Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

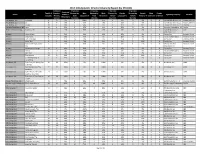

2017 DGA Episodic Director Diversity Report (By STUDIO)

2017 DGA Episodic Director Diversity Report (by STUDIO) Combined # Episodes # Episodes # Episodes # Episodes Combined Total # of Female + Directed by Male Directed by Male Directed by Female Directed by Female Male Female Studio Title Female + Signatory Company Network Episodes Minority Male Caucasian % Male Minority % Female Caucasian % Female Minority % Unknown Unknown Minority % Episodes Caucasian Minority Caucasian Minority A+E Studios, LLC Knightfall 2 0 0% 2 100% 0 0% 0 0% 0 0% 0 0 Frank & Bob Films II, LLC History Channel A+E Studios, LLC Six 8 4 50% 4 50% 1 13% 3 38% 0 0% 0 0 Frank & Bob Films II, LLC History Channel A+E Studios, LLC UnReal 10 4 40% 6 60% 0 0% 2 20% 2 20% 0 0 Frank & Bob Films II, LLC Lifetime Alameda Productions, LLC Love 12 4 33% 8 67% 0 0% 4 33% 0 0% 0 0 Alameda Productions, LLC Netflix Alcon Television Group, Expanse, The 13 2 15% 11 85% 2 15% 0 0% 0 0% 0 0 Expanding Universe Syfy LLC Productions, LLC Amazon Hand of God 10 5 50% 5 50% 2 20% 3 30% 0 0% 0 0 Picrow, Inc. Amazon Prime Amazon I Love Dick 8 7 88% 1 13% 0 0% 7 88% 0 0% 0 0 Picrow Streaming Inc. Amazon Prime Amazon Just Add Magic 26 7 27% 19 73% 0 0% 4 15% 1 4% 0 2 Picrow, Inc. Amazon Prime Amazon Kicks, The 9 2 22% 7 78% 0 0% 0 0% 2 22% 0 0 Picrow, Inc. Amazon Prime Amazon Man in the High Castle, 9 1 11% 8 89% 0 0% 0 0% 1 11% 0 0 Reunion MITHC 2 Amazon Prime The Productions Inc. -

The Aesthetic Sensibility of Indie TV

The Aesthetic Sensibility of Indie TV Graig Uhlin, Oklahoma State University The 2008 financial crisis helped to usher in the end of the Sundance-Miramax era of American independent filmmaking by collapsing its funding model. Investment capital dried up, financing through advanced sales to foreign markets remained available only to select filmmakers, and a number of studio specialty divisions closed their doors. Television and streaming services stepped into this gap to provide indie film personnel more stable sources of distribution and exhibition. If we adhere to a definition of “indie” based on economics, then this transition has been a relatively smooth one: television productions have found ways to successfully translate the practices of indie film to successful shows. Take, for an example, the TBS series Search Party. Its creators Sarah-Violet Bliss and Charles Rogers previously directed the 2014 indie film Fort Tilden, a caustic take on the vapid elements of Brooklyn hipster culture, then were recruited to television by writer-producer Michael Showalter. Search Party is the first self-financed project from Jax Media, founded in 2011, and newly purchased by Imagine Entertainment. Jax is known for its auteur comedies – among them, Broad City and Difficult People – and its success partly stems from utilizing indie film’s small-scale budgeting strategies. Jax guarantees creative autonomy to marketable talent by keeping production costs low (typically $750,000 per episode). It limits shooting days and writing staffs, and incentivizes talent by funneling unspent budget back into the show. This streamlined approach is directly modeled on indie film (the Search Party producers routinely raise this comparison), demonstrating how indie film personnel have adapted to a shifting media landscape, in the absence of viable paths to stable work in filmmaking. -

