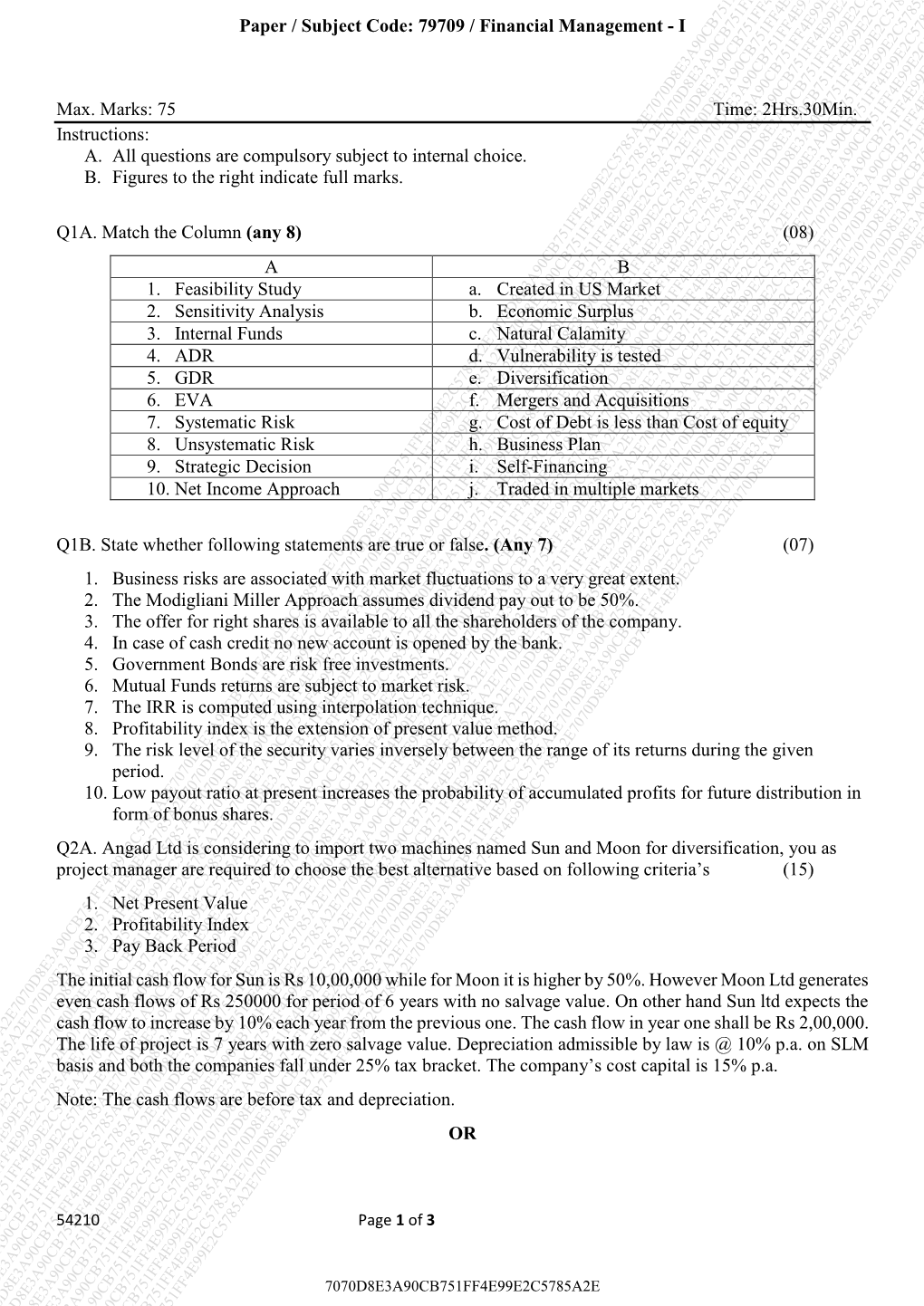

Max. Marks: 75 Time: 2Hrs.30Min. Instructions: A. All Questions Are Compulsory Subject to Internal Choice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ECORFAN Journal RISKS Economic Value Added (EVA) As an Indicator

