Blank Rome Reprint MR July08.Qxd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Iran's Dirty Banking

Tables 5–6 Avi Jorisch TABLE 6: Banks in Europe and Australia Providing Services to UN3* Iranian Banks CORRESPONDENT BANK IRANIAN BANK ACCOUNTS BY CURRENCY** Australia and New Zealand Banking Sepah AUD - SWIFT/BIC: ANZB AU 3M; Account: 710178/00001 Group Limited (Australia) CURRENT A/C No 1 Raiffeisen Zentralbank Österreich Sepah EUR - SWIFT/BIC: RZBA AT WW; Account: 001-50.054.808 AG (Austria) UniCredit Bank Austria AG (Austria) Sepah EUR - SWIFT/BIC: BKAU AT WW; Account: 0001-11583/00 EUR USD - SWIFT/BIC: BKAU AT WW; Account: 0001-11583/00 USD Fortis Bank SA/NV (Belgium) Sepah EUR - SWIFT/BIC: GEBA BE BB 36A; Account: 291-1173303-88-EUR-0 Danske Bank A/S (Denmark) Melli DKK - SWIFT/BIC: DABA DK KK; Account: 3007530897 Sepah DKK - SWIFT/BIC: DABA DK KK; Account: 3007530927 EUR - SWIFT/BIC: DABA DK KK; Account: 3007530927 Bank Melli, Paris Branch (France) Melli EUR - SWIFT/BIC: MELI FR PP; Account: 07000100237-17; IBAN: FR76412590000107000100237-17 Bank Sepah, Paris Branch (France) Sepah EUR - SWIFT/BIC: SEPB FR PP; Account: 00121710032 USD - SWIFT/BIC: SEPB FR PP; Account: 01121710012 Société Générale (France) Sepah EUR - SWIFT/BIC: SOGE FR PP; Account: 002015780790 Bank Melli, Hamburg Branch Melli EUR - SWIFT/BIC: MELI DE HH; Account: 21500/16/504; (Germany) IBAN: DE42202102002150016504 Sepah EUR - SWIFT/BIC: MELI DE HH; Account: 24408 13 504 Bank Saderat, Hamburg Branch Saderat EUR - SWIFT/BIC:BSIR DE HH; Account: 5001-15-4007 (Germany) Bank Sepah, Frankfurt am Main Sepah EUR - SWIFT/BIC: SEPB DE FF; Account: 5010020808EUR (Germany) USD - SWIFT/BIC: SEPB DE FF; Account: 5010020018 BHF-BANK Aktiengesellschaft Sepah EUR - SWIFT/BIC: BHFB DE FF 500; Account: 4400728659 (Germany) Bank Sepah Tehran USD - SWIFT/BIC: BHFB DE FF 500; Account: 0200728659 Bank Sepah Tehran Commerzbank AG (Germany) Sepah EUR -SWIFT/BIC: COBA DE FF; Account: 50040000/400 875 6033 00 EUR * UN3 – One of 3 Iranian banks designated or singled out by UN. -

