Richard Hanke

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 February 2019 Solvency and Diversification in Insurance Remain Key Strengths Despite Change in Structure

FINANCIAL INSTITUTIONS ISSUER IN-DEPTH Lloyds Banking Group plc 18 February 2019 Solvency and diversification in insurance remain key strengths despite change in structure Summary RATINGS In 2018, Lloyds Banking Group plc (LBG) altered its structure to comply with the UK's ring- Lloyds Banking Group plc Baseline Credit a3 fencing legislation, which requires large banks to separate their retail and SME operations, Assessment (BCA) and deposit taking in the European Economic Area (EEA) from their other activities, including Senior unsecured A3 Stable the riskier capital markets and trading business. As part of the change, LBG designated Lloyds Bank plc as the“ring-fenced” entity housing its retail, SME and corporate banking operations. Lloyds Bank plc It also assumed direct ownership of insurer Scottish Widows Limited, previously a subsidiary Baseline Credit A3 Assessment (BCA) of Lloyds Bank. The changes had little impact on the creditworthiness of LBG and Lloyds Adjusted BCA A3 Bank, leading us to affirm the deposit and senior unsecured ratings of both entities. Scottish Deposits Aa3 Stable/Prime-1 Widows' ratings were unaffected. Senior unsecured Aa3 Stable » LBG's reorganisation was less complex than that of most UK peers. The Lloyds Lloyds Bank Corporate Markets plc Banking Group is predominantly focused on retail and corporate banking, and the Baseline Credit baa3 required structural changes were therefore relatively minor. The group created a small Assessment (BCA) separate legal entity, Lloyds Bank Corporate Markets plc (LBCM), to manage its limited Adjusted BCA baa1 Deposits A1 Stable/Prime-1 capital markets and trading operations, and it transferred its offshore subsidiary, Lloyds Issuer rating A1 Stable Bank International Limited (LBIL), to LBCM from Lloyds Bank. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

Better Banking for Your Business

Better banking for your business 3 Business made more Running a small business is a big job. As well as being a master of your chosen trade, you also need to be a dab hand at admin, finance, management, marketing and more. And, often your day is a long one, outside of 9 to 5 hours. When you’re putting so much of your life into growing your business, we think you should have all the support we can give you. Which is why our business accounts are designed to help you control costs, manage payments, and help your money work harder with a little less effort. Because when you get the most out of your business, you get the most out of life. Starting with 25 months of free business banking Whether you’re opening your first You won’t pay any charges as long as you business account or switching an existing keep your account within agreed limits and one, we’ll give you free day-to-day don’t go overdrawn without arranging it business banking for the first 25 months. with us first. And when your free banking Which means that every single penny you ends, you’ll go onto a simple tariff with make goes towards making your business great ongoing value. successful. The benefits of business banking When you open your account, we’ll make • Free card reader from Square to take sure our services match your business chip and pin and contactless payments needs, including: with no fees on your first £1,000.* • Support from our team of Business • Business Debit card. -

Natwest Markets Plc

Information Memorandum 5 March 2020 NatWest Markets Plc (incorporated in Scotland with limited liability under the Companies Act 1948 to 1980, registered number SC090312) A$5,000,000,000 Debt Issuance Programme Arranger & Dealer National Australia Bank Limited Dealers Australia and New Zealand Banking Group Limited Commonwealth Bank of Australia Mizuho Securities Asia Limited NatWest Markets Plc The Toronto-Dominion Bank Westpac Banking Corporation Contents Important notices 1 1. Programme summary 4 2. Information about NatWest Markets Plc 9 3. UK Bank Resolution Regime 10 4. Selling restrictions 11 5. Summary of certain taxation matters 15 6. Other important matters 17 7. Conditions of the Notes 19 8. Form of Pricing Supplement 39 9. Glossary 44 Directory 47 42015475_33 Important notices This Information Memorandum The distribution and use of this Information Memorandum, including any Issue Materials, and the This Information Memorandum relates to a debt offer or sale of Notes may be restricted by law in certain issuance programme (“ Programme ”) established by jurisdictions and intending purchasers and other NatWest Markets Plc (the “Issuer ”), under which it may investors should inform themselves about them and issue Notes from time to time. It has been prepared by, observe any such restrictions. and is issued with the authority of, the Issuer. In particular: The Issuer is neither a bank nor an authorised deposit- taking institution which is authorised under the this Information Memorandum is not a prospectus Australian Banking Act and nor is it supervised by the or other disclosure document for the purposes of the Australian Prudential Regulation Authority. The Notes Corporations Act. -

