Taiwan Semiconductor Manufacturing Company Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016 Annual Report (Translation)

Stock Code 2204 China Motor Corporation 2016 Annual Report (Translation) Printed on March 31, 2017 Notice to Readers The Annual Report have been translated into English from the original Chinese version. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese version shall prevail. I. Information regarding Spokesperson, Deputy Spokesperson Spokesperson: Ching-Wu Chien Title: Vice President Deputy Spokesperson: Yu-Chun Su Title: General Manager, Corporate Planning Division, China Motor Corporation Tel: 886-3-4783191 Email: [email protected] II. Contact Information of Headquarter, Branch Company and Plant Headquarter Address: 11F., No.2, Sec. 2, Dunhua S. Rd., Da’an Dist., Taipei City 106, Taiwan Tel: 886-2-23250000 China Motor Training Center Address: No.3, Qingnian Rd., Yangmei Dist., Taoyuan City 326, Taiwan Tel: 886-3-4641100 Yang Mei Plant Address: No.618, Xiucai Rd., Yangmei Dist.,Taoyuan City 326, Taiwan Tel: 886-3-4783191 Hsin Chu Plant Address: No.2, Guangfu Rd., Hukou Township, Hsinchu County 303, Taiwan Tel: 886-3-5985841 III. Common Share Transfer Agent and Registrar Company: China Motor Corporation Address: 7F., No.150, Sec. 2, Nanjing E. Rd., Zhongshan Dist., Taipei City 104, Taiwan Tel: 886-2-25156421 Website: http:// www.china-motor.com.tw IV. Information regarding 2016 Auditors Company: Deloitte & Touche Auditors: Eddie Shao, Lilac Shue Address: 12F, 156, Sec. 3, Min-Sheng E. Rd., Taipei 105-96, Taiwan Tel: 886-2-25459988 Website: http://www.deloitte.com.tw V. Information regarding Depositary: N.A. -

Taiwan Semiconductor Manufacturing Company Limited

Taiwan Semiconductor Manufacturing Company Limited Parent Company Only Financial Statements for the Years Ended December 31, 2019 and 2018 and Independent Auditors’ Report Taiwan Semiconductor Manufacturing Company Limited NOTES TO PARENT COMPANY ONLY FINANCIAL STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2019 AND 2018 (Amounts in Thousands of New Taiwan Dollars, Unless Specified Otherwise) 1. GENERAL Taiwan Semiconductor Manufacturing Company Limited (the “Company” or “TSMC”), a Republic of China (R.O.C.) corporation, was incorporated on February 21, 1987. The Company is a dedicated foundry in the semiconductor industry which engages mainly in the manufacturing, selling, packaging, testing and computer-aided design of integrated circuits and other semiconductor devices and the manufacturing of masks. On September 5, 1994, the Company’s shares were listed on the Taiwan Stock Exchange (TWSE). On October 8, 1997, the Company listed some of its shares of stock on the New York Stock Exchange (NYSE) in the form of American Depositary Shares (ADSs). The address of its registered office and principal place of business is No. 8, Li-Hsin Rd. 6, Hsinchu Science Park, Taiwan. 2. THE AUTHORIZATION OF FINANCIAL STATEMENTS The accompanying parent company only financial statements were approved and authorized for issue by the Board of Directors on February 11, 2020. 3. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS a. Initial application of the amendments to the Regulations Governing the Preparation of Financial Reports by -

Business Groups in South Korea and Taiwan

Institute of Governmental Affairs University of California, Davis Business Groups in South Korea and Taiwan: A Comparison and Database by Robert C. Feenstra Revised, October 1997 Program on Pacific Rim Business and Development 2 Business Groups in South Korea and Taiwan: A Comparison and Database by Robert C. Feenstra Dept. of Economics, University of California, Davis and National Bureau of Economic Research Revised, October 1997 Abstract This paper describes a database of business groups in South Korea and Taiwan. The most detailed data are available for 1989 in South Korea and 1994 for Taiwan, though additional information is provided for the groups in both countries in 1983 and 1986. The detailed data includes a transactions matrix for each major business group, which specifies the sales to other member firms within the group, as well as total sales and other information for each firm. Thus, the detailed data can be used to construct measures of the vertical integration for each business group, and can also be used to analyze their sales across different sectors of the economy. These results are reported in the paper, along with documentation of the variables included in the database. The database for each country can be ordered for $50 from: Shelagh Matthews Mackay, Institute of Governmental Affairs, University of California, Davis, CA 95616, or downloaded from www.internationaldata.org (choose “Asia”). Note: This database has been assembled over the past decade at the Pacific Rim Business and Development Program, Institute of Governmental Affairs, under the direction of Gary Hamilton and Robert Feenstra. It would not have been possible without the help of the staff there and many research assistants. -

Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries

Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Financial Statements for the Nine Months Ended September 30, 2020 and 2019 and Independent Auditors’ Review Report Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2020 AND 2019 (Amounts in Thousands of New Taiwan Dollars, Unless Specified Otherwise) (Reviewed, Not Audited) 1. GENERAL Taiwan Semiconductor Manufacturing Company Limited (TSMC), a Republic of China (R.O.C.) corporation, was incorporated on February 21, 1987. TSMC is a dedicated foundry in the semiconductor industry which engages mainly in the manufacturing, selling, packaging, testing and computer-aided design of integrated circuits and other semiconductor devices and the manufacturing of masks. On September 5, 1994, TSMC’s shares were listed on the Taiwan Stock Exchange (TWSE). On October 8, 1997, TSMC listed some of its shares of stock on the New York Stock Exchange (NYSE) in the form of American Depositary Shares (ADSs). The address of its registered office and principal place of business is No. 8, Li-Hsin Rd. 6, Hsinchu Science Park, Taiwan. The principal operating activities of TSMC’s subsidiaries are described in Note 4. 2. THE AUTHORIZATION OF FINANCIAL STATEMENTS The accompanying consolidated financial statements were reported to the Board of Directors and issued on November 10, 2020. 3. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS a. Initial application of the amendments to the International Financial Reporting Standards (IFRS), International Accounting Standards (IAS), IFRIC Interpretations (IFRIC), and SIC Interpretations (SIC) (collectively, “IFRSs”) endorsed and issued into effect by the Financial Supervisory Commission (FSC) The initial application of the amendments to the IFRSs endorsed and issued into effect by the FSC did not have a significant effect on TSMC and its subsidiaries’ (collectively as the “Company”) accounting policies. -

STOXX Greater China 480 Last Updated: 01.04.2015

STOXX Greater China 480 Last Updated: 01.04.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 105.1 1 1 KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 92.5 2 2 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 70.6 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 64.3 4 3 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 61.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 52.5 6 6 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 40.9 7 7 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 35.1 8 8 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 30.3 9 9 HK0013000119 6448068 0013.HK 644806 Hutchison Whampoa Ltd. HK HKD Y 26.2 10 10 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 25.3 11 19 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 25.2 12 12 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 25.0 13 11 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 21.7 14 13 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 20.9 15 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. -

China Motor Corporation 2020 Annual Report (Translation)

Stock Code:2204 China Motor Corporation 2020 Annual Report (Translation) Printed on March 31, 2021 Notice to Readers The Annual Report have been translated into English from the original Chinese version. If there is any conflict between the English version and the original Chinese version or any difference in the interpretation of the two versions, the Chinese version shall prevail. I. Information regarding Spokesperson, Deputy Spokesperson Spokesperson: Cheng-Chang Huang Title: Vice President Deputy Spokesperson: Yu-Chun Su Title: General Manager, Corporate Planning Division, China Motor Corporation Tel: 886-3-4783191 Email: [email protected] II. Contact Information of Headquarter, Branch Company and Plant Headquarter Address: 11F., No.2, Sec. 2, Dunhua S. Rd., Da’an Dist., Taipei City 106, Taiwan Tel: 886-2-23250000 Yang Mei Plant Address: No.618, Xiucai Rd., Yangmei Dist.,Taoyuan City 326, Taiwan Tel: 886-3-4783191 Hsin Chu Plant Address: No.2, Guangfu Rd., Hukou Township, Hsinchu County 303, Taiwan Tel: 886-3-5985841 III. Common Share Transfer Agent and Registrar Company: China Motor Corporation Address: 7F., No.150, Sec. 2, Nanjing E. Rd., Zhongshan Dist., Taipei City 104, Taiwan Tel: 886-2-25156421 Website: http:// www.china-motor.com.tw IV. Information regarding 2020 Auditors Company: Deloitte & Touche Auditors: Eddie Shao, Ya-Ling Wong Address: 20F, Taipei Nan Shan Plaza, No. 100, Songren Rd., Xinyi Dist., Taipei 11073, Taiwan Tel: 886-2-27259988 Website: http://www.deloitte.com.tw V. Information regarding Depositary: N.A. VI. Corporation Website: http:// www.china-motor.com.tw Table of Contents Report to Shareholders ________________________________________________ 6 Company Overview __________________________________________________ 8 I. -

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Core Equity Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms -

Financial Statements for the Three Months Ended March 31, 2010 and 2009 and Independent Accountants’ Review Report INDEPENDENT ACCOUNTANTS’ REVIEW REPORT

