Marlborough Bond Income Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Draft Corporate Plan 2016 - 2021

Draft Corporate Plan 2016 - 2021 1 Contents Page 1. Consultation Overview 3 2. Introduction 4 3. Strategic Context 18 4. Corporate Plan 51 5. Strategic Framework and Strategy Map 55 6. Annex 1: The Consumer Council’s Statutory and Regulatory Duties and Powers 62 7. Annex 2: Consumer Survey 71 8. Annex 3: External Stakeholders Consulted 72 9. Annex 4: Acronyms 78 2 1. Consultation Overview 1.1 This draft Consumer Council’s corporate plan sets out our proposed strategic direction for the period 2016-2021. The corporate plan will provide the foundation for the development of the Council’s annual business plans. 1.2 This draft Corporate Plan provides an overview of the projects that we propose to do during 2016-2021 and is published for consultation. During the consultation, we would particularly welcome views on: Whether we have identified the right projects; Any objections to our proposed projects; and Any other comments. 1.3 Comments should be sent to us by 17 March 2016 at the latest to [email protected]. Alternatively comments can be provided through Survey Monkey at: https://www.surveymonkey.co.uk/r/7X932P6 1.4 We intend to hold a meeting during the consultation period, on 8 March 2016, at our offices. This will provide an opportunity to discuss the draft Corporate Plan. Please let us know before 3 March 2016 if you wish to attend. 1.5 A paper copy of the draft Corporate Plan can be obtained from: Keelin Kelly The Consumer Council for Northern Ireland Floor 3, Seatem House 28-32 Alfred Street Belfast BT2 8EN E-mail: [email protected] Telephone: 028 9025 1667 1.6 After reviewing consultation responses, we will publish, subject to final approval by the Department of Enterprise, Trade and Investment, a final Corporate Plan. -

Enquiries and Complaints Report

Enquiries and Complaints Report 2017-18 Enquiries and Complaints Report 2017-18 Contents Foreword 3 Introduction 4 Our year in review 6 Analysis of enquiries and complaints 9 Getting in touch 44 Customer Feedback & Satisfaction 47 2 Enquiries and Complaints Report 2017-18 Foreword The Consumer Council has an overarching statutory role to promote and safeguard the interests of consumers in Northern Ireland. As part of this remit we can investigate any complaint relating to consumer affairs; whilst having regard to other complaints remedies. In addition to this principal role, The Consumer Council has specific statutory complaints roles in relation to energy, transport, postal services, and water and sewerage in Northern Ireland. The year 2017-18 has seen a 47% increase in Stage 2 complaints from 2016-17; which in itself was a 23% increase from 2015-16. This shows that consumers in Northern Ireland are becoming more aware of their consumer rights and have a greater understanding of how The Consumer Council can help them. During this year, The Consumer Council has continued to improve our standards and has recertified against the Customer Service Excellence (CSE) Standard1. In providing the award the CSE Assessor, Paul Hindley, said, “This was an excellent assessment which showed the high degree of commitment by the staff to the process. It was abundantly clear during the assessment that improvement in customer service was at the heart of everything that the staff undertake”. In addition to this, The Consumer Council has been named as a finalist in the UK Complaints Handling Awards 2019, which recognises and rewards outstanding achievement in complaints handling. -