Report by Signatory Company

2017 DGA Episodic Director Diversity Report (by SIGNATORY COMPANY) Combined # Episodes # Episodes # Episodes # Episodes Combined Total # of Female + Directed by Male Directed by Male Directed by Female Directed by Female Male Female Signatory Company Title Female + Network Episodes Minority Male Caucasian % Male Minority % Female Caucasian % Female Minority % Unknown Unknown Minority % Episodes Caucasian Minority Caucasian Minority 50/50 Productions, LLC Workaholics 10 2 20% 8 80% 2 20% 0 0% 0 0% 0 0 Comedy Central ABC Studios American Crime 8 6 75% 2 25% 0 0% 2 25% 4 50% 0 0 ABC ABC Studios American Housewife 22 8 36% 13 59% 2 9% 5 23% 1 5% 1 0 ABC ABC Studios Catch, The 10 5 50% 5 50% 2 20% 2 20% 1 10% 0 0 ABC ABC Studios Code Black 16 4 25% 12 75% 1 6% 2 13% 1 6% 0 0 CBS ABC Studios Criminal Minds 22 9 41% 13 59% 5 23% 4 18% 0 0% 0 0 CBS ABC Studios Criminal Minds: Beyond 13 7 54% 6 46% 3 23% 4 31% 0 0% 0 0 CBS Borders ABC Studios Devious Maids 10 6 60% 4 40% 2 20% 4 40% 0 0% 0 0 Lifetime ABC Studios Grey's Anatomy 24 15 63% 9 38% 3 13% 2 8% 10 42% 0 0 ABC ABC Studios How To Get Away With 15 10 67% 5 33% 2 13% 3 20% 5 33% 0 0 ABC Murder ABC Studios Quantico 22 6 27% 16 73% 1 5% 4 18% 1 5% 0 0 ABC ABC Studios Real O'Neals, The 16 7 44% 9 56% 3 19% 3 19% 1 6% 0 0 ABC ABC Studios Scandal 16 9 56% 7 44% 1 6% 3 19% 5 31% 0 0 ABC Alameda Productions, LLC Love 12 4 33% 8 67% 0 0% 4 33% 0 0% 0 0 Netflix Altered Carbon Productions, LLC Altered Carbon 10 3 30% 7 70% 1 10% 2 20% 0 0% 0 0 Netflix And Action LLC Tyler Perry's If Loving You 22 22 100% 0 0% 22 100% 0 0% 0 0% 0 0 OWN is Wrong And Action LLC Tyler Perry's Love Thy 22 22 100% 0 0% 22 100% 0 0% 0 0% 0 0 OWN Neighbor And Action LLC Tyler Perry's The Haves 23 23 100% 0 0% 23 100% 0 0% 0 0% 0 0 OWN and the Have Nots And Action LLC Tyler Perry's Too Close to 16 16 100% 0 0% 16 100% 0 0% 0 0% 0 0 TLC Home Atlantic 2.1 Entertainment Group, Genius 10 4 40% 6 60% 2 20% 2 20% 0 0% 0 0 National Inc. -

Stash03 18494 Maya6 Stash Ad 5/5/04 10:41 AM Page 1 Yes, It’S True

DVD MAGAZINE Outstanding animation, VFX and motion graphics for design and advertising stash03 18494_Maya6_Stash Ad 5/5/04 10:41 AM Page 1 Yes, it’s true. Stash is off to a rip-snorting start. Our third issue, code named Stash 03, will land on the desks of visually acute stashDVD MAGAZINE and well-adjusted professionals in 30 countries on six contients - thank you Kuwait, Cypress and Nigeria. Those desks belong STASH MEDIA INC. to ad agencies, broadcasters, animation studios, post houses, Editor: STEPHEN PRICE producers, directors, creative directors, art directors, copywriters, Publisher: GREG ROBINS Associate editor: HEATHER GRIEVE editors, animators, designers, students and a dental receptionist DVD production: METROPOLIS DVD, in Dallas taking Maya and After Effects classes at night - thank New York you Maureen. This issue will also be available at discerning yet Animation: KYLE SIM, TOPIX, Toronto Toolkit: 3DS Max, Inferno friendly online retailers and terrestrial bookstores in New York, Music: TREVOR MORRIS, Toronto, Los Angeles, Vancouver and Singapore with London to Media Ventures, Santa Monica follow soon. Thanks: CHEYENNE, MAYA, NICOLE, JASON, TYLER, RADIOIO.COM Cover Image: Honda “Grrr” courtesy NEXUS PRODUCTIONS, London But wait, there’s more - we just renovated the website, rented Stash toolkit: Illustrator, Photoshop, InDesign, Transmit, Powerbook G4s, sunny new digs at Broadway and 12th from real nice people and Helvetica Neue, DIN Mittellschrift retained the multi-talented Heather G to keep us sane. Instructions: Fluff with a fork. SUBSCRIBE at www.stashmedia.tv Looks like this would be the time to get those submissions in Legal things: Stash Magazine and Stash DVD are published 12 times per year by Stash ‘cause I’m in a really good mood. -