1 Article ECORFAN Journal RISKS August 2013 Vol.4 No.10 1077-1086 Economic value added (EVA) as an indicator for financial decisions: An Application to the Province of Santa Elena, Ecuador SOLORZANO-Víctor † ⃰, GARCIA-Lupe ´, RAMOS-María ´, VARGAS-Oscar Universidad Península Santa Elena, Avda. principal La Libertad - Santa Elena, La Libertad, Ecuador, +593 4-278-0018. ´ Universidad Autónoma del Estado de México, Paseo Universidad, Universitaria, 50130 Toluca de Lerdo, Estado de México ´´ National Chengchi University, No. 64, Sec. Zhinan Road, Taipei, +886 2 2939 3091. Received December 4, 2012; Accepted April 17, 2013 ___________________________________________________________________________________________________ This paper analyses the need to use alternative methods to the traditional accepted techniques applied in investment analysis for associative groups. This paper exposes that the technique economic value added (EVA) can contribute to measure other aspects involved in financial decisions for associative groups omitted in traditional indicators of project evaluation, net present value (NPV) and internal rate of return (IRR) such as i) evaluation of the productive activity of the associated strategies popular and solidarity economy ii) quantifying the profitability generated by the implementation of the project, iii) identifying the main impacts generated by implementing the creation of the company and iv) the identification of the economic value added. This tool permits the employment of probabilistic scenarios, in order to simulate changes in the input parameters for determining when the EVA tends to zero, making a comparative analysis with the NPV. It is used to calculate the weighted average cost of capital (WACC) market financial returns because you cannot get or inefficient conduct the study by estimating the beta for the CAPM method because Ecuador has not data from the stock exchange. -

Capital Budgeting Model and Sensitivity Analysis of the Project Feasibility in Vietnam for the Period of 2019-2037

International Journal of Business, Economics and Law, Vol. 17, Issue 2 (December) ISSN 2289-1552 2018 CAPITAL BUDGETING MODEL AND SENSITIVITY ANALYSIS OF THE PROJECT FEASIBILITY IN VIETNAM FOR THE PERIOD OF 2019-2037 Dini Mentari Wiwiek Mardawiyah Daryanto ABSTRACT Oil and gas sector has long been a major pillar of the economics of Indonesia before the fall in oil prices in 2013. In 2016, this sector contributed USD 23.7 Billion to the country’s GDP, or about 3.3 % of the country’s economy. However, the total of oil and gas production declined around 4.41% per year since 2007, and the sharpest decline was in 2013. This situation gave impact to the performance of the industry, especially to the government revenues. The purpose of this study is to measure the feasibility of oil and gas industry investment project as an option to generate other revenue stream in a foreign country, Vietnam, for the period of 2019 – 2037. Capital Budgeting Model indicators: Payback Period, Return on Investment (ROI), Net Present Value (NPV), NPV Index, Discounted Payback Period, and Internal Rate of Return (IRR) were used to analyze the data, and sensitivity analysis. The calculation shows that the capital budgeting indicators fulfilled the standard required. This study will be beneficial for the investor to explore other revenue stream opportunity to generate higher return. Keywords: Capital budgeting model, net present value, internal rate of returns, project feasibility, other revenue 1. INTRODUCTION The oil and gas industry, both in Indonesia and globally, has experienced dramatic volatility. Global political-economic situations are believed to drive the sensitivity of oil prices. -

