Semiannual Report to Congress

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(SSN) Verification: Policy, Process, and Recommendations, a Report of the SSN Verification Sub-Team to the Enumeration Response Team, September 2003

Description of document: Social Security Number (SSN) Verification: Policy, Process, and Recommendations, A Report of the SSN Verification Sub-Team to the Enumeration Response Team, September 2003 Requested date: 28-December-2016 Released date: 12-July-2017 Posted date: 18-June-2018 Source of document: Social Security Administration Office of Privacy and Disclosure 617 Altmeyer Building 6401 Security Boulevard Baltimore, MD 21235 The governmentattic.org web site (“the site”) is noncommercial and free to the public. The site and materials made available on the site, such as this file, are for reference only. The governmentattic.org web site and its principals have made every effort to make this information as complete and as accurate as possible, however, there may be mistakes and omissions, both typographical and in content. The governmentattic.org web site and its principals shall have neither liability nor responsibility to any person or entity with respect to any loss or damage caused, or alleged to have been caused, directly or indirectly, by the information provided on the governmentattic.org web site or in this file. The public records published on the site were obtained from government agencies using proper legal channels. Each document is identified as to the source. Any concerns about the contents of the site should be directed to the agency originating the document in question. GovernmentAttic.org is not responsible for the contents of documents published on the website. Refer to: S9H: AR2496 July 12, 2017 This letter is in response to your December 28, 2016 Internet Freedom oflnformation Act (FOIA) request for the 2003 SSN Verification: Policy, Process, and Recommendations - A report of the SSN Verification Sub-Team to the Enumerations Response Team. -

Immigrant Diversity and Social Security: Recent Patterns and Future Prospects

Immigrant Diversity and Social Security: Recent Patterns and Future Prospects MELISSA M. FAVREAULT AUSTIN NICHOLS April 30, 2011 URBAN INSTITUTE 2100 M STREET, N.W. / WASHINGTON D.C. 20037-1231 The research reported herein was pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement Research Consortium (RRC). The findings and conclusions expressed are solely those of the authors and do not represent the views of SSA, any agency of the federal government, the RRC, the Urban Institute, its board, or its funders. We thank Richard Johnson and Juan Pedroza of the Urban Institute, Bill Davis of the Social Security Administration, plus participants in a seminar at the Social Security Administration’s Division of Policy Evaluation in the Office of Research, Evaluation, and Statistics for helpful comments. Thuy Ho of the Social Security Administration facilitated access to the survey data matched to the administrative records. All errors remain our own. ABSTRACT Immigration is transforming the U.S. labor force with important consequences for Social Security’s adequacy and finances. Using longitudinal data from the Survey of Income and Program Participation matched to administrative data on lifetime earnings and benefit receipt, we measure the extent to which nonnatives’ lifetime earning patterns, payroll taxes paid, benefits received, and total incomes differ from those for the U.S.-born population. We consider other outcomes important to retirement security, like health status, marital status, and financial wealth. We also compare various immigrant groups with one another. Our findings stress heterogeneity in labor force and Social Security experiences among immigrants. -

NCHS Record Linkage Program Cdc-Pdf

NCHS Record Linkage Program National Conference on Health Statistics August 16, 2010 NCHS Major Data Systems National Vital Statistics System and surveys Linkage source for death certificate information through the National Death Index National Health Interview Survey (NHIS) National Health and Nutrition Examination Survey (NHANES) National Health Care Surveys National Health Interview Survey Data source Representative in person, in home survey of ≈ 87,500 participants Data applications Health status and disability Insurance coverage Access to and use of health services Extent of illness and disability Immunization Health behaviors Second Longitudinal Study of Aging (LSOA II) Baseline data from 1994 NHIS National Health and Nutrition Examination Survey Data source Standardized physical examinations, laboratory tests, personal interviews with annual sample of 5,000 Data applications Disease or condition prevalence Risk factors Nutrition monitoring Anthropometry Growth and development Disease monitoring National Health Care Surveys Nursing Home Survey (NHHS) Survey of nursing homes and their residents and has been in the field periodically since 1973 Provides information on nursing homes from two perspectives The facilities Size, ownership, Medicare/Medicaid certification, services provided and specialty programs offered, and charges The recipients of care Demographic characteristics, health status and medications taken, services received, and sources of payment. 1985, 1995, 1997, and 2004 NNHS have been -