Svenska Handelsbanken AB

OFFERING CIRCULAR Svenska Handelsbanken AB (publ) (Incorporated as a public limited liability banking company in The Kingdom of Sweden) U.S.$50,000,000,000 Euro Medium Term Note Programme for the issue of Notes with a minimum maturity of one month On 26th June, 1992 Svenska Handelsbanken AB (publ) (the “Issuer” or the “Bank”) entered into a U.S.$1,500,000,000 Euro Medium Term Note Programme (the “Programme”) and issued an offering circular on that date describing the Programme. This Offering Circular supersedes any previous offering circular and supplements therein prepared in connection with the Programme. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Programme, the Bank may from time to time issue Notes (the “Notes”), which expression shall include Notes (i) issued on a senior preferred basis as described in Condition 3 (“Senior Preferred Notes”), (ii) issued on a senior non-preferred basis as described in Condition 4 (“Senior Non-Preferred Notes”), (iii) issued on a subordinated basis and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 5 (“Subordinated Notes”) and (iv) issued on a subordinated basis with no fixed maturity and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 6 (“Additional Tier 1 Notes”). The Outstanding Principal Amount (as defined in Condition 2) of each Series (as defined below) of Additional Tier 1 Notes will be subject to Write Down (as defined in Condition 2) if the Common Equity Tier 1 Capital Ratio (as defined in Condition 2) of the Bank and/or the Handelsbanken Group (as defined Condition 2) is less than the relevant Trigger Level (as defined in Condition 2). -

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution Electronic Bank Payments brings to NetSuite complementary electronic banking functionality Key Features that includes Electronic Funds Transfer (EFT) • Automated payment batch allows multiple payments, customer refunds and customer payment batch creation stemmed from payments (direct debits), as well as check fraud different batch criteria, controls and payment deadlines. prevention through the Positive Pay service offered by leading banks. It helps ensure that • Approval routing and email alert notification enables additional payment employees and vendors are paid on time authorization prior to payment processing. and customer bills are settled automatically. With support for a wide range of global and • Enhanced EFT capabilities with filtering options support bill display, partial payments, local bank formats, Electronic Bank Payments bill management and other controls. provides a single payment management • Automated direct debit customer solution worldwide. collections to settle outstanding invoices. Electronic Bank Payments creates files of • Payment management options include payments or direct debit information in bank’s payment batch queuing, rollbacks, reversals predefined file format ready for import into with notations and automated notifications. banking software or submission to the bank • Positive Pay anti-fraud capabilities with online, thus lowering payment processing proactive notification to banks processing expenses by eliminating checks, postage and the checks. envelopes, and saving time as well. In addition, • Support for more than 50 international it supports management of large payment bank formats with Advanced Electronic runs (typically up to 5,000 payments per file) Bank Payment License customers having with the ability to process reversals and partial the flexibility to add more. -

CYBG PLC Unifies Digital Banking Platform with Red Hat Openshift

Customer Case Study CYBG PLC unifies digital banking platform with Red Hat Openshift CYBG PLC, parent group of Clydesdale Bank, Yorkshire Bank, Virgin Money, and digital banking service B, wanted to expand and standardise its digital banking offer to stay competitive against market leaders and new disruptors. To gain the scalability and agility demanded by custom- ers, CYBG united three of its brands’ services on its Operational Platform based on Red Hat OpenShift Container Platform. With its Operational Platform, CYBG has established a more effi- cient, customer-focused business to build long-term growth. Software Glasgow, Scotland Red Hat® OpenShift® Container Platform Red Hat Consulting Banking Headquarters 159 branches ~6,500 employees +£1 billion 2018 revenue “With Red Hat OpenShift, we’ve improved our IT efficiency, reliability, security, and reusability.” Benefits • Gained responsive scal- Denis Blackwood ability to grow digital banking Head of IT services, CYBG PLC platform from 40,000 to more than 1 million customers in less than 12 months • Increased IT efficiency by automating repetitive tasks and optimizing hardware resource use • Established solid foundation for future innovation with open source IT experts facebook.com/redhatinc @redhat linkedin.com/company/red-hat redhat.com Customer case study Embracing digital banking to challenge established competitors “Red Hat’s engagement with the open source CYBG PLC is the parent group of Clydesdale Bank, Yorkshire Bank, Virgin Money, and digital banking service B. With a goal to disrupt the status quo in the banking industry, the group aims to capture community, and the market share as payment, mortgage, and lending markets evolve. -

