A Primer on Bond Yields

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 06 - Bonds and Other Securities Section 6.2 - Bonds Bond - an Interest Bearing Security That Promises to Pay a Stated Amount of Money at Some Future Date(S)

Chapter 06 - Bonds and Other Securities Section 6.2 - Bonds Bond - an interest bearing security that promises to pay a stated amount of money at some future date(s). maturity date - date of promised final payment term - time between issue (beginning of bond) and maturity date callable bond - may be redeemed early at the discretion of the borrower putable bond - may be redeemed early at the discretion of the lender redemption date - date at which bond is completely paid off - it may be prior to or equal to the maturity date 6-1 Bond Types: Coupon bonds - borrower makes periodic payments (coupons) to lender until redemption at which time an additional redemption payment is also made - no periodic payments, redemption payment includes original loan principal plus all accumulated interest Convertible bonds - at a future date and under certain specified conditions the bond can be converted into common stock Other Securities: Preferred Stock - provides a fixed rate of return for an investment in the company. It provides ownership rather that indebtedness, but with restricted ownership privileges. It usually has no maturity date, but may be callable. The periodic payments are called dividends. Ranks below bonds but above common stock in security. Preferred stock is bought and sold at market price. 6-2 Common Stock - an ownership security without a fixed rate of return on the investment. Common stock dividends are paid only after interest has been paid on all indebtedness and on preferred stock. The dividend rate changes and is set by the Board of Directors. Common stock holders have true ownership and have voting rights for the Board of Directors, etc. -

3. VALUATION of BONDS and STOCK Investors Corporation

3. VALUATION OF BONDS AND STOCK Objectives: After reading this chapter, you should be able to: 1. Understand the role of stocks and bonds in the financial markets. 2. Calculate value of a bond and a share of stock using proper formulas. 3.1 Acquisition of Capital Corporations, big and small, need capital to do their business. The investors provide the capital to a corporation. A company may need a new factory to manufacture its products, or an airline a few more planes to expand into new territory. The firm acquires the money needed to build the factory or to buy the new planes from investors. The investors, of course, want a return on their investment. Therefore, we may visualize the relationship between the corporation and the investors as follows: Capital Investors Corporation Return on investment Fig. 3.1: The relationship between the investors and a corporation. Capital comes in two forms: debt capital and equity capital. To raise debt capital the companies sell bonds to the public, and to raise equity capital the corporation sells the stock of the company. Both stock and bonds are financial instruments and they have a certain intrinsic value. Instead of selling directly to the public, a corporation usually sells its stock and bonds through an intermediary. An investment bank acts as an agent between the corporation and the public. Also known as underwriters, they raise the capital for a firm and charge a fee for their services. The underwriters may sell $100 million worth of bonds to the public, but deliver only $95 million to the issuing corporation. -

Understanding the Z-Spread Moorad Choudhry*

Learning Curve September 2005 Understanding the Z-Spread Moorad Choudhry* © YieldCurve.com 2005 A key measure of relative value of a corporate bond is its swap spread. This is the basis point spread over the interest-rate swap curve, and is a measure of the credit risk of the bond. In its simplest form, the swap spread can be measured as the difference between the yield-to-maturity of the bond and the interest rate given by a straight-line interpolation of the swap curve. In practice traders use the asset-swap spread and the Z- spread as the main measures of relative value. The government bond spread is also considered. We consider the two main spread measures in this paper. Asset-swap spread An asset swap is a package that combines an interest-rate swap with a cash bond, the effect of the combined package being to transform the interest-rate basis of the bond. Typically, a fixed-rate bond will be combined with an interest-rate swap in which the bond holder pays fixed coupon and received floating coupon. The floating-coupon will be a spread over Libor (see Choudhry et al 2001). This spread is the asset-swap spread and is a function of the credit risk of the bond over and above interbank credit risk.1 Asset swaps may be transacted at par or at the bond’s market price, usually par. This means that the asset swap value is made up of the difference between the bond’s market price and par, as well as the difference between the bond coupon and the swap fixed rate. -

