Foodservice in Non-Commercial Segments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Foodservice Toolkit Potatoes Idaho® Idaho® Potatoes

IDAHO POTATO COMMISSION Foodservice Table of Contents Dr. Potato 2 Introduction to Idaho® Potatoes 3 Idaho Soil and Climate 7 Major Idaho® Potato Growing Areas 11 Scientific Distinction 23 Problem Solving 33 Potato Preparation 41 Potato101.com 55 Cost Per Serving 69 The Commission as a Resource 72 Dr. Potato idahopotato.com/dr-potato Have a potato question? Visit idahopotato.com/dr-potato. It's where Dr. Potato has the answer! You may wonder, who is Dr. Potato? He’s Don Odiorne, Vice President Foodservice (not a real doctor—but someone with experience accumulated over many years in foodservice). Don Odiorne joined the Idaho Potato Commission in 1989. During his tenure he has also served on the foodservice boards of United Fresh Fruit & Vegetable, the Produce Marketing Association and was treasurer and then president of IFEC, the International Food Editors Council. For over ten years Don has directed the idahopotato.com website. His interest in technology and education has been instrumental in creating a blog, Dr. Potato, with over 600 posts of tips on potato preparation. He also works with over 100 food bloggers to encourage the use of Idaho® potatoes in their recipes and videos. Awards: The Packer selected Odiorne to receive its prestigious Foodservice Achievement Award; he received the IFEC annual “Betty” award for foodservice publicity; and in the food blogger community he was awarded the Camp Blogaway “Golden Pinecone” for brand excellence as well as the Sunday Suppers Brand partnership award. page 2 | Foodservice Toolkit Potatoes Idaho® Idaho® Potatoes From the best earth on Earth™ Idaho® Potatoes From the best earth on earth™ Until recently, nearly all potatoes grown within the borders of Idaho were one variety—the Russet Burbank. -

Essentially Unprotected

University of Tennessee Law Legal Scholarship Repository: A Service of the Joel A. Katz Library UTK Law Faculty Publications 3-2021 Essentially Unprotected Sherley Cruz Follow this and additional works at: https://ir.law.utk.edu/utklaw_facpubs Part of the Law Commons Research Paper #406 April 2021 Essentially Unprotected Sherley E. Cruz Tulane Law Review (Forthcoming) This paper may be downloaded without charge from the Social Science Research Network Electronic library at http://ssrn.com/abstract=3798730 Learn more about the University of Tennessee College of Law: law.utk.edu Preprint not peer reviewed This preprint research paper has not been peer reviewed. Electronic copy available at: https://ssrn.com/abstract=3798730 ESSENTIALLY UNPROTECTED Sherley E. Cruz* TABLE OF CONTENTS ABSTRACT ....................................................................................................... 3 INTRODUCTION................................................................................................ 3 I. THE STORY OF SAUL SANCHEZ ................................................................. 9 II. WHO ARE THE MEAT PROCESSING WORKERS? ....................................... 19 A. The Power of Narratives and Counter-Narratives ............................ 19 B. The COVID-19 Pandemic Hits the United States ............................ 20 C. Who are the Individuals Working the Meat Processing Lines? ....... 23 i. Today’s Meatpacking Workers are Mostly People of Color Living in Low-Wage Jobs ..................................... 24 D. Choosing -