China Steel Corporation Financial Statements for the Three Months Ended March 31, 2010 and 2009 and Independent Accountants’ Review Report INDEPENDENT ACCOUNTANTS’ REVIEW REPORT The Board of Directors and Stockholders China Steel Corporation We have reviewed the accompanying balance sheets of China Steel Corporation (the “Corporation”) as of March 31, 2010 and 2009, and the related statements of income and cash flows for the three months then ended. These financial statements are the responsibility of the Corporation’s management. Our responsibility is to issue a report on these financial statements based on our reviews. Except for the matters described in the third paragraph, we conducted our reviews in accordance with Statement of Auditing Standards No. 36 - “Review of Financial Statements” issued by the Auditing Committee of the Accounting Research and Development Foundation (“ARDF”) of the Republic of China. A review consists principally of applying analytical procedures to financial data and of making inquiries of officers responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with auditing standards generally accepted in the Republic of China, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion. As discussed in Note 12 to the accompanying financial statements, investments in certain equity-method investees (including unlisted subsidiaries and equity-method investees of listed subsidiaries) were NT$34,662,572 thousand and NT$94,255,085 thousand as of March 31, 2010 and 2009, respectively. The related net investment income (loss) were NT$1,505,698 thousand and NT$(298,189) thousand for the three months ended March 31, 2010 and 2009, respectively. -

2020 Six Months

Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries NOTES TO CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2020 AND 2019 (Amounts in Thousands of New Taiwan Dollars, Unless Specified Otherwise) (Reviewed, Not Audited) 1. GENERAL Taiwan Semiconductor Manufacturing Company Limited (TSMC), a Republic of China (R.O.C.) corporation, was incorporated on February 21, 1987. TSMC is a dedicated foundry in the semiconductor industry which engages mainly in the manufacturing, selling, packaging, testing and computer-aided design of integrated circuits and other semiconductor devices and the manufacturing of masks. On September 5, 1994, TSMC’s shares were listed on the Taiwan Stock Exchange (TWSE). On October 8, 1997, TSMC listed some of its shares of stock on the New York Stock Exchange (NYSE) in the form of American Depositary Shares (ADSs). The address of its registered office and principal place of business is No. 8, Li-Hsin Rd. 6, Hsinchu Science Park, Taiwan. The principal operating activities of TSMC’s subsidiaries are described in Note 4. 2. THE AUTHORIZATION OF FINANCIAL STATEMENTS The accompanying consolidated financial statements were reported to the Board of Directors and issued on August 11, 2020. 3. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING STANDARDS a. Initial application of the amendments to the International Financial Reporting Standards (IFRS), International Accounting Standards (IAS), IFRIC Interpretations (IFRIC), and SIC Interpretations (SIC) (collectively, “IFRSs”) endorsed and issued into effect by the Financial Supervisory Commission (FSC) The initial application of the amendments to the IFRSs endorsed and issued into effect by the FSC did not have a significant effect on TSMC and its subsidiaries’ (collectively as the “Company”) accounting policies. -

STOXX Greater China 480 Last Updated: 04.02.2014

STOXX Greater China 480 Last Updated: 04.02.2014 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 62.2 1 1 KYG875721485 B01CT30 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 53.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 41.1 3 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 41.0 4 3 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 36.5 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 35.0 6 6 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 23.9 7 7 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 23.8 8 8 HK0013000119 6448068 0013.HK 644806 Hutchison Whampoa Ltd. HK HKD Y 18.6 9 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.5 10 9 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 15.1 11 12 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 15.0 12 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 15.0 13 13 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 14.8 14 18 HK0001000014 6190273 0001.HK 619027 Cheung Kong (Holdings) Ltd. HK HKD Y 14.4 15 14 KYG7800X1079 B5B23W2 1928.HK PH256 Sands China Ltd. -

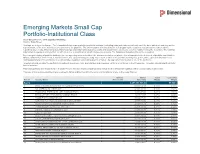

Emerging Markets Small Cap Portfolio-Institutional Class As of December 31, 2019 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Emerging Markets Small Cap Portfolio-Institutional Class As of December 31, 2019 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

China Steel Corporation

China Steel Corporation Financial Statements for the Six Months Ended June 30, 2009 and 2008 and Independent Auditors’ Report INDEPENDENT AUDITORS’ REPORT The Board of Directors and Stockholders China Steel Corporation We have audited the accompanying balance sheets of China Steel Corporation (the “Corporation”) as of June 30, 2009 and 2008, and the related statements of income, changes in stockholders’ equity and cash flows for the six months then ended. These financial statements are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the Rules Governing the Audit of Financial Statements by Certified Public Accountants and auditing standards generally accepted in the Republic of China. Those rules and standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion, the financial statements referred to in the first paragraph present fairly, in all material respects, the financial position of the Corporation as of June 30, 2009 and 2008, and the results of its operations and its cash flows for the six months then ended, in conformity with the Guidelines Governing the Preparation of Financial Reports by Securities Issuers, requirements of the Business Accounting Law and Guidelines Governing Business Accounting relevant to financial accounting standards, and accounting principles generally accepted in the Republic of China.