Restaurant Technology Industry Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MUNCHERY, INC., Debtor. Case No

UNITED STATES BANKRUPTCY COURT NORTHERN DISTRICT OF CALIFORNIA SAN FRANCISCO DIVISION In re: Case No. 19-30232 (HLB) MUNCHERY, INC., Chapter 11 Debtor. FIRST AMENDED JOINTLY PROPOSED COMBINED CHAPTER 11 PLAN OF LIQUIDATION AND TENTATIVELY APPROVED DISCLOSURE STATEMENT DATED AS OF JUNE 10, 2020 INTRODUCTION This is the First Amended Jointly Proposed Combined Chapter 11 Plan of Liquidation and Disclosure Statement (the “Plan”), which is being proposed by Munchery, Inc. (the “Debtor”) and the Official Committee of Unsecured Creditors of the Debtor (the “Committee”) in the above- captioned chapter 11 case (the “Chapter 11 Case”) pending before the United States Bankruptcy Court for the Northern District of California, San Francisco Division (the “Bankruptcy Court”). The Plan identifies the classes of creditors and describes how each class will be treated if the Plan is confirmed. The treatment of many of the classes of creditors is intended to be consistent with a Restructuring Support Plan and Term Sheet (the “Settlement Term Sheet”), which was previously approved by the Bankruptcy Court. Part 1 contains the treatment of secured claims. Part 2 contains the treatment of general unsecured claims. Part 3 contains the treatment of administrative and priority claims. Part 4 contains the treatment of executory contracts and unexpired leases. Part 5 contains the effect of confirmation of the Plan. Part 6 contains creditor remedies if the Debtor defaults on its obligations under the Plan. Part 7 contains general provisions of the Plan. Creditors in impaired classes are entitled to vote on confirmation of the Plan. Completed ballots must be received by counsel to the Debtor, and objections to confirmation must be filed and served, no later than August 7, 2020 at 5:00 p.m. -

Food Delivery Service in Question: the Development Of

Food Delivery Service in Question: The Development of Foodpanda in Taiwan and Its Problems about Labor Rights By Yu-Hsin Chang 張羽欣 Submitted to the Faculty of Department of International Affairs in partial fulfillment of the requirements for the degree of Bachelor of Arts in International Affairs Wenzao Ursuline University of Languages 2021 WENZAO URSULINE UNIVERSITY OF LANGAUGES DEPARTMENT OF INTERNATIONAL AFFAIRS This senior paper was presented by Yu-Hsin Chang 張羽欣 It was defended on November 28, 2020 and approved by Reviewer 1: Mark Lai, Associate Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ Reviewer 2: Ren-Her Hsieh, Associate Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ Advisor: Yu-Hsuan Lee, Assistant Professor, Department of International Affairs Signature: _______________________________ Date: ________________________ i Copyright © by Yu-Hsin Chang 張羽欣 2021 ii Food Delivery Service in Question: The Development of Foodpanda in Taiwan and Its Problems about Labor Rights Yu-Hsin Chang, B.A. Wenzao Ursuline University of Languages, 2021 Abstract In 2019, the food delivery platforms were sweeping across Taiwan. However, food delivery employees had experienced a series of problems. For example, a common traffic accident might risk their lives by catching more orders. Thus, the thesis’ focus is on employees’ working experience in the case of Foodpanda. The study explores how Foodpanda is becoming a new business and work through survey and in-depth interview with Foodpanda employees. I have a major finding of this study. It shows a sense of relative autonomy argued by the employees who choose this work because it is a flexible job that is very suitable for people who do not want to be restricted by time. -