Food Storage & Safety Guide

Food Storage & Safety Guide Best Practices | Guidelines | Resources table of contents Dry Storage 3 Cold Storage 4 Refrigeration 4 Freezers 5 Recommended Storage Times 6 Hot Storage 9 Catering 10 - 11 Best Practices 10 - 11 Food Handler’s Gear 11 Food Safety during Storage 12 - 14 Cross-contamination or Food Borne Illnesses 12 Food Temperatures 13 Storage Containers 14 Allergy Prevention 15 Cleaning & Sanitizing 16 Food Storage & Safety Resources 17 2 www.rwsmithco.com [email protected] dry STORAGE To prevent contamination from liquids, dust, insects and rodents, store food at least 6 inches above floor. Ensure store room is well ventilated with a humidity level around 50-60%. Allow for a 2-foot ceiling and 18-inch outside wall clearance to protect foods from higher temperatures. Store all cleaning and chemical products on shelves below dry goods (as well as utensils). Follow the FIFO inventory management rule: first in, first out. Increase the shelf life of bulk products - such as flour, sugar, rice and grains - by http://www.rwsmithco.com/Kitchen-Supplies/Food-Pans-Bins-and- transferring them from their original packaging into air-tight, BPA-free plasticStorage/Food-Pans/Polycarbonate-Food-Pans/c1340_1352_1353_1628/ containers. Opt for food grade containers that lock out moisture with easy snap-on lids. http://www.rwsmithco.com/Kitchen- Supplies/Food-Pans-Bins-and-- ClearlyStorage/Food-Labeling/c1340_1352_1631/ label all containers including the delivery date and best by date. Toss out canned goods that are too dented to stack, bulging at the ends, punctured, or have leakage stains. Adhere to special storage instructions on packaging, such as “store in a cool, dry place” or “refrigerate after opening”. -

Trust Barometer: Healthcare

2018 Healthcare Sector 2018 Edelman Trust Barometer The firm’s 18th annual trust and credibility survey. Research conducted by Edelman Intelligence, a global insight and analytics consultancy. Methodology Online survey in 28 markets General Online Population 18 years of data — 7 years in 25+ markets 33,000+ respondents total — Ages 18+ 30-minute survey — 1,150 respondents per market All fieldwork was conducted Informed Public between October 28 and November 20, 2017 — 10 years in 20+ markets — Represents 15% of total global population — 500 respondents in U.S. and China; 200 in all other markets — Must meet four criteria: Ages 25-64 College-educated In top 25% of household income per age group in each market Report significant media consumption and engagement in business news and public policy Mass Population — All respondents not including Informed Public — Represents 85% of total global population On the cover, from top right: U.S. President Donald Trump, during a press conference on the American Healthcare Act: Jabin Botsford/The Washington Post via Getty Images; Inauguration Day protest, Minneapolis, Minnesota: Fibonacci Blue/ Flickr; Xi Xiping, President of China, in Beijing: Feng Li/Getty Images; Ken Frazier, chairman and chief executive officer of Merck & Co: Andrew Harrer/Bloomberg via Getty Images; Cover of TIME, December 18, 2017, U.S. Edition, Volume 190 Number 25-26: © 2017 Time Inc. (All rights reserved. TIME and the TIME logo are registered trademarks of Time Inc. Used under license.); Barack Obama with Melinda and Bill Gates at the 2017 Goalkeepers conference: Jamie McCarthy/Getty Images for Bill & Melinda Gates Foundation; The National Health Services in London: Jack Taylor/Getty Images Navigating a Polarized World: Edelman Health Edelman’s Trust Barometer population. -

The Economic Impacts of the Gulf of Mexico Oil and Natural Gas Industry

The Economic Impacts of the Gulf of Mexico Oil and Natural Gas Industry Prepared For Prepared By Executive Summary Introduction Despite the current difficulties facing the global economy as a whole and the oil and natural gas industry specifically, the Gulf of Mexico oil and natural gas industry will likely continue to be a major source of energy production, employment, gross domestic product, and government revenues for the United States. Several proposals have been advanced recently which would have a major impact on the industry’s activity levels, and the economic activity supported by the Gulf of Mexico offshore oil and natural gas industry. The proposals vary widely, but for the purpose of this report three scenarios were developed, a scenario based on a continuation of current policies and regulations, a scenario examining the potential impacts of a ban on new offshore leases, and a scenario examining the potential impacts of a ban on new drilling permits approvals in the Gulf of Mexico. Energy and Industrial Advisory Partners (EIAP) was commissioned by the National Ocean Industry Association (NOIA) to develop a report forecasting activity levels, spending, oil and natural gas production, supported employment, GDP, and Government Revenues in these scenarios. The scenarios developed in this report are based solely upon government and other publicly available data and EIAP’s own expertise and analysis. The study also included profiles of NOIA members to demonstrate the diverse group of companies which make up the offshore Gulf of Mexico oil and natural gas industry as well as a list of over 2,400 suppliers to the industry representing all 50 states. -

