MINERALS and ENERGY Major Development Projects

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Engineering & Mining Journal

Know-How | Performance | Reliability With MineView® and SmartFlow® Becker Mining Systems offers two comprehensive and scalable data management solutions for your Digital Mine. MineView® is a powerful state-of-the-art 3D SCADA system, that analyses incoming data from various mine equipment and visualises it in a 3D mine model. SmartFlow® takes Tagging & Tracking to a new level: collected asset data is centrally processed and smart software analytics allow for process optimization and improved safety. MINEVIEW BECKER MINING SYSTEMS AG We have been at the forefront of technology in Energy Distribution, Automation, Communication, Transportation and Roof Support since 1964. Together with our customers we create and deliver highest quality solutions and services to make operations run more profi tably, reliably and safely. For more information go to www.becker-mining.com/digitalmine Becker Mining is a trademark of Becker Mining Systems AG. © 2018 Becker Mining Systems AG or one of its affi liates. DECEMBER 2018 • VOL 219 • NUMBER 12 FEATURES China’s Miners Promote New Era of Openness and Cooperation Major reforms within the mining sector and the government will foster green mines at home and greater investment abroad ....................................42 Defeating the Deleterious Whether at the head of a circuit or scavenging tailings, today’s flotation innovations address challenges presented by declining grades, rising costs and aging plants ..................................................................................52 Staying on Top of -

View Annual Report

2010 Annual Report We expect to triple our production base by 2015. A SOLID BASE A POSITION OF STRENGTH GroA ROBUST PROJwECT PIPELINE th A nickel A copper A copper-gold A nickel project under deposit in the One of the The 8th largest operation in a operation with construction in new Copperbelt world’s major copper mine in growing mining over 30 years mining-friendly located in undeveloped the world jurisdiction of mine life Finland NW Zambia copper deposits Kansanshi Guelb Moghrein Ravensthorpe Kevitsa Sentinel Haquira First Quantum Minerals Ltd. is a growing mining and metals First Quantum currently The Company’s current company engaged in mineral produces LME grade “A” copper approved copper projects are exploration, development cathode, copper in concentrate, expected to increase annual and mining. The Company’s gold and sulphuric acid and is production by at least 45% objective is to become a on track to become a significant by 2015. In addition, later-stage globally diversified nickel producer by 2012. The exploration projects have mining company. Company's current operations the potential to add a further are the Kansanshi copper-gold 500,000 tonnes of annual mine in Zambia and the Guelb copper production. Moghrein copper-gold mine in Mauritania. In 2010, First Quantum produced 323,017 tonnes of copper, 191,395 ounces of gold and generated $2.4 billion of revenues. Unless otherwise noted, all amounts in this report are expressed in United States dollars. 2010 Annual Report In 2010, our operations continued to provide a solid base to support our growth strategy. -

BHP “Extreme” Consequence Tailings Dams with Potential to Cause Fatality of 100 Employees

BHP “Extreme” consequence tailings dams with potential to cause fatality of 100 employees: Briefing Paper by David Noonan, Independent Environment Campaigner - 22 May 2020 BHP has Questions to answer on Worker Safety, Transparency and Accountability at Olympic Dam BHP took over Olympic Dam copper-uranium mine in 2005, operating the mine for a decade before a GHD “TSF Dam Break Safety Report”1 to BHP in August 2016 concluded all existing Tailings Storage Facilities (TSFs) are “Extreme” consequence tailings dams with a failure potential to cause the death of 100 BHP employees: “BHP OD has assessed the consequence category of the TSFs according to ANCOLD (2012a,b). A dam break study, which considered 16 breach scenarios of TSFs 1 to 5, was completed by GHD (2016) and indicated a potential for tailings and water flow into the mine’s backfill quarry and underground portal. The following conclusions were drawn: • The population at risk (PAR) for a TSF embankment breach is greater than 100 to less than 1000 mine personnel primarily as a result of the potential flow of tailings into the adjacent backfill quarry and entrance to the underground mine. • The financial cost to BHP OD for a tailings dam failure was assessed by BHP OD to be greater than US$1B, a “catastrophic” loss according to ANCOLD guidelines (2012a,b). Based on these criteria, the TSFs at Olympic Dam have been given a consequence category of “Extreme” to guide future assessments and designs. Note that this is an increase compared to the assessment prior to the FY16 Annual Safety Inspection and Review (Golder Associates, 2016a) which classified TSF 1-4 and TSF 5 as “High A” and “High B”, respectively. -

