Short Selling Manipulation Paper

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Economics of Commodity Market Manipulation: a Survey

The Economics of Commodity Market Manipulation: A Survey Craig Pirrong Bauer College of Business University of Houston February 11, 2017 1 Introduction The subject of market manipulation has bedeviled commodity markets since the dawn of futures trading. Allegations of manipulation have been extremely commonplace, but just what constitutes manipulation, and how charges of manipulation can be proven, have been the subject of intense controversy. The remark of a waggish cotton trader in testimony before a Senate Com- mittee in this regard is revealing: “the word manipulation . initsuse isso broad as to include any operation of the cotton market that does not suit the gentleman who is speaking at the moment.” The Seventh Circuit Court of Appeals echoed this sentiment, though less mordantly, in its decision in the case Cargill v. Hardin: “The methods and techniques of manipulation are limited only by the ingenuity of man.” Concerns about manipulation have driven the regulation of commodity markets: starting with the Grain Fu- tures Act of 1922, United States law has proscribed manipulation, including 1 specifically “corners” and “squeezes.” Exchanges have an affirmative duty to police manipulation, and in the United States, the Commodity Futures Trad- ing Commission and the Department of Justice can, and have exercised, the power to prosecute alleged manipulators. Nonetheless, manipulation does occur. In recent years, there have been allegations that manipulations have occurred in, inter alia, soybeans (1989), copper (1995), gold (2004-2014) nat- ural gas (2006), silver (1998, 2007-2014), refined petroleum products (2008), cocoa (2010), and cotton (2011). Manipulation is therefore both a very old problem, and a continuing one. -

Short Sellers and Financial Misconduct 6 7 ∗ 8 JONATHAN M

jofi˙1597 jofi2009v2.cls (1994/07/13 v1.2u Standard LaTeX document class) June 25, 2010 19:56 JOFI jofi˙1597 Dispatch: June 25, 2010 CE: AFL Journal MSP No. No. of pages: 35 PE: Beetna 1 THE JOURNAL OF FINANCE • VOL. LXV, NO. 5 • OCTOBER 2010 2 3 4 5 Short Sellers and Financial Misconduct 6 7 ∗ 8 JONATHAN M. KARPOFF and XIAOXIA LOU 9 10 ABSTRACT 11 12 We examine whether short sellers detect firms that misrepresent their financial state- ments, and whether their trading conveys external costs or benefits to other investors. 13 Abnormal short interest increases steadily in the 19 months before the misrepresen- 14 tation is publicly revealed, particularly when the misconduct is severe. Short selling 15 is associated with a faster time-to-discovery, and it dampens the share price inflation 16 that occurs when firms misstate their earnings. These results indicate that short sell- 17 ers anticipate the eventual discovery and severity of financial misconduct. They also convey external benefits, helping to uncover misconduct and keeping prices closer to 18 fundamental values. 19 20 21 22 SHORT SELLING IS A CONTROVERSIAL ACTIVITY. Detractors claim that short sell- 23 ers undermine investors’ confidence in financial markets and decrease market 24 liquidity. For example, a short seller can spread false rumors about a firm 25 in which he has a short position and profit from the resulting decline in the 1 26 stock price. Advocates, in contrast, argue that short selling facilitates market 27 efficiency and the price discovery process. Investors who identify overpriced 28 firms can sell short, thereby incorporating their unfavorable information into 29 market prices. -

