Clorox Urine Remover Wipes • Specially formulated to • One‐step disinfecting and effectively remove urine cleaning LPL01165 stains while neutralizing • Health Canada registered to Liquid Plumr Full Uric Acid Crystals to kill 11 pathogens in 4 minutes Clog Remover eliminate odour including E.coli and Influenza A • Unique formula goes • Exceptional cleaning • Sanitizes hard non‐porous straight to the clog performance on tough stains surfaces in 30 seconds • Active ingredients dissolve including urine, bodily fluids • Ready to use, pre‐moistened hair and food soils, and create and wine wipes free‐flowing drains • Can be used to clean both • Bleach‐free formula! • CFIA • Safe for disposals, septic hard and soft surfaces such -

Annual Report Worldreginfo - 1406D2bb-18Df-4748-A55f-0998B0bfcc11 Financial Highlights (Unaudited) Amounts in Billions, Except Per Share Amounts

2017 Annual Report WorldReginfo - 1406d2bb-18df-4748-a55f-0998b0bfcc11 Financial Highlights (unaudited) Amounts in billions, except per share amounts 2017 2016 2015 2014 2013 2017 NET SALES BY 2 Net Sales $65.1 $65.3 $70.7 $74.4 $73.9 BUSINESS SEGMENT Operating Income $14.0 $13.4 $11.0 $13.9 $13.1 Net Earnings $ $10.5 $7.0 $11.6 $11.3 Attributable to P&G 15.3 Net Earnings Margin from % 15.4% 11.7% 14.3% 14.0% Continuing Operations 15.7 Diluted Net Earnings Baby, Feminine, per Common Share from $ $3.49 $2.84 $3.63 $3.50 3.69 and Family Care 28% Continuing Operations 1 Diluted Net Earnings Beauty 18% $ $3.69 $2.44 $4.01 $3.86 per Common Share 1 5.59 Fabric and Home Care 32% Operating Cash Flow $12.8 $15.4 $14.6 $14.0 $14.9 Health Care 12% Grooming 10% Dividends per $ $2.66 $2.59 $2.45 $2.29 Common Share 2.70 2017 NET SALES BY MARKET MATURITY 2017 NET SALES BY GEOGRAPHIC REGION Developed Markets 65% Developing Markets 35% North America 45% Europe 23% Latin America 8% Asia Pacific 9% India, Middle East, Greater China 8% and Africa (IMEA) 7% (1) Diluted net earnings per common share are calculated based on net earnings attributable to Procter & Gamble. (2) These results exclude net sales in Corporate. VARIOUS STATEMENTS IN THIS ANNUAL REPORT, including estimates, projections, objectives and expected results, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are generally identified by the words “believe,” “expect,” “anticipate,” “intend,” “opportunity,” “plan,” “project,” “will,” “should,” “could,” “would,” “likely” and similar expressions. -

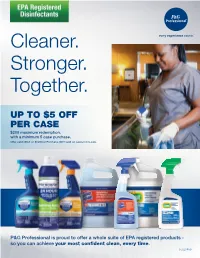

Rebate Check by Mail with a Minimum 5 Case Purchase

Cleaner. Stronger. Together. UP TO $5 OFF PER CASE $200 maximum redemption, with a minimum 5 case purchase. Offer valid ONLY on End User Purchase, NOT valid on cases for re-sale. P&G Professional is proud to offer a whole suite of EPA registered products - so you can achieve your most confident clean, every time. © 2020 P&G Receive a P&G Professional rebate check by mail with a minimum 5 case purchase. UP TO Offer valid between 7/1/2020 and 9/30/2020. To learn more, please call 1-800-332-7787. Visit pgpro.com or contact your $5 OFF P&G Professional representative today. PER CASE Offer valid ONLY on End User Purchase, NOT valid on cases for re-sale $200 maximum redemption REBATE FORM—NOT PAYABLE AT RETAIL By registering, I agree to receive emails from P&G Professional. View full P&G Terms and Conditions at http://www.pg.com/privacy/english/privacy_statement.html HOW TO GET YOUR REBATE: PLEASE MAIL P&G PROFESSIONAL REBATE #21145 TO THE FOLLOWING PAYEE: 1 BUY at least 5 cases (mix and match) of any of the Bounty, Charmin, Dawn, Spic and Span, Comet, Mr. Clean, Febreze, Microban, or Swiffer products listed in the chart below ALL SHADED FIELDS MUST BE COMPLETED FULLY TO RECEIVE REBATE between 7/1/2020 and 9/30/2020 2 SCAN Request Form and proof of purchase** and EMAIL to [email protected] before 11/30/2020 BUSINESS NAME (PAYEE) OR mail original Request Form, and proof of purchase,** dated with postmark before 11/30/2020 Jul.-Sept. -

