DS-2026 Hotel and Restaurant Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

New Honeymoon Cottages At

Guy Harvey RumFish Grill Joins the Team at Amalie Arena Restaurant opens branded concession stand at arena in November TAMPA, Fla. (November 20, 2014) – Guy Harvey RumFish Grill recently opened a branded concession area at the Amalie Arena, formerly the Tampa Bay Times Forum, home to the NHL’s Tampa Bay Lightning and the Arena Football League’s Tampa Bay Storm. The St. Pete Beach restaurant has a full-service concession area serving spicy firecracker shrimp, blue crab bisque, BBQ short rib flatbread, blackened fish sandwich and other popular menu items. The RumFish Grill also has a full-bar area across the aisle where thirsty fans can enjoy the signature beach-themed Blue Marlin, other mixed drinks and multiple beers on tap including Corona Light and Beach Blonde Ale from 3 Daughters Brewing, a fast-growing, St. Pete-based craft brewery known for their innovative brews for beer lovers. Although the new concession space does not have the St. Pete Beach restaurant’s famous fish tanks, it will be heavily themed and decorated with aquatic murals, marlin mounts, beach photography and large television monitors. “We’re very happy with the success of the RumFish Grill at Guy Harvey Outpost on St. Pete Beach and wanted to share it with an audience across the bridge,” said Keith Overton, president of TradeWinds Island Resorts. “We look forward to bringing the flavors of the beach to the patrons at Amalie Arena.” As part of the sponsorship with Amalie Arena and the Tampa Bay Lightning, RumFish Grill will also host food samplings in select areas such as the Chase Club, have a representative at all home games to promote TradeWinds, and participate in promotions during the games and on the post-game radio show and more. -

Nude in Mexico

Feb. 1, 2004---- RIVIERA MAYA, MEXICO -- The road is full of questions that inevitably lead to the beauty of travel. This is how I find myself leaning on a bar at the Moonlight disco at the Hidden Beach Resort-Au Naturel Club, the only upscale and not clothing- optional nudist resort in Mexico. A naked woman walks up to me and asks, "Is this your first naked experience?" Gee, how can she tell? I am standing in a corner of the bar that is under a shadow of doubt. About 20 naked couples have finished doing a limbo dance on a cool night along the Caribbean Sea. With the exception of a gentleman from Mexico, I am the only single guy in the disco. At this point, no one knows I am a journalist, but I am the only person in the room still wearing a bathrobe. It is too cold to be bold. Besides, I am so shy, I do not limbo with my clothes on. I barely ever go to clothed cocktail parties. My chipper friends are also mastering "The Macarena." Talk about your Polaroid moments. Cameras are not allowed at Hidden Beach. One dude is playing pool naked. Another guy looks like Jeff "Curb Your Enthusiasm" Garlin. His wife is applying for a job at Hidden Beach. He smiles and takes off his robe to join in a group dance to Marcia Griffith's "Electric Boogie." Nude tourists are more open and they bond faster. I have another shot of tequila. I am here for you. The nude recreation industry is news. -

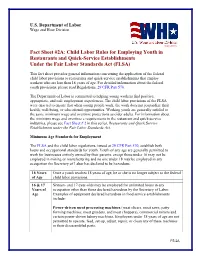

Child Labor Rules for Employing Youth in Restaurants and Quick-Service Establishments Under the Fair Labor Standards Act (FLSA)