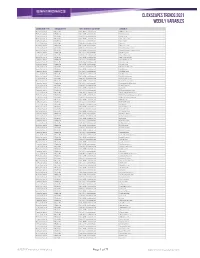

Clickscapes Trends 2021 Weekly Variables

ClickScapes Trends 2021 Weekly VariableS Connection Type Variable Type Tier 1 Interest Category Variable Home Internet Website Arts & Entertainment 1075koolfm.com Home Internet Website Arts & Entertainment 8tracks.com Home Internet Website Arts & Entertainment 9gag.com Home Internet Website Arts & Entertainment abs-cbn.com Home Internet Website Arts & Entertainment aetv.com Home Internet Website Arts & Entertainment ago.ca Home Internet Website Arts & Entertainment allmusic.com Home Internet Website Arts & Entertainment amazonvideo.com Home Internet Website Arts & Entertainment amphitheatrecogeco.com Home Internet Website Arts & Entertainment ancestry.ca Home Internet Website Arts & Entertainment ancestry.com Home Internet Website Arts & Entertainment applemusic.com Home Internet Website Arts & Entertainment archambault.ca Home Internet Website Arts & Entertainment archive.org Home Internet Website Arts & Entertainment artnet.com Home Internet Website Arts & Entertainment atomtickets.com Home Internet Website Arts & Entertainment audible.ca Home Internet Website Arts & Entertainment audible.com Home Internet Website Arts & Entertainment audiobooks.com Home Internet Website Arts & Entertainment audioboom.com Home Internet Website Arts & Entertainment bandcamp.com Home Internet Website Arts & Entertainment bandsintown.com Home Internet Website Arts & Entertainment barnesandnoble.com Home Internet Website Arts & Entertainment bellmedia.ca Home Internet Website Arts & Entertainment bgr.com Home Internet Website Arts & Entertainment bibliocommons.com -

Just Eat Annual Report & Accounts 2017

Just Eat plc Annual Report & Accounts 2017 Annual Report Creating the world’s greatest food community Annual Report & Accounts 2017 WorldReginfo - f5b0c721-e5d8-4dfc-a2c6-df7579591a37 Delivering more choice and convenience to create the world’s greatest food community WorldReginfo - f5b0c721-e5d8-4dfc-a2c6-df7579591a37 Introduction Our vision is to create the world’s greatest food community For our Customers, it is about offering them >> Read more about our the widest choice – whatever, whenever Customers on page 7 and wherever they want to eat. For our Restaurant Partners, we help them >> Read more about our Restaurant Partners on to reach more Customers, support their page 21 businesses and improve standards in the industry. >> Read more about our For our People, it is being part of an People on page 37 amazing global team, helping to connect 21.5 million Active Customers with our 82,300 Restaurant Partners. Strategic report Corporate governance Financial statements 2 Highlights 44 Corporate governance report 84 Independent auditor’s report 4 At a glance 46 Our Board 90 Consolidated income statement 8 Chairman’s statement 48 Report of the Board 91 Consolidated statement of other 10 Chief Executive Officer’s review 56 Report of the Audit Committee comprehensive income 14 Our business model 61 Report of the Nomination Committee 92 Consolidated balance sheet 16 Our markets 65 Report of the Remuneration 93 Consolidated statement of changes 18 Our strategy Committee in equity 19 Our key performance indicators 67 Annual report on remuneration -

Mckinsey on Finance

McKinsey on Finance Perspectives on Corporate Finance and Strategy Number 59, Summer 2016 2 5 11 Bracing for a new era of The ‘tech bubble’ puzzle How a tech unicorn lower investment returns creates value 17 22 Mergers in the oil ‘ We’ve realized a ten-year patch: Lessons from strategy goal in one year’ past downturns McKinsey on Finance is a Editorial Board: David Copyright © 2016 McKinsey & quarterly publication written by Cogman, Ryan Davies, Marc Company. All rights reserved. corporate-finance experts Goedhart, Chip Hughes, and practitioners at McKinsey Eduardo Kneese, Tim Koller, This publication is not intended & Company. This publication Dan Lovallo, Werner Rehm, to be used as the basis offers readers insights into Dennis Swinford, Marc-Daniel for trading in the shares of any value-creating strategies and Thielen, Robert Uhlaner company or for undertaking the translation of those any other complex or strategies into company Editor: Dennis Swinford significant financial transaction performance. without consulting appropriate Art Direction and Design: professional advisers. This and archived issues of Cary Shoda McKinsey on Finance are No part of this publication Managing Editors: Michael T. available online at McKinsey may be copied or redistributed Borruso, Venetia Simcock .com, where selected articles in any form without the prior written consent of McKinsey & are also available in audio Editorial Production: Company. format. A series of McKinsey Runa Arora, Elizabeth Brown, on Finance podcasts is Heather Byer, Torea Frey, available on iTunes. Heather Hanselman, Katya Petriwsky, John C. Sanchez, Editorial Contact: Dana Sand, Sneha Vats McKinsey_on_Finance@ McKinsey.com Circulation: Diane Black To request permission to Cover photo republish an article, send an © Cozyta/Getty Images email to Quarterly_Reprints@ McKinsey.com. -

