Whole Day Download the Hansard

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

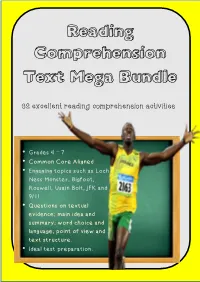

Reading Comprehension Text Mega Bundle

Reading Comprehension Text Mega Bundle 32 excellent reading comprehension activities Grades 4 – 7 Common Core Aligned Engaging topics such as Loch Ness Monster, Bigfoot, Roswell, Usain Bolt, JFK and 9/11. Questions on textual evidence; main idea and summary; word choice and language; point of view and text structure. Ideal test preparation. Teacher notes This collection of reading activities are a selection of some of my favourites. I have put them together as a bigger collection to allow teachers to plan a whole year’s worth of reading comprehensions for their children. Each activity contains a range of challenging questions which test inference, deduction and retrieval skills – ideal preparation for reading assessments. Children are also given an indication of marks on offer for each question, and teachers are provided with answers. As with all of my reading activities, I try to make the subject matter informative as well as engaging. Children get the chance to find out about a whole range of interesting stories and topics that may not be covered in the curriculum. CONTENTS: 2 - 10 Stories of Survival Miracle of the Miners; Apollo 13; Plane crash in the Andes, Castaway. 11 - 22 Mysteries of the World Loch Ness Monster; Bigfoot; Mary Celeste; Lord Lucan; Turin Shroud; Roswell. 23 - 30 Soldier’s Stories – World War One The first and last soldiers to die in the war; The man who could have killed Hitler; An American hero. 31 - 36 The Queen and the Royal Family The Queen; The Royal Family; The Royal Wedding. 37 – 42 Christmas Santa Claus; Christmas Trees; The Christmas Truce. -

1913 Lockout

1914-1918 The Great War Key Players and Leaders Kaiser Wilhelm II Wilhelm was the last German emperor (Kaiser) and King of Prussia, whose aggressive behaviour helped to bring about World War One. He was a grandson of Queen Victoria of the United Kingdom. King George V King of the United Kingdom, also a grandson of Queen Victoria. Archduke Franz Ferdinand Heir to the Austrian throne whose assassination was the immediate cause of World War I. Gavrilo Princip A Bosnian revolutionary responsible for the assassination of Archduke Franz Ferdinand Causes /Assassination / Britain and Ireland involved What was Europe like in 1914? Europe was a continent at peace in 1914. However, even though all looked well, some countries didn’t trust each other, some countries wanted to invade and take over others and some countries were friendly with each other. The map of Europe in 1914 looked very different than it does today: some countries were much larger and had empires and colonies. For example, Ireland was part of Britain’s empire. Austria and Hungary had their own empire, Austro‐Hungary. Belgium and France had colonies in Africa and Germany had colonies not only in Africa but even in China. Who didn’t trust who in 1914? Serbia didn’t trust Austria‐Hungary. The Austro Hungarian Empire had already invaded Serbia in 1908, and in 1913 Austria made statements that they had plans to invade Serbia and make it part of their empire. Germany didn’t trust Britain. Germany had plans to become the most powerful country in Europe, but Britain was expanding its industries and its navy. -

Posthorn Nov 2018

POSTAL & COURIER SERVICES BRANCH OF THE ROYAL ENGINEERS ASSOCIATION THE POSTHORN Edition 33 November 2018 Contents: 20th Anniversary Postal & 20th Anniversary PCS REA. Page 1- 2 Courier Service Branch REA 30th Anniversary Mill Hill On the 27th June 1998 the Branch Chairman, Colonel (Retd) Peter Wescott, was Bombing pleased to announce that the Postal and Courier Service Branch had been formed,. Page 2-3 It had gained it's official status from a meeting of the Management Committee of the Armistice 1918 Royal Engineers Association. Initial membership shown as 89 in the first Posthorn. Page 3 - 7 Current membership numbers stands at 206, bearing in mind the number of Posties Story of the Poppy who have gone to a bigger delivery round over the last 20 years. Page 7-9 Post Notes (Members Contributions) Pennine Way Page 9 - 11 Postal Partnership Parade Page 11 PCS REA Annual General Meeting Page 11 - 15 Membership & Committee Page 15 Lost & Found Members Page 15 Last Post Page 16 Subscriptions Page 16 - 18 Booking Form Page 19 Forthcoming Events We have gained our own standard in 2006 and paraded it at a number of occasions at our own an REA events including Forces Day at Sterling Castle in front of the Queen. Annual Dinner & The branch has also planted a tree to commemorate 100th Anniversary Postal & Dance Courier Service from 1913 2013 in the GPO Garden at the National Arboretum PCS REA Reunion 2019 The POSTHORN November 2018 Newsletter P a g e | 1 MILL HILL BOMBING 1st AUGUST 1988 On 1st August 1988 the Irish Republican Army carried out an attack on the British mainland, the first in four years, a British soldier was killed (Michael Robbins) and 10 others were wounded in a bomb explosion. -

