Fulfilling Dreams

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Familymart Branches

Sheet1 Participating FamilyMart Branches BRANCH ADDRESS CONTACT NUMBER G/F 139 CORPORATE CENTER, VALERO ST. 0917-8129710 139 CORPORATE SALCEDO VILLAGE, MAKATI CITY 978-0109 G/F STALL 21 ELJ COMMUNICATIONS 964-8279 ABS - CBN CENTER, QUEZON CITY 0917-5225533 GF AEON PRIME BUILDING, ALABANG- AEON PRIME ZAPOTE ROAD COR. NORTHGATE 0917-8458988 BRIDGEWAY, MUNTINLUPA CITY G/F UNIT 1-4, AIC GRAND DE TOWER, 0917-846-0651 AIC GRANDE TOWER GARNET ROAD, ORTIGAS CENTER, PASIG 507-6348 CITY G/F ALCO BLDG. 391 SEN. GIL PUYAT ALCO BLDG 954-1585 MAKATI CITY G/F ALPHALAND SOUTHGATE MALL EDSA 0917-5827526 ALPHALAND COR. PASONG TAMO ST. MAKATI CITY 959-0832 LG/F UNIT 7 ANONAS LRT CITY CENTER 978-0131 ANONAS LRT AURORA BLVD. & ANONAS ST. PROJECT 3 0917-8057206 QUEZON CITY AVIDA TOWERS NEW MANILA (TOWER# 5), 0917-8466236 AVIDA NEW MANILA B. SERRANO AVE., BRGY. BAGONG LIPUNAN 964-1352 NG CRAME, QUEZON CITY G/F RETAIL SPACE 2-4, AVIDA TOWERS SAN 0917-8940484 AVIDA SAN LORENZO LORENZO, CHINO ROCES AVE., MAKATI CITY 964-1499 959-1275 AYALA MRT 2/F AYALA MRT STATION 3 MAKATI CITY 09178207217 G/F C1 AYALA TOWER ONE & EXCHANGE AYALA TOWER ONE PLAZA AYALA TRIANGLE AYALA AVE. MAKATI 625 - 0446 CITY AYALA TRIANGLE GARDENS AYALA AVE., AYALA TRIANGLE GARDENS 729-7962 MAKATI CITY 11th AVE COR 30th ST., BONIFACIO GLOBAL 0917-5818190 BGC CORP CITY 978-0138 G/F BLDG K, BLUE BAYWALK MACAPAGAL, 0917-8103789 BLUE BAYWALK EDSA EXT. COR. MACAPAGAL AVE. 218-9335 METROPARK, PASAY CITY G/F SPACE #3 BONIFACIO ONE TECHNOLOGY TOWER RIZAL DRIVE COR. -

Creating Resilient & Livable Cities

Creating Resilient & Livable Cities Pacific Cities Sustainability Initiative Insights From The 2014 Annual PACIFIC Forum CITIES SUSTAINABILITY INITIATIVE 1 ASIA SOCIETY is the leading educational organization dedicated to promoting mutual understanding and strengthening part- nerships among peoples, leaders, and institutions of Asia and the United States in a global context. Across the fields of arts, business, culture, education, and policy, the Society provides insight, generates ideas, and promotes collaboration to address present challenges and create a shared future. Founded in 1956 by John D. Rockefeller 3rd, Asia Society is a nonpartisan, non- profit institution with headquarters in New York and centers in Hong Kong, Houston, Los Angeles, Manila, Sydney, Mumbai, San Francisco, Seoul, Shanghai, and Washington, D.C. THE URBAN LAND INSTITUTE is a global nonprofit education and research institute supported by its members. Its mission is to provide leadership in the responsible use of land and in creating and sustaining thriving communities worldwide. Estab- lished in 1936, the Institute has nearly 30,000 members representing all aspects of land use and development disciplines, and has offices around the world including Washington, D.C., London, Hong Kong, and Frankfurt. THE PACIFIC CITIES SUSTAINABILITY INITIATIVE (PCSI) is a collaborative dialogue which aims to foster long-term sharing of urban sustainability strategies between communities across the Pacific Rim. Launched in 2009 with the support of the USC Marshall School of Business and the UCLA Anderson School of Management, the initiative is a joint program of the Asia Society and the Urban Land Institute with support from leading organizations engaged in solving unprecedented challenges associated with rapid urbanization in Asia and across the Pacific Rim. -

