Brief Rationale September 29, 2014 CARE ASSIGNS 'CARE AAA (SO

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

C1-27072018-Section

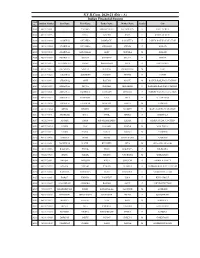

TATA CHEMICALS LIMITED LIST OF OUTSTANDING WARRANTS AS ON 27-08-2018. Sr. No. First Name Middle Name Last Name Address Pincode Folio / BENACC Amount 1 A RADHA LAXMI 106/1, THOMSAN RAOD, RAILWAY QTRS, MINTO ROAD, NEW DELHI DELHI 110002 00C11204470000012140 242.00 2 A T SRIDHAR 248 VIKAS KUNJ VIKASPURI NEW DELHI 110018 0000000000C1A0123021 2,200.00 3 A N PAREEKH 28 GREATER KAILASH ENCLAVE-I NEW DELHI 110048 0000000000C1A0123702 1,628.00 4 A K THAPAR C/O THAPAR ISPAT LTD B-47 PHASE VII FOCAL POINT LUDHIANA NR CONTAINER FRT STN 141010 0000000000C1A0035110 1,760.00 5 A S OSAHAN 545 BASANT AVENUE AMRITSAR 143001 0000000000C1A0035260 1,210.00 6 A K AGARWAL P T C P LTD AISHBAGH LUCKNOW 226004 0000000000C1A0035071 1,760.00 7 A R BHANDARI 49 VIDYUT ABHIYANTA COLONY MALVIYA NAGAR JAIPUR RAJASTHAN 302017 0000IN30001110438445 2,750.00 8 A Y SAWANT 20 SHIVNAGAR SOCIETY GHATLODIA AHMEDABAD 380061 0000000000C1A0054845 22.00 9 A ROSALIND MARITA 505, BHASKARA T.I.F.R.HSG.COMPLEX HOMI BHABHA ROAD BOMBAY 400005 0000000000C1A0035242 1,760.00 10 A G DESHPANDE 9/146, SHREE PARLESHWAR SOC., SHANHAJI RAJE MARG., VILE PARLE EAST, MUMBAI 400020 0000000000C1A0115029 550.00 11 A P PARAMESHWARAN 91/0086 21/276, TATA BLDG. SION EAST MUMBAI 400022 0000000000C1A0025898 15,136.00 12 A D KODLIKAR BLDG NO 58 R NO 1861 NEHRU NAGAR KURLA EAST MUMBAI 400024 0000000000C1A0112842 2,200.00 13 A RSEGU ALAUDEEN C 204 ASHISH TIRUPATI APTS B DESAI ROAD BOMBAY 400026 0000000000C1A0054466 3,520.00 14 A K DINESH 204 ST THOMAS SQUARE DIWANMAN NAVYUG NAGAR VASAI WEST MAHARASHTRA THANA -

Indian Financial System S.Y.B.Com. 2020-21 (Div

S.Y.B.Com. 2020-21 (Div - A) Indian Financial System Roll Student Number Last Name First Name Father Name Mother Name Gender City No. A001 40311190001 . ANUSHA GIREESAN KV KV SRIJITJA F SANTA CRUZ A002 40311190295 . NEHA JOSEPH JISHA F DAHISAR WEST A003 40311190003 AGARWAL ANUSHKA RAMBABU SANGEETA F JAIPUR RAILWAY STATION A004 40311190004 AGARWAL ANUSHKA SUBHASH SEEMA F MALAD A005 40311190808 AGARWAL KHUSHAAL AMIT MONIKA M MALAD A006 40311190007 AGARWAL NUPUR SANDEEP SAVITA F THANE A007 40311190015 AGASHIVALA SACHI DHARMESH ALPA F SANTACRUZ A008 40311190811 AGGARWAL VISHAL DEEPAK POOJA RANI M VAPI A009 40311190020 AGRAWAL ADISHREE SANJAY NUPUR F CANTT A010 40311190911 AGRAWAL AMIT RAJESH MANJU M RAIPUR RAILWAY STATION A011 40311190023 AGRAWAL DIVYA DEEPAK MINAKSHI F RAIGARH RAILWAY STATION A012 40311190908 AGRAWAL RADHIKA AVINASH SHIVANI F INDORE RAILWAY STATION A013 40311190027 AGRAWAL SAMPADA ATUL JAYA F ALLAHABAD A014 40311190028 AGRAWAL SANSKAR MUKESH SWETA M ANDHERI A015 40311190034 AHUJA DIKSHA DILIP MADHU F KOTA RAILWAY STATION A016 40311190041 AKERKAR RIYA SUNIL BIMBA F BORIVALI A017 40311190048 ANSARI SANA MD NIZAMUDDIN SEEMA F JHARSUGUDA JUNCTION A018 40311190814 ARORA LUV RAKESH MEENA M VILE PARLE A019 40311190815 ARORA RAHUL SANJIV SONALI M ANDHERI A020 40311190426 ASHRAFI IRAM MOHD HUSN BANO F ANDHERI A021 40311190051 BADHWAR RAHUL KULDEEP RITA M SRI GANGANAGAR A022 40311190056 BALSARA PAYAL VIJAY KALPANA F BILIMORA A023 40311190820 BANG SHLOK VISHNU VANDANA M GOREGAON A024 40311190061 BANSAL PARUSHI ARUN SURUCHI F AMBALA -