Stock Exchange Listing Agreements As a Vehicle for Corporate Governance

1981] STOCK EXCHANGE LISTING AGREEMENTS AS A VEHICLE FOR CORPORATE GOVERNANCE INTRODUCTION After nearly two hundred years of operation, stock exchanges remain largely unexplored as vehicles for regulating the internal affairs of corporations whose stocks they list for trading. Such regulation would seek to establish uniform, easily comprehensible standards of corporate conduct and to communicate them to every investor. The standards would be implemented by requiring that corporations conform to them as a prerequisite to having their securities traded on an exchange. As a result, investors could more accurately assess the value of corporate equity securities than they can today, and would be less likely to base an investment decision on a misunderstanding of their potential rights as shareholders.1 In evaluating the price of an equity security today, investors face fifty state corporation laws and as many state judicial systems, which together determine the bundle of rights the investor pur- chases. This problem stems from the principle that state law defines the rights and obligations a corporation owes to its share- holders.2 Investors who have neither the expertise to school them- selves in the nuances of state corporation law nor the resources to hire an attorney for that purpose 3 may choose "safer" invest- ments,4 or equally risky but more understandable investments,5 or I Stock exchanges currently regulate some aspects of internal corporate affairs, see, e.g., note 40 infra, but this Comment advocates greater supervisory powers. Furthermore, because of the relative obscurity of listing agreement provisions, investors do not generally appreciate the specifies of current exchange regulations. -

Why Are the First Day Returns of China's Ipos So High?

University of Wollongong Research Online Faculty of Commerce - Papers (Archive) Faculty of Business and Law 2005 Why Are the First Day Returns of China’s IPOs So High? S. Ma University of Wollongong, [email protected] Follow this and additional works at: https://ro.uow.edu.au/commpapers Part of the Business Commons, and the Social and Behavioral Sciences Commons Recommended Citation Ma, S.: Why Are the First Day Returns of China’s IPOs So High? 2005. https://ro.uow.edu.au/commpapers/474 Research Online is the open access institutional repository for the University of Wollongong. For further information contact the UOW Library: [email protected] Why Are the First Day Returns of China’s IPOs So High? Abstract We investigate the causes of the high first day returns of Chinese firms making an initial public offering (IPO) of A-shares from 1991 to 2003 on Shanghai and Shenzhen stock exchanges. Our results show an average underpricing of 175.21 percent. We argue that the IPO underpricing is an interaction of ex-market underpricing and on-market overpricing. The high first day returns of China’s IPOs are most likely generated from on-market overpricing. Government intervention, market speculation, special ownership structure, strategy of proceeds maximization and risk concerns are the main drivers of the high first day returns. However, the high first day returns have decreased significantly in ecentr years. We explained this change by testing the risk composition hypothesis, the realignment of incentives hypothesis and the changing issuer objective hypothesis, which shows that the reduction in risk, senior managerial shares and seasoned offerings mitigate the first day returns. -

Asset Securitization

L-Sec Comptroller of the Currency Administrator of National Banks Asset Securitization Comptroller’s Handbook November 1997 L Liquidity and Funds Management Asset Securitization Table of Contents Introduction 1 Background 1 Definition 2 A Brief History 2 Market Evolution 3 Benefits of Securitization 4 Securitization Process 6 Basic Structures of Asset-Backed Securities 6 Parties to the Transaction 7 Structuring the Transaction 12 Segregating the Assets 13 Creating Securitization Vehicles 15 Providing Credit Enhancement 19 Issuing Interests in the Asset Pool 23 The Mechanics of Cash Flow 25 Cash Flow Allocations 25 Risk Management 30 Impact of Securitization on Bank Issuers 30 Process Management 30 Risks and Controls 33 Reputation Risk 34 Strategic Risk 35 Credit Risk 37 Transaction Risk 43 Liquidity Risk 47 Compliance Risk 49 Other Issues 49 Risk-Based Capital 56 Comptroller’s Handbook i Asset Securitization Examination Objectives 61 Examination Procedures 62 Overview 62 Management Oversight 64 Risk Management 68 Management Information Systems 71 Accounting and Risk-Based Capital 73 Functions 77 Originations 77 Servicing 80 Other Roles 83 Overall Conclusions 86 References 89 ii Asset Securitization Introduction Background Asset securitization is helping to shape the future of traditional commercial banking. By using the securities markets to fund portions of the loan portfolio, banks can allocate capital more efficiently, access diverse and cost- effective funding sources, and better manage business risks. But securitization markets offer challenges as well as opportunity. Indeed, the successes of nonbank securitizers are forcing banks to adopt some of their practices. Competition from commercial paper underwriters and captive finance companies has taken a toll on banks’ market share and profitability in the prime credit and consumer loan businesses. -