Numerical Identification (NUMIDENT) Files Faqs

Frequently Asked Questions (FAQs) Numerical Identification (NUMIDENT) Files Record Group 47 Updated May 15, 2020 I. Questions about the Numerical Identification (NUMIDENT)Files I.1. What are the Numerical Identification (NUMIDENT) Files? I.2. What NUMIDENT Files has the National Archives received? I.3. What information is in the NUMIDENT Files? I.4. Why were these records created? I.5. What version of the NUMIDENT application records are accessible via AAD? I.6. What version of the NUMIDENT death records are accessible via AAD? I.7. What version of the NUMIDENT claimrecords are accessible via AAD? I.8. What are some of the limitations of the NUMIDENT Records? I.9. Are there plans to correct inaccuracies in the NUMIDENT Records? I.10. How do these records differ from those in the Social Security Death Index (SSDI)? I.11. Why has the National Archives (NARA) released the social security numbers in these records? II. Questions about obtaining vitalrecords and social security records II.1. How can I obtain a copy of a birth or death certificate? II.2. How can I get a copy of the original Social Security application form (SS-5)? III. Questions about searching the NUMIDENT Files and search results via the Access to Archival Databases (AAD) resource III.1. How do I find records in the Application (SS-5),Death, and Claim Files? III.2. How do I search by name? III.3. How do I search by names containing punctuation or spaces? III.4. How do I search by birth or death date? III.5. Why do some dates have an XX, 00, or XXXX for the value and “not captured or reported” or “Invalid Number” for the meaning? III.6. -

DAF) Public Use File (PUF

Overview and Documentation of the Social Security Administration’s Disability Analysis File (DAF) Public Use File (PUF) October 2018 Jody Schimmel Hyde Alex Bryce Cassandra Pickens Jewell Adele Rizzuto Abigail Philip Submitted to: Social Security Administration Office of Retirement and Disability Policy Office of Program Development and Research Washington, DC 20024-2796 Project Officers: Paul O’Leary and Debra Tidwell-Peters Contract Number: SS00-16-60003 Submitted by: Mathematica Policy Research 1100 1st Street, NE 12th Floor Washington, DC 20002-4221 Telephone: (202) 484-9220 Facsimile: (202) 863-1763 Project Director: Cassandra Pickens-Jewell Reference Number: 50214.01.260.490.000 This page has been left blank for double-sided copying. MATHEMATICA POLICY RESEARCH CONTENTS SUGGESTED CITATIONS ........................................................................................................................... 1 I. INTRODUCTION .............................................................................................................................. 3 A. What is the DAF? ...................................................................................................................... 4 B. Which Beneficiaries Have Records in the DAF? ....................................................................... 6 C. Why Work with the DAF? .......................................................................................................... 6 D. How Does the DAF PUF Differ from the DAF? ........................................................................ -

IM 5162 Numident Invalid Matches with Social Security

NORTH DAKOTA DEPARTMENT OF HUMAN SERVICES BISMARCK, NORTH DAKOTA February 7, 2013 IM 5162 TO: County Social Service Directors Economic Assistance Policy Regional Representatives Economic Assistance Policy Quality Control Reviewers FROM: Carol Cartledge, Director, Economic Assistance Policy SUBJECT: NUMIDENT - Invalid Matches with Social Security EFFECTIVE: Immediately PROGRAMS: SNAP, Medicaid, Healthy Steps and TANF RETENTION: Until Manualized SECTIONS AFFECTED: Administrative: 448-01-50-15-60 – NUMIDENT SNAP: 430-05-20-55-15 – Sources of Verification Medicaid: 510-05-35-80 – Social Security Numbers Healthy Steps: 510-07-25-50 - Social Security Number Report MR016-BB–NUMIDENT Non-Verified Report provides the same information as the NUMIDENT alerts that are generated in TECS in Vision. Effective March 2013, this report will no longer be sent to counties. Workers will need to process NUMIDENT alerts based on information in this IM. Administrative Manual On approximately the 4th of each month a file is sent to the Social Security Administration (SSA) containing the social security number, last name, first name, sex and date of birth (mm/yy) of all individuals in TECS and Vision that have not been previously verified by NUMIDENT. SSA returns the NUMIDENT file around the 15th of each month which verifies if client information in TECS and Vision matches with SSA's information for social - 1 - security number, date of birth, gender, and name. When the return NUMIDENT file is processed, the following indicators display in the NUMIDENT field on Client Profile in TECS or Vision with the results of the match: • Blank – means the information has not been sent to Social Security Administration • I – Invalid match for social security number • S – Sent to Social Security Administration for verification • V – Valid match for social security number If the indicator is ‘I’ (invalid) on client profile, one of the following alerts will be generated. -

![Computer Matching and Privacy Protection Act Agreement Between the Social Security Administration and the State of [State Name]](https://docslib.b-cdn.net/cover/5366/computer-matching-and-privacy-protection-act-agreement-between-the-social-security-administration-and-the-state-of-state-name-2375366.webp)