Canberra Telexes 30A

... Telex # 1240 Telex # 606 ý,,,9557951=8=4 IGOB76013 *** *+ ý848971 WACUK G ý214474 SHFT IR IN THE NAME OF GOD TO WALLAC {NEWBURY} LTD FM SHARIF UNIV. OF TECH. DEPT: 01 DTD AUG.8.89 MSG.NO.10078.O DEAR SIRS WE WOULD BE PLEASED TO RECEIVE YOUR GENERAL CATALOG AND ALSO MORE DETAILED INFORMATION FOR THE FOLLOWING ITEMS ý1- VARIOUS KINDS OF DETECTORS IN NUCLEAR INDUSTRY FIELD . ý2- SINGEL AND MULTICHANNEL ANALYSERS . ý3. OTHER RELATED INSTRUMENTS IN NUCLEAR PHYSICS AND ENGINEERING . ADRS SHARIF UNIV. OF TECH. DEPT:01 P.O.BOX:16765-1831 TEHRAN IRAN , FAX NO. 009821-908538 ý214474 SHFT IR = ý848971 WACUK G********NNN Telex # 286 T88223155 =+ ý134631 DHLVI A STORED MESSAGE FS.NR.: 004790/HH - 91.06.10/12:53 TO SANDY THR FM HELGA VIE TRC RE UNDEL AWBS 968055340 N AWB 968055373 S PACKARD INSTR C DR A SHAHMORADI PLS DEL SHPMTS AGAIN TO THE UNIVERSITY TO ATTN OF MR DR. ALI AKBAR SAEEHI OR TO THE PURCHASING MGR HOPE THIS HELPS N ADV FINAL DD B RGDS ý134631 DHLVI A *******....= Telex # 299 O88223155 + ý134631 DHLVI A STORED MESSAGE FS.NR.: 004790/HH - 91.06.10/11:12 TO SANDY THR FM HELGA VIE TRC RE UNDEL AWBS 968055340 N AWB 968055373 S PACKARD INSTR C DR A SHAHMORADI CNOR IS CHKG N WL ADV NEW INSTR ASAP B RGDS ý134631 DHLVI A Telex # 287 Telex # 1262 Telex # 1324 MV041416154 + ý416154 SEPAH D ý216579 SEPA IR -=-=-=-=-=-=-=- IN THE NAME OF ALLAH -=-=-=-=-=-=-=-= = CH/TH 178 DD.30/6/96 TEST 26-632 ON 30/6/96 FOR DM.334500/00 WITH OUR H/O . -

Department of the Treasury

Vol. 76 Thursday, No. 126 June 30, 2011 Part IV Department of the Treasury Office of Foreign Assets Control 31 CFR Chapter V Alphabetical Listings: Specially Designated Nationals and Blocked Persons; Blocked Vessels; Persons Determined To Be the Government of Iran; Final Rule VerDate Mar<15>2010 18:07 Jun 29, 2011 Jkt 223001 PO 00000 Frm 00001 Fmt 4717 Sfmt 4717 E:\FR\FM\30JNR3.SGM 30JNR3 srobinson on DSK4SPTVN1PROD with RULES3 38534 Federal Register / Vol. 76, No. 126 / Thursday, June 30, 2011 / Rules and Regulations DEPARTMENT OF THE TREASURY Background additions and deletions of names, as The Department of the Treasury’s well as changes in identifying Office of Foreign Assets Control Office of Foreign Assets Control information, it provides more up-to-date (‘‘OFAC’’) maintains a list of blocked information than the list of persons 31 CFR Chapter V persons, blocked vessels, specially previously published on an annual basis designated nationals, specially at Appendix A. Alphabetical Listings: Specially Persons engaging in regulated Designated Nationals and Blocked designated terrorists, specially designated global terrorists, foreign activities are advised to check the Persons; Blocked Vessels; Persons Federal Register and the most recent Determined To Be the Government of terrorist organizations, and specially designated narcotics traffickers whose version of the SDN List posted on Iran OFAC’s Web site for updated property and interests in property are information on blocking, designation, blocked pursuant to the various AGENCY: Office of Foreign Assets identification, and delisting actions economic sanctions programs Control, Treasury. before engaging in transactions that may administered by OFAC. OFAC be prohibited by the economic sanctions ACTION: Final rule. -

Secondary Sanctions on the Iranian Financial Sector Create De Facto Embargo with Lasting Implications for the Biden Administration