7-Eleven Partner Locations Nationwide for Cash-In & Loan Repayment Transactions Only

7-ELEVEN PARTNER LOCATIONS NATIONWIDE as of March 2021 FOR CASH-IN & LOAN REPAYMENT TRANSACTIONS ONLY REGION TOWN/CITY BRGY. PARTNER OUTLET TYPE ADDRESS REGION XIII AGUSAN DEL Brgy. 25 CAPITOL DRIVE Cash-in and NATIONAL HIGHWAY, 54 RABE NORTE Loan Repayment SUBDIVISION, TAGUM CITY REGION XIII AGUSAN DEL Brgy. 3 BUENAVISTA Cash-in and MDC BUILDING, DAHICAN, NORTE Loan Repayment NATIONAL HIGHWAY, MATI CITY, DAVAO ORIENTAL REGION XIII AGUSAN DEL Brgy. 4 (Poblacion) NASIPIT CENTRO Cash-in and AJT GAS STATION, KINGKING NORTE Loan Repayment PANTUKAN, COMPOSTELA VALLEY PROVINCE REGION XIII AGUSAN DEL Brgy. 8 CPI CABADBARAN Cash-in and OJEDA AVENUE, CORNER ASIS NORTE Loan Repayment STREET, CABADBARAN CITY, AGUSAN DEL NORTE REGION XIII AGUSAN DEL Brgy. Diego Silang PRINCE HOTEL Cash-in and PRK. SAMPAGUITA, VISAYAN NORTE Loan Repayment VILLAGE, TAGUM CITY, DAVAO DEL NORTE REGION XIII AGUSAN DEL Brgy. Doongan BUTUAN DOCTORS Cash-in and CROSSING MANIKLING, SAN NORTE Loan Repayment ISIDRO, DAVAO ORIENTAL REGION XIII AGUSAN DEL Brgy. Kananga UNI-V SOUTH MONTILLA Cash-in and RIZAL ST., CORNER ZAMORA ST., NORTE Loan Repayment BRGY. CENTRAL, MATI CITY, DAVAO ORIENTAL REGION XIII AGUSAN DEL Brgy. Libertad CPI LIBERTAD Cash-in and EIGHT HORSES ENTERPRISES II NORTE Loan Repayment BLDG., BRGY. POBLACION, LUPON, DAVAO ORIENTAL REGION XIII AGUSAN DEL Brgy. Mabini CABADBARAN TERMINAL Cash-in and NATIONAL HIGHWAY, POBLACION, NORTE Loan Repayment BANAYBANAY, DVAO ORIENTAL REGION XIII AGUSAN DEL Brgy. Mangagoy SHELL MANGAGOY Cash-in and EIGHT HORSES ENTERPRISES II NORTE Loan Repayment BLDG., BRGY. POBLACION, LUPON, DAVAO ORIENTAL REGION XIII AGUSAN DEL Brgy. Montilla SJIT MONTILLA Cash-in and CAMP UTLEY AVE., APOKON, NORTE Loan Repayment TAGUM CITY, DAVAO DEL NORTE CIMB Bank Philippines 28th Floor, Ore Central Tower, 9th Avenue corner 31st Street, Bonifacio Global City, Taguig City (+632) 85800100 www.cimbbank.com.ph Page 1 REGION XIII AGUSAN DEL Brgy. -

AYALA LAND, INC. ______(Company’S Full Name)

SEC Number: 152-747 File Number: ________ AYALA LAND, INC. ___________________________________ (Company’s Full Name) 31F, Tower One, Ayala Triangle Ayala Avenue, Makati City 1226 ___________________________________ (Company Address) (632) 750-6974 ___________________________________ (Telephone Number) June 30, 2018 ___________________________________ (Quarter Ending) SEC Form 17-Q Quarterly Report (Amended) ___________________________________ (Form Type) April 1 – June 3, 2018 Income Statement Items ___________________________________ (Amendments) SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-Q QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SRC RULE 17(2)(b) THEREUNDER 1. For the quarterly period ended June 30, 2018 2. Commission Identification Number 152747 3. BIR Tax Identification No. 000-153-790-000 4. Exact name of issuer as specified in its charter: AYALA LAND, INC. 5. Province, Country or other jurisdiction of incorporation or organization: Makati City, Philippines 6. Industry Classification Code: _______ (SEC Use Only) 7. Address of issuer’s principal office and postal code: 31F, Tower One, Ayala Triangle, Ayala Avenue, Makati City 1226 8. Issuer’s telephone number, including area code: (632) 750-6974 9. Former name, former address, former fiscal year: Not applicable 10. Securities registered pursuant to Sections 8 and 12 of the Code, or Sections 4 and 8 of the RSA As of June 30, 2018 Title of each class Number of shares issued and outstanding Common shares 14,726,564,771 Preferred shares 13,066,494,759 Amount of Debt Outstanding P105,387,600,000.00 11. Are any or all of the securities listed on a Stock Exchange? Yes [x] No [ ] Stock Exchange: Philippine Stock Exchange Securities listed: Common shares 12. -