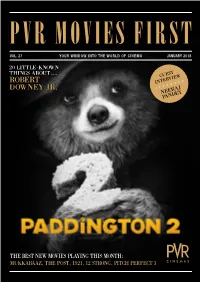

Robert Downey Jr

PVR MOVIES FIRST VOL. 27 YOUR WINDOW INTO THE WORLD OF CINEMA JANUARY 2018 20 LITTLE-KNOWN THINGS ABOUt…. GUEST RVIEW ROBERT INTE DOWNEY JR. RAJ NEE EY PAND THE BEST NEW MOVIES PLAYING THIS MONTH: MUKKABAAZ, THE POST, 1921, 12 STRONG, PITCH PERFECT 3 GREETINGS ear Movie Lovers, We rewind to “ Scent of a Woman, “ the 1992 film that earned Al Pacino his first Oscar for his portrayal of a Here’s the January edition of Movies First, your exclusive cantankerous colonel. window to the world of cinema. T race the fast-rising career graph of American writer- Th e year kickstarts with “ Paddington 2”, a fabulous follow director Alex Garland , and join us in wishing superstar up to Paul King’s superhit animation comedy. Watch Nicholas Cage a Happy Birthday. out for Hugh Grant’s scene-stealing turn as an appalling villain, and the non-stop side-splitting gags. We really hope you enjoy the issue. Wish you a fabulous month of movie watching. Neeraj Pandey’s much awaited “Aiyaary” arrives on screen, and we have the man himself telling us what to Regards expect from this intense patriotic thriller. Akshay Kumar plays “ Pad Man ,” which tackles a bold and beautiful Gautam Dutta social subject. CEO, PVR Limited USING THE MAGAZINE We hope youa’ll find this magazine easy to use, but here’s a handy guide to the icons used throughout anyway. You can tap the page once at any time to access full contents at the top of the page. PLAY TRAILER SET REMINDER BOOK TICKETS SHARE PVR MOVIES FIRST PAGE 2 CONTENTS This January everyone’s favourite bear is back for seconds. -

Viscosity from Newton to Modern Non-Equilibrium Statistical Mechanics

Viscosity from Newton to Modern Non-equilibrium Statistical Mechanics S´ebastien Viscardy Belgian Institute for Space Aeronomy, 3, Avenue Circulaire, B-1180 Brussels, Belgium Abstract In the second half of the 19th century, the kinetic theory of gases has probably raised one of the most impassioned de- bates in the history of science. The so-called reversibility paradox around which intense polemics occurred reveals the apparent incompatibility between the microscopic and macroscopic levels. While classical mechanics describes the motionof bodies such as atoms and moleculesby means of time reversible equations, thermodynamics emphasizes the irreversible character of macroscopic phenomena such as viscosity. Aiming at reconciling both levels of description, Boltzmann proposed a probabilistic explanation. Nevertheless, such an interpretation has not totally convinced gen- erations of physicists, so that this question has constantly animated the scientific community since his seminal work. In this context, an important breakthrough in dynamical systems theory has shown that the hypothesis of microscopic chaos played a key role and provided a dynamical interpretation of the emergence of irreversibility. Using viscosity as a leading concept, we sketch the historical development of the concepts related to this fundamental issue up to recent advances. Following the analysis of the Liouville equation introducing the concept of Pollicott-Ruelle resonances, two successful approaches — the escape-rate formalism and the hydrodynamic-mode method — establish remarkable relationships between transport processes and chaotic properties of the underlying Hamiltonian dynamics. Keywords: statistical mechanics, viscosity, reversibility paradox, chaos, dynamical systems theory Contents 1 Introduction 2 2 Irreversibility 3 2.1 Mechanics. Energyconservationand reversibility . ........................ 3 2.2 Thermodynamics. -