Annual Report and Accounts 2006/07 National Grid Gas Plc

Company Number 2006000 Annual Report and Accounts 2006/07 National Grid Gas plc National Grid Gas plc Annual Report and Accounts 2006/07 Contents 1 Operating and Financial Review 35 Directors’ Report 38 Statement of Directors’ Responsibilities 39 Independent Auditors’ Report 40 Accounting Policies 45 Consolidated Income Statement 46 Consolidated Balance Sheet 47 Consolidated Statement of Recognised Income and Expense 48 Consolidated Cash Flow Statement 49 Notes to the Accounts 83 Company Accounting Policies 86 Company Balance Sheet 87 Notes to the Company Accounts 94 Definitions National Grid Gas plc Annual Report and Accounts 2006/07 1 Operating and Financial Review This Operating and Financial Review describes the main trends Businesses and segments and factors underlying our development, performance and The performances of our businesses are reported by segment, position during the year ended 31 March 2007 as well as those reflecting the management responsibilities and economic likely to affect our future development, performance and characteristics of each activity. Our principal businesses and position. It has been prepared in line with the guidance provided segments are as follows: in the Reporting Statement on the Operating and Financial Review issued by the UK Accounting Standards Board in Business Segment Description of principal activities January 2006. Gas UK Gas Owner and operator of the gas Transmission Transmission national transmission system in Content of Operating and Financial Review Great Britain and storage facilities 01 About National Grid Gas for liquefied natural gas (LNG). 03 Current and future developments Gas UK Gas The distribution of gas within 05 Objectives and strategy Distribution Distribution England as the owner and operator 09 Principal risk and uncertainties of four of the UK’s eight gas 12 Key performance indicators distribution networks. -

All Council Areas in Northern Ireland

All council areas in Northern Ireland A few statistics in relation to firmus energy’s activity within all council areas: REDUCTION OF INVESTED 220,921 £140.7m CONNECTED TONNES OF SINCE 2005, 49,596 FROM THE £5.6m CUSTOMERS TO DATE 2 ATMOSPHERE PLANNED FOR 2020 CO EACH YEAR (INCLUDING OWNER-OCCUPIER PROPERTIES, NIHE, DOMESTIC (BASED ON 2019 FIGURES £ £ £ £ £ £ NEW BUILD AND INDUSTRIAL WHEN COMPARED TO OIL) AND COMMERICAL) IF ALL THESE REMAINING PROPERTIES CONNECTED TO GAS GAS THE ADDITIONAL C02 SAVINGS WOULD EQUATE TO IS AVAILABLE FOR 307,901 TONNES 104,884 GIVING A TOTAL REDUCTION OF FUTURE CUSTOMERS TONNES TO CONNECT 528,825 EVERY YEAR August 2020 About firmus energy Since 2005 firmus energy has been responsible The company employs over 100 direct staff, as well as for installing and maintaining over 1,600km of pipeline 300 indirectly in the construction, installation and service across 35 cities, towns and villages in Northern Ireland. support industries. firmus energy prides itself on achieving This natural gas network extends through the central strip and maintaining Investors in People - gold status and of Northern Ireland from Newry, through Antrim (our HQ) takes part each year in Business in the Community’s and on to Derry / Londonderry. firmus energy also has Environmental Benchmarking Survey which assesses the a supply business which purchases and sells natural environmental performance of organisations. In 2019, in gas to over 100,000 domestic and Industrial recognition of our ongoing work in this area, firmus customers throughout Northern Ireland. energy was awarded gold status. The Northern Ireland Gas Industry - £1bn network Environmental investment to date Benefits Northern Ireland benefits from having one of the most Energy users switching from home heating oil to natural modern and efficient natural gas networks in the world. -

PRCA Register December

Register for 1st December 2020 - 28th February 2021 3x1 Group Address(es) in the UK Contact Details 11 Fitzroy Place W Little Glasgow 0141 221 0707 G3 7RW [email protected] 26-28 Exchange Street Aberdeen AB11 6PH 16a Walker Street Edinburgh EH3 7LP 210 Borough High Street London SE1 1JX Practitioners (employed and sub-contracted) conducting PA activities this quarter Cameron Grant Patrick Hogan Will Little Graham McKendry Katrine Pearson Fee-Paying clients for whom UK PA consultancy services provided this quarter (i) Client description available Atos Orkney Harbours SICPA The Scottish Salmon Company Viridor Fee-Paying clients for whom UK monitoring services provided this quarter (i) Client description available Scottish Hospitals Inquiry 5654 Address(es) in the UK Contact Details Parchment House Ben Thornton 13 Northburgh Street 020 4534 2980 London [email protected] EC1V 0JP Practitioners (employed and sub-contracted) conducting PA activities this quarter Joseph Costello Imogen Osborne Laura Gabb Liz Morley Sally Payne James Starkie Ben Thornton Fee-Paying clients for whom UK PA consultancy services provided this quarter (i) Client description available Access Fertility Affinity Water Association of British Insurers Centrepoint Drax GKN Automotive HARIBO HySpectral Melrose Sainsbury’s Access Partnership Address(es) in the UK Contact Details 9th Floor Southside David Kaye 105 Victoria Street 0203 143 4900 London [email protected] SW1E 6QT www.accesspartnership.com Other Countries of Operation BELGIUM SENEGAL SINGAPORE -