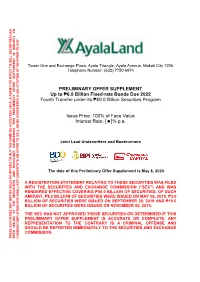

Preliminary Offering Memorandum

Tower One and Exchange Plaza, Ayala Triangle, Ayala Avenue, Makati City 1226 Telephone Number: (632) 7750-6974 PRELIMINARY OFFER SUPPLEMENT OFFER OFFER SUPPLEMENT IS SUBJECT TO PERMIT TO OFFER TO SELL SECURITIES HAS Up to ₱6.0 Billion Fixed-rate Bonds Due 2022 Fourth Tranche under its ₱50.0 Billion Securities Program UNTIL UNTIL A Issue Price: 100% of Face Value Interest Rate: []% p.a. THIS PRELIMINARY Joint Lead Underwriters and Bookrunners The date of this Preliminary Offer Supplement is May 8, 2020. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES WAS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ("SEC") AND WAS RENDERED EFFECTIVE COVERING ₱50.0 BILLION OF SECURITIES. OF SUCH SHALL NOT CONSTITUTE AN OFFER TO SELL OR BE CONSIDERED A SOLICITATION BUY. OFFER TO AN BE CONSIDERED OF TO SELL AN OFFER OR CONSTITUTE SHALL NOT AMOUNT, ₱8.0 BILLION OF SECURITIES WERE ISSUED ON MAY 06, 2019, ₱3.0 BILLION OF SECURITIES WERE ISSUED ON SEPTEMBER 30, 2019 AND ₱10.0 BILLION OF SECURITIES WERE ISSUED ON NOVEMBER 06, 2019. THE SEC HAS NOT APPROVED THESE SECURITIES OR DETERMINED IF THIS PRELIMINARY OFFER SUPPLEMENT IS ACCURATE OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE AND SHOULD BE REPORTED IMMEDIATELY TO THE SECURITIES AND EXCHANGE COMMISSION. THESE SECURITIES MAY NOT BE SOLD OR OFFERS TO BUY THE SAME BE ACCEPTED BEEN ISSUED AND CHANGE/COMPLETION BY THE SECURITIES AND EXCHANGE COMMISSION Ayala Land, Inc. (“ALI,” “Ayala Land,” the “Issuer” or the “Company”) prepared the prospectus dated April 16, 2019 and the prospectus dated September 12, 2019 (the “Prospectus”) relating to the offering of debt and other securities as provided by applicable Securities and Exchange Commission (“SEC”) rules and regulations effective at the time of issuance (the "Securities") of up to ₱50,000,000,000 to be issued in one or more tranches (each a “Tranche”) as authorized by a resolution of the Board of Directors of the Company dated February 27, 2019 (“Securities Program”). -

Enterprise Plaza

TRYNE ENTERPRISE PLAZA SYNCHRONIZING VISION IN BUSINESS Emerging at the gateway of ARCA South, a strategic location cultivates settings for a network of ideas and collaboration. Alveo Land opens the first office development in a technology-charged estate, presenting spaces for ownership and investment. Intuitive environments enveloped by an all-glass facade provide a clear business trajectory with an unobstructed view. Advancing growth and propelling businesses to the future. TRYNE ENTERPRISE PLAZA TRYNE ENTERPRISE PLAZA ARTIST’S PERSPECTIVE LEADING THE FUTURE Ayala Land continues to set the standard for property development in the Philippines. Creating a network of growth destinations in the country, Ayala Land links a dynamic range of communities—sustainably integrated estates to multigenerational homes and contemporary offices—with the singular vision of enhancing land and enriching lives for more people. With innovation as its main thrust, Alveo Land takes property development further, expanding the tradition of industry excellence grounded in its distinct Ayala Land heritage. A commitment best realized through fresh business and lifestyle concepts, and living solutions, pushing boundaries for masterplanned communities and diverse neighborhoods across the country. ARCA BOULEVARD ARTIST’S PERSPECTIVE ARCA SOUTH— THE GATEWAY TO PROGRESS Integrating organic systems for everyday life. ARCA South is a dynamic, future-oriented growth estate by Ayala Land in Taguig spanning 74 hectares—a sustainable, mixed-use development South of Metro Manila, masterplanned for urban synchronicity. This up-and-coming central business and lifestyle district converges a range of destinations for work, home, and play. The estate’s progressive urban design LIFESTYLE IMAGE creates links to main urban centers, with roads and transport systems, complemented by verdant open spaces activating possibilities. -

