Extensions of Remarks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Indians (2)” of the John G

The original documents are located in Box 4, folder “Indians (2)” of the John G. Carlson Files at the Gerald R. Ford Presidential Library. Copyright Notice The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Gerald R. Ford donated to the United States of America his copyrights in all of his unpublished writings in National Archives collections. Works prepared by U.S. Government employees as part of their official duties are in the public domain. The copyrights to materials written by other individuals or organizations are presumed to remain with them. If you think any of the information displayed in the PDF is subject to a valid copyright claim, please contact the Gerald R. Ford Presidential Library. Digitized from Box 4 of the John G. Carlson Files at the Gerald R. Ford Presidential Library THE WHITE HOUSE WASHINGTON January 8, 1974 Dear Chief Fools Crow and Matthew Kirig: On behalf of the President, I want to thank you for your letter of November 19 to him, and for the specific questions you enclosed in the Bill of Particulars which Vine DeLoria delivered to Brad Patterson. We promised to have a detailed response to the specific questions, and the enclosure to this letter, prepared principally by the Department of Justice, constitutes that response. As you asked, the response avoids rhetoric and" soothing words" in its answers and confines itself to facts of history and law, with citations of statutes and Court decisions. By way of preface, however, I would like to add a personal word. -

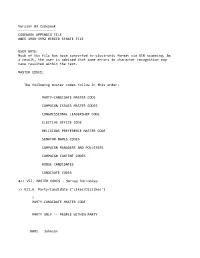

Appendix File Anes 1988‐1992 Merged Senate File

Version 03 Codebook ‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐ CODEBOOK APPENDIX FILE ANES 1988‐1992 MERGED SENATE FILE USER NOTE: Much of his file has been converted to electronic format via OCR scanning. As a result, the user is advised that some errors in character recognition may have resulted within the text. MASTER CODES: The following master codes follow in this order: PARTY‐CANDIDATE MASTER CODE CAMPAIGN ISSUES MASTER CODES CONGRESSIONAL LEADERSHIP CODE ELECTIVE OFFICE CODE RELIGIOUS PREFERENCE MASTER CODE SENATOR NAMES CODES CAMPAIGN MANAGERS AND POLLSTERS CAMPAIGN CONTENT CODES HOUSE CANDIDATES CANDIDATE CODES >> VII. MASTER CODES ‐ Survey Variables >> VII.A. Party/Candidate ('Likes/Dislikes') ? PARTY‐CANDIDATE MASTER CODE PARTY ONLY ‐‐ PEOPLE WITHIN PARTY 0001 Johnson 0002 Kennedy, John; JFK 0003 Kennedy, Robert; RFK 0004 Kennedy, Edward; "Ted" 0005 Kennedy, NA which 0006 Truman 0007 Roosevelt; "FDR" 0008 McGovern 0009 Carter 0010 Mondale 0011 McCarthy, Eugene 0012 Humphrey 0013 Muskie 0014 Dukakis, Michael 0015 Wallace 0016 Jackson, Jesse 0017 Clinton, Bill 0031 Eisenhower; Ike 0032 Nixon 0034 Rockefeller 0035 Reagan 0036 Ford 0037 Bush 0038 Connally 0039 Kissinger 0040 McCarthy, Joseph 0041 Buchanan, Pat 0051 Other national party figures (Senators, Congressman, etc.) 0052 Local party figures (city, state, etc.) 0053 Good/Young/Experienced leaders; like whole ticket 0054 Bad/Old/Inexperienced leaders; dislike whole ticket 0055 Reference to vice‐presidential candidate ? Make 0097 Other people within party reasons Card PARTY ONLY ‐‐ PARTY CHARACTERISTICS 0101 Traditional Democratic voter: always been a Democrat; just a Democrat; never been a Republican; just couldn't vote Republican 0102 Traditional Republican voter: always been a Republican; just a Republican; never been a Democrat; just couldn't vote Democratic 0111 Positive, personal, affective terms applied to party‐‐good/nice people; patriotic; etc. -

