Working with Slides

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

With Whalewisdom You Can Invest Like Your Research Budget Is $70 Million. Hedge Funds Are Very Secretive. That's Why It Was Su

With WhaleWisdom you can invest like your research budget is $70 million. Hedge funds are very secretive. That’s why it was surprising that in a 2015 letter to shareholders, a $10 billion hedge fund revealed its investment research budget for the year. The amount? $70 million. That’s right, the fund spent $70 million that year finding the best investment ideas in the word. How much did you spend in 2015 researching investments? Did the firm pay 70 world-class analysts $1 million apiece to scour the globe for ideas? Did it spend millions crunching “Big Data”? Did the manager send the brightest minds money can buy to meet face-to-face with cutting-edge companies? However it spent its research millions, it appears to have paid off. The firm -- Coatue Management, led by “Tiger Cub” Philippe Laffont -- has had stellar performance. The fund returned 30.32% in 2016, and has had an annualized return over the last three years of 18.48%. And that’s after 2% management and 20% performance fees. Want to place some money with Coatue management? Got 10 million bucks to invest? That might be enough to get you in the door. But don’t count on it -- most of the top performing hedge funds have been closed to new investors for years. So you’re probably out of luck. But maybe not. What if I told you there is a “back-door” way to replicate Coatue performance without placing money with the hedge fund? What if you could see the stocks Coatue was buying and selling and replicate the firm’s investment process? What if there is a way to benefit from the tens of millions worth of research carried out by hedge funds like Coatue? With WhaleWisdom, an investor can replicate the portfolios of the most profitable “Whales” -- huge investors with stellar track records. -

Marqeta | Private Company Profile

Generated by PitchBook Last Updated: 05-Apr-2021 pbId: 54330-13 Marqeta | Private Company Profile Highlights PitchBook Analyst Coverage Employees 562 As of 24-Mar-2021 Last Deal Details Post Valuation $10.00B E $4.30B E IPO 18-Feb-2021 As of 28-May-2020 Total Raised to Date Valuation Step-up $526.95M 2.20x As of 18-Feb-2021 Series E - Series E1 General Information Description Developer of an application programming interface payment platform designed to offer card issuing and payment processing services. The company's platform offers a set of controls and configurations to meet the needs of on-demand service businesses, alternative lenders as well as those looking for payouts for workers, flexible expense management and scalable, secure virtual card transactions, enabling developers and financial institutions to get a simplified way of managing payment programs. Most Recent Financing Status (as of 25-Feb-2021) The company filed to go public on February 18, 2021. The expected offering amount is $10 billion. Previously, the company received an undisclosed amount of financing from MasterCard (NYS:MA) on October 8, 2020. Prior to this, an undisclosed investor sold its stake in the company to Discovery Capital Management for an undisclosed amount on August 26, 2020. Earlier, the company raised $150 million of Series E1 venture funding from Vitruvian Partners and 7 other investors on May 28, 2020, putting the company's pre-money valuation at $4.15 billion. The company will use the funding to accelerate product development and international growth. The company is being actively tracked by PitchBook. -

Investing in Shipping Marine Capital’S Gihan Ismail Brings Shipping to the Institutional Investment Market

June 2015 AlphaFOR INSTITUTIONAL INVESTORS & ASSETQ MANAGERS CROWDFUNDING TIGER CUBS The new kid growing Sharpen their up on the block claws in the private markets INTELLECTUAL PROPERTY WINE SURVEY Mind the IP risks BNP Paribas reveals when doing the stats behind academic investing your glass of red MONETISING DATA STAMPS MANAGEMENT Using philately to Quality data breeds hedge inflation long-term success Investing in shipping Marine Capital’s Gihan Ismail brings shipping to the institutional investment market www.AlphaQ.world Source new investors Be the first to know about investors’ fund searches View performance of individual funds Customize performance benchmarks to meet your needs Access profiles for over 17,200 hedge funds Conduct market research and competitor analysis Develop new business Find out how Preqin’s Hedge Fund Online can help your business: www.preqin.com/hedge [email protected] | +44 (0)20 3207 0200 alternative assets. intelligent data. EDITORIAL elcome to the second edition of Global Fund Media’s AlphaQ, the digital magazine focused on skill-based, risk adjusted Wreturns. We have a plethora of subjects in this issue. Our cover story focuses on shipping, which provides institutional investment managers with true diversification. We look at the shipping industry and the fund route to investment. From here, our attention turns to crowdfunding which is rapidly maturing from its homespun origins to holding its own alongside its more traditional Private Equity and Venture Capital peers. Our piece explains how it can work for institutional investors. Stamp collecting has come a long way from its image of earnest ELEANOR ROSTRON youngsters, albums and pots of glue. -

