Candlestick Formation Prediction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Statistical Analysis of the Predictive Power of Japanese Candlesticks Mohamed Jamaloodeen Georgia Gwinnett College, [email protected]

Journal of International & Interdisciplinary Business Research Volume 5 Article 5 June 2018 A Statistical Analysis of the Predictive Power of Japanese Candlesticks Mohamed Jamaloodeen Georgia Gwinnett College, [email protected] Adrian Heinz Georgia Gwinnett College, [email protected] Lissa Pollacia Georgia Gwinnett College, [email protected] Follow this and additional works at: https://scholars.fhsu.edu/jiibr Part of the Finance and Financial Management Commons Recommended Citation Jamaloodeen, Mohamed; Heinz, Adrian; and Pollacia, Lissa (2018) "A Statistical Analysis of the Predictive Power of Japanese Candlesticks," Journal of International & Interdisciplinary Business Research: Vol. 5 , Article 5. Available at: https://scholars.fhsu.edu/jiibr/vol5/iss1/5 This Article is brought to you for free and open access by FHSU Scholars Repository. It has been accepted for inclusion in Journal of International & Interdisciplinary Business Research by an authorized editor of FHSU Scholars Repository. Jamaloodeen et al.: Analysis of Predictive Power of Japanese Candlesticks A STATISTICAL ANALYSIS OF THE PREDICTIVE POWER OF JAPANESE CANDLESTICKS Mohamed Jamaloodeen, Georgia Gwinnett College Adrian Heinz, Georgia Gwinnett College Lissa Pollacia, Georgia Gwinnett College Japanese Candlesticks is a technique for plotting past price action of a specific underlying such as a stock, index or commodity using open, high, low and close prices. These candlesticks create patterns believed to forecast future price movement. Although the candles’ popularity has increased rapidly over the last decade, there is still little statistical evidence about their effectiveness over a large number of occurrences. In this work, we analyze the predictive power of the Shooting Star and Hammer patterns using over six decades of historical data of the S&P 500 index. -

Copyrighted Material

Index 12b-1 fee, 68–69 combining with Western analysis, 3M, 157 122–123 continuation day, 116 ABC of Stock Speculation, 157 doji, 115 accrual accounting, 18 dragonfl y doji, 116–117 accumulated depreciation, 46–47 engulfi ng pattern, 120, 121 accumulation phase, 158 gravestone doji, 116, 117, 118 accumulation/distribution line, hammer, 119 146–147 hanging man, 119 Adaptive Market Hypothesis, 155 harami, 119, 120 Altria, 29, 127, 185–186 indicators 120 Amazon.com, 151 long, 116, 117, 118 amortization, 47, 49 long-legged doji, 118 annual report, 44–46 lower shadow, 115 ascending triangle, 137–138, 140 marubozu, 116 at the money, 192 real body, 114–115 AT&T, 185–186 segments illustrated, 114 shadows, 114 back-end sales load, 67–68 short,116, 117 balance sheet, 46–50 spinning top, 118–119 balanced mutual funds, 70–71 squeeze alert, 121, 122, 123 basket of stocks, 63 tails, 114 blue chip companies, 34 three black crows, 122, 123 Boeing, 134–135 three white soldiers, 122, 123 book value, 169 trend-based, 117–118 breadth, 82–83, 97 upper shadow, 115 breakaway gap, 144 wicks, 114 break-even rate, 16–17 capital assets, 48, 49 breakout, 83–84, 105–106 capitalization-based funds, 71 Buffett, Warren, 152 capitalization-weighted average, 157 bull and bear markets,COPYRIGHTED 81, 174–175 Caterpillar, MATERIAL 52–54, 55, 57, 58, 59, 131 Bureau of Labor Statistics (BLS), 15 CBOE Volatility Index (VIX), 170, 171 Buy-and-hold strategy, 32, 204–205 Chaikin Money Flow (CMF), 146 buy to open/sell to open, 96 channel, 131–132 charting calendar spreads, 200–201 -