10065764645F62f80e63964.Pdf

With origins from the word merge, defined as ‘forming a single entity,’ the name evokes dynamic pursuits coming together. Alluding to the intimate character of Poblacion, permeable environments shape vibrant intersections for home, business, and community, where people meet and thrive. BRING LIFE UP- CLOSE MULTITUDES OF EXPERIENCE AT YOUR DOOR Alveo Land’s first residential development in Poblacion, Makati opens spaces to connect, linger, and uncover vibrant encounters. Mergent Residences introduces you to an intimate neighborhood, where every day is both familiar and new. Mergent Residences Artist’s Perspective HERITAGE SHAPING CITIES AYALA LAND TRANSFORMS THE PHILIPPINE LANDSCAPE Ayala Land Setting the standard for property development, Ayala Land continues to transform the country’s landscape with mixed-use masterplanned communities. From the country’s financial capital of Makati, the fastest- growing lifestyle and business district of BGC, to the first large-scale eco-city of NUVALI, Ayala Land delivers dynamic destinations in pursuit of a singular vision—enhancing land and enriching lives for more people. Alveo Land Marked by the Ayala Land heritage of industry expertise, Alveo Land carries out the spirit of innovation with fresh lifestyle concepts and living solutions. Shaping worlds of possibilities, Alveo Land pushes boundaries further in realizing diverse neighborhoods for living well. Makati Actual Photograph LOCATION LEADING THE WAY MAKATI—AT THE FOREFRONT OF BUSINESS AND CULTURE From its first waterfront settlement in Poblacion, Ayala Land’s pioneering seat of heritage, Makati City, has become the premiere financial capital of the country. A fluid crossover of the fast-paced CBD into organic communities shapes a one-of-a-kind experience. -

Building a Strong Platform for Recovery, Renewed

2020 INTEGRATED REPORT BUILDING A STRONG PLATFORM FOR RECOVERY, RENEWED GROWTH, AND RESILIENCE Ayala Land’s various initiatives on stakeholder support, investment, and reinvention pave the way for recovery PAVING THE WAY FOR RECOVERY AND SUSTAINABLE GROWTH The ongoing COVID-19 pandemic and the natural calamities that of digital platforms to reach and engage buyers. Staff of APMC, struck the Philippines in 2020 are still being felt by Filipinos to this the company’s property management firm, stayed-in its managed day. Ayala Land’s swift response to face these challenges showed properties and communities while the enhanced community the resilience of both the company and its people. quarantine was enforced. In a strategic pivot, ALIzens executed a five-point action plan— Helping the Community protecting the workforce, financial sustainability, serving customers, Ayala Land employees raised PHP82.6 million under the Ayala helping the community, and thinking ahead towards recovery. Land Pays It Forward campaign to provide medical supplies and This action plan enabled Ayala Land, its employees, and its personal protective equipment to three COVID-19 designated communities to withstand the challenges and position for recovery. treatment hospitals. The company helped raise PHP425 million for Project Ugnayan and allocated PHP600 million in financial With the continued trust and confidence of its shareholders and assistance to more than 70 thousand “no work-no pay” contingent stakeholders, Ayala Land will count on bayanihan (community personnel during the critical first weeks of the quarantine. spirit) to move forward and pave the way for recovery and Recognizing the difficulties of its mall merchants, Ayala Land sustainable growth. -

