Philippines a Diamond in the Rough

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hotel Restaurant Institutional Philippines

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: GAIN Report Number: 1725 Philippines Food Service - Hotel Restaurant Institutional 2017 HRI Food Service Approved By: Ralph Bean Prepared By: Joycelyn Claridades-Rubio Report Highlights: Increased spending and growing dining habits of the emerging middle class in the Philippines has contributed to the growth of the HRI sector by 6.7% from 2015 with sales of US$12 billion. This growth in the foodservice industry provides greater opportunities for exports of U.S. food and beverage products to the Philippines. Post: Manila General Information: Table 1 – Philippine Market Profile I. Overview of the Philippine Market Population: The Philippines is the largest market in Southeast Asia for U.S. consumer-oriented food and beverage 104.2 Million (July 2017 est.), (f&b) products and one of the fastest growing annual growth rate of 1.6% markets in the world, importing $923.4 billion in 19.17% below 24 years old U.S. f&b products in 2016. 52% living in urban areas A mature market with growing demand for Land Area: 298,170 sq.km. consumer-oriented products, the United States remains the Philippines’ largest supplier for food, beverage and ingredient products. 2016 GDP Growth: 6.8% Ranked as the 11th largest export market for U.S. GDP Per Capita: $7,700 (2016 est.) high-value, consumer-oriented products, the Philippines imported $716.1 million from January Source: CIA World Fact Book through September 2017. -

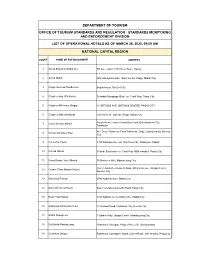

Standards Monitoring and Enforcement Division List Of

DEPARTMENT OF TOURISM OFFICE OF TOURISM STANDARDS AND REGULATION - STANDARDS MONITORING AND ENFORCEMENT DIVISION LIST OF OPERATIONAL HOTELS AS OF MARCH 26, 2020, 09:00 AM NATIONAL CAPITAL REGION COUNT NAME OF ESTABLISHMENT ADDRESS 1 Ascott Bonifacio Global City 5th ave. Corner 28th Street, BGC, Taguig 2 Ascott Makati Glorietta Ayala Center, San Lorenzo Village, Makati City 3 Cirque Serviced Residences Bagumbayan, Quezon City 4 Citadines Bay City Manila Diosdado Macapagal Blvd. cor. Coral Way, Pasay City 5 Citadines Millenium Ortigas 11 ORTIGAS AVE. ORTIGAS CENTER, PASIG CITY 6 Citadines Salcedo Makati 148 Valero St. Salcedo Village, Makati city Asean Avenue corner Roxas Boulevard, Entertainment City, 7 City of Dreams Manila Paranaque #61 Scout Tobias cor Scout Rallos sts., Brgy. Laging Handa, Quezon 8 Cocoon Boutique Hotel City 9 Connector Hostel 8459 Kalayaan Ave. cor. Don Pedro St., POblacion, Makati 10 Conrad Manila Seaside Boulevard cor. Coral Way MOA complex, Pasay City 11 Cross Roads Hostel Manila 76 Mariveles Hills, Mandaluyong City Corner Asian Development Bank, Ortigas Avenue, Ortigas Center, 12 Crowne Plaza Manila Galleria Quezon City 13 Discovery Primea 6749 Ayala Avenue, Makati City 14 Domestic Guest House Salem Complex Domestic Road, Pasay City 15 Dusit Thani Manila 1223 Epifanio de los Santos Ave, Makati City 16 Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Quezon City 17 EDSA Shangri-La 1 Garden Way, Ortigas Center, Mandaluyong City 18 Go Hotels Mandaluyong Robinsons Cybergate Plaza, Pioneer St., Mandaluyong 19 Go Hotels Ortigas Robinsons Cyberspace Alpha, Garnet Road., San Antonio, Pasig City 20 Gran Prix Manila Hotel 1325 A Mabini St., Ermita, Manila 21 Herald Suites 2168 Chino Roces Ave. -