Secondary Sanctions on the Iranian Financial Sector Create De Facto Embargo with Lasting Implications for the Biden Administration Abigail Eineman IRAN WATCH REPORT John P. Caves III January 2021 1 Introduction During their confirmation hearings last week in the U.S. Senate, President Joe Biden's key national security nominees noted that the new administration was prepared to return to the nuclear accord with Iran, but warned that such a return would not be swift. First, Iran would have to resume compliance with the accord's nuclear restrictions in a verifiable manner, according to Secretary of State designate Antony Blinken, at which point the United States would resume compliance as well. President Biden’s choice for director of national intelligence, Avril Haines, estimated during her confirmation hearing that “we are a long ways from that.”1 Compliance for the United States would mean reversing at least part of the Trump administration's “maximum pressure” campaign—a set of overlapping trade and financial restrictions on almost every part of Iran's economy. The outgoing administration made such a reversal more challenging, particularly as a result of the sanctions imposed on Iran's financial sector in the administration's final months. On October 8, 2020, the United States designated Iran’s financial sector pursuant to Executive Order (E.O.) 13902 and sanctioned eighteen Iranian banks.2 In doing so, the U.S. Treasury Department applied secondary sanctions to Iran's entire financial sector for the first time, potentially barring foreign entities from the U.S. financial system should they do business with Iranian banks. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Banking Crisis: Empirical Evidence of Iranian Bankers

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Salehi, Mahdi; Mansouri, Ali; Pirayesh, Reza Article Banking crisis: Empirical evidence of Iranian bankers Pakistan Journal of Commerce and Social Sciences (PJCSS) Provided in Cooperation with: Johar Education Society, Pakistan (JESPK) Suggested Citation: Salehi, Mahdi; Mansouri, Ali; Pirayesh, Reza (2009) : Banking crisis: Empirical evidence of Iranian bankers, Pakistan Journal of Commerce and Social Sciences (PJCSS), ISSN 2309-8619, Johar Education Society, Pakistan (JESPK), Lahore, Vol. 2, pp. 25-32 This Version is available at: http://hdl.handle.net/10419/187987 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von -

Billing Code 4810-Al Department

This document is scheduled to be published in the Federal Register on 10/14/2020 and available online at federalregister.gov/d/2020-22723, and on govinfo.gov BILLING CODE 4810-AL DEPARTMENT OF THE TREASURY Office of Foreign Assets Control Notice of OFAC Sanctions Actions AGENCY: Office of Foreign Assets Control, Treasury. ACTION: Notice. SUMMARY: The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) is publishing the names of one or more persons that have been placed on OFAC’s list of Specially Designated Nationals and Blocked Persons (SDN List) based on OFAC’s determination that one or more applicable legal criteria were satisfied. All property and interests in property subject to U.S. jurisdiction of these persons are blocked, and U.S. persons are generally prohibited from engaging in transactions with them. DATES: See Supplementary Information section for applicable date(s). FOR FURTHER INFORMATION CONTACT: OFAC: Associate Director for Global Targeting, tel.: 202-622-2420; Assistant Director for Sanctions Compliance & Evaluation, tel.: 202-622-2490; or Assistant Director for Licensing, tel.: 202-622-2480. SUPPLEMENTARY INFORMATION: Electronic Availability The SDN List and additional information concerning OFAC sanctions programs are available on OFAC’s Web site (www.treas.gov/ofac). Notice of OFAC Actions On October 8, 2020, OFAC determined that the property and interests in property subject to U.S. jurisdiction of the following persons are blocked under the relevant sanctions authorities listed below. Entities 1. AMIN INVESTMENT BANK (a.k.a. AMINIB; a.k.a. “AMIN IB”), No. 51 Ghobadiyan Street, Valiasr Street, Tehran 1968917173, Iran; Website http://www.aminib.com; Additional Sanctions Information - Subject to Secondary Sanctions [IRAN] [IRAN-EO13902]. -

FIN-2010-A008 Issued: June 22, 2010 Subject: Update on the Continuing Illicit Finance Threat Emanating from Iran

