Private Rental Market Trends Survey - Wales

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

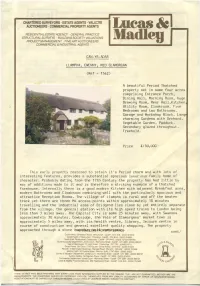

Can Yr Adar, Llampha, Nr Ewenny 1980S

CHARTERED SURVEYORS • ESTATE AGENTS • VALUERS AUCTIONEERS • COMMERCIAL PROPERTY AGENTS Lucas& RESIDENTIAL ESTATE AGENCY ■ GENERAL PRACTICE STRUCTURAL SURVEYS • BUILDING SOCIETY VALUATIONS PROJECT MANAGEMENT ■ FINE ART AUCTIONEERS Madteg COMMERCIAL & INDUSTRIAL AGENTS CAN-YR-ADAR LLAMPHA, EWENNV, MID GLAMORGAN (Ref - 1562) A beautiful Period Thatched property set in some four acres comprising Entrance Porch, Dining Hall, Morning Room, huge Drawing Room, Rear Hall,Kitchen, Utility Room, Cloakroom. Five Bedrooms and two Bathrooms. Garage and Workshop Block. Large charming Gardens with Orchard, Vegetable Garden, Paddock. Secondary glazed throughout. Freehold. Price £i5Ü,UÛG This early property restored to retain it's Period charm and with lots of interesting features, provides a substantial spacious luxurious family home of character. Probably dating from the 17th Century the property has had little by way of additions made to it and is therefore a striking example of a thatched farmhouse. Internally there is a good modern Kitchen with adjacent Breakfast area, modern Bathrooms and Cloakroom combining well with the particularly spacious and attractive Reception Rooms. The village of Llampha is rural and off the beaten track yet there are three M4 access points within approximately 10 minutes travelling and the industrial area of Bridgend lies close by yet entirely separate from the village, the general station with its high speed trains to London being less than 3 miles away. The Capital City is some 25 minutes away, with Swansea approximately 30 minutes. Cowbridge, the Vale of Glamorgáns' market town is approximately 5 miles away, with its health centre, library, leisure centre in course of construction and general excellent guality shopping. -

Thematic Geology Maps B-Ridgend Area

Natural Environment Research Council BRITISH GEOLOGICAL SURVEY PLANNING FOR DEVELOPMENT Thematic Geology Maps B-ridgend Area A report produced under contract to the Department of the Environment on behalf of the Welsh Office This report has been generated from a scanned image of the document with any blank pages removed at the scanning stage. Please be aware that the pagination and scales of diagrams or maps in the resulting report may not appear as in the original Natural Environment Research Council BRITISH GEOLOGICAL SURVEY PLANNING FOR DEVELOPMENT Thematic Geology Maps Bridgend Area D Wilson and M. Smith With contributions by D. C. Entwisle and R. A. Monkhouse Bibliographical reference \\'11,50:-'. D,. and S"ITH. 'vI. 1985, Planning for development: Thematic f!.eology maps. Bridgend area, Geological report for DoE. (Abervstwnh: British Geological Survey. ) Authors D. \\'II.SO~, BSc, PHD '-.1. S\IITH, BSc British Geological SurYev Brvn Eithvn Hall, Llanbrian. Aberystwyth. Dvfed SY23 +BY Contribulors D. C, Entwistle, BSc This report was produced under contract to the British Geological Sun'ev hehalf of the Welsh Oftice Kn"xorth. ~ortingham '-.;G 12 ,SGG R. A, Monkhouse. BA. \IA. '-.[S" ;\iominated Otticer for 'he Secretsary of State - '.,lr D, B, CUllrtier British Geological Sllrwv ;\iominated till' the British Geological Survey - Dr R, A. B. Bazky Crow marsh Gift()rd. \Vallingforci, Ox!orrlshire OXlO HBB ABERYST\YYTH BRITISH GEOLOGICAL SCR\TY 1985 ERRATA 4.1 Paragraph 1, line 6 For 'ST 066 862' read 'ST 066 864 4.1 Paragraph 3, line 14 For 'unknown' read 'also known' 5.5 line 4 For 'abandoned' read 'disused' 7.1 Paragraph 2, line 2 For 'north-east' read 'north-west' MAP 6 Legend. -