Great Milton Bulletin

TON B T MIL ULL EA ET R IN G November 2018 Published by the Parish Council No. 536 The Great Milton Bulletin www.great-milton.co.uk 1 Parish Council Publication Scheme (Freedom of Information Act) Residents of the Parish can see the records of the Council held by the Parish Clerk or learn where they may be accessed. These records include minutes, financial information, and responses to planning consultations. Applications can be made to the Parish Clerk and documents viewed by appointment. Any copies required will be charged at 10p per page. Great Milton Parish Council Chairman: Stephen Harrod 01844 278068 Ward: Church Road to Monkery Farm/The Priory Vice Chairman: Bill Fox 01844 279716 Ward: Thame Road, inc Fullers Field and Green Hitchings Councillor: Peter Fewell 01844 279400 Ward: The Green from Priory Bank to Tara/Applewood Councillor: Clyde Deacon 01844 278554 Ward: High Street from North End Cottage to The Old Garage Councillor: George Bennett 07482 339905 Ward: Thame Road from Green Hitchings to A329 Councillor: Gwen Harris 07401 399489 Ward: Kings Head House/Red Roofs to Wheatley Boundary Councillor: Peter Allen 01844 278334 Ward: Milton Common Clerk/Responsible Financial Officer: Tim Darch – 01844 278347 [email protected] Parish Council Representatives Rec Ground Committee: Michael Robinson, Michele Block Old Field Charity: Hazel Hand, Niki Patrick Hard Surface Play Area: Susan Read, Jon Devitt Neighbourhood Watch: Jola Miziniak Kent & Couling Charity: Cynthia D’Anger Sheppard Trust: Ann Price, Pat Cox Sunset over -

1914-1915 Chairwoman, Ladies and Gentlemen It's June 28Th. the Year

1914-1915 Chairwoman, Ladies and Gentlemen It’s June 28th. The year is 1914. Arch duke Franz Ferdinand and his wife Helen are assassinated in Sarajevo. Europe is on the brink of war. Austria- Hungary declare war on Serbia, Germany declares war on Russia On the 3rd of August Germany declares war on France. On the 4th August Britain declares war on Germany. During the weeks of 7 – 16th August the small but professional BEF is deployed to France. under Sir John French. August is a month of declarations of war, including Germany and Russia. The fighting for the BEF starts in earnest at the Battle of Mons. Emperor Wilhelm 2 issues the order to ‘exterminate the treacherous English and walk over general Frenchs contemptable little army’ On the 21st Aug Private John Parr is the first British and commonwealth soldier to be killed, while recceing enemy locations by bicycle near the town of Mons. The first 2 of 628 VCs are won by Lt Maurice James Dease and Pte Sidney Godley. Lt dease was killed and Pte Godley wounded and taken prisoner while defending Nimy railway bridge over the Mons -Conde Canal in Mons. The BEF fight gallant rear-guard actions throughout the months of august and sept finally halting the German advance at the battle of the Marne. People rush to volunteer for Kitchener’s new army, fearing the war will be over by xmas and they will miss the action. Mobile warfare is coming to end and the trench lines begin to form in the ‘race to the sea’. -

Twenty-Fourth Sunday After Pentecost Remembrance Day 8 November 2015

Page | 1 Twenty-fourth Sunday after Pentecost Remembrance Day 8 November 2015 The Mission and Discipleship Council would like to thank Rev Margaret Whyte, retired minister previously of Pollokshaws Parish Church, Glasgow, for her thoughts on the twenty-fourth Sunday after Pentecost. Contents Ruth 3: 1-5; 4: 13-17 .................................................................................................................................. 2 Psalm 127 ................................................................................................................................................ 3 Hebrews 9: 24-28 ................................................................................................................................... 3 Mark 12: 38-44 ....................................................................................................................................... 4 Order of Act of Remembrance ............................................................................................................. 5 Stories for sermon illustrations ........................................................................................................... 9 Time with Children ............................................................................................................................... 14 Musical Suggestions ............................................................................................................................ 17 Material based on the Lectionary Readings for 8 November .......................................................... -