Advisory FIN-2010-A008 Issued: June 22, 2010 Subject: Update on the Continuing Illicit Finance Threat Emanating from Iran The Financial Crimes Enforcement Network (FinCEN) is issuing this advisory to supplement information previously provided on the serious threat of money laundering, terrorism finance, and proliferation finance emanating from the Islamic Republic of Iran,1 and to provide guidance to financial institutions regarding United Nations Security Council Resolution (UNSCR) 1929, adopted on June 9, 2010. UNSCR 1929 contains a number of new provisions which build upon and expand the financial sanctions imposed in previous resolutions (UNSCRs 1737, 1747, and 1803) and which are designed to prevent Iran from abusing the international financial system to facilitate its illicit conduct. The resolution’s measures include a call for States, in addition to implementing their obligations pursuant to resolutions 1737, 1747, 1803, and 1929, to prevent the provision of any financial service – including insurance and reinsurance – or asset that does or could contribute to Iran’s proliferation activities; and to prohibit on their territories new relationships with Iranian banks, including the opening of any new branches of Iranian banks, if there is a suspected link to proliferation. The UNSCR also requires States to ensure their nationals exercise vigilance when doing business with any Iranian firm, including the Islamic Revolutionary Guard Corps (IRGC) and the Islamic Republic of Iran Shipping Lines (IRISL), when there is a possibility that -

UK HMT: Financial Sanctions Against Iran

Financial Sanctions Notification 27/07/2010 Iran Council Implementing Regulation (EU) No 668/2010 1. This notification is issued in respect of the financial measures taken against Iran. 2. Her Majesty’s Treasury issue this notification to advise that, with the publication of Council Implementing Regulation (EU) No 668/2010 of 26 July 2010 (‘Regulation 668/2010’) in the Official Journal of the European Union, (O.J. L195, 27.7.2010, P25) on 27 July 2010, the Council of the European Union has again amended Annex V to Council Regulation (EU) No. 423/2007 (‘Regulation 423/2007’). 3. Article 7(2) of Regulation 423/2007 provides for the Council to identify persons, not designated by the United Nations Security Council or by the Sanctions Committee established pursuant to paragraph 18 of UNSCR 1737 (2006), as subject to the financial sanctions imposed by Regulation 423/2007. Such persons are listed in Annex V to Regulation 423/2007. 4. The amendments made to Annex V by Regulation 668/2010 take the form of the addition of individuals and entities to the list of those subject to the financial sanctions imposed by Regulation 423/2007. Article 7 of Regulation 423/2007 imposes an asset freeze on these individuals and entities. 5. With effect from 27 July 2010, all funds and economic resources belonging to, owned, held or controlled by persons in Annex V to Regulation 423/2007 as amended by the Annex to Regulation 668/2010 must be frozen. No funds or economic resources are to be made available, directly or indirectly, to or for the benefit of persons listed in Annex V unless authorised by the Treasury. -

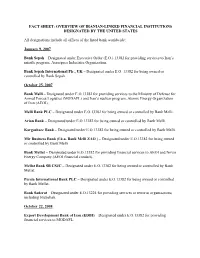

FACT SHEET: OVERVIEW of IRANIAN-LINKED FINANCIAL INSTITUTIONS DESIGNATED by the UNITED STATES All Designations Include All Offic

FACT SHEET: OVERVIEW OF IRANIAN-LINKED FINANCIAL INSTITUTIONS DESIGNATED BY THE UNITED STATES All designations include all offices of the listed bank worldwide: January 9, 2007 Bank Sepah – Designated under Executive Order (E.O.) 13382 for providing services to Iran’s missile program, Aerospace Industries Organization. Bank Sepah International Plc., UK – Designated under E.O. 13382 for being owned or controlled by Bank Sepah. October 25, 2007 Bank Melli – Designated under E.O.13382 for providing services to the Ministry of Defense for Armed Forces Logistics (MODAFL) and Iran’s nuclear program, Atomic Energy Organization of Iran (AEOI). Melli Bank PLC – Designated under E.O.13382 for being owned or controlled by Bank Melli. Arian Bank – Designated under E.O.13382 for being owned or controlled by Bank Melli. Kargoshaee Bank – Designated under E.O.13382 for being owned or controlled by Bank Melli. Mir Business Bank (f.k.a. Bank Melli ZAO ) – Designated under E.O.13382 for being owned or controlled by Bank Melli. Bank Mellat – Designated under E.O.13382 for providing financial services to AEOI and Novin Energy Company (AEOI financial conduit). Mellat Bank SB CSJC – Designated under E.O.13382 for being owned or controlled by Bank Mellat. Persia International Bank PLC – Designated under E.O.13382 for being owned or controlled by Bank Mellat. Bank Saderat – Designated under E.O.13224 for providing services to terrorist organizations, including Hizballah. October 22, 2008 Export Development Bank of Iran (EDBI) – Designated under E.O.13382 for providing financial services to MODAFL. Banco Internacional de Desarrollo – Designated under E.O.13382 for being owned or controlled by EDBI. -