County Treasures

The Vale of Glamorgan UDP Supplementary Planning Guidance County Treasures Contents Page 1. Introduction 3 2. Background to the County Treasures Inventory 3 3. Identification of Local Entries 4 4. Criteria for Selection and Review 5 5. Status and Policy Background of the Supplementary Planning Guidance 6 6. Planning Control over ‘Locally Listed’ Entries: Strategic Policy Context 8 7. Planning Control over ‘Locally Listed’ Entries: Detailed Implications 9 8. Where to View County Treasures 10 Appendices 1. List of Locally Listed County Treasures 11 2. Summary of Adopted Unitary Development Plan Policies 23 March 2009 The Vale of Glamorgan © 2009 The Vale of Glamorgan UDP Supplementary Planning Guidance The Vale of Glamorgan UDP Supplementary Planning Guidance 2 County Treasures The Vale of Glamorgan UDP Supplementary Planning Guidance 1.0 INTRODUCTION 1.1 National policy and legislation provide statutory protection for the most important elements of the historic built environment by recognising: - buildings/structures of special architectural/historic interest (listed buildings); - scheduled ancient monuments; and - conservation areas. These form the principal ways by which buildings, monuments and wider areas that make up the built cultural heritage of the Vale of Glamorgan are recognised. 1.2 It is also evident, however, that a number of other buildings and elements, whilst not of equal merit or interest in comparison with nationally recognised examples, are nevertheless of considerable local interest and value. 1.3 This supplementary planning guidance is specifically concerned with locally identified entries contained within the County Treasures list. 2.0 BACKGROUND TO THE COUNTY TREASURES INVENTORY 2.1 The County Treasures project is unique in Wales providing a unified list of historic built assets located in the Vale of Glamorgan. -

Colwinston: a Historical Journey

Colwinston: a historical journey by Chris Hawker First published by Cowbridge History Society, 2018 ISBN 978-1-9996874-0-3 © Chris Hawker, 2018 2 Cover illustration: Corner House Farm (now The Sages). Below: Colwinston Church Both sketches by Jeff Alden. Reproduced by kind permission of Mrs Betty Alden. 3 Acknowledgements I am very grateful to the very many people who have informed the development of this ‘story’. Mention must be made of Phil Jones who shaped many ideas and whose enthusiasm has kept local history alive in the village. Personal stories told to me by Clive Hawkins, Gwynneth Jeavons, Sheila and Jack Madge, Marion and Will Thomas and others tell of life in the more recent past. Richard and Myfanwy Edwards have given an insight into recent farming development. Pam Haines has prepared a history of the Church from which I have borrowed. This ‘project’ started with reading R. Gwyn Thomas’ History of Colwinston, based on a personal archive he built over many years as a tenant farmer, District and County Councillor, and a true champion of the village in the second half of the 20th century. This history is intended to complement and update his work, taking a more chronological approach. It will also be supported by the forthcoming publication of an updated village record, Colwinston – A Changing Village, being published by the local community, led by Heather Maclehose. Cowbridge History Society encouraged me to develop this into a final text, in particular putting me in touch with local experts and advising on the final presentation. The accuracy and authenticity of the work has depended heavily on the detailed knowledge and authority of Brian Ll. -

1918 Surname First Name/S Date of Death Place of Death Age Cause of Death Other Information Date of Page Col Newspaper Adams Mary 21/04/1912 in Memoriam