John Ellis Mobile 085 834 8936 Email: [email protected]

Examining Energy Market Developments October 2010 Developments in the Wholesale Gas Market David Strahan Managing Director, Phoenix Energy Ltd Examining Energy Market Developments October 2010 Agenda _ About Phoenix Energy Ltd _ Wholesale Gas Market Developments _ Unconventional Gas Examining Energy Market Developments October 2010 About Phoenix Energy _ Part of Phoenix Energy Holdings Ltd Group of companies _ Phoenix Natural Gas is the largest distribution network owner in Northern Ireland _ Phoenix Supply is the largest natural gas supplier in Northern Ireland _ Owned by Terra Firma Examining Energy Market Developments October 2010 Customers Supplied on the island of Ireland _ In customer number terms, Phoenix is Number of natural gas customers supplied the second largest natural gas supplier on the island of Ireland (June 2010) on the island of Ireland _ Phoenix has 135,000 customers Customer numbers based on Commission for Energy Regulation Gas Market Update – 2010 (Q2) (CER/10/133) and NIAUR consultation on the options for co-ordinating the relinquishing of firmus energy’s supply exclusivity in the ten towns area Examining Energy Market Developments October 2010 Gas Supplied on the island of Ireland _ In volume terms, Phoenix is the third Volume of natural gas supplied on the island largest natural gas supplier on the of Ireland (January 2010 - June 2010) island of Ireland (excluding power generation) _ Phoenix is growing by around 8,000 new customers each year Volume supplied based on Commission for Energy Regulation Gas Market Updates -

Annual Reports Is Charged to the Company in Accordance with the Provisions of the Regulations and the Prospectus

Interim Report BNY Mellon Investment Funds All sub-funds report 31 December 2010 (Unaudited) BNY Mellon Investment Funds Interim Report & Accounts Table of Contents Report of the Authorised Corporate Director 3 Economic & Market Overview 5 Aggregated Financial Statements 8 BNY Mellon Global Strategic Bond Fund 11 BNY Mellon Long-Term Global Equity Fund 26 Newton 50/50 Global Equity Fund 36 Newton American Fund 50 Newton Asian Income Fund 61 Newton Balanced Fund 74 Newton Cautious Managed Fund 89 Newton Continental European Fund 101 Newton Corporate Bond Fund 111 Newton European Higher Income Fund 125 Newton Global Balanced Fund 139 Newton Global Dynamic Bond Fund 154 Newton Global High Yield Bond Fund 171 Newton Global Higher Income Fund 186 Newton Global Opportunities Fund 202 Newton Growth Fund 213 Newton Higher Income Fund 226 Newton Income Fund 243 Newton Index Linked Gilt Fund 258 Newton International Bond Fund 268 Newton International Growth Fund 284 Newton Japan Fund 297 Newton Long Corporate Bond 307 Newton Long Gilt Fund 319 Newton Managed Fund 330 Newton Oriental Fund 344 Newton Overseas Equity Fund 355 - 1 - BNY Mellon Investment Funds Interim Report & Accounts Newton Pan-European Fund 369 Newton Phoenix Multi-Asset Fund 380 Newton Real Return Fund 394 Newton UK Equity Fund 412 Newton UK Opportunities Fund 425 Additional Information Directors’ Statement 436 Investor Information 437 Significant Events 437 Investment Funds Information 443 Management and Professional Services 443 - 2 - BNY Mellon Investment Funds Interim Report & Accounts Report of the Authorised Corporate Director This is the interim report for BNY Mellon Investment Funds ICVC (‘BNYMIF’) for the six-months ended 31 December 2010. -