Hedge Funds Oversight, Report of the Technical Committee Of

Hedge Funds Oversight Consultation Report TECHNICAL COMMITTEE OF THE INTERNATIONAL ORGANIZATION OF SECURITIES COMMISSIONS MARCH 2009 This paper is for public consultation purposes only. It has not been approved for any other purpose by the IOSCO Technical Committee or any of its members. Foreword The IOSCO Technical Committee has published for public comment this consultation report on Hedge Funds Oversight. The Report makes preliminary recommendations of regulatory approaches that may be used to mitigate the regulatory risks posed by hedge funds. The Report will be finalised after consideration of comments received from the public. How to Submit Comments Comments may be submitted by one of the three following methods on or before 30 April 2009. To help us process and review your comments more efficiently, please use only one method. 1. E-mail • Send comments to Greg Tanzer, Secretary General, IOSCO at the following email address: [email protected] • The subject line of your message should indicate “Public Comment on the Hedge Funds Oversight: Consultation Report”. • Please do not submit any attachments as HTML, GIF, TIFF, PIF or EXE files. OR 2. Facsimile Transmission Send a fax for the attention of Greg Tanzer using the following fax number: + 34 (91) 555 93 68. OR 3. Post Send your comment letter to: Greg Tanzer Secretary General IOSCO 2 C / Oquendo 12 28006 Madrid Spain Your comment letter should indicate prominently that it is a “Public Comment on the Hedge Funds Oversight: Consultation Report” Important: All comments will be made available publicly, unless anonymity is specifically requested. Comments will be converted to PDF format and posted on the IOSCO website. -

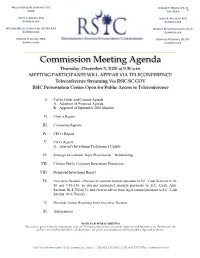

2020.12.03 RSIC Meeting Materials

WILLIAM (BILL) H. HANCOCK, CPA RONALD P. WILDER, PH. D CHAIR VICE-CHAIR 1 PEGGY G. BOYKIN, CPA ALLEN R. GILLESPIE, CFA COMMISSIONER COMMISSIONER WILLIAM (BILL) J. CONDON, JR. JD, MA, CPA REBECCA M. GUNNLAUGSSON, PH. D COMMISSIONER COMMISSIONER EDWARD N. GIOBBE, MBA REYNOLDS WILLIAMS, JD, CFP COMMISSIONER COMMISSIONER _____________________________________________________________________________________ Commission Meeting Agenda Thursday, December 3, 2020 at 9:30 a.m. MEETING PARTICIPANTS WILL APPEAR VIA TELECONFERENCE Teleconference Streaming Via RSIC.SC.GOV RSIC Presentation Center Open for Public Access to Teleconference I. Call to Order and Consent Agenda A. Adoption of Proposed Agenda B. Approval of September 2020 Minutes II. Chair’s Report III. Committee Reports IV. CEO’s Report V. CIO’s Report A. Quarterly Investment Performance Update VI. Strategic Investment Topic Presentation – Rebalancing VII. Chinese Public Company Investment Discussion VIII. Delegated Investment Report IX. Executive Session – Discuss investment matters pursuant to S.C. Code Sections 9-16- 80 and 9-16-320; to discuss personnel matters pursuant to S.C. Code Ann. Section 30-4-70(a)(1); and receive advice from legal counsel pursuant to S.C. Code Section 30-4-70(a)(2). X. Potential Action Resulting from Executive Session XI. Adjournment NOTICE OF PUBLIC MEETING This notice is given to meet the requirements of the S.C. Freedom of Information Act and the Americans with Disabilities Act. Furthermore, this facility is accessible to individuals with disabilities, and special accommodations will be provided if requested in advance. 1201 MAIN STREET, SUITE 1510, COLUMBIA, SC 29201 // (P) 803.737.6885 // (F) 803.737.7070 // WWW.RSIC.SC.GOV 2 AMENDED DRAFT South Carolina Retirement System Investment Commission Meeting Minutes September 10, 2020 9:30 a.m. -