Senator Dole FR: Kerry RE: Rob Portman Event

This document is from the collections at the Dole Archives, University of Kansas http://dolearchives.ku.edu TO: Senator Dole FR: Kerry RE: Rob Portman Event *Event is a $1,000 a ticket luncheon. They are expecting an audience of about 15-20 paying guests, and 10 others--campaign staff, local VIP's, etc. *They have asked for you to speak for a few minutes on current issues like the budget, the deficit, and health care, and to take questions for a few minutes. Page 1 of 79 03 / 30 / 93 22:04 '5'561This document 2566 is from the collections at the Dole Archives, University of Kansas 141002 http://dolearchives.ku.edu Rob Portman Rob Portman, 37, was born and raised in Cincinnati, in Ohio's Second Congressional District, where he lives with his wife, Jane. and their two sons, Jed, 3, and Will~ 1. He practices business law and is a partner with the Cincinnati law firm of Graydon, Head & Ritchey. Rob's second district mots run deep. His parents are Rob Portman Cincinnati area natives, and still reside and operate / ..·' I! J IT ~ • I : j their family business in the Second District. The family business his father started 32 years ago with four others is Portman Equipment Company headquartered in Blue Ash. Rob worked there growing up and continues to be very involved with the company. His mother was born and raised in Wa1Ten County, which 1s now part of the Second District. Portman first became interested in public service when he worked as a college student on the 1976 campaign of Cincinnati Congressman Bill Gradison, and later served as an intern on Crradison's staff. -

GPO-CRECB-1988-Pt17-5-3.Pdf

25026 EXTENSIONS OF REMARKS September 22, 1988 EXTENSIONS OF REMARKS H.R. 5233, THE MEDICAID QUAL ing payments for services provided in ICF's/ Revising Current Waiver Authority (Sec ITY SERVICES TO THE MEN MR with more than 15 beds. It does not re tion 102). Under the current "section 2176 TALLY RETARDED AMEND quire States to draw up and implement a 5- home and community-based services" waiver, Stat~s may, on a budget-neutral MENTS OF 1988 year plan for transferring individuals out of basis, provide habilitation services to the · large ICF's/MR into smaller residential set mentally retarded in designated areas tings. And it does not prohibit the Secretary within the State, if those individuals have HON. HENRY A. WAXMAN from setting minimum standards for the quality been discharged from a nursing facility or OF CALIFORNIA of community-based services paid for with ICF /MR. This section would delete the re Federal Medicaid funds. quirement that waiver beneficiaries must IN THE HOUSE OF REPRESENTATIVES In response to the great Member and public have been discharged from an institution. Thursday, September 22, 1988 interest in this issue, the Subcommittee on Quality Assurance for Community Habili Mr. WAXMAN. Mr. Speaker, on August 11, I Health and the Environment will hold a hear tation Services (Section 103J. Directs the Secretary of HHS to develop, by January 1, introduced H.R. 5233, the Medicaid Quality ing on September 30, 1988, on this bill and on 1991, outcome-oriented instruments and Services to the Mentally Retarded Amend the Medicaid Home and Community Quality methods for evaluating and assuring the ments of 1988. -

("DSCC") Files This Complaint Seeking an Immediate Investigation by the 7

COMPLAINT BEFORE THE FEDERAL ELECTION CBHMISSIOAl INTRODUCTXON - 1 The Democratic Senatorial Campaign Committee ("DSCC") 7-_. J _j. c files this complaint seeking an immediate investigation by the 7 c; a > Federal Election Commission into the illegal spending A* practices of the National Republican Senatorial Campaign Committee (WRSCIt). As the public record shows, and an investigation will confirm, the NRSC and a series of ostensibly nonprofit, nonpartisan groups have undertaken a significant and sustained effort to funnel "soft money101 into federal elections in violation of the Federal Election Campaign Act of 1971, as amended or "the Act"), 2 U.S.C. 5s 431 et seq., and the Federal Election Commission (peFECt)Regulations, 11 C.F.R. 85 100.1 & sea. 'The term "aoft money" as ueed in this Complaint means funds,that would not be lawful for use in connection with any federal election (e.g., corporate or labor organization treasury funds, contributions in excess of the relevant contribution limit for federal elections). THE FACTS IN TBIS CABE On November 24, 1992, the state of Georgia held a unique runoff election for the office of United States Senator. Georgia law provided for a runoff if no candidate in the regularly scheduled November 3 general election received in excess of 50 percent of the vote. The 1992 runoff in Georg a was a hotly contested race between the Democratic incumbent Wyche Fowler, and his Republican opponent, Paul Coverdell. The Republicans presented this election as a %ust-win81 election. Exhibit 1. The Republicans were so intent on victory that Senator Dole announced he was willing to give up his seat on the Senate Agriculture Committee for Coverdell, if necessary. -