Annexure-V State/Circle Wise List of Post Offices Modernised/Upgraded

State/Circle wise list of Post Offices modernised/upgraded for Automatic Teller Machine (ATM) Annexure-V Sl No. State/UT Circle Office Regional Office Divisional Office Name of Operational Post Office ATMs Pin 1 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA PRAKASAM Addanki SO 523201 2 Andhra Pradesh ANDHRA PRADESH KURNOOL KURNOOL Adoni H.O 518301 3 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM AMALAPURAM Amalapuram H.O 533201 4 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Anantapur H.O 515001 5 Andhra Pradesh ANDHRA PRADESH Vijayawada Machilipatnam Avanigadda H.O 521121 6 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA TENALI Bapatla H.O 522101 7 Andhra Pradesh ANDHRA PRADESH Vijayawada Bhimavaram Bhimavaram H.O 534201 8 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA VIJAYAWADA Buckinghampet H.O 520002 9 Andhra Pradesh ANDHRA PRADESH KURNOOL TIRUPATI Chandragiri H.O 517101 10 Andhra Pradesh ANDHRA PRADESH Vijayawada Prakasam Chirala H.O 523155 11 Andhra Pradesh ANDHRA PRADESH KURNOOL CHITTOOR Chittoor H.O 517001 12 Andhra Pradesh ANDHRA PRADESH KURNOOL CUDDAPAH Cuddapah H.O 516001 13 Andhra Pradesh ANDHRA PRADESH VISAKHAPATNAM VISAKHAPATNAM Dabagardens S.O 530020 14 Andhra Pradesh ANDHRA PRADESH KURNOOL HINDUPUR Dharmavaram H.O 515671 15 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA ELURU Eluru H.O 534001 16 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudivada Gudivada H.O 521301 17 Andhra Pradesh ANDHRA PRADESH Vijayawada Gudur Gudur H.O 524101 18 Andhra Pradesh ANDHRA PRADESH KURNOOL ANANTAPUR Guntakal H.O 515801 19 Andhra Pradesh ANDHRA PRADESH VIJAYAWADA -

No. Sub Division Designation,Address & Telephone

No. Sub Division Designation,Address & Designation,Address & Designation,Address & Telephone Telephone Number of Assistant Telephone Number of Number of Government Information Information Officer Government Information Officer Officer 1 Office of the 1] Administrative Officer,Desk -1 1] Assistant Commissiner 1] Deputy Commissiner of Commissioner of {Confidential Br.},Office of the of Police,{Head Quarter- Police,{Head Quarter-1},Office of the Police,Mumbai Commissioner of Police, 1},Office of the Commissioner of Police, D.N.Road, D.N.Road,Mumbai-01,Telephone Commissioner of Police, Mumbai-01,Telephone No.2620043 No.22695451 D.N.Road, Mumbai-01, Telephone No.22624426 Confidential Report, Sr.Esstt., 2] Sr.Administrative Officer, Assistant Commissiner of Deputy Commissiner of Police, {Head Dept.Enquiry, Pay, Desk-3 {Sr.Esstt. Br.}, Office of Police, {Head Quarter- Quarter-1},Office of the Commissioner Licence, Welfare, the Commissioner of Police, 1},Office of the of Police, D.N.Road, Mumbai- Budget, Salary, D.N.Road,Mumbai-01, Telephone Commissioner of Police, 01,Telephone No.2620043 Retirdment No.22620810 D.N.Road, Mumbai-01, etc.Branches Telephone No.22624426 3] Sr.Administrative Officer,Desk - Assistant Commissiner of Deputy Commissiner of Police, {Head 5 {Dept.Enquiry} Br., Office of the Police, {Head Quarter- Quarter-1},Office of the Commissioner Commissioner of Police, 1},Office of the of Police, D.N.Road, Mumbai- D.N.Road,Mumbai-01,Telephone Commissioner of Police, 01,Telephone No.2620043 No.22611211 D.N.Road, Mumbai-01, Telephone -

