BLOCKCHAIN and the CHIEF STRATEGY OFFICER How Distributed Ledger Technology Will Change Strategy Design and Delivery

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pwc I 2Nd Global Crypto M&A and Fundraising Report

2nd Global Crypto M&A and Fundraising Report April 2020 2 PwC I 2nd Global Crypto M&A and Fundraising Report Dear Clients and Friends, We are proud to launch the 2nd edition of our Global Crypto M&A and Fundraising Report. We hope that the market colour and insights from this report will be useful data points. We will continue to publish this report twice a year to enable you to monitor the ongoing trends in the crypto ecosystem. PwC has put together a “one stop shop” offering, focused on crypto services across our various lines of services in over 25 jurisdictions, including the most active crypto jurisdictions. Our goal is to service your needs in the best possible way leveraging the PwC network and allowing you to make your project a success. Our crypto clients include crypto exchanges, crypto investors, crypto asset managers, ICOs/IEOs/STOs/stable and asset backed tokens, traditional financial institutions entering the crypto space as well as governments, central banks, regulators and other policy makers looking at the crypto ecosystem. As part of our “one stop shop” offering, we provide an entire range of services to the crypto ecosystem including strategy, legal, regulatory, accounting, tax, governance, risk assurance, audit, cybersecurity, M&A advisory as well as capital raising. More details are available on our global crypto page as well as at the back of this report. 2nd Global Crypto M&A and Fundraising Report April 2020 PwC 2 3 PwC I 2nd Global Crypto M&A and Fundraising Report 5 Key takeaways when comparing 2018 vs 2019 There -

BLOCKCHAIN REVOLUTION: Surviving and Thriving in the 2Nd Era of the Internet

BLOCKCHAIN REVOLUTION: Surviving and Thriving in the 2nd Era of the Internet Alex Tapscott TWITTER: @alextapscott Swiss Re January 23rd, 2017 © 2016 Don Tapscott and Alex Tapscott. All Rights Reserved. The Technological Revolution mobility social big web data internet machine of things learning the cloud drones & robotics 2 | © 2016 The Tapscott Group. All Rights Reserved. The Technological Revolution mobility social big web data internet BLOCKCHAIN machine of things learning the cloud drones & robotics 3 | © 2016 The Tapscott Group. All Rights Reserved. The Internet of Information Web Photos Sites Word INFORMATION PDFs Docs PPT Voice Slides 4 | © 2016 The Tapscott Group. All Rights Reserved. The Internet of Information ▶ The Internet of Value Social Reputation Capital Intellectual Money property Loyalty Attestations Identity points ASSETS Contracts Deeds Carbon credits Energy ASSETS Coupons Other Financial Assets Bonds Premiums Music Art Votes Stocks Other Futures Receivables Swaps IOUs Visual Art Film 5 | © 2016 The Tapscott Group. All Rights Reserved. The Middleman 6 | © 2016 The Tapscott Group. All Rights Reserved. BLOCKCHAIN: The Second Era of the Internet 7 | © 2016 The Tapscott Group. All Rights Reserved. Just Another Block in the Chain 1 2 3 4 5 Block 53 Block50.dat Block51.dat Previous Block52.dat block: 00000zzxvzx5 Timestamp Proof of work: 00000090b41b 04.19.2016.09.14.5 x 3 Block53.dat Transaction: 94lxcv14 Community Reference to Distributed ledger New blocks added Permanent validation previous blocks time-stamp 8 | © 2016 The Tapscott Group. All Rights Reserved. 9 | © 2016 The Tapscott Group. All Rights Reserved. 10 | © 2016 The Tapscott Group. All Rights Reserved. Seven Transformations for a Prosperous World 1. -

Cryptocurrencies and Blockchain Technology

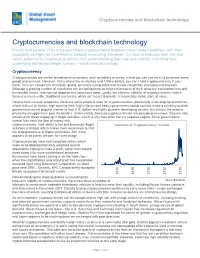

Cryptocurrencies and blockchain technology Cryptocurrencies and blockchain technology Bitcoin and several of its more prominent cryptocurrency brethren have made headlines, with their popularity as high-risk investments steadily increasing. However, it’s hard to evaluate their risk and return potential as investments without first understanding their use and viability, including their underlying distributed ledger system – blockchain technology. Cryptocurrency Cryptocurrencies are similar to traditional currencies, such as dollars or euros, in that you can use them to purchase some goods and services. However, that’s where the similarities end. Unlike dollars, you can’t hold cryptocurrencies in your hand. They are completely electronic, global, generally unregulated and almost completely anonymous to transact. Although a growing number of merchants are accepting them as payment because of their attractive transaction fees and irrevocable nature, widespread adoption is a long ways away. Lastly, the extreme volatility of cryptocurrencies makes them very much unlike traditional currencies, which are meant to provide a reasonably stable store of value. Despite their unusual properties, there are some practical uses for cryptocurrencies, particularly in developing economies where distrust for banks, high banking fees, high inflation and heavy government capital controls make a currency outside government control popular (similar to how U.S. dollars are highly prized in developing nations, but without the need to physically smuggle them past the border). Unfortunately, because cryptocurrencies are pseudo-anonymous, they are also attractive for those engaging in illegal activities, which is why they often carry a negative stigma. Since governments cannot fully track the flow of money with cryptocurrencies, their ability to tax and prosecute illegal Instances of "Cryptocurrency" Articles activities is limited, which makes them more likely to limit the widespread use of digital currencies. -