Financial Management

Intermediate Course Study Material (Modules 1 to 2) PAPER 8A Financial Management MODULE – 2 BOARD OF STUDIES THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA © The Institute of Chartered Accountants of India ii This study material has been prepared by the faculty of the Board of Studies. The objective of the study material is to provide teaching material to the students to enable them to obtain knowledge in the subject. In case students need any clarifications or have any suggestions for further improvement of the material contained herein, they may write to the Director of Studies. All care has been taken to provide interpretations and discussions in a manner useful for the students. However, the study material has not been specifically discussed by the Council of the Institute or any of its Committees and the views expressed herein may not be taken to necessarily represent the views of the Council or any of its Committees. Permission of the Institute is essential for reproduction of any portion of this material. © The Institute of Chartered Accountants of India All rights reserved. No part of this book may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise, without prior permission, in writing, from the publisher. Edition : July, 2019 Website : www.icai.org E-mail : [email protected] Committee/ : Board of Studies Department ISBN No. : Price (All Modules) : ` Published by : The Publication Department on behalf of The Institute of Chartered Accountants of India, ICAI Bhawan, Post Box No. 7100, Indraprastha Marg, New Delhi 110 002, India. -

July 2017. Ivo W Elch,Corp Lch,Corporate Finance

4 A First Encounter with Capital-Budgeting Rules The Internal Rate of Return, and More This chapter elaborates on the ideas presented in the previous chapter. We still remain in a world of constant interest rates, perfect foresight, and perfect markets. Let’s look a little more closely at capital budgeting—the possible decision rules that can tell you whether to accept or reject projects. You already know the answer to the mystery, though: NPV is best. Still, there is one very important alternative to NPV: the internal rate of return, which generalizes the rate of return concept and can often give you good recommendations, too. You will see how these approaches fit together. One caveat—although you already know the concept of NPV,and although you will learn more about capital-budgeting rules in this chapter, most of the interesting and difficult issues in NPV’s application are delayed until Chapter 13 (i.e., after we have covered uncertainty and imperfect markets). 4.1 Net Present Value Recap: NPV is the most You have already learned how to use NPV in our perfect world. You first translate cash flows important building block in at different points in time into the same units—dollars today—before they can be compared or finance. You must be able to added. This translation between future values and present values—and its variant, net present compute it in your sleep. value—ranks among the most essential concepts in finance. But why is NPV the right rule to use? The reason is that, at least in our perfect world with perfect information, a positive-NPV project is the equivalent of free money. -

A Methodology for Determining the Profitability Index of Real Estate Initiatives Involving Public– Private Partnerships

Article A Methodology for Determining the Profitability Index of Real Estate Initiatives Involving Public– Private Partnerships. A Case Study: The Integrated Intervention Programs in Rome Fabrizio Battisti * and Orazio Campo Department of Architecture and Design, Sapienza University of Rome, Via Flaminia 359, 00196 Rome, Italy; [email protected] * Correspondence: [email protected]; Tel.: +39-338-1079177 Received: 8 February 2019; Accepted: 23 February 2019; Published: 5 March 2019 Abstract: In the European Union, real estate initiatives involving public–private partnerships (PPPs) are characterized by the payment of a charge, which is generally used for public purposes (and works). In Italy, since the 1990s, PPPs have also been used to start negotiated initiatives giving the possibility of modifying town planning forecasts. Such initiatives are aimed at increasing the value of private properties and, through the charge, financing public works. This charge was regulated only in 2014 with the change of Article 16, paragraph 4, point d-ter of the Presidential Decree 380/2001 (Consolidated building law) and was named the “extraordinary urbanization contribution” (or simply the “extraordinary contribution”). The extraordinary contribution makes it possible to finance public works with private monetary resources. The amount of the extraordinary contribution is not less than 50% of the capital gain that is produced by real estate initiatives concerning modifications to town planning forecasts. A crucial issue of the this kind of PPPs has always been the appraisal of the capital gain of real estate initiatives due to changes in town planning forecasts. The factors to be considered while evaluating the extraordinary contribution, the appraisal tools and procedures to be used in assessing the capital gain are not indicated at regulatory level. -