Mumbai JUHU BEACH

MUMBAI JUHU BEACH Make your way to Novotel Mumbai Juhu Beach and you will soon realise that its location is truly idyllic. A stroll away from the sprawling Juhu Beach and the glitterati of Bollywood, the hotel with its tropical charm and mesmerising views of the Arabian Sea epitomises the perfect balance of nature and luxury. This luxurious cocoon is just a drive away from all major business parks, shopping malls, cinemas, heritage sights and domestic & international airports. The Novotel bedroom: your own living area • 203 rooms • 12 suites, 60 premier rooms, 130 superior rooms, 1 accessible superior room • Wi-Fi connectivity • Minibar • Tea & coffee maker • Electronic safe • Media hub connectivity • iPod docking station • Flat screen LCD television Enjoy the simple pleasures Sun-kissed restaurants and aromatic kitchens with mesmerising views of the Arabian Sea. • the Square — Pan-Indian All Day Dining Interactive Cuisine • Olio — Italian Dining • Sampan — Chinese Dining • Bageecha — Indian Dining • Gadda Da Vida — Chic Sea Lounge • Péché Mignon — Juhu’s Only French Pâtisserie novotel.com : the expert advice NOVOTEL • Partitionable Champagne ballroom for MUMBAI JUHU BEACH larger conferences and social gatherings Balraj Sahani Marg • Burgundy for conferences with Juhu Beach mesmerising views of the Arabian Sea Mumbai 400 049 • Bordeaux for mid-sized conferences • Sea-facing terrace with a large Maharashtra, INDIA pre-function area Information and • Dedicated in-house event management reservations: team Email: [email protected] • Customised -

Maharashtra Vidhan Sabha Candidate List.Xlsx

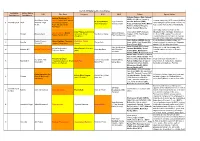

List of All Maharashtra Candidates Lok Sabha Vidhan Sabha BJP Shiv Sena Congress NCP MNS Others Special Notes Constituency Constituency Vishram Padam, (Raju Jaiswal) Aaditya Thackeray (Sunil (BSP), Adv. Mitesh Varshney, Sunil Rane, Smita Shinde, Sachin Ahir, Ashish Coastal road (kolis), BDD chawls (MHADA Dr. Suresh Mane Vijay Kudtarkar, Gautam Gaikwad (VBA), 1 Mumbai South Worli Ambekar, Arjun Chemburkar, Kishori rules changed to allow forced eviction), No (Kiran Pawaskar) Sanjay Jamdar Prateep Hawaldar (PJP), Milind Meghe Pednekar, Snehalata ICU nearby, Markets for selling products. Kamble (National Peoples Ambekar) Party), Santosh Bansode Sewri Jetty construction as it is in a Uday Phanasekar (Manoj Vijay Jadhav (BSP), Narayan dicapitated state, Shortage of doctors at Ajay Choudhary (Dagdu Santosh Nalaode, 2 Shivadi Shalaka Salvi Jamsutkar, Smita Nandkumar Katkar Ghagare (CPI), Chandrakant the Sewri GTB hospital, Protection of Sakpal, Sachin Ahir) Bala Nandgaonkar Choudhari) Desai (CPI) coastal habitat and flamingo's in the area, Mumbai Trans Harbor Link construction. Waris Pathan (AIMIM), Geeta Illegal buildings, building collapses in Madhu Chavan, Yamini Jadhav (Yashwant Madhukar Chavan 3 Byculla Sanjay Naik Gawli (ABS), Rais Shaikh (SP), chawls, protests by residents of Nagpada Shaina NC Jadhav, Sachin Ahir) (Anna) Pravin Pawar (BSP) against BMC building demolitions Abhat Kathale (NYP), Arjun Adv. Archit Jaykar, Swing vote, residents unhappy with Arvind Dudhwadkar, Heera Devasi (Susieben Jadhav (BHAMPA), Vishal 4 Malabar Hill Mangal -