The Economic Limits of Bitcoin and the Blockchain∗†

The Economic Limits of Bitcoin and the Blockchain∗† Eric Budish‡ June 5, 2018 Abstract The amount of computational power devoted to anonymous, decentralized blockchains such as Bitcoin’s must simultaneously satisfy two conditions in equilibrium: (1) a zero-profit condition among miners, who engage in a rent-seeking competition for the prize associated with adding the next block to the chain; and (2) an incentive compatibility condition on the system’s vulnerability to a “majority attack”, namely that the computational costs of such an attack must exceed the benefits. Together, these two equations imply that (3) the recurring, “flow”, payments to miners for running the blockchain must be large relative to the one-off, “stock”, benefits of attacking it. This is very expensive! The constraint is softer (i.e., stock versus stock) if both (i) the mining technology used to run the blockchain is both scarce and non-repurposable, and (ii) any majority attack is a “sabotage” in that it causes a collapse in the economic value of the blockchain; however, reliance on non-repurposable technology for security and vulnerability to sabotage each raise their own concerns, and point to specific collapse scenarios. In particular, the model suggests that Bitcoin would be majority attacked if it became sufficiently economically important — e.g., if it became a “store of value” akin to gold — which suggests that there are intrinsic economic limits to how economically important it can become in the first place. ∗Project start date: Feb 18, 2018. First public draft: May 3, 2018. For the record, the first large-stakes majority attack of a well-known cryptocurrency, the $18M attack on Bitcoin Gold, occurred a few weeks later in mid-May 2018 (Wilmoth, 2018; Wong, 2018). -

A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets

Journal of Risk and Financial Management Review A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets Nikolaos A. Kyriazis Department of Economics, University of Thessaly, 38333 Volos, Greece; [email protected] Abstract: This study is an integrated survey of GARCH methodologies applications on 67 empirical papers that focus on cryptocurrencies. More sophisticated GARCH models are found to better explain the fluctuations in the volatility of cryptocurrencies. The main characteristics and the optimal approaches for modeling returns and volatility of cryptocurrencies are under scrutiny. Moreover, emphasis is placed on interconnectedness and hedging and/or diversifying abilities, measurement of profit-making and risk, efficiency and herding behavior. This leads to fruitful results and sheds light on a broad spectrum of aspects. In-depth analysis is provided of the speculative character of digital currencies and the possibility of improvement of the risk–return trade-off in investors’ portfolios. Overall, it is found that the inclusion of Bitcoin in portfolios with conventional assets could significantly improve the risk–return trade-off of investors’ decisions. Results on whether Bitcoin resembles gold are split. The same is true about whether Bitcoins volatility presents larger reactions to positive or negative shocks. Cryptocurrency markets are found not to be efficient. This study provides a roadmap for researchers and investors as well as authorities. Keywords: decentralized cryptocurrency; Bitcoin; survey; volatility modelling Citation: Kyriazis, Nikolaos A. 2021. A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets. Journal of Risk and 1. Introduction Financial Management 14: 293. The continuing evolution of cryptocurrency markets and exchanges during the last few https://doi.org/10.3390/jrfm years has aroused sparkling interest amid academic researchers, monetary policymakers, 14070293 regulators, investors and the financial press. -