Northern Ireland Gas Capacity Statement 2019/20 – 2028/29

Northern Ireland Gas Capacity Statement 2019/20 – 2028/29 1 Purpose of this Document The aim of the Northern Ireland Capacity Statement (NIGCS) is to provide an assessment of the ability of the Northern Ireland transmission network to meet forecast demands on the network over a ten-year period. The system is assessed by using network modelling on days of different demands over a number of different scenarios. The modelling results for each of the scenarios and demand days are presented and discussed. The paper is intended primarily for the gas and electricity power sectors. However, we expect that there is a wider interest in terms of the security of gas supplies to Northern Ireland. The paper provides an assessment of the ability of the transmission network to flow gas over a number of potential future scenarios. Disclaimer: The TSOs have followed accepted industry practice in the collection and analysis of data available. However, prior to taking business decisions, interested parties are advised to seek separate and independent opinion in relation to the matters covered by the present NIGCS and should not rely solely upon data and information contained therein. Information in this document does not purport to contain all the information that a prospective investor or participant in the Northern Ireland gas market may need. 2 Contents 1 Executive Summary ...........................................................................................5 2 Introduction ........................................................................................................8 -

World Bank Document

Note No. 179 April 1999 Public Disclosure Authorized Regulation in New Natural Gas Markets— The Northern Ireland Experience Peter Lehmann So far gas market liberalization has generally occurred in mature markets—particularly where much of the pipeline system has already been laid, as in Argentina, Britain, and the United States. In these cases a competitive structure is appropriate. In new markets, however, it may be difficult to introduce a competitive regime from the outset, and a different approach and form of regulation, such as a period of exclusive licenses, may be needed.1 In 1997 the Northern Ireland Public Disclosure Authorized authorities awarded Phoenix Natural Gas an exclusive license for a limited period to develop a new gas market from scratch in the greater Belfast area. This Note explains the rationale for a period of exclusivity and describes Northern Ireland’s approach to gas market regulation. The Northern Ireland authorities had been eager The economics of supplying gas to areas outside to develop a natural gas market, both for envi- Belfast are difficult, though better opportunities ronmental reasons and to make the province may develop. Indeed, in a new gas industry it more attractive to foreign investors. Their effort can be argued that the initial development was triggered by the conversion to natural gas of license should be granted only for part of a a power plant in Northern Ireland, with com- region or country. In that case it may be best to missioning in 1996. The plant was owned by develop the network as a series of regional fran- British Gas (now BG), and the gas is transported chises. -

