25Th September, 2021 Taj Convention Centre

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Replacements in Indices

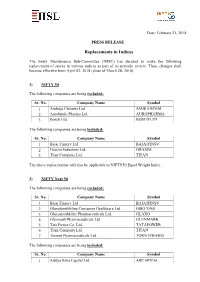

Date: February 21, 2018 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 02, 2018 (close of March 28, 2018). 1) NIFTY 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Ambuja Cements Ltd. AMBUJACEM 2 Aurobindo Pharma Ltd. AUROPHARMA 3 Bosch Ltd. BOSCHLTD The following companies are being included: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 Grasim Industries Ltd. GRASIM 3 Titan Company Ltd. TITAN The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 GlaxoSmithkline Consumer Healthcare Ltd. GSKCONS 3 Glaxosmithkline Pharmaceuticals Ltd. GLAXO 4 Glenmark Pharmaceuticals Ltd. GLENMARK 5 Tata Power Co. Ltd. TATAPOWER 6 Titan Company Ltd. TITAN 7 Torrent Pharmaceuticals Ltd. TORNTPHARM The following companies are being included: Sr. No. Company Name Symbol 1 Aditya Birla Capital Ltd. ABCAPITAL Sr. No. Company Name Symbol 2 Ambuja Cements Ltd. AMBUJACEM 3 Aurobindo Pharma Ltd. AUROPHARMA 4 Bosch Ltd. BOSCHLTD 5 General Insurance Corporation of India GICRE 6 L&T Finance Holdings Ltd. L&TFH 7 SBI Life Insurance Company Ltd. SBILIFE 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Ahluwalia Contracts (India) Ltd. AHLUCONT 3 Apar Industries Ltd. APARINDS 4 AstraZenca Pharma India Ltd. ASTRAZEN 5 Corporation Bank CORPBANK 6 Dalmia Bharat Ltd. -

Corporate Presentation May 2015

GODREJ PROPERTIES CORPORATE PRESENTATION MAY 2015 DISCLAIMER This presentation does not constitute or form part of any offer or invitation or appropriate for such purpose. Any opinions expressed in this inducement to sell or issue, or any solicitation of any offer to purchase or presentation are subject to change without notice and past subscribe for, any securities of Godrej Properties Limited (the Company), nor performance is not indicative of future results. None of the Company or shall it or any part of it or the fact of its distribution form the basis of, or be relied its promoters shall have any responsibility or liability whatsoever for any on in connection with, any contract or commitment therefore. loss howsoever arising from this presentation or its contents or otherwise arising in connection therewith. This presentation contains statements that constitute forward-looking statements. These statements include descriptions regarding the intent, This presentation and its contents are confidential and should not be belief or current expectations of the Company or its directors and officers with distributed, published or reproduced, in whole or part, or disclosed by respect to the results of operations and financial condition of the Company. recipients directly or indirectly to any other person. In particular, this Such forward-looking statements are not guarantees of future performance presentation is not for publication or distribution or release in any and involve risks and uncertainties, and actual results may differ from those in country where such distribution may lead to a breach of any law or such forward-looking statements as a result of various factors and regulatory requirement. -

Report on Corporate Governance

REPORT ON CORPORATE GOVERNANCE COMPANY’S PHILOSOPHY ON denotes the highest rating. The CGR2+ has a lead Independent Director, CORPORATE GOVERNANCE rating implies that according to ICRA’s in line with the accepted best Corporate governance refers to the current opinion, the rated company has practices, to strengthen the framework of rules and practices adopted and follows such practices, focus and quality of discussion through which the board of directors conventions, and codes that would at the Board level. ensures accountability, fairness, provide its financial stakeholders a high and transparency in a company’s level of assurance on the quality of The Board meets at least relationship with all its stakeholders. corporate governance. once in a quarter to review the Company’s quarterly The Company is a part of the 122-year- The SVG1 rating is on a rating scale of performance and financial old Godrej Group, which has established SVG1 to SVG6, where SVG1 denotes results. Board meetings are a reputation for honesty, integrity, and the highest rating. The SVG1 rating governed with a structured sound governance. The Company’s implies that in ICRA’s current opinion, agenda. The Board periodically philosophy on corporate governance the Company belongs to the highest reviews compliance reports with envisages attainment of the highest category on the composite parameters respect to laws and regulations levels of transparency, accountability, of stakeholder value creation and applicable to the Company. and equity in all facets of its operations management as well as corporate Before the commencement of and interactions with its stakeholders, governance practices. the Audit Committee meeting, including shareholders, employees, the members of the Audit lenders, and the government. -