Win Awenen Nisitotung Free Healthy Moms Moving ? Participate in Surveys Aanii, My Name Is Barb Sault Tribe, Which Means Your Smutek

Win eaders please note: In the 10th paragraph of Denise Chase’s unit report on page 23, there has been a change to the text that differs from Awenen theR print edition of this month’s newspaper, with a line drawn through the text, “six (6) months prior to.” Nisitotung Ode’imin Giizis• Strawberry Moon Official newspaper of the Sault Ste. Marie Tribe of Chippewa Indians June 10 • Vol. 32 No. 6 Sault Tribe selects John Wernet as general counsel BY MICHELLE BOUSCHOR officially starts the job on June for the state of Michigan John Wernet, former deputy 13. “The Sault Tribe is the and served as counsel to the legal counsel to Gov. Jennifer state’s largest sovereign Native Michigan Commission on M. Granholm and a recognized community and is vitally Indian Affairs from 1980 expert in Native American important as a job provider. I through 1988, as First Assistant law, will be the new general am proud to be a member of in the Indian Law Unit from counsel to the Sault Ste. Marie their team.” 1992-1995, and as Assistant in Tribe of Chippewa Indians. Wernet earned his B.A. Charge of the Native American Wernet will become the lead from the University of Affairs Division from 1998 attorney for the Sault Tribe, Michigan’s Residential College through 2003. In 2003, he the largest federally recog- in 1972 and his J.D. from became Deputy Legal Counsel nized Indian tribe east of the Antioch School of Law in to Michigan Gov. Granholm Mississippi with nearly 39,000 Washington, D.C. -

All Rights Reserved This Dissertation Has Been

71-22,493 JOHNSTON, Richard Elwyn, 1924- THE HISTORY OF TRADE AND INDUSTRIAL EDUCATION IN OHIO. The Ohio State University, Ph.D., 1971 Education, vocational University Microfilms, A XEROX Company, Ann Arbor, Michigan © 1971 RICHARD ELWYN JOHNSTON ALL RIGHTS RESERVED THIS DISSERTATION HAS BEEN MICROFILMED EXACTLY AS RECEIVED THE HISTORY OP TRADE AND INDUSTRIAL EDUCATION IN OHIO DISSERTATION Presented In partial Fulfillment of the Requirements for the Degree Doctor of philosophy in the Graduate School of The Ohio State University ,<n By y^\ Richard E* Johnston, B.Ed.s M.S* ***** The Ohio State university 1971 Approved by Adviser College of Eduoation PLEASE NOTE: Several pages contain colored illustrations. Filmed in the best possible way. UNIVERSITY MICROFILMS PREFACE Difficulties become apparent in the historical compilation of this single categorical concept of educa tion when one considers the multi-faceted educational elements of specialization which are germane to each occupational area. Problems of gathering early voca tional trade and industrial research materials have been magnified as a result of incomplete or missing records because of carelessness, deaths and personnel turnover. This writer has been made aware of the fact that authen ticated historical documentation is extremely important to all educational areas, if for no other reason than that it creates a solid foundation upon which one may project or build toward the future. Those of us in vocational education submit that this type of education builds a bridge to a more meaning ful future heretofore reserved only for those with pro fessional aspirations. We, in turn, contend that voca tional education is an answer to the complex ramifica tions which have evolved from increased patterns of world-wide technological changes and population growth never experienced by any previous culture. -

December 2016 Table of Contents Section 1: Introduction

Traill County Mitigation Plan December 2016 Table of Contents Section 1: Introduction ............................................................................................................................ 13 1.1 Plan Goals and Authority ................................................................................................................... 14 1.2 Hazard Mitigation Grant Program (HMGP) ........................................................................................ 14 1.3 Pre-Disaster Mitigation (PDM) ........................................................................................................... 15 1.4 Flood Mitigation Assistance (FMA) .................................................................................................... 15 1.5 Participation....................................................................................................................................... 15 Section 2: Mitigation Plan Update .......................................................................................................... 17 2.1 Planning Process .............................................................................................................................. 17 2.1.1 Plan Administrators ................................................................................................................... 19 2.1.2 Emergency Manager Role and Responsibilities ........................................................................ 19 2.1.3 The Mitigation Steering Committee (Note: The Local -

