Asset Valuation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redevelopment Plan for 2 Pioneer Sector 1

(a real estate investment trust constituted on 13 December 2012 under the laws of the Republic of Singapore) For Immediate Release REDEVELOPMENT PLAN FOR 2 PIONEER SECTOR 1 Singapore, 19 March 2020 - SB REIT Management Pte. Ltd. (the “Manager”), the Manager of Soilbuild Business Space Real Estate Investment Trust (“Soilbuild REIT”), is pleased to announce its proposed redevelopment plan (the “Proposed Redevelopment”) at 2 Pioneer Sector 1, Singapore 628414 (“the Property”), which will transform the existing facility into a 4- storey ramp-up warehouse facility with open yard space (the “Warehouse”). The existing plot ratio is 0.55. According to the Urban Redevelopment Authority (“URA”) Master Plan, the current permitted development plot ratio is 1.00. The Manager has the intention of increasing the plot ratio to 1.32 and has had several discussions with the authorities. The redevelopment is based on plot ratio of 1.00 and upon receipt of approval from JTC Corporation and other relevant authorities, the redevelopment would be based on an increased plot ratio of 1.32. The Proposed Redevelopment will increase the gross floor area of the facility and enhance the asset’s value. The Manager has commenced marketing the Property and is currently in negotiation with a few potential multi-national anchor users for the Warehouse. The Property holds a prominent frontage at Pioneer Road and is a short drive to the upcoming Tuas Port which is slated to be the world’s largest fully automated terminal when completed in 20401. The site is accessible to several major expressways including the Ayer Rajah Expressway and Pan Island Expressway and is strategically located at the gateway of Jurong Island and Malaysia via the Tuas Link. -

Annex B Links Between Previously Announced and New Cases

Annex B Links between Previously Announced and New Cases Further epidemiological investigations and contact tracing have uncovered links between previously announced and new cases. i. 35 additional cases are linked to the cluster at Acacia Lodge (530-540 Bukit Batok Street 23), which has a total of 600 confirmed cases now. ii. Five additional cases are linked to the cluster at ASPRI-Westlite Papan (5 Jalan Papan), which has a total of 538 confirmed cases now. iii. One additional case is linked to the cluster at Avery Lodge Dormitory (2D Jalan Papan), which has a total of 1,071 confirmed cases now. iv. 15 additional cases are linked to the cluster at Blue Stars Dormitory (3 Kian Teck Lane), which has a total of 302 confirmed cases now. v. One additional case is linked to the cluster at Cassia @ Penjuru (15 Penjuru Walk), which has a total of 1,483 confirmed cases now. vi. Three additional cases are linked to the cluster at CDPL Tuas Dormitory (6 Tuas South Street 15), which has a total of 1,476 confirmed cases now. vii. Eight additional cases are linked to the cluster at Cochrane Lodge I (51 Admiralty Road West), which has a total of 355 confirmed cases now. viii. One additional case is linked to the cluster at Cochrane Lodge II (49 Admiralty Road West), which has a total of 486 confirmed cases now. ix. One additional case is linked to the cluster at Jurong Penjuru Dormitory (58 Penjuru Place), which has a total of 1,850 confirmed cases now. x. -

Ministry of Health List of Approved Offsite Providers for Polymerase Chain Reaction (PCR) Tests for COVID-19