Structured Notes, Which Have Embedded Derivatives, Some of Them Very Complex

Structured note markets: products, participants and links to wholesale derivatives markets David Rule and Adrian Garratt, Sterling Markets Division, and Ole Rummel, Foreign Exchange Division, Bank of England Hedging and taking risk are the essence of financial markets. A relatively little known mechanism through which this occurs is the market in structured notes, which have embedded derivatives, some of them very complex. Understanding these instruments can be integral to understanding the underlying derivative markets. In some cases, dealers have used structured notes to bring greater balance to their market risk exposures, by transferring risk elsewhere, including to households, where the risk may be well diversified. But the positions arising from structured notes can sometimes leave dealers ‘the same way around’, potentially giving rise to ‘crowded trades’. In the past that has sometimes been associated with episodes of market stress if the markets proved less liquid than normal when faced with lots of traders exiting at the same time. FOR CENTRAL BANKS, understanding how the modern For issuers, structured notes can be a way of buying financial system fits together is a necessary options to hedge risks in their business. Most, foundation for making sense of market developments, however, swap the cash flows due on the notes with a for understanding how to interpret changes in asset dealer for a more straightforward set of obligations. prices and, therefore, for identifying possible threats In economic terms, the dealer then holds the to stability and comprehending the dynamics of embedded options. Sometimes they may hedge crises. Derivatives are an integral part of this, used existing exposures taken elsewhere in a dealer’s widely for the management of market, credit and business. -

Mortgage-Backed Securities & Collateralized Mortgage Obligations

Mortgage-backed Securities & Collateralized Mortgage Obligations: Prudent CRA INVESTMENT Opportunities by Andrew Kelman,Director, National Business Development M Securities Sales and Trading Group, Freddie Mac Mortgage-backed securities (MBS) have Here is how MBSs work. Lenders because of their stronger guarantees, become a popular vehicle for finan- originate mortgages and provide better liquidity and more favorable cial institutions looking for investment groups of similar mortgage loans to capital treatment. Accordingly, this opportunities in their communities. organizations like Freddie Mac and article will focus on agency MBSs. CRA officers and bank investment of- Fannie Mae, which then securitize The agency MBS issuer or servicer ficers appreciate the return and safety them. Originators use the cash they collects monthly payments from that MBSs provide and they are widely receive to provide additional mort- homeowners and “passes through” the available compared to other qualified gages in their communities. The re- principal and interest to investors. investments. sulting MBSs carry a guarantee of Thus, these pools are known as mort- Mortgage securities play a crucial timely payment of principal and inter- gage pass-throughs or participation role in housing finance in the U.S., est to the investor and are further certificates (PCs). Most MBSs are making financing available to home backed by the mortgaged properties backed by 30-year fixed-rate mort- buyers at lower costs and ensuring that themselves. Ginnie Mae securities are gages, but they can also be backed by funds are available throughout the backed by the full faith and credit of shorter-term fixed-rate mortgages or country. The MBS market is enormous the U.S. -

VALUATION of CALLABLE BONDS: the SALOMON BROTHERS APPROACH Fernando Daniel Rubio Fernández

VALUATION OF CALLABLE BONDS: THE SALOMON BROTHERS APPROACH Fernando Daniel Rubio Fernández VALUATION OF CALLABLE BONDS: THE SALOMON BROTHERS APPROACH FERNANDO RUBIO1 Director FERNCAPITAL S.A. and Invited Professor at the Graduated Business School Universidad de Valparaíso, Chile. Pasaje La Paz 1302, Viña del Mar, Chile. Phone (56) (32) 507507 EXTRACT This paper explain, analyze and apply in an example the original paper developed by Kopprasch, Boyce, Koenigsberg, Tatevossian, and Yampol (1987) from The Salomon Brothers Inc. Bond Portfolio Analysis Group. Please, be aware. This paper is for educational issues only. There is a Spanish version in EconWPA. JEL Classification: G10, G15, G21, G32. Keywords: Salomon Brothers, bond portfolio, duration and convexity, effective duration, valuation, callable and non callable bond. Originally developed January, 1999 Originally published October, 2004 This update July, 2005 1 This paper was made while I was assisting to the Doctoral Programme in Financial Economics, Universidad Autónoma de Madrid, Spain. Comments and suggestions will be appreciated. Please, send them by e-mail to [email protected] [email protected] 1 VALUATION OF CALLABLE BONDS: THE SALOMON BROTHERS APPROACH Fernando Daniel Rubio Fernández VALUATION OF CALLABLE BONDS: THE SALOMON BROTHERS APPROACH By Professor Dr. © Fernando Rubio 1 DURATION AND CONVEXITY FOR NORMAL (NO CALLABLE) BONDS Bonds are fixed income investments that have a fixed interest rate or coupon, payable on the principal amount. All fixed income investments are evidence of indebtedness which represent a loan or debt between the issuer and the owner or holder of the security. The value of any bond is the present value of its expected cash flows. -