The Definitive Review of the US Venture Capital Ecosystem Credits & Contact

Q4 2019 In partnership with Angel & seed deal value remains Value of VC deals with 2019 marks record year for elevated in 2019 at $9.1B nontraditional investor VC exit value despite tepid exit Page 7 participation approaches $100B for activity in Q4 second consecutive year Page 32 Page 27 The definitive review of the US venture capital ecosystem Credits & contact PitchBook Data, Inc. JOHN GABBERT Founder, CEO ADLEY BOWDEN Vice President, Research & Analysis Content NIZAR TARHUNI Director, Research JAMES GELFER Senior Strategist & Lead Analyst, VC ALEX FREDERICK Senior Analyst, VC CAMERON STANFILL, CFA Analyst II, VC KYLE STANFORD Analyst, VC VAN LE Senior Data Analyst RESEARCH Contents [email protected] Report & cover design by CONOR HAMILL Executive summary 3 National Venture Capital Association (NVCA) BOBBY FRANKLIN President & CEO NVCA policy highlights 4 MARYAM HAQUE Senior Vice President of Industry Advancement Overview 5-6 CASSIE HODGES Director of Communications DEVIN MILLER Manager of Communications & Digital Angel, seed & first financings 7-8 Strategy Early-stage VC 9-10 Contact NVCA nvca.org Late-stage VC 11-12 [email protected] SVB: Resilience is the theme for 2020 14-15 Silicon Valley Bank Deals by region 17 GREG BECKER Chief Executive Officer MICHAEL DESCHENEAUX President Deals by sector 18-21 BEN STASIUK Vice President SVB: Global trade tensions create stress—and opportunity 22-23 Contact Silicon Valley Bank svb.com Female founders 24-25 [email protected] Nontraditional investors 27-28 Carta: How dual-class and single-class companies Carta 29-30 MISCHA VAUGHN Head of Editorial compare JEFF PERRY Vice President of Revenue D’ARCY DOYLE Senior Vice President of Investor Exits 32-33 Services Sales VINCENT TIMONEY Director of Channel Strategy Fundraising 34-35 Contact Carta Methodology 37 carta.com 2 Q4 2019 PITCHBOOK-NVCA VENTURE MONITOR Executive summary The big question mark at the start of 2019 was how VC deal value would fare after a historic showing in the year prior. -

Ex-Commonwealth PM Set to Launch $500M Macro Fund LAUNCH

The long and the short of it www.hfmweek.com ISSUE 497 3 MAY 2018 INFRAHEDGE CEO BRUCE KEITH DEPARTS AFTER 7 YEARS HFM EUROPEAN 2018 $30bn MAP co-founder to be replaced by Andrew Allright PEOPLE MOVES 03 PERFORMANCE AWARDS DEUTSCHE PUTS PRIME FINANCE BUSINESS UNDER REVIEW HF head Tarun Nagpal to leave bank after 15 years PRIME BROKERAGE 07 EX-GRUSS CAPITAL PROS PREP EVENT-DRIVEN FUND HFMWEEK REVEALS ALL Indar Capital expected to launch later this year LAUNCHES 10 THE WINNERS AWARDS 23 Ex-CommonWealth PM set to launch $500m macro fund Christopher Wheeler readies between 2013 and 2016. London-based CJW Capital CommonWealth closed BY SAM MACDONALD down last year as Fisher depart- ed to join $26bn Soros Fund FORMER CITADEL AND Management. CommonWealth Opportunity From November 2016 until Capital portfolio manager Chris- March this year, Wheeler is topher Wheeler is set to launch a understood to have traded a sub- LAUNCH macro fund with at least $500m stantial macro sleeve for Citadel. initial investment, HFMWeek He previously spent five years has learned. with London-based liquid multi- ANALYSIS Wheeler is starting London- asset business Talisman Global NUMBERS SURGE IN 2017 based CJW Capital Management Asset Management. He earlier with backing from a large asset worked at Morgan Stanley. manager and is looking to begin CJW Capital could become trading this year, HFMWeek one of this year’s largest HFM Global’s annual survey shows understands. European start-ups, amid a num- He registered the firm with ber of prominent macro hedge equity strategies remained most in UK Companies House on 23 fund launches. -