Pincode Officename Mumbai G.P.O. Bazargate S.O M.P.T. S.O Stock

pincode officename districtname statename 400001 Mumbai G.P.O. Mumbai MAHARASHTRA 400001 Bazargate S.O Mumbai MAHARASHTRA 400001 M.P.T. S.O Mumbai MAHARASHTRA 400001 Stock Exchange S.O Mumbai MAHARASHTRA 400001 Tajmahal S.O Mumbai MAHARASHTRA 400001 Town Hall S.O (Mumbai) Mumbai MAHARASHTRA 400002 Kalbadevi H.O Mumbai MAHARASHTRA 400002 S. C. Court S.O Mumbai MAHARASHTRA 400002 Thakurdwar S.O Mumbai MAHARASHTRA 400003 B.P.Lane S.O Mumbai MAHARASHTRA 400003 Mandvi S.O (Mumbai) Mumbai MAHARASHTRA 400003 Masjid S.O Mumbai MAHARASHTRA 400003 Null Bazar S.O Mumbai MAHARASHTRA 400004 Ambewadi S.O (Mumbai) Mumbai MAHARASHTRA 400004 Charni Road S.O Mumbai MAHARASHTRA 400004 Chaupati S.O Mumbai MAHARASHTRA 400004 Girgaon S.O Mumbai MAHARASHTRA 400004 Madhavbaug S.O Mumbai MAHARASHTRA 400004 Opera House S.O Mumbai MAHARASHTRA 400005 Colaba Bazar S.O Mumbai MAHARASHTRA 400005 Asvini S.O Mumbai MAHARASHTRA 400005 Colaba S.O Mumbai MAHARASHTRA 400005 Holiday Camp S.O Mumbai MAHARASHTRA 400005 V.W.T.C. S.O Mumbai MAHARASHTRA 400006 Malabar Hill S.O Mumbai MAHARASHTRA 400007 Bharat Nagar S.O (Mumbai) Mumbai MAHARASHTRA 400007 S V Marg S.O Mumbai MAHARASHTRA 400007 Grant Road S.O Mumbai MAHARASHTRA 400007 N.S.Patkar Marg S.O Mumbai MAHARASHTRA 400007 Tardeo S.O Mumbai MAHARASHTRA 400008 Mumbai Central H.O Mumbai MAHARASHTRA 400008 J.J.Hospital S.O Mumbai MAHARASHTRA 400008 Kamathipura S.O Mumbai MAHARASHTRA 400008 Falkland Road S.O Mumbai MAHARASHTRA 400008 M A Marg S.O Mumbai MAHARASHTRA 400009 Noor Baug S.O Mumbai MAHARASHTRA 400009 Chinchbunder S.O -

1. Councillors & Officers List

Yeejleer³e je<ì^ieerle HetCe& peveieCeceve-DeefOevee³ekeÀ pe³e ns Yeejle-Yeei³eefJeOeelee ~ Hebpeeye, efmebOeg, iegpejele, cejeþe, NATIONAL ANTHEM OF INDIA êeefJe[, GlkeÀue, yebie, efJebO³e, efncee®eue, ³ecegvee, iebiee, Full Version G®íue peueeqOelejbie leJe MegYe veeces peeies, leJe MegYe DeeeqMe<e ceeies, Jana-gana-mana-adhinayaka jaya he ieens leJe pe³eieeLee, Bharat-bhagya-vidhata peveieCe cebieueoe³ekeÀ pe³e ns, Punjab-Sindhu-Gujarata-Maratha Yeejle-Yeei³eefJeOeelee ~ Dravida-Utkala-Banga pe³e ns, pe³e ns, pe³e ns, pe³e pe³e pe³e, pe³e ns ~~ Vindhya-Himachala-Yamuna-Ganga mebef#eHle Uchchala-jaladhi-taranga peveieCeceve-DeefOevee³ekeÀ pe³e ns Tava Shubha name jage, tava subha asisa mage Yeejle-Yeei³eefJeOeelee ~ Gahe tava jaya-gatha pe³e ns, pe³e ns, pe³e ns, Jana-gana-mangala-dayaka jaya he pe³e pe³e pe³e, pe³e ns ~~ Bharat-bhagya-vidhata Jaya he, jaya he, jaya he, Jaya jaya jaya jaya he. Short version Jana-gana-mana-adhinayaka jaya he Bharat-bhagya-vidhata Jaya he, Jaya he, jaya he jaya jaya jaya, jaya he, PERSONAL MEMORANDUM Name ............................................................................................................................................................................ Office Address .................................................................................................................... ................................................................................................................................................ .................................................... .............................................................................................. -