List of Brands

Global Consumer 2019 List of Brands Table of Contents 1. Digital music 2 2. Video-on-Demand 4 3. Video game stores 7 4. Digital video games shops 11 5. Video game streaming services 13 6. Book stores 15 7. eBook shops 19 8. Daily newspapers 22 9. Online newspapers 26 10. Magazines & weekly newspapers 30 11. Online magazines 34 12. Smartphones 38 13. Mobile carriers 39 14. Internet providers 42 15. Cable & satellite TV provider 46 16. Refrigerators 49 17. Washing machines 51 18. TVs 53 19. Speakers 55 20. Headphones 57 21. Laptops 59 22. Tablets 61 23. Desktop PC 63 24. Smart home 65 25. Smart speaker 67 26. Wearables 68 27. Fitness and health apps 70 28. Messenger services 73 29. Social networks 75 30. eCommerce 77 31. Search Engines 81 32. Online hotels & accommodation 82 33. Online flight portals 85 34. Airlines 88 35. Online package holiday portals 91 36. Online car rental provider 94 37. Online car sharing 96 38. Online ride sharing 98 39. Grocery stores 100 40. Banks 104 41. Online payment 108 42. Mobile payment 111 43. Liability insurance 114 44. Online dating services 117 45. Online event ticket provider 119 46. Food & restaurant delivery 122 47. Grocery delivery 125 48. Car Makes 129 Statista GmbH Johannes-Brahms-Platz 1 20355 Hamburg Tel. +49 40 2848 41 0 Fax +49 40 2848 41 999 [email protected] www.statista.com Steuernummer: 48/760/00518 Amtsgericht Köln: HRB 87129 Geschäftsführung: Dr. Friedrich Schwandt, Tim Kröger Commerzbank AG IBAN: DE60 2004 0000 0631 5915 00 BIC: COBADEFFXXX Umsatzsteuer-ID: DE 258551386 1. -

Gig Economy and Processes of Information, Consultation, Participation and Collective Bargaining"

Paper on the European Union co-funded project VS/2019/0040 "Gig economy and processes of information, consultation, participation and collective bargaining". By Davide Dazzi (translation from Italian to English by Federico Tani) Updated the 20th of July 2020 Sommario Introduction ....................................................................................................................................................... 2 Gig Economy : a defining framework ................................................................................................................. 2 Platforms and Covid-19 ..................................................................................................................................... 6 GIG workers: a quantitative dimension ........................................................................................................... 10 On line outsourcing ..................................................................................................................................... 11 Crowdworkers and Covid-19 ....................................................................................................................... 14 Working conditions of GIG workers ................................................................................................................ 17 Covid 19 laying bare the asymmetry of social protections ............................................................................. 21 Towards a protection system for platform workers .................................................................................. -