Bloomberg Briefs: Hedge Funds

Tuesday March 7, 2017 March 7, 2017 Alaska's Wealth Fund Seeks 11 Funds for Investments Number of the Week By Hema Parmar Alaska’s $55.4 billion wealth fund is seeking up to 11 hedge funds for allocations, following its decision in May to redeem from its funds of hedge funds and invest in $1.06 Billion managers directly. The Alaska Permanent Fund Corp. prefers experienced managers that have a track Net inflows into macro hedge funds in record of producing returns of at least inflation plus 5 percent, according to public January, according to eVestment. documents from its quarterly board of trustees meeting. Alaska is seeking funds with low correlation to equity markets, "appropriate" risk controls as measured by historical drawdowns and volatility and that can show they have protected capital during down Inside markets, the documents from the Feb. 22-23 board meeting show. Equity-focused Viking Global saw a Marcus Frampton, Alaska’s director of private markets, declined to comment. slight loss in February, while Alaska currently has nine managers in its program that invests directly in hedge funds. Renaissance's equities fund gained It plans to invest a total 5 percent of the firm’s assets, or about $2.8 billion, in managers in the month: Returns in Brief via that program, the documents said. As of Dec. 31, Alaska had a 4.5 percent exposure to commingled funds, either directly Macro funds run by Prologue and or via the funds of hedge funds from which it is redeeming. The move to allocate to State Street are closing: Closures managers directly will save Alaska $15 million a year, according to the documents, as it allows the wealth fund to cut the layer of fees paid to funds of funds for making Ray Dalio jolts Bridgewater as Jon investments. -

Alternative Investments 2020: the Future of Capital for Entrepreneurs and Smes Contents Executive Summary

Alternative Investments 2020 The Future of Capital for Entrepreneurs and SMEs February 2016 World Economic Forum 2015 – All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, or by any information storage and retrieval system. B Alternative Investments 2020: The Future of Capital for Entrepreneurs and SMEs Contents Executive summary 1 Executive summary Over the past decade, the external environment for alternative investments has seen 2 1. Introduction enormous changes. The areas affected the most are start-up capital and venture 3 1.1. Background funding for entrepreneurs, crowdfunding and marketplace lending for small businesses, 3 1.2. Scope and private debt for mid-market enterprises. 6 2. The shake-up of traditional start-up capital 6 2.1. Overview In all three cases, a set of interlocking factors is driving the emergence of new 8 2.2. What you need to know capital sources: 11 2.3. What to look out for 11 2.4. Take-away Regulation: where regulation constrains a capital flow for which there 1. is demand, a new source of capital will emerge to fulfil that demand; 12 3. The rise of crowdfunding 12 3.1. Overview 14 3.2. What you need to know Changes in demand for capital: where capital destinations develop 16 3.3. What to look out for 2. demand for new forms of funding, investors will innovate to meet it; 17 3.4. Take-away Technology: where technology enables new types of origination, 18 4. Mid-market capital 18 4.1. -