Managerial Finance

PROJ_MGT 405 Managerial Finance Course Objective: This Course provides an introduction to corporate finance, with an emphasis on project valuation. We review important ideas from modern finance theory and develop financial tools needed for valuing investment projects. Topics covered include the time value of money, estimating cash flows, accounting for risk, performing sensitivity analysis, developing appropriate selection criteria, and valuing projects as real options. The objective of the course is to apply basic insights from corporate finance theory to real business decisions. Where possible, real-world examples are used to link theory with practice with an emphasis on the construction industry. A major portion of the class effort is devoted to a case study of an actual project financed cogeneration facility. Students work in groups to prepare a presentation on its financial performance, including quantifying the risks it faces under changing circumstances. The following is a week-by-week description of the course: Week 1 Introduction and basics of present value. Course overview and objectives are presented as well as housekeeping matters such as the use of Canvas, syllabus and the text. Why financial issues are important to a Project Manager. The time value of money and present value. Related key terms are defined. Use of cash flow diagrams to aid in financial analysis. Rules for choosing the best investment. Useful short cuts. Chapter 2 of the text; no homework due Week 2 Using net present value to rank projects. Evaluating investments; using EXCEL financial function included with EXCEL. Alternative methods of ranking projects: the payback period, the discounted payback period, internal rate of return, book rate of return, and profitability index. -

15.401 Finance Theory I, Capital Budgeting

15.401 15.40115.401 FinanceFinance TheoryTheory MIT Sloan MBA Program Andrew W. Lo Harris & Harris Group Professor, MIT Sloan School Lectures 18–20: Capital Budgeting © 2007–2008 by Andrew W. Lo Critical Concepts 15.401 NPV Rule Cash Flow Computations Discount Rates Discount Rates Over Time Project Interactions Alternatives to the NPV Rule The Practice of Capital Budgeting Key Points Readings Brealey, Myers, and Allen Chapter 5–6, 9, 22 Graham and Harvey (2001) © 2007–2008 by Andrew W. Lo Lecture 18-20: Capital Budgeting Slide 2 NPV Rule 15.401 Objective: Increase Firm’s Current Market Value Implication: take projects with positive NPV Project has cashflows of: Its current market value is This is the addition to the firm's market value by the project (recall value additivity). © 2007–2008 by Andrew W. Lo Lecture 18-20: Capital Budgeting Slide 3 NPV Rule 15.401 Investment Criteria: For a single project, take it if and only if its NPV is positive For many independent projects, take all those with positive NPV For mutually exclusive projects, take the one with positive and highest NPV To Compute the NPV of a Project, We Need To Consider: Cash flows Discount rates Strategic options © 2007–2008 by Andrew W. Lo Lecture 18-20: Capital Budgeting Slide 4 Cash Flow Calculations 15.401 Main Points: 1. Use cash flows, not accounting earnings 2. Use after-tax cashflows 3. Use cash flows attributable to the project (compare firm value with and without the project): – Use incremental cash flows – Forget sunk costs: bygones are bygones – Include investment in working capital as capital expenditure – Include opportunity costs of using existing equipment, facilities, etc. -