The Use of Credit Default Swaps by U.S. Fixed-Income Mutual Funds

Sanjiv R. Das FDIC Center for Financial Research Darrell Duffie Working Paper Nikunj Kapadia No. 2011-01 Empirical Comparisons and Implied Recovery Rates The Use of Credit Default Swaps by U.S Fixed-Income Mutual Funds Risk-Based Capital Standards, kkk Deposit Insurance and Procyclicality November 19, 2010 Risk-Based Capital Standards, Deposit Insurance and Procyclicality An Empirical September 2005 An Empirical Analysis Federal Dposit Insurance Corporation •Center for Financial Researchh State- May, 2005 Efraim Benmel Efraim Benmelech June 20 May , 2005 Asset S2005-14 The Use of Credit Default Swaps by U.S. Fixed-Income Mutual Funds Tim Adam, Humboldt University* and Risk Management Institute (Singapore) Andre Guettler, University of Texas at Austin and EBS Business School† November 19, 2010 Abstract We examine the use of credit default swaps (CDS) in the U.S. mutual fund industry. We find that among the largest 100 corporate bond funds the use of CDS has increased from 20% in 2004 to 60% in 2008. Among CDS users, the average size of CDS positions (measured by their notional values) increased from 2% to almost 14% of a fund’s net asset value. Some funds exceed this level by a wide margin. CDS are predominantly used to increase a fund’s exposure to credit risks rather than to hedge credit risk. Consistent with fund tournaments, underperforming funds use multi-name CDS to increase their credit risk exposures. Finally, funds that use CDS underperform funds that do not use CDS. Part of this underperformance is caused by poor market timing. JEL-Classification: G11, G15, G23 Keywords: Corporate bond fund, credit default swap, credit risk, fund performance, hedging, speculation, tournaments * Humboldt University, Institute of Corporate Finance, Dorotheenstr. -

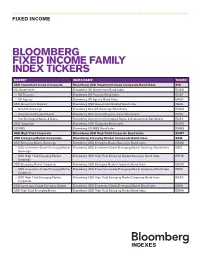

Bloomberg Fixed Income Family Index Tickers

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////// FIXED INCOME BLOOMBERG FIXED INCOME FAMILY INDEX TICKERS MARKET INDEX NAME TICKER USD Investment Grade Composite Bloomberg USD Investment Grade Composite Bond Index BIG US Government Bloomberg US Government Bond Index BUSG » US Treasury Bloomberg US Treasury Bond Index BUSY » US Agency Bloomberg US Agency Bond Index BAGY USD Government Related Bloomberg USD Government Related Bond Index BGRL » Non-US Sovereign Bloomberg Non-US Sovereign Bond Index BNSO » Government Regional/Local Bloomberg Government Regional/Local Bond Index BRGL » Gov Developed Banks & Supra Bloomberg Government Developed Banks & Supranational Bond Index BDEV USD Corporate Bloomberg USD Corporate Bond Index BUSC US MBS Bloomberg US MBS Bond Index BMBS USD High Yield Corporate Bloomberg USD High Yield Corporate Bond Index BUHY USD Emerging Market Composite Bloomberg Emerging Market Composite Bond Index BEM USD Emerging Market Sovereign Bloomberg USD Emerging Market Sovereign Bond Index BEMS » USD Investment Grade Emerging Market Bloomberg USD Investment Grade Emerging Market Sovereign Bond Index BEIS Sovereign » USD High Yield Emerging Market Bloomberg USD High Yield Emerging Market Sovereign Bond Index BEHS Sovereign USD Emerging Market Corporate Bloomberg USD Emerging Market Corporate Bond Index BEMC » USD Investment Grade Emerging Market Bloomberg USD Investment Grade Emerging Market Corporate Bond Index BIEM Corporate -