Office Candidate President & Vice

DOÑA ANA COUNTY GENERAL ELECTION NOVEMBER 8, 2016 OFFICE CANDIDATE DONALD J TRUMP/MICHAEL R PENCE (R) HILLARY RODHAM CLINTON/TIM KAINE (D) GLORIA LA RIVA/DENNIS BANKS (SOCIALISM & LIBERATION) GARY JOHNSON/BILL WELD PRESIDENT & VICE PRESIDENT OF THE UNITED STATES (LIBERTARIAN) ALL PRECINCTS DARRELL CASTLE/SCOTT BRADLEY (CONSTITUTION) JILL STEIN/AJAMU BARAKA (GREEN) “ROCKY” ROQUE DE LA FUENTE/MICHAEL STEINBERG (AMERICAN DELTA) EVAN MCMULLIN/NATHAN JOHNSON (BETTER FOR AMERICA) STEVE PEARCE (R) UNITED STATES REPRESENTATIVE DISTRICT 2 MERRIE LEE SOULES (D) ALL PRECINCTS WRITE-IN SECRETARY OF STATE NORA ESPINOZA (R) ALL PRECINCTS MAGGIE TOULOUSE OLIVER (D) STATE SENATOR DISTRICT 31 NO CANDIDATE (R) 6, 7, 9, 10, 11, 12, 13, 14, 15, 71, 73, 74, 76, 77, 80, 81, 97, 104, 114, 120 JOSEPH CERVANTES (D) STATE SENATOR DISTRICT 34 RON GRIGGS (R) 75 NO CANDIDATE (D) STATE SENATOR DISTRICT 35 NO CANDIDATE (R) 3, 18, 19, 107, 108 JOHN ARTHUR SMITH (D) STATE SENATOR DISTRICT 36 LEE S COTTER (R) 1, 2, 4, 20, 21, 22, 24, 25, 26, 28, 29, 30, 32, 33, 35, 36, 41, 42, 43, 44, 60, 63, 83, 84, 85, 86, 87, 88, 89, 92, 93, 94, 95, 99, JEFF STEINBORN (D) 100, 109, 111, 115 STATE SENATOR DISTRICT 37 CECELIA H LEVATINO (R) 5, 27, 34, 59, 61, 62, 64, 65, 66, 67, 68, 69, 70, 72, 91, 102, 103, 105, 106, 110, 112, 113, 116, 117, 118, 119 WILLIAM P SOULES (D) STATE SENATOR DISTRICT 38 CHARLES R WENDLER (R) 8, 16, 17, 23, 31, 37, 38, 39, 40, 45, 46, 47, 48, 49, 50, 51, 52, 53, 54, 55, 56, 57, 58, 78, 79, 82, 90, 96, 98, 101 MARY KAY PAPEN (D) STATE REPRESENTATIVE DISTRICT -

2017 Online Commencement Program

SOUTHERN NEW HAMPSHIRE UNIVERSITY SOUTHERN NEW HAMPSHIRE UNIVERSITY COMMENCEMENT 2017 EIGHTY-FIFTH COMMENCEMENT SATURDAY, MAY 13 SUNDAY, MAY 14 2017 WELCOME TO THE SOUTHERN NEW HAMPSHIRE UNIVERSITY EIGHTY-FIFTH COMMENCEMENT SATURDAY, MAY 13 SUNDAY, MAY 14 2017 SNHU Arena Manchester, New Hampshire SATURDAY, MAY 13 AT 10:00 A.M. UNIVERSITY COLLEGE COLLEGE OF ONLINE AND CONTINUING EDUCATION UNDERGRADUATE, GRADUATE, AND DOCTORAL DEGREES ............................. 1 SATURDAY, MAY 13 AT 2:30 P.M. COLLEGE OF ONLINE AND CONTINUING EDUCATION COLLEGE FOR AMERICA UNDERGRADUATE DEGREES AND GRADUATE DEGREES ................................ 7 SUNDAY, MAY 14 AT 10:00 A.M. COLLEGE OF ONLINE AND CONTINUING EDUCATION UNDERGRADUATE DEGREES ....................................................................... 13 SUNDAY, MAY 14 AT 2:30 P.M. COLLEGE OF ONLINE AND CONTINUING EDUCATION GRADUATE DEGREES .................................................................................. 19 Awards: The Loeffler Prize ...................................................................................... 25 Excellence in Teaching ............................................................................... 26 Excellence in Advising ................................................................................ 27 SNHU Honor Societies Honor Society Listing ................................................................................. 28 Presentation of Degree Candidates ARTS AND SCIENCES ................................................................................. -