Stretegic Financial Management Theory Notes

Page Number: 1 KALPESH CLASSES ChapterProf. 1L.Muralidharan (Best in south) [email protected] PROJECT PLANNING AND CAPITAL BUDGETING An Overview 1.1 Project Planning 1.2 Project Report · Meaning · Objective · Advantages · Contents · Techniques of project planning and scheduling 1.3 Capital Budgeting · Meaning · Need for Capital Budgeting · Types of investment proposals · Techniques of Evaluation Pay back period Pay back reciprocal Average or Accounting rate of return Net present value Desirability factor/Profitability index Internal rate of return Comparison of Techniques · Impact of inflation Þ Relevance of inflation Þ Inflation and financial analysis Þ Project appraisal under inflationary conditions Þ Impact of inflation on Capital Budgeting Þ Impact of inflation on investors Þ Impact of inflation on inventory management · Estimation of future cash flows Þ Steps in developing relevant information for cash flow analysis Þ Elements of risk and uncertainties Þ Models of Risk analysis C.A.FINAL – FINANCIAL MANAGEMENT ALL THE BEST For any queries on Accounts or FM you can email to Prof. L.Muralidharan Page Number: 2 SREERAM COACHING POINT E-mail : [email protected] § Hillier’s Model § Hertz Model Þ Methods of accounting for risk · Social Cost Benefit Analysis Þ Meaning Þ Need Þ Indicators of social desirability of the product Þ Steps TEAM OF PROFESSORS AT KALPESH CLASSES PROF. KALPESH SANGHAVI (C.A.) PROF. L.MURALIDHARAN (C.A.) PROF. SOWMYNARAYANAN (C.A.) PROF. RAJAGOPALAN (C.A.) PROF. JAISON (C.A.) NOW LIVING WORKING TOGETHER. KALPESH CLASSES SREERAM COACHING POINT Sreeram coaching point and KALPESH CLASSES is one FAMILY. Page Number: 3 KALPESH CLASSES Prof. L.Muralidharan (Best in south) [email protected] 1.1 PROJECT PLANNING: Define Project Planning It refers to the plan of an undertaking to: a. -

Session #CTP-04 Copyright © 2018 – The

Essential Learning for CTP Candidates Carolinas Cash Adventure 2018 – Session #CTP-04 Carolinas Cash Adventure - 2018: CTP Track Financial Statements, Analysis & Decisions Session #4 (Mon. 9:15 – 10:15 am) ETM5-Chapter 8: Financial Accounting and Reporting ETM5-Chapter 9: Financial Planning and Analysis Essentials of Treasury Management, 5th Ed. (ETM5) is published by the AFP which holds the copyright and all rights to the related materials. As a prep course for the CTP exam, significant portions of these lectures are based on materials from the Essentials text. © 2018 - The Treasury Academy, Inc. - All Rights Reserved 1 To Sign up for On-Line Access E-mail request to: [email protected] You will receive an invitation to join the class from Canvas-Instructure Click on link and use your e-mail address as Username and you can set your own password First place to go is MODULES Materials for all of the chapters in ETM5 are provided © 2018 - The Treasury Academy, Inc. - All Rights Reserved 2 Addition Information Check out the web site for The Treasury Academy www.treasuryacademy.org Copies of all session lecture notes from conference Additional handouts and other items of interest are provided there Please note that the full content and on- line support are all on the Canvas site, which requires you to e-mail me for an invitation © 2018 - The Treasury Academy, Inc. - All Rights Reserved 3 Copyright © 2018 – The Treasury Academy, Inc. All Rights Reserved 1 Essential Learning for CTP Candidates Carolinas Cash Adventure 2018 – Session #CTP-04 Overview of Chapter 8 Topics Introduction Accounting Concepts and Standards Financial Reporting Statements Accounting for Derivatives, Hedges, and Foreign Exchange(FX) Translation Accounting for G/NFP © 2018 - The Treasury Academy, Inc. -

Discounted Cash Flow Techniques

Discounted Cash Flow Techniques: The discounted cash flow methods provide a more objective basis for evaluating and selecting an investment project. These methods consider the magnitude and timing of cash- flows in each period of a project’s life. Discounted cash-flow methods enable us to isolate the differences in the timing of cash-flows of the project by discounting them to know the present value. The present value can be analysed to determine the desirability of the project. These techniques adjust the cash-flows over the life of a project for the time value of money. Time Value of Money: Sound decision making demands logical comparability of cash-flows, which differ in timing and risk. Recognition of time value of money and risk by adjusting cash-flows for their differences in timing and risk is extremely vital in financial decision making. Most financial decisions, such as buying assets or borrowing funds involve cash-flows at different periods of time. For example, if a firm purchases any machinery which will be used to produce a certain type of product; the firm will have an immediate cash outflow; and a series of cash inflows will be there for many future periods as the finished products will be sold. Similarly, if an individual borrows money, she will have an immediate cash inflow and a series of cash outflows as she will commit an obligation to service the debt for many future periods. These cash-flows which differ in timing are not directly comparable. And, sound decision making demands logical comparability of cash-flows. -