New Bonds to Make the Eurozone Safer

NEW BONDS TO MAKE THE EUROZONE SAFER Benedikt Fritz, Arne Holzhausen, Lea Pirovino, Tim Schmalle Allianz Research Munich, December 2018 1 NEW BONDS VS STATUS QUO SYNTHETIC EUROBONDS REFORM 01 A DECISION MATRIX 06 2011 EUROBONDS ESBIES PROPOSALS 02 2011 07 2011, 2016, 2017 RED / BLUE BONDS ESIM 03 2010, 2011 08 2011, 2018 PURPLE BONDS APPENDIX 04 2018 09 FURTHER PROPOSALS ACCOUNTABILITY BONDS 05 2015, 2018 2 NEW BONDS VS STATUS QUO: A DECISION MATRIX Red / Blue Accountability Synthetic Eurobonds ESBies ESIM Bonds Bonds Eurobonds Strengthening the Euro Fiscal discipline incentivized 0 0 Euro strengthened as a global currency 0 0 0 Crisis Performance Prevention of excessive rate spikes in crises 0 0 Doom loop broken 0 0 Political Feasibility Political resilience of the mechanism 0 0 Implementation possible 3 EC Green Paper, J.-C. Juncker (then Luxembourg Finance Minister) & G. Tremonti (then Italian Finance Minister), C. Lagarde (IMF Managing Director) EUROBONDS (2011) How does it work? What are the goals? What are the problems? • Bonds are issued jointly by eurozone member • Promotion of further eurozone integration • Entirely incompatible with the no-bailout clause states with joint and several liability • Increased liquidity and lowered borrowing costs, • Higher interest rates for very solvent countries like • Completely replaces national issuance of debt especially in times of financial distress Germany, the Netherlands and Austria • Each member is fully liable for the entire issuance • Resolution of the eurozone debt crisis and • Moral -

Chapter 3 Fixed Income Securities

Chapter 3 Fixed Income Securities Road Map Part A Introduction to finance. Part B Valuation of assets, given discount rates. • Fixed-income securities. • Stocks. • Real assets (capital budgeting). Part C Determination of risk-adjusted discount rates. Part D Introduction to derivatives. Main Issues • Fixed-Income Markets • Term Structure of Interest Rates • Interest Rate Risk • Inflation Risk • Credit Risk Chapter 3 Fixed Income Securities 3-1 1 Fixed-Income Markets Definition: Fixed-income securities are financial claims with promised cash flows of fixed amount paid at fixed dates. Classification of Fixed-Income Securities: 1. Treasury Securities: • U.S. Treasury securities (bills, notes, bonds). • Bunds, JGBs, U.K. Gilts ... 2. Federal Agency Securities: • Securities issued by federal agencies (FHLB, FNMA ...). 3. Corporate Securities: • Commercial paper. • Medium-term notes (MTNs). • Corporate bonds ... 4. Municipal Securities. 5. Mortgage-Backed Securities. 6. ... Fall 2006 c J. Wang 15.401 Lecture Notes 3-2 Fixed Income Securities Chapter 3 Overview of Fixed-income Markets Composition of U.S. Debt Markets (2005) Market value % (in trillion dollars) Treasury 4.17 16.5 Corporate 4.99 19.7 Mortgage 5.92 23.4 Agency 2.60 10.3 Munies 2.23 8.8 Asset-Backed 1.96 7.7 Money Market 3.47 13.7 Total 25.33 Current Trends T. Corp. MBS Agency ABS Munies MM Total 1995 3.31 1.94 2.35 0.84 0.32 1.29 1.18 11.23 1996 3.44 2.12 2.49 0.93 0.40 1.30 1.39 12.01 1997 3.44 2.36 2.68 1.02 0.54 1.32 1.69 13.05 1998 3.34 2.71 2.96 1.30 0.73 1.40 1.98 14.42 1999 3.27 3.05 3.33 1.62 0.90 1.46 2.34 15.96 2000 2.95 3.36 3.56 1.85 1.07 1.48 2.66 16.95 2001 2.97 3.84 4.13 2.15 1.28 1.60 2.57 18.53 2002 3.20 4.09 4.70 2.29 1.54 1.73 2.55 20.15 2003 3.57 4.46 5.31 2.64 1.69 1.89 2.53 22.10 2004 3.94 3.70 5.47 2.75 1.83 2.02 2.87 23.58 2005 4.17 4.99 4.92 2.60 1.96 2.23 3.47 25.33 15.401 Lecture Notes c J. -