49422 DO PROSPECT SEPT.Indd

WESTERN AUSTRALIA’S INTERNATIONAL RESOURCES DEVELOPMENT MAGAZINE September–November 2004 $3 (inc GST) Nickel Kambalda reborn Discoveries: The search takes off Kwinana’s golden anniversary DEPARTMENT OF INDUSTRY AND RESOURCES Investment Services 168 St Georges Terrace PERTH Western Australia 6000 Postal address: Box 7606 • Cloisters Square Perth Western Australia 6850 FROM THE MINISTER Tel: +61 8 9327 5555 • Fax: +61 8 9222 3862 Email: [email protected] www.doir.wa.gov.au New hi-tech airborne geological survey INTERNATIONAL OFFICES Europe European Offi ce • 5th fl oor, Australia Centre he Western Australian Government’s However, while Corner of Strand and Melbourne Place A$12million hi-tech airborne our resources sector LONDON WC2B 4LG • UNITED KINGDOM geological survey program will is vital to our State’s Tel: +44 20 7240 2881 • Fax: +44 20 7240 6637 T Email: [email protected] potentially unlock billions of dollars in economy, nothing is Clive Brown, MLA Minister for State India — Mumbai natural resources and create new jobs more important than Development Western Australian Trade Offi ce and opportunities for current and future ensuring workers return 93 Jolly Maker Chambers No 2 9th fl oor, Nariman Point • MUMBAI 400 021 INDIA generations of Western Australians. home safely. Tel: +91 22 5630 3979/74/78 • Fax: +91 22 5630 3977 The new four-year program is designed Western Australia’s resources sector has Email: [email protected] to double the area of the State covered by a strong and enviable record in protecting India — Chennai Western Australian Trade Offi ce - Advisory Offi ce base-line airborne geophysical data that the health and safety of its workers and the 1 Doshi Regency • 876 Poonamallee High Road provides an image of the rocks beneath number one priority of the industry is to Kilpauk • Chennai 600 084 • INDIA soil and sand cover. -

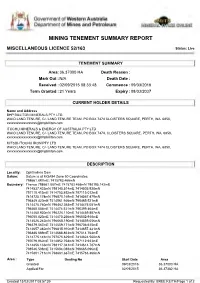

Mining Tenement Summary Report

Government of Western Australia Department of Mines and Petroleum MINING TENEMENT SUMMARY REPORT MISCELLANEOUS LICENCE 52/163 Status: Live TENEMENT SUMMARY Area: 36.37000 HA Death Reason : Mark Out : N/A Death Date : Received : 02/09/2015 08:33:48 Commence : 09/03/2016 Term Granted : 21 Years Expiry : 08/03/2037 CURRENT HOLDER DETAILS Name and Address BHP BILLITON MINERALS PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] ITOCHU MINERALS & ENERGY OF AUSTRALIA PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474, CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] MITSUI-ITOCHU IRON PTY LTD WAIO LAND TENURE, C/- LAND TENURE TEAM, PO BOX 7474 CLOISTERS SQUARE, PERTH, WA, 6850, [email protected] DESCRIPTION Locality: Ophthalmia Dam Datum: Datum is at MGA94 Zone 50 Coordinates. 798661.887mE; 7415783.466mN Boundary: Thence 798661.887mE 7415783.466mN 798195.142mE 7414537.433mN 798145.514mE 7414505.938mN 797110.415mE 7414753.892mN 797115.012mE 7414725.174mN 796870.169mE 7414567.479mN 796849.420mE 7414561.946mN 796465.521mE 7414475.760mN 796462.363mE 7414475.051mN 796460.004mE 7414474.521mN 796399.464mE 7414460.930mN 796226.110mE 7414459.887mN 796050.820mE 7414470.256mN 796032.918mE 7414526.242mN 796068.190mE 7414559.056mN 796379.567mE 7414559.171mN 796736.615mE 7414657.382mN 796815.910mE 7414657.431mN 796886.689mE 7414688.863mN 797014.764mE 7414775.141mN 797075.629mE 7414824.500mN 797079.962mE 7414852.758mN 797112.933mE 7414856.133mN -