The Function and Science of Financial Management Studies

2011 International Conference on Social Science and Humanity IPEDR vol.5 (2011) © (2011) IACSIT Press, Singapore The Function and Science of Financial Management Studies Prof. Malek Elahi Dr. Reynaldo R. Banzon Graduate School Graduate School Holy Angel University University of the East Angeles City, Philippines Manila, Philippines Email: [email protected] Email: [email protected] Masoud Dehdashti Jamal Ansari Economics Department Law Department Islamic Azad University Dashtestan Branch, Iran Islamic Azad University Email: [email protected] Zanjan Branch, Iran Email: [email protected] Abstract-Financial planning is concerned about a good I. INTRODUCTION projection of future financial requirements of the firm in order to avoid short falls in financing availability. Financial An understanding of financial statements is necessary in analysis will help in pinpointing problem areas that have to be order to have an adeptness in the mechanics of finance. The resolved. goal of the financial manager is the maximization of shareholders’ wealth expressed by the market price of Investment decision is crucial since this involves the choice corporate stocks [4]. Market price of stock would increase among investment projects of the one which will yield the not only because of improvement in business profitability highest benefit for the firm in terms of profitability. After but also by means of various financial maneuverings which choosing the best investment project, the financial manager is must be an expertise by financial managers. In order to confronted with the financing decision. What financing achieve the goal of maximizing shareholders’ wealth, the package should be chosen to finance the project. Financing financial manager must engage in financial analysis and may come from borrowings (bank loans or bonds) or from planning and balance sheet management (managing the flotation of equity (common and/or preferred stocks). -

Capital Budgeting: Investment Decision Rules

Capital Budgeting: Investment Decision Rules Gestão Financeira I Gestão Financeira Corporate Finance I Corporate Finance Licenciatura 2017-2018 Outline • Criteria for Accep;ng or Rejec;ng a Project: – The Payback Rule – Net Present Value (NPV) – Internal Rate of Return (IRR) and Modified Internal rate of return (MIRR) • Choosing between mutually exclusive alternaves • Evaluate projects with different lives • Resourse Constraints: Rank projects when a company’s resources are limited so that it cannot take all posi;ve- NPV projects GFI / GF /CF1/CF 2017-2018 2 Payback Period • The Payback period is the amount of ;me it takes to recover or pay back the ini;al investment. • If the payback period is less than a pre-specified length of ;me (which can be subjec;ve), you accept the project. Otherwise, you reject the project. – The payback rule is used by many companies because of its simplicity. • Example: t 0 1 2 3 4 cash flow -1000 250 330 500 610 Cumulave cash flow -1000 -750 -420 80 690 420 Payback Period = 2 + = 2.84 years 500 • Limitaon: Does not take into account the ;me value of money. GFI / GF /CF1/CF 2017-2018 3 Payback Period (discounted version) • Example: Consider a discount rate (or cost of capital) r=11%. t 0 1 2 3 4 cash flow -1000 250 330 500 610 Discounted cash flow -1000 225,2252 267,8354 365,5957 401,8259 Cumulave Discounted cash flow -1000 -774,775 -506,939 -141,344 260,4822 141,344 Discounted Payback Period = 3+ = 3.351754 years 401,826 • Limitaons of the Payback Rule: – Ignores what happens aer the payback period (what if there were more cash flows?); – Difficult to apply when there are mul;ple investments over ;me.