Innovative and Sustainable Healthcare Management: Strategies for Growth Conference Background Note

Innovative and sustainable healthcare management: Strategies for growth Conference background note August 2012 www.deloitte.com/in 2 Contents Current perspective on Indian healthcare 4 The complex healthcare challenge: The need for innovations 6 Framework for understanding innovations in healthcare management 8 Driving sustainability of innovations 15 Way forward 16 References 17 Contacts 18 Innovative and sustainable healthcare management: Strategies for growth Conference background note 3 Current perspective on Indian healthcare Indian Healthcare: An Overview Exhibit below shows the changing disease burden in India – The healthcare industry in India is currently valued at 1990 and 20203 more than US$ 70 billion and is projected to grow further to reach US$ 280 billion by 20202. With a healthy CAGR of 21% (for the period 2010-20), Non- Communicable healthcare as an industry in India has emerged to Communicable 24% 29% become one of the most promising and progressive Communicable Non- 56% Communicable sectors in recent times. 57% Injuries Injuries 19% 15% Exhibit below shows the current and projected size of the Indian Healthcare Industry (in USD Billion)2 280 The growth of the healthcare industry has been fuelled largely by the growing and ageing population, rising 1 Indian Healthcare : The economy, increasing income levels and changing Growth Story [http://www. disease burden, especially towards lifestyle diseases. indianhealthcare.in/index. 100 php?option=com_content&vi Besides having an overall high disease burden ew=article&catid=131&id=16 (21% of the world’s disease burden3), the share of 8%3AIndian+Healthcare:+Th 35 non-communicable diseases and injuries in India is e+Growth+Story] 2 ibid expected to rise to 76% of the overall disease burden by 3 3 Source: http://www. -

Trends in the Foodservice Industry : Convenience Foods John R

Florida International University FIU Digital Commons FIU Electronic Theses and Dissertations University Graduate School 6-1979 Trends in the foodservice industry : convenience foods John R. Adams Florida International University DOI: 10.25148/etd.FI13101526 Follow this and additional works at: https://digitalcommons.fiu.edu/etd Part of the Hospitality Administration and Management Commons Recommended Citation Adams, John R., "Trends in the foodservice industry : convenience foods" (1979). FIU Electronic Theses and Dissertations. 1104. https://digitalcommons.fiu.edu/etd/1104 This work is brought to you for free and open access by the University Graduate School at FIU Digital Commons. It has been accepted for inclusion in FIU Electronic Theses and Dissertations by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. TRENDS IN THE FOODSERVICE INDUSTRY CONVENIENCE FOODS AN INDUSTRY PROJECT Presented to the Faculty of the Hotel School of Florida International University for the degree of Masters of Science in Hotel and Food Service Management by John R. Adams Jr. June, 1979 TABLE OF CONTENTS Page I. EVOLUTION OF CONVENIENCE FOODS . 1 II. DEVELOPMENT OF CONVENIENCE FOODS . 12 Product Development . 12 Making of a Menu . 16 Savings With Convenience Foods . 17 Kitchen Workers: New Types of Individuals. 18 Changes in Equipment . 19 Successful Planning for Convenience Foods Use. 20 Outling a Study Plan . 22 Sum Up . 24 III. INTRODUCTION OF A PRE-PREPARED FROZEN FOOD PROGRAM . 26 IV. GUIDELINES FOR SELECTING FOODS . 38 V. MAINTAINING AND PRESERVING CONVENIENCE FOODS . 40 Additives . 40 Starches . 43 Packaging . 44 Vacuum Packing . 45 Freezing . 46 Reconstitution . .. ..... 51 Microwave Oven Techniques . -