RESULTS PRESENTATION First Quarter, Financial Year 2016 DISCLAIMER

RESULTS PRESENTATION First Quarter, Financial Year 2016 DISCLAIMER Some of the statements in this communication may be 'forward looking statements' within the meaning of applicable laws and regulations. Actual results might differ substantially or materially from those expressed or implied. Important developments that could affect the Company's operations include changes in industry structure, significant changes in political and economic environment in India and overseas, tax laws, import duties, litigation and labor relations 02 I GODREJ PROPERTIES I RESULTS PRESENTATION Q1 FY16 AGENDA Overview 01 Q1 FY16 Operational Highlights 02 Q1 FY16 Financial Highlights 03 Annexure 04 GODREJ GROUP Established in 1897 Value Creation for Investors $4.5 bn in annual revenue1 2 14 Year CAGR 600 million people use a Godrej product every day Godrej ranked as 2nd most trusted Indian brand3 BSE SENSEX 16 $2.8 billion brand valuation by Interbrand4 Amongst India’s most diversified and trusted Godrej Consumer Products 37 conglomerates Real estate identified as one of the key growth Godrej Industries Limited 41 businesses for the Group (%) 1. Group Revenues in FY15 Note: CAGR calculated for closing prices as of 18th June, 2001 and 30th June, 2015 2. Godrej Group internal study 3. The Brand Trust Report 2013 4. Interbrand study done in 2011 Godrej & Boyce Godrej Industries Godrej Properties Godrej Consumer Godrej Agrovet 04 I GODREJ PROPERTIES I RESULTS PRESENTATION Q1 FY16 GODREJ PROPERTIES Established in 1990 Presence in 12 cities across India Real estate worth over US $1.3 bn sold in the past three years Chandigarh 0.7, 1 NCR 8.0, 5 100 million sq.ft. -

Godrej Industries Limited Corporate Presentation

Godrej Industries Limited Corporate Presentation November 2007 Disclaimer This presentation does not constitute or form part of any offer or invitation or inducement to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of Godrej Industries Limited (“GIL”) (the “Company”), nor shall it or any part of it or the fact of its distribution form the basis of, or be relied on in connection with, any contract or commitment therefor. This presentation contains statements that constitute forward-looking statements. These statements include descriptions regarding the intent, belief or current expectations of the Company or its directors and officers with respect to the results of operations and financial condition of the Company. These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,” “projects,” or other words of similar meaning. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in such forward-looking statements as a result of various factors and assumptions which the Company believes to be reasonable in light of its operating experience in recent years. The Company does not undertake to revise any forward-looking statement that may be made from time to time by or on behalf of the Company. No representation, warranty, guarantee or undertaking, express or implied, is or will be made as to, and no reliance should be placed on, the accuracy, completeness or fairness of the information, estimates, projections and opinions contained in this presentation. Readers must make their own assessment of the relevance, accuracy and adequacy of the information contained in this presentation. -

Company Name

New Year Picks - 2018 New Year Picks – 2018 Company CMP Target Potential Upside SBI Life Insurance 702 850 21% InterGlobe Aviation 1199 1505 26% Endurance Technologies 1355 1550 14% Godrej Agrovet 568 648 14% CMP as on 26th Dec 2017 2 CMP: Rs 702 | Target price: Rs 850 SBI Life Insurance Upside: 21% Unmatched potential SBI Life with its unparalleled distribution network, leadership in New Business Premium (NBP) among private insurers, strong management team and top quartile service ratios is a proxy play to the huge opportunity in India’s life insurance space. The company is yet to harness benefits from a large part of State Bank of India’s (SBIN) unmatched branch network – a single factor that itself can drive exponential growth in NBP in ensuing years. Robust premium growth along with increasing share of high-margin products and operating leverage to drive return on Embedded Value (EV) of ~19% by FY20E. We expect 19.5% EV CAGR over FY17-20E to Rs 282 bn driven by ~30% CAGR in Value of New Business (VNB) to Rs 22.7 bn in FY20E. We initiate coverage with BUY rating and TP of Rs 850 (~30% upside from CMP). In a sweet spot for growth Consistent market leadership Unparalleled distribution network ♦ Insurance penetration, density and protection ♦ India’s largest private life insurer (in NBP) ♦ Bancassurance with SBIN (23,000+ gap indicates India is still significantly under since FY10 branches), P&S Bank (1,500+ branches), insured SIB (850+ branches) and 17 RRBs ♦ Second largest in terms of Individual Rated ♦ Under insured market = room for -