Candlestick—The Main Mistake of Economy Research in High Frequency Markets

International Journal of Financial Studies Article Candlestick—The Main Mistake of Economy Research in High Frequency Markets Michał Dominik Stasiak Department of Investment and Real Estate, Poznan University of Economics and Business, al. Niepodleglosci 10, 61-875 Poznan, Poland; [email protected] Received: 4 August 2020; Accepted: 1 October 2020; Published: 10 October 2020 Abstract: One of the key problems of researching the high-frequency financial markets is the proper data format. Application of the candlestick representation (or its derivatives such as daily prices, etc.), which is vastly used in economic research, can lead to faulty research results. Yet, this fact is consistently ignored in most economic studies. The following article gives examples of possible consequences of using candlestick representation in modelling and statistical analysis of the financial markets. Emphasis should be placed on the problem of research results being detached from the investing practice, which makes most of the results inapplicable from the investor’s point of view. The article also presents the concept of a binary-temporal representation, which is an alternative to the candlestick representation. Using binary-temporal representation allows for more precise and credible research and for the results to be applied in investment practice. Keywords: high frequency econometric; technical analysis; investment decision support; candlestick representation; binary-temporal representation JEL Classification: C01; C53; C90 1. Introduction While researching any subject literature, often one can notice that some popular methods in scientific research are copied and used without second thought by further researchers. Nowadays, the vast majority of papers pertaining to the analysis of course trajectory on financial markets and connected prediction possibilities use historical data in the form of a candlestick representation (or its derivatives such as daily opening prices, usually called daily prices, etc.) (Burgess 2010; Kirkpatrick and Dahlquist 2010; Schlossberg 2012). -

Japanese Candlestick Patterns

Presents Japanese Candlestick Patterns www.ForexMasterMethod.com www.ForexMasterMethod.com RISK DISCLOSURE STATEMENT / DISCLAIMER AGREEMENT Trading any financial market involves risk. This course and all and any of its contents are neither a solicitation nor an offer to Buy/Sell any financial market. The contents of this course are for general information and educational purposes only (contents shall also mean the website http://www.forexmastermethod.com or any website the content is hosted on, and any email correspondence or newsletters or postings related to such website). Every effort has been made to accurately represent this product and its potential. There is no guarantee that you will earn any money using the techniques, ideas and software in these materials. Examples in these materials are not to be interpreted as a promise or guarantee of earnings. Earning potential is entirely dependent on the person using our product, ideas and techniques. We do not purport this to be a “get rich scheme.” Although every attempt has been made to assure accuracy, we do not give any express or implied warranty as to its accuracy. We do not accept any liability for error or omission. Examples are provided for illustrative purposes only and should not be construed as investment advice or strategy. No representation is being made that any account or trader will or is likely to achieve profits or losses similar to those discussed in this report. Past performance is not indicative of future results. By purchasing the content, subscribing to our mailing list or using the website or contents of the website or materials provided herewith, you will be deemed to have accepted these terms and conditions in full as appear also on our site, as do our full earnings disclaimer and privacy policy and CFTC disclaimer and rule 4.41 to be read herewith. -

The Best Candlestick Patterns

Candlestick Patterns to Profit in FX-Markets Seite 1 RISK DISCLAIMER This document has been prepared by Bernstein Bank GmbH, exclusively for the purposes of an informational presentation by Bernstein Bank GmbH. The presentation must not be modified or disclosed to third parties without the explicit permission of Bernstein Bank GmbH. Any persons who may come into possession of this information and these documents must inform themselves of the relevant legal provisions applicable to the receipt and disclosure of such information, and must comply with such provisions. This presentation may not be distributed in or into any jurisdiction where such distribution would be restricted by law. This presentation is provided for general information purposes only. It does not constitute an offer to enter into a contract on the provision of advisory services or an offer to buy or sell financial instruments. As far as this presentation contains information not provided by Bernstein Bank GmbH nor established on its behalf, this information has merely been compiled from reliable sources without specific verification. Therefore, Bernstein Bank GmbH does not give any warranty, and makes no representation as to the completeness or correctness of any information or opinion contained herein. Bernstein Bank GmbH accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this presentation. This presentation may contain forward- looking statements of future expectations and other forward-looking statements or trend information that are based on current plans, views and/or assumptions and subject to known and unknown risks and uncertainties, most of them being difficult to predict and generally beyond Bernstein Bank GmbH´s control. -