Pp43-45 6.3-Oliver

THE FINANCIAL SERVICES FORUM Retail Banking BANK TO THE FUTURE The high street banks have alienated many of their customers in their search for efficiency, depersonalising the whole experience with offshore call centres and centralised lending decisions. Malcolm Oliver looks at how two relative newcomers to the UK retail banking scene are reviving the old concept of real bank managers and personal service. The future of retail banking is a self-evidently important The key to success is often not the development of theme, and indeed one that The Financial Services Forum the ideas themselves but having the confidence (and addresses each year in the slightly broader context of its perhaps the commercial and professional courage) to Future of Retail Financial Services conferences. stand out and not dismiss them, like most of the herd, But between the positive idea and the delivered reality as passé or inappropriate to the needs of twenty-first- can fall a huge shadow. If speakers really have cracked century customers. As Allan Leighton said recently, in the problem in a way that will deliver lasting customer his new book on leadership, “the biggest challenge to satisfaction and regulatory approval and sustainable senior management is being able to listen effectively to profitability, why on earth would they want to give their those below who know what will and will not work”. secrets away to commercial rivals? Just reflect on how many financial services companies The Forum largely avoids this problem by its in the last decade or so have put in place new strategies membership formula, which means that most presenters to relocate call centres overseas, or to close local will already have built informal relationships with most of branches, or to withdraw free ATMs, or to restrict opening the audience, and will therefore feel that they are talking hours – only to have to perform an embarrassing volte- amongst friends rather than competitors. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

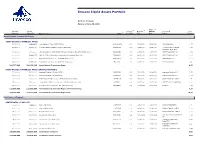

Invesco Liquid Assets Portfolio

Invesco Liquid Assets Portfolio Portfolio Holdings Data as of June 30, 2021 4 2 3 Final Principal Market 1 Coupon/ Maturity Maturity Associated % of Amount Value ($) Name of Issue CUSIP Yield (%) Date Date Issuer Portfolio Asset Backed Commercial Paper ASSET-BACKED COMMERCIAL PAPER 25,000,000 24,998,958 Ionic Capital III Trust (CEP-UBS AG) 46220WUG9 0.13 07/16/2021 07/16/2021 UBS GROUP AG 1.27 37,777,000 37,774,140 Lexington Parker Capital Company (Multi-CEP) 52953AUV5 0.15 07/29/2021 07/29/2021 Lexington Parker Capital 1.93 Company (Multi-CEP) 10,500,000 10,500,000 LMA Americas LLC (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QXR6 0.05 10/25/2021 10/25/2021 CREDIT AGRICOLE SA 0.54 40,000,000 39,992,272 LMA SA (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QW30 0.24 09/03/2021 09/03/2021 CREDIT AGRICOLE SA 2.04 20,000,000 20,000,000 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JW26 0.14 09/02/2021 09/02/2021 BNP PARIBAS SA 1.02 55,000,000 54,964,250 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JY81 0.14 11/08/2021 11/08/2021 BNP PARIBAS SA 2.80 188,277,000 188,229,620 Asset-Backed Commercial Paper 9.60 ASSET-BACKED COMMERCIAL PAPER (INTEREST BEARING) 50,000,000 50,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VG1 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 2.55 25,000,000 25,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VL0 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 1.27 10,000,000 10,000,000 Bedford Row Funding Corp. -