Closure Management and Rehabilitation Plan Olympic Dam

CLOSURE MANAGEMENT AND REHABILITATION PLAN OLYMPIC DAM May 2019 Copyright BHP is the sole owner of the intellectual property contained in any documentation bearing its name. All materials including internet pages, documents and online graphics, audio and video, are protected by copyright law. Apart from any fair dealing for the purposes of private study, research, criticism or review as permitted under the provisions of the Copyright Act 1968, no part of this document may be reproduced, transmitted in any form or re-used for any commercial purposes whatsoever without the prior written permission of BHP. This document represents the status of the topic at the date shown and is subject to change without notice. The latest version of this document is available from Document Control. © 2019 BHP. All rights reserved. This document is uncontrolled when printed. This Closure and Rehabilitation Plan has been prepared as information only and is not to be relied on as final or definitive. It would continue to be developed and would be subject to change. BHP Olympic Dam Closure Management and Rehabilitation Plan Closure Management Plan Summary Olympic Dam Mine Project Olympic Dam Document Title Olympic Dam Mine Closure Management and Rehabilitation Plan Document Reference 99232 Mining Tenements Special Mining Lease 1 Company Name BHP Billiton Olympic Dam Corporation Pty Ltd Electronic Approval Record Business Role Name Authors Role Name Principal Strategic Planning Don Grant Principal Environment A&I Murray Tyler Principal Closure Planning Craig Lockhart Reviewer Role Name Manager Closure Planning Rebecca Wright Superintendent Environment, Radiation and Occupational Hygiene James Owen Principal Legal Zoe Jones Approver Role Name Head of Environment Analysis and Improvement Gavin Price Head of Geoscience and Resource Engineering Amanda Weir Asset President Olympic Dam Laura Tyler Document Amendment Record Version. -

Notice of Meeting for Approval of the Proposed Transaction with BBIG

30 January 2020 ASX ANNOUNCEMENT Notice of Meeting for approval of the Proposed Transaction with BBIG Flinders Mines Limited (ASX:FMS) (Flinders) is pleased to announce the release of the attached notice of meeting, including an explanatory memorandum and independent expert's report (Notice of Meeting) in respect of an Extraordinary General Meeting (EGM) to consider the proposed transaction with BBI Group Pty Ltd (BBIG) to form an incorporated joint venture for the development of Flinders' Pilbara Iron Ore Project (PIOP), as announced on 28 November 2019 (Proposed Transaction). The Proposed Transaction represents the outcome of extensive commercial negotiations conducted by the Company’s independent PIOP Infrastructure Committee with BBIG to provide an infrastructure solution, facilitate the development of the PIOP and provide a pathway to market. Vote in favour of the Proposed Transaction The Independent Flinders Directors (Neil Warburton, The Hon. Cheryl Edwardes AM and James Gurry) unanimously recommend that Flinders shareholders vote in favour of the Proposed Transaction in the absence of a superior proposal. The Independent Flinders Directors appointed Grant Samuel as independent expert to consider and provide an opinion on the Proposed Transaction. The independent expert has concluded that the Proposed Transaction is fair and reasonable to non-associated Flinders shareholders, i.e. those shareholders other than TIO (NZ) Pty Ltd (TIO), Flinders’ largest shareholder and also a shareholder of BBIG. TIO will also be excluded from voting in favour of the Proposed Transaction. Ms Edwardes, Deputy Chair and Chair of Flinders’ PIOP Infrastructure Committee, said: “I am very pleased with the outcome of the negotiations with BBIG. -