Development and Analysis of a Trading Algorithm Using Candlestick Patterns

COMP 4971C – Independent Study (Summer 2016) DEVELOPMENT AND ANALYSIS OF A TRADING ALGORITHM USING CANDLESTICK PATTERNS By MUTHUKUMAR, Sivaraam Year 4, Dual Degree in Technology and Management (MEGBA) [email protected] 11th August 2016 Supervised by: Dr David Rossiter Department of Computer Science and Engineering Development and Analysis of a Trading Algorithm using Candlestick Patterns Table of Contents ABSTRACT .................................................................................................................................. 3 INTRODUCTION ......................................................................................................................... 3 Assumptions .......................................................................................................................... 3 PROCESS FLOW .......................................................................................................................... 4 GETTING DATA ........................................................................................................................... 5 Assumptions .......................................................................................................................... 5 COLOUR CODING THE CANDLESTICK CHART ............................................................................. 5 Assumptions .......................................................................................................................... 6 Colour coding algorithm ....................................................................................................... -

Candlestick Patterns

INTRODUCTION TO CANDLESTICK PATTERNS Learning to Read Basic Candlestick Patterns www.thinkmarkets.com CANDLESTICKS TECHNICAL ANALYSIS Contents Risk Warning ..................................................................................................................................... 2 What are Candlesticks? ...................................................................................................................... 3 Why do Candlesticks Work? ............................................................................................................. 5 What are Candlesticks? ...................................................................................................................... 6 Doji .................................................................................................................................................... 6 Hammer.............................................................................................................................................. 7 Hanging Man ..................................................................................................................................... 8 Shooting Star ...................................................................................................................................... 8 Checkmate.......................................................................................................................................... 9 Evening Star .................................................................................................................................... -

Technical-Analysis-Bloomberg.Pdf

TECHNICAL ANALYSIS Handbook 2003 Bloomberg L.P. All rights reserved. 1 There are two principles of analysis used to forecast price movements in the financial markets -- fundamental analysis and technical analysis. Fundamental analysis, depending on the market being analyzed, can deal with economic factors that focus mainly on supply and demand (commodities) or valuing a company based upon its financial strength (equities). Fundamental analysis helps to determine what to buy or sell. Technical analysis is solely the study of market, or price action through the use of graphs and charts. Technical analysis helps to determine when to buy and sell. Technical analysis has been used for thousands of years and can be applied to any market, an advantage over fundamental analysis. Most advocates of technical analysis, also called technicians, believe it is very likely for an investor to overlook some piece of fundamental information that could substantially affect the market. This fact, the technician believes, discourages the sole use of fundamental analysis. Technicians believe that the study of market action will tell all; that each and every fundamental aspect will be revealed through market action. Market action includes three principal sources of information available to the technician -- price, volume, and open interest. Technical analysis is based upon three main premises; 1) Market action discounts everything; 2) Prices move in trends; and 3) History repeats itself. This manual was designed to help introduce the technical indicators that are available on The Bloomberg Professional Service. Each technical indicator is presented using the suggested settings developed by the creator, but can be altered to reflect the users’ preference. -