Office of Foreign Assets Control, Notice 95-61

F e d e r a l R e s e r v e B a n k OF DALLAS ROBERT D. McTEER, JR. tnna 10 1 HOC p r e s i d e n t J U H 6 IZ , LyyJ DALLAS, TEXAS A N D CHIEF EXECUTIVE OFFICER 7 5 2 6 5 - 5 9 0 6 Notice 95-61 TO: The Chief Executive Officer of each state member bank and foreign agency in the Eleventh Federal Reserve District SUBJECT Office of Foreign Assets Control DETAILS The Office of Foreign Assets Control (OFAC) has issued General License Number 2, clarifying funds transfer restrictions on transactions involving Iran, and General License Number 3, involving operation of bank accounts for the government of Iran and persons in Iran. According to General License No. 2, transfers not involving Iranian accounts in the United States are permissible, provided the United States remitting or beneficiary bank verifies that the underlying transaction is authorized. Under General License No. 3, effective June 6, 1995, bank accounts for the government of Iran and persons in Iran cannot be serviced except for payments for exempt transac tions, crediting interest, debiting service charges, or closing an account. General License No. 3 also contains a list of Iranian banks subject to the restrictions. National banks which do not have access to computer bulletin boards used by the OFAC may obtain details of the General License by dialing the Comptroller of the Currency’s information line from a Touch-Tone phone. ATTACHMENT Attached is a copy of the Office of Foreign Assets Control’s General License Nos. -

FIN-2008-A002 Issued: March 20, 2008 Subject: Guidance to Financial Institutions on the Continuing Money Laundering Threat Involving Illicit Iranian Activity

Advisory FIN-2008-A002 Issued: March 20, 2008 Subject: Guidance to Financial Institutions on the Continuing Money Laundering Threat Involving Illicit Iranian Activity The Financial Crimes Enforcement Network (FinCEN) is issuing this advisory to supplement information previously provided1 on serious deficiencies present in the anti-money laundering systems of the Islamic Republic of Iran. The Financial Action Task Force (FATF) stated in October 2007 that Iran’s lack of a comprehensive anti-money laundering and combating the financing of terrorism (AML/CFT) regime represents a significant vulnerability in the international financial system. In response to the FATF statement, Iran passed its first AML law in February 2008. The FATF, however, reiterated its concern about continuing deficiencies in Iran’s AML/CFT system in a statement on February 28, 2008. Further, on March 3, 2008, the United Nations Security Council passed Resolution 1803 (UNSCR 1803), calling on all states to exercise vigilance over activities of financial institutions in their territories with all banks domiciled in Iran and their branches and subsidiaries abroad. The FATF statement, combined with the UN’s specific call for vigilance, illustrates the increasing risk to the international financial system posed by the Iranian financial sector, including the Central Bank of Iran. Iran’s AML/CFT deficiencies are exacerbated by the Government of Iran’s continued attempts to conduct prohibited proliferation related activity and terrorist financing. Through state-owned banks, the Government of Iran disguises its involvement in proliferation and terrorism activities through an array of deceptive practices specifically designed to evade detection. The Central Bank of Iran and Iranian commercial banks have requested that their names be removed from global transactions in order to make it more difficult for intermediary financial institutions to determine the true parties in the transaction.