Initial Public Offerings

November 2017 Initial Public Offerings An Issuer’s Guide (US Edition) Contents INTRODUCTION 1 What Are the Potential Benefits of Conducting an IPO? 1 What Are the Potential Costs and Other Potential Downsides of Conducting an IPO? 1 Is Your Company Ready for an IPO? 2 GETTING READY 3 Are Changes Needed in the Company’s Capital Structure or Relationships with Its Key Stockholders or Other Related Parties? 3 What Is the Right Corporate Governance Structure for the Company Post-IPO? 5 Are the Company’s Existing Financial Statements Suitable? 6 Are the Company’s Pre-IPO Equity Awards Problematic? 6 How Should Investor Relations Be Handled? 7 Which Securities Exchange to List On? 8 OFFER STRUCTURE 9 Offer Size 9 Primary vs. Secondary Shares 9 Allocation—Institutional vs. Retail 9 KEY DOCUMENTS 11 Registration Statement 11 Form 8-A – Exchange Act Registration Statement 19 Underwriting Agreement 20 Lock-Up Agreements 21 Legal Opinions and Negative Assurance Letters 22 Comfort Letters 22 Engagement Letter with the Underwriters 23 KEY PARTIES 24 Issuer 24 Selling Stockholders 24 Management of the Issuer 24 Auditors 24 Underwriters 24 Legal Advisers 25 Other Parties 25 i Initial Public Offerings THE IPO PROCESS 26 Organizational or “Kick-Off” Meeting 26 The Due Diligence Review 26 Drafting Responsibility and Drafting Sessions 27 Filing with the SEC, FINRA, a Securities Exchange and the State Securities Commissions 27 SEC Review 29 Book-Building and Roadshow 30 Price Determination 30 Allocation and Settlement or Closing 31 Publicity Considerations -

A Fidelity Investments Webinar Series: Basics of Stock Investing

A Fidelity Investments Webinar Series: Basics of Stock Investing Fidelity Brokerage Services, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917. © 2016 FMR LLC. All rights reserved. 734380.2.0 1 Agenda • Reasons for stock investing • Getting started • Research stocks • Analyze stocks • Buy Stocks • Monitor stocks • Resources 2 Reasons for Stock Investing • Why do you invest in stocks? – Create or grow your portfolio – Increase income 3 Getting Started with Stock Investing - Make a list Research – make a list of stocks to consider Analyze – narrow down your list Buy – place your trades Monitor – track performance and news to determine next steps 4 Stock Investing To Do List What to consider … – Timeframe – what timeframe are you looking to invest in stocks? – Investment – how much money do you want to put towards this strategy? – Exit Strategy – what is your plan if the stocks performs well or badly? 5 What are the different stock types? Equity Share Classes Common Stock • Represents ownership in a company and a claim (dividends) portion of the profits; investors get one vote per share to elect board members. Preferred Stock • Represents a class of ownership in a company that has a higher claim on the assets compared to common stock; has a dividend that must be paid out prior to common stockholders; these shares do not have voting rights. 6 Research Stocks Using Fidelity.com Research Analyze Buy • Where to start? Monitor – Determine proper research tools and information to help identify stocks • What tools to use? – Read Fidelity Viewpoints articles – Read Fidelity White papers – Review quarterly market updates – Use the Stock Screener • Where can I learn more? – View the Getting Started with the Stock Screener video from the Fidelity Learning Center Screenshots are for illustrative purposes only. -