Coatue CT 92 LLC Form D Filed 2020-12-14

SECURITIES AND EXCHANGE COMMISSION FORM D Official notice of an offering of securities that is made without registration under the Securities Act in reliance on an exemption provided by Regulation D and Section 4(6) under the Act. Filing Date: 2020-12-14 SEC Accession No. 0000919574-20-007497 (HTML Version on secdatabase.com) FILER Coatue CT 92 LLC Mailing Address Business Address 9 WEST 57TH STREET, 25TH 9 WEST 57TH STREET, 25TH CIK:1836052| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1231 FLOOR FLOOR Type: D | Act: 33 | File No.: 021-383093 | Film No.: 201385524 NEW YORK NY 10019 NEW YORK NY 10019 212-715-5100 Copyright © 2020 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL OMB Number: 3235-0076 Washington, D.C. 20549 June 30, Expires: FORM D 2012 Estimated average burden hours per 4.00 Notice of Exempt Offering of Securities response: 1. Issuer's Identity CIK (Filer ID Number) Previous Name(s) ☒ None Entity Type 0001836052 ☐Corporation Name of Issuer ☐ Limited Partnership Coatue CT 92 LLC ☒ Limited Liability Company Jurisdiction of Incorporation/ Organization ☐ General Partnership DELAWARE ☐ Business Trust Year of Incorporation/Organization ☐Other ☐ Over Five Years Ago ☒ Within Last Five Years (Specify Year) 2020 ☐ Yet to Be Formed 2. Principal Place of Business and Contact Information Name of Issuer Coatue CT 92 LLC Street Address 1 Street Address 2 COATUE MANAGEMENT, L.L.C. 9 WEST 57TH STREET, 25TH FLOOR City State/Province/Country ZIP/Postal Code Phone No. -

Chase Coleman Makes a Killing

COVER STORieS THE WORLD’S RICHEST HEDGE FUNDS ILLUSTRATION BY ISTVÁN SZUGYICZKY Month 2012 BLOOMBERG MARKETS 29 CHASE COLEMAN’S TIGER GLOBAL FUND SCORED A 45 PERCENT GAIN AND THE NO. 1 SPOT. OtHER ACOLYTES OF TIGER MANAGEMENT FOUNDER JULIAN ROBERTSON ALSO THE DISTINGUISHED THEMSELVES IN A YEAR WHEN PERFORMANCE WAS GENERALLY DISMAL. THE WORLD’S 100 RICHEST HEDGE FUNDS TIGER CUBS ROAR BY ANTHONY EFFINGER, KATHERINE BURTON AND ARI LEVY ILLUSTRATION BY DAVID JOHNSON Left to right, Bill Hwang of Tiger Asia, Chase Coleman of Tiger Global, Julian Robertson of Tiger Management and Philippe Laffont of Coatue Management February 2012 BLOOMBERG MARKETS 31 THE WORLD’S 100 RICHEST HEDGE FUNDS TOP-P100ERFORMING LARGE HEDGE FUNDS CHARLES PAYSON ASSETS, IN YTD TOTAL 2010 Fund, Manager(s) Management Firm, Location Strategy BILLIONS RETURN RETURN COLEMAN III, KNOWN AS CHASE, 1 Tiger Global, Chase Coleman, Feroz Dewan Tiger Global Management, U.S. Long/short 6.0 45.0% 18.0% IS AS CLOSE AS ONE 2 Renaissance Institutional Equities, Peter Brown, Robert Mercer Renaissance Technologies, U.S. Quantitative 7.0 33.1 16.4 GETS TO AMERICAN 3 Pure Alpha II, Ray Dalio Bridgewater Associates, U.S. Macro 53.0 23.5 44.8 ARISTOCRACY. 4 Discus Managed Futures Program, Team managed Capital Fund Management, France Managed futures 2.5 20.9 –6.7 A descendent of Peter Stuyvesant, 5 Providence MBS, Russell Jeffrey Providence Investment Management, U.S. Mortgage-backed arbitrage 1.3 20.6 30.3 the last Dutch governor of New York, 6 Oculus, David E. Shaw D.E. -