ANNIE GUIDICE Editor

ANNIE GUIDICE Editor PROJECTS Partial List DIRECTORS STUDIOS/PRODUCERS MAID John Wells WARNER BROS. TV / NETFLIX Season 1 Molly Smith Metzler, Terri Murphy, John Wells, Margot Robbie A LOT OF NOTHING Mo McRae ANONYMOUS CONTENT Feature Film Zak Kristofek, Ethan Lazar David Oyelowo BETTER THINGS Pamela Adlon 3 ARTS ENTERTAINMENT / FX Season 4 Erica Sterne, Nisha Ganatra, Dave Becky Blair Breard, Joanne Toll DARE ME Various Directors UNIVERSAL / USA Season 1 Gina Fattore, Megan Abbott, Peter Berg TOO OLD TO DIE YOUNG Nicolas Winding Refn AMAZON Season 1 Ed Brubaker, Brendan Garst Jeffrey Stott LOST TRANSMISSIONS Katharine O’Brien ROYAL ROAD ENTERTAINMENT Feature Film - Additional Editing Filip Jan Rymsza, Alyssa Swanzey Tribeca Film Festival SIMPLE WEDDING Sara Zandieh MAINSTAY ENTERTAINMENT Feature Film Rita Wilson, Shohreh Aghdashloo Norman Aladjem, Ray Moheet STRONGER David Gordon Green MANDEVILLE / BOLD FILMS Feature Film ROADSIDE ATTRACTIONS Additional Editor Jake Gyllenhaal, Riva Marker David Hoberman, Todd Lieberman THE BOSS Ben Falcone GARY SANCHEZ PRODUCTIONS Feature Film UNIVERSAL Visual Effects Editor Adam McKay, Melissa McCarthy Ben Falcone PITCH PERFECT 2 Elizabeth Banks BROWNSTONE PRODUCTIONS Feature Film UNIVERSAL Visual Effects Editor Elizabeth Banks, Max Handelman Paul Brooks FREAKS OF NATURE Robbie Pickering COLUMBIA PICTURES Feature Film Jonah Hill, Ron Schmidt, Matt Tolmach Visual Effects Editor THIS IS IT Kenny Ortega COLUMBIA PICTURES Feature Film Michael Bearden, John Branca Digital Content Specialist Todd Cogan FIRED! Chris Bradley SHOUT! FACTORY INTERNATIONAL Feature Film Kyle LaBrache FILM CIRCUIT Richard Foos, Annabelle Additional Editing Gurwitch INNOVATIVE-PRODUCTION.COM | 310.656.5151 . -

Heather Farah Resume Art Director

HEATHER FARAH ART DIRECTOR 424.835.0608 [email protected] Art Directors Guild IATSE 800 Features Director/Production Company London Fields Mathew Cullen/Cream Rises Art Director - Los Angeles (2014) Snabba Cash-Livet Deluxe Jens Jonsson/Tre Vänner Art Director - Los Angeles (2013) Television Director/Production Company Gordon Ramsay’s Hotel Britannia Rupert Jones/US Production Services Art Director - Los Angeles (2012) The Head Huntress Roy Bank (EP)/Merv Griffin Entertainment Art Director (2011) Germany’s Next Top Model Thomas Hayo/Tresor Assistant Art Director (2011) Commercials & Promos (Partial List) Director/Production Company The Interview Promo Seth Rogen/Good Hustle Productions 2014 MTV’s Sex Tape Promo Ivan Gold/Good Hustle Productions 2014 CA Lottery Mathew Cullen/Motion Theory 2014 Wendy’s Chris Leone, Chris Reihl/Motion Theory 2014 Neighbors Promo Dan Appel/Bacon & Sons 2014 USA Network Mondo LA & NY Chris Weinstein/Still Films 2014 Dig Promo Andy Meyers/M3 Creative 2014 Top Gear Dan Appel/Bacon & Sons 2014 Jeep Dan Appel/Bacon & Sons 2014 eHarmony David Brandvik/Armada 2013 Modern Family Promo Chris McKenna/Wee Beastie 2013 Benjamin Moore Dan Appel/Bacon & Sons 2013 Moen Roderick Beltran/Armada 2013 Tylenol Dan Appel/Bacon & Sons 2013 Counting Cars Dan Appel/Bacon & Sons 2013 Hershey’s Roderick Beltran/Armada 2013 Horizon Promo Adam Reid/Bodega 2013 Ancestry.com Dan Appel/Bacon & Sons 2013 Google Chrome Todd Krolczyk/Arts and Sciences 2013 Togos Luke Savage/Bully Pictures 2012 Inova: DNA Chris Reihl/Motion Theory 2012 -

Byronecho2136.Pdf

THE BYRON SHIRE ECHO Advertising & news enquiries: Mullumbimby 02 6684 1777 Byron Bay 02 6685 5222 seven Fax 02 6684 1719 [email protected] [email protected] http://www.echo.net.au VOLUME 21 #36 TUESDAY, FEBRUARY 20, 2007 echo entertainment 22,300 copies every week Page 21 $1 at newsagents only YEAR OF THE FLYING PIG Fishheads team wants more time at Brothel approval Byron Bay swimming pool goes to court Michael McDonald seeking a declaration the always intended ‘to hold Rick and Gayle Hultgren, development consent was activities involving children’ owners of the Byron Enter- null and void. rather than as for car parking tainment Centre, are taking Mrs Hultgren said during as mentioned in the staff a class 4 action in the Land public access at Council’s report. and Environment Court meeting last Thursday that ‘Over 1,000 people have against Byron Shire Coun- councillors had not been expressed their serious con- cil’s approval of a brothel aware of all the issues cern in writing. Our back near their property in the involved when considering door is 64 metres away from Byron Arts & Industry the brothel development the brothel in a direct line of Estate. An initial court hear- application (DA). She said sight. Perhaps 200 metres ing was scheduled for last their vacant lot across the would be better [as a Council Friday, with the Hultgrens street from the brothel was continued on page 2 Fishheads proprietors Mark Sims and Ralph Mamone at the pool. Photo Jeff Dawson Paragliders off to world titles Michael McDonald dispute came to prominence requirement for capital The lessees of the Byron Bay again with Cr Bob Tardif works. -