Online Services Tariff for Business Customers

Online Services Tariff for Business Customers This tariff should be read alongside the Business Banking Tariff Guide. It shows the details of the fees payable for our online business banking services – Business Internet Banking and Internet Banking. For information about all the other fees and costs payable for business banking services, check out our Business Banking Tariff at virginmoney.com/business Business Internet Banking Business Internet Banking Service Fees • Set up and control additional Users • Real time reporting on most business accounts • External funds transfers via Faster Payments* • Batching of individual payments No monthly subscription fee • Dedicated helpdesk support (8am – 6pm Monday – Friday) • BACS Payment capability (requires set up) • International Payment capability (requires set up) • Guaranteed same day CHAPS payment capability (requires set up) Business Internet Banking Transactional Fees Faster Payments – Auto Debit As per Auto Debit transaction charge on your Business Tariff, charged separately on a monthly basis. Standard Tariff = £0.30 per payment. BACS Payments £0.18 per payment Charge for exceeding BACS credit limit £40.00 charged separately on a quarterly basis CHAPS Payments £17.50 per payment charged separately† Copies of confirmation/advices £5.00 per item charged separately International Payments SWIFT £17.50 per payment charged separately††^ SEPA £15.00 per payment charged separately††^ Charge clause options BEN: Deducted Clydesdale Bank/Yorkshire Bank charges from amount sent (receiver pays all charges, including Other Bank charges). SHA: Debit me with Clydesdale Bank/Yorkshire Bank charges only. OUR: Debit me with all charges (payer pays all sending and receiving bank charges). Copies of confirmations/advices £5.00 per item charged separately. -

Settlement Banks for FX and MM Transactions, Options and Derivatives

Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Australia AUD National Australia Bank Ltd., Me lbourne NATAAU33033 Acc. 1803012548500 Bulgaria BGN Unicredit Bulbank AD, Sofia UNCRBGSF IBAN BG42UNCR96601030696607 Canada CAD Royal Bank of Canada, Toronto ROYCCAT2 Acc. 095912454619 SYDBANK A/S China CNY Standard Chartered Bank Ltd., Hong Kong SCBLHKHH Acc. 44709448980 Czech R epublic CZK Unicredit Bank Czech Republic AS , Prague BACXCZPP IBAN: CZ242700000000008166802 8 Acc. 81668028 Denmark DKK Danmarks Nationa lbank, Copenhagen DKNBDKKK Acc. 1115 -4 IBAN DK0910050000011154 Euroland EUR Commerzbank A G, Frankfurt COBADEFF Acc. 4008724346 IBAN DE 83500400000872434600 Hong Kong HKD Stan dard Chartered, Hong Kong SCBLHKHH Acc. 44708122739 Hungary HUF OTP Bank PLC , Budapest OTPVHUHB IBAN: HU66117820078102030800000000 Iceland ISK NBI HF NBIIISRE IBAN: IS230100270912726805925439 India INR Standard Chartered Bank , New Delhi SCBLINBB Acc. 222 -0-523804 -8 Indonesia IDR Standard Chartered Bank, Jakarta SCBLIDJX Japan JPY Bank of Tokyo -Mitsubishi UFJ Ltd , Tokyo BOTKJPJT Acc. 653 -0440973 Kenya KES Kenya Commercial Bank, Nairobi KCBLKENX Mexico MXN BBVA Bancomer S.A., Mexico BCMRMXMMCOR Acc. 0095001475 Morocco MAD Banque Marocaine du Commerce Extérieur, Cass ablanca BMCEMAMC New Ze aland NZD ANZ National Bank Ltd , Wellin gton ANZBNZ22058 Acc. 266650 -00001 NZD NO.1 Nor way NOK DNB Nor Bank ASA , Oslo DNBANOKK IBAN: NO32 70010213124 Acc. 7001.02.13124 Valid from: 24.02.2021 Sydbank A/S, CVR No DK 12626509, Aabenraa www.sydbank.com Page: 1/2 Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Poland PLN Bank Millennium SA, Warsaw BIGBPLPW IBAN PL 02116022020000000039897935 Romania RO N UniCredit Tiriac Bank SA, Bucharest BACXROBU IBAN RO65B ACX0000000001413310 Saudi Arabia SAR Saudi British Bank, Riyadh SABBSARI Acc.