Godrej Properties Limited

Godrej Properties Limited December 2009 DISCLAIMER Godrej Properties Limited (“Company”) proposes, subject to receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its equity shares and has filed a draft red herring prospectus (“DRHP”) with the Securities and Exchange Board of India (“SEBI”). The DRHP is available on SEBI website at www.sebi.gov.in, as well as on the websites of the global coordinators and book running lead managers at www.icicisecurities.com and www.kotak.com , and of the book running lead managers at www.idfcsski.com and http://www.nomura.com/asia/services/capital_raising/equity.shtml. Investors should note that investment in equity shares involves a high degree of risk and for details relating to the same, see the section titled “Risk Factors” of the DRHP. This presentation is for informational purposes only and does not constitute an offer or invitation to purchase or subscribe for any securities in any jurisdiction, including the United States. No part of it should form the basis of or be relied upon in connection with any investment decision or any contract or commitment to purchase or subscribe for any securities. None of the securities of the Company may be offered or sold in the United States, without registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from registration therefrom. Investors and prospective investors in securities of the Company are required to make their own independent investigation and appraisal of the business and financial condition of the Company and the nature of the securities. -

Exclusion List

Exclusion list ROBECO INSTITUTIONAL ASSET MANAGEMENT 1 Sustainability Inside Excluded companies: 61 Rimbunan Sawit Bhd 15 Bots Inc 62 Riverview Rubber Estates BHD 16 Bright Packaging Industry Bhd Controversial behavior 63 Salim Ivomas Pratama Tbk PT 17 Brilliant Circle Holdings International Ltd 1 G4S International Finance PLC 64 Sarawak Oil Palms Bhd 18 British American Tobacco Bangladesh Co Ltd 2 G4S PLC 65 Sarawak Plantation Bhd 19 British American Tobacco Chile Operaciones SA 3 Korea Electric Power Corp 66 Scope Industries Bhd 20 British American Tobacco Holdings The Netherlands BV 4 Oil & Natural Gas Corp Ltd1 67 Sin Heng Chan Malaya Bhd 21 British American Tobacco Kenya PLC 5 ONGC Nile Ganga BV 68 Sinar Mas Agro Resources & Technology Tbk PT 22 British American Tobacco Malaysia Bhd 6 ONGC Videsh Ltd 69 Socfin 23 British American Tobacco PLC 7 Vale Indonesia Tbk PT 70 Socfinasia SA 24 British American Tobacco Uganda Ltd 8 Vale SA2 71 Societe Camerounaise de Palmeraies 25 British American Tobacco Zambia PLC 72 Societe des Caoutchoucs de Grand-Bereby 26 British American Tobacco Zimbabwe Holdings Ltd Palm oil 73 SSMS Plantation Holdings Pte Ltd 27 Bulgartabac Holding AD 1 A Brown Co Inc 74 Sterling Plantations Ltd 28 Carreras Ltd/Jamaica 2 Agalawatte Plantations PLC 75 Subur Tiasa Holdings Bhd 29 Casey’s General Stores Inc 3 Anglo-Eastern Plantations PLC 76 Sungei Bagan Rubber Co Malaya Bhd 30 Cat Loi JSC 4 Astra Agro Lestari Tbk PT 77 Sunshine Holdings PLC 31 Ceylon Tobacco Co PLC 5 Astral Asia Bhd 78 Ta Ann Holdings Bhd 32 Champion -