U.S. Department of Labor Wage and Hour Division (July 2010) Fact Sheet #2A: Child Labor Rules for Employing Youth in Restaurants and Quick-Service Establishments Under the Fair Labor Standards Act (FLSA) This fact sheet provides general information concerning the application of the federal child labor provisions to restaurants and quick-service establishments that employ workers who are less than 18 years of age. For detailed information about the federal youth provisions, please read Regulations, 29 CFR Part 570. The Department of Labor is committed to helping young workers find positive, appropriate, and safe employment experiences. The child labor provisions of the FLSA were enacted to ensure that when young people work, the work does not jeopardize their health, well-being, or educational opportunities. Working youth are generally entitled to the same minimum wage and overtime protections as older adults. For information about the minimum wage and overtime e requirements in the restaurant and quick-service industries, please see Fact Sheet # 2 in this series, Restaurants and Quick Service Establishment under the Fair Labor Standards Act. Minimum Age Standards for Employment The FLSA and the child labor regulations, issued at 29 CFR Part 570, establish both hours and occupational standards for youth. Youth of any age are generally permitted to work for businesses entirely owned by their parents, except those under 16 may not be employed in mining or manufacturing and no one under 18 may be employed in any occupation the Secretary of Labor has declared to be hazardous. 18 Years Once a youth reaches 18 years of age, he or she is no longer subject to the federal of Age child labor provisions. -

Government, Civil Society and Private Sector Responses to the Prevention of Sexual Exploitation of Children in Travel and Tourism

April 2016 Government, civil society and private sector responses to the prevention of sexual exploitation of children in travel and tourism A Technical Background Document to the Global Study on Sexual Exploitation of Children in Travel and Tourism Child Protection Section, Programme Division, UNICEF Headquarters ACKNOWLEDGEMENTS ‘ The paper was prepared by Clara Sommarin (Child Protection Specialist, Programme Division, UNICEF Headquarters), Frans de Man and Amaya Renobales (independent consultants) and Jeanette Trang (intern Child Protection Section, Programme Division, UNICEF Headquarters) and copyedited by Alison Raphael. FRONT COVER: On 14 March 2016, a young vendor walks along a highly trafficked street in the heart of the city of Makati’s “red light district,” in Metro Manila, Philippines. Makati is considered the financial and economic centre of Manila, and is also a hub for sexual exploitation in the context of travel and tourism. © UNICEF/UN014913/Estey FACING PAGE: [NAME CHANGED] Rosie, 16, in Dominica in the eastern Caribbean on 8 July 2017. Rosie was 15 yrs old when she underwent sexual abuse. © UNICEF/UN0142224/Nesbitt i CONTENTS 1. INTRODUCTION ....................................................................................................................... 1 2. INTERNATIONAL FRAMEWORK FOR ACTION .................................................................... 3 2.1 International Human Rights Standards ................................................................................... 3 2.2 Global Political Commitments -

Sweet Honeymoons at Caramel

Sweet Honeymoons at Caramel SWEETNESS OF LIFE … From the moment you check-in as husband and wife, we promise you an unforgettable experience. The sparkling blue sea, twinkling stars, sensuously decorated suites & villas and discrete service will make your honeymoon a once in a lifetime experience. Luxuriate in a romantic breakfast served on your secluded veranda before soaking up the sun beside your private pool. The Caramel, Grecotel Boutique Resort is unique: a suite & villa hotel on the glorious 14 km sandy beach near Rethymno, Crete. Once you have chosen your accommodation & honeymoon package, your biggest choice will be whether to relax by the pools or sea for your honeymoon… or to experience unforgettable moments. Couples who also celebrate their wedding at the hotel will receive a 20% discount on the Honeymoon packages. Please note that the honeymoon options are complete packages and items are not interchangeable. In the event that you decide not to use one of the services, no refund or alternative can be given. Prices include all local taxes at current rate. ROSE GARDEN HONEYMOON – FREE* A refreshing welcome drink upon arrival at the hotel Honeymoon welcome with chilled sparkling wine and fresh fruits waiting in your guestroom Special decoration of the honeymoon bed with sugared almonds & scented rose petals “Melokarido” – a Greek tradition of honey and walnuts, symbolizing virility and the sweetness of life Romantic continental breakfast served in the privacy of your room the next morning Room upgrade upon availability * Valid for all Grecotel Hotels & Resorts (5* & 4*). To enjoy this free offer, inform the hotel up to 14 days before your arrival and present a copy of your wedding certificate (dated within last 12 months) at reception. -