2009 Annual Report

2009 ANNUAL REPORT Table of Contents Letter from the President & CEO ......................................................................................................................5 About The Paley Center for Media ................................................................................................................... 7 Board Lists Board of Trustees ........................................................................................................................................8 Los Angeles Board of Governors ................................................................................................................ 10 Media Council Board of Governors ..............................................................................................................12 Public Programs PALEYDOCEVENTS ..................................................................................................................................14 INSIDEMEDIA Events .................................................................................................................................15 PALEYDOCFEST .......................................................................................................................................19 PALEYFEST: Fall TV Preview Parties ..........................................................................................................20 PALEYFEST: William S. Paley Television Festival ..........................................................................................21 Robert M. -

Emmy Nominations

2021 Emmy® Awards 73rd Emmy Awards Complete Nominations List Outstanding Animated Program Big Mouth • The New Me • Netflix • Netflix Bob's Burgers • Worms Of In-Rear-Ment • FOX • 20th Century Fox Television / Bento Box Animation Genndy Tartakovsky's Primal • Plague Of Madness • Adult Swim • Cartoon Network Studios The Simpsons • The Dad-Feelings Limited • FOX • A Gracie Films Production in association with 20th Television Animation South Park: The Pandemic Special • Comedy Central • Central Productions, LLC Outstanding Short Form Animated Program Love, Death + Robots • Ice • Netflix • Blur Studio for Netflix Maggie Simpson In: The Force Awakens From Its Nap • Disney+ • A Gracie Films Production in association with 20th Television Animation Once Upon A Snowman • Disney+ • Walt Disney Animation Studios Robot Chicken • Endgame • Adult Swim • A Stoopid Buddy Stoodios production with Williams Street and Sony Pictures Television Outstanding Production Design For A Narrative Contemporary Program (One Hour Or More) The Flight Attendant • After Dark • HBO Max • HBO Max in association with Berlanti Productions, Yes, Norman Productions, and Warner Bros. Television Sara K. White, Production Designer Christine Foley, Art Director Jessica Petruccelli, Set Decorator The Handmaid's Tale • Chicago • Hulu • Hulu, MGM, Daniel Wilson Productions, The Littlefield Company, White Oak Pictures Elisabeth Williams, Production Designer Martha Sparrow, Art Director Larry Spittle, Art Director Rob Hepburn, Set Decorator Mare Of Easttown • HBO • HBO in association with wiip Studios, TPhaeg eL o1w Dweller Productions, Juggle Productions, Mayhem Mare Of Easttown • HBO • HBO in association with wiip Studios, The Low Dweller Productions, Juggle Productions, Mayhem and Zobot Projects Keith P. Cunningham, Production Designer James F. Truesdale, Art Director Edward McLoughlin, Set Decorator The Undoing • HBO • HBO in association with Made Up Stories, Blossom Films, David E. -

DVD MAGAZINE Outstanding Animation, VFX and Motion Graphics for Design and Advertising 15 ��������������������

DVD MAGAZINE Outstanding animation, VFX and motion graphics for design and advertising 15 �������������������� ������������������������������������������������������������������������������� ��������������������������������������������������������������������������������� ������������������������������������������������������������������������������ �������� ������� �������� ������������ ������� ��������������� ������� ��� �������� ������������������������������������������������������������������������������ ������������������������������������������������ �������������������������������������������������������������������������������� ��������������������������������������������������������������������������������� ������������������� ������������������������������������������������������������������������������� ������������������������������������������������������������������������������������ ���������������������������������������������������������������������������������� �������������������������������������������������������������������������������� ������������������������������������������������������������������������������ �������������������������������������������������������������������������������������� ������������������������ ��������������������������������������������������������������������� �������������������������� ���������������������������������� �������������������� ����������������������������������������� ���������������������������������������� �������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������������