Ministry of Health List of Approved Offsite Providers for Polymerase Chain Reaction (PCR) Tests for COVID-19 List updated as at 26 February 2021. Service Provider Name of Location Address Service Provided Partnering Lab Acumed Offsite PCR Swab Parkway Laboratory Services Shangri-La Hotel 22 Orange Grove Rd, Singapore 258350 Medical and Serology Ltd Group Parkway Laboratory Services St Engineering Marine 16 Benoi Road S(629889) Ltd Quest Laboratories Pte Ltd Offsite PCR Swab Ally Health Q Squared Solutions Bukit Batok North N4 432A Bukit Batok West Avenue 8, S(651432) and Serology (In Laboratory Partnership C882 6A Raeburn Park, S(088703) National Public Health With Jaga- Laboratory Me) Sands Expo And Convention Centre 10 Bayfront Ave, Singapore 018956 Parkway Laboratory Services 1 Harbour Front Ave Level 2 Keppel Bay Tower, Singapore Ltd Keppel Office 098632 Offsite PCR Swab 40 Scotts Road, #22-01 Environment Building, Singapore PUB Office 228231 The Istana 35 Orchard Rd, Singapore 238823 One Marina Boulevard 1 Marina Boulevard S018989 Rasa Sentosa Singapore 101 Siloso Road S098970 Bethesda MWOC @ Ponggol Northshore 501A Ponggol Way, Singapore 828646 Offsite PCR Swab Innovative Diagnostics Pte Ltd Medical MWOC @ CCK 10A Lorong Bistari, Singapore 688186 And Serology Centre MWOC @ Eunos 10A Eunos Road 1, Singapore 408523 Services MWOC @ Tengah A 1A Tengah Road, Singapore 698813 Page 1 of 85 MWOC @ Tengah B; 3A Tengah Road, Singapore 698814 Parkway Laboratory Services Hotel Chancellor 28 Cavenagh / Orchard Road, Singapore 229635 Limited -

Pursuant to Rule 703 of the SGX-ST Listing Manual, SB REIT Management Pte

(a real estate investment trust constituted on 13 December 2012 under the laws of the Republic of Singapore) ANNOUNCEMENT REVALUATION OF PROPERTIES IN SOILBUILD BUSINESS SPACE REIT 21 January 2021 – Pursuant to Rule 703 of the SGX-ST Listing Manual, SB REIT Management Pte. Ltd. (the “Manager”), the Manager of Soilbuild Business Space REIT (“Soilbuild REIT”), wishes to announce that the following valuers have completed independent valuations of Soilbuild REIT’s portfolio as at 31 December 2020: The valuation details are as follows: Property Name Valuer SGD AUD1 (‘000) (‘000) Singapore portfolio Business Park Buildings 1. Eightrium @ Changi CBRE Pte. Ltd. 89,700 Business Park 2. Solaris CBRE Pte. Ltd. 365,800 Industrial Buildings 3. Tuas Connection CBRE Pte. Ltd. 109,000 4. West Park BizCentral CBRE Pte. Ltd. 286,700 5. 2 Pioneer Sector 1 Savills Valuation and 30,3492 (Based on plot ratio of Professional Services (S) 1.0) Pte Ltd 6. COS Printers CBRE Pte. Ltd. 8,900 7. Beng Kuang Marine CBRE Pte. Ltd. 13,400 8. 39 Senoko Way CBRE Pte. Ltd. 14,700 1 Exchange rate used for the translation of Australian dollar denominated balances as at 31 December 2020 of AUD 1.00: SGD 1.0187. 2 The valuation of 2 Pioneer Sector 1 based on plot ratio of 1.32 is S$46,849,324. Soilbuild REIT has obtained the requisite regulatory approvals to pursue development of 2 Pioneer Sector 1 based on a plot ratio of 1.0 and is in the process of seeking approvals for a revised plot ratio of 1.32. -

Asset Valuation

(Constituted in the Republic of Singapore pursuant to a trust deed dated 31 March 2006 (as amended)) ASSET VALUATION Pursuant to Rule 703 of the SGX-ST Listing Manual, ESR Funds Management (S) Limited, as Manager of ESR-REIT, wishes to announce that it has obtained new independent valuations as at 30 June 2020 for ESR-REIT’s properties for the purpose of the Proposed Merger of ESR-REIT and Sabana Shari'ah Compliant Industrial Real Estate Investment Trust by way of a Trust Scheme of Arrangement. The below independent valuations conducted by Savills Valuation and Professional Services (S) Pte Ltd (“Savills”), CBRE Pte Ltd (“CBRE”) and Knight Frank Pte Ltd (“Knight Frank”) are reported on the basis of material valuation uncertainty due to COVID-19. No. Address Valuation as at 30 June 2020 Logistics/Warehousing 1 1 Third Lok Yang Road and 4 Fourth Lok Yang Road (a) $10,400,000 2 25 Changi South Avenue 2 (a) $12,200,000 3 160 Kallang Way (b) $25,000,000 4 6 Chin Bee Avenue (b) $94,300,000 5 30 Pioneer Road (b) $48,800,000 6 3C Toh Guan Road East (b) $30,500,000 7 4/6 Clementi Loop (a) $39,700,000 8 24 Jurong Port Road (b) $80,000,000 9 3 Pioneer Sector 3 (b) $95,800,000 10 15 Greenwich Drive (a) $96,500,000 11 48 Pandan Road (b) (d) $225,000,000 General Industrial 12 70 Seletar Aerospace View (a) $8,600,000 13 30 Teban Gardens Crescent (b) $30,000,000 14 11 Ubi Road 1 (c) $85,800,000 15 29 Tai Seng Street (c) $34,900,000 16 30 Toh Guan Road (a) $58,400,000 17 128 Joo Seng Road (a) $11,700,000 1 No. -

