Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Retail Outlook

RETAIL OUTLOOK 2019 TRENDS IMPACTING RETAIL M & A +1 212 508 1600 www.pjsolomon.com New York | Houston [email protected] JANUARY 2019 PJ SOLOMON GLOBAL RETAIL, CONSUMER, FOOD RETAIL & RESTAURANTS GROUPS MARC S. COOPER DAVID A. SHIFFMAN CATHY LEONHARDT [email protected] [email protected] [email protected] +1.212.508.1680 +1.212.508.1642 +1.212.508.1660 JEFFREY DERMAN SCOTT MOSES MICHAEL GOTTSCHALK GREG GRAMBLING [email protected] [email protected] [email protected] [email protected] +1.212.508.1625 +1.212.508.1675 +1.212.508.1649 +1.212.508.1674 The wave of disruption to the retail industry continues, but retailers and stakeholders now have a clearer vision of where the industry is headed. Against the backdrop of the strongest consumer market in over a decade, supported by near 50 year-low unemployment, robust consumer spending and strong 18 year-high consumer confidence, the 2018 holiday season brought healthy results for a select number of retailers, particularly those executing a strategy designed for the new world order of retailing. It also amplified the ongoing narrative of the industry’s big getting stronger – one of the themes highlighted in this paper. Despite this reasonably positive setting, we have entered 2019 amidst market volatility, a nascent trade war with China and the prospects of a slowdown in global growth, particularly in China and Europe. Any combination of such factors could once again cloud the retail sector picture and challenge retailers less prepared for change. With an eye towards these developing factors, we evaluate the trends shaping retail today and spotlight the critical themes we believe will impact retail deal-making in 2019. -

Moosejaw Market Expansion Into France

Bowling Green State University ScholarWorks@BGSU Honors Projects Honors College Spring 5-17-2019 Moosejaw Market Expansion into France Rachel Renou [email protected] Follow this and additional works at: https://scholarworks.bgsu.edu/honorsprojects Part of the Business Administration, Management, and Operations Commons, E-Commerce Commons, International Business Commons, and the Marketing Commons Repository Citation Renou, Rachel, "Moosejaw Market Expansion into France" (2019). Honors Projects. 439. https://scholarworks.bgsu.edu/honorsprojects/439 This work is brought to you for free and open access by the Honors College at ScholarWorks@BGSU. It has been accepted for inclusion in Honors Projects by an authorized administrator of ScholarWorks@BGSU. 1 Moosejaw Market Expansion into France Rachel Renou Honors Project Submitted to the Honors College at Bowling Green State University in partial fulfillment of the requirements for graduation with UNIVERSITY HONORS DATE Dr. Zhang Management Department; College of Business, Advisor Dr. Gremler Marketing Department; College of Business, Advisor 2 Table of Contents Executive Summary…………………………………………………………………………….....3 Introduction………………………………………………………………………………………..4 Background……………….…………………………………………………………………….....5 Country Analysis………………………………………………………………………...…….….8 Political Environment……………………………………………..………………..…..…8 Social/Cultural Environment………………………………………………………….....11 Industry/Business Analysis…………………………………………………………………..….16 Five Forces Analysis……………………………………………………………………….....….22 SWOT Analysis……………………………………………………………………………….....27 -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

A Perfect Score the Airport As Travel- Ers Posted Video and Photos Online Jasper High School of Officers with Their Junior Earns Perfect Weapons Drawn

INSIDE TODAY: Top Trump aide exiting: First shoe to drop in wider shuffle? / A8 MAY 31, 2017 JASPER, ALABAMA — WEDNESDAY — WWW.MOUNTAINEAGLE.COM 75 CENTS CURRY HIGH SCHOOL BRIEFS Armed man at Orlando airport in An impactful gift police custody Bush Hog donates mower to Curry ag program Police say a gun- man at the Orlando By JAMES PHILLIPS “We are very thankful for the kind- International Airport Daily Mountain Eagle ness that has been shown to our pro- has been taken into gram,” said Stephen Moore, ag CURRY — The agriscience program instructor and Future Farmers of custody and that at Curry High School recently received America advisor at Curry High. “This everyone is safe. a large donation from an Alabama- is a big deal for our turf management Orlando police based company. students.” Bush Hog, based in Selma, presented During the 2016 school year, 30 of said a call about an CHS with a professional level, zero- Daily Mountain Eagle - James Phillips armed man came in the 120 agriscience students at Curry turn mower for the turf grass manage- received their turf management cre- Rep. Connie Rowe, right, and Dorman Grace speak to about 7:30 p.m. and ment certification aspect of the dential, which gives students a founda- Curry High officials and students Friday to announce the situation was re- program. The mower is an estimated See CURRY, A7 donations to the school’s agriscience program. solved nearly three value of $6,000. hours later, after a crisis negotiator was called in to INSIDE help. The situation created confusion and uncertainty at A perfect score the airport as travel- ers posted video and photos online Jasper High School of officers with their junior earns perfect weapons drawn. -