Customs Colony - Andheri East, Mumbai 2BHK Residential Apartments in Marol, Andheri East, Mumbai

https://www.propertywala.com/customs-colony-mumbai Customs Colony - Andheri East, Mumbai 2BHK Residential Apartments in Marol, Andheri East, Mumbai. Beautiful 2BHK Residential apartments in Customs Colony at Marol, Andheri East, Mumbai. Project ID : J919056791 Builder: Customs Colony Properties: Apartments / Flats Location: Customs Colony, Andheri East, Mumbai (Maharashtra) Completion Date: Dec, 2014 Status: Started Description Customs Colony is one of the special residential projects located in the arm of Andheri East, Mumbai. The project is offering beautiful fully furnished 2BHK residential apartments in the size of 1150 Sq Ft in very reasonable price which can be easily affordable by most of the people. Customs Colony is offering luxurious amenities as well as specifications of modern life style and it is also located in that place which is pollution less and very peace full. Around the Customs Colony you will easily find lots of markets, educational institutions, Banks, etc. so this is one of the best place to make your dream house. Location - Marol, Andheri East, Mumbai Type - 2BHK Residential Apartments Size - 1150 Sq Ft Price - On Request Amenities Mini boiler geyser Sliding windows Round the clock security Lifts Interior walls with Paint Intercom Facility Park Security Personnel Maintenance Staff Waste disposal GYM Low maintenance Fitness Center Features Luxury Features Security Features Power Back-up Room AC Lifts RO System Security Guards Intercom Facility Fire Alarm Water Softner High Speed Internet Wi-Fi Lot Features Interior -

Itherm 2938107 09/04/2015 ENDRESS+HAUSER WETZER GMBH+CO

Trade Marks Journal No: 1986 , 08/02/2021 Class 9 iTherm 2938107 09/04/2015 ENDRESS+HAUSER WETZER GMBH+CO. KG OBERE WANK 1, D-87484 NESSELWANG, GERMANY MANUFACTURERS AND MERCHANTS A COMPANY INCORPORATED UNDER THE LAWS OF GERMANY Address for service in India/Attorney address: LEXORBIS 709/710 Tolstoy House, 15-17 Tolstoy Marg, New Delhi-110001 Proposed to be Used MUMBAI THE DEVICES FOR MEASURING TEMPERATURE, TEMPERATURE SE SORS, TEMPERATURE HEAD TRANSMITTERS, TRANSMITTER HEAD FOR MEASURING TEMPERATURE ALL THE ABOVE EXCLUDING TEMPERATURE CONTROLLING APPARATUS. 1328 Trade Marks Journal No: 1986 , 08/02/2021 Class 9 NEPTUNE 3425579 05/12/2016 BHAVESHGIRI GOSWAMI trading as ;DIVINE ENTERPRISE D-401, SECTOR - 5, SUNCITY, BOPAL, AHMEDABD - 380058, GUJARAT, INDIA. MANUFACTURER AND MERCHANT Used Since :01/12/2016 AHMEDABAD ELECTRICAL POWER SAVING APPRATUS INCLUDING IN CLASS 9. 1329 Trade Marks Journal No: 1986 , 08/02/2021 Class 9 3451251 06/01/2017 AMNEX INFOTECHNOLOGIES PRIVATE LIMITED B-1301, Mondeal Heights, Near Novotel Hotel, S.G. Highway, Ahmedabad-380015 TRADER AND DEALER Address for service in India/Attorney address: UNIVERSAL LEGAL 505-506, Shivalik High Street, Nr. Keshavbaug Party Plot, Opp. HDFC Bank, Vastrapur, Ahmedabad-380015 Used Since :27/02/2014 To be associated with: 3451201 AHMEDABAD DATA PROCESSING EQUIPMENT AND COMPUTERS 1330 Trade Marks Journal No: 1986 , 08/02/2021 Class 9 ROYAL INDIA 3505275 04/03/2017 YASH KHURANA S/o Sh. Anil Khurana R/o 843, Gautam Gali, Jwala Nagar, Shahdara, Delhi-110032 YASH KHURANA Address for service in India/Agents address: VIKAS MITTAL FLAT NO.302, PLOT NO.149, SECTOR 6, VAISHALI, GHAZIABAD, UTTAR PRADEHS-201010 Proposed to be Used DELHI CABLES AND WIRES(ELECTRIC),SWITCHES,SWITCHBOARDS,PLUGS,SOCKETS,CONNECTORS,CUT-OUTS, ELECTRICAL CONTACTS TERMINALS,BATTERIES,WELDING APPRATUS,ELECTRIC AND ELECTRONIC TESTING, CHECKING, WEIGHING, AND MEASURING DEVICES AND INSTRUMENTS, WELDING APPARATUS REGISTRATION OF THIS TRADE MARK SHALL GIVE NO RIGHT TO THE EXCLUSIVE USE OF THE WORD INDIA. -