National Day Awards 2019

1 NATIONAL DAY AWARDS 2019 THE ORDER OF TEMASEK (WITH DISTINCTION) [Darjah Utama Temasek (Dengan Kepujian)] Name Designation 1 Mr J Y Pillay Former Chairman, Council of Presidential Advisers 1 2 THE ORDER OF NILA UTAMA (WITH HIGH DISTINCTION) [Darjah Utama Nila Utama (Dengan Kepujian Tinggi)] Name Designation 1 Mr Lim Chee Onn Member, Council of Presidential Advisers 林子安 2 3 THE DISTINGUISHED SERVICE ORDER [Darjah Utama Bakti Cemerlang] Name Designation 1 Mr Ang Kong Hua Chairman, Sembcorp Industries Ltd 洪光华 Chairman, GIC Investment Board 2 Mr Chiang Chie Foo Chairman, CPF Board 郑子富 Chairman, PUB 3 Dr Gerard Ee Hock Kim Chairman, Charities Council 余福金 3 4 THE MERITORIOUS SERVICE MEDAL [Pingat Jasa Gemilang] Name Designation 1 Ms Ho Peng Advisor and Former Director-General of 何品 Education 2 Mr Yatiman Yusof Chairman, Malay Language Council Board of Advisors 4 5 THE PUBLIC SERVICE STAR (BAR) [Bintang Bakti Masyarakat (Lintang)] Name Designation Chua Chu Kang GRC 1 Mr Low Beng Tin, BBM Honorary Chairman, Nanyang CCC 刘明镇 East Coast GRC 2 Mr Koh Tong Seng, BBM, P Kepujian Chairman, Changi Simei CCC 许中正 Jalan Besar GRC 3 Mr Tony Phua, BBM Patron, Whampoa CCC 潘东尼 Nee Soon GRC 4 Mr Lim Chap Huat, BBM Patron, Chong Pang CCC 林捷发 West Coast GRC 5 Mr Ng Soh Kim, BBM Honorary Chairman, Boon Lay CCMC 黄素钦 Bukit Batok SMC 6 Mr Peter Yeo Koon Poh, BBM Honorary Chairman, Bukit Batok CCC 杨崐堡 Bukit Panjang SMC 7 Mr Tan Jue Tong, BBM Vice-Chairman, Bukit Panjang C2E 陈维忠 Hougang SMC 8 Mr Lien Wai Poh, BBM Chairman, Hougang CCC 连怀宝 Ministry of Home Affairs -