Computer Matching and Privacy Protection Act Agreement Between the Social Security Administration and the State of [State Name]

Model CMPPA Agreement COMPUTER MATCHING AND PRIVACY PROTECTION ACT AGREEMENT BETWEEN THE SOCIAL SECURITY ADMINISTRATION AND THE STATE OF [STATE NAME] I. Purpose and Legal Authority A. Purpose This Computer Matching and Privacy Protection Act (CMPPA) Agreement between the Social Security Administration (SSA) and the State of [STATE NAME] (State) sets forth the terms and conditions governing disclosures of records, information, or data (collectively referred to herein as “data”) made by SSA to various State agencies and departments (State Agencies) that administer federally funded benefit programs, including those under various provisions of the Social Security Act (Act), such as section 1137 (42 U.S.C. § 1320b-7), as well as the state-funded state supplementary payment programs under Title XVI of the Act. The terms and conditions of this Agreement ensure that SSA makes such disclosures of data, and the State uses such disclosed data, in accordance with the requirements of the Privacy Act of 1974, as amended by the CMPPA of 1988, 5 U.S.C. § 552a. Under section 1137 of the Act, the State is required to use an income and eligibility verification system to administer specified federally funded benefit programs, including the state-funded state supplementary payment programs under Title XVI of the Act. To assist the State in determining entitlement to and eligibility for benefits under those programs, as well as other federally funded benefit programs, SSA discloses certain data about applicants (and in limited circumstances, members of an applicant’s household), for state benefits from SSA Privacy Act Systems of Records (SOR) and verifies the Social Security numbers (SSN) of the applicants. -

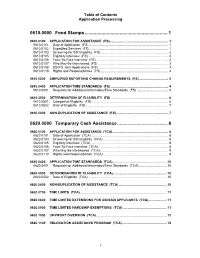

600 Non-Duplication of Assistance (Fs)

Table of Contents Application Processing 0610.0000 Food Stamps ................................................................ 1 0610.0100 APPLICATION FOR ASSISTANCE (FS)................................................................. 1 0610.0101 Date of Application (FS) ........................................................................................ 1 0610.0102 Expedited Services (FS) ....................................................................................... 1 0610.0103 Screening for SSI Eligibility (FS) ........................................................................... 2 0610.0105 Eligibility Interview (FS) ......................................................................................... 2 0610.0106 Face-To-Face Interview (FS) ................................................................................ 2 0610.0107 Who May Be Interviewed (FS) .............................................................................. 3 0610.0108 SSI/FS Joint Applications (FS) .............................................................................. 3 0610.0110 Rights and Responsibilities (FS) ........................................................................... 4 0610.0200 SIMPLIFIED REPORTING CHANGE REQUIREMENTS (FS) ................................ 4 0610.0400 APPLICATION TIME STANDARDS (FS) ................................................................ 4 0610.0401 Requests for Additional Information/Time Standards (FS) ................................... 5 0610.0500 DETERMINATION OF ELIGIBILITY -

Assessing Measurement Error in Medicare Coverage from the National Health Interview Survey Renee Gindi and Robin A

MMRR 2012: Volume 2 (2) Medicare & Medicaid Research Review 2012: Volume 2, Number 2 A publication of the Centers for Medicare & Medicaid Services, Center for Strategic Planning Assessing Measurement Error in Medicare Coverage From the National Health Interview Survey Renee Gindi and Robin A. Cohen National Center for Health Statistics Objectives: Using linked administrative data, to validate Medicare coverage estimates among adults aged 65 or older from the National Health Interview Survey (NHIS), and to assess the impact of a recently added Medicare probe question on the validity of these estimates. Data sources: Linked 2005 NHIS and Master Beneficiary Record and Payment History Update System files from the Social Security Administration (SSA). Study design: We compared Medicare coverage reported on NHIS with “benchmark” benefit records from SSA. Principal findings: With the addition of the probe question, more reports of coverage were captured, and the agreement between the NHIS-reported coverage and SSA records increased from 88% to 95%. Few additional overreports were observed. Conclusions: Increased accuracy of the Medicare coverage status of NHIS participants was achieved with the Medicare probe question. Though some misclassification remains, data users interested in Medicare coverage as an outcome or correlate can use this survey measure with confidence. Keywords: National Health Interview Survey, measurement, Medicare, administrative data, National Center for Health Statistics. doi: http://dx.doi.org/10.5600/mmrr.002.02.a05 Gindi, R., Cohen, R.A. E1 MMRR 2012: Volume 2 (2) Introduction The National Health Interview Survey (NHIS) is a principal source of information on the health of the civilian noninstitutionalized population of the United States. -

Follow-Up Report on Anti-Fraud Efforts Requested at the January 16, 2014 Hearing on Disability Fraud