Public Affairs Parliament House PERTH WA 6000 \

12 November 2009 Hon Brian Ellis MLC BY EMAIL: [email protected] Chairman Standing Committee on Environment and Public Affairs Parliament House PERTH WA 6000 \ Dear Mr Ellis RE: Submission-Petition No. 45 Esperance Anglican Community School, kirrars 11 and 1 10/ I thank you for the opportunity to make a submission on the petition relating Derance Anglica -•• unity School. The petition is in response to the decision by the Minister for Education not to a . 6 tile 'm of the condition on the registration of the Esperance Anglican Community School (EACS) for Year 11/12 in 201.1, ason given by the Minister was that such an action would have a detrimental effect on the upper secondary (Year 11 and 12) educational program of Esperance Senior High School (ESHS). The petitioners who represent families of Esperance and the surrounding regions serviced by the Esperance Anglican Community School believe that the Minister has erred in her decision and I support the view of the petitioners. The Minister, in making her decision, discussed four main reasons for her conclusion which I will address as follows: 1. Source of Year 11 Cohort for EACS The Minister has concluded that the major source of enrolment for the year 11 cohort would be from ESHS and this would have a detrimental impact on current programmes. However, in spite of the closure of the Ravensthorpe Nickel Mine, enrolments at Esperance Senior High School are significantly up, particularly in Year 11 and 12 in 2009 in comparison to the previous year. Year 11 has 236 students in 2009 compared to 200 in 2008 and Year 12 has 162 in Year 12 compared to 130 in 2008. -

View Annual Report

CREATING TOMORROW TODAY BHP BILLITON LIMITED ANNUAL REPORT 2004 BHP Billiton is the world's largest diversified resources group, operating a unique mix of high-quality assets across the globe. We structure our portfolio of assets into seven customer-oriented groupings called Customer Sector Groups. These are Petroleum, Aluminium, Base Metals, Carbon Steel Materials, Diamonds and Specialty Products, Energy Coal and Stainless Steel Materials. As you will see on the following pages, our commodities are used in a vast range of products, from playful plastics to powerful PCs to super-fast trains. We're proud of the contribution our operations are making to 'creating tomorrow today' while delivering value and sustainable returns for our shareholders. WE CREATE VALUE THROUGH THE DISCOVERY, DEVELOPMENT, CONVERSION AND MARKETING OF NATURAL RESOURCES ANNUAL GENERAL MEETING The Annual General Meeting of BHP Billiton Limited will be held at the Harbourside Auditorium, Sydney Convention and Exhibition Centre, Darling Harbour, Sydney on Friday 22 October 2004 commencing at 11.00 am. ABOUT THIS REPORT BHP Billiton is a Dual Listed Company comprising BHP Billiton Limited and BHP Billiton Plc. The two entities continue to exist BHP Billiton Limited. as separate companies but operate as a combined group known as BHP Billiton. ABN 49 004 028 077. Registered in Australia. The headquarters of BHP Billiton Limited and the global headquarters of the combined BHP Billiton Group are located in Registered Office: Melbourne, Australia. BHP Billiton Plc is located in London, UK. Both companies have identical Boards of Directors and are 180 Lonsdale Street, run by a unified management team. -

Threatening Lives, the Environment and People's Future

other sides to the story Threatening lives, the environment and people’s future An Alternative Annual Report 2010 FRONT COVER: Stockphoto.com INSIDE BACK COVER: BHP Billiton protest. Photo courtesy of the ACE Collective, Friends of the Earth Melbourne. BACK COVER: Mine tailings at the BHP Billiton’s Olympic Dam Mine in South Australia (2008). Photo: Jessie Boylan BELOW: Nickel laterite ore being loaded at Manuran Island, Philipines. The ore is then taken by barge to waiting ships. Credit: CT Case studies questioning BHP Billiton’s record on human rights, transparency and ecological justice CONTENTS Introduction 2 BHP Billiton Shadow Report: Shining a light on revenue flows 3 MOZAMBIQUE: The double standards of BHP Billiton 4 WESTERN SAHARA: Bou Craa phosphate mine 6 PHILIPPINES: BHP Billiton pulls out of Hallmark Nickel 7 CAMBODIA: How “tea-money” got BHP-Billiton into hot water 8 PAPUA NEW GUINEA: Ok Tedi – a legacy of destruction 9 BORNEO: Exploiting mining rights in the Heart of Borneo 11 BHP Billiton Around the World 12 COLOMBIA: Cerrejon Coal mine 14 SOUTH AUSTRALIA: Olympic Dam Mine 16 WESTERN AUSTRALIA: Yeelirrie ‘Wanti - Uranium leave it in the ground’ 18 WESTERN AUSTRALIA: Hero or destroyer 20 NEW SOUTH WALES, AUSTRALIA: Farmers triumph 20 Conclusion 21 Footnotes 23 Credits 24 | 1 | BHP Billiton Alternative Annual Report 2010 This report examines a number of BHP Billiton’s activities must not take place. To date, BHP Billiton has operations around the world. The collection of merely noted that there are “a wide diversity of views” on case studies highlights the disparity between BHP FPIC, and fails to rise to the challenge needed to genuinely Billiton’s ‘Sustainability Framework’ and the reality implement it. -