Member Directory

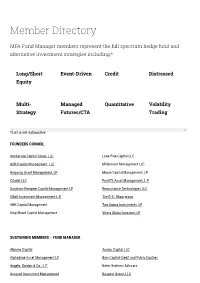

Member Directory MFA Fund Manager members represent the full spectrum hedge fund and alternative investment strategies including:* Long/Short Event-Driven Credit Distressed Equity Multi- Managed Quantitative Volatility Strategy Futures/CTA Trading *List is not exhaustive FOUNDERS COUNCIL Anchorage Capital Group, LLC Lone Pine Capital LLC AQR Capital Management, LLC Millennium Management LLC Balyasny Asset Management, LP Moore Capital Management, LP Citadel LLC Point72 Asset Management, L.P. Davidson Kempner Capital Management LP Renaissance Technologies LLC Elliott Investment Management L.P. The D. E. Shaw group HBK Capital Management Two Sigma Investments, LP King Street Capital Management Viking Global Investors LP SUSTAINING MEMBERS – FUND MANAGER Abrams Capital Axonic Capital LLC Alphadyne Asset Management LP Bain Capital Credit and Public Equities Angelo, Gordon & Co., L.P. Baker Brothers Advisors Assured Investment Management Baupost Group, LLC BlackRock Alternative Investors IONIC Capital Management LLC Bracebridge Capital, LLC Junto Capital Management LP Bridgewater Associates, LP. Kensico Capital Management Brigade Capital Management, LP Kepos Capital LP Cadian Capital Management Kingdon Capital Management, LLC Campbell & Company, LP Laurion Capital Management LP Capula Investment Management LLP Magnetar Capital LLC CarVal Investors Man Group Casdin Capital Marathon Asset Management, L.P. Castle Hook Partners LP Marshall Wace North America LP Centerbridge Partners, L.P. Melvin Capital CIFC Asset Management Meritage Group LP Coatue Management LLC Millburn Ridgeeld Corporation D1 Capital Partners MKP Capital Management Diameter Capital Partners LP Monarch Alternative Capital LP EJF Capital, LLC Napier Park Global Capital Element Capital Management LLC One William Street Capital Management LP Eminence Capital, LP P. Schoenfeld Asset Management LP Empyrean Capital Partners, LP Palestra Capital Management LLC Emso Asset Management Limited Paloma Partners Management Company ExodusPoint Capital Management, LP PAR Capital Management, Inc. -

United States Venture Capital Review

United States Venture Capital Review FIRST HALF 2021 An LSEG Company United States Venture Capital First Half 2021 | United States Venture Capital Review United States Venture Capital Deals Intelligence Venture Capital Investment Activity in U.S. Companies $140 3,500 UNITED STATES VC INVESTMENT REACHES $123.2 BILLION United States venture capital investments reached a record high of $123.2 billion from 3,100 deals in the first half, an explosive rate of growth. For the second quarter in a row, this set an all-time high in terms of $120 3,000 disbursements in any quarter in United States history. Indeed, of the top six quarters ever recorded in terms of dollars invested, five have occurred since Q1 2020, while of the top 25 states all of them $100 2,500 received more capital invested in the first half of 2021 than in the same period last year. The average venture capital round size in the first half also reached $40 million for the first time in history. $80 2,000 While the 1,585 venture capital deals recorded in the second quarter was not itself an all-time high, it did represent the most deals completed since any quarter in 2000, when 2,202 deals were completed in Q2 $60 1,500 2000, and round sizes were only $13.0 million on average. $40 1,000 SEVEN VENTURE INVESTMENTS OVER $1 BILLION COMPLETED While four venture-stage investments $1 billion or greater, totaling $8.4 billion, were completed in all of 2020, in the first half of 2021 alone there were seven such investments recorded totaling $13.7 billion. -

Multiadvisers*

Multiadvisers* * Formerly named Lombard Odier Multiadvisers Audited annual report 30.09.2017 Multiadvisers is an investment company with variable capital ("SICAV") incorporated in Luxembourg RCS Luxembourg B 105 457 IMPORTANT This report does not constitute an offer of Shares. No subscriptions can be received on the basis of financial reports alone. Subscriptions can only be accepted on the basis of the current Prospectus accompanied by the most recent annual report and subsequent semi-annual report if later than such annual report. The current Prospectus, the Articles, the annual and semi-annual reports as well as other notices to Shareholders may be obtained free of charge from either the Registered Office of the Company or the foreign representatives. The issue and redemption prices of Shares may also be obtained from these offices upon request. It is prohibited to reproduce (either in full or in part), transmit (electronically or by any other means), alter, create a link to, or use for public or commercial use of any kind any information contained in this report. Table of contents List of parties and addresses.......................................................................................................................................................................................................................................... 4 Management report.........................................................................................................................................................................................................................................................