Enclosure – The Honorable Sam Johnson Follow-up Report on Anti-Fraud Efforts Requested at the January 16, 2014 Hearing On Disability Fraud The Social Security Administration (SSA) administers the Old-Age, Survivors, and Disability Insurance program, commonly referred to as “Social Security,” which protects against loss of earnings due to retirement, death, and disability. Social Security provides a financial safety net for millions of people—few programs touch so many. We also administer the Supplemental Security Income (SSI) program, funded by general revenues, which provides cash assistance to persons who are aged, blind, or disabled, as defined in the Social Security context, with very limited means. The responsibilities with which we have been entrusted are immense in scope. To illustrate, in fiscal year (FY) 2013 we: • Paid over $850 billion to almost 63 million beneficiaries, of whom almost 11 million receive disability insurance benefits; • Handled over 53 million transactions on our National 800 Number Network; • Received over 68 million calls to field offices nationwide; • Served about 43 million visitors in over 1,200 field offices nationwide; • Completed over 8 million claims for benefits and 794,000 hearing dispositions; and • Completed over 429,000 full medical continuing disability reviews (CDRs). Given the scope and importance of our responsibilities, we continually strive to preserve the public’s trust in our programs. Toward that end, we have zero tolerance for fraud. Historically, we have been successful in this regard; the best available evidence shows that the level of actual disability fraud is less than 1 percent.1 Acting Commissioner Carolyn W. Colvin has consistently reinforced her commitment to infuse long-term strategic thinking and planning at SSA, and to implement a more robust approach to performance management and improvement. -

DAF17 Construction Workflow Charts and Task Tables

Anc hor Volume 8: DAF17 Construction Workflow Charts and Task Tables October 2019 Submitted to: Social Security Administration Office of Retirement and Disability Policy Office of Research, Demonstration, and Employment Support Washington, DC 20024-2796 Project Officers: Paul O’Leary and Debra Tidwell-Peters Contract Number: SS00-16-60003 Submitted by: Mathematica 1100 1st Street, NE 12th Floor Washington, DC 20002-4221 Telephone: (202) 484-9220 Facsimile: (202) 863-1763 Project Director: Cassandra Pickens Jewell Reference Number: 50214.03.260.490.000 Suggested Citation: “Disability Analysis File 2017 (DAF17) Documentation: Data from January 1994 through December 2017.” Washington, DC: Mathematica, October 2019. This page has been left blank for double-sided copying. MATHEMATICA CONTENTS GLOSSARY .................................................................................................................................................. V OVERVIEW OF DAF DOCUMENTATION ................................................................................................... IX I. UNDERS TANDING WORKFLOW CHARTS AND TASK TABLES ................................................. 1 A. Workflow charts ............................................................................................................... 1 B. Task tables ....................................................................................................................... 1 C. Le gend for DAF16 Construction Workflow Charts .......................................................... -

Social Security Numbers in Medicaid Records: Reporting and Validity, 2009

Social Security Numbers in Medicaid Records: Reporting and Validity, 2009 Final Report January 15, 2013 John L. Czajka Shinu Verghese This page has been left blank for double-sided copying. Contract Number: Social Security Numbers in HHSM-500-2005-00025I Medicaid Records: Reporting Task Number: HHSM-500-T0002 and Validity, 2009 Mathematica Reference Number: Final Report 06759.410 Submitted to: January 15, 2013 Centers for Medicare & Medicaid Services 7111 Security Blvd., B2-27-00 John L. Czajka Baltimore, MD 21244-1850 Shinu Verghese Project Officer: Cara Petroski Submitted by: Mathematica Policy Research 1100 1st Street, NE 12th Floor Washington, DC 20002-4221 Telephone: (202) 484-9220 Facsimile: (202) 863-1763 Project Director: Julie Sykes This page has been left blank for double-sided copying. ACKNOWLEDGMENTS The authors wish to express their gratitude to staff in the Center for Administrative Records Research and Applications (CARRA) at the Census Bureau for making this work possible. We especially want to thank Juan Carlos Humud and Joey Morales for their extensive assistance with the use of the CARRA computer network and the validation programs on which our research depended, and Amy B. O’Hara for facilitating our access to CARRA’s resources. We are grateful to our colleagues David Baugh for reviewing the draft manuscript; to Julie Sykes for her support of this work, expressed in many ways; to Jane Retter for editing the initial draft; and to Sharon Clark for preparing the final manuscript. We also want to express our appreciation to our project officer, Cara Petroski, in the Office of Information Products and Data Analytics, Centers for Medicare & Medicaid Services, for her careful review and helpful comments on the draft report and for maintaining her interest in the topic throughout the long period required to bring this work to fruition.