Ravensthorpe Nickel BHP Billiton Project Opens on South Coast Resources Education Partnerships Formed for Industry's Future

WESTERN AUSTRALIA’S INTERNATIONAL RESOURCES DEVELOPMENT MAGAZINE June - August 2008 $3 (inc GST) Ravensthorpe Nickel BHP Billiton project opens on south coast Print post approved PP 665002/00062 approved Print post Resources education Partnerships formed for industry’s future DEPARTMENT OF INDUSTRY AND RESOURCES Investment Services 1 Adelaide Terrace East Perth, Western Australia 6004 Tel: +61 8 9222 3333 • Fax: +61 8 9222 3862 Email: [email protected] www.doir.wa.gov.au INTERNATIONAL OFFICES Europe European Office • 5th floor, Australia Centre Corner of Strand and Melbourne Place London WC2B 4LG • UNITED KINGDOM Tel: +44 20 7240 2881 • Fax: +44 20 7240 6637 Email: [email protected] India — Mumbai Western Australian Trade Office 93 Jolly Maker Chambers No 2 9th floor, Nariman Point • Mumbai 400 021 • INDIA Tel: +91 22 6630 3973 • Fax: +91 22 6630 3977 Email: [email protected] India — Chennai Western Australian Trade Office - Advisory Office 1 Doshi Regency • 876 Poonamallee High Road Kilpauk • Chennai 600 084 • INDIA Tel: +91 44 2640 0407 • Fax: +91 44 2643 0064 Email: [email protected] Indonesia — Jakarta Facing up to the challenges Western Australia Trade Office Wisma Budi Building Floor 5 Suite 504 JI H R Rasuna Said Kav C-6 Kuningan, Jakarta 12940 • INDONESIA Tel: +62 21 5290 2860 • Fax: +62 21 5296 2722 It seems strange to talk of the challenges facing the Western Australian Email: [email protected] resources industry when the sales value of minerals and petroleum from the Japan — Tokyo Government of Western Australia, Tokyo Office State jumped 7 per cent last year to A$53.1 billion, and spending on exploration 13th floor, Fukoku Seimei Building for new resources was a record at more than A$3 billion. -

BHP Billiton: Dirty Energy

dirty energy Alternative Annual Report 2011 Contents Introduction 1 BHP Global mining operations – dirty energy investments 3 Coal BHP Billiton in Colombia: Destroying communities for coal 4 BHP Billiton in Indonesia: Going for Deadly Coal in Indonesia 7 BHP Billiton in Australia: When too much in!uence is never enough 8 BHP Billiton Australia: Coal mine workers "ght back - Queensland 10 BHP Billiton Australia: BHP battle with farmers - New South Wales 10 Oil and Gas and Greenhouse Gases BHP Billiton globally: Re-carbonising instead of decarbonising 11 BHP Billiton in Australia: Hero or destroyer? 12 Uranium BHP Billiton in Australia: “Wanti” uranium – leave it 13 BHP Billiton in Australia: Irradiating the future 15 BHP Billiton in Indonesia: Mining for REDD a false solution to climate change 18 Solutions? Less mining, more reuse and recycling? 19 Moving into rare earths? 20 Footnotes 22 Introduction “More than 30 million people were displaced in 2010 by environmental and weather-related disasters across Asia, experts have warned, and the problem is only likely to grow worse as cli- mate change exacerbates such problems. Tens of millions more people are likely to be similarly displaced in the future by the effects of climate change, including rising sea levels, floods, droughts and reduced agricultural productivity. Such people are likely to migrate in regions across Asia, and governments must start to prepare for the problems this will create.” – Asian Development Bank Report1 %+3 %LOOLWRQ LV WKH ZRUOG¶V ODUJHVW GLYHUVL¿HG QDWXUDO SROLF\