List of Endorsements from the 1-10-2020 Meeting of the Ohio Republican State Central and Executive Committee

List of Endorsements from the 1-10-2020 Meeting of the Ohio Republican State Central and Executive Committee President of the United States Donald J. Trump U.S. Congress 1st District – Rep. Steve Chabot 2nd District – Rep. Brad Wenstrup 4rd District – Rep. Jim Jordan 5th District – Rep. Bob Latta 6th District – Rep. Bill Johnson 7th District – Rep. Bob Gibbs 8th District – Rep. Warren Davidson 10th District – Rep. Mike Turner 11th District – Laverne Gore 12th District – Rep. Troy Balderson 14th District – Rep. David Joyce 15th District – Rep. Steve Stivers 16th District – Rep. Anthony Gonzalez Ohio State Senate - Incumbents 2nd District - Theresa Gavarone 8th District - Bill Blessing 10th District - Bob Hackett 12th District - Matt Huffman 14th District - Terry Johnson 16th District - Stephanie Kunze 20th District - Tim Schaffer 24th District - Matt Dolan 30th District - Frank Hoagland Ohio State Senate – Uncontested Non-Incumbents 18th District - Jerry Cirino 28th District - Mike Downey Ohio State Senate – Contested Non-Incumbents 4th District - George Lang 6th District - Niraj Antani 22nd District - Mark Romanchuk 26th District - Bill Reineke Ohio House of Representatives – Incumbents 1st District - Scott Wiggam 70th District - Darrell Kick 3rd District - Haraz Ghanbari 71st District - Mark Fraizer 4th District - Bob Cupp 72nd District - Larry Householder 5th District - Tim Ginter 74th District - Bill Dean 7th District - Tom Patton 76th District - Diane Grendell 16th District - Dave Greenspan 77th District - Jeff LaRe 23rd District - Laura Lanese 79th District - Kyle Koehler 27th District - Tom Brinkman 80th District - Jena Powell 29th District - Cindy Abrams 81st District - Jim Hoops 30th District - Bill Seitz 82nd District - Craig Riedel 38th District - Bill Roemer 83rd District - Jon Cross 40th District - Phil Plummer 84th District - Susan Manchester 43rd District - J. -

Daughter, 16, Conspired with Others to Kill Her Mother, D.A. Says Student

SERVING EASTERN SHASTA, NORTHERN LASSEN, WESTERN MODOC & EASTERN SISKIYOU COUNTIES 70 Cents Per Copy Vol. 45 No. 27 Burney, California Telephone (530) 335-4533 FAX (530) 335-5335 Internet: im-news.com E-mail: [email protected] SEPTEMBER 17, 2003 Daughter, 16, conspired with others to kill her mother, D.A. says Bail was set Tuesday at $1 mil- lion each for four defendants and $50,000 for another defendant, fol- The fi ve suspects in lowing their arrest for the murder of connection with the a 41-year-old woman. death of a 41-year-old Sandra Lynn Metz was found woman were in court shot to death at the Round Moun- tain home of her boyfriend Jeff Tuesday. From left, Miller, owner of the Dry Creek Sta- front row, Meghan tion restaurant in Bella Vista. Powell and Danielle Shasta County sheriff’s inves- Rodriguez. Back row, tigators arrested Meghan Powell, Jack Thomas Morris, Clifton Garrett Sherer and Calvin William What’s Happening Hodge. Hodge’s bail Here In Days Ahead was set at $50,000. Bail for the other four High school rodeo was set at $1 million District 1 high school rodeo each. is slated for Saturday and NEWS PHOTO / Ron Harrington Sunday at the fairgrounds in McArthur. Cutting will begin 16, of Oak Run, Metz’s daughter, Igo. Powell was later arrested at the Red edly used in the killing. According to Saturday at 8 a.m. with the on Sunday. According to Deputy District Lion Inn where she was staying with Jankowitz, that weapon was a .357 rodeo at noon.