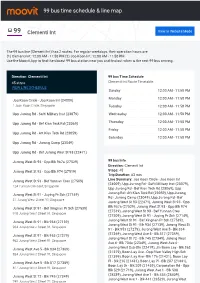

99 Bus Time Schedule & Line Route

99 bus time schedule & line map 99 Clementi Int View In Website Mode The 99 bus line (Clementi Int) has 2 routes. For regular weekdays, their operation hours are: (1) Clementi Int: 12:00 AM - 11:50 PM (2) Joo Koon Int: 12:00 AM - 11:50 PM Use the Moovit App to ƒnd the closest 99 bus station near you and ƒnd out when is the next 99 bus arriving. Direction: Clementi Int 99 bus Time Schedule 45 stops Clementi Int Route Timetable: VIEW LINE SCHEDULE Sunday 12:00 AM - 11:50 PM Monday 12:00 AM - 11:50 PM Joo Koon Circle - Joo Koon Int (24009) 1 Joon Koon Circle, Singapore Tuesday 12:00 AM - 11:50 PM Upp Jurong Rd - Safti Military Inst (23079) Wednesday 12:00 AM - 11:50 PM Upp Jurong Rd - Bef Kian Teck Rd (23069) Thursday 12:00 AM - 11:50 PM Friday 12:00 AM - 11:50 PM Upp Jurong Rd - Aft Kian Teck Rd (23059) Saturday 12:00 AM - 11:50 PM Upp Jurong Rd - Jurong Camp (23049) Upp Jurong Rd - Bef Jurong West St 93 (22471) Jurong West St 93 - Opp Blk 987a (27529) 99 bus Info Direction: Clementi Int Jurong West St 93 - Opp Blk 974 (27519) Stops: 45 Trip Duration: 63 min Jurong West St 93 - Bef Yunnan Cres (27509) Line Summary: Joo Koon Circle - Joo Koon Int (24009), Upp Jurong Rd - Safti Military Inst (23079), 124 Yunnan Crescent, Singapore Upp Jurong Rd - Bef Kian Teck Rd (23069), Upp Jurong Rd - Aft Kian Teck Rd (23059), Upp Jurong Jurong West St 91 - Juying Pr Sch (27149) Rd - Jurong Camp (23049), Upp Jurong Rd - Bef 31 Jurong West Street 91, Singapore Jurong West St 93 (22471), Jurong West St 93 - Opp Blk 987a (27529), Jurong West St 93 - Opp Blk -

Annex I 01 September 2015

Quarantine & Inspection Group Agri-Food & Veterinary Authority of Singapore Sembawang Research Station Lorong Chencharu, Singapore 769194 PR 11.4 Annex I 01 September 2015 To: All NPPO, Traders & Forwarding Agents LIST OF AVA ACCREDITED TREATMENT PROVIDERS Please find below the list of treatment providers accredited to carry out phytosanitary treatment for solid wood packing materials under International Standards for Phytosanitary Measures (i.e. ISPM 15) and other agricultural commodities that require phytosanitary certification. These accredited treatment providers would also issue Fumigation Certificate or Heat Treatment Certificate to certify that the solid wood packaging materials or other agricultural commodities had been treated in accordance to the standard such as ISPM 15 and other treatment specifications imposed by the importing countries. 2. The list of AVA accredited treatment providers will be updated from time to time and posted in the AVA website http://www.ava.gov.sg. For any other clarifications, you can contact us at Tel No: (65) 67591-9816, (65) 6753-0657, (65) 6751-9842 or email to Mr. Eric Casiano Tulang at [email protected] or Ms. Ong Ai Khim at: [email protected]. Yours faithfully, Eric Casiano Tulang Senior Executive Manager for Director General Agri-Food & Veterinary Authority of Singapore September 2015 Page 1 of 6 Quarantine & Inspection Group Agri-Food & Veterinary Authority of Singapore Sembawang Research Station Lorong Chencharu, Singapore 769194 LIST OF AVA ACCREDITED PEST CONTROL AGENCIES TYPE OF TREATMENT: HEAT TREATMENT (HT) TPS CONTACT S/N NAME OF PEST CONTROL AGENCY ADDRESS EFFECTIVE DATE CODE NUMBER 36 Sungei Kadut Street 2 Tel: 62696265 01 HOCK HUAT SAW MILL CO. -