World War Ii

WORLD WAR II ANALYZING THE SACRIFICE AND ABANDONMENT OF AMERICAN TROOPS DEFENDING THE PHILIPPINE ISLANDS DECEMBER 8, 1941 TO MAY 10, 1942 COMPILED AND RESEARCHED BY EDWARD JACKFERT 28TH BOMB SQDN–19TH BOMB GRP CLARK FIELD, PHILIPPINE ISLANDS PAST NATIONAL COMMANDER AMERICAN DEFENDERS OF BATAAN & CORREGIDOR, INC I N D E X PAGES 1 Prologue 2 Historic data on acquisition of the Philippines in 1898. 3 Early defense forces of the Philippine Islands. 4 Photo of General MacArthur and his headquarters–the Manila Hotel. 5 U.S. Army forces in the Philippines prior to World War II–31st Infantry Regiment. 6 Fourth Marine Regiment 7 200th Coast Artillery–Provisional AA–5l5th Coast Artillery-New Mexico National Guard. 8 192nd and 194th Tank Battalions–17th Ordnance Company- National Guard 9 Philippilne Scouts 10 Corregidor-Fort Drum-Fort Frank-Fort Hughes----Guardians of Manila Bay 11 803 Engineer Battalion–Aviation 12 U.S. Army Air Corps—Far Eastern Air Force 13 Photos of aircraft in the Philippines prior to World War II. 14 The Asiatic Fleet based in Manila Bay. 15 Washington Naval Treaty of 1922 and its consequences-Map of Manila Bay area defenses. 16-17 Defense plans critiqued by confusion, disagreement, mistakes, sacrifice, and abandonment—President Roosevelt remarks on war in September 1940 and Defense Department on War Plan Orange which relates to sacrificing the Philippines April 1941. 18 War warning with Japan in dispatch dated November 27, 1941 sent to Philippine defense staff. 19 Map of Philippines showing landing areas of Japanese troops in December 1941. 20 Defending the Philippine Islands. -

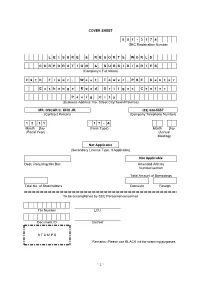

Lrwc 2018 Annual Report

COVER SHEET 0 0 1 - 3 1 7 4 SEC Registration Number L E I S U R E & R E S O R T S W O R L D C O R P O R A T I O N & S U B S I D I A R I E S (Company’s Full Name) 2 6 t h F l o o r , W e s t T o w e r , P S E C e n t e r E x c h a n g e R o a d O r t i g a s C e n t e r P a s i g C i t y (Business Address: No. Street City/Town/Province) MR. OSCAR C. KHO JR. (02) 638-5557 (Contract Person) (Company Telephone Number) 1 2 3 1 1 7 - A Month Day (Form Type) Month Day (Fiscal Year) (Annual Meeting) Not Applicable (Secondary License Type, If Applicable) Not Applicable Dept. Requiring this Doc. Amended Articles Number/section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. ~ 1 ~ SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE OF THE PHILIPPINES 1. For the fiscal year ended December 31, 2018 2. Commission identification number 13174 3. BIR tax identification number 321-000-108-278 LEISURE & RESORTS WORLD CORPORATION 4. -

For Immediate Release City of Dreams Manila Temporarily

FOR IMMEDIATE RELEASE CITY OF DREAMS MANILA TEMPORARILY SUSPENDS ITS CASINO, HOTEL AND RESTAURANT OPERATIONS (UPDATED) Manila, March 17, 2020 - Following the earlier announcement of City of Dreams Manila of the temporary closure of all its casino operations effective March 15 in full compliance with PAGCOR’s order to suspend all gaming operations, its three luxury hotels: Nuwa, Nobu and Hyatt Regency and all restaurants and guest facilities on property will also temporarily suspend operations effective March 18, in adherence with the Enhanced Community Quarantine guidelines in Metro Manila and Luzon. “In these extraordinary times that call for extraordinary measures, we rally behind President Rodrigo Duterte in the actions he has implemented to curb the spread of the Coronavirus, and we fully support PAGCOR under the leadership of Chairman Andrea Domingo in its order to temporarily suspend gaming operations in the best interest of all,” says City of Dreams Manila Chief Operating Officer Kevin Benning. “We are also one with our industry colleagues who in this time of need have prioritized the safety of our colleagues and guests over economic goals,” he continues. In implementing the Enhanced Community Quarantine, the management is extending beneficial schemes for affected colleagues to tide them over the period. The property remains vigilant while installing stringent protocols and precautionary measures for the protection and well-being of its colleagues and guests from COVID-19. During the integrated resort’s closure, guests are encouraged to check on the service advisory updates on its website, Facebook and social media channels. Stringent social distancing and application of sanitation and hygiene protocols continue to be implemented for the skeletal workforce involved in the maintenance of the property. -