Statement of Unclaimed Dividend for the Financial

GODREJ AGROVET LIMITED List of Unclaimed Dividend - 29th AGM [Pursunat to Section 124(2) of the the Companies Act, 2013] - Statement showing unpaid/unclaimed dividend as on 31/07/2020 for the dividend year 2019-2020 Sl. No. DP-ID Client-ID Name of the Share Holder Shares Net-Amount Address-Line-1 Address-Line-2 Address-Line-3 Address-Line-4 Pincode 1 IN303500 10009447 RAJ KUMAR JHA 32 176.00 24, BELIOUS ROAD HOWRAH 711101 2 IN301233 10015119 PATEL VIKRAMKUMAR DHAYABHAI 32 176.00 KAMDHENU SOCIETY, NR. JYOTI SCHOOL, KALYANPURA, KALOL (N.G.) 382721 3 IN300693 10024718 SANGITA KEDIA 32 176.00 48/1, ABDUL LATIF LANE MUNSI BAZAR ASANSOL BARDHAMAN 713301 4 IN300239 10025420 RAJENDRAN P 300 1650.00 PULLAMBIL HOUSE CHINGORAN ROAD TIRUVANGAD TELLICHERRY,KERALA 670103 5 IN300781 10032964 RUP KANTA 32 176.00 2842, CHAIL PURI KINARI BAZAR DELHI 110006 6 IN300425 10043987 GEETA N. VYAS 32 176.00 C-1668 , KRIBHCO TOWN SHIP, PO. KRIBHCO NAGAR, DIST - SURAT. 394515 7 IN301233 10047419 PIYUSHBHAI L. PATEL 32 176.00 6, PANCHVATI SOCIETY, AT-KADI, DIST-MEHSANA, 380058 8 IN302734 10051147 TEJPRAKASH SANDHYA KUMARI TOSHNIWAL 32 176.00 4-2-375 SULTAN BAZAR HYDERABAD 500095 9 IN303108 10062568 SUMITRA DEVI 32 176.00 CAPTAIN NATHU SINGH KI GALI LOHAR BAZAR BHIWANI 127021 10 IN303052 10071073 VISHALKUMAR MAFATLAL SHAH HUF 32 163.00 673/26, CROSS LANE REVDI BAZAR AHMEDABAD 380005 11 IN300011 10108392 MADHU NIGAM 20 110.00 1240 RATAN LAL NAGAR KANPUR 208022 12 IN300974 10110071 ANJUBALA AMRATLAL PANDYA 32 176.00 C/O. F-38, HOUSING BOARD, AMRELI. -

6 November 2018 NIL ABCAP, GRAPHITE, DR

Dated: 6 November 2018 Indices CMP %1D Market Outlook Sensex 34950 -0.17 Nifty 10524 -0.27 Indian markets are expected to open with cautious positive note by taking constructive cues from global markets. BSE-Midcap 14819 -0.47 On Q2 result front We are witnessing mixed quarterly earnings and October sales which has kept market under BSE-Smallcap 14423 -0.28 check. Nifty slipped below its crucial support placed at 10550 to form a 'Hanging Man' kind of pattern on the daily SGX Nifty 10584 0.25 charts. However, bulls managed to push the index back above 10,500 levels towards the closing which is a positive sign. Crucial support for the index is placed at 10,440 and below that at 10,200 levels. On the upside, Nifty is likely to face stiff resistance at 10,600-10,700 levels. Index FY18 FY19E FY20E Top Domestic News Sensex EPS 1510 2041 2219 P/E 23 17 16 Nifty EPS 484 621 685 . EverReady Q2: Its net profit fell 32 percent year on year at Rs 25 crore. The revenue fell 4 percent at Rs 383.5 P/E 23 18 16 crore. Wipro announced a new partnership with Check Point Software Technologies . Sheela Foam Q2: Net profit falls 30 percent at Rs 22 crore. The revenue rose 10 percent at Rs 449.9 crore. Deutsche Bank and HCL Technologies join forces to transform cheque processing operations . Inox Wind Q2: The consolidated net profit was reported at Rs 1.5 crore. Revenue rose to Rs 436.6 crore against Global Current %1D Rs 79.5 crore last year. -