Auction & Sales Private Treaty

Auction & Sales Private Treaty. DECEMBER 2019: RESIDENTIAL Salespersons to contact: Tricia Tan, CEA R021904I, 6228 7349 / 9387 9668 Gwen Lim, CEA R027862B, 6228 7331 / 9199 2377 Noelle Tan, CEA R047713G, 6228 7380 / 9766 7797 Teddy Ng, CEA R006630G, 6228 7326 / 9030 4603 Lock Sau Lai, CEA R002919C, 6228 6814 / 9181 1819 Sharon Lee (Head of Auction), CEA R027845B, 6228 6891 / 9686 4449 Ong HuiQi (Admin Support) 6228 7302 Website: http://www.knightfrank.com.sg/auction Email: [email protected] LANDED PROPERTIES FOR SALE * Owner's ** Public Trustee's *** Estate's @ Liquidator's @@ Bailiff's % Receiver's # Mortgagee's ## Developer's ### MCST's Approx. Land / Guide Contact S/no District Street Name Tenure Property Type Room Remarks Floor Area (sqft) Price Person MORTGAGEE SALE One of the best location in Sentosa Cove with a picturesque waterway view. Leasehold 99 2½-Storey Bungalow Noelle / Upside potential. Foreigners are eligible to purchase landed properties only in # 1 D04 PARADISE ISLAND years wef. with Private Pool and 5- 5 7,045 / 8,170 $11.59M Sau Lai / Sentosa Cove. 5 ensuite bedrooms. Efficient layout. Private pool & yacht 07/11/2005 Bedrooms Sharon berth. Vacant possession. More Info MORTGAGEE SALE Leasehold 99 2½-Storey Detached Noelle / Scenic waterway view. Unique façade. Internal lift serving all levels. With # 2 D04 SANDY ISLAND years wef. House with Basement 7 7,307 / 6,727 $11.57M Sau Lai private pool and yacht berth. Basement parking with mechanized parking. 13/06/2007 Parking More Info MORTGAGEE SALE Leasehold 2½-Storey Detached Noelle / Lifestyle living with an enchanting waterway view! 4 ensuite bedrooms. -

Submerged Outlet Drain Once in Three Month Desilting and Flushing

Submerged Outlet Drain Once in Three Month Desilting and Flushing Drain S/No Location Frequency Length 4.5m wide U-drain from the culvert at Jurong Road near Track 22 to the 1 outlet of the culvert at PIE (including the culverts across Jurong Road and 65 1st week of the month across PIE) 9m/12m wide Sungei Jurong subsidiary drain running along PIE from L/P 2 380 1st week of the month 606 to L/P 586 1.5m wide U-drain/covered drain from the junction of Yuan Ching Road/ 3 790 2nd week of the month Jalan Ahmad 13m wide U-drain from Jurong West Street 65 to Major Drain MJ 14 near 4 450 2nd week of the month Blk 664A 15m wide Sg Jurong subsidiary drain from L/P 586 at PIE to Sg Jurong 5 950 2nd week of the month including one 6 10m wide Sg Jurong subsidiary drain from L/P 534 at PIE to Sg Jurong 1180 3rd week of the month Along Boon Lay Way opposite Jurong West Street 61 to Jalan Boon Lay 7 1300 4th week of the month and at Enterprise Road 8 Blk 664A Jurong West Street 64 to MJ13 650 4th week of the month 9 Sungei Lanchar (From Jalan Boon Lay to Jurong Lake 1,600 5th week of the month 10 Sungei Jurong (From Ayer Rajah Expressway to Jurong Lake) 1070 6th week of the month 3.0m wide Outlet drain from culvert at Teban Garden Road running along 11 Jurong Town Hall Road and West Coast Road to Sg Pandan opposite Block 650 7th week of the month 408 30.0m wide Sg Pandan from the branch connection to the downstream Boon 12 350 7th week of the month Lay Way to Sg Ulu Pandan 13 Sungei Pandan (from confluence of Sg Pandan to West Coast Road) 600 7th week -

Ministry of Health List of Approved Offsite Providers for Polymerase Chain Reaction (PCR) Tests for COVID-19