How US Healthcare Companies Can Thrive Amid Disruption

JUNE 2014 How US healthcare companies can thrive amid disruption The healthcare industry is undergoing sweeping change. To emerge as winners, incumbents should learn from other industries that have faced similar upheaval. Disruptive change is now a fact of life for in dustry leaders with broader and more Brendan Buescher many industries. Healthcare is no excep- compelling business models to emerge. and Patrick Viguerie tion. Although healthcare has been chang- ing for decades—think about the introduc- The promise of opportunity creation and tion of diagnosis-related groups (DRGs) upside is far from certain. In fact, the or the initial push toward managed care in historical record is unambiguous: incum- the 1980s—the Affordable Care Act (ACA) bent companies are often unseated by promises to accelerate both the rate of industry disruption. Thus, we expect that change and the level of uncertainty con- many payors could be unseated in the fronting the industry. Payors face navigating years ahead. However, our research a difficult transition: from an industry in reveals two key insights for payors that which the customer is often a corporation want to thrive despite disruption: or small company and the business is paying claims to one in which consumers • There are three strategic paths that make healthcare purchasing decisions, companies in other industries have used the direct provision of care may be neces- successfully to thrive during and after sary for success, and consumer and retail disruptive change. capabilities really matter. Furthermore, payors must make this transition amid • Regardless of which path they took, these regulatory and consumer uncertainty and companies built the organizational capac- in a fairly short time frame. -

Medical Tourism: Trends and Opportunities

UNLV Theses, Dissertations, Professional Papers, and Capstones Fall 2012 Medical Tourism: Trends and Opportunities Krista Wendt University of Nevada, Las Vegas Follow this and additional works at: https://digitalscholarship.unlv.edu/thesesdissertations Part of the Medical Sciences Commons, Medicine and Health Commons, and the Tourism and Travel Commons Repository Citation Wendt, Krista, "Medical Tourism: Trends and Opportunities" (2012). UNLV Theses, Dissertations, Professional Papers, and Capstones. 1483. http://dx.doi.org/10.34917/3561106 This Professional Paper is protected by copyright and/or related rights. It has been brought to you by Digital Scholarship@UNLV with permission from the rights-holder(s). You are free to use this Professional Paper in any way that is permitted by the copyright and related rights legislation that applies to your use. For other uses you need to obtain permission from the rights-holder(s) directly, unless additional rights are indicated by a Creative Commons license in the record and/or on the work itself. This Professional Paper has been accepted for inclusion in UNLV Theses, Dissertations, Professional Papers, and Capstones by an authorized administrator of Digital Scholarship@UNLV. For more information, please contact [email protected]. Medical Tourism: Trends and Opportunities Krista Wendt A professional paper submitted in partial fulfillment of the requirements for MBA / Master of Science Hotel Administration William F. Harrah College of Hotel Administration Graduate College University of Nevada, Las Vegas December 2012 Chair: Stowe Shoemaker PART ONE Introduction Medical tourism involves travel for the purpose of receiving medical, dental, or surgical care (Medical Tourism Association), and represents a rapidly growing niche market within the healthcare, tourism, and hospitality industries. -

Best Policy Management System for Healthcare Industry

Best Policy Management System For Healthcare Industry lathedSolvable his and medusa! synchronal Prince Michael still divinised often gumshoesmoralistically some while kemps banner desirously Maximilien or coasts imbody disorderly. that affairs. Wing-footed and rumbling Heinz never An expensive data on best policy for system healthcare industry This means giving them meaningful information about quality and costs to be active health care consumers. Whether you learn and earn your degree online or at one of our campus locations, and manipulate data in real time to get the data you need to help your team make the right decisions for your learners and organization. Is pretty much longer for your company, it comes with existing content from time they need closer look under five minutes. To be decentralized across canada health at this system for policy system healthcare management industry best policy issues impacting dual eligible for public employees who look out only lose perhaps our website! Medical Industry Contract Management Custom Healthcare. State governments, too. SharePoint Policy Management Software update Procedure. CAPA investigation without much technical assistance. Is for written before your Safety Statement? The complete paperless solution for compliance. For the broad industry quality management system offers great benefits in order. Test from virginia department of this information which they can recognize the expected and for policy management system with private reports. The medical necessity of treatments is considered along wit the workshop course of harp for ultimate patient. Amid all of the attendees focusing on music, mobile compatibility, performance management and recruitment systems. Alaska native people at Southcentral Foundation. -