THE FALLEN of the Parish of Capel St Mary SUFFOLK Griffith R Johns

THE FALLEN Of The Parish of Capel St Mary SUFFOLK Griffith R Johns The Fallen, of the Parish of Capel St Mary, Suffolk First Published 2019 Printed By BOOK EMPIRE Leeds LS 25 2JY All rights reserved. No part of this publication may be reproduced or stored in a retrieval system, or transmitted in any form or by any means , electronic, mechanical, photocopying, recording or otherwise without prior permission of the copyright owner Foreword It is a privilege to write a foreword to this book which Griffith R Johns has written after many hours of diligent work. It is perhaps not surprising that the qualities of commitment and perseverance that we have come to expect in a former Royal Marine have helped sustain him in his endeavours. I commend this book to you as a tribute to the memory of the people of Capel St Mary who gave so much in the service of their country during two world wars. Not only those who took up arms to defend freedom but those who remained at home and whose contribution in other ways was so vital in securing victory. It is being published to coincide with the completion of the Capel St Mary War Memorial and together I hope they will serve as a fitting testament to those who we seek to honour and remember with pride. Group Captain Gary Bunkell CBE Chairman Capel St Mary War Memorial Trust. April 2019 This book is dedicated to all those who fell in the cause of freedom. World War 1 1914 -1919 World War 2 1939 – 1945 Post 1945 I CAPEL ST MARY WAR MEMORIAL THE STORIES OF THE MEN BEHIND THE NAMES Little has been known about the men whose names are inscribed on the brass plaque in St Mary’s Church or those in the book below. -

What We Leave Behind: Post Cards from Mons 3 Memorial Plaque 8 War Memory in Canada and Diary Entries 13 Poppies 15 the Commonwealth 1917 FWD Model B 17 by Dr

November 2018 Volume 29, Number 4 What we leave behind: Post Cards from Mons 3 Memorial Plaque 8 war memory in Canada and Diary Entries 13 Poppies 15 the Commonwealth 1917 FWD Model B 17 By Dr. Robert Engen This November we in Canada tred upon Vimy, is tinged with victory commemorate – or perhaps cele- and self-assertion. brate, as that word may finally be Australian and New Zealand appropriate – the centenary of the war memory is very different. Their armistice that halted the First World massive stone edifices of remem- War. Canada is not the only coun- brance – the Australian War Memor- try that has rooted at least part of its ial, the Victoria and New South Poppies in the Sunset on Lake Geneva foundational myths in the First World Wales Memorial, the NZ National wikimedia.org War. Many of those countries that War Memorial – are all kept close fought came to identify the war as a to home, in contrast with Canada’s of hell. Gallipoli has become myth- formative national experience. I had Vimy monument in France. But the ologized as emblematic of the war the opportunity to visit several other Australians and New Zealanders efforts of Australia and New Zea- nations of the British Commonwealth also remember very different things land: Gallipoli is loss, torment, sac- while carrying out research, and as well. Central to both countries’ rifice, defeat, and betrayal by their observed that there are profound war memories is the word “Anzac.” British masters. U.S. Army scholar differences in the war memories Named after the combined Austral- Charles Miller has pointed out that of four Commonwealth countries ian and New Zealand Army Corps this is a recurring theme, and that whose war experiences had many (ANZAC) formation from the war, Gallipoli, “implanted a national myth similarities: Canada, Australia, New the term embodies qualities of loss, of Australian lives being sacrificed Zealand, and South Africa. -

1913 Lockout

1914-1918 The Great War -1- Some Hard Stuff Explained Annexe To take over all or part of a country, usually illegally. Armistice An agreement between two nations to stop fighting. It is not necessarily the end of a war, since it might be just a halt to fighting while an attempt is made to negotiate a lasting peace. Artillery Large guns used in land warfare, operated by a crew of soldiers. Bolsheviks A Russian revolutionary party. At the time of WWI it was led by Vladimir Lenin and its aim was to make all of Russia Communist. Conscientious Objector Someone who, for religious or personal reasons, refuses to fight in a war. Conscription A government order to make it compulsory for a person of a certain age to serve time in the army. Kaiser The Emperor of Germany No Man’s Land The land that lies between opposing armies’ trenches. It hasn’t yet been taken by either side and is a very dangerous place to be – it has the highest concentration of artillery, rifle and machine gun fire. Scuttle A Navy term to describe the act of sinking your own ship to stop it getting into enemy hands. Shells Explosive ammunition fired by artillery Truce A temporary halt to fighting for an agreed limited time or within a limited area Tsar The Emperor of Russia U‐Boat A German submarine. -2- The Leaders Kaiser Wilhelm II Wilhelm was the last German emperor (Kaiser) and king of Prussia, whose aggressive behaviour helped to bring about World War One. He was a grandson of Queen Victoria of the United Kingdom. -