Ministry of Health List of Approved Offsite Providers for Polymerase Chain Reaction (PCR) Tests for COVID-19 List updated as at 1 August 2021. S/N Service Provider Name of Location Address Service Provided Partnering Lab 1 Acumen Diagnostics Former Siglap Secondary School 10 Pasir Ris Drive 10, Singapore 519385 Offsite PCR Swab Acumen Pte. Ltd K.H. Land Pte Ltd. The Antares @ Mattar Road and Serology Diagnostics Pte. Ltd Keong Hong Construction Pte Ltd National Skin Centre @ 1 Mandalay Road Keong Hong Construction Pte Ltd Sky Everton @ 42 Everton Road The Antares 23 Mattar Road, Singapore 387730 National Skin Centre 1 Mandalay Road, Singapore 308205 Sky Everton 50 Everton Road, Singapore 627860 2 ACUMED MEDICAL Shangri-La Hotel 22 Orange Grove Rd, Singapore 258350 Offsite PCR Swab Parkway Laboratory GROUP PEC Ltd 20 Benoi Lane Singapore 627810 and Serology Services Ltd LC&T Builder (1971) Pte Ltd 172A Sengkang East Drive Singapore 541172 Dyna-Mac Engineering Services Pte 59 Gul Road Singapore 629354 Ltd Franklin Offshore International Pte 11 Pandan Road Singapore 609259 Ltd CFE Engineers Pte Ltd 10 Pioneer Sector Singapore 628444 Syscon Private Limited 30 Tuas Bay Drive Singapore 637548 3 Ally Health ST Engineering Marine 16 Benoi Road S(629889) Offsite PCR Swab Parkway Laboratory Bukit Batok North N4 432A Bukit Batok West Avenue 8, S(651432) and Serology Services Ltd Quest Laboratories C882 6A Raeburn Park, S(088703) Pte Ltd CSC@Tessensohn 60 Tessensohn Road S217664 Q Squared Sands Expo and Convention Centre 10 Bayfront Ave, Singapore -

CONTRACTS EXECUTED by YENG TONG CONSTRUCTION PTE LTD * All Amounts Are in SGD Unless Otherwise Stated

CONTRACTS EXECUTED BY YENG TONG CONSTRUCTION PTE LTD * All Amounts are in SGD unless otherwise stated. YENG TONG'S SCOPE OF TITLE YEAR CLIENT MAIN CONTRACTOR WORKS Proposed Construction and Completion of East Coast Economic July 2012 ~ Jan Pembinaan Yeng Tong Sdn Coastal Protection Works at Teluk Lipat, Shore Protection Works Region Development 2015 Bhd Dungun, Terengganu Darul Iman Council (ECERDC) Proposed Construction and Completion of East Coast Economic Aug 2012 ~ Nov Pembinaan Yeng Tong Sdn Coastal Protection Works at Tanjung Shore Protection Works Region Development 2012 Bhd Batu, Pekan, Pahang Darul Makmur Council (ECERDC) Maintenance dredging at tanjong pagar, 26/11/2012~ PSA CORPORATION Yeng Tong Construction PJ105 Dredging Works keppel and brani terminal defined areas 25/08/2013 LIMITED Pte Ltd Shore Protection Work for Reclaimation Hyundai Engineering & PJ104 Reclamation works Aug 2012~ JTC Corporation Work At RRM V/O Construction Co. Ltd Penta Ocean Construction Koon Construction & PJ103 Reclamation of T-Bund at Jurong Island Reclamation works May 2012 ~ Pte Ltd Transport Co. Pte Ltd. Reclaimation of Jurong Shore Protection Work for Reclaimation Hyundai Engineering & PJ102 Island Phrase 4 % Tuas View Apr 2012 ~ JTC Corporation Work At A2 - A3a Corner V/O Construction Co. Ltd Extension Option 1-1 Feb 2012~ Yeng Tong Construction PJ101 Proposed Dredging of Benoi Basin Dredging Works JTC Corporation Jun 2012 Pte Ltd Reclamation of Jurong Island PH4 & Tuas Sep 2011~ Hyundai Engineering & PJ100 View Extension Shore Protection Works Shore Protection Works JTC Corporation Mar 2012 Construction Co. Ltd For New Yard Phase 2 V.O. Reclamation of Jurong Island Phase 4 & Shore Protection Works at Sept 2011~ Hyundai Engineering & PJ099 JTC Corporation Tuas View Extension - Option 1-1 New Yard Phase 2 Feb 2012 Construction Co.