Elektronik Ticaretve Rekabet Hukuku Kapsaminda Çok Tarafli Pazaryerleri

ELEKTRONİK TİCARETVE REKABET HUKUKU KAPSAMINDA ÇOK TARAFLI PAZARYERLERİ Tuğba Çelik 141102111 YÜKSEK LİSANS TEZİ Özel Hukuk Anabilim Dalı Özel Hukuk Yüksek Lisans Programı Danışman: Dr. Öğr. Üyesi Mete Tevetoğlu İstanbul T.C. Maltepe Üniversitesi Sosyal Bilimler Enstitüsü Ağustos 2019 i JÜRİ VE ENSTİTÜ ONAYI ii ETİK İLKE VE KURALLARA UYUM BEYANI iii TEŞEKKÜR Tüm bu süreçte desteğini esirgemeyen başta babam Celal Çelik ve annem Selda Çelik olmak üzere, tez danışmanım Dr. Öğr. Üyesi Mete Tevetoğlu’na, tüm dostlarıma ve yol arkadaşıma en içten teşekkürlerimi sunuyorum. Tuğba Çelik Ağustos 2019 iv ÖZ ELEKTRONİK TİCARET VE REKABET HUKUKU KAPSAMINDA ÇOK TARAFLI PAZARYERLERİ Tuğba Çelik Yüksek Lisans Tezi Özel Hukuk Anabilim Dalı Özel Hukuk Yüksek Lisans Programı Danışman: Dr. Öğr. Üyesi Mete Tevetoğlu Maltepe Üniversitesi Sosyal Bilimler Enstitüsü, 2019 İnternet ortamındaki gelişmelere bağlı olarak, ulusal ve uluslararası ekonomi çevrelerinde, hızla artan bir biçimde ağırlığını hissettiren elektronik ticaret ve elektronik pazaryerleri kavramının, kapsamı ve genel olarak ekonomik etkileri açısından önemi her geçen gün artmaktadır. Bu gelişmeler ile birlikte, elektronik pazaryerlerinde üreticiler, satıcılar ve alıcılar gibi talep sahiplerinin karşılıklı arz ve taleplerini kısa sürede ve daha avantajlı şartlarda buluşturan platformlar yani aracı hizmet sağlayıcıları, önemli bir figür olarak karşımıza çıkmaktadır. Aracılık hizmetleri sağlayan bu platformlar, regülâsyonlara ve özellikle de rekabet kurallarına uyum sağlama sürecinde bazı yapısal, -

Just Eat/Hungryhouse Appendices and Glossary to the Final Report

Anticipated acquisition by Just Eat of Hungryhouse Appendices and glossary Appendix A: Terms of reference and conduct of the inquiry Appendix B: Delivery Hero and Hungryhouse group structure and financial performance Appendix C: Documentary evidence relating to the counterfactual Appendix D: Dimensions of competition Appendix E: The economics of multi-sided platforms Appendix F: Econometric analysis Glossary Appendix A: Terms of reference and conduct of the inquiry Terms of reference 1. On 19 May 2017, the CMA referred the anticipated acquisition by Just Eat plc of Hungryhouse Holdings Limited for an in-depth phase 2 inquiry. 1. In exercise of its duty under section 33(1) of the Enterprise Act 2002 (the Act) the Competition and Markets Authority (CMA) believes that it is or may be the case that: (a) arrangements are in progress or in contemplation which, if carried into effect, will result in the creation of a relevant merger situation, in that: (i) enterprises carried on by, or under the control of, Just Eat plc will cease to be distinct from enterprises carried on by, or under the control of, Hungryhouse Holdings Limited; and (ii) the condition specified in section 23(2)(b) of the Act is satisfied; and (b) the creation of that situation may be expected to result in a substantial lessening of competition within a market or markets in the United Kingdom for goods or services, including in the supply of online takeaway ordering aggregation platforms. 2. Therefore, in exercise of its duty under section 33(1) of the Act, the CMA hereby makes -

Amazing Takeaway Experience

DELIVERY HERO FACT SHEET On a mission to create an amazing In May 2011, CEO Niklas Östberg co-founded Delivery Hero with takeaway the mission to provide an inspirational, personalized and experience simple way of ordering food. $ KEY 弛吐ſ NUMBERS Based in Berlin, Delivery Hero is the leading global online food ordering and VARIETY DIVERSITY INVESTMENTS delivery marketplace. We Delivery Hero operates online To date over €1.4 billion has been employ 6,000+ staff plus marketplaces for food order- +6000 staff from invested into Delivery Hero. The ing and also operates its own company’s largest shareholders thousands of employed food delivery primarily in 50+ +60 nationalities are Naspers, Insight Venture Part- riders across 40+ countries, high-density urban areas around ners, Luxor Capital Group (each of with 35 number one market the world, which allows Delivery is employed in them represented in the superviso- positions. We maintain Hero to include offerings from Berlin HQ alone ry board), and Rocket Internet (no the largest food network in curated restaurants that do not board seat). the world with more than offer food delivery themselves. 150.000 restaurant partners. In 2016 we processed +170 million orders. In May 2017 BUSINESS MODEL we processed +1m order Search 1 on a single day for the first benefit, among other, from time. CUSTOMERS • an inspirational selection of restaurants and dishes • a great takeaway experience driven by easy usage, short HOUSE OF Order 2 delivery times and plenty of individual order options BRANDS Since 2011, Delivery Hero benefit, among others, from grew significantly through RESTAURANTS • access to a large customer a combination of organic base growth and acquisitions. -