The Dominance of Intellectual Property

3143 P-01 3/23/99 10:07 AM Page 1 1 The Dominance of Intellectual Property 1.1 Eclectic Science 3 1.2 Paradigm Shift 4 1.3 Looking at Intellectual Property Value 6 (a) H. J. Heinz Company 7 (b) Johnson & Johnson 10 (c) Merck & Company 10 (d) Microsoft Corporation 11 (e) Minnesota Mining & Manufacturing Company (3M) 13 (f) Philip Morris Company 13 (g) Nike, Inc. 14 (h) Procter & Gamble Company 15 1.4 Investment Performance 15 (a) Intellectual Property Infringement Damages 17 (b) Patent Infringement Damages 17 (c) Trademark Infringement Damages 18 (d) Copyright Infringement Damages 18 1.5 Overview of This Book 19 010 3143 P-01 3/23/99 10:07 AM Page 2 3143 P-01 3/23/99 10:07 AM Page 3 ntellectual property is the central resource for creating wealth in Ialmost all industries. The foundation of commercial power has shifted from capital resources to intellectual property. In fact, the def- inition of capital resources is shifting. No longer does the term capital resource bring to mind balance sheets of cash or pictures of sprawling manufacturing plants. The definition of capital includes intellectual property such as technological know-how, patents, trademarks, copy- rights, and trade secrets. Corporations once dominated industries by acquiring and managing extensive holdings of natural resources and manufacturing facilities. Barriers to entry were high because enormous amounts of fixed asset investments were required to displace well- entrenched players. Today, companies that once dominated industries are finding themselves fighting for survival. Up-start companies are creating new products and services based, not on extensive natural resource holdings or cash hordes, but on intellectual property resources. -

Easy Steps! Redeem In

Choose a FREE BACKPACK when you spend $50 on your favorite participating P&G brands.* *Terms apply. See reverse side for details. Redeem in Easy Steps! 3 OR fill out mail-in form on back Buy $50 Snap Upload at of participating a photo of PGHaulPass.com 1 P&G products 2 your receipt 3 How to Receive Your Reward: Please allow 4-6 weeks for delivery of your reward BUY Important Information: Limit one (1) reward per person. Product exclusions apply. A limited $50 worth of P&G products in one transaction, before taxes and after all other discounts and coupons number of rewards are available, while supplies last. P&G reserves the right to substitute the reward are applied. Purchase must be made between 6/25/2019 and 10/7/2019. Submission must be offered for an item of equivalent value, if available. Trust is a cornerstone of our corporate mission and postmarked or submitted online by 10/14/2019. the success of our business depends on it. P&G is committed to maintaining your trust by protecting MAIL the personal information we collect about you, our customers. For full details of our privacy statement In a first class stamped envelope, mail: visit www.pg.com/privacy/english/privacy_notice.html. -This original form Please print clearly; proper delivery depends on a complete and correct form. - Original dated sales receipt with store name and product price(s) circled to the following address: Backpack Telephone number and email address will only be used to provide order status, PO Box 49233 Dept PG-294 clarify information and send reward. -

“The Jensen Project” Follows on the Success of P&G's and Walmart's First Made-For-TV Movie

In response to research indicating parents are looking for more family- oriented entertainment, Procter & Gamble and Walmart are bringing back Family Movie Night with the premier of their second made-for-TV movie: “The Jensen Project.” According to research from the ANA’s Alliance for Family Entertainment, only 23% of respondents were satisfied with the amount of family-oriented programming available. Advertising appearing in a family- friendly context is much more effective in reaching consumers. “The Jensen Project” follows on the success of P&G’s and Walmart’s first made-for-TV movie, “Secrets of the Mountain,” which aired in April 2010: • “Secrets of the Mountain” generated more than • Following in the footsteps of that first movie, one billion impressions, resulting in 7.5 million “The Jensen Project” will include co-advertising viewers and a 4.5 television household rating. between Walmart and P&G featuring a single The movie was the #1 show of the night and family creating “family moments” that has proven claimed NBC’s top spot for the week, beating first to increase trip and purchase intent. So while run episodes of “The Biggest Loser,” “Parenthood” families are enjoying the movie, they’ll be seeing and “The Celebrity Apprentice.” “Secrets of the inspiring co-advertising vignettes featuring Swiffer, Mountain” was also the #1 Friday movie of the Charmin, Tide, Iams, Pampers, Bounty, and year, beating network premiers of box office hits regimens for Gillette shaving, Crest 3D White, and “Shrek The Third” and “Ice Age 2: The Meltdown.” P&G Beauty (Pantene, Covergirl, Olay). latest innovations pginnovation.com About “The Jensen Project”: Air & Release Dates: “The Jensen Project” is supported with a fully “The Jensen Project” will air Friday, July 16, 2010 at integrated marketing plan designed to create an 8 PM Eastern/7 PM Central on NBC.