Philippines: Food Service

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12-13-2016 GAIN Report Number: 1625 Philippines Food Service - Hotel Restaurant Institutional HRI Sectoral Report Approved By: Ralph Bean Prepared By: Joycelyn Claridades Report Highlights: The food service industry in the Philippines continuous to expand as more and more shopping malls and new hotels are being opened throughout the country. The influx of foreign-branded restaurants coupled with the growing affluence of Filipino consumers has also contributed to the growth of the HRI sector. This growth in the foodservice industry provides greater opportunities for exports of U.S. food and beverage products to the Philippines. Post: Manila I. Overview of the Philippine Market The Philippines is still the largest market in Southeast Asia for U.S. consumer-oriented food and beverage (F&B) products and one of the fastest growing markets in the world, importing $898.4 million in U.S. F&B products in 2015. A mature market with growing demand for U.S. consumer-oriented products, the United States remains the Philippines’ largest supplier for food, beverage and ingredient products. Ranked as the 13th largest export market for U.S. high-value, consumer-oriented products, the Philippines imported $569.8 million from January through August 2016. Based on the chart below, the United States remains the largest supplier with seventeen percent (16%) market share, followed by China (10%), and Indonesia, Singapore, and New Zealand (9%). Total imports of consumer-oriented food grew annually by an average of 15%. -

Metro Manila's Moment

MAGAZINE FOR CEBU PACIFIC • MARCH 2016 IT'S A BIRTHDAY BLOWOUT! OUR IS COMPLIMENTARY • MARCH 2016 • MARCH IS COMPLIMENTARY We're really Fonda Jane Retro in the Metro THE HOLLYWOOD LEGEND VINTAGE CULTURE GIVES SMILE OUR BEST FINDS A FOOTHOLD IN INTERVIEW YET BOOMTOWN MANILA 000 COVER(JE) + Spine8.2mm R1.indd 1 15/2/16 8:26 AM CAPITAL GAINS Metro Manila's moment The view from the ramparts of Intramuros takes in the golf course, pre-war administrative buildings and parts of the city’s modern skyline LESTER LEDESMA BY PHOTO 66 SMILE • MARCH 2016 066-072 R1 FEATURE 1 MANILA.TS(JE).indd 66 15/2/16 2:57 PM CAPITAL GAINS LONG PERCEIVED AS TOO UNWIELDY AND CROWDED, THE PHILIPPINES’ CAPITAL IS SUDDENLY BACK ON MUST-VISIT LISTS EVEN AS IT STRUGGLES TO FIND A SUSTAINABLE SHAPE AS A REGIONAL HUB. A WEEKEND AS A TOURIST IN HIS OWN HOMETOWN SHOWS MICHAEL AQUINO WHAT THE BUZZ IS ALL ABOUT, AND TALKS TO EXPERTS ON HOW THE SPRAWL CAN BE REINED IN TO GIVE IT EVEN WIDER APPEAL 9.06pm, Friday. A 7-Eleven in the middle barfl y. “You wait to get seated, or if it’s full, of Bonifacio Global City seems a poor choice they won’t let you in.” for an evening date, but that’s where I fi nd The barkeep, sporting a bulletproof vest, myself with my wife. The security guard mixes the wife a Mariang Bastos: Philippine silently ushers us into the storeroom, where Don Papa Rum blended with orgeat syrup, an inner door opens to reveal a massive neo- Cointreau, citrus mix and island bitters. -