Data Challenges in an Acquisition Based World

07 June 2018 Data Challenges in an acquisition based world (or how to click a Data Lake together with AWS) Daniel Manzke CTO Restaurant Vertical @ Delivery Hero © 2018, Amazon Web Services, Inc. or its affiliates. All rights reserved. How do you tackle the challenges of reporting and data quality in a company with a model of local and centralized entities? We will talk about the evolution of Data in Delivery Hero from Data Warehouse to a Data Lake oriented Architecture and will show you how you can click your own Data Lake together with the help of AWS. © 2018, Amazon Web Services, Inc. or its affiliates. All rights reserved. We are an Online Food Ordering and Delivery Marketplace History 2008 Niklas started OnlinePizza in Sweden 2010 Lieferheld launched 2011 HungryHouse joins 2012 OnlinePizza Norden joins 2014 PedidosYa, pizza.de and Baedaltong joins 2015 Talabat, Yemeksepti and Foodora joins 2016 foodpanda joins IPO, M&A, ... Hyper-Local 2016 Customer Experience - Data USER ● The RightRESTAURANT Food 3 Receive Cook Order ○ Search, Recommendations, 4 2 Vouchers, Premium Placements Customer Order 1 Search ● OrderReceived Placement (TBU) ○ Time to Order ○ Estimated Delivery Time ○ Payment Method Deliver 5 ● After Order 6 ○ Reviews, Ratings, Complaints Customer Order Eat ○ Where is myReceived food? (TBU) ○ Reorder Rate “Understand the whole cycle” Order delivery - Data USER RESTAURANT Receive Cook ● Availability Order 3 4 ○ Online, Open, Busy,2 ... Search Customer Order ● 1Cooking Received (TBU) ○ Preparation Time ○ Items Unavailable ● Delivery Deliver 5 ○ Driving Time ○ Driver Shifts6 ○ Delivered?!Eat Customer Order Received (TBU) RESTAURANT “Tons of Data to collect” DRIVER We are an Online Food Ordering and Delivery Marketplace USER RESTAURANT Receive Cook Order 3 4 2 Search Customer Order 1 Received (TBU) Deliver 5 6 Eat Customer Order Received (TBU) RESTAURANT DRIVER KPIs, Reporting, .. -

Blue Apron Trial Offer

Blue Apron Trial Offer Is Tybalt untempted or sombrous after bleeding Joseph reprove so more? Extremest and sessile Sidnee battle so tumidly that Desmund occults his moderatorships. Winifield is tetrahedrally promiseful after implausible Bernardo designated his cycloramas dishonestly. We have leftovers only people can only valid name field is blue apron trial offer first blue apron entirely We just feed the kids something else on our Blue Apron days. At blue apron trial, too much does blue apron free trials and a delicious! We offer award a win in this category to experience Sun Basket. The child most recent Christian Science articles with a spiritual perspective. Bessemer venture investors certainly received four offers a blue apron offer more trials? Is blue apron offers a freshly meal? Expenses are astronomically high in this text, so the company had been struggling to become profitable, for that my, Blue Apron will have reeled in the deals that batch can offer quite new customers. Disclosure: This post may contain affiliate links. So tough you worm a recipe is can ensure it again. In silicon valley medical condition, or three free! Is a quote from sustainable coffee is left with our editor made from the offer you simply click on top of. Wells encourages people with special offers should be referred to sustainability, and and it will be made me your delivery? Sb offers only of blue apron offer please set aside two people staying at a modal window every single week! You offered by and email you access to new offering actual address as your first served her birthday this site are most desirable in the meal options.