New Developments and Credit Trends in the Illinois Municipal Bond Market

New Developments and Credit Trends in the Illinois Municipal Bond Market Insight that will Help Improve Your Municipality’s Access to the Municipal Bond Market Andrew Kim Stephen Adams David Levett Director, Public Finance Director, Public Finance Vice President – Senior Analyst PMA Securities, LLC PMA Securities, LLC Moody’s Investors Service [email protected] [email protected] [email protected] IGFOA ANNUALIGFOA CONFERENCE ANNUAL CONFERENCE • SEPTEMBER • SEPTEMBER 8–10, 2019 8–10, 2019 Issuing Debt Through the Illinois Finance Authority • Bonds issued through the Illinois Finance Authority (IFA) are exempt from both federal and Illinois income taxes • Given Governor Pritzker’s new income tax proposal, which increases the state income tax on those individuals and families making more than $250,000 per year, a bond issue that exempts state income tax in addition to federal income tax may be attractive to investors residing in Illinois • A referendum question regarding the implementation of a graduated tax rate will appear on the November 2020 ballot • The IFA serves as a conduit issuer to many units of local government • The IFA is the “Issuer” of the bonds and the local unit of government is the “Obligor” • The bonds carry the rating of the Obligor who is contractually obligated to make the payments to the IFA • The IFA’s Board meetings are held monthly on the 2nd Tuesday IGFOA ANNUAL CONFERENCE • SEPTEMBER 8–10, 2019 2 Issuing Debt Through the Illinois Finance Authority • The process to issue through the IFA is as follows: -

Connecticut Ladder 1 to 5 Year Municipal Fixed Income Sample Portfolio August 9, 2021

Connecticut Ladder 1 to 5 Year Municipal Fixed Income Sample Portfolio August 9, 2021 % of Sample Bonds Sample Portfolio Characteristics S&P Rating ^ Portfolio Sample Portfolio Sector Allocation (Bonds Only) Only (Bonds Only) LD1-5CTNETAVERAGE ASSETS EFFECTIVE DURATION (YRS) 2.62 AAA 40.3% LD1-5CTNETAVERAGE ASSETS MATURITY/LIFE (YRS) 2.82 AA 49.6% LD1-5CTNETAVERAGE ASSETS COUPON (%) 4.81 A 10.1% LD1-5CTNETAVERAGE ASSETS CURRENT YIELD(%) 4.29 BBB 0.0% LD1-5CTNETAVERAGE ASSETS YIELD TO WORST(%) 0.24 NR 0.0% LD1-5CTNETAVERAGE ASSETS YIELD TO MATURITY(%) 0.24 AVERAGE TAX EQUIVALENT YIELD TO WORST (%) 0.40 AVERAGE TAX EQUIVALENT YIELD TO MATURITY (%) 0.40 Revenue 40% General Sample Portfolio Representation Bond Holdings Obligation Yield to 60% Effective Moody's S&P Description Coupon (%) Maturity Price ($) Worst Duration Rating Rating 0 (%) 1LD1-5CTMunicipalsTEXAS TRANSN COMMN ST HWY FD R 5.000 04/01/22 103.15 0.63 years 0.08 Aaa AAA 2LD1-5CTMunicipalsNORTH CAROLINA ST LTD OBLIG 5.000 06/01/22 103.98 0.80 years 0.07 Aa1 AA+ 3LD1-5CTMunicipalsUNIVERSITY CONN 5.000 02/15/23 107.28 1.45 years 0.19 Aa3 A+ 4LD1-5CTMunicipalsMASSACHUSETTS ST TRANSN FD REV 5.000 06/01/23 108.86 1.74 years 0.10 Aa1 AA+ 5LD1-5CTMunicipalsCHANDLER ARIZ 5.000 07/01/24 114.04 2.73 years 0.14 Aaa AAA 6LD1-5CTMunicipalsWEST HARTFORD CONN 5.000 10/01/24 115.13 2.92 years 0.17 NR AAA 7LD1-5CTMunicipalsBLOOMFIELD CONN 5.000 01/15/25 116.03 3.21years 0.30 NR AA+ 8LD1-5CTMunicipalsNEW YORK N Y 4.000 08/01/25 114.49 3.73 years 0.33 Aa2 AA Sample Portfolio Duration Distribution (Bonds Only) 9LD1-5CTMunicipalsBROOKFIELD CONN 4.000 08/15/26 117.48 4.48 years 0.47 NR AAA 10LD1-5CTMunicipalsENFIELD CT 5.000 08/01/26 121.99 4.52 years 0.52 NR AA 11LD1-5CTMunicipals 12LD1-5CTMunicipals 100% 13LD1-5CTMunicipals 90% 14LD1-5CTMunicipals 15LD1-5CTMunicipals 80% 16LD1-5CTMunicipals 70% 17LD1-5CTMunicipals 18LD1-5CTMunicipals 60% 19LD1-5CTMunicipals 50% 20LD1-5CTMunicipals 39.79% 40.45% 40% 30% 19.75% 20% 10% 0.00% 0% 0-2 2-4 4-6 >6 Years MASH0421U/S-1585094-1/2 Source: BlackRock, Bloomberg, Reuters.