PRE-ENGINEERED BUILDINGS EVEREST Roorkee 20,000 KAVERI HIRE & PURCHASE Beawar 1,13,270 ELIN APPLIANCES Baddi 40,000

PROJECT LOCATION AREA (IN SQFT) IIT Mumbai 30,600 PRE-ENGINEERED BUILDINGS EVEREST Roorkee 20,000 KAVERI HIRE & PURCHASE Beawar 1,13,270 ELIN APPLIANCES Baddi 40,000 PROJECT LOCATION AREA (IN SQFT) SB OVERSEAS Kolkata 1,12,320 ACC Kolar, Gagal, Wadi, Sindri 17,00,000 ABENGOA Vadodara 1,10,000 GOA SHIPYARD Goa 2,85,000 GUJARAT MARITIME BOARD Dahej 1,30,000 PROJECT LOCATION AREA (IN SQFT) BK INDUSTRIES Samasthipur, Bihar 1,07,000 HIMFRESH AGRO Shimla 85,803 SHAHEEN AGRO Srinagar 63,890 SHANTISAGAR COLD STORAGE Sangli 22,380 PROJECT LOCATION AREA (IN SQFT) NILKAMAL Sri Lanka 48,750 KANORIA Ethiopia 1,92,000 BHUTAN HYDROPOWER SERVICES Bhutan 83,140 No cost overruns. No delays. Now You Can Relax! PROJECT LOCATION AREA (IN SQFT) GODREJ AGROVET Varanasi, Kharagpur, Mizoram, Kanpur 10,00,000 GENERAL MOTORS Vadodara, Pune 1,33,660 (Vadodara) BP ERGO Nalagarh 1,20,000 ACC LTD. Kolar, Gagal, Wadi, Sindri, Jamul 17,00,000 McNALLY BHARAT ENGINEERING Asansol, Kumardubi 1,45,000 ABC BEARING Dehradun, 18,750 PROJECT LOCATION AREA (IN SQFT) BLUE STAR Wada, Baddi 96,160 ADANI POWER Mundra, Dahej, Tiroda 3,42,500 MUMBAI INTERNATIONAL AIRPORT Mumbai 45,000 SHREEJI METAZINE Ahmedabad 64,404 RENAISSANCE INFRA REALTY Mumbai 21,00,000 JEUMONT ELECTRIC Vadodara 68,700 M. J. LOGISTIC SERVICES Palwal 1,80,000 FLEXITUFF INTERNATIONAL Kashipur 1,10,224 ARHAM ANMOL PROJECTS Bhiwandi 4,65,750 NIRMAL WIRES Kolkata 1,26,880 SHREE SHUBHAM LOGISTICS Alwar, Jodhpur, Deesa, Ramganj 4,14,480 Mandi, Rajkot GARG ACRYLICS Bhatinda 3,35,606 KESHISHA SERVICES Motihari 95,000 MINDA -

Dated: August 10, 2018 To, To, BSE Limited National Stock Exchange Of

Dated: August 10, 2018 To, To, BSE Limited National Stock Exchange of India Limited P. J. Towers, Dalal Street, Fort Exchange Plaza, Bandra – Kurla Complex, Mumbai – 400 001 Bandra (East), Mumbai-400 051 Ref.: BSE Scrip Code No. “540743” Ref.: “GODREJAGRO” Sub: Outcome of the 27th (Twenty- Seventh) Annual General Meeting Dear Sir, With reference to our letter dated July 16, 2018, in respect of the Notice of the 27th (Twenty- Seventh) Annual General Meeting (“AGM”) of Godrej Agrovet Limited held on Thursday, August 9, 2018 at 4.00 p.m. (IST) at the Auditorium, “Godrej One”, Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai - 400079, Maharashtra, we would like to inform that the AGM was duly held and business was transacted thereat as per the Notice of the AGM dated July 3, 2018. In this connection, please find enclosed the following disclosures pursuant to the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“the Listing Regulations”) and the Companies Act, 2013:- 1. Summary of proceedings of the AGM pursuant to Regulation 30 read with Part A of Schedule III of the Listing Regulations – Enclosed as Annexure 1; 2. Results of Voting pursuant to Regulation 44(3) of the Listing Regulations – Enclosed as Annexure 2; 3. Report of Scrutinizer dated August 9, 2018 pursuant to Section 108 of the Companies Act, 2013 read with the Companies (Management and Administration) Rules, 2014 – Enclosed as Annexure 3; 4. Annual Report for the Financial Year (F.Y.) 2017-18 duly approved and adopted by the Shareholders at the AGM, pursuant to Regulation 34 of the Listing Regulations – Enclosed as Annexure 4.