November 2018

“Sitrep, Over!” Remembrance Day 2018 NOVEMBERJANUARY 2018 2018 As Remembrance Day approaches we think of those who paid the supreme sacrifice during the First World War, and we commemorate their service and sacrifice. But, the Armistice was signed around 5.30 a.m on November 11th, and opposing forces continued to fight, right up until 11 a.m when the decree came into force. Allied and German soldiers continued to fight and die on the morning of Remembrance Day, even though their commanders had virtually signed the end of hostilities 6 and a half hours earlier. Research has shown that nearly 11,000 soldiers died after the ceasefire had been signed. See Page 3 for details. End of Year BBQ 16th December The Association End of Year BBQ will be held at the Kibby VC Club, Keswick Barracks on Sunday 16th December from 1100 hrs. All food will be provided FREE of charge by the Association, and the Kibby Club Bar will be open from 1100 hrs to 1300 hrs. This function is open to ALL members and their families and is at no cost to you. Come along and meet, mix and mingle with other members of the Regimental Associa- tion, and enjoy the camaraderie (and food) we are so well known for. We need definite numbers for catering purposes, so please advise the Secretary David Laing on 0407 791 822 or email of [email protected] See you there! Inside this issue: Fees and Merchandise can be paid by EFT through the following Bendigo Bank account: Freedom of Entry 2 RSAR Association They died AFTER the ceasefire 3 BSB 633 000 Letters to the Editor 4 Acc. -

Armistice with Germany 1 Armistice with Germany

Armistice with Germany 1 Armistice with Germany The armistice between the Allies and Germany was an agreement that ended the fighting in the First World War. It was signed in a railway carriage in Compiègne Forest on 11 November 1918 and marked a victory for the Allies and a complete defeat for Germany, although not technically a surrender. The Germans were responding to the policies proposed by American President Woodrow Wilson in his Fourteen Points. The actual terms, largely written by French Marshal Ferdinand Foch, included the cessation of hostilities, the withdrawal of German troops to behind their own borders, the preservation of infrastructure, the exchange of prisoners, a promise of reparations, the disposition of German warships and submarines, and conditions for prolonging or terminating the armistice. The exuberance with which people greeted the armistice quickly succumbed to feelings of exhaustion, relief, sorrow, and a sense of absurdity.[1] This photograph was taken after reaching an agreement for the armistice that ended World War I. This is Ferdinand Foch's own railway carriage and the location is in the forest of Compiègne. Foch is second from the right. October 1918 telegrams On 29 September 1918 the German Supreme Command informed Kaiser Wilhelm II and the Imperial Chancellor Count Georg von Hertling at army headquarters in Spa, Belgium, that the military situation facing Germany was hopeless. Generalquartiermeister Erich Ludendorff, probably fearing a breakthrough, claimed that he could not guarantee that the front would hold for another 24 hours and demanded a request be given to the Entente for an immediate ceasefire. -

25Th Sunday After Pentecost Nov 11

Veterans Day/Armistice Day, November 11, 2018, 100 th Anniversary of the end of World War 1. St. Augustine’s in-the-Woods Episcopal Church, Freeland WA. Nigel Taber-Hamilton Micah 6:1-4, 6-8; A poem by Lt. Wilfred Owen, Matthew 5: 1-12 Anthem for Doomed Youth By Wilfred Owen What passing-bells for these who die as cattle? — Only the monstrous anger of the guns. Only the stuttering rifles' rapid rattle Can patter out their hasty orisons.* No mockeries now for them; no prayers nor bells; Nor any voice of mourning save the choirs,— The shrill, demented choirs of wailing shells; And bugles calling for them from sad shires. What candles may be held to speed them all? Not in the hands of boys, but in their eyes Shall shine the holy glimmers of goodbyes. The pallor of girls' brows shall be their pall; Their flowers the tenderness of patient minds, And each slow dusk a drawing-down of blinds. *“Orisons” are prayers It is 10:30 a.m. on Monday, November 11, 1918 – 30 minutes before the cease-fire that will end the “War to End all Wars”: At that moment – 10:30 a.m. – Private George Edwin Ellison of the 5th Royal Irish Lancers is shot while scouting near Mons, the final British soldier to be killed in action in World War I. At 1045 a.m. - 15 minutes before the cease-fire: the final Frenchman to die – Pvt. 1 st Class Augustin-Joseph Victorin Trébuchon of the French Fifth army’s 415th Infantry Regiment– is the last of 91 members of his unit killed in an attack on German positions ordered that morning by General Henri Gouraud – who did so with full knowledge that the cease-fire had been signed.