Timeframeset

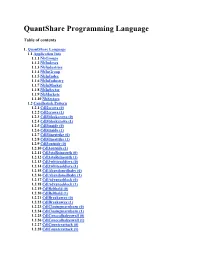

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

On-Line Manual for Successful Trading

On-Line Manual For Successful Trading CONTENTS Chapter 1. Introduction 7 1.1. Foreign Exchange as a Financial Market 7 1.2. Foreign Exchange in a Historical Perspective 8 1.3. Main Stages of Recent Foreign Exchange Development 9 The Bretton Woods Accord 9 The International Monetary Fund 9 Free-Floating of Currencies 10 The European Monetary Union 11 The European Monetary Cooperation Fund 12 The Euro 12 1.4. Factors Caused Foreign Exchange Volume Growth 13 Interest Rate Volatility 13 Business Internationalization 13 Increasing of Corporate Interest 13 Increasing of Traders Sophistication 13 Developments in Telecommunications 14 Computer and Programming Development 14 FOREX. On-line Manual For Successful Trading ii Chapter 2. Kinds Of Major Currencies and Exchange Systems 15 2.1. Major Currencies 15 The U.S. Dollar 15 The Euro 15 The Japanese Yen 16 The British Pound 16 The Swiss Franc 16 2.2. Kinds of Exchange Systems 17 Trading with Brokers 17 Direct Dealing 18 Dealing Systems 18 Matching Systems 18 2.3. The Federal Reserve System of the USA and Central Banks of the Other G-7 Countries 20 The Federal Reserve System of the USA 20 The Central Banks of the Other G-7 Countries 21 Chapter 3. Kinds of Foreign Exchange Market 23 3.1. Spot Market 23 3.2. Forward Market 26 3.3. Futures Market 27 3.4. Currency Options 28 Delta 30 Gamma 30 Vega 30 Theta 31 FOREX. On-line Manual For Successful Trading iii Chapter 4. Fundamental Analysis 32 4.1. Economic Fundamentals 32 Theories of Exchange Rate Determination 32 Purchasing Power Parity 32 The PPP Relative Version 33 Theory of Elasticities 33 Modern Monetary Theories on Short-term Exchange Rate Volatility 33 The Portfolio-Balance Approach 34 Synthesis of Traditional and Modern Monetary Views 34 4.2. -

Everything You Wanted to Know About Candlestick Charts Is an Unregulated Product Published by Thames Publishing Ltd

EEvveerryytthhiinngg yyoouu wwaanntteedd ttoo kknnooww aabboouutt ccaannddlleessttiicckk cchhaarrttss by Mark Rose • Read candlestick charts accurately • Spot patterns quickly and easily • Use that information to make profitable trading decisions Contents Chapter 1. What is a candlestick chart? 3 Chapter 2. Candlestick shapes: 6 Anatomy of a candle 6 Doji 7 Marubozo 8 Chapter 3. Candlestick Patterns 9 Harami (bullish / bearish) 9 Hammer / Hanging Man 11 Inverted Hammer / Shooting Star 13 Engulfing (bullish/ bearish) 14 Morning Star / Evening Star 15 Three White Soldiers / Three Black Crows 16 Piercing Line / Dark Cloud Cover 17 Chapter 4. The history of candlestick charts 18 Conclusion 20 Candlestick Cheat Sheet 22 2 Chapter 1. What is a candlestick chart? Before I start to talk about candlestick patterns, I’d like to get right back to basics on candles: what they are, what they look like, and why we use them … Drawing lines When you look at a chart of market prices, you can usually choose from line charts or candlestick charts. A line chart will take its price levels from the opening or closing prices according to the timeframe you have selected. So, if you’re looking at a one-minute line chart of closing prices, it will plot the closing price for each one-minute period – something like this … Line charts can be useful for looking at the “bigger picture” and finding long-term trends, but they simply cannot offer up the kind of information contained in a candlestick chart. Here is a one-minute candlestick chart for the same period … 3 At first glance, it might look a little confusing, but I can assure you that once you’re used to candlestick charts – you won’t look back. -

Bearish Belt Hold Line

How to Day Trade using the Belt Hold Line Pattern Belt Hold Line Definition The belt hold line candlestick is basically the white marubozu and black marubozu within the context of a trend. The bullish belt hold candle opens on the low of the day and closes near the high. This candle presents itself in a downtrend and is an early sign that there is a potential bullish reversal. Conversely the bearish belt candle opens at the high of the day and closes near the low. This candle presents itself in an uptrend and is an early sign that there is a potential bearish reversal. These candles are reliable reversal bars, but lose their importance if there are a number of belt hold lines in close proximity. Not to complicate the matter further, but the pattern can also act as a continuation pattern, which we will cover later in this post. Bullish Belt Hold Line The bullish belt hold line gaps down on the open of the bar, which represents the low of the bar, and then rallies higher. Shorts who entered positions on the open of the bar are now underwater, which adds to the buying frenzy. Bullish Belt Hold Line You are now looking at a chart which shows the bullish belt hold line candlestick pattern. As you see, the trading day starts with a big bearish gap, which is the beginning of the pattern. The price action then continues with a big bullish candle. The candle has no lower candle wick and closes at its high. This price action confirms both a bullish marubozu and bullish belt hold line pattern.