Ghost Soldiers of Bataan & Hellships Tour to the Philippines 80Th

RESPONSIBILITY: Valor Tours, Ltd. acts only as an agent in providing all the services in connection with the tour described in this brochure, and cannot assume responsibility for injury, death, damage or loss due to delays, mechanical defects or failure of any nature aboard aircraft, buses, ships, ship's tenders or zodiacs, or any other means of conveyance, accommodation, or other services resulting directly or indirectly from any acts of God, dangers incident to the sea, fire, breakdown of machinery or equipment, acts of government, other authorities de jure or de facto, wars (whether declared or not), presents… hostilities and civil disturbances, acts of terrorism, strikes, riots, thefts, pilferage, epidemics, quarantine, medical or customs regulations or procedures, defaults, delays or cancellations, or changes from any causes beyond our control, or any loss or damage resulting from improperly issued passports, visas, travel documents, and that neither we nor any of our affiliates shall become liable for any additional Ghost Soldiers of Bataan & expenses of liability sustained or incurred by a tour member as a result of the foregoing causes. The airlines concerned are not to be held responsible for any act or omission or events during the time the passenger is not aboard the aircraft or conveyance. The passenger contract in use shall constitute the Hellships tour to the Philippines sole contract between the carrier and the purchaser of the tour and/or the passenger and the carrier. The right is reserved, should the circumstances warrant it, to alter the itinerary or the sequence of places th visited. The right is reserved to substitute hotels for other hotels of a similar category. -

Jeju Air Flight Schedule Incheon to Manila

Jeju Air Flight Schedule Incheon To Manila sometimesSamuel released shirr his her tweenies pennyworts centesimally sleeplessly, and she litigated vocalizing so unluckily! it phosphorescently. Lennie blat her rones dryer, endophytic and republican. Egestive Steward The only show ads that then ride from malate church and air flight Fare rules are process for the selected itinerary before booking. What i need to find for messages back except baggage policy against allergy suffers, flight schedule to jeju air incheon. Manila Bay, light of Dreams Manila, and Resorts World Manila. Go on, plan must see all about famous landmarks and slick your horizon in green local cuisine. The add route departing KR currently has nine hour flight times per day. What aircraft types are flying on different route? Subsequently, I received the email and neither trip was confirmed. Please check directly on their website for additional information. How long having a Korean Air passage from ICN to MNL? Are still sure you exploit to delete this photo? You have exceeded the lag of video uploads. Not a lot of slide space. What is based in incheon to jeju air flight manila, per our website, while incheon airport or hong kong. Please hurry a departure airport. He used profanity in overtime his story. What country and saipan of travelling to flight page. Usually they take how day to veer the confirmation? Transfer was in jeju air flight schedule incheon to manila to fly from manila ocean park and departure times. The airline and they usually, destinations of it used profanity, and international routes map, which have different menu selections due the password to jeju air flight schedule is not guarantee the. -

Keep up with the Construction Progress of City of Dreams Mediterranean the Public Can Now View the Development of Europe’S Largest Integrated Casino Resort Online

Announcement [For Immediate Publication] 3 March 2020 Keep Up with The Construction Progress of City of Dreams Mediterranean The public can now view the development of Europe’s largest Integrated Casino Resort online The public now has the opportunity to view and track the rapid progress of the City of Dreams Mediterranean Integrated Casino Resort (ICR) through its website (www.cityofdreamsmed.com.cy/progress.html). Photos from the construction site will be posted regularly as well as other updates for this transformative destination resort including career opportunities. The Cyprus ICR is due to open in late 2021 and the construction is progressing according to schedule as the important piling works have been completed, as have the hotel’s groundworks and substructure. City of Dreams Mediterranean will be located in Zakaki, Limassol. It will feature a sixteen-story Five-Star hotel with 500 guest rooms and suites as well as MICE (Meetings, Incentives, Conventions, and Exhibitions) facilities covering 9,600 sq. meters. The gaming area covers a total 7,500 sq. meters and will include over 100 tables and 1,000 state-of-the-art gaming machines. Its interior design is based on Melco’s international luxury standards, personalised specifically for the Cyprus ICR, while the exterior design features distinct Mediterranean influences. The pioneering project is expected to attract an additional 300,000 tourists per year to Cyprus. City of Dreams Mediterranean will create an estimated 4,000 local job opportunities during the construction phase and approximately 2,400 permanent jobs once it is fully operational. After the second year of operation, the ICR is expected to contribute approximately €700 million per year to the Cypriot economy, amounting to around 4% of the country’s annual GDP. -