Luciana De Paula Soares.Pdf

UNIVERSIDADE NOVE DE JULHO FACULDADE DE DIREITO MESTRADO EM DIREITO LUCIANA DE PAULA SOARES CRIPTOMOEDA E BLOCKCHAIN: O RIGOR DAS REGRAS BRASILEIRAS FRENTE AO MERCADO TRADICIONAL São Paulo 2021 LUCIANA DE PAULA SOARES CRIPTOMOEDA E BLOCKCHAIN: O RIGOR DAS REGRAS BRASILEIRAS FRENTE AO MERCADO TRADICIONAL Dissertação de mestrado apresentada ao Programa de Pós-graduação em Direito da Universidade Nove de Julho - UNINOVE, como requisito parcial para obtenção do grau de Mestre em Direito. Orientador: Prof. Dr. Dr. h.c. João Maurício Adeodato São Paulo 2021 Soares, Luciana de Paula. Criptomoeda e Blockchain: o rigor das regras brasileiras frente ao mercado tradicional / Luciana de Paula Soares. 2021. 119 f. Dissertação (Mestrado) - Universidade Nove de Julho - UNINOVE, São Paulo, 2021. Orientador (a): Prof. Dr. João Maurício Adeodato. 1. Criptomoeda. 2. Blockchain. 3. Regulamentação. 4. Receita Federal do Brasil. 5. Banco Central do Brasil. I. Adeodato, João Maurício. II. Titulo. CDU 34 Luciana de Paula Soares CRIPTOMOEDA E BLOCKCHAIN: O RIGOR DAS Dissertação apresentada ao REGRAS BRASILEIRAS FRENTE AO MERCADO TRADICIONAL Programa Pós-Graduação Stricto Sensu Em Direito da Universidade Nove de Julho como parte das exigências para a obtenção do título de Mestre em Direito São Paulo, 04 de março de 2021. BANCA EXAMINADORA __________________________________ Prof. Dr. João Mauricio Leitão Adeodato Orientador UNINOVE ________________________________________ Prof. Dr. José Renato Nalini Examinador Interno UNINOVE ________________________________________ Profa. Dra. Alexandre Freire Pimentel Examinador Externo UNICAP AGRADECIMENTOS Agradeço primeiramente à minha família que sempre me apoiou nessa estrada sem fim e de inestimável valor, o estudo. Agradeço, ainda, a paciência dos meus filhos, ainda pequenos, em disponibilizar sua mãe para os livros em plena pandemia da Covid-19. -

A Behavioral Economics Approach to Regulating Initial Coin Offerings

A Behavioral Economics Approach to Regulating Initial Coin Offerings NATHAN J. SHERMAN* INTRODUCTION Initial coin offerings (ICOs) are an outgrowth of the cryptocurrency space in which companies raise capital by issuing their own cryptocurrency coin to investors. Although ICOs are an innovative method of raising capital, the growth of the ICO market is troubling considering no investor protection regulations govern the ICO process. Investors pour large amounts of money into these offerings, which are issued by companies that typically have no history of producing a product or revenue, and the prices of coins issued in ICOs are only rising because other investors also funnel money into them.1 This pattern is markedly similar to that of a speculative bubble. A speculative bubble occurs when there are “‘unsustainable increases’ in asset prices caused by investors trading on a pattern of price increases rather than information on fundamental values.”2 In a bubble, “smart money”—informed investors—bid up prices in anticipation of “noise traders” entering the market.3 The noise traders then enter the market due to the psychological biases they encounter in making their investment decisions.4 Eventually, the smart money investors sell their holdings and the bubble bursts. 5 Thus, regulators should create a framework that adequately protects investors in ICOs. The behavioral economics theory of bounded rationality provides insights for building this regulatory framework. Bounded rationality implies that humans make suboptimal choices.6 By understanding the psychological biases that influence investors’ choices, regulators will be able to help investors adopt habits that reduce the harmful effects of speculative bubbles. -

A Bitcoin Governance Network: the Multi-Stakeholder Solution to the Challenges of Cryptocurrency

A BITCOIN GOVERNANCE NETWORK: The Multi-stakeholder Solution to the Challenges of Cryptocurrency Alex Tapscott Director, Institutional Equity Sales Canaccord Genuity Cryptocurrencies are products of the digital revolution and the networked age. As distributed networks with no central issuer and no central command, they are also a distinctly global phenomenon that will force national governments to not only re-evaluate a number of substantive regulatory issues but perhaps also re-think the very nature of governance itself. Cryptocurrencies are wresting control over many issues from traditional decision-makers. Multi-stakeholder governance, founded on principles of transparency and inclusiveness and legitimized by consensus, is the 21st century solution. When leaders of the old paradigm adapt and collaborate more closely with private enterprise, civil society organizations and other stakeholders in the network, then bitcoin and other cryptocurrency technologies can fulfill their potential and gain widespread adoption. © Global Solution Networks 2014 A Bitcoin Governance Network: The Multi-stakeholder Solution to the Challenges of Cryptocurrency i Table of Contents Idea in Brief 1 The Challenge for Governments 2 How Cryptocurrencies Work 4 Bitcoin Volatility and Price 5 Opportunities and Challenges 6 Opportunities 6 Challenges 11 A Bitcoin Governance Network 13 GSN Types for a Bitcoin Governance Network 16 Standards Networks 16 Policy Networks 18 Knowledge Networks 19 Watchdog Networks 20 The GSN Approach: Core Principles, Conclusions and -