Deaths taken from Glamorgan Gazette 1918 Surname First Name/s Date of Death Place of Death Age Cause of Death Other Information Date of Page Col Newspaper Adams Mary 21/04/1912 In memoriam. Late of Bryndu, 19/04/1918 3 1 Kenfig Hill. Remembered by her children. Afford Frank 20/10/1917 King Edward's 13 yrs, In memoriam. Son of Pte. H. 25/10/1918 3 2 Hospital 10 mths Afford and Fanny Afford. Remembered by father, mother, brothers and sisters. Aldridge Thomas (Gnr.) 24/04/1917 Gas. In memoriam. Member of the 26/04/1918 3 1 R. G. A. Of 64, Victoria Street, Pontycymmer. Remembered by wife, sons and daughter. Allen George In hospital at Bronchial Of Bridgend. Has two 27/12/1918 3 1 Salonika pneumonia. brothers: Bob and Eric. More details in article. Allen Mary (Mrs) 08/03/1918 2, Gower Villas 82 yrs Suddenly. Deceased was a native of the 15/03/1918 3 5 Gower and a descendant of the Flemish Colony established there in Henry II's Allport Issacker (Sgt.) 27/03/1918France K. I. A. Son of Mr and Mrs Issacker 26/04/1918 4 3 Allport, 30 High Street, Pontycymmer. Member of the Royal Engineers. Surname First Name/s Date of Death Place of Death Age Cause of Death Other Information Date of Page Col Newspaper Andrews William 14/10/1917 Born 27th April 1838. Long 14/06/1918 3 5 article describing the memorial ceremony for Mr Andrews. Andrews Wm. Henry (Pte.) 04/11/1918 K. I. A. -

GGAT 110 Abandoned Medieval Chapels and Churches in Glamorgan and Gwent

GGAT 110: Abandoned Medieval Chapels and Churches in Glamorgan and Gwent December 2011 A report for Cadw by Rachel Bowden BA (Hons) and GGAT report no. 2011/099 Richard Roberts BA (Hons) Project no. GGAT 110 STE GI RE E D R O I A R N G IO A N ISAT The Glamorgan-Gwent Archaeological Trust Ltd Heathfield House Heathfield Swansea SA1 6EL GGAT 110 Abandoned Medieval Chapels and Churches in Glamorgan and Gwent CONTENTS ..............................................................................................Page Number SUMMARY...................................................................................................................3 1. INTRODUCTION .....................................................................................................4 2. METHODOLOGY ....................................................................................................6 3. SOURCES CONSULTED.........................................................................................9 4. RESULTS ................................................................................................................10 Revised Desktop Appraisal......................................................................................10 Stage 1 Assessment..................................................................................................10 Stage 2 Assessment..................................................................................................20 5. SITE VISITS............................................................................................................25 -

GGAT 132: Lowland Settlement in Glamorgan and Gwent

GGAT 132: Lowland Settlement in Glamorgan and Gwent March 2015 A report for Cadw GGAT report no. 2015/007 by Richard Roberts BA (Hons) Project no. GGAT 132 The Glamorgan-Gwent Archaeological Trust Ltd Heathfield House Heathfield Swansea SA1 6EL GGAT 132: Lowland Settlement in Glamorgan and Gwent CONTENTS ........................................................................................... Page Number 1. INTRODUCTION .................................................................................................... 7 2. PREVIOUS SCOPING .......................................................................................... 10 3. METHODOLOGY ................................................................................................ 11 4. SOURCES CONSULTED ..................................................................................... 16 5. RESULTS ............................................................................................................... 17 6. SITE VISITS .......................................................................................................... 39 7. GAZETTEER ......................................................................................................... 44 8. SELECTED FIGURES AND PLATES ............................................................. 102 9. RECOMMENDATIONS ..................................................................................... 186 10. CONCLUSIONS ................................................................................................ 187 -

Deaths Taken from Glamorgan Gazette 1885 Surname First Name/S Date

Deaths taken from Glamorgan Gazette 1885 Surname First Name/s Date of Death Place of Death Age Cause of Death Other Information Date of Page Col Newspaper Andrews Mary 08/04/1885 Alma Road, 1 day Daughter of Richard Andrews. 17/04/1885 2 4 Maesteg Anthony Mary 18/04/1885 Coychurch 88 yrs Widow of Thomas Anthony - 24/04/1885 3 3 labourer. Arnold (Mrs) 20/02/1885 The Warren, Briton Wife of John Arnold. 27/02/1885 3 6 Ferry Arthur Thomas 02/05/1885 Colwinstone 66 yrs 22/05/1885 2 6 Ash 22/03/1885 High Street, Infant son of Mr. Henry Ash. 27/03/1885 3 2 Tynewydd Ashton Thomas 26/12/1884 Nolton Street, 80 yrs Tinker. 02/01/1885 3 7 Bridgend Austin John 10/11/1885 Bridgend 77 yrs Carpenter. 13/11/1885 2 7 Ayres Charles E. 14/06/1885 19, Aber Houses, 24 yrs Collier. 26/06/1885 2 7 Llandyfodwg Bagg Kezia 02/01/1885 Porthcawl 2 days Daughter of Mr. Thomas D. Bagg 09/01/1885 2 2 - coal trimmer. Ballard Thomas 31/12/1884 Merthyr 59 yrs "After a lingering "Connected in the leather trade 09/01/1885 2 2 illness". with Messrs Price". Funeral took place at Cefn Cemetery on Monday last. Batts Wm. 31/05/1885 Llwydarth Road, 56 yrs Labourer. 05/06/1885 3 4 Maesteg Baugh Mary 08/12/1885 Newcastle, 38 yrs Wife of Charles Baugh - general 11/12/1885 2 5 Bridgend labourer. Bawden Esther 14/03/1885 Bridge Street, 70 yrs Wife of Mr. -