Company-Profile-Of-J

COMPANY BACKGROUND Incorporated in 2008, Jinisys Software Inc. was established due to the market demands through Above Infranet Solutions Inc. its subsidiary that is known in communication solutions. Aims to be globally-recognized software solutions provider in the industry, thus, Jinisys is now recognized as reliable partner in customizing, designing and providing a one- stop solution that gives strategic value to your business. Company Vision A globally-recognized software solutions provider. Company Mission Deliver world-class business solutions and software outsourcing services. Provide leading-edge solutions for the hospitality industry. Employ bleeding-edge technologies in creating products and services that gives strategic value to the business. Corporate Values Our Corporate Culture provides growth and development opportunities for all employees, committed to fulfilling the organization’s vision and leading how we respond and take actions. TRUSTWORTHINESS We can be relied upon to do what we say by acting with honesty, sense of duty, moral principles and highest standard of ethics. CUSTOMER SUCCESS We believe that developing a long-term business relationship with our customers is essential to our mutual success. EXCELLENCE Stimulate product innovations in order to provide the industry with leading- edge solution. QUALITY We ensure quality in all products and services that we deliver SERVICES Above Infranet Solutions & Jinisys Software provides diverse and scalable ICT and telecommunications technology solutions that suit any size of business communications network need. It includes design, installation and maintenance of standalone or distributed PBX/IP PBX systems that integrates standards based TDM and IP; PSTN, GSM and IP trunks; digital and analog phones; IP telephones and Soft phones; DECT (digitally enhanced cordless telecommunications); Voice Over WLAN, auto attendant and voice mail; call accounting and hotel system interfaces; hotel management Software solutions, paging system; building security system and etc. -

Alp Sales Directory Area Manager

ALP SALES DIRECTORY AREA MANAGER Provides standard term computation sheets, availability, and project information Assists sellers and clients for on-site visits Handles manual holding of lots and units Oversees project inventory per area/geography GEM SY ABBY FONTE JONATHAN TAN JOHN CORDA MOBILE NO. (0917) 530 8100 (0917) 821 3477 (0917) 855 4877 (0917) 544 0358 E-MAIL sy.gem@ fonte.abby@ tan.jonathan@ corda.john@ ayalaland.com.ph ayalaland.com.ph ayalaland.com.ph ayalaland.com.ph Park Central Towers West Gallery Place Anvaya Cove Arbor Lanes Two Roxas Triangle East Gallery Place Alviera Garden Towers Park Terraces The Suites at One The Courtyards Bonifacio High Street The Alcoves NUVALI Projects Amara One Serendra PROJECTS 1016 Residences Ayala Westgrove Park Point Residences Lio Heights The Enclaves Ayala Greenfield Ayala North Point Estates Verdana Homes Asyana Alegria Hills SITE MANAGER Provides standard term computation sheets, availability, and project information Assists sellers and clients for on-site visits Handles manual holding of lots and units JOHN GO ARNETTE MALATAG JJ GATCHALIAN MOBILE NO. (0917) 827 7510 (0917) 578 0913 (0915) 294 2433 go.john@ malatag.arnette@ gatchalian.jj@ E-MAIL ayalaland.com.ph ayalaland.com.ph ayalaland.com.ph Arbor Lanes Arbor Lanes Park Central Towers PROJECTS West Gallery Place Two Roxas Triangle Park Central Towers East Gallery Place Garden Towers Garden Towers M A K AT I / B G C MIC NAIG JEFF MACASAET BEN UMALI MOBILE NO. (0915) 192 2931 (0917) 329 2558 (0917) 510 2400 naig.mic@ macasaet.jeff@ umali.ben@ E-MAIL ayalaland.com.ph ayalaland.com.ph ayalaland.com.ph PROJECTS Anvaya Cove Ayala Greenfield Estates Ayala Greenfield Estates N O R T H / A G E RICHARD MENDOZA KEL BAUTISTA JERSEY DIEGO CHRISTIAN TAMUNDAY MOBILE NO. -

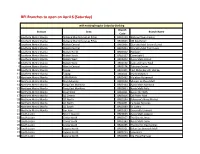

BPI Branches to Open on April 6 (Saturday)