Consumer Checklist

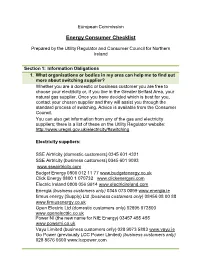

European Commission Energy Consumer Checklist Prepared by the Utility Regulator and Consumer Council for Northern Ireland Section 1: Information Obligations 1. What organisations or bodies in my area can help me to find out more about switching supplier? Whether you are a domestic or business customer you are free to choose your electricity or, if you live in the Greater Belfast Area, your natural gas supplier. Once you have decided which is best for you, contact your chosen supplier and they will assist you through the standard process of switching. Advice is available from the Consumer Council. You can also get information from any of the gas and electricity suppliers; there is a list of these on the Utility Regulator website: http://www.uregni.gov.uk/electricity/#switching Electricity suppliers: SSE Airtricity (domestic customers) 0345 601 4321 SSE Airtricity (business customers) 0345 601 9093 www.sseairtricity.com Budget Energy 0800 012 11 77 www.budgetenergy.co.uk Click Energy 0800 1 070732 www.clickenergyni.com Electric Ireland 0800 056 9914 www.electricireland.com Energia (business customers only) 0345 073 0099 www.energia.ie firmus energy (Supply) Ltd (business customers only) 08456 08 00 88 www.firmusenergy.co.uk Open Electric Ltd (domestic customers only) 02895 072800 www.openelectric.co.uk Power NI (the new name for NIE Energy) 03457 455 455 www.powerni.co.uk Vayu Limited (business customers only) 028 9073 5883 www.vayu.ie Go Power (previously LCC Power Limited) (business customers only) 028 8676 0600 www.lccpower.com Gas suppliers: SSE Airtricity Gas NI 0345 900 5253 www.airtricitygasni.com firmus energy (Supply) Ltd 028 9442 7836 www.firmusenergy.co.uk Electric Ireland (daily metered business customers only) 0800 056 9914 www.electricireland.com Vayu Limited (business customers only) 028 9073 5883 www.vayu.ie Go Power (previously LCC Power Limited) (business customers only) 028 8676 0600 www.lccpower.com Flogas Natural Gas Limited (business customers only) 028 9073 0277 www.flogasni.com/naturalgas 2. -

Energy Consumer Checklist

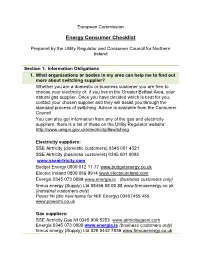

European Commission Energy Consumer Checklist Prepared by the Utility Regulator and Consumer Council for Northern Ireland Section 1: Information Obligations 1. What organisations or bodies in my area can help me to find out more about switching supplier? Whether you are a domestic or business customer you are free to choose your electricity or, if you live in the Greater Belfast Area, your natural gas supplier. Once you have decided which is best for you, contact your chosen supplier and they will assist you through the standard process of switching. Advice is available from the Consumer Council. You can also get information from any of the gas and electricity suppliers; there is a list of these on the Utility Regulator website: http://www.uregni.gov.uk/electricity/#switching Electricity suppliers: SSE Airtricity (domestic customers) 0345 601 4321 SSE Airtricity (business customers) 0345 601 9093 www.sseairtricity.com Budget Energy 0800 012 11 77 www.budgetenergy.co.uk Electric Ireland 0800 056 9914 www.electricireland.com Energia 0345 073 0099 www.energia.ie (business customers only) firmus energy (Supply) Ltd 08456 08 00 88 www.firmusenergy.co.uk (industrial customers only) Power NI (the new name for NIE Energy) 03457455 455 www.powerni.co.uk Gas suppliers: SSE Airtricity Gas NI 0345 900 5253 www.airtricitygasni.com Energia 0345 073 0099 www.energia.ie (business customers only) firmus energy (Supply) Ltd 028 9442 7836 www.firmusenergy.co.uk 2. What are my rights as an electricity and / or gas consumer? This checklist provides consumers with answers to many questions on your rights as an electricity and/or gas consumer. -

Public Utilities and Energy

Local Development Plan - Position Paper Public Utilities and Energy Table of Contents Executive Summary ............................................................................................................. 5 Introduction ............................................................................................................................ 6 Regional Planning Policy Context .................................................................................... 7 Regional Development Strategy 2035 (RDS) ......................................................... 7 Telecommunications ................................................................................................... 7 Energy Supply and Renewable Energy ................................................................... 7 Waste Management .................................................................................................... 8 Housing Evaluation Framework .............................................................................. 10 Strategic Planning Policy Statement (SPPS) ........................................................ 11 Telecommunications ................................................................................................. 11 Waste Management .................................................................................................. 12 Renewable Energy .................................................................................................... 13 Relevant Operational Planning Policy ..........................................................................