Imagining Others: Sex, Race, and Power in Transnational Sex Tourism

Imagining Others: Sex, Race, and Power in Transnational Sex Tourism Megan Rivers-Moore1 Women and Gender Studies Institute University of Toronto [email protected] Abstract While most research into the sex tourism industry focuses on the often stark inequalities that exist between sex tourists and sex workers, there are a plethora of other subjects that are involved in the complicated web of transnational interactions involving travel and sex. This article focuses on the ways in which other subjects who may not actually be present in sex tourism spaces are constructed and put to use in the context of sex tourism. The aim is to explore the ways in which sex tourists and sex workers imagine and invoke two specific groups, Costa Rican men and North American women, in order to make meaning out of their encounters with one another. The article asks how these imagined others are implicated in sex tourism and how they are made present in ways that enable commercial sex between North American tourists and Latin American sex workers in San José, Costa Rica. I argue that understanding sex tourism necessitates looking at the relationships between various social groups rather than only between sex tourists and sex workers, in order to better understand the intense complexities of the encounters of transnational, transactional sex. 1 Creative Commons licence: Attribution-Noncommercial-No Derivative Works ACME: An International E-Journal for Critical Geographies, 2011, 10 (3), 392-411 393 Introduction The men in Costa Rica, they’re very macho, and the women just don’t like the men here. -

Hotel & Restaurant Management

Hotel & Restaurant The staff members in the Academic Student Services Office at the UC assist all students in Management determining which program of study to pursue. This includes providing information about the The Conrad N. Hilton College ranks among the variety of programs available, reviewing transcripts Hotel & world’s premier hotel and restaurant management to aid in identifying any courses to be completed programs. As the economy continues to be more before entering the program of choice, and serving service-oriented, the challenges and opportunities as liaison between the student and university of the hospitality industry demands the best from a program representatives. Students who have Restaurant new generation. The legendary Conrad N. Hilton’s already earned an associate’s degree or have a confidence in and vision for the University of substantial number of college academic credit Houston makes the future even brighter. hours should contact the Academic Student Services Office for advising and to begin the Management Houston’s restaurants, hotels and clubs feature a transfer admission process for the university variety of facilities and cuisines. Thus, work in, offering the degree program they desire to pursue. and interaction opportunities with, the hospitality industry are impressive. This sophisticated This brochure was created by the Academic environment, in addition to enriching the students’ Student Services Office based on information from learning process, provides direct and substantial the partner university. Bachelor of support to the Conrad N. Hilton College hospitality management program. LSCS and the partner universities provide equal employment, admission, and educational opportunities without regard to race, color, religion, national origin, sex, age or disability. -

BS with a Major in Hotel and Restaurant Management

Bachelor of Science This school offers the Bachelor of Science degree with majors in home furnishings merchandising, hotel and restaurant management, and merchandising. The following requirements must be satisfied for a Bachelor of Science. 1. Hours for the Degree: A minimum of 124 or 132 semester hours, depending upon major. 2. General University Requirements: See “General University Requirements” and “University Core Curriculum Requirements” in the Academics section of this catalog, and “Core Requirements” in this section of the catalog. 3. Major Requirements: See individual degree program. 4. Area of Concentration: See individual degree program. 5. Minor: See individual degree program. 6. Electives: See individual degree program. 7. Other Course Requirements: See individual degree program. 8. Other Requirements: • 42 hours must be advanced. • 24 of the last 30 must be taken at UNT. Hotel and Restaurant Management The hotel and restaurant management program prepares qualified individuals for managerial positions in the hospitality industry, and contributes to the profession through research, publication, consulting and related service activities. Major in Hotel and Restaurant Management Following is one suggested four-year degree plan. Students are encouraged to see their adviser each semester for help with program decisions and enrollment. BS with a Major in Hotel and Restaurant Management FRESHMAN YEAR FRESHMAN YEAR FALL HOURS SPRING HOURS ECON 1100, Principles of Microeconomics 3 ECON 1110, Principles of Macroeconomics 3 3 ENGL 1310, -