3Rd Global Cryptoasset Benchmarking Study

3RD GLOBAL CRYPTOASSET BENCHMARKING STUDY Apolline Blandin, Dr. Gina Pieters, Yue Wu, Thomas Eisermann, Anton Dek, Sean Taylor, Damaris Njoki September 2020 supported by Disclaimer: Data for this report has been gathered primarily from online surveys. While every reasonable effort has been made to verify the accuracy of the data collected, the research team cannot exclude potential errors and omissions. This report should not be considered to provide legal or investment advice. Opinions expressed in this report reflect those of the authors and not necessarily those of their respective institutions. TABLE OF CONTENTS FOREWORDS ..................................................................................................................................................4 RESEARCH TEAM ..........................................................................................................................................6 ACKNOWLEDGEMENTS ............................................................................................................................7 EXECUTIVE SUMMARY ........................................................................................................................... 11 METHODOLOGY ........................................................................................................................................ 14 SECTION 1: INDUSTRY GROWTH INDICATORS .........................................................................17 Employment figures ..............................................................................................................................................................................................................17 -

Blockchain in Japan

Blockchain in Japan " 1" Blockchain in Japan " "The impact of Blockchain is huge. Its importance is similar to the emergence of Internet” Ministry of Economy, Trade and Industry of Japan1 1 Japanese Trade Ministry Exploring Blockchain Tech in Study Group, Coindesk 2" Blockchain in Japan " About this report This report has been made by Marta González for the EU-Japan Centre for Industrial Cooperation, a joint venture between the European Commission and the Japanese Ministry of Economy, Trade and Industry (METI). The Centre aims to promote all forms of industrial, trade and investment cooperation between Europe and Japan. For that purpose, it publishes a series of thematic reports designed to support research and policy analysis of EU-Japan economic and industrial issues. To elaborate this report, the author has relied on a wide variety of sources. She reviewed the existing literature, including research papers and press articles, and interviewed a number of Blockchain thought leaders and practitioners to get their views. She also relied on the many insights from the Japanese Blockchain community, including startups, corporation, regulators, associations and developers. Additionally, she accepted an invitation to give a talk1 about the state of Blockchain in Europe, where she also received input and interest from Japanese companies to learn from and cooperate with the EU. She has also received numerous manifestations of interest during the research and writing of the report, from businesses to regulatory bodies, revealing a strong potential for cooperation between Europe and Japan in Blockchain-related matters. THE AUTHOR Marta González is an Economist and Software Developer specialized in FinTech and Blockchain technology. -

Tokenize the Musician

Tokenize the Musician Stanley Sater* I. INTRODUCTION ................................................................................. 107 II. THE MUSIC INDUSTRY ...................................................................... 110 A. Control Concentrated Among the Few ............................. 110 B. A Record Label’s Deal ..................................................... 110 III. FINANCIAL INSTRUMENTS AND ECONOMICS ................................... 113 A. The Music Industry’s First Asset-Backed Security ........... 113 B. Blockchain Tokens: A New Financial Instrument ............ 114 1. The Economics of Blockchain Tokens ........................... 118 2. Initial Coin Offerings ...................................................... 119 IV. TOKENIZING THE MUSICIAN ............................................................. 120 A. Gramatik: The Tokenized Musician ................................. 122 B. Regulating ICOs ............................................................... 123 V. CONCLUSION .................................................................................... 128 I. INTRODUCTION The centralization of the music industry has led to an imbalance of power and misaligned incentives for those involved.1 With technological advancements, the cost of both creating and distributing music is negligible compared to prior decades.2 Musicians can connect directly to fans, yet major record labels retain their domineering status as middlemen, extracting exorbitant fees from this content exchange.3 As record sales -

Is It Better to Invest in Bitcoin Or Ethereum

1 Is It Better to Invest in Bitcoin or Ethereum Update [06-07-2021] The Ethereum Virtual Machine is the global virtual computer whose state every participant on the Ethereum network stores and agrees on. A blockchain is best described as a public database that is updated and shared across many computers in a network. This causes a state change in the EVM, which is committed and propagated throughout the entire network. Execution of any code causes a state change in the EVM; upon commitment, this state change is broadcast to all nodes in the network. Etc rally strength only exceeded by the rally into the end of may 2017. Cryptocurrency buy entries june 2021. Etc and eth technologies such as;. Bitcoin, ethereum, and dogecoin are plunging. Meanwhile, KODAKCoin will help photographers get paid when their content is used. 7 billion to 20. Ethereum has been a go-to alternative to Bitcoin because it typically offers shorter transaction wait times and lower transaction fees. Launched in August, Bitcoin Cash is hard fork of Bitcoin. The Ethereum Virtual Machine is the global virtual computer whose state every participant on the Ethereum network stores and agrees on. A blockchain is best described as a public database that is updated and shared across many computers in a network. This causes a state change in the EVM, which is committed and propagated throughout the entire network. Execution of any code causes a state change in the EVM; upon commitment, this state change is broadcast to all nodes in the network. Etc rally strength only exceeded by the rally into the end of may 2017.