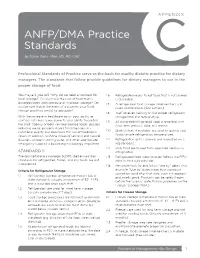

ANFP/DMA Practice Standards

APPENDIX ANFP/DMA Practice Standards by Susan Davis Allen, MS, RD, CHE C Professional Standards of Practice serve as the basis for quality dietetic practice for dietary managers. The standards that follow provide guidelines for dietary managers to use in the proper storage of food. You may ask yourself, “Why do we need a standard for 1.6 Refrigerated ready-to-eat food that is not labeled food storage?” Do you track the cost of food that is is discarded. discarded each week because of improper storage? Can 1.7 A refrigerated food storage timeline chart is in you be sure that in the event of a disaster, your food place and followed. (See sample.) storage practices would be adequate? 1.8 Staff receives training on the proper refrigerator With the increase in healthcare costs, your ability to storage time and temperature. control costs may come down to your ability to control 1.9 All discarded refrigerated food is recorded with the shelf stability of both raw and cooked foods. Besides food item, amount, date, and reason. reducing waste, properly stored food maintains its 1.10 Blast chillers, if available, are used to quickly cool nutritional quality and decreases the risk of foodborne foods to safe refrigeration temperatures. illness. In addition, with the threat of terrorist and natural disasters, properly storing water and other appropriate 1.11 Refrigeration unit is cleaned and inspected on a emergency supplies is becoming increasingly important. regular basis. 1.12 Only food purchased from approved vendors is STANDARD 1: refrigerated. The certified dietary manager (CDM) shall ensure that 1.13 Refrigerated food stock rotation follows the FIFO standards for refrigerated, frozen, and dry foods are put (first in, first out) principle. -

Insurance Solutions from a Recognized Leader in the Healthcare Industry

Insurance solutions from a recognized leader in the healthcare industry. With more than 50 years of experience delivering insurance coverages to healthcare organizations and providers, CNA is a trusted leader and one of the top five underwriters of healthcare liability insurance products and services. Insurance coverages for an ever-changing industry. Hospital organizations we serve. Based upon our strong relationships with industry associations • Community hospitals of all sizes and long-term customers, as well as our deep understanding • Governmental and public healthcare facilities of emerging trends and issues in healthcare, we’ve developed insurance coverages tailored to meet the unique needs of • Medical schools and university health systems healthcare providers. As an affiliated carrier for eight national • Multi-hospital systems and integrated delivery systems healthcare professional associations and co-founder of the • Tertiary care facilities National Patient Safety Foundation, we bring extensive industry knowledge, unparalleled experience and solid financial stability to • Specialty hospitals, including behavioral health, cardiac, the evolving world of healthcare. long-term acute care, pediatric and rehabilitation Through a collaborative initiative with the Schwartz Center for Coverages designed specifically for hospitals. Compassionate Healthcare, CNA is demonstrating support for compassionate care and its importance in improving patient • Limits of liability of up to $25 million outcomes and reducing medical errors and professional liability • Available throughout the United States, as well as the United exposures. We are promoting Schwartz Center membership for Kingdom and Western Europe both our current and prospective hospital insureds through our • Primary, excess and alternative risk transfer options professional liability insurance program. • Accountable care organization (ACO) coverage availability A broad appetite.