Andheri West May-2015

Real Insights: Real Estate Overview Andheri West May-2015 Executive Summary Andheri, a western suburb in Mumbai, has metamorphosed over the last several years to become one of the most sought-after regions in the city. It has transformed into being one of the posh localities in the financial capital, largely in demand by Bollywood stars and TV personalities and other high net worth individuals. The suburb is essentially divided into East and West regions. The following report tries to identify the various factors that led to realty growth in Andheri West. Since inception, the region has essentially developed as a residential area and, as a result, has witnessed rapid growth in its social and physical infrastructure. Further, the report identifies the present real estate market scenario in terms of housing sale and rent, the key real estate trends, the top builders and projects available, the civic issues, the opportunities available for area’s future growth, amongst others. To summarize it all, Andheri West continues to grow as a real estate hub with increasing demand by high net worth individuals. Offering properties for both sale and rentals, the area is witnessing continued growth in infrastructure and appreciating property prices over the years. Moreover, considering the various parameters, one can expect a positive real estate growth in the area in the near future. Index Executive Summary ................................................................................................................................................................................ -

Annexure-II Circle-Wise List of Aadhar Updation & Enrolment Facility

Annexure-II Circle-wise list of Aadhar Updation & Enrolment Facility Centres Name of the Post Offices where Aadhaar Enrolment cum Updation Centres Sl.No. have been set up ANDHARA PRADESH 1 Guntakal HO 2 Madanapalle HO 3 Rajampet HO 4 Dharmavaram HO 5 Adoni HO 6 Markapur HO 7 Proddatur HO 8 Pulivendla HO 9 Tirupati HO 10 Chandragiri HO 11 Srikalahasti HO 12 Anantapur HO 13 Chittoor HO 14 Cuddappah HO 15 Hindupur HO 16 Kurnool HO 17 Nandyal HO 18 Kanekal 19 Pamidi 20 Gooty RS 21 Thimmanacherla 22 Beerangi Kothakota S.O 23 Chowdepalli S.O 24 RAVINDRA NAGAR 25 YERRAMUKKAPALLI 26 NANDALUR 27 PORUMAMILLA 28 madakasira 29 Donakonda R.S. S.O 30 Holmespet S.O 31 Kalikiri S.O 32 Pakala S.O 33 Vayalpad S.O 34 Panagal S.O 35 Sainagar 36 Anantapur Collectorate 37 Anantapur Engg.college 38 Narpala 39 Yadiki 40 Jayalakshmipuram (Ananthapur) 41 Sri Venkateswarapuram 42 Arugonda 43 Bangarupalem 44 Chittor Bazar SO 45 Chittor Courtbuildings SO 46 Chittor Market S.O 47 Lalugardens SO 48 Murakambattu S.O 49 Nagamangalam S.O 50 Penumuru S.O 51 Thamballapalle S.O 52 Venkatagiri Kota S.O 53 JAYANAGAR 54 MANNUR (CUDDAPAH) 55 CHENNUR (CUDDAPAH) 56 KHAJIPET 57 VONTIMITTA 58 SIDDAVATAM 59 LAKKIREDDYPALLI 60 GALIVEEDU 61 Hindupur Extension 62 Gorantla 63 H.S.Mandir 64 Tanakallu 65 Dharmavaram RS 66 BETHAMCHERLA 67 BHAGYA NAGAR 68 KODUMUR 69 KNL. BAZAR 70 KNL. CHOWK 71 Collectorate Complex (Kurnool) 72 PEAPULLY 73 S.A.P. CAMP 74 SRI SAILAM 75 VELDURTHY 76 VELGODE 77 ADONI ARTS COLLEGE 78 ALUR 79 Besthavari Peta S.O 80 Chagalamarri S.O 81 Erragondapalem S.O 82 Komarole