S18 (Nash Manor, Castle Upon Alun

THESt VALE Georges OF GLAMORGANSuper Ely to Peterston COUNCIL- Super/ CYNGOR-Ely Primary BRO MORGANNWG School Service Number/Rhif Gwasanaeth: S18 St Brides Major, Llampha & Nash Manor to Cowbridge Comprehensive Morning / Y Bore 0740 Castle upon Alun Route/Llwybr: 0750 Llampha 0755 Court House, Wick Road Lane to Castle-Upon Alun and Lampha, 0800 Bron Hyfryd B4270 Llantwit Major Road, Westgate, 0810 Strembridge High Street, Eastgate, Aberthin Road 0815 Nash Manor 0825 Cowbridge Comprehensive Afternoon / Y Prynhawn 1505 Cowbridge Comprehensive Route/Llwybr: 1520 Nash Manor 1525 Stembridge Aberthin Road, Eastgate, High Street, 1535 Bron Hyfryd Westgate, B4270 Llantwit Major Road, 1540 Court House, Wick Road lane to Lampha and Castle upon Alun, 1545 Llampha 1550 Castle Upon Alun Please note: This bus can only be used by holders of a valid Vale of Glamorgan Council School Bus pass bearing the bus service number above. Anyone not holding a valid pass for this service will be refused travel. Please ensure that pupils are at the pick-up point at least 5 minutes before the times quoted. Cofiwch: Dim ond deiliaid tocyn Bws Ysgol Cyngor Bro Morgannwg dilys gyda’r rhif gwasanaeth bws uchod all ddefnyddio’r bws hwn. Bydd unrhyw un heb docyn dilys ar gyfer y gwasanaeth hwn yn cael ei wrthod. Sicrhewch fod y disgyblion ar y pwynt codi o leiaf 5 munud cyn yr amser a nodir. Contact details / Manylion Cyswllt Vale of Glamorgan Council – 01446 700111 Cowbridge Comprehensive– 01446 772311 Operator/Gweithredwr – Denway Travel 01656 725266 You can ask us any questions on school or public transport via email - [email protected] Gallwch ofyn unrhyw gwestiynau ar drafnidiaeth ysgol neu gyhoeddus drwy e-bost - [email protected] www.valeofglamorgan.gov.uk valid from/yn ddilys o 01/09/2021 www.valeofglamorgan.gov.uk . -

Planning Committee 01-10-2015 Report

Agenda Item No. THE VALE OF GLAMORGAN COUNCIL PLANNING COMMITTEE : 1 OCTOBER 2015 REPORT OF THE DIRECTOR OF DEVELOPMENT SERVICES 1. BUILDING REGULATION APPLICATIONS AND OTHER BUILDING CONTROL MATTERS DETERMINED BY THE DIRECTOR UNDER DELEGATED POWERS (a) Building Regulation Applications - Pass For the information of Members, the following applications have been determined: 2015/0801/BR AC Land at Romilly Park Road, Proposed residential Barry development of 4 detached dwellings 2015/0878/BR AC Plot 5, Craig Yr Eos Proposed construction of Avenue, detached dwelling Ogmore By Sea 2015/1210/BR AC 15, Countess Place, Proposed singe storey rear Penarth, Vale of extension and internal Glamorgan, alterations. 2015/1239/BR AC 27, Vincent Close, Barry Conservatory with W.C. to rear of premises 2015/1240/BN A 18, Maes-Y-Ffynnon , Loft conversion Bonvilston 2015/1241/BN A The Chantry, Flemingston, Single storey extension Barry 2015/1242/BN A 18, Wye Close, Barry removal of laodbearing wall between kitchen and utility room to enlarge kitchen 2015/1243/BN A 22, Maes Y Coed, The Renewal of roof covering Knap, Barry complete, External wall insulation 2015/1244/BR AC 62, Adenfield Way, Rhoose 2, storey side extension, internal re-modelling & relocation of f/floor bathroom P.1 2015/1245/BN A 2, Glanmor Crescent, Barry Widening of front door access 2015/1246/BN A 10, Romilly Park Road, Domestic alterations, take Barry down walls, install lintels 2015/1248/BN A 13, Station Road, Rhoose Knock through wall between 2 reception rooms in a mid terraced 3 bedroom house. 2015/1249/BN A 22, York Place, Barry Remove internal loadbearing wall, remove external loadbearing wall. -