China Client Alert

China Client Alert Hong Kong Regulator issues Guidelines on IPO Cornerstone Investments Last month, the Hong Kong Stock Exchange ("HKEx") issued new guidelines for cornerstone investments (the “Guidance Letter”). In the Guidance Letter, HKEx sets out its general policies on IPO cornerstone investments and expresses its concerns over side arrangements made between cornerstone investors and listing applicants. Paul, Weiss Asia Offices Highlights of HKEx's policies on IPO Cornerstone Investments: A) Principles for Approving IPO Cornerstone Investments BEIJING Unit 3601, Fortune Plaza Office HKEx approves a preferential placing to cornerstone investors Tower A based on the following principles: No. 7 Dong Sanhuan Zhonglu Chao Yang District, Beijing 100020 • Placing price is at IPO price, People’s Republic of China • +86 10 5828 6300 IPO shares are subject to lock-up (at least 6 months), • Investor has no board representation, HONG KONG Hong Kong Club Building, 12th Flo0r • Investor is independent of listing applicant, its connected persons 3A Chater Road, Central and their respective associates, Hong Kong • Details of placing arrangements are disclosed in the prospectus, +852 2846 0300 and TOKYO • IPO shares are counted as part of the public float so long as the Fukoku Seimei Building investor is a member of the public under Hong Kong Listing Rules. 2-2, Uchisaiwaicho 2-chome Chiyoda-ku, Tokyo 100-0011, B) Reclassification of Cornerstone Investors as Pre-IPO Japan Investors +81 3 3597 8101 HKEx may reclassify a cornerstone investor as a pre-IPO investor if, with respect to acquisition of IPO shares, such investor (whether by way of side letters or otherwise): (i) receives any direct or indirect benefit (other than a guaranteed allocation of IPO shares), for example: • waiver of brokerage commission, • ©2013 Paul, Weiss, Rifkind, Wharton & put option for other person to buy back shares after listing, Garrison LLP. -

Preparing a Venture Capital Term Sheet

Preparing a Venture Capital Term Sheet Prepared By: DB1/ 78451891.1 © Morgan, Lewis & Bockius LLP TABLE OF CONTENTS Page I. Purpose of the Term Sheet................................................................................................. 3 II. Ensuring that the Term Sheet is Non-Binding................................................................... 3 III. Terms that Impact Economics ........................................................................................... 4 A. Type of Securities .................................................................................................. 4 B. Warrants................................................................................................................. 5 C. Amount of Investment and Capitalization ............................................................. 5 D. Price Per Share....................................................................................................... 5 E. Dividends ............................................................................................................... 6 F. Rights Upon Liquidation........................................................................................ 7 G. Redemption or Repurchase Rights......................................................................... 8 H. Reimbursement of Investor Expenses.................................................................... 8 I. Vesting of Founder Shares..................................................................................... 8 J. Employee -

Japan to Normalize Short-Selling Regulations

lakyara vol.164 Japan to normalize short-selling regulations Sadakazu Osaki 10. May. 2013 Japan to normalize short-selling regulations vol.164 Executive Summary Japan's Financial Services Agency has unveiled plans to rescind the emergency short-selling restrictions imposed during the 2008 financial crisis and replace them with revised permanent regulations. Its proposed revisions are timely and sensible. They should help to improve market liquidity and price formation. Sadakazu Osaki Head of Research Center for Strategic Management and Innovation Emergency short-selling restrictions have remained in effect in Japan In March 2013, Japan's Financial Services Agency (FSA) released a draft of revised short-selling regulations. In Japan, short-selling restrictions were tightened as an emergency measure in response to the market turmoil triggered by Lehman Brothers' September 2008 collapse. These emergency restrictions are still in effect, having been extended 12 times. With the recently released revised regulations slated to take effect in November, regulation of short-selling in Japanese markets is set to finally return to normal. Short selling is an investment technique whereby an investor borrows from a third party securities that he does not currently own and sells them in the aim of repurchasing them later at a lower price. When a security is sold short, its market price reflects the investment opinion of investors that do not own the security in the cash market. Short selling also enhances market liquidity by increasing sell orders. It thus fulfills a legitimate economic function but it can also trigger steep price declines if certain stocks are heavily sold short within a short timeframe.