WAL-MART STORES, INC. (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________________________________ FORM 10-K ___________________________________________ Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended January 31, 2013, or ¨ Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 Commission file number 1-6991. ___________________________________________ WAL-MART STORES, INC. (Exact name of registrant as specified in its charter) ___________________________________________ Delaware 71-0415188 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) 702 S.W. 8th Street Bentonville, Arkansas 72716 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (479) 273-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $0.10 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None ___________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. -

Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock

FINAL TRANSCRIPT WMT - Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock Conference Presentation Event Date/Time: Jun. 15. 2011 / 1:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2011 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. FINAL TRANSCRIPT Jun. 15. 2011 / 1:00PM, WMT - Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock Conference Presentation CONFERENCE CALL PARTICIPANTS Mark Miller William Blair - Analyst Bill Simon Wal-Mart Stores, Inc. - President & CEO Walmart U.S. PRESENTATION Mark Miller - William Blair - Analyst I think I©ll go ahead and get started so as not to cut in on management©s time. For those of you that I©ve not met, my name is Mark Miller; I follow the broadlines food, drug and e-commerce space at William Blair. I©m required to inform you that for a complete list of disclosures and potential conflicts of interest please see WilliamBlair.com. Following this presentation we will have a breakout in the Bellevue Room which, I think most of you know, is through at the restaurant. It is my pleasure this morning to introduce to you the management of Walmart. Walmart has presented now at our conference for nine of the ten years that I©ve been covering the Company. Carol, I appreciate the Company is back again this year. -

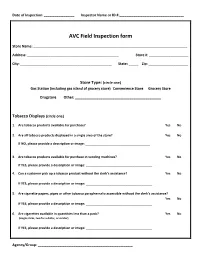

AVC Field Inspection Form

Date of Inspection: _________________ Inspector Name or ID #:____________________________________ AVC Field Inspection form Store Name: ______________________________________________________________________________________ Address: ___________________________________________________ Store #: ______________________ City: ___________________________________________________ State: _____ Zip: ______________________ Store Type: (circle one) Gas Station (including gas island of grocery store) Convenience Store Grocery Store Drugstore Other: ____________________________________________ Tobacco Displays (circle one) 1. Are tobacco products available for purchase? Yes No 2. Are all tobacco products displayed in a single area of the store? Yes No If NO, please provide a description or image: ____________________________________ 3. Are tobacco products available for purchase in vending machines? Yes No If YES, please provide a description or image: _____________________________________ 4. Can a customer pick up a tobacco product without the clerk’s assistance? Yes No If YES, please provide a description or image: _____________________________________ 5. Are cigarette papers, pipes or other tobacco paraphernalia accessible without the clerk’s assistance? Yes No If YES, please provide a description or image: _____________________________________ 6. Are cigarettes available in quantities less than a pack? Yes No (single sticks, two for a dollar, or similar) If YES, please provide a description or image: _____________________________________ Agency/Group: -

China's E-Commerce Market Leapfrogged

05 August 2015 Asia Pacific/India Equity Research India Internet Primer #2 Connections Series Ten lessons from China Figure 1: E-commerce in India is 4-10 years behind China on several parameters Organised retail Online shopping penetration penetration Online Internet shoppers penetration China (1999): ~10% China (2007): 0.6% India (2014): 9-10% India (2014): 0.7% China (2006): 43 mn China (2008): 23% India (2014): 38 mn India (2014): 20% Urbanisation GDP per-capita (US$) Spend per online Smartphone The Credit Suisse Connections Series buyer (US$) penetration China (1997): ~33% China (2004): 1,498 India (2014): 32% India (2014): 1,487 leverages our exceptional breadth of China (2007): 135 China (2010): 13% macro and micro research to deliver India (2014): 104 India (2014): 14% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 incisive cross-sector and cross-border (-17) (-16) (-15) (-14) (-13) (-12) (-11) (-10) (-9) (-8) (-7) (-6) (-5) (-4) thematic insights for our clients. Year (years from 2014) Source: Credit Suisse research Research Analysts Anantha Narayan ■ India at the 'tipping point', based on the China experience. While there 91 22 6777 3730 are differences, the two internet markets are similar in many ways—a large [email protected] population, growing middle class, and an underdeveloped organised market. Nitin Jain 91 22 6777 3851 From 0.2% of GDP in 2007, the Chinese e-tailing market rose to about 5% in [email protected] 2014, an 80% CAGR from US$7.4 bn to US$458 bn. -