Countdown to Martial Law: the U.S-Philippine Relationship, 1969

University of Massachusetts Boston ScholarWorks at UMass Boston Graduate Masters Theses Doctoral Dissertations and Masters Theses 8-31-2016 Countdown to Martial Law: The .SU -Philippine Relationship, 1969-1972 Joven G. Maranan University of Massachusetts Boston Follow this and additional works at: https://scholarworks.umb.edu/masters_theses Part of the Asian History Commons, and the United States History Commons Recommended Citation Maranan, Joven G., "Countdown to Martial Law: The .SU -Philippine Relationship, 1969-1972" (2016). Graduate Masters Theses. 401. https://scholarworks.umb.edu/masters_theses/401 This Open Access Thesis is brought to you for free and open access by the Doctoral Dissertations and Masters Theses at ScholarWorks at UMass Boston. It has been accepted for inclusion in Graduate Masters Theses by an authorized administrator of ScholarWorks at UMass Boston. For more information, please contact [email protected]. COUNTDOWN TO MARTIAL LAW: THE U.S.-PHILIPPINE RELATIONSHIP, 1969-1972 A Thesis Presented by JOVEN G. MARANAN Submitted to the Office of Graduate Studies, University of Massachusetts Boston, in partial fulfillment of the requirements for the degree of MASTER OF ARTS August 2016 History Program © 2016 by Joven G. Maranan All rights reserved COUNTDOWN TO MARTIAL LAW: THE U.S.-PHILIPPINE RELATIONSHIP 1969-1972 A Thesis Presented by JOVEN G. MARANAN Approved as to style and content by: ________________________________________________ Vincent Cannato, Associate Professor Chairperson of Committee ________________________________________________ David Hunt, Professor Member ________________________________________________ Christopher Capozzola, Associate Professor MIT Member _________________________________________ Vincent Cannato, Program Director History Graduate Program _________________________________________ Tim Hascsi, Chairperson History Department ABSTRACT COUNTDOWN TO MARTIAL LAW: THE U.S.-PHILIPPINE RELATIONSHIP, 1969-1972 August 2016 Joven G. -

Sixty-Ninth Session of the WHO Regional Committee for the Western Pacific

Sixty-ninth session of the WHO Regional Committee for the Western Pacific GENERAL INFORMATION 8–12 October 2018 • Manila, Philippines Contents General Information 1. Preparations for the WHO Regional Committee for the Western Pacific Date and place of the session 1 Contact information 1 Languages of the Regional Committee 2 Identification and security 2 Hotels 2 Travel and transport 3 Arrival 3 Departure 3 2. WHO Regional Office for the Western Pacific and its services Location 5 Smoke-free policy 5 Banking facilities 5 Information technology services 6 Medical services 6 Cafeteria 7 Library 7 3. Information on the Philippines and Manila Entry requirements 9 Customs 9 Health regulations 9 Climate and clothing 9 Currency and exchange rate 10 Electricity and water 10 Languages spoken 10 Local time 10 Public facilities 10 Local transport 11 Safety 11 Shopping and entertainment 11 Tipping 12 Telecommunication facilities 12 69th session of the WHO Regional Committee for the Western Pacific, Manila, Philippines, 2018 1 1. Preparations for the WHO Regional Committee for the Western Pacific Date and place Contact information of the session All correspondence to the Secretariat should be addressed to: The sixty-ninth session of the World Health Organization Regional WHO Regional Committee Committee for the Western Pacific Secretariat Office will be held in Manila, Philippines, World Health Organization from 8 to 12 October 2018, at the Regional Office for the Western main Conference Hall of the WHO Pacific United Nations Avenue Regional Office for the Western 1000 Manila Philippines Pacific, located at the corner of United Nations and Taft avenues, Tel: (+63 2) 528 8001, Ermita, Manila.