BPI Branches to open on April 6 (Saturday) with existing/regular Saturday Banking Branch Division Area Branch Name Code 1 Southern Metro Manila Alabang Muntinlupa Las Piñas BR00159 Alabang Town Center 2 Southern Metro Manila Alabang Muntinlupa Las Piñas BR00833 SM Southmall 3 Southern Metro Manila Makati Central BR00006 Glorietta Mall Ground Level 4 Southern Metro Manila Makati Central BR00453 Glorietta Mall Third Level 5 Southern Metro Manila Makati North BR00352 Rockwell 6 Southern Metro Manila Makati South BR00157 Greenbelt 5 7 Southern Metro Manila Makati West BR00303 Ayala Malls Circuit 8 Southern Metro Manila Makati West BR00430 Cash and Carry Mall 9 Southern Metro Manila Manila Central BR00174 Tutuban Center 10 Southern Metro Manila Taguig BR01004 Fort Mckinley Hill- Venice 11 Southern Metro Manila Taguig BR00161 Market Market 12 Northern Metro Manila CAMANAVA BR00462 Malabon Fishermall 13 Northern Metro Manila Mandaluyong BR00250 Shangri-La Plaza Mall 14 Northern Metro Manila Pasig East Marikina BR00164 Ayala Malls Marikina 15 Northern Metro Manila Pasig East Marikina BR00804 Ayala Malls Feliz 16 Northern Metro Manila Pasig West BR00411 Ayala The 30th 17 Northern Metro Manila QC Central BR00446 QA Fisher Mall 18 Northern Metro Manila QC North BR00194 Robinson's Nova Market 19 Northern Metro Manila QC North BR00451 Fairview Terraces 20 Northern Metro Manila QC South BR00389 St. Luke's 21 Northern Metro Manila San Juan BR00193 Greenhills Unimart 22 South Luzon Bicol / Quezon BR00066 Ayala Malls Legazpi 23 South Luzon Cavite North BR00357 The District Imus 24 South Luzon Cavite South BR00180 Ayala Malls Serin 25 South Luzon Cavite South BR00285 The District Dasmarinas 26 South Luzon Laguna North BR00221 Biñan Southwoods Mall 27 South Luzon Laguna North BR00233 Solenad 3 28 South Luzon Laguna North BR00898 Sta. -

Alp Sales Directory

ALP SALES DIRECTORY July 2018 AREA MANAGER Manages project inventory per area/geography Administers site/showroom related concerns Assists sellers and clients on and off-site July 2018 GEM SY JONATHAN TAN JOHN CORDA MOBILE NO. (0917) 530 8100 (0917) 855 4877 (0917) 544 0358 sy.gem@ tan.jonathan@ corda.john@ E-MAIL ayalaland.com.ph ayalaland.com.ph ayalaland.com.ph Park Central Towers Garden Towers Anvaya Cove Two Roxas Triangle Arbor Lanes The Suites at One Bonifacio West Gallery Place Project Oasis High Street East Gallery Place The Alcoves Amara The Courtyards PROJECTS 1016 Residences NUVALI Projects Park Point Residences Ayala Westgrove Heights Ayala Greenfield Estates The Enclaves Alegria Hills One Vertis Plaza (Office) Project Bravo (Parklinks) The Residences at Azuela Cove July 2018 SITE MANAGER Manages project inventory per area/geography Administers site/showroom related concerns Assists sellers and clients on and off-site July 2018 ARNETTE MALATAG VICKIE MIRANDA MOBILE NO. (0917) 578 0913 (0917) 862 1006 malatag.arnette@ miranda.vickie@ E-MAIL ayalaland.com.ph ayalaland.com.ph Park Central Towers Park Central Towers PROJECTS Two Roxas Triangle M A K AT I July 2018 JOHN GO PAUL MACALISANG CEASAR “KIDD” BUGTAI MOBILE NO. (0917) 827 7510 (0917) 578 0913 (0995) 756 2641 go.john@ macalisang.paul@ bugtai.caesar@ E-MAIL ayalaland.com.ph ayalaland.com.ph ayalalandpremier.com Arbor Lanes Arbor Lanes Arbor Lanes PROJECTS West Gallery Place East Gallery Place BGC/TAGUIG July 2018 MIC NAIG JEFF MACASAET BEN UMALI MOBILE NO. (0915) 192 2931 (0917) 329 2558 (0917) 510 2400 naig.mic@ macasaet.jeff@ umali.ben@ E-MAIL ayalaland.com.ph ayalaland.com.ph ayalaland.com.ph PROJECTS Anvaya Cove Ayala Greenfield Estates Ayala Greenfield Estates NORTH / AGE July 2018 RICHARD MENDOZA KEL BAUTISTA JERSEY DIEGO CHRISTIAN TAMUNDAY MOBILE NO.