CARDINAL BEAUFORT and ALICE of ARUNDEL by Brad Verity1

-246- NON-AFFAIR TO REMEMBER A NON-AFFAIR TO REMEMBER – THE ALLEGED LIAISON OF CARDINAL BEAUFORT AND ALICE OF ARUNDEL by Brad Verity1 ABSTRACT This article explores the historiography of the Beaufort/Arundel affair. It examines what can be determined from contemporary records about the early years of the Cardinal, his illegitimate daughter, and their relationship, as well as the lives of Alice and the Arundel daughters. Evidence that the affair never took place will be followed by a theory of how and why Alice of Arundel was put forward as the mistress of Beaufort and mother of his child. Foundations (2004) 1 (4): 246-268 © Copyright FMG In a magnificent chantry within Winchester Cathedral lies the tomb of Henry Beaufort (c.1375-1447), Bishop of Winchester, the first English bishop of royal blood since the 12th century and the first cardinal to retain his English see (Harriss, 1988, p.395). The power and influence Beaufort wielded as a statesman and diplomat – he served as Chancellor to his half-brother Henry IV, his nephew Henry V, and his great-nephew Henry VI – underscore his abilities as a man of wisdom, self-confidence and competence. He inspired just as much jealousy and apprehension as admiration among his contemporaries. “Proud, ambitious, and avaricious, delegating his spiritual responsibility in his diocese to subordinates, he stands as the exemplar of a worldly political prelate in late medieval England, outshining even Thomas Wolsey.” (Cannon, 2002). Cardinal Beaufort is perhaps best remembered today for his role in the trial of Joan of Arc in 1431. What is generally not known is that the Cardinal who watched the French peasant maiden burn at the stake had an illegitimate daughter with the same first name. -

St David's Meadow, Colwinston Local Lettings & Sales Policy

St David’s Meadow, Colwinston Local Lettings & Sales Policy The aim of the Local Lettings and Sales policy is to ensure that the new Hafod development at St David’s, Colwinston is sustainable and will become part of the local community. It is the intention of the policy to ensure new residents wish to remain in the area and show a commitment to the locality in which they will live. To achieve this aim, the local lettings and sales policy has been developed by and agreed in partnership with the Vale of Glamorgan Council, Hafod Housing Association and Colwinston Community Council, who represent the residents of the Colwinston Community Council area. Applicants for Lettings and Sales should satisfy the main principles of the policy and be prioritised according to the following criteria: Priority 1 Priority will be given to those applicants with a local connection to the Colwinston Community Council area. Local connection will be defined as follows: • Resident in the community of Colwinston for the last 12 months or 3 out of the last 5 years. • Have parents or grandparents living in the Colwinston Community Council area. • Permanently employed (or moving to be permanently employed) in the Colwinston Community Council area. • Retiring from tied accommodation in the Colwinston Community Council area. Priority 2 If there are insufficient applicants within Priority 1 then applicants with a local connection to the neighbouring areas of Tair Croes, Llampha, Llandow, Llysworney, and Pentre Meyrick will be next in line to be considered. 2a) If insufficient applications are received from Priority Level 1 and 2, priority will then be given to applicants with an extended family connection to the Colwinston Community Council area, including children, grandchildren, brothers and sisters, aunts and uncles, and nephews and nieces.