Marijuana Tourism in Denver

DEPARTMENT OF DESIGN AND COMMUNICATION CENTRE FOR TOURISM, INNOVATION AND CULTURE (TIC) Maarja Nomme & Bodil Stilling Blichfeldt Marijuana Tourism in Denver The real, but non-touristic deal! TIC TALKS no. 1, January 2017 MARIJUANA TOURISM IN DENVER Author info Maarja Nõmme, Department of Tourism, Tartu Vocational Education Center, Tartu, Estonia. Email: [email protected]. Bodil Stiling Blichfeldt, Deparment of Design and Communication, University of Southern Denmark. Email: [email protected] TIC is University of Southern Denmark’s multidisciplinary research center with focus on tourism, innovation and culture. The center is located at the Kolding campus. TIC strives to transform the university to an engaged, collaborative institution where academics and students pursue an unre- lenting examination of knowledge, its sources and its uses. TIC defines the university as a center for higher order knowledge development and for collaboration with, and for, society at large. We do this through research-based education, education-based research and collaborative engagements. We aim to charter new territory in international academe, as well as in multi-level collaboration based on interdisciplinary research with a strong foundation in the Humanities. TIC engages in research dialogues through both a traditional peer-review publication strategy and through free access to knowledge in progress. Supplementing traditional journal articles, TIC TALKS is TIC’s contribution to open access sharing and collaborative development of knowledge. TIC TALKS are provided by Centre for Tourism, Innovation and Culture, University of Southern Denmark Universitetsparken 1, Kolding, DK-6000 http://www.sdu.dk/en/Om_SDU/Institutter_centre/C_Tik.aspx 1 Marijuana tourism in Denver: The real, but non-touristic deal! Abstract Destinations can best be described as ‘composite products’ and may therefore undergo fundamental changes when new tourism actors enter the stage. -

Restaurants As a Contributor to Tourist Destination Attractiveness Phase Two: Consumer Interviews

RESTAURANTS AS A CONTRIBUTOR TO TOURIST DESTINATION ATTRACTIVENESS PHASE TWO: CONSUMER INTERVIEWS By Beverley Sparks, Karen Wildman & John Bowen RESEARCH REPORT RESEARCH REPORT SERIES The primary aim of CRC Tourism's research report series is technology transfer. The reports are targeted toward both industry and government users and tourism researchers. The content of this technical report series primarily focuses on applications, but may also advance research methodology and tourism theory. The report series titles relate to CRC Tourism's research program areas. All research reports are peer reviewed by at least two external reviewers. For further information on the report series, access the CRC website [www.crctourism.com.au]. EDITORS Prof Chris Cooper University of Queensland Editor-in-Chief Prof Terry De Lacy CRC for Sustainable Tourism Chief Executive Prof Leo Jago CRC for Sustainable Tourism Director of Research National Library of Australia Cataloguing-in-Publication Data Sparks, Beverley. Restaurants as a contributor to tourist destination attractiveness: phase two: consumer interviews. Bibliography. ISBN 1 876685 44 1. 1. Tourism – Australia. 2. Food service – Australia. 3. Tourists – Australia – Interviews. 4. Consumption (Economics) – Australia. I. Bowen, John (John T.). II. Wildman, Karen. III. Cooperative Research Centre for Sustainable Tourism. IV. Title. V. Title : Phase two: consumer interviews. (Series : research report series (Cooperative Research Centre for Sustainable Tourism) ). 338.479194 © 2002 Copyright CRC for Sustainable Tourism Pty Ltd All rights reserved. No parts of this report may be reproduced, stored in a retrieval system or transmitted in any form or by means of electronic, mechanical, photocopying, recording or otherwise without the prior permission of the publisher. -