Walmart Inc. Takes on Amazon.Com

For the exclusive use of Q. Mays, 2020. 9-718-481 REV: JANUARY 21, 2020 DAVID COLLIS ANDY WU REMBRAND KONING HUAIYI CICI SUN Walmart Inc. Takes on Amazon.com At the start of 2018, Walmart faced critical decisions about its future as e-commerce continued to explode. Walmart just lost its long-held crown as the most valuable retailer in the world to online leader Amazon. With Amazon’s recent acquisition of Whole Foods for $13 billion, Amazon moved aggressively into the offline world to challenge Walmart in its biggest business, grocery. Walmart was not standing still, making moves like buying Jet.com for $3 billion in 2016. While Walmart’s U.S. e- commerce revenues grew to $11.5 billion in 2017, there was no debate in Bentonville, AR: Walmart remained far behind. The question for Walmart CEO Doug McMillon and Walmart.com head Marc Lore was how to respond to its most aggressive competitor ever (Exhibits 1a and 1b).1 Amazon The Early Years (1994–2001) Jeff Bezos founded Amazon in 1994 to exploit the Internet, still a relatively nascent technology. He determined that selling books online was most promising, because the number of titles available was greater than even the largest brick-and-mortar store could stock. Bezos and his wife drove west to start “Earth’s Biggest Bookstore” in Seattle, WA. Amazon offered 1 million titles for sale on its opening day in July 1995. Next year, the company had over 2.5 million book titles for sale, with revenue doubling every quarter (Exhibit 2). -

NOW ACCEPTING GROCERY COMPETITOR COUPONS and ALL MANUFACTURER COUPONS ARE NOW WORTH up to $1.00 Competitor Coupons

NOW ACCEPTING GROCERY COMPETITOR COUPONS AND ALL MANUFACTURER COUPONS ARE NOW WORTH UP TO $1.00 Competitor Coupons We will gladly accept grocery competitor coupons from Albertsons, Safeway, Basha’s, Fresh & Easy, Sunflower, Sprouts, Walmart Marketside, Walmart Neighborhood Market, Whole Foods, Target, AJ’s, Trader Joes, Food City and Ranch Market. All limits and restrictions apply. All competitor amount-off total order coupons will be redeemed after all other discounts and coupons have been applied, as long as the requirements of the coupon have been met. Only one competitor amount-off total order coupon from the same competitor may be used per shopping visit. Customers may use more than one Competitor. Example: A Fresh & Easy $5 off with a $50 required purchase plus an Albertsons $10 off with a $100 required purchase, for a total required purchase of $150, after all other discounts and coupons have been applied. • Competitor coupons will be accepted on identical items, no substitutions. • For competitor brand items use our comparable brand item. • Sorry, no rain checks. • We accept Print at Home Competitor coupons. o Competitor coupons printed from the internet may be printed in black & white. All Manufacturer Coupons Are Worth Up To $1.00! During this promotion we will make all paper manufacturer coupons up to $1.00, even those that state “Do Not Double” or “Not Subject to Doubling.” o Digital coupons downloaded onto a shopper’s VIP card are not subject to doubling Limit one manufacturer and one competitor coupon per item. Coupons Under $1: We will make up to three of the same coupon for like items up to $1.00. -

Bernstein's 36Th Annual Strategic Decisions

Corrected Transcript 27-May-2020 Walmart, Inc. (WMT) Bernstein Strategic Decisions Virtual Conference Total Pages: 22 1-877-FACTSET www.callstreet.com Copyright © 2001-2020 FactSet CallStreet, LLC Walmart, Inc. (WMT) Corrected Transcript Bernstein Strategic Decisions Virtual Conference 27-May-2020 CORPORATE PARTICIPANTS Brett M. Biggs Chief Financial Officer & Executive Vice President, Walmart, Inc. ..................................................................................................................................................................................................................................................................... OTHER PARTICIPANTS Brandon Fletcher Analyst, Sanford C. Bernstein & Co. LLC ..................................................................................................................................................................................................................................................................... MANAGEMENT DISCUSSION SECTION Brandon Fletcher Analyst, Sanford C. Bernstein & Co. LLC Good morning, everybody. Hi. Welcome to the Bernstein Strategic Decisions Conference. We're very happy today to have Brett Biggs join us for a second showing at the conference. Of course, he's the master of ceremonies and the CFO for Walmart, Inc., the big boss job. And I've known Brett for a long time. I have immense respect for him and the work that he and his team do all the time. Obviously Walmart has done an incredible job now and we're very happy to have them -

WALMART INC. (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________________________________ FORM 10-K ___________________________________________ ☒ Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended January 31, 2020, or ☐ Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 Commission file number 001-6991. ___________________________________________ WALMART INC. (Exact name of registrant as specified in its charter) ___________________________________________ DE 71-0415188 (State or other jurisdiction of (IRS Employer Identification No.) incorporation or organization) 702 S.W. 8th Street Bentonville, AR 72716 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (479) 273-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.10 per share WMT NYSE 1.900% Notes Due 2022 WMT22 NYSE 2.550% Notes Due 2026 WMT26 NYSE Securities registered pursuant to Section 12(g) of the Act: None ___________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý WorldReginfo - ddf1e3e1-b7d7-4a92-84aa-57ea0f7c6df3 Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days.