Fantasy Island Restaurant Holiday's Menu Dec 24,25,31 & Jan

Fantasy Island Restaurant Holiday’s Menu Dec 24,25,31 & Jan 1st Selection is modified to provide more efficient service. Qty Appetizers Price Subtotal Qty Beef Price Subtotal Pu Pu Platter for 2 23.50 Beef with Vegetables 14.00 Spareribs 12.00 Beef with Peapods 15.00 Golden Shrimps 12.00 Beef with Mushroom 14.00 Chicken Wings 11.00 Beef with Broccoli 14.00 Chicken Fingers 11.00 Teriyaki Beef 12.00 Qty Egg Foo Yong Price Subtotal Egg Rolls 6.50 Pork Egg Foo Yong 9.50 Fried Wonton 6.50 Boneless Spareribs 12.00 Peking Ravioli 9.00 Pork Strips 12.00 Qty Chow Mein/Lo Mein Price Subtotal Crab Rangoon 10.00 Subgum Pork Chow Mein 11.50 Chicken Chow Mein 10.50 Pork Lo Mein 12.00 Qty Chicken Price Subtotal Chicken Lo Mein 12.00 Moo Goo Gai Pan 13.50 Chicken w/ Broccoli 13.50 Kung Pao Chicken Peanut* 13.50 Qty Choy Suey Price Subtotal General Gau’s Chicken* 14.00 Chicken Chop Suey 10.50 Sesame Chicken 14.00 Shrimp Chop Suey 11.50 Qty Seafood Price Subtotal Qty Rice Price Subtotal Lobster Sauce 10.00 Pork Fried Rice 10.00 Shrimp w/ Lobster Sauce 15.00 Steamed White Rice Small 3.00 Yushiang Shrimp* 16.00 Steamed White Rice Large 5.00 Shrimp w/ Vegetables 15.00 Fantasy Island Fried Rice 13.00 Qty Sweet & Sour Price Subtotal Qty Vegetables Price Subtotal Sweet & Sour Chicken 13.50 Vegetables Delight 11.00 Hot and Spicy Total: Name: ____________________________________ Phone_______________________________________ Pick up Time: ______________________________ Email _______________________________________ To place your order for takeout, call (978) 745-1700 fax to (978) 740-9121 or Email to [email protected]. -

Hospitality, Restaurant and Tourism Management (HRTM) 1

Hospitality, Restaurant and Tourism Management (HRTM) 1 HRTM 880 Advanced Tourism HOSPITALITY, RESTAURANT Crosslisted with: HRTM 480 Prerequisites: HRTM 280 AND TOURISM MANAGEMENT Description: Introduction to the integrated and sustainable development approach in tourism. Explore the background of and approaches to (HRTM) tourism planning, historical and contemporary development of tourism, as well as the concepts and components of the planning process. HRTM 871 Vines, Wines and You Credit Hours: 3 Crosslisted with: HORT 471, HORT 871, NUTR 471, NUTR 871, HRTM 471 Max credits per semester: 3 Prerequisites: 6 hrs science or equivalent experience; 21 years of age or Max credits per degree: 3 older Grading Option: Graded Notes: Proof of age is required. Offered: FALL Description: Origin, botany, historical and cultural significance of the HRTM 881 Legal Environment in Hospitality Management grapevine and related species. Principles and practices of vineyard Crosslisted with: HRTM 481 establishment, management and processing of grape products, Prerequisites: Senior standing; HRTM major or minor importance and/or scope of grape and wine industry; global and local Notes: Letter grade only. significance. Culinary applications, health, environmental and safety- Description: Laws and regulations affecting the hospitality industry. related issues, business and industry relations and experience. Recognition of potential legal hazards, correcting hazardous situations, Credit Hours: 3 and reacting in unforeseen circumstances. Max credits per semester: 3 Credit Hours: 3 Max credits per degree: 3 Max credits per semester: 3 Grading Option: Grade Pass/No Pass Option Max credits per degree: 3 HRTM 874 Food and Beverage Management Grading Option: Graded Crosslisted with: HRTM 474 HRTM 883 Hospitality Finance Prerequisites: HRTM 274 or equivalent Crosslisted with: HRTM 483 Notes: Letter Grade only Prerequisites: Senior standing; HRTM major Description: Functioning and operation of food-service units.